Daily Trade Journal - 18.06.2013

-

Upload

randora-lk -

Category

Documents

-

view

220 -

download

0

Transcript of Daily Trade Journal - 18.06.2013

-

7/28/2019 Daily Trade Journal - 18.06.2013

1/7

q

p

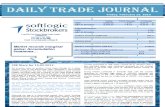

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

YTD Performance

S&P SL 20 Index

40.8

32.7

16.0

92.1

59.4

Tuesday, June 18, 2013

922.6

% ChangePoint ChangeToday

23.8

291.7

-0.42 %

0.01 %

2,378.4

ASPI

S&P SL 20 Index

- 26.11

+ 0.33

6,193.00

3,497.12

ASPI 9.7%

13.3%

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 18.06.2013Indices closed broadly flat: The bourse extended its

consolidation phase while activity remained dormant.

The benchmark index mirrored marginal fluctuations

and remained broadly flat during mid-day before

dipping 26 points at close primarily denoting losses in;

NDB Capital Holdings (-9.1%), Ceylon Beverage

Holdings (-8.2%) and Sri Lanka Telecom (-1.2%). The

S&P SL20 index closed on a marginally positive note

reflecting the gain in Ceylon Tobacco Company

(+1.2%).

CTC gathered interest spearheading the turnover:

Ceylon Tobacco Company continued to gather

investor focus as it attracted on-board interest

gaining 2.0% at its new 52-week high of LKR1010.0

while it recorded the sole crossing for the day; 25k

shares at a 52-week high (off-board) price of

LKR1000,0. The counter closed with a gain of 1.2% at

LKR1,002.2.

BFI sector added 28% to turnover backed by larger

banks: Hatton National Bank edged up to the top

turnover slot denoting activity weighing largely on the

selling side. Turnover in the counter heightened with a

block of c.64k shares which was transacted on-board

at LKR163.0 before it closed with a marginal gain at

LKR164.0 (+0.3%). Commercial Bank gathered some

interest trading between LKR116.3 and LKR116.9. Both

counters denote impressive valuations at current

levels with PER standing at 5.9x and 6.8x for 2014Erespectively. Diversifieds; Expolanka (+1.5%) and John

Keells Holdings (-0.1%) also witnessed some activity

while the former saw several mid-sized on-board

blocks. Renewed interest stemmed in PC House as a

block of 1.3 mn shares were transacted on-board at

LKR2.0.

Retailers on a watchful mode: Retail activity remained

low and surrounded a few counters. PC House, Expo

Lanka, Blue Diamond [Non-Voting] and Nation Lanka

Finance depicted some interest.

Ind ices broadly f lat am idst

sluggish activity

-

7/28/2019 Daily Trade Journal - 18.06.2013

2/7

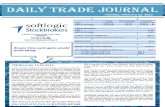

Statistical Look Up

Treasury Bill (%) 12.06.2013

8.67

9.80

10.85

12.69

Inflation (%) May-13 7.3

8.8

All Share Price Index q

S&P SL20 Index p

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance q

Beverage, Food & Tobacco q

Construction & Engineering q

Diversified q

Healthcare q

Hotels & Travels p

Land & Property q

Manufacturing q

Plantation q

Telecom q

-2.66%

2.3

145.5

213.1

13,560.7

% Change

-0.42%2.3

-63.85%

16.9

-2.25%

-2.22%

-1.33%

-2.59%

% WoW

ChangeLast Week

-1.75%

-74.32%

-59.17%

-84.66%

358.6

2,388.4

8.7

-61.13%

-61.13%

% WoW

ChangeLast Week

750.6

5.8

-2.23%

0.12%

-0.42%

Today

32.7

2.3

59.4

16.8

6,193.0

0.01%

2,378.4

2.2

92.1

-5.93%

-5.93%172.51%

6.93%

2.323.8

247

3,497.1

310.1

2.4

231

291.7

-0.42%

-37.00%

6.57%

Week ending

-0.68%

-25.05%

5.11%

-1.75%

-1.78%

-1.76%

235

2,420.7

6,303.8

3,560.5

31.7

-1.75%

4.76%

146.2

55.7

90.4

Change %

6,219.1

3,496.8

2.1

-0.42% 17.1

Pre Day

13,789.2

19,156.8

2,030.7

3,487.7

611.7

0.00%

2,904.0

2,073.4

-0.58%

-0.08%

-0.49%

-0.17%

2,898.7

19,117.6

624.3

164.7 166.5-1.17%162.8

2.2

3,054.4

19,141.0

2,884.4

2,027.3

13,482.1

Pre Day

0.00%

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 18.06.2013

Today

-20.67

673.4 674.0 -0.09% 688.2 -2.15%

793.4 804.1 -1.33% 809.3 -1.96%

3,137.9

3,534.7

-0.59%

3,487.7

608.1

-0.81%3,079.4

6000

6100

6200

6300

6400

6500

6600

Index

ASPI

3400

3450

3500

3550

3600

3650

3700

Index

S&P SL20

0.0

10.0

20.0

30.0

40.0

50.0

60.0

0

500

1,000

1,500

2,000

2,500

3,000

Volume('mn)

TurnoverLKR('mn)

Turnover Volume

Softlogic Equity Research Page | 2.

-

7/28/2019 Daily Trade Journal - 18.06.2013

3/7

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

CEYLON TOBACCO

HNB

PC HOUSE

EXPOLANKA

JKH

Most Active

Close

264.00

1,002.20

263.50

1,010.00

164.00

135.70

700.00

8.70

Volume (mn)

0.6%

Turnover

(LKR)

0.6%

64,952,013

10,569,459

9,962,476

21,468,997

14,788,685

1.13

0.13

0.04

0.1% 2,943,873

14,788,685

0.9%

2.00

7.00

264.00

BLUE DIAMONDS[NON VOTING] 1.40

EXPOLANKA 7.00

% Change

FREE LANKA

NATION LANKA 9.70

1.22

7.24

1.51

10.10

0.31%163.50

7.24

1.511.45%

0.92

-23.08%

1.45%

0.00%

0.4%

0.4%

0.4%

Contribution to

Total T/O

9,082,264

-0.08%

2.70

10,569,459

1,712,961

20.35

HOTEL SIGIRIYA

PC PHARMA

Pre Day

1.23%990.00 2.7%0.06

Volume (mn)% Change

6.13%

+ 9.60 7.55%

1002.20

CompanyContribution to

Total T/O

140.70

0.1%

0.4%

Turnover

(LKR)

171.90

0.16

0.01

116.30

0.00

171.30

41.00

1,887.05

73.10

211.40

162.50

41.40

700.00

70.80

3.10

228.20

TodayCompany

172.00

PCH HOLDINGS

4.30

14.67

0.0810.69

166.95

105.32

20.13

0.00

Today

5.93%

Turnover

USD ('000)

26.109.60%

Intraday

Low (LKR)

Turnover

LKR ('000)

9,405.54

0.00

73.14

0.82

990.00

9,962.48

Intraday

High (LKR)

264.90

0.30

140.00

211.10

134.10

191.50

42.00

8.70

% Change

JOHN KEELLS HOLDINGS 37,751

SAMPATH BANK

ASIAN HOTELS & PROPERTIES 151

1.6%

7,21145

202

9.5%

7.9%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOM

COMMERCIAL BANK [V]

3.7%

3.0%BUKIT DARAH

DIALOG AXIATA

HNB [V]

DFCC BANK

CARGILLS

505.10

1,920.00

116.90

38.95

0.07

LOLC

AITKEN SPENCE 138.00

2.4% 6.56

8.38

164.90

3,202.3686.63

24.900.67

444.00

708.90

8.80

1,930.80

116.50

445.001,939.70

21,469.00

843.31

3.9%

2.3%

1.2%

150

2,289

131,782

288

4.4%

193.00

0.00

3.0%

192.00

60.10

444.00

3.1%

164.00

-23.08%

1.5%

2.2%

Change

- 3.70

- 0.60

- 0.40

- 25.70

% Change

213.60

6.90

264.20

2.60

INDUSTRIAL ASPH.

+ 4.90

PRINTCARE PLC

73.10

140.00

Volume

77.47

-3.70%

-3.96%

80,678

2,617.42

1.89

64,958 64,952.01

1.4%

Change

54.80

Company% of

Mkt Cap

2.60

Today Pre Day

2.60

6.90

1.40

+ 4.80

DISTILLERIES

18,692

8,909

PC HOUSE 2.00

Company

4,385

0

11

CIT

ON'ALLY

Company Today

1.6%

CEYLINCO INS.

CEYLON LEATHER 79.10 + 7.00 9.71% PC HOUSE 2.00 - 0.60 -23.08%

-10.12%

-11.43%

-12.42%

-12.24%

1,016.90

84.90

136.80

+ 56.90

Softlogic Equity Research Page | 3.

-

7/28/2019 Daily Trade Journal - 18.06.2013

4/7

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar Sthosa Motors PLC

Yuan AMW Capital Leasing & Financ

Euro 0

Rupee 0

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

p

p

p

p

q

p

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) q

Crude Oil (WTI) q

ICE Cotton #2 q

CBOT Wheat p

COMEX Gold q

COMEX Silver q

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

00-Jan-00

28-06-2013

03-07-2013

1/0/1900

00-Jan-00

Description

0.00

0.00

0 1/0/1900

0

XR Date

00-Jan-00

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

00-Jan-00

0.00

Time*

USd/bu.

87.80

Price

105.28

97.55

USD/bbl.

102.11

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

EU

202.00

5.00

0.55 26-06-2013

24-06-2013

128.59

0.0034.29

Malaysia

4.05

122.25

20.98

2.22

1.36

40.80

India

Currency

171.77

Indicative Rate

18.06.2013

China

0

Payment DateDPS (LKR) XD Date

6,381.9

Singapore

Switzerland

Thailand

UK

-0.19

0.0

0

2,703.5

139.34

1/0/1900

1/0/1900

4.18

USA

02:28

51.4

1/0/1900

Change

0.03%

-25.8

04:01

0

00-Jan-00

1/0/1900

1/0/1900

06:30

06:31

0.81%

06:31

Company

06:48

06:31

06:31

0-Jan

0-Jan

06:40

06:40

Time*

06:31

-0.66%

Change %

0.99%

-0.24%

-0.18%

-0.23%

-0.20%

0.00%

-0.42%

12.3

Change

-1.34%-1.19

0

-0.22

Change %

317.65

USD/t oz.

USD/t oz. -0.05

687.25

-2.10

21.71

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

13,007.3

Value

15,179.9

1,639.0

USD/bbl.

USd/lb.

USd/lb.

AMERICA

6.75

METALS

ENERGY

Commodity

21,225.9

Units

0

0.8

Proportion

00-Jan-00

00-Jan-00

0.00

0.00

0.73%

0.76%

109.7

Russia

Saudi Arabia

Japan

1,377.30 -5.80

Australia

Softlogic Equity Research Page | 4.

-

7/28/2019 Daily Trade Journal - 18.06.2013

5/7

Softlogic Equity Research Page | 5

CSE Announcements

Central Finance Company [CFIN: LKR185.0] -Debenture Issue:

Local News

Sri Lanka economy grows 6.0% in 2013 first quarter: Sri Lanka's gross domestic product grew 6.0% in thefirst quarter of 2013 from a year earlier, slowing from 8.0% last year and 6.3% in the fourth quarter of 2012,

the state statistics office said. Agriculture grew 2.0% (slowing from 12.0% last year), industry grew 10.7%

(from 10.8% last year) and services grew 4.3% down from 5.8% last year. The first quarter of 2012 was when

the breaks were put on a credit bubble that pushed Sri Lanka into a balance of payments crisis. The statistics

office said the implicit GDP deflator was 8.5% for the quarter, close to inflation measured by the Colomboconsumer price index of 9.0%.

[Source: www.lbo.lk]

NDB secures USD24 mn IFC loan: IFC, the private sector investment arm of the World Bank Group hasextended a USD 24 million tenor loan to National Development Bank (NDB), the bank said in a statement.

IFCs funding will enable the bank to extend financing options across all business segments, generating

employment opportunities and providing access to long term funding to small businesses, the bank said.

IFCs investment brings the required long-term financing which will help NDB to promote the much needed

investments within the country while bringing global best practices and sector knowledge to further

strengthen our internal capacity NDB Chief Executive Russell De Mel said.

[Source: www.dailymirror.lk]

Sri Lanka tourist arrivals up 21% in May: Sri Lanka's tourist arrivals rose 21% to 70,026 in May 2013 from ayear earlier, with a recovery in the Indian market and Western Europe growing strongly, official data shows.

In the first five months of the year, visitors were up 13.2% to 438,653. Arrivals from Western Europe rose

28% to 19,966 with the biggest market UK up 27.5% to 6,299 and Germany up 45% to 4,263. France rose

8.2% to 3,490 and the Netherlands rose 44.7% to 1,376. Eastern Europe was up 48% 3,502, with Russia up

78% to 1,579 and Ukraine up 22% 1,008. Middle East fell 1.6% to 2,632.

[Source: www.lbo.lk]

Sri Lanka promises fast-track investment approvals from July 01st: Sri Lanka's investment promotionministry said a new fast-track unit will be opened from July 01, to give approvals for projects within three

months.The Board of Investment of Sri Lanka will staff the office with six officers who have multi-lingual

capabilities, the ministry said in a statement. All applications that are submitted will be copied to the

investment promotions minister and the ministry secretary who will solve any outstanding problems. Issues

that cannot be solved at a ministry level will be forwarded to a progress monitoring committee chaired by

the President. Investment promotions minister Lakshman Yapa Abeywardene expects the procedure to

provide all necessarily approvals, within three months, the statement said.

[Source: www.lbo.lk]

Rupee steady on CB intervention amid downward pressure: The rupee ended steady on Monday as theCentral Bank intervened in the currency market for a second day to help ease depreciation pressure amid

importer demand for dollars, dealers said. There was intervention as we were giving away some dollars we

have bought early June, Central Bank Governor Ajith Nivard Cabraal told Reuters. The rupee closed flat at

LKR128.50/60 per dollar. Currency dealers said the lowest trade was done at LKR128.80 before one of the

State-run banks, through which the Central Bank usually directs the market, sold dollars at LKR128.70. The

bank sold at that price selectively and that helped the currency to recover, a dealer said. The rupee lost

Category Type Basis of Allotment

TYPE A Up to 4000 debentures - 100% and 10.45% for the balance

TYPE B Up to 4000 debentures - 100% and 52.93% for the balance

-

7/28/2019 Daily Trade Journal - 18.06.2013

6/7

Softlogic Equity Research Page | 6

1.6% last week. It had fallen to LKR129.00/129.10 per dollar in early trades on Friday, its lowest in six

months, as foreign investors sold bonds as part of a broader sell-off in emerging markets on fears that loose

global monetary conditions were about to end. Investment promotions minister Lakshman Yapa

Abeywardene expects the procedure to provide all necessarily approvals, within three months, the

statement said.

[Source: www.ft.lk]

Global News

U.S. and Europe kick off free trade talks: The U.S. and Europe announced the start of negotiations on atransatlantic trade and investment pact, which has the potential to add about USD420 billion a year to the

global economy. Under pressure to find new ways of stimulating demand to end recession in Europe,

accelerate sluggish growth in the U.S. and bring down unemployment, President Obama and EU leaders said

much was achieved in starting formal talks but plenty of hard work lay ahead. "It's a testament to the

leadership and political will of everyone here that we've reached this point," said U.K. Prime Minister David

Cameron. "We must maintain that political will in the months ahead -- this is a once in a generation prize and

we're determined to seize it."

[Source: www.money.cnn.com]

Americans Exporting More Oil First Time Since 70s: The U.S. oil boom is moving Congress closer than it hasbeen in more than three decades to easing the ban on exporting crude imposed after the Arab embargo.

Advances such as hydraulic fracturing are leading to record production that may outstrip refinery capacity

within 18 months to three years, said Benjamin Salisbury, a senior energy policy analyst at FBR Capital

Markets Corp. in Arlington, Virginia. Net petroleum imports now account for about 40% of demand, down

from 60% in 2005, according to the U.S. Energy Information Administration, the Energy Department research

unit. Americans are unbelievably politically sensitive to oil and more specifically to gasoline prices,

Salisbury said in an interview.

[Source: www.bloomberg.com]

-

7/28/2019 Daily Trade Journal - 18.06.2013

7/7

Softlogic Equity Research Page | 7

Softlogic Equity ResearchDimantha Mathew

+94 11 7277030

Kavindu [email protected]

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277032

Softlogic Equity SalesBranches

Horana

Madushanka Rathnayaka

No. 212, 1st

Floor, Panadura Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

Matara

Lalith Rajapaksha

No.8A, 2nd

Floor, FN Building, Station Road, Matara

[email protected]+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Sonali Abayasekera

+94 11 7277051, +94 77 7736059

Thanuja De Silva

+94 11 7277059, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions ar e subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customeLKRNot all customers will receive the material at the same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer t o make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying or

related to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not be

reproduced, distributed, or published for any purposes.