Daily Trade Journal -27.02

Transcript of Daily Trade Journal -27.02

-

7/29/2019 Daily Trade Journal -27.02

1/12

p

p

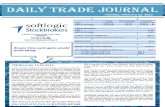

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

YTD Performance

S&P SL 20 Index

38.3

-107.2

-0.4

98.6

205.8

Wednesday, February 27, 2013

879.2

% ChangePoint ChangeToday

23.7

623.0

0.09 %

0.27 %

2,180.1

ASPI

S&P SL 20 Index

+ 4.99

+ 8.61

5,674.47

3,210.82

ASPI 0.6%

4.1%

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 27.02.2013Colombo bourse rebounded to the green with sustained buying interest as

steady accumulation in banking players and a few selected counters

prevailed. Four large off-market blocks supported the sluggish turnover

during early trading breathing in 40%. The ASPI remained in the green

during majority of trading before settling broadly flat at 5,674.47 backed

by gains made in Commercial Leasing & Finance (+5.3%), Commercial

Bank(+1.4%), Sampath Bank(+2.6%) and Asian Hotels & Properties (+2.9%).

Consequently the S&P SL20 index secured a marginal gain at its close of

3,210.82 points.

The consistency in notably large transactions drawn up in fundamental

play depicts accumulation by wise value investors continuing to hunt for

counters with good bargains. The bourse currently trades at attractive

valuations having dipped over 180 points within the past two weeks amidst

macroeconomic woes. Banking & finance sector play has not subsided

backed by anticipated earnings growth thereby continuing to emerge

prominent hence we reiterate investors to utilize the stagnating trend to

focus on value picks in order to surface ahead of the sidelined lot who

accumulates the most at the upturn and the least during the downtrend.Unending interest in Hatton National Bank led the counter to spearhead

the days turnover while trades weighed largely on the buying side

proceeding from a 100k on-board block which was transacted at LKR148.0

followed by two crossings which carried 900k shares at a similar price. The

counter dipped marginally at its close of LKR147.8. Commercial Bankand

Sampath Bank continued their momentum with the former adding 700k

shares to the crossings board at LKR108.5 during mid-day and interest in

the latter emerging towards latter trading. Each saw price appreciations of

1.9% and 2.9% before settling at LKR109.0 and LKR233.0 respectively.

Seylan Bank [Non-Voting] saw some interest with a block of c.484k shares

being picked on-board at LKR35.5.

Notable buying was witnessed in Access Engineering with a quantity of

c.958k shares taken on-board at LKR21.0. Similarly John Keells Holdings

emerged ahead with a marginal gain at its intra-day high of LKR236.1.

Renewed play was observed in Kegalle plantations and its parent, Richard

Peiris Company with both denoting strong interest registering two on-

board parcels of c.100k shares and 1 mn shares at LKR6.8 and LKR112.0

respectively while Chevron Lubricants grabbed some renewed focus

trading between LKR213.0 and LKR217.0.Dialog Axiata added a further 4.4 mn shares to the crossings board atLKR9.1 after an on-board block totaling c.653k shares was transacted at

the same price. Retail activity was subdued while a few penny stocks

sustained interest.Asian Stocks outside Japan Advance on US Economic Data; European

Stocks Advance before Italian Debt Auction: Asian stocks outside Japan

gained after US housing and consumer confidence data beat estimates.

The MSCI Asia Pacific Excluding Japan Index gained 0.6% to 476.05 as of

1:40 p.m. in Tokyo. The Stoxx Europe 600 Index advanced 0.3% to 285.54 at

8:06 a.m. in London.WTI Oil Trades near Lowest Price of 2013 as Crude Supplies Gain: West

Texas Intermediate oil traded near the lowest level this year after an

industry report showed U.S. crude stockpiles increased for the seventh

week in eight. WTI for April delivery was unchanged at USD92.63 a barrel inelectronic trading on the New York Mercantile Exchange at 1:25 p.m.

Singapore time.

ASPI stagnates amidst valueseekers extending BFI sectorplay...

-

7/29/2019 Daily Trade Journal -27.02

2/12

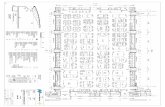

Statistical Look Up

Treasury Bill (%) 22.02.2013

9.10

10.08

11.10

14.40

Inflation (%) Jan-13 9.8

8.1

All Share Price Index p

S&P SL20 Index p

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance p

Beverage, Food & Tobacco q

Construction & Engineering p

Diversified q

Healthcare p

Hotels & Travels p

Land & Property p

Manufacturing p

Plantation p

Telecom p

-1.25%

2.1

534.1

-224.0

12,668.4

% Change

0.09%2.1

-129.69%

15.3

-1.37%

-0.69%

-0.40%

-2.13%

% WoW

ChangeLast Week

-5.44%

-68.20%

-61.47%

-52.14%

310.1

2,178.1

28.2

-18.40%

-18.40%

% WoW

ChangeLast Week

763.5

6.0

-0.24%

-2.44%

0.09%

Today

-107.2

2.1

205.8

15.3

5,674.5

0.27%

2,180.1

2.3

98.6

-12.74%

-12.74%-15.95%

0.00%

4.923.7

238

3,210.8

714.0

5.6

238

623.0

0.09%

-79.02%

88.58%

Week ending

-0.13%

37.12%

4.39%

-0.98%

-0.44%

-0.98%

228

2,201.5

5,730.5

3,224.9

17.3

-0.61%

0.00%

470.1

109.1

361.0

Change %

5,669.5

3,202.2

2.3

0.09% 16.2

Pre Day

12,797.7

15,861.6

1,869.5

3,350.2

468.8

0.26%

2,798.4

1,875.1

0.78%

-0.04%

0.08%

-0.39%

2,792.4

16,252.2

481.6

167.9 170.50.12%168.1

2.3

2,574.1

15,855.5

2,794.6

1,862.2

12,767.0

Pre Day

0.00%

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 27.02.2013

Today

-44.17

604.3 600.4 0.64% 599.8 0.75%

788.2 781.1 0.90% 785.0 0.40%

2,606.8

3,372.5

0.56%

3,359.0

471.4

0.30%2,566.5

5500

5600

5700

5800

5900

Index

ASPI

3140

3160

3180

3200

3220

3240

3260

3280

3300

Index

S&P SL20

0.0

20.0

40.0

60.0

80.0

100.0

120.0

140.0

0

1,000

2,000

3,000

4,000

Volume('mn)

TurnoverLKR('mn)

Turnover Volume

Softlogic Equity Research Page | 2.

-

7/29/2019 Daily Trade Journal -27.02

3/12

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

HNB

COMMERCIAL BANK

DIALOG

SAMPATH

ACCESS ENG SL

Most Active

Close

235.80

766.60

233.00

770.00

147.80

118.50

715.80

9.00

Volume (mn)

2.1%

Turnover

(LKR)

2.1%

154,373,541

45,279,109

24,346,421

126,009,690

46,344,050

1.27

1.16

1.16

0.2% 5,327,863

46,344,050

5.8%

9.00

233.00

20.60

S M B LEASING[NON VOTING] 0.40

FREE LANKA 2.40

% Change

PC HOUSE

RICHARD PIERIS 6.70

1.28

5.09

1.48

6.80

1.40%107.50

5.09

0.202.64%

1.24

0.00%

0.00%

0.00%

2.1%

1.1%

0.2%

Contribution to

Total T/O

8,377,108

0.49%

4.20

3,550,221

495,592

0.47

RENUKA HOLDINGS

SELINSING

Pre Day

-0.07%147.90 7.1%1.04

Volume (mn)% Change

9.09%

+ 2.80 9.93%

147.80

CompanyContribution to

Total T/O

119.60

0.0%

0.4%

Turnover

(LKR)

148.50

363.50

0.23

107.50

57.90

148.50

42.30

45,279.11

69.90

233.00

146.00

42.70

710.00

67.00

799.90

13.20

TodayCompany

148.50

AUTODROME

970.00

355.15

0.97123.34

1,210.83

35.86

46,344.05

5.60

Today

7.14%

Turnover

USD ('000)

24.7011.94%

Intraday

Low (LKR)

Turnover

LKR ('000)

126,009.69

714.40

988.36

0.28

760.00

22,116.12

Intraday

High (LKR)

236.10

8.98

119.50

227.00

117.00

181.00

44.20

8.90

% Change

JOHN KEELLS HOLDINGS 93,859

SAMPATH BANK

ASIAN HOTELS & PROPERTIES 1,802

1.5%

13280

1,950

9.2%

6.6%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOM

COMMERCIAL BANK [V]

4.0%

3.3%BUKIT DARAH

DIALOG AXIATA

HNB [V]

DFCC BANK

CARGILLS

5.85

1,585.00

109.50

1,144.38

0.66

LOLC

AITKEN SPENCE 119.90

2.5% 39.76

84.26

148.00

5.73451.81

0.043.54

440.00

719.00

9.10

1,617.40

109.00

448.901,620.00

154,373.54

5,069.19

3.9%

2.2%

1.3%

50

5,092,995

1,043,118

9,768

4.0%

183.00

60.00

3.4%

181.50

60.00

440.70

3.5%

109.00

0.00%

1.7%

2.2%

Change

- 3.80

- 129.00

- 98.00

- 1.30

% Change

233.50

227.00

20.50

9.00

SWISSTEK

+ 2.90

UDAPUSSELLAWA

69.00

119.60

Volume

173.47

-2.38%

-1.47%

1,161,453

59.79

29.70

976 746.24

1.4%

Change

30.00

Company% of

Mkt Cap

4.10

Today Pre Day

9.00

2.40

0.40

+ 3.20

DISTILLERIES

500

196,481

DIALOG 9.00

Company

27,727

12,147

200

HAYLEYS FIBRE

EQUITY ONE PLC

Company Today

1.5%

NATION LANKA [W 0021]

PC PHARMA 9.80 + 1.30 15.29% HARISCHANDRA 2,050.00 - 350.00 -14.58%

-8.97%

-10.91%

-13.33%

-11.74%

1.50

34.80

31.00

+ 0.10

Softlogic Equity Research Page | 3.

-

7/29/2019 Daily Trade Journal -27.02

4/12

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar Colombo Dockyard PLC

Yuan Union Assurance PLC

Euro Finlay Colombo PLC

Rupee Nations Trust Bank PLC

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

p

p

p

p

q

p

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) p

Crude Oil (WTI) p

ICE Cotton #2 p

CBOT Wheat p

COMEX Gold q

COMEX Silver q

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

00-Jan-00

15-03-2013

18-03-2013

1/0/1900

00-Jan-00

Description

2.10

0.00

0 1/0/1900

01-04-2013

XR Date

01-04-2013

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

09-04-2013

2.00

Time*

USd/bu.

82.79

Price

112.98

92.87

USD/bbl.

102.97

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

EU

192.70

8.00

5.00 07-03-2013

06-03-2013

127.49

0.0034.00

Malaysia

4.16

130.27

20.47

2.36

1.39

41.10

India

Currency

166.37

Indicative Rate

27.02.2013

China

0

Payment DateDPS (LKR) XD Date

6,280.2

Singapore

Switzerland

Thailand

UK

0.25

57.3

0

2,571.9

136.69

1/0/1900

1/0/1900

4.27

USA

01:28

9.1

1/0/1900

Change

0.05%

-144.8

03:01

0

00-Jan-00

09-04-2013

1/0/1900

06:29

06:28

0.14%

06:29

Company

06:26

06:20

06:29

0-Jan

0-Jan

06:20

06:20

Time*

06:28

-0.36%

Change %

0.46%

-0.75%

0.22%

0.25%

-1.27%

0.25%

-0.67%

9.1

Change

1.17%0.96

0

0.23

Change %

357.05

USD/t oz.

USD/t oz. -0.22

714.25

-1.30

29.12

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

11,254.0

Value

13,900.1

1,496.9

USD/bbl.

USd/lb.

USd/lb.

AMERICA

3.25

METALS

ENERGY

Commodity

22,577.0

Units

0

1.7

Proportion

00-Jan-00

00-Jan-00

0.00

0.00

0.84%

0.61%

116.0

Russia

Saudi Arabia

Japan

1,606.20 -10.80

Australia

Softlogic Equity Research Page | 4.

-

7/29/2019 Daily Trade Journal -27.02

5/12

Softlogic Equity Research Page | 5

CSE Announcements

Hayleys MGT Knitting Mills [MGT: LKR10.4]:The company informs thatDr. E.M Fernando will relinquish his position as CEO/Director with effect from

28th

Feb 2013 while Mr. Rohan Goonetilleke will be appointed as Managing

Director with effect from 1st

March 2013.

Disclosure of Related Party Dealings:

Local News

Mixed forecast for Lankan sovereign debt performance: The announcement of the failure to agree on a newfollow-up funding package by the International Monetary Fund (IMF) has led to a slide in investor sentiments

and countrys sovereign bond prices from 1 to 1.25 points, according to a US banking giant. Evaluating the

Lankan macroeconomic environment in the aftermath of IMF engagement failure, JP Morgan asserted that

the impact on the economy was largely psychological at least in the short term. Since the announcement

early last week, Sri Lankas sovereign bond prices have fallen 1-2.5 points and Sri Lankas sovereign Emerging

Markets Bond Index Global (EMBIG) spread has risen 25 basis points while the EMBIG spread has been

basically unchanged, the bank stated. JP Morgan is of the view that the disappointment from the lack of a

follow up program was not because of the financial resources IMF would have brought along. This is because

planned follow up program would most likely to be spread over 1-2 years, unlike a typical Stand-by-

Arrangement which has a longer tenure.

[Source: www.dailymirror.lk]

Sri Lanka state entity listing a 2-3 year process: SEC chief: Listing minority stakes in state entities is a two tothree year process, but there is positive response to the move from the highest levels of the administration,

Securities and Exchange Commission Chairman Nalaka Godahewa said."Sri Lanka Insurance is already in the

pipe line. By 2015 it will come to the market," Godahewa told the LBR-LBO Chief Financial Officers forum

Tuesday. "Before that we need to bring others to the market. Godahewa said the policy of the

administration was not to privatize state entities, but listing minority stakes was not privatization as many

people would own the stock. "We are telling the government that this is not privatization, it is actually

peoplisation," he said. "You are putting out state entity shares to a large base of ordinary people to buy."The good thing is that at senior levels of government, that acceptance is there. Now it is a matter of who

comes first."

[Source: www.lbo.lk]

Sri Lanka Treasuries yields flat: Sri Lanka's Treasuries yields were flat at Wednesday's auction with the 3-months with LKR18.7 bn in bids being accepted from the market after LKR15.0 bn of maturing bills being

offered, the state debt office said.The 3-month yield eased 01 basis point to 9.09%, the 6-month yield was

unchanged at 10.08% and the 12-month yield was also flat at 11.10%. Five year gilts maturing on 01.04.2018

were quoted in the market at around 11.15/20%, up from yesterday's 11.10/15 levels dealers said. Sri

Lanka's risk free yield curve was inverted a few months back. Meanwhile bank deposit rates remains high,with some state banks paying as much as 17% for one year bills. December credit data showed heavy

borrowings by the state from banks, crowding out private borrowers.[Source: www.lbo.lk]

Company Name Relationship Transaction Quantity Price (LKR) Date

United Motors [UML:LKR95.7] Mr. Chanaka Yatawara Director/CEO Purchase 2,000 96.0 26.02.13

Acme Printing & Packaging [ACME:LKR13.0] Mr. J D Peiris Director Purchase 12,199 12.1-12.5 26.02.13

-

7/29/2019 Daily Trade Journal -27.02

6/12

Softlogic Equity Research Page | 6

Sri Lanka's Renuka group buys snack brand: Sri Lanka's Renuka Shaw Wallace [COCO: LKR18.2], a consumergoods firm said it had bought a snack brand for 36 million rupees from Hemas group. The firm said it had

bought the brand names and stock of Mr Pop, Chatters, Taze, Yummee, Rockers and Pik Nik brands from

Hemas Manufacturing (Pvt) Ltd, and Hemas Marketing (Pvt) Ltd. Renuka said Mr Pop had the second largest

brand in the extruded snack market in Sri Lanka.

[Source: www.lbo.lk]

AIA makes LKR927 mn voluntary offer for remaining 7.7% stake: Asian insurance giant AIA yesterdayannounced a voluntary offer worth LKR927 mn to acquire the remaining 7.7% stake in its listed Sri Lankan

entity on the basis of LKR400 per share.The move sent AIA Insurance (formerly Aviva NDB Insurance) share

price rise to an intra-day high of LKR338 before closing at LKR333.40, up by a sizeable LKR38.40. In what was

the biggest deal last year, AIA paid USD108 mn to acquire control of Aviva NDB via the latters holding

company, Aviva NDB Holdings Lanka Ltd. The unconditional voluntary offer was to acquire 2.3178 mn shares

or a 7.7% stake in the listed entity. The highest price paid by AIA as part of its overall was LKR349 per share

on a block of 1.5 mn shares of 5% stake in December. Via the holding company, AIA acquired a 87.3% stake

previously. AIA said in the event the holders of more than 90% of the shares of AIA Insurance accept the

offer, AIA will pay a higher amount of LKR400 per share. The offer will be open for 21 business days. Whilst

the 2012 Annual Report is still pending, as of end 2011 Aviva NDB Insurance had 2,204 shareholders, ofwhich 1,917 had shares between one and 1,000 accounting for a 1.7% stake and a further 254 in the

category of 1001 and 10,000 shares holding a 2.1% stake.

[Source: www.ft.lk]

Global News

US economy shows signs of stronger recovery: The US has registered surprisingly strong economic data,suggesting the recovery may be gathering steam. New home sales, a lead component of past recoveries,

surged 16% in January to the highest rate since July 2008. The Conference Board index of consumer attitudes

rebounded to 69.6 in February - the highest since November - from an upwardly revised 58.6 in January. It

suggested Americans had recovered from the shock of a sharp rise in payroll taxes over the New Year.Markets had been rattled a month ago by the size of the knock to consumer sentiment from the tax rise,

which came as part of a deal between Democrats and Republicans to avert the much bigger round of

automatic tax rises and spending cuts dubbed the fiscal cliff.

[Source: www.bbc.co.uk]

Hong Kong to see higher growth amid signs of recovery: Hong Kong's government said it will look to boostgrowth and employment after the territory expanded at its slowest pace since 2009. Financial Secretary,

John Tsang, unveiled relief measures as part of his budget proposal for the 2013-2014 year. He added that

he expects the economy to grow by 1.5% to 3.5% in 2013. Hong Kong, and the rest of Asia, saw global

demand fall during Europe's debt crisis, although there have recently been some signs of recovery. Hong

Kong saw growth slow to 1.4% in 2012 compared to the previous year, lower than the average over the past10 years according to Mr Tsang. He warned of risk factors in the global economy that could weigh on Hong

Kong's open economy including a trade slowdown and possible currency war. "The intricate external

environment will remain unstable in the year ahead," he said.[Source: www.bbc.co.uk]

Italy faces deadlock, uncertainty after divided vote: Italy faces a period of uncertainty and political horsetrading Tuesday after parliamentary elections left no party in a clear position to form a government. The

center-left coalition headed by Pier Luigi Bersani won by a narrow margin in Italy's lower house of

parliament, according to final figures released by the Interior Ministry. But Bersani's coalition, with 29.54%

of the vote, finished less than half a percentage point ahead of the anti-austerity center-right coalition

headed by controversial three-time Prime Minister Silvio Berlusconi, which garnered 29.18%. It was a similarstory in Italy's upper house, where the lack of a clear majority means that no one has a firm enough mandate

to govern the country.

[Source: www.cnn.com]

-

7/29/2019 Daily Trade Journal -27.02

7/12

Softlogic Equity Research Page | 7

Daily Stock Movements

Ticker Counter Open High Low Close Trades Volume Turnover

AAF -N-0000 ASIA ASSET 2.30 2.40 2.30 2.40 4 1,798 4,142

AAIC-N-0000 ASIAN ALLIANCE 80.20 84.00 80.00 83.00 36 15,982 1,302,575

ABAN-N-0000 ABANS 93.10 95.00 93.00 93.30 9 1,650 153,782ACAP-N-0000 ASIA CAPITAL 27.20 27.20 26.10 27.00 4 301 8,146

ACL -N-0000 ACL 64.10 64.10 64.10 64.10 1 1 64

ACME-N-0000 ACME 12.20 12.40 12.20 12.20 38 21,601 264,278

AEL -N-0000 ACCESS ENG SL 20.50 21.00 20.50 20.60 57 1,161,303 24,346,421

AFSL-N-0000 ABANS FINANCIAL 30.00 30.00 30.00 30.00 1 22 660

AGAL-N-0000 AGALAWATTE 33.00 33.10 31.50 32.90 3 11 362

AGST-N-0000 AGSTARFERTILIZER 5.60 5.60 5.60 5.60 5 5,136 28,762

AGST-X-0000 AGSTARFERTILIZER[NON VOTING] 0.00 0.00 0.00 15.00 0 0 0

AHPL-N-0000 AHOT PROPERTIES 69.90 69.90 67.00 69.00 6 1,802 123,337

AHUN-N-0000 A.SPEN.HOT.HOLD. 76.00 76.90 75.00 76.00 14 14,003 1,064,220

ALLI-N-0000 ALLIANCE 770.00 775.00 755.00 771.30 20 984 758,896

ALUF-N-0000 ALUFAB 18.90 18.90 18.00 18.10 20 7,556 137,021

AMCL-N-0000 CAPITAL LEASING 0.00 0.00 0.00 22.40 0 0 0

AMF -N-0000 AMF CO LTD 351.00 360.00 326.00 350.00 8 19 6,650

AMSL-N-0000 ASIRI SURG 8.90 8.90 8.90 8.90 4 19,440 173,016

APLA-N-0000 ACL PLASTICS 0.00 0.00 0.00 90.10 0 0 0

ARPI-N-0000 ARPICO 80.30 80.30 80.30 80.30 1 1 80

ASCO-N-0000 ASCOT HOLDINGS 136.30 136.30 136.30 136.30 1 1 136

ASHA-N-0000 ASIRI CENTRAL 0.00 0.00 0.00 274.90 0 0 0

ASHO-N-0000 LANKA ASHOK 1675.00 1675.00 1650.40 1650.40 9 98 161,863

ASIR-N-0000 ASIRI 10.90 11.80 10.90 11.80 6 2,499 29,397

ASIY-N-0000 ASIA SIYAKA 3.00 3.20 2.90 3.00 11 27,840 84,520

ASPH-N-0000 INDUSTRIAL ASPH. 200.00 203.50 190.00 190.00 3 7 1,394

ATL -N-0000 AMANA TAKAFUL 1.50 1.50 1.40 1.50 27 285,257 423,327

AUTO-N-0000 AUTODROME 600.30 799.90 600.30 799.90 3 4 3,000

BALA-N-0000 BALANGODA 35.50 37.70 35.00 36.30 16 34,168 1,202,764

BBH -N-0000 BROWNS BEACH 17.80 17.80 17.30 17.30 24 22,165 384,412

BERU-N-0000 BERUWALA RESORTS 2.20 2.30 2.20 2.30 9 11,617 25,617

BFL -N-0000 BAIRAHA FARMS 126.00 130.00 125.00 128.60 14 2,559 329,582

BIL -N-0000 BROWNS INVSTMNTS 3.50 3.60 3.40 3.50 46 145,469 508,391

BINN-N-0000 BERUWELA WALKINN 65.30 70.00 65.30 70.00 2 206 14,392

BLI -N-0000 BIMPUTH FINANCE 14.70 16.40 14.10 15.40 16 6,819 104,412

BLUE-N-0000 BLUE DIAMONDS 3.40 3.50 3.30 3.40 24 63,277 216,243

BLUE-X-0000 BLUE DIAMONDS[NON VOTING] 1.50 1.70 1.50 1.60 24 269,540 430,495

BOGA-N-0000 BOGALA GRAPHITE 22.50 22.50 21.50 22.50 5 478 10,681

BOPL-N-0000 BOGAWANTALAWA 12.30 12.30 12.30 12.30 1 167 2,054

BREW-N-0000 CEYLON BEVERAGE 0.00 0.00 0.00 469.50 0 0 0

BRWN-N-0000 BROWNS 110.00 110.50 109.40 109.70 23 4,516 497,046

BUKI-N-0000 BUKIT DARAH 719.00 719.00 710.00 715.80 7 50 35,855

CABO-N-0000 CARGO BOAT 85.00 93.20 76.00 84.10 8 5,116 390,273

CALF-N-0000 CAL FINANCE 17.00 17.00 15.70 16.90 3 52 871

CARE-N-0000 PRINTCARE PLC 0.00 0.00 0.00 26.50 0 0 0

CARG-N-0000 CARGILLS 148.50 148.50 148.50 148.50 1 200 29,700

CARS-N-0000 CARSONS 440.00 448.90 440.00 440.70 2 13 5,729

CCS -N-0000 COLD STORES 0.00 0.00 0.00 127.30 0 0 0

CDB -N-0000 CDB 40.10 40.10 39.50 39.60 4 2,920 115,622CDB -X-0000 CDB[NON VOTING] 29.00 29.00 28.60 28.60 7 2,347 67,556

CDIC-N-0000 N D B CAPITAL 499.90 499.90 490.00 490.00 8 484 237,200

CERA-N-0000 LANKA CERAMIC 63.60 63.60 63.60 63.60 1 1 64

CFI -N-0000 CFI 94.00 96.00 91.10 96.00 4 2,815 263,586

CFIN-N-0000 CENTRAL FINANCE 180.10 180.10 180.00 180.10 7 10,237 1,843,660

CFL -N-0000 CHILAW FINANCE 12.40 13.00 12.00 12.50 6 1,554 18,855

CFLB-N-0000 FORT LAND 29.70 29.70 29.50 29.50 8 3,700 109,420

CFT -N-0000 CFT 5.20 5.40 5.20 5.20 9 18,141 94,655

CFVF-N-0000 FIRST CAPITAL 11.60 11.80 11.60 11.70 7 22,906 267,980

CHL -N-0000 DURDANS 0.00 0.00 0.00 105.00 0 0 0

CHL -X-0000 DURDANS[NON VOTING] 72.10 72.10 72.00 72.00 2 3,680 265,028

CHMX-N-0000 CHEMANEX 0.00 0.00 0.00 72.00 0 0 0

CHOT-N-0000 HOTELS CORP. 18.30 18.30 17.50 17.90 31 23,844 426,229

CHOU-N-0000 CITY HOUSING 12.10 12.20 11.70 11.80 26 10,521 124,778

CIC -N-0000 CIC 60.10 62.50 60.10 62.50 5 20,505 1,232,363CIC -X-0000 CIC[NON VOTING] 50.20 50.20 50.20 50.20 1 1,790 89,858

CIFL-N-0000 CIFL 3.30 3.30 3.20 3.30 107 645,282 2,127,667

CIND-N-0000 CENTRAL IND. 65.20 65.20 64.00 64.00 4 1,000 64,017

CINS-N-0000 CEYLINCO INS. 821.00 960.00 821.00 958.50 8 1,001 959,285

CINS-X-0000 CEYLINCO INS.[NON VOTING] 312.00 312.00 312.00 312.00 2 100 31,200

-

7/29/2019 Daily Trade Journal -27.02

8/12

Softlogic Equity Research Page | 8

Ticker Counter Open High Low Close Trades Volume Turnover

CINV-N-0000 CEYLON INV. 0.00 0.00 0.00 83.00 0 0 0

CIT -N-0000 CIT 102.00 102.00 102.00 102.00 1 5 510

CITH-N-0000 CITRUS HIKKADUWA 0.00 0.00 0.00 19.10 0 0 0

CITK-N-0000 CITRUS KALPITIYA 6.00 6.00 5.80 5.80 27 233,943 1,359,411

CITW-N-0000 CITRUS WASKADUWA 6.00 6.00 5.50 5.50 9 44,810 250,420

CLC -N-0000 COMM LEASE & FIN 3.90 4.00 3.90 4.00 8 120,799 483,166

CLND-N-0000 COLOMBO LAND 31.30 32.50 31.30 32.10 50 50,631 1,620,533

CLPL-N-0000 CEYLON LEATHER 68.50 68.50 68.00 68.40 3 30 2,053

CLPL-W-0012 CEYLON LEATHER[WARRANTS] 0.00 0.00 0.00 1.80 0 0 0

CLPL-W-0013 CEYLON LEATHER[WARRANTS] 0.00 0.00 0.00 4.20 0 0 0

CLPL-W-0014 CEYLON LEATHER[WARRANTS] 4.50 4.50 4.50 4.50 1 1 5

COCO-N-0000 RENUKA SHAW 18.90 18.90 18.20 18.20 2 21 383

COCO-X-0000 RENUKA SHAW[NON VOTING] 13.00 13.00 13.00 13.00 1 20 260

COCR-N-0000 COM.CREDIT 13.50 13.50 12.50 12.70 11 2,506 31,945

COLO-N-0000 COLONIAL MTR 92.60 92.80 90.00 90.00 5 225 20,810

COMB-N-0000 COMMERCIAL BANK 107.50 109.50 107.50 109.00 172 1,161,453 126,009,690

COMB-P-0005 COMMERCIAL BANK 0.00 0.00 0.00 9.00 0 0 0

COMB-X-0000 COMMERCIAL BANK[NON VOTING] 90.00 92.00 90.00 91.00 28 4,767 432,377

COMD-N-0000 COMMERCIAL DEV. 0.00 0.00 0.00 61.20 0 0 0

CONN-N-0000 AMAYA LEISURE 0.00 0.00 0.00 77.50 0 0 0

CPRT-N-0000 CEYLON PRINTERS 0.00 0.00 0.00 1280.00 0 0 0

CRL -N-0000 SOFTLOGIC FIN 25.00 25.00 25.00 25.00 1 10 250

CSD -N-0000 SEYLAN DEVTS 8.50 8.80 8.50 8.50 11 15,583 132,456

CSEC-N-0000 DUNAMIS CAPITAL 11.30 11.30 11.30 11.30 3 175 1,978

CSF -N-0000 NATION LANKA 8.60 9.00 8.60 8.80 73 173,490 1,525,041

CSF -W-0021 NATION LANKA[WARRANTS] 1.50 1.60 1.40 1.50 50 265,585 398,093

CTBL-N-0000 CEYLON TEA BRKRS 4.70 4.90 4.70 4.70 13 21,536 102,361

CTC -N-0000 CEYLON TOBACCO 770.00 770.00 760.00 766.60 18 976 746,240

CTCE-N-0000 A I A INSURANCE 350.00 372.00 342.00 345.10 87 14,796 5,150,593

CTEA-N-0000 TEA SERVICES 647.00 647.00 645.20 646.10 2 2 1,292

CTHR-N-0000 C T HOLDINGS 135.00 135.00 135.00 135.00 2 9,000 1,215,000

CTLD-N-0000 C T LAND 24.50 26.00 24.50 25.50 6 784 19,660

CWM -N-0000 C.W.MACKIE 69.80 69.80 69.80 69.80 1 100 6,980

DFCC-N-0000 DFCC BANK 119.50 119.60 119.50 119.60 4 500 59,790

DIAL-N-0000 DIALOG 9.00 9.10 8.90 9.00 21 5,092,995 46,344,050

DIMO-N-0000 DIMO 575.00 575.00 547.00 547.80 26 403 222,072

DIPD-N-0000 DIPPED PRODUCTS 0.00 0.00 0.00 110.00 0 0 0

DIST-N-0000 DISTILLERIES 182.90 183.00 181.00 181.50 10 27,727 5,069,187DOCK-N-0000 DOCKYARD 225.50 225.90 225.50 225.90 4 1,443 325,800

DPL -N-0000 DANKOTUWA PORCEL 13.60 14.40 13.60 14.00 84 81,044 1,141,848

EAST-N-0000 EAST WEST 12.90 13.60 12.90 13.10 19 15,816 209,876

EBCR-N-0000 E B CREASY 925.70 925.70 925.70 925.70 1 1 926

ECL -N-0000 E - CHANNELLING 6.90 7.00 6.90 7.00 22 633,420 4,427,984

EDEN-N-0000 EDEN HOTEL LANKA 34.40 34.50 34.20 34.30 7 2,000 68,747

ELPL-N-0000 ELPITIYA 17.20 17.20 16.80 17.10 9 3,400 58,240

EMER-N-0000 EASTERN MERCHANT 9.00 9.20 8.80 9.00 14 41,672 375,556

EQIT-N-0000 EQUITY 30.00 30.00 30.00 30.00 1 100 3,000

ESL -N-0000 ENTRUST SEC 18.40 18.40 18.40 18.40 1 500 9,200

ETWO-N-0000 EQUITY TWO PLC 25.00 25.00 25.00 25.00 1 2 50

EXPO-N-0000 EXPOLANKA 6.90 7.00 6.80 6.80 29 88,206 601,961

FLCH-N-0000 FREE LANKA 2.40 2.50 2.40 2.40 60 1,479,242 3,550,221

GEST-N-0000 GESTETNER 176.90 176.90 176.80 176.80 3 100 17,682

GHLL-N-0000 GALADARI 12.00 12.50 12.00 12.30 17 2,083 25,038GLAS-N-0000 PIRAMAL GLASS 6.20 6.20 6.10 6.20 35 378,700 2,347,580

GOOD-N-0000 GOOD HOPE 0.00 0.00 0.00 1300.00 0 0 0

GRAN-N-0000 GRAIN ELEVATORS 46.20 49.00 46.20 47.50 24 4,761 225,993

GREG-N-0000 ENVI. RESOURCES 15.20 15.40 14.90 15.30 89 237,162 3,585,747

GREG-P-0002 ENVI. RESOURCES 0.00 0.00 0.00 0.00 0 0 0

GREG-W-0002 ENVI. RESOURCES[WARRANTS] 0.00 0.00 0.00 2.90 0 0 0

GREG-W-0003 ENVI. RESOURCES[WARRANTS] 2.20 2.30 2.10 2.10 30 79,749 177,012

GREG-W-0006 ENVI. RESOURCES[WARRANTS] 3.00 3.10 3.00 3.10 36 68,500 209,237

GSF -N-0000 G S FINANCE 0.00 0.00 0.00 650.00 0 0 0

GUAR-N-0000 CEYLON GUARDIAN 162.90 168.90 162.70 162.70 11 3,950 644,753

HAPU-N-0000 HAPUGASTENNE 38.80 38.80 38.80 38.80 2 100 3,880

HARI-N-0000 HARISCHANDRA 2050.00 2050.00 2050.00 2050.00 1 1 2,050

HASU-N-0000 HNB ASSURANCE 52.00 52.00 52.00 52.00 3 126 6,552

HAYC-N-0000 HAYCARB 170.10 170.10 170.10 170.10 2 120 20,412

HAYL-N-0000 HAYLEYS 296.00 296.00 296.00 296.00 4 173 51,208HDEV-N-0000 HOTEL DEVELOPERS 0.00 0.00 0.00 94.80 0 0 0

HDFC-N-0000 HDFC 45.50 45.50 45.00 45.00 15 896 40,393

HEXP-N-0000 HAYLEYS FIBRE 31.70 31.70 31.00 31.00 2 3 94

HHL -N-0000 HEMAS HOLDINGS 27.80 28.00 27.50 27.60 34 34,818 960,717

HNB -N-0000 HNB 148.00 148.00 146.00 147.80 42 1,043,118 154,373,541

HNB -X-0000 HNB[NON VOTING] 117.30 117.30 116.80 117.00 38 31,524 3,688,175

-

7/29/2019 Daily Trade Journal -27.02

9/12

Softlogic Equity Research Page | 9

Ticker Counter Open High Low Close Trades Volume Turnover

HOPL-N-0000 HORANA 26.10 27.00 26.10 26.50 16 32,187 847,356

HPFL-N-0000 HYDRO POWER 5.80 5.80 5.80 5.80 1 1,000 5,800

HPWR-N-0000 HEMAS POWER 20.70 21.70 20.70 21.70 2 27 561

HSIG-N-0000 HOTEL SIGIRIYA 77.60 78.10 76.10 78.10 5 2,505 195,593

HUEJ-N-0000 HUEJAY 0.00 0.00 0.00 68.60 0 0 0

HUNA-N-0000 HUNAS FALLS 0.00 0.00 0.00 59.00 0 0 0

HUNT-N-0000 HUNTERS 281.50 294.00 281.50 294.00 2 6 1,702

HVA -N-0000 HVA FOODS 11.30 11.70 11.30 11.50 80 95,324 1,101,502

IDL -N-0000 INFRASTRUCTURE 0.00 0.00 0.00 150.50 0 0 0

INDO-N-0000 INDO MALAY 0.00 0.00 0.00 1350.00 0 0 0

JFIN-N-0000 FINLAYS COLOMBO 0.00 0.00 0.00 309.00 0 0 0

JINS-N-0000 JANASHAKTHI INS. 10.50 10.90 10.50 10.70 8 5,889 63,015

JKH -N-0000 JKH 234.50 236.10 233.00 235.80 57 93,859 22,116,120

JKL -N-0000 JOHN KEELLS 63.70 63.70 63.50 63.60 2 15 954

KAHA-N-0000 KAHAWATTE 31.50 33.30 31.00 33.20 4 293 9,482

KAPI-N-0000 MTD WALKERS 21.10 22.50 21.00 21.20 24 32,040 678,358

KCAB-N-0000 KELANI CABLES 0.00 0.00 0.00 65.50 0 0 0

KDL -N-0000 KELSEY 14.30 14.30 14.20 14.20 3 647 9,199

KFP -N-0000 KEELLS FOOD 67.00 67.00 67.00 67.00 3 499 33,433

KGAL-N-0000 KEGALLE 108.00 112.00 108.00 111.90 41 208,680 23,347,127

KHC -N-0000 KANDY HOTELS 9.20 9.40 9.00 9.10 12 10,040 91,715

KHC -P-0002 KANDY HOTELS 0.00 0.00 0.00 0.00 0 0 0

KHL -N-0000 KEELLS HOTELS 13.30 13.40 13.30 13.30 16 240,882 3,224,151

KOTA-N-0000 KOTAGALA 53.90 54.90 53.90 54.90 6 12,700 696,560

KURU-N-0000 KURUWITA TEXTILE 21.50 21.50 21.50 21.50 1 1,000 21,500

KVAL-N-0000 KELANI VALLEY 83.50 86.00 83.50 84.20 4 700 58,929

KZOO-N-0000 KALAMAZOO 1810.00 2000.00 1810.00 2000.00 3 13 25,810

LALU-N-0000 LANKA ALUMINIUM 30.00 30.00 30.00 30.00 7 2,002 60,060

LAMB-N-0000 KOTMALE HOLDINGS 34.10 34.10 34.00 34.10 7 4,488 152,802

LCEM-N-0000 LANKA CEMENT 8.20 8.30 8.20 8.30 5 16,794 138,211

LCEY-N-0000 LANKEM CEYLON 0.00 0.00 0.00 154.00 0 0 0

LDEV-N-0000 LANKEM DEV. 6.30 6.30 6.00 6.10 25 44,300 270,300

LFIN-N-0000 LB FINANCE 144.90 147.00 140.00 146.60 15 3,432 500,573

LGL -N-0000 LAUGFS GAS 24.30 24.70 24.10 24.50 13 3,903 95,174

LGL -X-0000 LAUGFS GAS[NON VOTING] 17.10 17.20 17.00 17.00 36 95,900 1,630,363

LHCL-N-0000 LANKA HOSPITALS 36.40 37.50 36.00 36.80 37 25,564 937,110

LHL -N-0000 LIGHTHOUSE HOTEL 0.00 0.00 0.00 42.30 0 0 0

LIOC-N-0000 LANKA IOC 21.10 21.50 21.10 21.20 13 16,500 349,988LION-N-0000 LION BREWERY 318.00 322.00 318.00 322.00 8 1,277 410,288

LITE-N-0000 LAXAPANA 5.10 5.10 4.70 5.10 50 163,200 803,695

LLUB-N-0000 CHEVRON 213.00 217.00 213.00 215.50 27 95,465 20,692,909

LMF -N-0000 LMF 0.00 0.00 0.00 108.00 0 0 0

LOFC-N-0000 LANKAORIXFINANCE 3.40 3.40 3.30 3.30 30 87,361 288,301

LOLC-N-0000 LOLC 57.90 60.00 57.90 60.00 12 12,147 714,402

LPRT-N-0000 LAKE HOUSE PRIN. 0.00 0.00 0.00 103.00 0 0 0

LVEN-N-0000 LANKA VENTURES 32.00 32.00 32.00 32.00 3 10,000 320,000

LWL -N-0000 LANKA WALLTILE 56.00 56.00 55.00 55.50 10 48,895 2,690,254

MADU-N-0000 MADULSIMA 12.40 12.40 12.30 12.30 4 1,114 13,703

MAL -N-0000 MALWATTE 4.60 4.70 4.50 4.60 16 44,421 202,915

MAL -X-0000 MALWATTE[NON VOTING] 4.50 4.50 4.50 4.50 1 1 5

MARA-N-0000 MARAWILA RESORTS 6.10 6.40 6.10 6.30 4 1,112 6,816

MASK-N-0000 MASKELIYA 12.60 12.60 12.60 12.60 2 105 1,323

MBSL-N-0000 MERCHANT BANK 17.70 18.00 17.00 17.10 45 23,300 402,489MEL -N-0000 MACKWOODS ENERGY 11.30 11.90 11.20 11.20 5 1,396 15,656

MERC-N-0000 MERCANTILE INV 0.00 0.00 0.00 2200.00 0 0 0

MFL -N-0000 MULTI FINANCE 26.00 26.00 26.00 26.00 1 2 52

MGT -N-0000 HAYLEYS - MGT 10.40 10.40 10.40 10.40 1 1 10

MIRA-N-0000 MIRAMAR 0.00 0.00 0.00 71.40 0 0 0

MORI-N-0000 MORISONS 170.00 170.00 170.00 170.00 13 16,457 2,797,690

MORI-X-0000 MORISONS[NON VOTING] 0.00 0.00 0.00 99.00 0 0 0

MPRH-N-0000 MET. RES. HOL. 22.00 22.00 22.00 22.00 1 100 2,200

MRH -N-0000 MAHAWELI REACH 20.00 20.00 18.10 19.40 10 1,987 38,815

MSL -N-0000 MERC. SHIPPING 0.00 0.00 0.00 149.90 0 0 0

MULL-N-0000 MULLERS 1.50 1.50 1.50 1.50 7 71,250 106,875

NAMU-N-0000 NAMUNUKULA 72.20 75.00 72.00 75.00 11 1,564 115,683

NAVF-U-0000 NAMAL ACUITY VF 63.50 64.00 63.00 63.70 10 1,307 82,950

NDB -N-0000 NAT. DEV. BANK 145.00 145.50 145.00 145.00 99 70,118 10,171,876

NEH -N-0000 NUWARA ELIYA 1221.00 1250.00 1221.00 1250.00 2 6 7,471NEST-N-0000 NESTLE 1616.10 1620.00 1585.00 1617.40 10 280 451,810

NHL -N-0000 NAWALOKA 3.00 3.00 2.90 3.00 12 41,247 123,741

NIFL-N-0000 NANDA FINANCE 0.00 0.00 0.00 6.10 0 0 0

NTB -N-0000 NATIONS TRUST 59.00 60.00 59.00 59.90 33 24,957 1,489,885

ODEL-N-0000 ODEL PLC 22.20 23.00 22.20 23.00 32 55,276 1,250,961

OFEQ-N-0000 OFFICE EQUIPMENT 0.00 0.00 0.00 2000.00 0 0 0

-

7/29/2019 Daily Trade Journal -27.02

10/12

Softlogic Equity Research Page | 10

Ticker Counter Open High Low Close Trades Volume Turnover

OGL -N-0000 ORIENT GARMENTS 9.10 9.20 8.50 8.60 18 21,171 183,201

ONAL-N-0000 ON'ALLY 0.00 0.00 0.00 52.00 0 0 0

ORIN-N-0000 ORIENT FINANCE 0.00 0.00 0.00 13.80 0 0 0

OSEA-N-0000 OVERSEAS REALTY 14.00 14.00 14.00 14.00 5 11,300 158,200

PABC-N-0000 PAN ASIA 17.50 17.60 17.50 17.60 17 8,641 151,678

PALM-N-0000 PALM GARDEN HOTL 105.10 105.10 105.10 105.10 1 1 105

PAP -N-0000 PANASIAN POWER 2.70 2.80 2.70 2.70 34 398,467 1,076,571

PARA-N-0000 PARAGON 0.00 0.00 0.00 900.00 0 0 0

PARQ-N-0000 SWISSTEK 13.00 13.90 13.00 13.20 16 14,250 185,607

PCH -N-0000 PC HOUSE 4.20 4.30 4.10 4.10 49 1,269,532 5,327,863

PCHH-N-0000 PCH HOLDINGS 6.90 9.00 6.90 7.00 11 20,769 145,446

PCP -N-0000 PC PHARMA 9.60 10.30 9.60 9.80 3 939 9,232

PDL -N-0000 PDL 43.00 43.00 42.60 42.70 3 35 1,500

PEG -N-0000 PEGASUS HOTELS 0.00 0.00 0.00 41.80 0 0 0

PHAR-N-0000 COL PHARMACY 460.00 465.00 450.30 454.30 13 575 261,307

PLC -N-0000 PEOPLES LEASING 13.90 13.90 12.90 13.40 39 137,527 1,811,742

PMB -N-0000 PEOPLE'S MERCH 13.30 13.30 13.00 13.00 9 5,601 72,838

RAL -N-0000 RENUKA AGRI 4.30 4.40 4.30 4.30 6 9,311 40,237

RCL -N-0000 ROYAL CERAMIC 99.00 100.00 98.00 98.00 10 61,150 6,053,980

REEF-N-0000 CITRUS LEISURE 20.90 20.90 19.80 20.00 67 66,441 1,329,633

REEF-W-0017 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 32.90 0 0 0

REEF-W-0018 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0

REEF-W-0019 CITRUS LEISURE[WARRANTS] 2.90 2.90 2.70 2.70 32 30,211 83,582

REG -N-0000 REGNIS 61.90 64.20 61.00 63.90 49 45,663 2,848,248

RENU-N-0000 RENUKA CITY HOT. 229.00 229.00 229.00 229.00 2 20 4,580

REXP-N-0000 RICH PIERIS EXP 30.00 32.50 30.00 30.10 2 52 1,565

RFL -N-0000 RAMBODA FALLS 14.90 15.50 14.20 14.30 12 16,900 241,389

RGEM-N-0000 RADIANT GEMS 45.00 46.00 45.00 45.90 4 1,160 52,342

RHL -N-0000 RENUKA HOLDINGS 31.40 34.80 31.40 34.80 7 2,129 69,799

RHL -X-0000 RENUKA HOLDINGS[NON VOTING] 0.00 0.00 0.00 22.50 0 0 0

RHTL-N-0000 FORTRESS RESORTS 14.30 14.80 14.30 14.30 8 5,488 78,578

RICH-N-0000 RICHARD PIERIS 6.80 6.80 6.70 6.70 60 1,235,110 8,377,108

RPBH-N-0000 ROYAL PALMS 37.00 37.00 37.00 37.00 6 22,019 814,703

RWSL-N-0000 RAIGAM SALTERNS 2.60 2.60 2.40 2.40 4 10,001 24,003

SAMP-N-0000 SAMPATH 227.00 233.50 227.00 233.00 119 196,481 45,279,109

SCAP-N-0000 SOFTLOGIC CAP 5.70 5.70 5.70 5.70 1 500 2,850

SDB -N-0000 SANASA DEV. BANK 64.30 65.00 64.10 64.40 27 2,784 179,621

SELI-N-0000 SELINSING 970.00 970.00 970.00 970.00 1 1 970SEMB-N-0000 S M B LEASING 0.80 0.90 0.80 0.80 36 547,323 447,868

SEMB-W-0015 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.70 0 0 0

SEMB-W-0016 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0

SEMB-X-0000 S M B LEASING[NON VOTING] 0.40 0.40 0.30 0.40 34 1,276,480 495,592

SERV-N-0000 HOTEL SERVICES 14.10 14.50 14.10 14.40 7 2,012 28,720

SEYB-N-0000 SEYLAN BANK 60.00 60.00 59.00 59.50 17 20,238 1,199,667

SEYB-X-0000 SEYLAN BANK[NON VOTING] 35.00 35.50 34.80 35.50 52 538,091 19,084,191

SFCL-N-0000 SENKADAGALA 0.00 0.00 0.00 50.00 0 0 0

SFIN-N-0000 SINGER FINANCE 12.20 12.30 12.20 12.20 23 12,780 156,114

SFL -N-0000 SINHAPUTHRA FIN 0.00 0.00 0.00 73.10 0 0 0

SFS -N-0000 SWARNAMAHAL FIN 3.40 3.40 3.30 3.30 39 204,567 675,093

SHAL-N-0000 SHALIMAR 835.00 835.00 835.00 835.00 1 1 835

SHAW-N-0000 LEE HEDGES 253.00 253.00 250.00 250.40 3 500 125,210

SHL -N-0000 SOFTLOGIC 11.40 11.50 11.20 11.30 42 43,710 494,759

SHOT-N-0000 SERENDIB HOTELS 22.60 22.60 22.60 22.60 1 2,000 45,200SHOT-X-0000 SERENDIB HOTELS[NON VOTING] 16.00 18.00 16.00 17.70 8 4,549 80,610

SIGV-N-0000 SIGIRIYA VILLAGE 0.00 0.00 0.00 60.10 0 0 0

SIL -N-0000 SAMSON INTERNAT. 91.90 91.90 91.90 91.90 1 10 919

SING-N-0000 SINGALANKA 62.00 62.50 62.00 62.20 4 372 23,150

SINI-N-0000 SINGER IND. 127.50 127.50 125.00 125.30 5 785 98,358

SINS-N-0000 SINGER SRI LANKA 100.00 100.00 100.00 100.00 12 23,894 2,389,400

SIRA-N-0000 SIERRA CABL 2.10 2.20 2.10 2.20 32 259,250 549,445

SLND-N-0000 SERENDIB LAND 1400.00 1400.00 1301.00 1350.50 2 2 2,701

SLTL-N-0000 SLT 44.20 44.20 42.30 42.70 8 1,950 84,255

SMLL-N-0000 PEOPLE'S FIN 38.50 38.80 37.70 37.80 22 12,247 463,662

SMLL-W-0020 PEOPLE'S FIN[WARRANTS] 0.00 0.00 0.00 3.70 0 0 0

SMOT-N-0000 SATHOSA MOTORS 0.00 0.00 0.00 230.00 0 0 0

SOY -N-0000 CONVENIENCE FOOD 129.90 129.90 127.00 127.00 3 1,002 128,704

SPEN-N-0000 AITKEN SPENCE 119.90 119.90 117.00 118.50 7 9,768 1,144,382

STAF-N-0000 DOLPHIN HOTELS 32.30 32.30 32.30 32.30 1 100 3,230SUGA-N-0000 PELWATTE 0.00 0.00 0.00 23.50 0 0 0

SUN -N-0000 SUNSHINE HOLDING 27.00 27.00 26.00 26.40 7 3,330 87,883

SWAD-N-0000 SWADESHI 0.00 0.00 0.00 8200.00 0 0 0

TAFL-N-0000 THREE ACRE FARMS 40.00 41.20 40.00 40.00 21 4,913 196,524

TAJ -N-0000 TAJ LANKA 26.00 27.30 26.00 26.00 24 35,564 929,953

TANG-N-0000 TANGERINE 0.00 0.00 0.00 75.00 0 0 0

-

7/29/2019 Daily Trade Journal -27.02

11/12

Softlogic Equity Research Page | 11

Ticker Counter Open High Low Close Trades Volume Turnover

TAP -N-0000 TAPROBANE 0.00 0.00 0.00 4.10 0 0 0

TESS-N-0000 TESS AGRO 2.20 2.30 2.20 2.20 44 271,528 597,612

TFC -N-0000 THE FINANCE CO. 13.60 14.70 12.00 14.00 30 19,750 256,140

TFC -X-0000 THE FINANCE CO.[NON VOTING] 4.80 4.80 4.60 4.60 20 60,527 281,811

TFIL-N-0000 TRADE FINANCE 11.70 11.90 11.50 11.70 9 18,877 219,230

TILE-N-0000 LANKA FLOORTILES 66.00 66.00 66.00 66.00 2 15 990

TJL -N-0000 TEXTURED JERSEY 9.10 9.20 9.00 9.10 46 170,853 1,554,182

TKYO-N-0000 TOKYO CEMENT 24.60 25.00 24.50 24.50 15 13,454 329,748

TKYO-X-0000 TOKYO CEMENT[NON VOTING] 18.00 18.00 17.80 18.00 10 2,644 47,492

TPL -N-0000 TALAWAKELLE 25.00 25.00 24.50 24.50 4 1,508 37,696

TRAN-N-0000 TRANS ASIA 67.20 74.90 67.20 74.90 2 108 8,028

TSML-N-0000 TEA SMALLHOLDER 0.00 0.00 0.00 40.60 0 0 0

TWOD-N-0000 TOUCHWOOD 5.50 5.70 5.50 5.50 86 186,360 1,036,461

TYRE-N-0000 KELANI TYRES 31.20 31.90 31.20 31.90 6 1,487 46,396

UAL -N-0000 UNION ASSURANCE 86.90 94.00 86.90 92.00 11 6,209 576,453

UBC -N-0000 UNION BANK 15.30 15.50 15.30 15.40 18 13,201 202,045

UCAR-N-0000 UNION CHEMICALS 450.00 450.00 450.00 450.00 1 1 450

UDPL-N-0000 UDAPUSSELLAWA 24.70 25.00 24.50 24.70 4 175 4,330

UML -N-0000 UNITED MOTORS 95.60 96.50 95.50 95.70 15 11,431 1,094,175

VANI-N-0000 VANIK INCORP LTD 0.00 0.00 0.00 0.80 0 0 0

VANI-X-0000 VANIK INCORP LTD[NON VOTING] 0.00 0.00 0.00 0.80 0 0 0

VFIN-N-0000 VALLIBEL FINANCE 29.70 29.70 29.20 29.50 15 2,900 85,550

VLL -N-0000 VIDULLANKA 3.40 3.50 3.40 3.40 20 43,570 149,148

VONE-N-0000 VALLIBEL ONE 16.00 16.10 15.70 15.90 58 82,842 1,319,742

VPEL-N-0000 VALLIBEL 5.90 5.90 5.80 5.80 5 19,400 112,660

WAPO-N-0000 GUARDIAN CAPITAL 38.50 40.90 38.50 39.00 60 27,425 1,069,082

WATA-N-0000 WATAWALA 11.80 11.90 11.50 11.50 22 22,830 262,844

YORK-N-0000 YORK ARCADE 14.30 14.50 14.30 14.50 14 13,600 195,850

-

7/29/2019 Daily Trade Journal -27.02

12/12

Softlogic Equity Research P | 12

Softlogic Equity ResearchDimantha Mathew

[email protected]+94 11 7277030

Akeela Imthinam Rasheed

+94 11 7277032

Crishani Perera

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277004

Softlogic Equity SalesBranches

Horana

Madushanka Rathnayaka

No. 101, 1/1, Aguruwathota Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

MataraLalith Rajapaksha

No.8A, 2nd

Floor, FN Building, Station Road, Matara

+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Shafraz Basheer

+94 11 7277054, +94 77 2333233

Sonali Abayasekera

+94 11 7277059, +94 77 7736059

Thanuja De Silva

[email protected]+94 11 7277053, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently veri fied and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions ar e subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customers. Not all customers will receive the material at t he same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying or

related to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not be

reproduced, distributed, or published for any purposes.