Daily Trade Journal - 17.06.2013

-

Upload

randora-lk -

Category

Documents

-

view

215 -

download

0

Transcript of Daily Trade Journal - 17.06.2013

-

7/28/2019 Daily Trade Journal - 17.06.2013

1/7

q

q

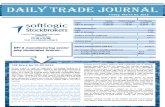

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

YTD Performance

S&P SL 20 Index

40.8

90.4

16.0

146.2

55.7

Monday, June 17, 2013

922.6

% ChangePoint ChangeToday

8.7

310.1

0.00 %

-0.22 %

2,388.4

ASPI

S&P SL 20 Index

- 0.28

- 7.56

6,219.11

3,496.79

ASPI 10.2%

13.3%

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 17.06.2013Dull momentum in the bourse: Bourse displayed a

range-play today where the indices traded on a

technically called rectangle pattern on a band of

nearly 29 points. However market activity were dull in

most part of the day and ASPI ended marginally

negative at 6,219.11with a loss of 0.2 points. Gains

recorded in Ceylon Tobacco Company (+1.0%),

Ceylon Beverage Holdings (14.1%) and the losses

denoted in Commercial Leasing and Finance (-4.7%)

and John Keells Holdings (-0.5%) kept the indices on

marginal grounds.

Dormant off-board interest: The activities on the

crossing board were low and were topped by a

single off-board transaction of Distilleries Company of

200k shares which was dealt at LKR.195.0. DIST also

showed active on-board interest where it recorded a

single 99k share transaction at LKR195.0. The counter

closed at LKR193.0 with a dip of 1.0%. CeylonTobacco Company too recorded a single crossing of

25k shares at LKR1000.0.

Heavy caps leading the daily turnover: Notable on-

board interest was seen in heavy caps John Keells

Holdings, Ceylon Tobacco Company and Distilleries

Company. John Keells Holdings further dipped today

by 0.5% and settled at LKR264.2. JKH recorded several

on-board transactions of 10k at LKR265.0.

Retail activity slowed: Retail activity was low.

However selected counters Nanda Investments and

Finance, Kelsey Developments and MTD Walkers

displayed some retail interest.

ASPI on a consolidation tone

-

7/28/2019 Daily Trade Journal - 17.06.2013

2/7

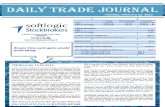

Statistical Look Up

Treasury Bill (%) 12.06.2013

8.67

9.80

10.85

12.69

Inflation (%) May-13 7.3

8.8

All Share Price Index q

S&P SL20 Index q

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance q

Beverage, Food & Tobacco p

Construction & Engineering q

Diversified q

Healthcare q

Hotels & Travels q

Land & Property q

Manufacturing q

Plantation p

Telecom q

-3.73%

2.3

112.5

357.6

13,603.6

% Change

0.00%2.3

-210.40%

16.9

-1.21%

-1.78%

-2.35%

-4.22%

% WoW

ChangeLast Week

-1.92%

-68.90%

-50.46%

-74.71%

470.1

2,388.5

28.4

-62.45%

-62.45%

% WoW

ChangeLast Week

825.9

6.4

-2.06%

-1.00%

0.00%

Today

90.4

2.3

55.7

16.9

6,219.1

-0.22%

2,388.4

2.2

146.2

-46.27%

-46.27%-69.23%

-2.53%

2.48.7

231

3,496.8

577.2

4.5

237

310.1

0.00%

-8.48%

-76.93%

Week ending

-0.48%

-67.24%

-5.33%

-1.92%

-2.17%

-1.93%

244

2,435.1

6,341.3

3,574.5

26.6

-1.92%

4.76%

159.7

241.6

-81.9

Change %

6,219.4

3,504.4

2.1

0.00% 17.2

Pre Day

13,846.1

18,940.7

2,033.0

3,500.5

621.6

-0.37%

2,912.6

2,067.4

-0.32%

1.14%

-0.73%

-0.11%

2,919.9

19,349.3

638.7

164.9 166.7-0.12%164.7

2.2

3,079.4

19,156.8

2,898.7

2,030.7

13,560.7

Pre Day

0.00%

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 17.06.2013

Today

-15.28

674.0 684.1 -1.48% 695.2 -3.04%

804.1 802.0 0.26% 819.5 -1.89%

3,198.5

3,571.6

-1.58%

3,487.7

611.7

-0.94%3,108.7

6000

6100

6200

6300

6400

6500

6600

Index

ASPI

3400

3450

3500

3550

3600

3650

3700

Index

S&P SL20

0.0

10.0

20.0

30.0

40.0

50.0

60.0

70.0

0

500

1,000

1,500

2,000

2,500

3,000

Volume('mn)

TurnoverLKR('mn)

Turnover Volume

Softlogic Equity Research Page | 2.

-

7/28/2019 Daily Trade Journal - 17.06.2013

3/7

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

DISTILLERIES

CEYLON TOBACCO

JKH

HNB

COMMERCIAL BANK

Most Active

Close

264.20

990.00

263.90

994.00

163.50

137.00

700.10

8.80

Volume (mn)

0.3%

Turnover

(LKR)

1.2%

62,283,972

21,077,637

11,555,599

49,350,479

28,217,658

0.32

0.05

0.10

2.6% 62,283,972

7,866,932

2.1%

264.20

163.50

116.40

BROWNS BEACH 18.50

S M B LEASING 0.80

% Change

DISTILLERIES

NATION LANKA 10.10

0.48

0.95

0.63

10.20

1.04%979.80

0.11

0.130.00%

0.29

0.00%

0.00%

-4.15%

0.9%

0.5%

0.0%

Contribution to

Total T/O

2,919,597

-0.26%

195.00

501,816

8,941,625

54.71

HUEJAY

PROPERTY DEVELOPMENT

Pre Day

-1.03%195.00 2.6%0.32

Volume (mn)% Change

12.11%

+ 74.00 14.10%

193.00

CompanyContribution to

Total T/O

144.90

0.4%

0.1%

Turnover

(LKR)

175.00

7.89

31.72

116.20

59.90

170.00

40.50

3,113.52

73.90

211.80

163.00

41.90

700.00

70.00

50.00

20.10

TodayCompany

175.00

ON'ALLY

54.00

24.23

0.7899.71

164.01

70.01

1,013.51

7.10

Today

9.93%

Turnover

USD ('000)

30.5016.67%

Intraday

Low (LKR)

Turnover

LKR ('000)

11,555.60

912.02

89.92

0.54

940.00

28,217.66

Intraday

High (LKR)

265.50

1.91

139.50

211.00

135.00

191.10

41.90

8.70

% Change

JOHN KEELLS HOLDINGS 106,494

SAMPATH BANK

ASIAN HOTELS & PROPERTIES 1,400

1.6%

452191

352

9.5%

7.8%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOM

COMMERCIAL BANK [V]

3.7%

3.0%BUKIT DARAH

DIALOG AXIATA

HNB [V]

DFCC BANK

CARGILLS

384.00

1,900.00

118.00

245.71

0.11

LOLC

AITKEN SPENCE 137.00

2.4% 484.64

14.40

168.50

199.02366.94

1.552.86

440.00

708.90

8.90

1,928.60

116.40

445.001,939.00

21,077.64

62,283.97

3.9%

2.3%

1.2%

100

115,168

128,920

1,808

4.3%

196.90

60.20

3.0%

193.00

60.10

444.00

3.2%

990.00

-0.53%

1.5%

2.2%

Change

- 4.00

- 4.90

- 4.50

- 1.80

% Change

215.00

163.50

116.70

265.60

BIMPUTH FINANCE

+ 8.20

SOFTLOGIC FIN

70.80

140.00

Volume

219.56

-1.03%

-0.98%

99,194

7,031.45

4,076.84

49,707 49,350.48

1.3%

Change

4.90

Company% of

Mkt Cap

193.00

Today Pre Day

8.20

0.80

19.30

+ 0.70

DISTILLERIES

50,176

14,632

NANDA FINANCE 8.20

Company

319,429

15,183

23,418

CEYLON BEVERAGE

PC PHARMA

Company Today

1.6%

GESTETNER

TEA SMALLHOLDER 52.30 + 9.10 21.06% HAYLEYS FIBRE 26.20 - 4.80 -15.48%

-8.22%

-8.26%

-11.59%

-8.32%

194.80

75.90

599.00

+ 17.60

Softlogic Equity Research Page | 3.

-

7/28/2019 Daily Trade Journal - 17.06.2013

4/7

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar Peoples Leasing & Finance PL

Yuan 0

Euro 0

Rupee 0

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

q

q

p

p

p

p

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) p

Crude Oil (WTI) p

ICE Cotton #2 q

CBOT Wheat q

COMEX Gold q

COMEX Silver q

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

00-Jan-00

30-07-2013

1/0/1900

1/0/1900

00-Jan-00

Description

0.00

0.00

0 1/0/1900

0

XR Date

00-Jan-00

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

00-Jan-00

0.00

Time*

USd/bu.

87.87

Price

106.28

98.50

USD/bbl.

102.48

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

EU

201.94

0.50

0.00 0

19-07-2013

128.52

0.0034.27

Malaysia

4.05

123.45

20.98

2.23

1.36

41.14

India

Currency

171.34

Indicative Rate

17.06.2013

China

0

Payment DateDPS (LKR) XD Date

6,362.7

Singapore

Switzerland

Thailand

UK

0.35

256.8

0

2,712.6

139.23

1/0/1900

1/0/1900

4.19

USA

02:28

54.5

1/0/1900

Change

1.70%

346.6

04:01

0

00-Jan-00

1/0/1900

1/0/1900

06:53

06:53

0.86%

06:54

Company

07:13

06:52

06:53

0-Jan

0-Jan

07:03

07:03

Time*

06:53

-0.14%

Change %

-0.33%

-0.47%

0.33%

0.66%

2.73%

1.22%

-0.18%

-9.6

Change

-1.76%-1.57

0

0.65

Change %

319.70

USD/t oz.

USD/t oz. -0.10

678.50

-0.45

21.85

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

13,033.1

Value

15,070.2

1,626.7

USD/bbl.

USd/lb.

USd/lb.

AMERICA

-2.25

METALS

ENERGY

Commodity

21,225.9

Units

0

45.3

Proportion

00-Jan-00

00-Jan-00

0.00

0.00

-0.70%

-0.59%

-105.9

Russia

Saudi Arabia

Japan

1,385.10 -2.50

Australia

Softlogic Equity Research Page | 4.

-

7/28/2019 Daily Trade Journal - 17.06.2013

5/7

Softlogic Equity Research Page | 5

CSE Announcements

Anilana Hotels and Properties Limited-IPO: The Company informed thatsubscriptions amounting to LKR 486,565,200 were received today. Accordingly

the issue closed at 4.30 pm.

Central Finance Company [CFIN: LKR190.0] -Debenture Issue: Finaldetails of the applications received for each category of debentures are asfollows. 49 applications of type A- debentures were received with a value of

LKR1.8252 bn. 19 applications of type B -debentures were received with a value of LKR539.6 mn. 44

applications of type C- debentures were received with a value of LKR1.9647 bn.

Local News

Sri Lanka growth to be on track: Sri Lanka is expecting 7.5% growth this year despite a slowdown in exports,and adverse weather hitting fisheries, Central Bank Governor Nivard Cabraal said. Cabraal said Gross

Domestic growth in the first quarter is expected to be close to 6.0%. "If we have that number our 7.5%number could be reached," Cabraal told foreign correspondents in Colombo. "That was the highest base

(quarter) in the previous year. So if we have 6 or close to 6% it will give us the confidence to keep our

numbers without a change." The Central Bank usually revises its annual growth target based on ongoing

developments while also tweaking interest rates and other policies to manage inflation and allow credit to

flow into the economy, which will boost activity. Credit to the private sector has slowed in the first four

months of the year, amid still high state borrowings. Cabraal said bad weather had hit fisheries, which may

also impact inflation in the short term, but he was also confident of maintaining single digit inflation.

[Source: www.lbo.lk]

Cabraal says rupee movement no cause for concern: The fall in Sri Lankas rupee currency is no cause forconcern as foreign investors have been changing their positions rather than pulling out of the countrys bondmarket, Central Bank Governor Ajith Nivard Cabraal said. The rupee had sunk to a more than six-month low

of 129.00/129.10 per dollar on Friday, as foreign investors sold bonds as part of a broader sell-off in

emerging markets on fears that loose global monetary conditions were about to end. We havent seen

foreigners cashing out we havent seen any (rupee) movement that has caused us any concerns,Cabraal

told a Foreign Correspondents Association Forum late on Friday. We have actually seen some of the banks

changing their positions and booking forwards, perhaps, with the conditions that are taking place in the rest

of the Asia. They are doing it mainly as a hedge because they believe that there could be a movement in the

direction of depreciation.

[Source: www.ft.lk]

Sri Lanka private credit falls to three year low in April: Sri Lanka's credit to private business fell to a threeyear low of LKR7.6 bn in April 2013 the lowest since May 2010, with state borrowings continuing to crowd

out other loans. In the same month, central government borrowing from domestic banks rose LKR76.8 bn to

LKR851.2 bn, with borrowings in the past 12 months growing 54.6% accelerating from 41.9% in March. State

enterprises borrowed another LKR9.1 bn in April, with total borrowings up 34% in the 12-months to

LKR344.6 bn. The increase was lower than in March. Foreign currency borrowings by state enterprises were

steady at LKR233.9 bn in the month from LKR234.1 bn, while rupee borrowings rose to LKR110.6 bn from

101.4 bn a month earlier. Net bank borrowings by the central government rose LKR36.7 bn to LKR1,217 bn,

in April up 18.3% from a year earlier. Net credit to government was lower than gross borrowings from

commercial banks due a contraction in central bank credit by LKR40.7 bn.

[Source: www.lbo.lk]

Exchange relaxation to boost apartment sales: Leading property developers welcomed last weeksexchange controls relaxations by the Central Bank, which permitted the repatriation of capital and capital

gains from the sale of residential properties by non- residents. This is one of the issues which restricted

foreigners buying Sri Lankan apartments. We have been asking to liberalize this area as we believed that

-

7/28/2019 Daily Trade Journal - 17.06.2013

6/7

Softlogic Equity Research Page | 6

investors should have the liberty to buy and sell property at their discretion similar to any other inves tment,

said CEO of Overseas Realty Ceylon [OSEA: LKR18.5]. The relaxed rules are expected to boost apartment

sales as they will now provide a clear pathway for foreigners to buy as well as invest in apartments,

according to another leading property developer. The relaxed exchange controls will now provide hassle-

free and streamlined ways for foreigners to buy apartments. Apart from that, this will also open up the

market for the overseas investors to invest in our condominiums with the option of res elling at a later date,

said the head of Marketing and Sales at Imperial Builders Private Limited, Dilshan Kodituwakku.[Source: www.dailymirror.lk]

Sri Lanka promises fast-track investment approvals from July 01: Sri Lanka's investment promotion ministrysaid a new fast-track unit will be opened from July 01, to give approvals for projects within three months.

The Board of Investment of Sri Lanka will staff the office with six officers who have multi-lingual capabilities,

the ministry said in a statement. All applications that are submitted will be copied to the investment

promotions minister and the ministry secretary who will solve any outstanding problems. Issues that cannot

be solved at a ministry level will be forwarded to a progress monitoring committee chaired by the President.

Investment promotions minister Lakshman Yapa Abeywardene expects the procedure to provide all

necessarily approvals, within three months, the statement said.

[Source: www.lbo.lk]

Global News

India Holds Rates as Rupee Drop Risks Fueling Inflation: ndia left interest rates unchanged after a plunge inthe rupee to a record low threatened to stoke inflation in Asias third-largest economy. Governor Duvvuri

Subbarao kept the repurchase rate at 7.25% as 15 of 25 analysts in a Bloomberg News survey predicted, a

Reserve Bank of India statement showed in Mumbai today. Ten called for a fourth straight cut of 25 basis

points. The rupees fall of about 6% versus the dollar this quarter is among the steepest in Asia and may fan

import costs in a country with the second-highest consumer inflation in the Group of 20 nations. The

currency has been weighed down by an unprecedented current-account deficit that Subbarao has said is the

biggest risk in an economy hurt by moderating investment.[Source: www.bloomberg.com]

Singapore Exports Fall More Than Estimated on Electronics Slump: Singapores exports fell more thaneconomists estimated in May as manufacturers shipped fewer electronics after an uneven global recovery

hurt demand. Non-oil domestic exports slid 4.6% from a year earlier, after falling 1 percent in April, the trade

promotion agency said in a statement today. The median of 10 estimates in a Bloomberg News survey was

for a 0.2% drop. Shipments of electronics dropped 13.2% from a year ago, extending the slump to a 10th

month. The World Bank last week cut its global growth forecast for 2013 after emerging markets from China

to Brazil slowed more than projected, weakening prospects for Singapores trade-dependent economy.

Analysts have lowered their estimate for the islands export expansion this year to 2.5% from 4%, according

to a survey by the central bank this month.[Source: www.bloomberg.com]

-

7/28/2019 Daily Trade Journal - 17.06.2013

7/7

Softlogic Equity Research Page | 7

Softlogic Equity ResearchDimantha Mathew

+94 11 7277030

Kavindu Ranasinghe

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277032

Softlogic Equity SalesBranches

Horana

Madushanka Rathnayaka

No. 212, 1st

Floor, Panadura Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

Matara

Lalith RajapakshaNo.8A, 2

ndFloor, FN Building, Station Road, Matara

+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Sonali Abayasekera

+94 11 7277051, +94 77 7736059

Thanuja De Silva

+94 11 7277059, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions ar e subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell a ny securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customeLKRNot all customers will receive the material at the same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer t o make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying orrelated to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not be

reproduced, distributed, or published for any purposes.