Daily Trade Journal - 29.05.2013

-

Upload

randora-lk -

Category

Documents

-

view

223 -

download

0

Transcript of Daily Trade Journal - 29.05.2013

-

7/28/2019 Daily Trade Journal - 29.05.2013

1/7

p

p

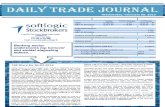

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

YTD Performance

S&P SL 20 Index

40.9

102.5

13.2

239.4

136.9

Wednesday, May 29, 2013

897.4

% ChangePoint ChangeToday

49.3

906.1

0.33 %

0.49 %

2,479.0

ASPI

S&P SL 20 Index

+ 21.11

+ 17.68

6,455.81

3,644.64

ASPI 14.4%

18.1%

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 29.05.2013Bourse gains closing up on 6,500: The bourse

witnessed heavy volatility throughout the day though

the index stayed in the green all day long providing

some comfort to investors. Considerable

improvement in retail activity was observed during

the day on selected counter while Commercial Bank,

Ceylon Beverage Holdings, Sri Lanka Telecom and

Asian Hotels and Properties were the primary

contributors to the index.Retail favourite counters climb to the top of the

turnover list: Nation Lanka Finance saw renewed

buying following a prolonged quiet period as the

counter saw 9.7mn shares being traded with 1 large

block of 715k share changing hands at LKR10.2. The

counter gained sharply closing with a 17% gain at

LKR11.7. Blue chips Chevron Lubricants and John

Keells Holdings generated investor attention with the

latter recording some selling pressure as countersclosed at LKR318.1 and LKR288.6.

Land and Property sector retains buying interest:

Investor play was steady in the land and property

counters Overseas Reality and Colombo Land as the

former renewed its 52-week high to LKR21.3 while

both counters recorded gains of 2.4% and 2.7%.Retail interest strengthens: Retail investors were active

on a otherwise dull day changing the momentum on

the market. Nation Lanka Finance, Colombo Land

and Overseas Reality were some of the favourite

picks of the retailers.

Bourse trends up on vo latilefooting

-

7/28/2019 Daily Trade Journal - 29.05.2013

2/7

Statistical Look Up

Treasury Bill (%) 31.05.2013

8.73

9.90

10.86

13.08

Inflation (%) Apr-13 6.4

8.8

All Share Price Index p

S&P SL20 Index p

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance p

Beverage, Food & Tobacco p

Construction & Engineering p

Diversified q

Healthcare p

Hotels & Travels p

Land & Property p

Manufacturing p

Plantation q

Telecom p

1.23%

2.4

48.0

308.4

13,987.3

% Change

0.33%2.4

37.18%

17.5

-1.21%

-1.81%

0.51%

4.13%

% WoW

ChangeLast Week

-0.09%

-32.83%

185.45%

-66.77%

356.4

2,470.9

36.2

18.25%

18.25%

% WoW

ChangeLast Week

766.2

6.1

-1.47%

3.00%

0.33%

Today

102.5

2.4

136.9

17.5

6,455.8

0.49%

2,479.0

2.1

239.4

63.79%

63.79%36.04%

-1.60%

7.249.3

246

3,644.6

553.2

4.4

250

906.1

0.33%

122.55%

316.55%

Week ending

0.44%

140.71%

-0.81%

-0.09%

-0.53%

-0.09%

248

2,481.3

6,461.6

3,664.0

20.5

-0.09%

0.00%

107.6

32.9

74.7

Change %

6,434.7

3,627.0

2.1

0.33% 17.5

Pre Day

14,253.6

19,384.2

2,127.7

3,605.2

655.3

0.23%

2,931.8

2,164.9

0.41%

0.45%

1.03%

-0.09%

2,914.7

18,903.9

640.2

172.4 175.30.47%173.2

2.1

3,206.3

19,471.1

2,944.6

2,125.8

14,044.5

Pre Day

0.00%

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 29.05.2013

Today

-7.89

714.0 703.2 1.53% 716.4 -0.34%

821.2 829.7 -1.02% 825.9 -0.57%

3,167.4

3,595.2

1.73%

3,613.4

666.7

0.40%3,193.5

5600

5800

6000

6200

6400

6600

Index

ASPI

3200

3300

3400

3500

3600

3700

Index

S&P SL20

0.0

20.0

40.0

60.0

80.0

0

1,000

2,000

3,000

4,000

5,000

Volume('mn)

TurnoverLKR('mn)

Turnover Volume

Softlogic Equity Research Page | 2.

-

7/28/2019 Daily Trade Journal - 29.05.2013

3/7

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

NATION LANKA

CHEVRON

JKH

NAT. DEV. BANK

COLOMBO LAND

Most Active

Close

288.60

974.90

288.00

975.00

167.50

135.20

710.00

9.40

Volume (mn)

4.3%

Turnover

(LKR)

2.4%

107,270,019

51,916,872

50,811,046

73,946,777

58,657,705

3.33

0.23

0.97

0.4% 8,990,930

107,270,019

3.0%

288.60

177.20

52.60

VALLIBEL 6.10

NATION LANKA[WARRANTS] 1.20

% Change

PANASIAN POWER

OVERSEAS REALTY 21.00

3.34

9.77

6.36

20.50

0.86%315.40

0.20

0.291.61%

2.12

17.00%

200.00%

0.00%

2.1%

2.0%

0.3%

Contribution to

Total T/O

44,357,908

2.73%

2.70

6,437,709

20,680,940

7.03

SOFTLOGIC FIN

PCH HOLDINGS

Pre Day

17.00%10.00 4.3%9.77

Volume (mn)% Change

11.67%

+ 1.70 17.00%

11.70

CompanyContribution to

Total T/O

145.00

0.8%

1.8%

Turnover

(LKR)

175.00

48.32

3.55

121.00

60.00

174.50

42.80

18,846.71

76.30

224.80

167.50

43.40

701.10

75.00

1,000.00

1,122.10

TodayCompany

175.00

PARAGON

4.00

149.03

3.58453.36

33.88

123.42

6,110.23

10.63

Today

10.13%

Turnover

USD ('000)

31.0025.00%

Intraday

Low (LKR)

Turnover

LKR ('000)

39,835.54

1,343.93

314.99

0.98

950.00

58,657.70

Intraday

High (LKR)

290.00

17.70

143.00

222.00

135.00

199.50

43.50

9.30

% Change

JOHN KEELLS HOLDINGS 203,092

SAMPATH BANK

ASIAN HOTELS & PROPERTIES 6,020

1.5%

1751,004

277

10.0%

7.4%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOM

COMMERCIAL BANK [V]

3.5%

2.9%BUKIT DARAH

DIALOG AXIATA

HNB [V]

DFCC BANK

CARGILLS

261.90

2,003.00

124.00

2,239.03

0.09

LOLC

AITKEN SPENCE 137.00

2.4% 170.46

11.98

168.00

77.372,013.28

0.6115.92

440.40

710.00

9.50

2,009.00

123.60

445.002,015.00

4,285.20

21,557.28

4.0%

2.2%

1.2%

174

650,014

25,580

16,537

4.4%

201.00

61.90

3.1%

200.10

61.00

440.80

3.2%

318.10

-0.14%

1.5%

2.2%

Change

- 3.30

- 0.40

- 98.20

- 97.90

% Change

225.00

174.40

51.20

289.00

SELINSING

+ 3.50

EQUITY ONE PLC

76.00

144.00

Volume

463.82

0.00%

2.44%

322,028

889.68

448.90

33,978 33,121.43

1.4%

Change

0.50

Company% of

Mkt Cap

2.70

Today Pre Day

10.00

0.40

6.10

+ 0.10

DISTILLERIES

6,180

83,870

NATION LANKA 11.70

Company

107,730

22,083

2,570

NATION LANKA

S M B LEASING [X]

Company Today

1.6%

VALLIBEL FINANCE

NATION LANKA [W 0021] 1.20 + 0.80 200.00% G S FINANCE 598.50 - 71.50 -10.67%

-8.02%

-8.94%

-9.62%

-9.09%

33.70

33.50

11.70

+ 3.10

Softlogic Equity Research Page | 3.

-

7/28/2019 Daily Trade Journal - 29.05.2013

4/7

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar John Keells PLC

Yuan John Keells Holdings PLC

Euro Keells Food Products PLC

Rupee Ceylon Cold Stores PLC

Yen Trans Asia Hotels PLC

Ringgit United Motors Lanka PLC

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

p

p

q

q

p

q

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) q

Crude Oil (WTI) q

ICE Cotton #2 q

CBOT Wheat q

COMEX Gold p

COMEX Silver p

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

17-06-2013

17-06-2013

17-06-2013

1/0/1900

06-06-2013

Description

4.00

2.00

0 1/0/1900

06-06-2013

XR Date

06-06-2013

00-Jan-00

09-07-201301-07-2013

Renunciation

17-06-2013

2.00

Time*

USd/bu.

81.29

Price

103.86

94.35

USD/bbl.

99.67

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

EU

190.06

3.50

1.50 06-06-2013

06-06-2013

126.47

0.0033.72

Malaysia

4.01

120.96

20.63

2.26

1.24

41.39

India

Currency

162.61

Indicative Rate

29.05.2013

China

0

Payment DateDPS (LKR) XD Date

6,664.0

Singapore

Switzerland

Thailand

UK

-0.37

-369.3

0

2,798.2

129.78

1/0/1900

1/0/1900

4.20

USA

02:28

-98.0

1/0/1900

Change

-1.32%

14.5

04:01

0

00-Jan-00

17-06-2013

1/0/1900

07:11

07:11

-1.45%

07:11

Company

07:11

07:10

07:11

0-Jan

0-Jan

07:00

06:59

Time*

07:11

-0.87%

Change %

-0.29%

0.48%

-0.35%

-0.69%

0.10%

-1.61%

0.83%

10.5

Change

-0.16%-0.13

0

-0.66

Change %

328.60

USD/t oz.

USD/t oz. 0.11

691.75

-2.90

22.30

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

14,326.5

Value

15,409.4

1,660.1

USD/bbl.

USd/lb.

USd/lb.

AMERICA

-2.00

METALS

ENERGY

Commodity

22,554.9

Units

0

-37.7

Proportion

00-Jan-00

00-Jan-00

4.00

0.00

0.69%

0.63%

106.3

Russia

Saudi Arabia

Japan

1,391.10 11.40

Australia

Softlogic Equity Research Page | 4.

-

7/28/2019 Daily Trade Journal - 29.05.2013

5/7

Softlogic Equity Research Page | 5

CSE Announcements

PC House [PCH: LKR3.2] : Notification on listing of shares (Rights Issue)

Brown and Company [BRWN: LKR126.0]: Mr. N M Prakash informed theBoard of his intention to resign from the position holds as Group ManagingDirector / Chief Executive Officer.

Royal Ceramics Lanka [RCL: LKR109.0]: Further to the Announcement made by RCL on 28th May 2013, it ishereby announced that RCL purchased a further 1,592 Ordinary Shares on 28.05.2013 constituting

approximately 0,005% of the total shares in issue in Lanka Ceramic, on the CSE. RCL currently holds a total of

22,983,557 shares constituting approximately 76.61% of the total shares in issue in Lanka Ceramic.

Local News

Sri Lanka to sell 30-year long bonds: Sri Lanka is selling 30-year long bonds for the first time this week whichfill a need for long term gilts, help better manage the state debt stock and extend a risk free yield curve,officials said. We think it is a good time," Central Bank Nivard Cabraal said. "There will be plenty of long term

investors because they know that interest rates would trend down in the future "Then from the governments

point of view it will help them to better manage their debt stock, by moving maturities to the higher range."

A unit of Sri Lanka's central bank, the department of public debt manages and issues debt for the Treasury. It

is offering LKR2.0 bn of 30 year bonds maturing on June 01, 2043 with a coupon of 9.0% at an auction on

May 30.

[Source: www.lbo.lk]

Sri Lanka and China to negotiate free trade deal, expressway funding: Sri Lanka and China will negotiate afree trade deal and Chinese support has been pledged for a planned expressway to the north of the islandfollowing a state visit by President Rajapaksa to Beijing. During bilateral meetings, agreement had been

reached to set up two committees that will work towards a free trade deal the president s media office said.

A target to attract 100,000 Chinese tourists to Sri Lanka has been set. "This would give Sri Lankan products

such as apparel, gems and jewelry, tea and rubber wider access in the Chinese market,"the statement said.

Last year Sri Lanka imported USD2.66 bn of goods from China and exported only USD113 mn in 2012.

[Source: www.lbo.lk]

Softlogic Finance in LKR500 mn securitization deal: Softlogic Finance [CRL: LKR30.0] announced theconclusion of its latest securitization transaction that will enable the company to access funding of LKR500

mn to grow and develop the business of the company for the current quarter. The transaction, signed

recently has drawn considerable interest and full subscription from a number of diverse investors that

include commercial banks, development banks and other institutional investors. The tenor of the transaction

was for two years and will enable the company to enhance lending volumes in the initial part of the year and

potentially gain by re-financing with lower interest rates towards the latter part of the period. The trustee to

the transaction was Deutsche Bank AG and lawyers to the issue were Nithya Partners. The transaction was

arranged by Liege Capital. The securitization by Softlogic Finance was developed as a stable funding source

to push its aggressive business plans with this transaction being the 20th securitization completed by the

company.

[Source: www.dailynews.lk]

Fitch assigns Lion's Debt Final 'AA-(lka)': Fitch Ratings has assigned Sri Lanka-based Lion Brewery (Ceylon)[LION: LKR425.0] listed unsecured redeemable debentures of LKR3bn a final 'AA-(lka)' rating. The LKR3bn

includes an additional LKR500m which will be raised in the event of an oversubscription. The agency has also

affirmed Lion's National Long-Term rating at 'AA-(lka)' with a Stable Outlook, and affirmed the company's

senior unsecured rating at 'AA-(lka)'. The assignment of the final rating to Lion's listed unsecured debentures

follows the receipt of final documents which conform to information previously received. The final rating is

Alloted/Listed Proportion Consideration Raised Date Listed

114,466,667 1 for 2 LKR3.0 343,400,001 29.05.2013

-

7/28/2019 Daily Trade Journal - 29.05.2013

6/7

Softlogic Equity Research Page | 6

at the same level as the expected rating assigned on March 25, 2013. The debentures are rated in line with

Lion's National Long-Term Rating of 'AA-(lka)', as they rank equally with the company's unsecured creditors.

Lion expects to use the debenture proceeds to fund the upgrade and modernisation of its plant over FY13-

FY14 (financial year ends March). The affirmation of Lion's ratings reflects Fitch's view that the increase in

leverage (lease-adjusted debt net of cash/EBITDAR) to 1.85x in FY13from an annualized 1.09x in 9MFY13, is a

temporary feature, and that it does not signify a structural weakening in the company's risk profile.

[Source: www.dailynews.lk]

Amana Takaful distributes surplus to policyholders Amana Takaful [ATL: LKR1.6]announced to its Generalinsurance customers a payment of surplus, which gives Takaful policyholders a proportionate rate from the

surplus of the risk fund. As opposed to conventional insurance, the Takaful concept not only benefits

claimants but also takes care of non-claimants. Non-claimants receive a proportionate share of the surplus

from the risk fund at the end of a defined period. By virtue of being a Takaful policyholder one becomes a

participant of the risk pool. The Risk pool meets all claims of the membership among other expenses. In the

event of a surplus in the risk pool, non-claimants among the participants are entitled to a proportionate

share of the proceeds. With our relentless pursuit to achieve sustainable growth and profits we are

delighted to share a surplus in the first year of our revised strategic plan. Non-claimant Takaful policyholderswill receive their share of the surplus amounting 12.5% of the residual portion of the risk fund shortly," said

Fazal Ghaffoor, Chief Executive Officer, Amana Takaful. "All policyholders will do well to note that this must

not be confused with the No Claim Bonus (NCB), which is a feature of any regular Motor insurance policy", he

added.

[Source: www.island.lk]

Global News

China Growth Outlook Cut by IMF as Decisive Reforms Urged:The International Monetary Fund loweredits forecasts for Chinas growth and said making decisivepolicy changes would put the economy on a moresustainable path. Expansion will be about 7.75% this year and next, David Lipton, first deputy managing

director of the IMF, said today at a press briefing in Beijing after concluding an annual review of China. In

April, the IMF forecast growth of 8% this year and 8.2% expansion in 2014. While China still has significant

policy space and financial capacity to maintain stability even in the face of adverse shocks, the margins of

safety are narrowing and a decisive impetus to reforms is needed to contain vulnerabilities and move the

economy to a more sustainable growth path,Lipton said.

[Source: www.bloomberg.com]

Slowing Thai Growth Aids Government Call for Rate Cut: Thailands central bank may cut its benchmarkinterest rate today for the first time this year as slowing economic growth bolsters government calls for

easing. The Bank of Thailand will probably lower its one-day bond repurchase rate by a quarter of apercentage point to 2.5%, the first reduction since October, according to 15 of 24 economists surveyed by

Bloomberg News. One expects a half-point reduction and eight predict no change. The central bank may

need to ease to ensure continuity of the economic recovery, said Usara Wilaipich, a Bangkok-based

economist at Standard Chartered Plc, who predicts a quarter-point cut. It could also help reduce pressure on

the baht to appreciate. But the central bank may also want to consider other macro-prudential measures to

reduce concern about the risk of bubbles and other side effects from a rate cut.

[Source: www.bloomberg.com]

-

7/28/2019 Daily Trade Journal - 29.05.2013

7/7

Softlogic Equity Research Page | 7

Softlogic Equity ResearchDimantha Mathew

+94 11 7277030

Kavindu Ranasinghe

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277032

Softlogic Equity SalesBranches

Horana

Madushanka Rathnayaka

No. 212, 1st

Floor, Panadura Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

Matara

Lalith RajapakshaNo.8A, 2

ndFloor, FN Building, Station Road, Matara

+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Sonali Abayasekera

+94 11 7277051, +94 77 7736059

Thanuja De Silva

+94 11 7277059, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions ar e subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell a ny securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customeLKRNot all customers will receive the material at the same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer t o make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying orrelated to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not be

reproduced, distributed, or published for any purposes.