Daily Trade Journal -12.02

Transcript of Daily Trade Journal -12.02

-

7/29/2019 Daily Trade Journal -12.02

1/14

q

q

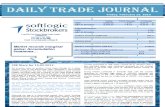

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

YTD Performance

S&P SL 20 Index

40.1

38.2

-1.3

386.6

348.4

Tuesday, February 12, 2013

916.8

% ChangePoint ChangeToday

21.6

705.3

-0.26 %

-0.31 %

2,242.0

ASPI

S&P SL 20 Index

- 15.24

- 10.26

5,836.11

3,257.98

ASPI 3.4%

5.6%

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 12.02.2013

Bourse witnessed relatively slow paced activity as the benchmark index

shot up 22 points during the first half of trading and stepped into the

red, dipping15 points at its close of 5,836.11points. S&P caliber players

booked the top turnover slot during the day denoting the confidence

placed on steady play. Consequently the index settled with a lesser dip

of 10 points at 3,257.98 points. Counters backed by steady

fundamentals supported the index with notable gains derived from Lion

Brewery (+5.9%), John Keells Holdings (+0.5%), Ceylon Tobacco

Company (+0.5%)and Aitken Spence Hotel Holdings (+2.8%) however

losses made in heavy caps outweighed these gains.

Four off-board blocks in Hatton National Bank which accounted for

considerable foreign interest recently were transacted during early

hours breathing in LKR287 mn to the turnover level where c.1.9 mn

shares changed hands at LKR147.0 contributing 40% to the days

turnover. The counter secured a 0.4% gain at its close of LKR148.9.

Another banking player; National Development Bankattracted interest

on-board with its price appreciating to LKR151.0 (+1.3%) within the day

while the rest of the banking players continued to trim early gains.Dialog Axiata continued to gather focus with majority of the days

trades weighing on the buying side. Two significant on-board blocks in

the counter totaling c.4.9 mn shares were transacted at its intra-day

high of LKR9.2 before it closed flat for the day.

Aitken Spence and its hotel arm Aitken Spence Hotel Holdings were

noted in the top turnover slot with the latter depicting strong buying

interest. Its price shot up to LKR79.0 (+6.5%) at its peak before settling

with a 2.8% gain at LKR76.3. Royal Ceramics Lanka attracted notable

buying interest with 3 blocks carrying 195k shares being traded on

board.

Retail activity was subdued during trading while penny play sustained

focus. Bairaha Farms witnessed reactivated play with its earnings

announcement for 3QFY13. The counter having seen its profits gliding

down 96% YoY saw its price plunging amidst selling pressure to close

with a 7% drop at LKR136.0.Some activity was noted in the counters which traded at their 52 week

high levels lately; Ceylon Tobacco Company, Sampath Bank and

Distilleries. The former gained 0.5% for the day while the latter counters

dipped at their close having traded on thin volumes.

European Stocks Pare Decline as Barclays Rises; Asian Stocks Rise on

Japan Easing Bets: European stocks pared their decline, following

yesterdays slide for the Stoxx Europe 600 Index, as Barclays Plc cut jobs

to reduce its costs while Asian shares climbed. The benchmark Stoxx 600

fell 0.1% to 285.46 at 9:33 a.m. in London, paring a drop of 0.3%. The

MSCI Asia Pacific Index gained 0.2% to 132.73 as of 3:16 p.m in Tokyo.Oil Slips from One-Week High; US Crude Supplies Rising: West Texas

Intermediate slipped from the highest level in more than a week after

the biggest gain since January. US crude stockpiles probably increased

last week, a Bloomberg News survey showed. Crude for March delivery

was at USD96.70 a barrel in electronic trading on the New YorkMercantile Exchange as of 8:56 a.m. London time.

-

7/29/2019 Daily Trade Journal -12.02

2/14

Statistical Look Up

Treasury Bill (%) 08.02.2013

9.25

10.16

11.11

14.30

Inflation (%) Jan-13 9.8

8.1

All Share Price Index q

S&P SL20 Index q

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance q

Beverage, Food & Tobacco p

Construction & Engineering q

Diversified q

Healthcare p

Hotels & Travels q

Land & Property q

Manufacturing q

Plantation p

Telecom q

1.48%

2.1

219.8

4.1

12,981.4

% Change

-0.26%2.1

-120.17%

16.6

1.02%

0.89%

0.11%

-1.10%

% WoW

ChangeLast Week

0.95%

72.69%

58.53%

828.08%

223.9

2,247.8

40.1

57.67%

57.67%

% WoW

ChangeLast Week

447.3

3.5

1.85%

1.33%

-0.26%

Today

38.2

2.1

348.4

16.5

5,836.1

-0.31%

2,242.0

2.3

386.6

-24.84%

-24.84%-46.21%

-0.42%

5.621.6

235

3,258.0

938.3

7.4

236

705.3

-0.26%

84.97%

-12.59%

Week ending

0.49%

11.47%

-3.29%

0.95%

1.69%

0.95%

243

2,220.9

5,781.3

3,203.9

19.3

0.95%

0.00%

209.0

398.6

-189.6

Change %

5,851.4

3,268.2

2.3

-0.26% 16.4

Pre Day

12,690.1

16,619.7

1,906.7

3,526.7

496.0

-0.26%

2,799.6

1,889.2

-0.43%

0.19%

-0.47%

-0.04%

2,826.6

16,432.3

491.4

171.3 169.0-0.36%170.7

2.3

2,687.8

16,651.1

2,813.2

1,905.9

12,925.1

Pre Day

0.00%

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 12.02.2013

Today

-43.94

605.2 600.1 0.84% 600.7 0.74%

811.5 804.6 0.86% 800.9 1.32%

2,648.7

3,513.7

-2.02%

3,517.4

486.0

-0.59%2,703.7

5650

5700

5750

5800

5850

5900

Index

ASPI

3000

3050

3100

3150

3200

3250

3300

Index

S&P SL20

0.0

50.0

100.0

150.0

200.0

250.0

0

1,000

2,000

3,000

4,000

Volume('mn)

TurnoverLKR('mn)

Turnover Volume

Page | 2.

-

7/29/2019 Daily Trade Journal -12.02

3/14

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

HNB

JKH

DIALOG

AITKEN SPENCE

A.SPEN.HOT.HOLD.

Most Active

Close

231.00

839.40

229.00

840.00

148.90

126.40

710.00

9.10

Volume (mn)

2.1%

Turnover

(LKR)

2.1%

298,511,766

31,448,334

31,381,288

78,307,615

47,089,484

1.08

0.34

0.41

0.0% 433,479

47,089,484

3.5%

9.10

126.40

76.30

FREE LANKA 2.50

HNB 148.90

% Change

S M B LEASING[NON VOTING]

SWARNAMAHAL FIN 3.70

1.19

5.12

2.03

3.60

0.48%229.90

5.12

0.250.32%

0.96

0.00%

0.40%

0.00%

1.4%

1.4%

13.3%

Contribution to

Total T/O

3,533,417

2.83%

0.40

298,511,766

2,966,184

4.51

AMANA TAKAFUL

INFRASTRUCTURE

Pre Day

0.40%148.30 13.3%2.03

Volume (mn)% Change

6.67%

+ 2.30 7.42%

148.90

CompanyContribution to

Total T/O

124.30

0.1%

0.2%

Turnover

(LKR)

150.00

372.66

0.58

107.20

63.00

150.00

43.00

8,396.90

72.00

235.80

146.80

43.50

702.00

72.00

0.80

5.30

TodayCompany

154.00

S M B LEASING

140.00

66.45

0.1417.86

2,362.38

45.78

47,089.48

6.39

Today

6.56%

Turnover

USD ('000)

1,291.008.79%

Intraday

Low (LKR)

Turnover

LKR ('000)

6,142.66

807.08

48.61

0.36

820.00

78,307.61

Intraday

High (LKR)

231.00

248.88

123.50

230.50

126.00

170.10

43.90

9.00

% Change

JOHN KEELLS HOLDINGS 340,377

SAMPATH BANK

ASIAN HOTELS & PROPERTIES 248

1.5%

241390

1,687

8.8%

7.0%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOM

COMMERCIAL BANK [V]

4.1%

3.2%BUKIT DARAH

DIALOG AXIATA

HNB [V]

DFCC BANK

CARGILLS

94.58

1,640.00

108.90

31,448.33

0.58

LOLC

AITKEN SPENCE 126.50

2.4% 66.20

73.55

149.50

112.07643.63

0.895.09

456.00

746.90

9.20

1,640.00

107.90

474.901,690.00

298,511.77

8,365.23

3.8%

2.3%

1.3%

63

5,121,226

2,030,646

249,585

3.9%

182.80

65.00

3.3%

181.90

63.10

469.00

3.5%

231.00

0.00%

1.7%

2.1%

Change

- 259.00

- 24.90

- 0.10

- 0.60

% Change

239.60

126.00

74.20

9.10

CEYLON LEATHER [W 0013]

+ 0.10

CEYLON PRINTERS

72.00

124.00

Volume

619.71

0.00%

2.78%

56,936

569.62

73.21

14,250 11,951.03

1.4%

Change

9.90

Company% of

Mkt Cap

0.40

Today Pre Day

9.10

148.30

2.50

+ 0.80

DISTILLERIES

4,595

35,697

DIALOG 9.10

Company

46,001

12,751

488

LANKA VENTURES

PC PHARMA

Company Today

1.5%

SOFTLOGIC CAP

HUNAS FALLS 58.70 + 5.70 10.75% AMF CO LTD 311.00 - 89.00 -22.25%

-10.17%

-11.11%

-16.71%

-15.10%

6.50

1.60

33.30

+ 0.40

Page | 3.

-

7/29/2019 Daily Trade Journal -12.02

4/14

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar No Announcements

Yuan 0

Euro 0

Rupee 0

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

q

q

p

p

p

p

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) p

Crude Oil (WTI) q

ICE Cotton #2 q

CBOT Wheat q

COMEX Gold q

COMEX Silver q

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

00-Jan-00

00-Jan-00

1/0/1900

1/0/1900

00-Jan-00

Description

0.00

0.00

0 1/0/1900

0

XR Date

00-Jan-00

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

00-Jan-00

0.00

Time*

USd/bu.

82.28

Price

118.58

96.98

USD/bbl.

101.63

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

EU

197.87

0.00

0.00 0

0

126.36

0.0033.69

Malaysia

4.19

129.72

20.27

2.35

1.34

40.78

India

Currency

169.35

Indicative Rate

12.02.2013

China

0

Payment DateDPS (LKR) XD Date

6,289.7

Singapore

Switzerland

Thailand

UK

0.46

38.2

0

2,626.9

137.27

1/0/1900

1/0/1900

4.23

USA

01:28

12.6

1/0/1900

Change

0.17%

216.0

03:01

0

00-Jan-00

1/0/1900

1/0/1900

05:54

05:54

0.20%

05:53

Company

05:53

05:50

05:54

0-Jan

0-Jan

05:48

05:47

Time*

05:54

-0.07%

Change %

-0.40%

-0.58%

0.39%

-0.05%

1.94%

0.16%

-0.41%

-0.9

Change

-0.77%-0.64

0

-0.05

Change %

372.00

USD/t oz.

USD/t oz. -0.18

738.50

-0.25

30.72

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

11,369.1

Value

13,971.2

1,517.0

USD/bbl.

USd/lb.

USd/lb.

AMERICA

-3.00

METALS

ENERGY

Commodity

23,215.2

Units

0

4.5

Proportion

00-Jan-00

00-Jan-00

0.00

0.00

-0.16%

-0.06%

-21.7

Russia

Saudi Arabia

Japan

1,642.40 -6.70

Australia

Page | 4.

-

7/29/2019 Daily Trade Journal -12.02

5/14

Softlogic Equity Research Page | 5

CSE Announcements

Merchant Bank of Sri Lanka [MBSL: LKR19.5]: Mr. D M Gunasekara hasbeen appointed as a Director with effect from today.

Hunters & Co. [HUNT: LKR307.2]: A fraud has been discovered at LankaCanneries (Pvt) Ltd amounting to LKR44.5 mn which has been confirmed by aforensic audit performed by KPMG. The said company is in the process of

making a complaint to CID. Lanka Canneries (Pvt) Ltd is a 90% owned subsidiary

of Health & Company (Pvt) Ltd which in turn is a 90.9% owned subsidiary of

HUNT.

Sathosa Motors [SMOT: LKR231.3]: SML Frontier Automotive (Pvt) Ltd, a 50% owned subsidiary of SMOTwhich hopes to commence operations in April 2013, has received the Letter of Intent giving the company

then exclusive rights to sell, distribute and service Land Rover/Range Rover vehicles in Sri Lanka. Land

Rover/Range Rover has been one of the top three European luxury automobile brands in Sri Lanka during

last 5 years.Access Engineering [AEL: LKR20.3]owns 84.39% stake in SMOT.

Commercial Credit & Finance [COCR: LKR14.5]-Debenture Issue:The cumulative figures of the total applications received and the amounts subscribed as at end of 11th

February 2013 is given below:

Disclosure on Related Party Dealings:

Local News

Sri Lanka holds policy rates amid higher inflation: Sri Lanka's Central Bank held its main policy rate at whichmoney is injected at 9.5% in February after cutting rates in December, while inflation continued to blaze at

four year highs above the policy rate. Consumer prices in Sri Lanka's rose to 9.3% in June 2012 following

steep depreciation of the rupee against the US dollar in the first two quarters of the year, and had remained

stubbornly high losing its recent record of generating only single digit inflation. The monetary authority cut

policy rates by 25 basis points in December and in January inflation rose 9.8% from a year earlier, overtaking

its key policy rate. Analysts had also voiced concern at volumes of money injected (at below its policy rate)

into the banking sector, through so-called term auctions a type of dangerous quantity easing activity, from

the the third quarter of 2012, rather than the absolute interest rate. The Central Bank said following its

policy rate cut in December secondary market interest rates had started to decline and bank deposit and

lending rates will also start to fall. The Central Bank said in 2012 private bank credit grew at 17.6% but

borrowings by the government and state enterprises made overall bank credit grow 21.7%. Last year banks

had given LKR352 bn in credit to private business. In 2013 the Central Bank expects private sector credit to

grow 18.5% to LKR435 bn. "Since such a credit growth will be compatible with the anticipated expansion in

economic activity, it is not expected to fuel any demand driven inflationary pressures during the year, " the

Central Bank said in its February monetary policy statement.

[Source: www.lbo.lk]

Sri Lanka forex reserves at USD6.8 bn in December: Sri Lanka's official forex reserves rose by USD387 mn toUSD6,877 mn by end December 2012 from USD6,490 mn a month earlier, the Central Bank said. Foreign

reserves were up 15% from the December 2011 level of USD5,957. In order to build up foreign reserves Sri

Lanka's Central Bank has to save money by killing credit to prevent the proceeds of dollar inflows being

spent by domestic economic agents, typically by sterilizing forex reserves. In addition, interest earnings from

No. of Applications received 244

No. of Debentures Applied 4,407,555

Value of Debentures applied (LKR) 440,755,500

Company Name Relationship Transaction Quantity Price (LKR) Date

Sathosa Motors [SMOT: LKR231.3] Access Engineering [AEL : LKR20.3] Parent Company Purchase 4,357 230-232 06.02.13-11.02.13

United Motors Lanka [UML: LKR89.5] Mr. Chanaka Yatawara CEO/Executive Director Purchase 500 89.0 11.12.2012

-

7/29/2019 Daily Trade Journal -12.02

6/14

Softlogic Equity Research Page | 6

foreign reserves themselves, net capital gains from foreign reserve assets including gold can boost the dollar

value of reserves without domestic agents being involves. Sri Lanka's official foreign reserves also include

unspent fiscal reserves held temporarily as foreign exchange, in addition to monetary reserves of the Central

Bank.

[Source: www.lbo.lk]

Sri Lanka drops 'budget support' loan with IMF: Sri Lanka has dropped plans for a new budget support loanprogram with the International Monetary Fund, the island's central bank said as the lender was not willing togive money directly for government spending. The IMF usually funds the central bank and other lenders such

as its 'Bretton Woods twin' World Bank give direct budget support, though in the case of Europe, fiscal

support has been given. The Central Bank said the Fund has conveyed that it may not be in a position to

consider any direct or indirect budget support to Sri Lanka, since Sri Lanka did not need any exceptional

financial support from the IMF. The Central Bank said since foreign reserves were now about USD7 bn, from

the USD1 bn level in 2009 when the country started a USD2.5 bn bailout from the IMF the Central Bank also

did not need reserves. But other analysts have pointed out that Sri Lanka has to start repaying the IMF loan

from this year and new funding may be useful as it will reduce the need to kill domestic credit to maintain or

build foreign reserves.

[Source: www.lbo.lk]

Sri Lanka sells 5-year bonds to yield 10.73%: Sri Lanka has sold 5-year bonds maturing on July 15, 2018 toyield 10.73% at Tuesday's auction one basis point below the previous auction, data from the state debt

office showed. The previous auction had a June maturity. In the secondary market 5-year bonds were trading

at around 10.84/88% delays said. After offering LKR2.0 bn of bonds, the debt office, which is a unit of the

Central Banks said LKR4.3 bn worth securities were sold.

[Source: www.lbo.lk]

Sri Lanka sugar refinery, power plant by Indian firm: Sri Lanka's state run investment promotion agencywhich gives tax breaks to investors said it had signed a USD220 mn deal with India's Shree Renuka Sugars

which will build a sugar refinery and power plant. The facility will be located in the Hambantota port in Sri

Lanka's South. The plant will bring raw sugar from Brazil and refine it for sale in the domestic market at for

export, the Board of Investment said. At the moment Sri Lanka's domestic sugar mills are allowed extract get

tax-arbitrage profits consumers through duty protection, it is not clear whether the same privilege will be

given to the refinery. The BOI said the refinery will generate about a million metric tonnes of traffic for the

port, during an unspecified period. The refinery will also generate power and surplus energy from surplus

capacity of 12 to 15 MW would be sold to the state-run Ceylon Electricity Board. The project will provide

direct employment for 300 direct and 1,500 indirect opportunities through various services in operation,

maintenance and logistics, the BOI said. The statement quoted Shree Renuka chairman Vidya Murkumbi as

saying that project will start within a few months immediately after the procedures and necessary approvals

are completed. The statement also said the mill will save USD450 mn in foreign exchange during an

unspecified period.

[Source: www.lbo.lk]

Sri Lanka IOC unit says blocked shipment not substandard: Indian Oil Corporation's Sri Lanka unit said ashipment of diesel which had been held up at Colombo port following a quality test was found to be off

specification in colour and appearance and not in core chemical properties. The contract for 7,562 metric

tonnes for diesel was awarded to Glencore Singapore (Pte) Ltd of which 4,712 metric tonnes was to be

discharged in Colombo and 2,850 metric tonnes in Trincomalee. In Trincomalee Lanka IOC [LIOC: LKR20.2]

had its own testing lab and in Colombo testing was done by CPSTL, a common user facility used both by

state-run Ceylon Petroleum Corporation. Managing director Subodh Dakwale said out of 19 parameters for

which the diesel was tested, it was found to be off - specification on two parameters. The company says it

was off-specification for colour and appearance and it was not substandard in other aspects and in case it

was not unloaded at all. In some countries colour is not a criteria and in Sri Lanka till August last year there

were no criteria for colour, officials said. Dakwale said in other critical parameters its sulphur content was

only 1,440 parts per million when the requirement was 2,550 parts per million and its Decane (C10) count

was 55 when the requirement was 46, which was similar to super diesel he said.

[Source: www.lbo.lk]

-

7/29/2019 Daily Trade Journal -12.02

7/14

Softlogic Equity Research Page | 7

Motor vehicle and spare part imports dip 21% in 2012 - Study: Vehicle and vehicle spare part imports fell21% in 2012, after seeing a robust growth of 200% and 86% in 2010 and 2011, respectively, a study carried

out by the Ceylon Chamber of Commerce (CCC) noted. As the study pointed out, a number of factors

including duty increases, credit ceiling imposed on banks on loans extended to private sector and hike in fuel

prices mainly contributed towards this decline. The government increased the excise taxes on vehicles in

March 2012 to discourage imports to bridge a widening trade deficit, while imposing an 18% credit ceiling oncommercial banks amidst a depreciating rupee. However, the report pointed out that the year 2012

commenced with buoyant demand for vehicles. The vehicle registration data indicate that during the first

quarter, the number of vehicles registered in fact is higher than the number registered the previous year. The

impact of the negative developments had started making dents into the market from the second quarter

onwards, the study noted. As the study illustrated, several vehicle categories recorded a steep decline of

above 50% in terms of quantity imported in 2012. These are small passenger vehicles of less than 1000 cc

(and passenger vehicles between 10001500 cc, both of which declined by 72% each. Passenger vehicles

exceeding 1500 cc but below 3000 cc declined by 65%, while passenger vehicles exceeding 3000 cc declined

by 77%. Import of hybrid electric vehicles declined by 67% and diesel auto-trishaws by 55%. According to the

CCC study, India continued to dominate the market for imported vehicles in 2012, accounting for 50% of the

total vehicle imports to the country. The market share of Japan declined to 22% from 36% in 2011, showing asteady decline market share. However, the study noted that this could be partly due to a shift in production

facilities by the Japanese companies to other Asian countries such as India and Thailand and also to the high

taxes imposed on Japanese vehicles by the government, making them less affordable. China is the third

leading supplier of vehicles to Sri Lanka and its share has increased from 5% in 2011 to 7% in 2012.

[Source: www.dailymirror.lk]

Global News

Cotton Crops Slumping Most Since 1993 as China Buys: Cotton harvests are heading for the biggest drop inmore than two decades as farmers from the US to India reduce planting and China increases demand for

higher- quality imports. Crops will tumble 11%, the most since 1993, to 23.2 million metric tons in the yearbeginning Aug. 1, data from the International Cotton Advisory Committee show. Farmers will reduce sowing

to 31.58 million hectares (78 million acres), a 7.7% decline and the largest in 11 years, according to

Washington-based ICAC, which represents 41 governments. By July 2014, stockpiles will shrink 4.9% to 15.9

million tons, the first reduction in four years, the groups data show.Prices that slumped 62% from a record

in 2011, prompting farmers to switch to soybeans and corn, are poised to rally 15% to 95 cents a pound by

the end of 2013, according to the median of 16 estimates from analysts and traders compiled by Bloomberg.

China is buying higher-grade American and Australian fiber for textile makers at cheaper prices than

domestic supplies and sitting on lower-quality local stockpiles to subsidize farmers. China will want to

import some cotton that the world doesnt have to give next season, said Peter Egli, director at Chicago-

based Plexus Cotton Ltd. Prices will have to go higher to satisfy mill demand and China imports, he said in a

telephone interview.[Source: www.bloomberg.com]

G-7 Wont Target Exchange Rates Amid Currency War Concern : The worlds major industrial nations soughtto soothe mounting fears of a currency war with a pledge to avoid devaluing their exchange rates in the

pursuit of stronger economic growth. We reaffirm that our fiscal and monetary policies have been and will

remain oriented towards meeting our respective domestic objectives using domestic instruments, and that

we will not target exchange rates,the Group of Sevens finance ministers and central bank governors said in

a statement released today in London. The stance is tougher than the G-7s last joint comment on exchange

rates in 2011 and marks an effort to avoid a 1930s- style spiral of retaliatory devaluations in which weak

economies try to boost exports by driving currencies down. It follows an outbreak of concern that Japans

new campaign to beat deflation is an outright attempt to weaken the yen, an allegation its governmentdenied again today. The yen pared gains versus the dollar after the statements release and as Finance

Minister Taro Aso said the G-7 acknowledged Japan is not chasing a weaker yen and that its monetary policy

is aimed at reversing a decline in prices.

[Source: www.bloomberg.com]

-

7/29/2019 Daily Trade Journal -12.02

8/14

Softlogic Equity Research Page | 8

U.K. Inflation Stays at 2.7% as Price Pressures Mount: UK inflation held at the highest rate since May lastmonth and pipeline price pressures increased as crude oil costs rose. Consumer prices rose 2.7% from a year

earlier, the Office for National Statistics said today in London, matching the median estimate of 36

economists in a Bloomberg News survey. Separate reports showed factory input prices surged the most in

five months in January while house prices gained in December by the most since November 2010. The Bank

of England will publish new economic projections tomorrow after it said inflation may accelerate in thecoming months and stay above its goal for the next two years. With the economic recovery struggling to gain

momentum, the central bank said it was right to look through this period of above- target price growth. The

high inflation, low growth dilemma will probably once again be the main topic of the Inflation Report,

Joost Beaumont, an economist at ABN Amro Bank in Amsterdam, said in an e-mailed statement. We expect

the BOE to stay on the sidelines. The euro crisis is likely to remain contained and we see the U.K. economy

gradually regaining some traction. UK inflation has been boosted in recent months by price increases by

some of Britains biggest electricity and gas companies. There may be a further impact next month when

another increase by E.ON AG is included in the February data, the ONS said. The pounds decline is also

adding upward pressure by increasing import costs.

[Source: www.bloomberg.com]

Yellen Signals Fed Would Maintain Easing After Halting QE: UFederal Reserve Vice Chairman Janet Yellensignaled stimulus may outlast the Feds bond purchases, saying the central bank has the option to hold

interest rates near zero even after reaching near-term targets for inflation or unemployment. Yellens

comments yesterday coincide with a Federal Open Market Committee debate over when to bring bond

buying to an end, a shift that may prompt expectations of an interest-rate increase. The FOMC said in

December it will hold the main interest rate in a range of zero to 0.25% so long as inflation isnt forecast to

rise to more than 2.5% in one to two years and unemployment exceeds 6.5 percent. The speech by the Fed

vice chairman reminds people that if they are successful and if they get to their unemployment objective

that doesnt automatically mean they are going to slam on the brakes, said Dominic Konstam, head of

interest rate research at Deutsche Bank AG in New York. As better data come out, they want to make sure

the market doesnt want to get carried away and anticipate a boost in interest rates. Yellen, who leads aFed committee created by Chairman Ben S. Bernanke on improving monetary policy communications, said

the targets announced in December are thresholds for possible action, not triggers that will necessarily

prompt an immediate increase in the main interest rate. When one of these thresholds is crossed, action is

possible but not assured,she said in a speech to the AFL-CIO in Washington. Several members of the FOMC

thought that it would probably be appropriate to slow or to stop purchases well before the end of 2013 ,

minutes from the December meeting said.

[Source: www.bloomberg.com]

-

7/29/2019 Daily Trade Journal -12.02

9/14

Softlogic Equity Research Page | 9

Daily Stock Movements

Ticker Counter Open High Low Close Trades Volume Turnover

AAF -N-0000 ASIA ASSET 2.60 2.70 2.60 2.60 22 18,667 48,751

AAIC-N-0000 ASIAN ALLIANCE 82.50 82.50 82.50 82.50 10 1,260 103,950

ABAN-N-0000 ABANS 97.20 97.20 96.90 96.90 2 301 29,167

ACAP-N-0000 ASIA CAPITAL 29.50 30.00 29.00 30.00 3 499 14,621ACL -N-0000 ACL 68.50 68.50 68.50 68.50 1 100 6,850

ACME-N-0000 ACME 13.50 14.00 13.40 13.80 9 14,105 193,067

AEL -N-0000 ACCESS ENG SL 20.30 20.40 20.10 20.30 58 186,672 3,783,457

AFSL-N-0000 ABANS FINANCIAL 35.00 35.00 33.00 33.00 8 1,106 37,862

AGAL-N-0000 AGALAWATTE 31.50 32.80 31.40 32.80 5 163 5,204

AGST-N-0000 AGSTARFERTILIZER 0.00 0.00 0.00 6.20 0 0 0

AGST-X-0000 AGSTARFERTILIZER[NON VOTING] 0.00 0.00 0.00 15.00 0 0 0

AHPL-N-0000 AHOT PROPERTIES 72.00 72.00 72.00 72.00 2 248 17,856

AHUN-N-0000 A.SPEN.HOT.HOLD. 74.50 79.00 74.20 76.30 58 411,638 31,381,288

ALLI-N-0000 ALLIANCE 740.00 760.00 740.00 740.00 14 364 274,783

ALUF-N-0000 ALUFAB 20.20 21.00 20.00 20.70 11 2,100 42,276

AMCL-N-0000 CAPITAL LEASING 0.00 0.00 0.00 22.40 0 0 0

AMF -N-0000 AMF CO LTD 371.00 371.00 300.00 311.00 4 301 91,592

AMSL-N-0000 ASIRI SURG 9.00 9.00 8.90 9.00 8 2,313 20,776

APLA-N-0000 ACL PLASTICS 0.00 0.00 0.00 95.00 0 0 0ARPI-N-0000 ARPICO 82.50 83.00 82.50 83.00 5 1,500 124,495

ASCO-N-0000 ASCOT HOLDINGS 167.00 167.00 167.00 167.00 10 14 2,338

ASHA-N-0000 ASIRI CENTRAL 0.00 0.00 0.00 230.00 0 0 0

ASHO-N-0000 LANKA ASHOK 0.00 0.00 0.00 1890.00 0 0 0

ASIR-N-0000 ASIRI 12.30 12.40 12.30 12.30 18 55,701 685,622

ASIY-N-0000 ASIA SIYAKA 3.90 4.00 3.90 4.00 7 5,010 19,540

ASPH-N-0000 INDUSTRIAL ASPH. 202.00 202.00 190.00 196.20 8 100 19,620

ATL -N-0000 AMANA TAKAFUL 1.50 1.60 1.50 1.60 51 687,655 1,098,598

AUTO-N-0000 AUTODROME 0.00 0.00 0.00 897.90 0 0 0

BALA-N-0000 BALANGODA 39.00 39.00 38.00 38.80 5 405 15,645

BBH -N-0000 BROWNS BEACH 18.90 19.10 18.80 18.80 14 17,511 329,343

BERU-N-0000 BERUWALA RESORTS 2.40 2.40 2.40 2.40 4 6,450 15,480

BFL -N-0000 BAIRAHA FARMS 145.00 145.00 135.10 136.00 198 63,217 8,658,315

BIL -N-0000 BROWNS INVSTMNTS 3.40 3.50 3.40 3.40 23 62,952 214,482

BINN-N-0000 BERUWELA WALKINN 0.00 0.00 0.00 74.90 0 0 0BLI -N-0000 BIMPUTH FINANCE 0.00 0.00 0.00 15.50 0 0 0

BLUE-N-0000 BLUE DIAMONDS 3.80 4.00 3.80 3.80 45 332,337 1,267,125

BLUE-X-0000 BLUE DIAMONDS[NON VOTING] 1.70 1.70 1.70 1.70 9 83,824 142,501

BOGA-N-0000 BOGALA GRAPHITE 24.00 24.00 22.60 22.70 3 505 11,468

BOPL-N-0000 BOGAWANTALAWA 12.70 13.40 12.70 13.30 17 25,556 332,693

BREW-N-0000 CEYLON BEVERAGE 470.00 470.00 470.00 470.00 1 150 70,500

BRWN-N-0000 BROWNS 128.00 128.00 124.00 124.00 5 268 33,795

BUKI-N-0000 BUKIT DARAH 740.00 746.90 702.00 710.00 8 63 45,780

CABO-N-0000 CARGO BOAT 0.00 0.00 0.00 87.30 0 0 0

CALF-N-0000 CAL FINANCE 18.00 18.00 17.70 17.70 7 9,529 169,400

CARE-N-0000 PRINTCARE PLC 31.50 31.50 31.50 31.50 1 1 32

CARG-N-0000 CARGILLS 154.00 154.00 150.00 150.00 5 488 73,206

CARS-N-0000 CARSONS 456.10 474.90 456.00 469.00 7 241 112,069

CCS -N-0000 COLD STORES 142.00 142.00 140.00 140.20 6 1,001 140,643

CDB -N-0000 CDB 42.00 42.00 41.00 41.00 5 3,504 143,918

CDB -X-0000 CDB[NON VOTING] 30.10 30.10 30.00 30.10 2 604 18,170

CDIC-N-0000 N D B CAPITAL 480.00 498.20 480.00 480.00 22 2,207 1,059,691

CERA-N-0000 LANKA CERAMIC 0.00 0.00 0.00 67.20 0 0 0

CFI -N-0000 CFI 0.00 0.00 0.00 110.00 0 0 0

CFIN-N-0000 CENTRAL FINANCE 182.00 183.00 182.00 183.00 9 2,434 445,213

CFL -N-0000 CHILAW FINANCE 13.40 13.80 13.40 13.40 13 8,567 114,996

CFLB-N-0000 FORT LAND 32.50 33.00 32.10 33.00 10 21,200 693,700

CFT -N-0000 CFT 5.80 5.80 5.50 5.60 17 21,900 121,281

CFVF-N-0000 FIRST CAPITAL 11.60 11.60 11.60 11.60 7 7,600 88,160

CHL -N-0000 DURDANS 95.20 100.00 95.00 99.90 7 260 25,390

CHL -X-0000 DURDANS[NON VOTING] 0.00 0.00 0.00 72.10 0 0 0

CHMX-N-0000 CHEMANEX 79.00 79.00 79.00 79.00 1 100 7,900

CHOT-N-0000 HOTELS CORP. 20.90 20.90 20.10 20.50 4 42 846

CHOU-N-0000 CITY HOUSING 14.50 14.50 14.40 14.40 6 185,519 2,681,747

CIC -N-0000 CIC 65.00 65.00 65.00 65.00 1 1 65

CIC -X-0000 CIC[NON VOTING] 49.70 49.70 49.50 49.60 12 11,575 573,733CIFL-N-0000 CIFL 4.00 4.00 3.90 4.00 57 107,453 423,026

CIND-N-0000 CENTRAL IND. 66.50 66.50 66.10 66.10 2 201 13,287

CINS-N-0000 CEYLINCO INS. 0.00 0.00 0.00 1000.00 0 0 0

CINS-X-0000 CEYLINCO INS.[NON VOTING] 334.00 334.00 334.00 334.00 2 105 35,070

CINV-N-0000 CEYLON INV. 88.20 88.20 88.00 88.00 5 3,000 264,000

-

7/29/2019 Daily Trade Journal -12.02

10/14

Softlogic Equity Research Page | 10

Ticker Counter Open High Low Close Trades Volume Turnover

CIT -N-0000 CIT 0.00 0.00 0.00 129.00 0 0 0

CITH-N-0000 CITRUS HIKKADUWA 20.50 20.50 19.80 19.80 3 1,020 20,197

CITK-N-0000 CITRUS KALPITIYA 6.40 6.40 6.10 6.20 38 112,386 697,756

CITW-N-0000 CITRUS WASKADUWA 6.30 6.30 6.20 6.30 2 11 69

CLC -N-0000 COMM LEASE & FIN 4.00 4.20 4.00 4.10 56 573,951 2,358,013

CLND-N-0000 COLOMBO LAND 34.80 34.80 32.20 32.30 35 166,488 5,440,624

CLPL-N-0000 CEYLON LEATHER 0.00 0.00 0.00 73.10 0 0 0

CLPL-W-0012 CEYLON LEATHER[WARRANTS] 0.00 0.00 0.00 1.80 0 0 0

CLPL-W-0013 CEYLON LEATHER[WARRANTS] 5.60 5.60 5.30 5.30 24 48,590 257,924

CLPL-W-0014 CEYLON LEATHER[WARRANTS] 5.70 5.90 5.50 5.50 25 16,945 93,846

COCO-N-0000 RENUKA SHAW 21.00 21.20 20.80 20.90 37 154,269 3,228,739

COCO-X-0000 RENUKA SHAW[NON VOTING] 0.00 0.00 0.00 16.00 0 0 0

COCR-N-0000 COM.CREDIT 14.50 15.00 14.50 14.50 4 1,101 15,977

COLO-N-0000 COLONIAL MTR 143.50 143.50 137.00 140.50 8 438 61,669

COMB-N-0000 COMMERCIAL BANK 108.00 108.90 107.20 107.90 78 56,936 6,142,659

COMB-P-0005 COMMERCIAL BANK 0.00 0.00 0.00 9.00 0 0 0

COMB-X-0000 COMMERCIAL BANK[NON VOTING] 92.60 93.00 92.50 92.50 21 14,100 1,305,068

COMD-N-0000 COMMERCIAL DEV. 70.00 70.00 70.00 70.00 1 10 700

CONN-N-0000 AMAYA LEISURE 83.50 83.50 83.50 83.50 2 28 2,338

CPRT-N-0000 CEYLON PRINTERS 1300.00 1300.00 1282.00 1291.00 2 20 25,820

CRL -N-0000 SOFTLOGIC FIN 26.50 26.80 26.50 26.80 12 20,967 561,117

CSD -N-0000 SEYLAN DEVTS 9.10 9.30 9.10 9.20 18 43,175 397,214

CSEC-N-0000 DUNAMIS CAPITAL 12.50 12.50 10.80 11.30 10 30,130 375,704

CSF -N-0000 NATION LANKA 9.90 10.00 9.70 9.80 52 148,653 1,462,585

CSF -W-0021 NATION LANKA[WARRANTS] 1.90 2.00 1.90 1.90 21 389,197 739,684

CTBL-N-0000 CEYLON TEA BRKRS 5.40 5.40 4.90 4.90 21 29,776 149,058

CTC -N-0000 CEYLON TOBACCO 834.90 840.00 820.00 839.40 24 14,250 11,951,032

CTCE-N-0000 AVIVA N D B 300.00 305.00 300.00 304.90 7 1,300 394,405

CTEA-N-0000 TEA SERVICES 653.00 653.00 649.90 650.00 27 2,671 1,736,246

CTHR-N-0000 C T HOLDINGS 140.00 140.00 140.00 140.00 9 49,022 6,863,080

CTLD-N-0000 C T LAND 26.10 27.60 26.10 26.30 5 1,235 32,435

CWM -N-0000 C.W.MACKIE 0.00 0.00 0.00 67.00 0 0 0

DFCC-N-0000 DFCC BANK 124.00 124.30 123.50 124.00 17 4,595 569,617

DIAL-N-0000 DIALOG 9.10 9.20 9.00 9.10 52 5,121,226 47,089,484

DIMO-N-0000 DIMO 595.30 599.00 595.00 595.00 6 109 64,888

DIPD-N-0000 DIPPED PRODUCTS 115.50 116.00 115.00 116.00 8 10,269 1,184,185

DIST-N-0000 DISTILLERIES 182.80 182.80 170.10 181.90 24 46,001 8,365,227

DOCK-N-0000 DOCKYARD 228.50 228.50 226.00 226.00 4 116 26,219DPL -N-0000 DANKOTUWA PORCEL 17.00 17.00 16.60 16.70 38 25,930 435,140

EAST-N-0000 EAST WEST 14.20 14.20 14.00 14.00 38 26,862 376,370

EBCR-N-0000 E B CREASY 1000.00 1000.00 1000.00 1000.00 1 3 3,000

ECL -N-0000 E - CHANNELLING 7.20 7.20 6.90 7.00 125 684,567 4,782,569

EDEN-N-0000 EDEN HOTEL LANKA 35.00 35.00 35.00 35.00 2 3,400 119,000

ELPL-N-0000 ELPITIYA 18.20 18.20 18.00 18.10 10 2,401 43,618

EMER-N-0000 EASTERN MERCHANT 10.10 10.10 10.00 10.00 6 17,570 176,045

EQIT-N-0000 EQUITY 31.20 31.30 31.20 31.20 6 500 15,610

ESL -N-0000 ENTRUST SEC 19.30 19.30 19.30 19.30 2 1,900 36,670

ETWO-N-0000 EQUITY TWO PLC 27.00 27.00 27.00 27.00 1 200 5,400

EXPO-N-0000 EXPOLANKA 7.00 7.20 7.00 7.10 47 336,282 2,389,335

FLCH-N-0000 FREE LANKA 2.60 2.60 2.50 2.50 86 1,186,406 2,966,184

GEST-N-0000 GESTETNER 200.00 200.00 200.00 200.00 1 4 800

GHLL-N-0000 GALADARI 13.40 13.40 13.00 13.30 24 6,889 90,776

GLAS-N-0000 PIRAMAL GLASS 6.30 6.30 6.10 6.10 33 220,401 1,348,616GOOD-N-0000 GOOD HOPE 1350.00 1350.00 1350.00 1350.00 1 5 6,750

GRAN-N-0000 GRAIN ELEVATORS 52.50 52.50 50.50 50.70 43 43,575 2,227,917

GREG-N-0000 ENVI. RESOURCES 17.50 17.60 17.30 17.50 50 91,802 1,608,426

GREG-P-0002 ENVI. RESOURCES 0.00 0.00 0.00 0.00 0 0 0

GREG-W-0002 ENVI. RESOURCES[WARRANTS] 0.00 0.00 0.00 2.90 0 0 0

GREG-W-0003 ENVI. RESOURCES[WARRANTS] 3.10 3.10 3.00 3.00 59 146,440 444,549

GREG-W-0006 ENVI. RESOURCES[WARRANTS] 3.90 3.90 3.70 3.80 38 91,576 346,201

GSF -N-0000 G S FINANCE 0.00 0.00 0.00 625.00 0 0 0

GUAR-N-0000 CEYLON GUARDIAN 175.00 177.00 171.00 171.80 13 4,295 750,734

HAPU-N-0000 HAPUGASTENNE 38.10 38.10 38.10 38.10 4 202 7,696

HARI-N-0000 HARISCHANDRA 2499.90 2499.90 2400.00 2400.00 3 15 36,500

HASU-N-0000 HNB ASSURANCE 51.00 51.00 51.00 51.00 2 445 22,695

HAYC-N-0000 HAYCARB 177.10 177.10 177.00 177.00 2 1,700 300,910

HAYL-N-0000 HAYLEYS 300.00 300.00 296.00 299.00 10 1,082 323,491

HDEV-N-0000 HOTEL DEVELOPERS 0.00 0.00 0.00 94.80 0 0 0HDFC-N-0000 HDFC 49.00 49.00 48.90 49.00 6 550 26,916

HEXP-N-0000 HAYLEYS FIBRE 29.60 30.00 28.00 28.10 9 1,997 56,249

HHL -N-0000 HEMAS HOLDINGS 28.00 28.80 28.00 28.00 16 71,140 1,991,921

HNB -N-0000 HNB 149.50 149.50 146.80 148.90 41 2,030,646 298,511,766

HNB -X-0000 HNB[NON VOTING] 115.60 115.60 115.00 115.10 43 54,178 6,239,218

HOPL-N-0000 HORANA 26.10 27.40 25.50 27.00 74 97,004 2,586,029

-

7/29/2019 Daily Trade Journal -12.02

11/14

Softlogic Equity Research Page | 11

Ticker Counter Open High Low Close Trades Volume Turnover

HPFL-N-0000 HYDRO POWER 6.90 7.10 6.70 6.70 13 131,199 927,513

HPWR-N-0000 HEMAS POWER 22.70 22.80 22.70 22.70 5 30,020 681,456

HSIG-N-0000 HOTEL SIGIRIYA 83.20 83.20 81.00 83.10 3 71 5,900

HUEJ-N-0000 HUEJAY 0.00 0.00 0.00 74.50 0 0 0

HUNA-N-0000 HUNAS FALLS 58.00 60.00 58.00 58.70 3 775 45,480

HUNT-N-0000 HUNTERS 307.20 310.00 301.00 307.20 4 195 59,898

HVA -N-0000 HVA FOODS 13.20 13.30 13.00 13.10 62 83,888 1,100,798

IDL -N-0000 INFRASTRUCTURE 140.00 140.00 140.00 140.00 1 10 1,400

INDO-N-0000 INDO MALAY 0.00 0.00 0.00 1360.00 0 0 0

JFIN-N-0000 FINLAYS COLOMBO 0.00 0.00 0.00 316.20 0 0 0

JINS-N-0000 JANASHAKTHI INS. 10.80 10.80 10.80 10.80 23 92,700 1,001,160

JKH -N-0000 JKH 229.00 231.00 229.00 231.00 89 340,377 78,307,615

JKL -N-0000 JOHN KEELLS 67.10 67.10 67.00 67.00 8 2,609 174,808

KAHA-N-0000 KAHAWATTE 32.00 34.00 32.00 32.90 8 488 15,829

KAPI-N-0000 MTD WALKERS 26.00 26.00 25.60 25.70 10 4,290 110,504

KCAB-N-0000 KELANI CABLES 69.50 69.50 69.50 69.50 1 10 695

KDL -N-0000 KELSEY 0.00 0.00 0.00 15.50 0 0 0

KFP -N-0000 KEELLS FOOD 70.00 73.00 70.00 70.30 2 11 773

KGAL-N-0000 KEGALLE 108.00 110.00 108.00 109.70 13 6,594 723,735

KHC -N-0000 KANDY HOTELS 9.70 10.00 9.70 9.80 10 60,507 604,969

KHC -P-0002 KANDY HOTELS 0.00 0.00 0.00 0.00 0 0 0

KHL -N-0000 KEELLS HOTELS 13.70 13.80 13.70 13.70 11 42,750 585,775

KOTA-N-0000 KOTAGALA 57.00 57.90 56.00 56.90 17 4,372 248,643

KURU-N-0000 KURUWITA TEXTILE 21.00 21.00 20.50 21.00 22 32,495 682,394

KVAL-N-0000 KELANI VALLEY 85.90 86.00 85.20 85.70 10 1,371 117,471

KZOO-N-0000 KALAMAZOO 0.00 0.00 0.00 2165.00 0 0 0

LALU-N-0000 LANKA ALUMINIUM 34.00 34.80 32.50 32.50 6 1,128 37,624

LAMB-N-0000 KOTMALE HOLDINGS 0.00 0.00 0.00 35.50 0 0 0

LCEM-N-0000 LANKA CEMENT 9.00 9.00 9.00 9.00 2 900 8,100

LCEY-N-0000 LANKEM CEYLON 162.00 162.00 162.00 162.00 5 2,000 324,000

LDEV-N-0000 LANKEM DEV. 6.80 6.90 6.80 6.80 7 13,800 93,920

LFIN-N-0000 LB FINANCE 141.50 144.60 141.50 143.00 4 591 84,356

LGL -N-0000 LAUGFS GAS 26.90 26.90 25.50 26.30 17 16,702 428,890

LGL -X-0000 LAUGFS GAS[NON VOTING] 18.80 18.80 18.30 18.50 29 52,601 970,929

LHCL-N-0000 LANKA HOSPITALS 39.00 39.40 38.00 38.80 29 10,414 398,977

LHL -N-0000 LIGHTHOUSE HOTEL 46.00 46.00 46.00 46.00 1 1 46

LIOC-N-0000 LANKA IOC 20.00 20.60 20.00 20.20 22 28,415 569,416

LION-N-0000 LION BREWERY 340.00 340.00 340.00 340.00 1 1 340LITE-N-0000 LAXAPANA 6.10 6.10 6.00 6.00 8 13,900 84,240

LLUB-N-0000 CHEVRON 222.40 222.40 219.00 221.00 10 2,987 659,651

LMF -N-0000 LMF 115.00 115.00 115.00 115.00 4 1,000 115,000

LOFC-N-0000 LANKAORIXFINANCE 3.60 3.60 3.50 3.50 27 158,530 556,555

LOLC-N-0000 LOLC 65.00 65.00 63.00 63.10 37 12,751 807,081

LPRT-N-0000 LAKE HOUSE PRIN. 108.00 108.00 91.70 92.90 3 21 1,948

LVEN-N-0000 LANKA VENTURES 33.30 33.30 33.30 33.30 1 1 33

LWL -N-0000 LANKA WALLTILE 0.00 0.00 0.00 60.00 0 0 0

MADU-N-0000 MADULSIMA 13.50 13.50 13.20 13.40 9 1,812 24,312

MAL -N-0000 MALWATTE 4.90 4.90 4.70 4.70 19 53,726 257,386

MAL -X-0000 MALWATTE[NON VOTING] 4.70 4.70 4.70 4.70 1 1 5

MARA-N-0000 MARAWILA RESORTS 6.80 6.90 6.60 6.70 32 25,442 171,670

MASK-N-0000 MASKELIYA 13.70 13.90 13.20 13.70 24 23,950 324,954

MBSL-N-0000 MERCHANT BANK 19.90 19.90 19.50 19.50 55 66,897 1,314,235

MEL -N-0000 MACKWOODS ENERGY 0.00 0.00 0.00 11.50 0 0 0MERC-N-0000 MERCANTILE INV 0.00 0.00 0.00 2200.00 0 0 0

MFL -N-0000 MULTI FINANCE 26.80 26.80 26.40 26.80 14 33,199 889,064

MGT -N-0000 HAYLEYS - MGT 11.00 11.20 10.40 11.00 14 17,421 189,697

MIRA-N-0000 MIRAMAR 82.30 85.00 82.30 85.00 2 150 12,480

MORI-N-0000 MORISONS 0.00 0.00 0.00 170.00 0 0 0

MORI-X-0000 MORISONS[NON VOTING] 0.00 0.00 0.00 106.00 0 0 0

MPRH-N-0000 MET. RES. HOL. 23.00 23.80 23.00 23.50 107 75,159 1,759,560

MRH -N-0000 MAHAWELI REACH 21.00 21.80 20.80 21.20 4 500 10,560

MSL -N-0000 MERC. SHIPPING 0.00 0.00 0.00 184.70 0 0 0

MULL-N-0000 MULLERS 1.60 1.70 1.60 1.60 7 26,450 42,365

NAMU-N-0000 NAMUNUKULA 78.90 78.90 73.40 78.00 4 351 26,289

NAVF-U-0000 NAMAL ACUITY VF 0.00 0.00 0.00 65.00 0 0 0

NDB -N-0000 NAT. DEV. BANK 148.20 151.00 148.00 150.00 100 153,493 22,972,662

NEH -N-0000 NUWARA ELIYA 0.00 0.00 0.00 1399.00 0 0 0

NEST-N-0000 NESTLE 1650.00 1690.00 1640.00 1640.00 13 390 643,630NHL -N-0000 NAWALOKA 3.00 3.10 3.00 3.10 19 65,062 199,286

NIFL-N-0000 NANDA FINANCE 7.10 7.10 6.70 6.80 21 29,484 201,033

NTB -N-0000 NATIONS TRUST 59.80 60.00 59.20 59.90 29 22,919 1,369,480

ODEL-N-0000 ODEL PLC 23.00 23.00 22.50 22.50 11 8,200 184,770

OFEQ-N-0000 OFFICE EQUIPMENT 0.00 0.00 0.00 3000.00 0 0 0

OGL -N-0000 ORIENT GARMENTS 11.70 11.70 11.20 11.30 11 6,500 73,860

-

7/29/2019 Daily Trade Journal -12.02

12/14

Softlogic Equity Research Page | 12

Ticker Counter Open High Low Close Trades Volume Turnover

ONAL-N-0000 ON'ALLY 0.00 0.00 0.00 53.00 0 0 0

ORIN-N-0000 ORIENT FINANCE 15.50 15.50 15.50 15.50 2 1,450 22,475

OSEA-N-0000 OVERSEAS REALTY 14.00 14.10 14.00 14.00 3 4,300 60,210

PABC-N-0000 PAN ASIA 18.50 18.50 18.10 18.40 94 192,548 3,536,146

PALM-N-0000 PALM GARDEN HOTL 0.00 0.00 0.00 117.00 0 0 0

PAP -N-0000 PANASIAN POWER 2.70 2.80 2.70 2.70 20 79,143 213,806

PARA-N-0000 PARAGON 905.00 910.00 900.00 900.80 9 27 24,315

PARQ-N-0000 SWISSTEK 14.80 14.80 14.80 14.80 2 450 6,660

PCH -N-0000 PC HOUSE 5.00 5.00 4.80 4.90 94 157,906 773,509

PCHH-N-0000 PCH HOLDINGS 7.30 7.30 7.00 7.00 4 3,601 25,207

PCP -N-0000 PC PHARMA 9.90 9.90 9.50 9.90 3 1,101 10,500

PDL -N-0000 PDL 0.00 0.00 0.00 43.30 0 0 0

PEG -N-0000 PEGASUS HOTELS 0.00 0.00 0.00 40.10 0 0 0

PHAR-N-0000 COL PHARMACY 510.00 515.00 498.90 500.00 44 846 423,642

PLC -N-0000 PEOPLES LEASING 13.00 13.30 13.00 13.20 34 65,815 862,028

PMB -N-0000 PEOPLE'S MERCH 13.80 13.80 13.60 13.70 7 3,632 49,932

RAL -N-0000 RENUKA AGRI 4.80 4.90 4.70 4.70 17 41,796 197,741

RCL -N-0000 ROYAL CERAMIC 98.50 100.00 98.50 100.00 13 202,860 20,285,940

REEF-N-0000 CITRUS LEISURE 22.80 23.70 22.80 23.30 12 17,583 406,012

REEF-W-0017 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 32.90 0 0 0

REEF-W-0018 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0

REEF-W-0019 CITRUS LEISURE[WARRANTS] 3.50 3.60 3.40 3.50 114 64,272 225,435

REG -N-0000 REGNIS 59.00 60.00 59.00 59.10 8 922 55,004

RENU-N-0000 RENUKA CITY HOT. 238.00 240.00 238.00 240.00 24 21,909 5,257,907

REXP-N-0000 RICH PIERIS EXP 35.00 35.00 35.00 35.00 1 300 10,500

RFL -N-0000 RAMBODA FALLS 15.10 15.10 15.00 15.00 2 225 3,378

RGEM-N-0000 RADIANT GEMS 0.00 0.00 0.00 58.90 0 0 0

RHL -N-0000 RENUKA HOLDINGS 0.00 0.00 0.00 35.30 0 0 0

RHL -X-0000 RENUKA HOLDINGS[NON VOTING] 24.00 24.70 24.00 24.10 4 1,138 27,318

RHTL-N-0000 FORTRESS RESORTS 16.00 16.00 15.70 15.70 5 903 14,318

RICH-N-0000 RICHARD PIERIS 7.70 7.70 7.60 7.60 25 67,798 515,725

RPBH-N-0000 ROYAL PALMS 40.30 40.30 40.30 40.30 1 300 12,090

RWSL-N-0000 RAIGAM SALTERNS 2.70 2.70 2.50 2.50 8 25,101 63,253

SAMP-N-0000 SAMPATH 239.60 239.60 230.50 235.80 108 35,697 8,396,904

SCAP-N-0000 SOFTLOGIC CAP 6.50 6.50 6.40 6.50 52 3,402 22,083

SDB -N-0000 SANASA DEV. BANK 73.50 73.50 72.60 72.90 57 6,096 444,963

SELI-N-0000 SELINSING 0.00 0.00 0.00 1000.20 0 0 0

SEMB-N-0000 S M B LEASING 0.90 0.90 0.80 0.80 28 382,220 343,108SEMB-W-0015 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.70 0 0 0

SEMB-W-0016 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0

SEMB-X-0000 S M B LEASING[NON VOTING] 0.40 0.40 0.40 0.40 25 1,083,697 433,479

SERV-N-0000 HOTEL SERVICES 16.30 16.30 16.20 16.20 3 645 10,450

SEYB-N-0000 SEYLAN BANK 60.20 60.20 58.50 59.00 3 686 40,471

SEYB-X-0000 SEYLAN BANK[NON VOTING] 34.50 35.50 34.40 35.00 29 43,646 1,524,666

SFCL-N-0000 SENKADAGALA 0.00 0.00 0.00 50.00 0 0 0

SFIN-N-0000 SINGER FINANCE 13.10 13.30 13.10 13.10 12 4,980 65,572

SFL -N-0000 SINHAPUTHRA FIN 81.00 81.00 81.00 81.00 1 55 4,455

SFS -N-0000 SWARNAMAHAL FIN 3.60 3.80 3.50 3.70 158 959,469 3,533,417

SHAL-N-0000 SHALIMAR 1037.90 1037.90 800.40 804.00 11 78 67,250

SHAW-N-0000 LEE HEDGES 0.00 0.00 0.00 251.90 0 0 0

SHL -N-0000 SOFTLOGIC 11.40 11.40 11.00 11.30 37 26,845 301,910

SHOT-N-0000 SERENDIB HOTELS 23.40 23.40 23.40 23.40 2 300 7,020

SHOT-X-0000 SERENDIB HOTELS[NON VOTING] 0.00 0.00 0.00 18.70 0 0 0SIGV-N-0000 SIGIRIYA VILLAGE 0.00 0.00 0.00 67.00 0 0 0

SIL -N-0000 SAMSON INTERNAT. 94.00 94.00 90.00 90.00 4 103 9,282

SING-N-0000 SINGALANKA 85.50 88.00 85.20 88.00 5 120 10,507

SINI-N-0000 SINGER IND. 133.00 133.00 132.30 132.30 3 408 54,258

SINS-N-0000 SINGER SRI LANKA 100.70 104.80 100.50 104.00 8 840 86,035

SIRA-N-0000 SIERRA CABL 2.40 2.40 2.30 2.30 20 58,301 136,172

SLND-N-0000 SERENDIB LAND 0.00 0.00 0.00 1775.00 0 0 0

SLTL-N-0000 SLT 43.90 43.90 43.00 43.50 13 1,687 73,547

SMLL-N-0000 PEOPLE'S FIN 39.00 39.50 38.00 38.30 26 21,215 825,925

SMLL-W-0020 PEOPLE'S FIN[WARRANTS] 0.00 0.00 0.00 3.70 0 0 0

SMOT-N-0000 SATHOSA MOTORS 230.00 235.00 230.00 231.30 8 231 53,434

SOY -N-0000 CONVENIENCE FOOD 0.00 0.00 0.00 124.50 0 0 0

SPEN-N-0000 AITKEN SPENCE 126.00 126.50 126.00 126.40 26 249,585 31,448,334

STAF-N-0000 DOLPHIN HOTELS 34.40 35.00 34.20 34.90 9 4,520 157,619

SUGA-N-0000 PELWATTE 0.00 0.00 0.00 23.50 0 0 0SUN -N-0000 SUNSHINE HOLDING 29.00 29.00 28.50 28.50 13 26,570 770,003

SWAD-N-0000 SWADESHI 0.00 0.00 0.00 8200.00 0 0 0

TAFL-N-0000 THREE ACRE FARMS 48.60 49.80 48.00 48.40 12 6,391 309,632

TAJ -N-0000 TAJ LANKA 27.50 29.50 27.50 29.20 28 18,152 521,952

TANG-N-0000 TANGERINE 0.00 0.00 0.00 80.00 0 0 0

TAP -N-0000 TAPROBANE 0.00 0.00 0.00 4.80 0 0 0

-

7/29/2019 Daily Trade Journal -12.02

13/14

Softlogic Equity Research Page | 13

Ticker Counter Open High Low Close Trades Volume Turnover

TESS-N-0000 TESS AGRO 2.40 2.40 2.30 2.30 18 183,200 428,899

TFC -N-0000 THE FINANCE CO. 17.30 17.30 17.30 17.30 1 120 2,076

TFC -X-0000 THE FINANCE CO.[NON VOTING] 5.60 5.60 5.40 5.40 32 75,312 409,466

TFIL-N-0000 TRADE FINANCE 13.00 13.00 13.00 13.00 1 999 12,987

TILE-N-0000 LANKA FLOORTILES 62.70 66.50 62.70 62.80 2 27 1,697

TJL -N-0000 TEXTURED JERSEY 10.20 10.20 10.00 10.10 90 221,812 2,235,389

TKYO-N-0000 TOKYO CEMENT 25.60 26.00 25.50 25.60 16 9,205 234,913

TKYO-X-0000 TOKYO CEMENT[NON VOTING] 18.80 18.80 18.70 18.80 4 1,200 22,530

TPL -N-0000 TALAWAKELLE 25.30 25.30 25.30 25.30 2 230 5,819

TRAN-N-0000 TRANS ASIA 77.00 77.00 77.00 77.00 1 1 77

TSML-N-0000 TEA SMALLHOLDER 0.00 0.00 0.00 49.00 0 0 0

TWOD-N-0000 TOUCHWOOD 7.90 7.90 7.50 7.60 105 229,644 1,753,698

TYRE-N-0000 KELANI TYRES 34.00 34.00 33.00 33.00 8 19,382 640,506

UAL -N-0000 UNION ASSURANCE 89.10 89.50 89.00 89.50 3 590 52,760

UBC -N-0000 UNION BANK 15.30 15.80 15.20 15.40 103 421,056 6,550,917

UCAR-N-0000 UNION CHEMICALS 0.00 0.00 0.00 460.00 0 0 0

UDPL-N-0000 UDAPUSSELLAWA 0.00 0.00 0.00 28.60 0 0 0

UML -N-0000 UNITED MOTORS 96.00 97.00 96.00 96.10 10 1,997 191,945

VANI-N-0000 VANIK INCORP LTD 0.00 0.00 0.00 0.80 0 0 0

VANI-X-0000 VANIK INCORP LTD[NON VOTING] 0.00 0.00 0.00 0.80 0 0 0

VFIN-N-0000 VALLIBEL FINANCE 30.60 31.00 30.50 31.00 8 24,387 753,941

VLL -N-0000 VIDULLANKA 3.70 3.80 3.70 3.80 3 1,000 3,700

VONE-N-0000 VALLIBEL ONE 17.10 17.60 17.10 17.20 44 37,070 638,747

VPEL-N-0000 VALLIBEL 6.40 6.40 6.40 6.40 9 37,150 237,760

WAPO-N-0000 GUARDIAN CAPITAL 46.80 48.00 45.70 47.60 23 3,522 164,550

WATA-N-0000 WATAWALA 12.20 12.40 12.10 12.30 35 60,071 740,946

YORK-N-0000 YORK ARCADE 0.00 0.00 0.00 16.20 0 0 0

-

7/29/2019 Daily Trade Journal -12.02

14/14

Softlogic Equity ResearchDimantha Mathew

[email protected]+94 11 7277030

Akeela Imthinam Rasheed

+94 11 7277032

Crishani Perera

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277004

Softlogic Equity SalesBranches

Horana

Madushanka Rathnayaka

No. 101, 1/1, Aguruwathota Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

MataraLalith Rajapaksha

No.8A, 2nd

Floor, FN Building, Station Road, Matara

+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Shafraz Basheer

+94 11 7277054, +94 77 2333233

Sonali Abayasekera

+94 11 7277059, +94 77 7736059

Thanuja De Silva

[email protected]+94 11 7277053, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions ar e subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or s ell any securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customers. Not all customers will receive the material at the same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer t o make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying or

related to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not be

reproduced, distributed, or published for any purposes.