Daily Trade Journal -06.03

Transcript of Daily Trade Journal -06.03

7/29/2019 Daily Trade Journal -06.03

http://slidepdf.com/reader/full/daily-trade-journal-0603 1/7

p

p

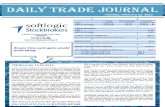

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

YTD Performance

S&P SL 20 Index

38.3

-248.5

0.2

419.2

667.7

Wednesday, March 06, 2013

854.1

% ChangePoint ChangeToday

60.6

1,305.9

0.65 %

0.19 %

2,176.2

ASPI

S&P SL 20 Index

+ 36.59

+ 5.94

5,663.36

3,214.86

ASPI 0.4%

4.2%

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 06.03.2013

The bourse reversed from its sluggish negative tone with a

surge in the index amidst renewed buying interest which

was primarily concentrated upon the big caps in the

market. Though the market saw some volatility in the 1st half

an hour of trading, buying interest of investors stepped

securing the direction of the index which recorded a gain

of 37 points. Ceylon Tobacco (+2.5%), Cargills (+3.6%) and

Selinsing (13.3%) were the main positive contributors for theindex. However the positives and negative of selected blue

chips of the S&P SL20 registered a rather slow uptick with

only a gain of 6 points. The buying interest in the market is mostly gathered around

the blue chip counters while speculative counters have

dipped further in the recent past with most of the counters

recording 52-week low prices during the last month. Thus

we continue stress to our investors to shift away from the

known speculative lot to the more fundamental counters

backed by earnings which are generating attractive returns

even in this stagnant market. The 2nd largest listed bank Hatton National bank recorded 3

large crossings accounting for 4.1mn shares at LKR149.0

which is a 52-week low off- board price for the counter. The

crossings contributed 46% to the day’s turnover. Onboard

activity of the counter was rather weak with only 15k shares

changing hands while the counter closed at LKR150.4

(+0.3%). The Non-Voting share of the counter, too,

generated strong investor attention as the bullish investors

pushed the counter to a new 52-week high price of

LKR123.0. The counter recorded a mid-sized block of 63k

shares which changed hands on board at LKR121.0 while

the counter closed the day at its high price of LKR123.0 withgain of 2.5%. Cargills, the company with the country’s largest

supermarket chain supported turnover with 4 crossings

accounting for 1.9mn shares dealt at LKR155.0. A further on-

board block of 108k shares was dealt at LKR155.0 as the

counter closed at LKR151.3 (+3.6%). Investor play was

witnessed in the diversified sector counters; Softlogic

Holdings and John Keells Holdings. The former recorded a

large block of 2.9mn shares at LKR10.3 as the counter

generated positive returns of 1.0% closing at LKR10.6. The

latter which reached a 52-week high price last week saw

some profit taking resulting in the counter closing down atLKR234.3 (-0.1%).

Bourse surge 37 points; Diversifieds and Banks generate turnover…

7/29/2019 Daily Trade Journal -06.03

http://slidepdf.com/reader/full/daily-trade-journal-0603 2/7

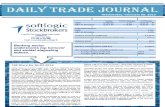

Statistical Look Up

Treasury Bill (%) 08.03.2013

9.11

10.10

11.14

14.42

Inflation (%) Feb-13 9.8

8.6

All Share Price Index p

S&P SL20 Index p

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance p

Beverage, Food & Tobacco p

Construction & Engineering q

Diversified p

Healthcare q

Hotels & Travels q

Land & Property p

Manufacturing p

Plantation p

Telecom p

0.06%

2.1

205.8

-107.2

12,666.1

% Change

0.67%2.1

-188.14%

15.2

0.24%

-0.69%

-0.58%

-1.32%

% WoW

ChangeLast Week

-0.18%

325.10%

224.45%

131.85%

98.6

2,161.8

13.5

109.61%

109.61%

% WoW

ChangeLast Week

623.0

4.9

-0.39%

0.68%

0.65%

Today

-248.5

2.1

667.7

15.3

5,663.4

0.19%

2,176.2

2.3

419.2

116.66%

116.66%348.99%

3.83%

10.260.6

244

3,214.9

602.8

4.7

235

1,305.9

0.67%

43.11%

5972.42%

Week ending

-3.22%

155.69%

2.52%

-0.18%

0.13%

-0.20%

238

2,180.1

5,674.5

3,210.8

23.7

-0.18%

0.00%

292.9

11.0

282.0

Change %

5,626.8

3,208.9

2.3

0.67% 15.3

Pre Day

12,767.0

15,691.2

1,848.5

3,339.6

459.3

0.00%

2,794.6

1,862.2

0.41%

1.74%

-1.73%

0.04%

2,752.1

15,855.5

471.4

166.8 168.11.03%168.6

2.4

2,575.6

15,964.1

2,704.5

1,849.2

12,717.9

Pre Day

-4.17%

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 06.03.2013

Today

-38.46

591.6 598.4 -1.13% 604.3 -2.09%

776.1 769.0 0.93% 788.2 -1.54%

2,574.1

3,359.0

1.27%

3,339.5

465.2

1.17%2,545.8

5500

5600

5700

5800

5900

I n d e x

ASPI

3140

3160

3180

3200

3220

3240

3260

3280

3300

I n d e x

S&P SL20

0.0

20.0

40.0

60.0

80.0

100.0

120.0

140.0

0

500

1,000

1,500

2,000

2,500

V o l u m e ( ' m n )

T u r n o v e r L K R ( ' m n )

Turnover Volume

Softlogic Equity Research Page | 2.

7/29/2019 Daily Trade Journal -06.03

http://slidepdf.com/reader/full/daily-trade-journal-0603 3/7

High Index Calibre ≥ USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

HNB

CARGILLS

ASIA SIYAKA

DISTILLERIES

SOFTLOGIC

Most Active

Close

234.30

770.00

233.50

770.00

150.40

119.70

730.00

9.00

Volume (mn)

4.3%

Turnover

(LKR)

4.3%

605,959,870

38,163,932

35,225,840

311,311,509

93,267,305

2.42

2.01

3.41

0.0% 968,186

93,267,305

14.3%

3.00

180.00

10.60

SOFTLOGIC 10.60

HNB 150.40

% Change

S M B LEASING[NON VOTING]

CARGILLS 151.30

3.41

33.30

4.07

146.10

3.56%146.10

33.30

0.210.00%

2.01

3.45%

0.27%

0.95%

1.8%

1.6%

27.8%

Contribution to

Total T/O

311,311,509

0.95%

0.40

605,959,870

35,225,840

23.56

SELINSING

AUTODROME

Pre Day

0.27%150.00 27.8%4.07

Volume (mn)% Change

13.30%

+ 4.40 16.24%

150.40

CompanyContribution to

Total T/O

120.00

1.6%

14.3%

Turnover

(LKR)

151.30

4.98

2,442.25

108.80

56.50

149.50

42.10

1,189.68

71.20

231.40

150.00

42.90

730.00

70.00

60.50

65.00

TodayCompany

155.00

BERUWELA WALKINN

765.20

9.33

83.8710,690.82

4,753.78

80.38

635.26

18.51

Today

12.78%

Turnover

USD ('000)

1,105.0022.41%

Intraday

Low (LKR)

Turnover

LKR ('000)

10,008.71

2,359.99

78.52

0.63

750.00

24,486.96

Intraday

High (LKR)

234.60

11.77

119.00

230.00

118.00

178.10

43.00

8.90

% Change

JOHN KEELLS HOLDINGS 104,564

SAMPATH BANK

ASIAN HOTELS & PROPERTIES 152,700

1.5%

47337

42,919

9.2%

6.6%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOM

COMMERCIAL BANK [V]

4.0%

3.4%BUKIT DARAH

DIALOG AXIATA

HNB [V]

DFCC BANK

CARGILLS

46.40

1,610.00

109.20

1,500.19

14.42

LOLC

AITKEN SPENCE 120.40

2.5% 299.40

1,838.67

153.00

208.0859.75

1.630.47

435.00

738.00

9.10

1,640.00

108.90

449.001,640.00

605,959.87

38,163.93

3.9%

2.2%

1.3%

110

70,725

4,066,721

12,507

4.0%

180.00

59.90

3.4%

180.00

58.00

440.00

3.6%

151.30

3.45%

1.7%

2.2%

Change

- 245.50

- 131.80

- 9.50

- 10.00

% Change

233.00

180.00

10.50

2.90

TANGERINE

+ 129.00

SERENDIB LAND

70.00

119.20

Volume

192.10

0.00%

3.56%

91,830

3,003.26

311,311.51

7,871 5,914.82

1.4%

Change

49.70

Company% of

Mkt Cap

0.40

Today Pre Day

2.90

150.00

10.50

+ 9.10

DISTILLERIES

25,160

5,154

ASIA SIYAKA 3.00

Company

212,022

40,793

2,008,561

PRINTCARE PLC

RADIANT GEMS

Company Today

1.6%

AGALAWATTE

ENVI. RESOURCES [W 0003] 1.80 + 0.50 38.46% HUEJAY 53.90 - 14.70 -21.43%

-13.33%

-13.57%

-18.18%

-14.69%

30.00

1,099.00

31.50

+ 3.40

Softlogic Equity Research Page | 3.

7/29/2019 Daily Trade Journal -06.03

http://slidepdf.com/reader/full/daily-trade-journal-0603 4/7

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar No Announcements

Yuan 0

Euro 0

Rupee 0

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

p

p

p

p

p

p

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) q

Crude Oil (WTI) q

ICE Cotton #2 p

CBOT Wheat q

COMEX Gold q

COMEX Silver p

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

00-Jan-00

00-Jan-00

1/0/1900

1/0/1900

00-Jan-00

Description

0.00

0.00

0 1/0/1900

0

XR Date

00-Jan-00

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

00-Jan-00

0.00

Time*

USd/bu.

87.04

Price

111.45

90.72

USD/bbl.

102.42

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

EU

193.01

0.00

0.00 0

0

127.47

0.0033.99

Malaysia

4.16

131.11

20.50

2.33

1.37

41.09

India

Currency

166.50

Indicative Rate

06.03.2013

China

0

Payment DateDPS (LKR) XD Date

6,452.8

Singapore

Switzerland

Thailand

UK

-0.15

217.3

0

2,694.7

135.53

1/0/1900

1/0/1900

4.29

USA

01:28

20.9

1/0/1900

Change

0.43%

248.8

03:01

0

00-Jan-00

1/0/1900

1/0/1900

06:51

06:51

0.33%

06:51

Company

06:50

06:50

06:51

0-Jan

0-Jan

06:45

06:46

Time*

06:52

-0.13%

Change %

-0.42%

0.30%

-0.13%

-0.09%

2.13%

0.96%

-0.03%

14.6

Change

0.07%0.06

0

-0.08

Change %

351.05

USD/t oz.

USD/t oz. 0.09

703.00

-0.45

28.69

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

11,932.3

Value

14,253.8

1,539.8

USD/bbl.

USd/lb.

USd/lb.

AMERICA

-3.00

METALS

ENERGY

Commodity

22,777.8

Units

0

11.5

Proportion

00-Jan-00

00-Jan-00

0.00

0.00

0.89%

0.96%

126.0

Russia

Saudi Arabia

Japan

1,574.50 -0.40

Australia

Softlogic Equity Research Page | 4.

7/29/2019 Daily Trade Journal -06.03

http://slidepdf.com/reader/full/daily-trade-journal-0603 5/7

Softlogic Equity Research Page | 5

CSE Announcements

People’s Leasing & Finance Company [PLC: LKR13.1]: The CSE has

approved in principle an Application for listing the debt securities of the

Company. The debt securities are to be listed on the Main Board of the CSE.

Details of the above issue are as follows; Debt Securities to Be Offered30,000,000 Senior, Unsecured, Redeemable Debentures at an issue price of

LKR100.00 each (with an option to issue up to a further 30,000,000 Debentures

in the event the initial 30,000,000 Debentures are oversubscribed). Date of

opening of The Subscription List 19th March 2013.

Local News

Sri Lanka Treasuries slightly up: Sri Lanka's Treasuries yields edged up slightly across maturities and

Wednesday's auction with the three month yield rising 04 basis points to 11.14%, data from the state debtoffice showed. The 3-month yield rose 02 basis points to 9.11% and the 6-month yield rose 02 basis points to

10.10%. The debt office said LKR27 bn of bills were sold, with LKR2.4 bn in 3-month bills, LKR1.2 bn in 6-

month bills and LKR24.2 bn in one year bolls being sold.

[Source: www.lbo.lk]

Sri Lanka LKR2.4bn road to be financed by HNB: A 27 kilometre stretch of a in Sri Lanka's central hills

running from Haputale, Boralanda will built by a domestic contractor with finance from Hatton National

Bank [HNB: LKR150.4, HNB.X: LKR123.0] , the state information office said. The cabinet of ministers had

approved a proposal to build the road with bank finance under a scheme where over 600 kilometres of roads

will be built under a USD500 loan scheme from commercial banks under Treasury guarantee. The contract

to build the road had been given to Consulting Engineers and Contractors (Pvt) Ltd, for LKR2,445 mn. The

external resources department of the ministry of finance will negotiate terms of the loan.

[Source: www.lbo.lk]

Sri Lanka bans ethanol imports: Sri Lanka has banned the import of ethanol from March 01, using import

and export control laws, a notice on the website of the customs office said. The customs office said un-

denatured ethyl alcohol of 80% strength and denatured spirits have been prohibited. Last year Sri Lanka

expropriated two sugar privately held sugar mills which produced ethanol and LKR550 mn of people's tax

money was used to keep them afloat. Analysts say the trade control will force industries that use ethanol

including alcohol producers to purchase from state producers.

[Source: www.lbo.lk]

Sri Lanka railways get US278mn China loan: Sri Lanka will get USD278 mn in loans from China to build 26.75

kilometres of rail track from Matara to Beliatta in the South of the island, the finance ministry said. The Exim

Bank of China will provide USD200 mn under an agreement signed on February 18 as a preferential buyers'

credit at 2.0% interest with a 20-year repayment and 5-year grace period. The balance USD78.2 mn will be

provided by the Chinese government, the finance ministry said without elaborating. Previous Chinese

government loans have been denominated in Yuan. The construction of the railroad involves building,

bridges, culverts, viaducts, level crossings, road diversions, earth embankments and four railway stations.

The rail track is the first phase of an extension running to Karataragama from Matara, via Hambantota. A

new sea port and airport has been built in Hambantota with Chinese finance.

[Source: www.lbo.lk]

Sri Lanka NSB hires lead managers for international bond: Sri Lanka's state-run National Savings Bank has

hired HSBC, Citibank and Barclays to lead manage an international bond sale of up to a billion US dollars,

sources familiar with the deal said. Authorities have said that Sri Lanka's government is not directly going to

international capital markets this year. The sale is expected to begin with the next three to four weeks,

7/29/2019 Daily Trade Journal -06.03

http://slidepdf.com/reader/full/daily-trade-journal-0603 6/7

Softlogic Equity Research Page | 6

market sources said. By September 2012 NSB had LKR481 bn in assets or about USD3.7 bn. National

Development Bank [NDB: LKR146.0] and DFCC Bank [DFCC: LKR119.2] are also expected to raise USD 250

mn from international markets this year.

[Source: www.lbo.lk]

Global News

Service Industries in US Grow at Fastest Pace in a Year: Service industries in the US expanded in February at

the fastest pace in a year as a recovery in housing rippled through the economy. The Institute for Supply

Management’s non-manufacturing index unexpectedly increased to 56 last month from 55.2 in January, the

Tempe, Arizona-based group said today. Readings above 50 signal expansion in the industries comprising 90

percent of the economy. The median Bloomberg forecast called for the measure to ease to 55. The fastest

pace of new-home sales since 2008 is benefiting builders such as Hovnanian Enterprises Inc., real-estate

agents and mortgage-finance companies. Accelerating service orders, along with a pickup in manufacturing

reported last week, show the economy is withstanding budget battles in Washington.

[Source: www.bloomberg.com]

Eurozone confident on Cyprus bailout: Eurozone finance ministers, known collectively as the Eurogroup, are

confident of agreeing a bailout for Cyprus by the end of March. The bailout could be worth up to 17bn euros

(USD22 bn; GBP15bn). Eurogroup head Jeroen Dijsselbloem said ministers were ready to help Cyprus, but

the details still needed to be worked out. Cyprus's new government has agreed to a review of how banks are

implementing anti-money laundering laws, he said. This is likely to appease Germany, which had raised

concerns about money-laundering on the island. "We agreed to target a political endorsement of the

programme towards the second half of March," Mr Dijsselbloem said, referring to the rescue package. EU

Commissioner for Economic Affairs Olli Rehn hailed the breakthrough on money-laundering. He had warned

over the weekend that Cyprus leaving the eurozone remained a dangerous possibility.

[Source: www.bloomberg.com]

7/29/2019 Daily Trade Journal -06.03

http://slidepdf.com/reader/full/daily-trade-journal-0603 7/7

Softlogic Equity Research Page | 7

Softlogic Equity Research Dimantha Mathew

+94 11 7277030

Kavindu Ranasinghe

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277032

Softlogic Equity Sales

Branches

Horana

Madushanka Rathnayaka

No. 101, 1/1, Aguruwathota Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

Matara

Lalith Rajapaksha

No.8A, 2nd Floor, FN Building, Station Road, [email protected]

+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Shafraz Basheer

+94 11 7277054, +94 77 2333233

Sonali Abayasekera

+94 11 7277059, +94 77 7736059

Thanuja De Silva

+94 11 7277053, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently veri fied and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customers. Not all customers will receive the material at the same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer t o make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying or

related to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not bereproduced, distributed, or published for any purposes.