Daily Trade Journal - 20.06.2013

-

Upload

randora-lk -

Category

Documents

-

view

222 -

download

0

Transcript of Daily Trade Journal - 20.06.2013

-

7/28/2019 Daily Trade Journal - 20.06.2013

1/7

p

q

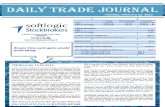

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

YTD Performance

S&P SL 20 Index

40.5

-183.0

15.9

2,826.4

3,009.4

Thursday, June 20, 2013

933.6

% ChangePoint ChangeToday

23.1

3,475.9

0.04 %

-0.10 %

2,385.5

ASPI

S&P SL 20 Index

+ 2.21

- 3.54

6,211.44

3,492.14

ASPI 10.1%

13.2%

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 20.06.2013Indices trading on a range: The bourse heavily

consolidated on a 20 points restricted band during

most part of trading hours. However turnover was

heavy today due to large-sized off-board block

transacted on JKH. At the end of the day ASPI

settled at 6,211.44 with a marginal gain of 2 points.

Gains recorded on John Keells Holdings (+1.7%),Ceylon Cold Stores (+9.3%) and losses denoted on

Dialog Axiata (-1.1%) and Carsons Cumberbatch (-

0.7%) held the indices on marginal ground.John Keells Holdings spearheaded the daily

turnover: John Keells Holdings spearheaded

turnover adding 80.0% to the daily turnover

backed by two large-sized off-board transactions

amounting to 10.1mn shares which were dealt at

LKR265.0. The counter witnessed notable on-board

interest as well led by a single transaction of 174kshares which was traded at LKR270.0. JKH closed at

LKR269.5 with an intra-day gain of 1.7%.

Commercial Bank too denoted off-board interest

with four crossing totaling to 2.7mn which was

transacted at LKR115.70-80. Carsons Cumberbatch

and Distilleries Company followed up with small-

sized off-board transactions during the day.BFI sector attain investor attention: Banking sectors

counters Sampath Bank, Commercial Bank and

Nations Trust Bank denoted on-board interestduring the day. Sampath Bank witnessed a single

on-board transaction of 100k shares which was

traded at LKR209.0. SAMP further dipped today by

1.2% and closed at LKR208.1. Commercial Bank

and Nations Trust Bank too dipped by 0.3% and

1.9% respectively to settle at LKR115.8 and LKR63,5.

Low Retail activity Retail activity was low and

concentrated on selected counters Environmental

Resources Investments and Janashakthi Insurance.

Bourse remains dull despiteheavy turnover by JKH

-

7/28/2019 Daily Trade Journal - 20.06.2013

2/7

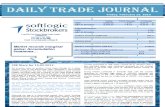

Statistical Look Up

Treasury Bill (%) 21.06.2013

8.66

9.80

10.85

12.69

Inflation (%) May-13 7.3

8.8

All Share Price Index p

S&P SL20 Index q

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance q

Beverage, Food & Tobacco p

Construction & Engineering q

Diversified p

Healthcare q

Hotels & Travels p

Land & Property q

Manufacturing p

Plantation p

Telecom q

-1.35%

2.3

24.9

42.8

13,515.9

% Change

0.03%2.3

-384.88%

16.9

-0.99%

0.61%

0.04%

-0.80%

% WoW

ChangeLast Week

0.06%

4075.73%

12009.38%

-527.27%

67.7

2,384.6

12.7

624.12%

624.12%

% WoW

ChangeLast Week

480.0

3.7

-1.01%

1.85%

0.04%

Today

-183.0

2.3

3,009.4

16.9

6,211.4

-0.10%

2,385.5

2.2

2,826.4

910.94%

910.94%81.88%

0.84%

27.123.1

241

3,492.1

343.8

2.7

239

3,475.9

0.04%

1717.61%

3197.79%

Week ending

-1.91%

-7.76%

1.69%

0.06%

-0.20%

0.06%

237

2,384.0

6,207.9

3,499.1

25.0

0.06%

0.00%

155.5

91.3

64.2

Change %

6,209.2

3,495.7

2.2

0.04% 16.9

Pre Day

13,608.3

19,138.4

2,030.6

3,502.2

616.6

0.00%

2,918.4

2,028.7

-0.34%

0.13%

-0.79%

0.52%

2,885.5

18,813.9

617.8

162.5 163.8-0.19%162.2

2.2

3,085.9

19,162.7

2,862.6

2,041.2

13,470.6

Pre Day

0.00%

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 20.06.2013

Today

-14.95

676.3 677.3 -0.15% 689.8 -1.96%

796.1 790.5 0.71% 804.5 -1.04%

3,128.0

3,500.8

-0.60%

3,502.2

612.9

0.15%3,081.4

6000

6100

6200

6300

6400

6500

6600

Index

ASPI

3400

3450

3500

3550

3600

3650

3700

Index

S&P SL20

0.0

10.0

20.0

30.0

40.0

50.0

60.0

0

1,000

2,000

3,000

4,000

Volume('mn)

TurnoverLKR('mn)

Turnover Volume

Softlogic Equity Research Page | 2.

-

7/28/2019 Daily Trade Journal - 20.06.2013

3/7

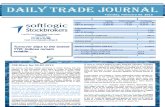

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

JKH

COMMERCIAL BANK

CARSONS

SAMPATH

DISTILLERIES

Most Active

Close

269.50

1,007.00

264.50

1,019.00

162.70

134.10

700.40

8.70

Volume (mn)

116.4%

Turnover

(LKR)

3.7%

2,777,608,337

50,542,203

42,077,281

356,536,497

89,002,204

0.38

3.08

0.22

0.2% 3,759,710

2,777,608,337

14.9%

440.70

208.10

192.90

EXPOLANKA 7.00

COMMERCIAL BANK 115.80

% Change

SOFTLOGIC

FREE LANKA 2.60

0.52

10.48

3.08

2.60

-0.34%116.20

0.20

0.24-1.19%

0.33

1.70%

-0.34%

-1.41%

2.1%

1.8%

14.9%

Contribution to

Total T/O

875,103

-0.05%

9.90

356,536,497

3,647,574

0.32

KURUWITA TEXTILE

S M B LEASING

Pre Day

1.70%265.00 116.4%10.48

Volume (mn)% Change

10.48%

+ 11.00 11.22%

269.50

CompanyContribution to

Total T/O

139.90

0.2%

0.0%

Turnover

(LKR)

166.10

5.23

8.42

115.80

58.30

165.10

40.50

50,542.20

73.40

208.10

162.50

41.10

700.00

70.00

1,301.00

9.70

TodayCompany

174.50

NUWARA ELIYA

0.80

393.54

0.011.48

49.94

22.41

671.14

6.00

Today

9.25%

Turnover

USD ('000)

25.5017.45%

Intraday

Low (LKR)

Turnover

LKR ('000)

356,536.50

771.03

2,776.11

0.17

1,002.00

2,777,608.34

Intraday

High (LKR)

270.00

13.00

138.50

208.00

134.10

192.90

41.70

8.70

% Change

JOHN KEELLS HOLDINGS 10,478,149

SAMPATH BANK

ASIAN HOTELS & PROPERTIES 21

1.5%

200,005119

3,400

9.7%

7.9%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOM

COMMERCIAL BANK [V]

3.6%

3.0%BUKIT DARAH

DIALOG AXIATA

HNB [V]

DFCC BANK

CARGILLS

6.36

1,900.10

116.50

1,669.83

1.09

LOLC

AITKEN SPENCE 135.00

2.4% 327.63

139.67

164.50

89,002.20227.41

693.001.77

435.00

708.90

8.80

1,911.10

115.80

444.501,913.00

6,413.37

42,077.28

3.9%

2.3%

1.2%

32

77,126

39,416

12,385

4.3%

193.00

60.00

3.0%

192.90

60.00

440.70

3.1%

115.80

-0.74%

1.5%

2.2%

Change

- 3.50

- 0.10

- 99.00

- 0.70

% Change

211.00

210.60

193.00

444.00

MACKWOODS ENERGY

+ 2.20

EQUITY TWO PLC

72.00

138.60

Volume

21,627.34

0.00%

0.00%

3,078,612

40.75

1,081.35

811 817.06

1.3%

Change

32.30

Company% of

Mkt Cap

9.90

Today Pre Day

265.00

116.20

7.10

+ 4.80

DISTILLERIES

293

240,929

JKH 269.50

Company

218,017

12,866

6,511

LAKE HOUSE PRIN.

UDAPUSSELLAWA

Company Today

1.6%

COLD STORES

S M B LEASING [X] 0.50 + 0.10 25.00% CEYLON PRINTERS 1,293.50 - 305.50 -19.11%

-6.73%

-7.07%

-12.07%

-11.11%

174.80

23.20

109.00

+ 14.80

Softlogic Equity Research Page | 3.

-

7/28/2019 Daily Trade Journal - 20.06.2013

4/7

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar No Announcements

Yuan 0

Euro 0

Rupee 0

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

q

q

q

q

q

q

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) q

Crude Oil (WTI) q

ICE Cotton #2 q

CBOT Wheat q

COMEX Gold q

COMEX Silver q

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

00-Jan-00

00-Jan-00

1/0/1900

1/0/1900

00-Jan-00

Description

0.00

0.00

0 1/0/1900

0

XR Date

00-Jan-00

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

00-Jan-00

0.00

Time*

USd/bu.

85.35

Price

104.02

96.14

USD/bbl.

101.31

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

EU

198.56

0.00

0.00 0

0

128.43

0.0034.25

Malaysia

3.97

119.13

20.95

2.19

1.33

40.17

India

Currency

170.52

Indicative Rate

20.06.2013

China

0

Payment DateDPS (LKR) XD Date

6,205.2

Singapore

Switzerland

Thailand

UK

-2.10

-604.0

0

2,617.0

138.48

1/0/1900

1/0/1900

4.16

USA

02:28

-143.7

1/0/1900

Change

-2.49%

-230.6

04:01

0

00-Jan-00

1/0/1900

1/0/1900

06:16

06:18

-2.26%

06:17

Company

06:35

06:17

06:12

0-Jan

0-Jan

06:32

06:32

Time*

06:18

-2.25%

Change %

-1.65%

-8.50%

-1.98%

-2.14%

-1.74%

-2.88%

-6.03%

-22.9

Change

-1.44%-1.25

0

-2.10

Change %

308.05

USD/t oz.

USD/t oz. -1.84

702.50

-7.10

19.79

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

13,014.6

Value

15,112.2

1,628.9

USD/bbl.

USd/lb.

USd/lb.

AMERICA

-11.75

METALS

ENERGY

Commodity

20,382.9

Units

0

-67.0

Proportion

00-Jan-00

00-Jan-00

0.00

0.00

-1.35%

-1.39%

-206.0

Russia

Saudi Arabia

Japan

1,291.20 -82.80

Australia

Softlogic Equity Research Page | 4.

-

7/28/2019 Daily Trade Journal - 20.06.2013

5/7

Softlogic Equity Research Page | 5

CSE Announcements

Bogala Graphite [BOGA:LKR26.0]: The Company has obtained a licensefrom Geological Survey and Mines Bureau Sri Lanka for exploration of new

graphite deposits at Kohombagahawatte, Rangala and Galigamuwa in Kegalle

district covering 33 square kilometers and Mathugama of Kalutara District

covering 56 square kilometers.

Local News

JKH to sign USD640 mn hotel deal next week: Sri Lankas top conglomerate, John Keells Holdings [JKH:LKR269.5], will sign a USD640 mn deal to establish an integrated hotel complex in the capital of Colombo,

three sources told Reuters yesterday. JKH, the heavyweight of the USD18.5 bn Colombo Stock Exchange with

a USD1.77 bn market cap, will sign the deal with a company from outside the country, the sources who have

the direct knowledge on the deal told Reuters. Investment Promotion Minister Lakshman Yapa

Abeywardena, without naming the company, said the government will sign a USD640 mn agreement next

week with a local company for a 500-room hotel complex with apartments, supermarkets and restaurants.

John Keells Holdings Deputy Chairman Ajith Gunawardena told Reuters that the project is in progress but

declined to comment on the size of the project and if the company would sign the deal next week.

[Source: www.dailymirror.lk]

Sampath Bank raises USD100 m through international loan syndication: Sampath Bank [SAMP: LKR208.1]recently celebrated the success of its largest international loan transaction of USD100 m that was concluded

in the first quarter of 2013. The banks consistent performance over the years coupled with its potential for

sustainable growth have been the key driving forces in the success of this transaction and we are pleased to

witness the high level of confidence placed by the off shore investors on the banks strategic direction,

Managing Director Aravinda Perera said. The bank has established a great track record in the loansyndications space with this latest transaction drawing a great deal of interest from a diverse range of

investors from a large number of Middle Eastern and Asian banks. Consequently, this deal which was

launched for USD50 mn was upsized over two fold as the bank consciously decided to cap the final size to

USD100 mn to suit its cash flow requirements. The transaction was facilitated by HSBC who acted as the lead

arranger and book runner.

[Source: www.ft.lk]

Casino recants?: Gambling with fate, a top Minister on Wednesday rejected claims that the Governmentplans to open a casino in Colombo with Australian gaming mogul James Packer, but did not rule out the

possibility in the future. Investment Promotions Minister Lakshman Yapa Abeywardana insisted that the

investment proposal under discussion from casino kingpin James Packer was only for a mixed developmentproject of USD350 mn that would include a five star hotel, restaurants and penthouses but not a casino.

However, he admitted that there was room for the investors to transfer an existing gaming license from

another owner and operate a casino. Abeywardana defended the loophole by vehemently pointing out that

the Government would not issue new gaming licenses and that if Sri Lanka wished to reach the target of 2.5

mn arrivals by 2016 it would need to open itself up to similar investment options.In 2012 the Government

set a target of USD2 bn but only managed to attract USD1.2 bn. Nonetheless Abeywardana is upbeat of the

islands chances of meeting the mark in 2013.

[Source: www.ft.lk]

10 investment proposals from China: Ten proposals from Chinese companies have been handed over to theInvestment Promotion Ministry, an official said yesterday. Investment Promotions Minister Lakshman YapaAbeywardana responding to questions noted that the proposals were to set up factories in areas such as

Suriyaweva and Sampur. The proposals include a steel factory, IT Park and assembling motor vehicles. One

proposal was to produce herbal beauty products but most of them are for smaller ventures of around USD25-

50 mn,he added. The Sampur investment zone received Cabinet approval over the weekend. Abeywardana

-

7/28/2019 Daily Trade Journal - 20.06.2013

6/7

Softlogic Equity Research Page | 6

rejected concerns that disputes over the 13th Amendment would hamper Indo-Lanka investment

opportunities stressing that political issues would not infringe on business decisions.

[Source: www.ft.lk]

Krrish told to pay up or lose concessions: Taking an unusually tough stance the Investment PromotionMinister has told Krrish to pay up before 15 July or risk losing tax concessions that could be granted under

the Strategic Development Act in Parliament. Investment Promotions Minister Lakshman Yapa Abeywardanastated that while 84% of the USD460 mn project has been paid he had told the investors to complete the

transaction by 15 July or risk tax concessions that can be bestowed upon it. The practice is for any project

investing above USD250 mn to receive tax and other concessions by being put under the Strategic

Investment Act, which would then be approved by Parliament. We have charged them 12% interest on the

previously delayed payments. If they fail to meet the 15 July deadline then we will charge them a further 12%

interest and refuse it concessions eligible under the Strategic Investment Act. However, the project can still

continue,he said.

[Source: www.ft.lk]

Global News

China Manufacturing Contraction Deepens Amid Cash Pinch: Chinas manufacturing is shrinking at a fasterpace this month, adding to stresses in the economy and financial system after interbank borrowing costs

surged to the highest in seven years. The preliminary reading of 48.3 for a Purchasing Managers Index

(EC11FLAS) released today by HSBC Holdings Plc and Markit Economics compares with the 49.1 median

estimate in a Bloomberg News survey of 15 economists. Mays final reading of 49.2 was the first below 50

since October, indicating contraction. If market rates remain at such high levels, the only scenario for the

Chinese economy is a hard landing, said Xu Gao, chief economist with Everbright Securities Co. in Beijing.

That possibility is growing now. It seems the leadership is deliberately taking a wait-and-see stance to see

how low China growth can be.

[Source: www.bloomberg.com]

Euro ministers to decide direct bank recapitalization rules on Thursday: Euro zone finance ministers willdecide on Thursday when and how their bailout fund can invest in a bank to save it from failure, laying a

cornerstone of the banking union seen as vital to restore economic growth. Ministers from the 17 countries

using the euro will also set guidelines for how much a government would have to contribute to such a bank

rescue, which banks would be eligible, and who would lose money in the process. "We will reach a decision

on all aspects of direct recapitalization," a senior European Union official involved in preparations for the

meeting said. Euro zone leaders want the European Stability Mechanism (ESM) bailout fund to be able to

become a shareholder in a systemically important bank so that the expense of saving the institution does not

fall just on the shoulders of a government that may already be struggling with huge debts. The possibility of

such direct recapitalization should help boost confidence among euro zone banks, encouraging them to lend

to the real economy and so boost growth.[Source: www.reuters.com]

-

7/28/2019 Daily Trade Journal - 20.06.2013

7/7

Softlogic Equity Research Page | 7

Softlogic Equity ResearchDimantha Mathew

+94 11 7277030

Kavindu Ranasinghe

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277032

Softlogic Equity SalesBranches

Horana

Madushanka Rathnayaka

No. 212, 1st

Floor, Panadura Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

Matara

Lalith Rajapaksha

No.8A, 2nd Floor, FN Building, Station Road, [email protected]

+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Sonali Abayasekera

+94 11 7277051, +94 77 7736059

Thanuja De Silva

+94 11 7277059, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently veri fied and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customeLKRNot all customers will receive the material at the same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying or

related to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not bereproduced, distributed, or published for any purposes.