Daily Trade Journal - 05.02

Transcript of Daily Trade Journal - 05.02

-

7/29/2019 Daily Trade Journal - 05.02

1/13

q

p

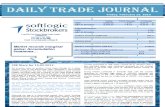

Today's Turnover (LKR mn) Annual Average Daily Turnover (LKR mn)

Volume (mn) Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn] - Foreign Buying (LKR mn)- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

YTD Performance

S&P SL 20 Index

39.9

4.1

-0.9

223.9219.8

Tuesday, February 05, 2013

911.0

% ChangePoint ChangeToday

19.3

447.3

-0.32 %0.22 %

2,220.9

ASPI S&P SL 20 Index

- 18.39+ 7.10

5,781.30 3,203.91

ASPI 2.5%3.8%

Level 23, East Tower, World Trade Centre,Colombo 01

Tel: +94 11 727 7000, Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 05.02.2013 The bourse extended volatile sentiments to initiate trading followingholidays, as the benchmark index failed to sustain its initial uptick touching a high of 5,816.5 (+16.8), as it followed a slippery paththereafter to close at its low of 5,781.3 points with a 18.4 points plunge.Nations Lanka Finance (-1%), Asian Hotels & Properties (-4.2%), LankaOrix Leasing (-3%) and Peoples Leasing & Finance (-3.7%) weighed onthe index negatively. On the contrary, S&PSL20 index managed to closein the green with a 13.2 points advance with outstanding contributionsfrom solid stocks in the S&P caliber; Ceylon Tobacco (+0.6%),

Commercial Bank (+1%), Dialog Axiata (+1.2%) and Distilleries (+1.3%).The market turnover dipped to the lowest recorded so far in 2013reading LKR447.3 mn amidst subdued retail play.

Bourse has been experiencing a consolidation phase over the past twoweeks which seems to extend to the current trading week as well. Profittaking in few selected counters has kept the indices down, yetaccumulation into steady play has continued with considerable activityby foreign & local institutions coupled with the local high net worthinvestors. This we reiterate as a strong indication of high confidenceshown in the equity prospects over the coming periods. We expect theindices to gather momentum in the coming weeks reasoned by theattractive earnings flow as well.

Interest didnt fade away in Commercial Bank of Ceylon as the counter yet again spearheaded the days turnover list with a c.27% contribution.Followed by heavy foreign & high net worth investor play in the counter,buying interest extended in it as it witnessed several large on-boarddeals including 469.9k & 379.5k share blocks. The counter advanced 1%

to close at LKR106.8 trading at highly attractive valuations. Diversifiedsector players John Keells Holdings and Aitken Spence also grabbedconsiderable attention as they registered a crossing each. The former saw a parcel of c.130.7k shares being traded at LKR229.0, whilst thelatter encountered a block of c.202.5k shares being crossed off atLKR125.0. Both the counters witnessed significant on-board parcels aswell.

Buying interest was notable in Access Engineering amidst sizeable on-board trades as the counter advanced 1.5% to close at LKR20.0.Interest renewed in CT Holdings , whilst baking sector play washighlighted in Sampath Bank , Hatton National Bank [Non-Voting] andUnion Bank . Hotel sector players, John Keells Hotels & Aitken SpenceHotel Holdings also proved to be active during the day.

European Stocks Climb: European stocks climbed, rebounding fromtheir biggest plunge in more than three months, as companies fromMunich Re to BP Plc reported earnings. The Stoxx Europe 600 Indexgained 0.5% to 285.3 at 8:48 a.m. in London. Standard & Poors 500Index futures added 0.3% following the equity benchmarks biggestdrop since November, while the MSCI Asia Pacific Index fell 1.1%.

Oil Trades Near One-Week Low on Forecast of US Supply: Oil tradednear its lowest closing level in a week in New York, after sliding the mostin two months yesterday, before a report that may show rising stockpilesin the US. Crude for March delivery gained as much as 29 cents to

USD96.46 a barrel in electronic trading on the New York MercantileExchange and was at USD96.38 at 9:10 a.m. London time.

Turnover slips to the lowest YTD; Indices remain volatile

-

7/29/2019 Daily Trade Journal - 05.02

2/13

Statistical Look Up

Treasury Bill (%) 01.02.2013

9.47

10.28

11.11

14.30

Inflation (%) Jan-13 9.8

8.1

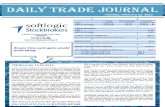

All Share Price Index q

S&P SL20 Index p

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)Traded EntitiesMarket Capitalization (LKR bn)

Foreign Purchases (LKR mn)Foreign Sales (LKR mn)Net Foreign Inflow (LKR mn)

Market PER (X)Market PBV (X)Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance q

Beverage, Food & Tobacco p

Construction & Engineering q

Diversified q

Healthcare q

Hotels & Travels q

Land & Property q

Manufacturing q

Plantation p

Telecom p

-1.93%

2.1

491.421.9

12,779.9

% Change

-0.31%2.1

-99.08%

16.4

-2.95%

0.51%

-0.89%-3.96%

% WoWChange

Last Week

-1.26%

-56.39%-55.28%-81.21%

513.4

2,227.9

14.6

-41.12%

-41.12%

% WoWChange

Last Week

759.6

6.0

-1.94%-2.08%

-0.32%

Today

4.1

2.1

219.8

16.4

5,781.30.22%

2,220.9

2.3

223.9

-52.94%

-52.94%32.50%

8.97%

3.519.3243

3,203.9

950.5

7.5

223

447.3

-0.32%

-66.53%-1.41%

Week ending

-1.23%

18.47%4.74%

-1.26%

0.29%-1.26%

2322,249.1

5,855.13,194.7

16.3

-1.26%0.00%

669.0222.9446.1

Change %

5,799.73,196.8

2.3

-0.32% 16.6

Pre Day

12,941.416,388.7

1,893.0

3,557.5500.1

-1.23%

2,834.51,879.6

-0.70%0.27%

-0.18%-0.20%

2,804.616,780.7

511.7

168.0 174.10.54%169.0

2.3

2,648.7

16,432.32,799.61,889.2

12,690.1

Pre Day

0.00%

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 05.02.2013

Today

-52.08

600.7 611.0 -1.68% 615.6 -2.42%

800.9 799.9 0.13% 812.3 -1.40%2,700.7

3,545.4-1.74%

3,513.7491.4

-0.35%2,657.9

56505700

5750

5800

5850

5900

I n d e x

ASPI

3050

3100

3150

3200

3250

I n d e x

S&P SL20

0.0

50.0

100.0

150.0

200.0

250.0

0

1,000

2,000

3,000

4,000

V o l u m e ( ' m n )

T u r n o v e r L K R

( ' m n

)

Turnover Volume

Softlogic Equity Research Page | 2 .

-

7/29/2019 Daily Trade Journal - 05.02

3/13

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

COMMERCIAL BANK

JKHAITKEN SPENCE

ACCESS ENG SL

C T HOLDINGS

Most Active

Close

229.10830.10

228.00839.00

145.10125.00

704.508.80

Volume (mn)

0.2%

Turnover(LKR)

2.4%

119,194,882

21,009,58120,757,168

76,087,49252,248,795

1.06

0.33

0.14

0.1% 2,441,512

5,053,559

3.4%125.00

20.00144.00

COMMERCIAL BANK 106.80S M B LEASING[NON VOTING] 0.40

% Change

SIERRA CABLACCESS ENG SL 20.00

1.12

5.621.18

19.70

-0.35%229.900.421.051.52%

1.05

0.00%0.00%1.04%

0.9%0.9%

0.0%

Contribution toTotal T/O

21,009,581

0.00%

2.40

472,583119,194,882

25.11

LANKEM CEYLONEQUITY TWO PLC

Pre Day

1.04%105.70 5.4%1.12

Volume (mn)% Change

5.25%+ 14.40 7.29%

106.80

CompanyContribution to

Total T/O

125.50

5.4%

0.9%

Turnover(LKR)

150.00

7.43

5.89

106.00

65.00150.00

44.00

15,789.2573.20

221.30

145.00

44.00

702.00

72.50

32.006.00

TodayCompany

150.50

LANKA ALUMINIUM

25.00

125.086.71846.46

12.10

818.59937.68

14.72

Today

4.76%

TurnoverUSD ('000)

42.309.41%

IntradayLow (LKR)

TurnoverLKR ('000)

119,194.88

1,857.93

944.256.48

830.0076,087.49

IntradayHigh (LKR)

229.50

413.91

124.20220.10

124.00181.00

45.00

8.80

% Change

JOHN KEELLS HOLDINGS 332,235

SAMPATH BANKASIAN HOTELS & PROPERTIES 11,630

1.5%

4,4501,7068,920

8.8%7.0%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOMCOMMERCIAL BANK [V]

4.0%

3.2%BUKIT DARAHDIALOG AXIATAHNB [V]

DFCC BANK

CARGILLS

6.85

1,598.00

107.50

52,248.80

3.11

LOLC

AITKEN SPENCE 126.002.5% 50.74

392.84

146.00

2,004.692,729.30

15.8821.62

450.10

704.909.00

1,599.80

106.80

452.001,600.00

1,527.53

6,404.50

3.8%

2.3%

1.4%

1,166106,476

10,532417,991

3.9%

184.0068.00

3.2%

183.5065.90

450.30

3.6%

229.100.81%

1.6%

2.1%

Change

- 4.70- 2.40- 3.00- 0.50

% Change

221.40

19.70144.00

124.00

CEYLON LEATHER [W 0014]

+ 8.20

LIGHTHOUSE HOTEL

72.80

124.50

Volume

602.75

0.00%1.52%

1,117,721

3,169.08

743.87

1,041 865.15

1.5%

Change

27.90

Company% of

Mkt Cap

2.40

Today Pre Day

0.900.40

105.70

+ 2.40

DISTILLERIES

25,33771,571

S M B LEASING 0.90

Company

34,97427,907

4,946

INDUSTRIAL ASPH.

TALAWAKELLE

Company Today

1.5%

CDB

LANKA CERAMIC 67.90 + 7.40 12.23% G S FINANCE 575.30 - 122.70 -17.58%

-7.69%-8.57%

-10.00%-8.76%

44.00164.40212.00

+ 2.00

Softlogic Equity Research Page | 3 .

-

7/29/2019 Daily Trade Journal - 05.02

4/13

Currency Board AnnouncementsLocal - Indicative Rate against LKR Dividends

Dollar Ceylon Tobacco Company

Yuan 0

Euro 0

Rupee 0

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / CapitalizationFranc CompanyBaht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

q

q

pp

q

q

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) p

Crude Oil (WTI) p

ICE Cotton #2 q

CBOT Wheat p

COMEX Gold p

COMEX Silver p

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

00-Jan-00

09-04-2013

1/0/1900

1/0/1900

00-Jan-00

Description

0.000.00

0 1/0/1900

0

XR Date

00-Jan-00

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

00-Jan-00

0.00

Time*

USd/bu.81.39

Price

116.1396.60

USD/bbl.

101.97

AGRICULTURE

Hong Kong Hang Seng IndexNikkei 225 ASIAFTSE 100 Index

EU

198.89

6.50

0.00 0

01-04-2013

126.23

0.0033.66

Malaysia

4.19

131.81

20.26

2.37

1.3740.83

India

Currency

170.38

Indicative Rate05.02.2013

China

0

Payment DateDPS (LKR) XD Date

6,267.4

Singapore

SwitzerlandThailand

UK

0.51

-536.5

0

2,639.5

138.69

1/0/1900

1/0/1900

4.24

USA

01:28

20.5

1/0/1900

Change

0.55%

-213.403:01

0

00-Jan-00

1/0/1900

1/0/1900

05:4005:40

0.33%

05:40

Company

05:3905:40

05:40

0-Jan0-Jan

05:3705:36

Time*

05:40

-0.04%

Change %

0.13%

0.56%

0.44%0.45%

-1.90%-2.27%

0.15%

-17.5

Change

-0.42%-0.34

0

0.43

Change %

376.70

USD/t oz.USD/t oz. 0.18

764.00

-0.1531.90

Index

Dow Jones Industrial AverageS&P 500 IndexEUROPEEURO STOXX 50 Price EUR

11,046.9

Value

13,880.11,495.7

USD/bbl.

USd/lb.

USd/lb.

AMERICA

1.00METALS

ENERGY

Commodity

23,148.5

Units

0

14.3

Proportion

00-Jan-0000-Jan-00

0.00

0.00

-0.93%-1.15%

-129.7

Russia

Saudi Arabia

Japan

1,678.80 2.50

Australia

Softlogic Equity Research Page | 4 .

-

7/29/2019 Daily Trade Journal - 05.02

5/13

Softlogic Equity Research Page | 5

CSE Announcements

Commercial Credit & Finance [COCR: LKR14.8]-Debenture Issue:

Blue Diamonds [BLUE: LKR3.7, BLUE.X: LKR1.7]: Mr. Asanga RohithaKarunaratna resigned from the post of Chief Executive Officer of BLUE witheffect from today.

Ceylon Tobacco Company [CTC: LKR830.1]: Mr. Henry Koo has been appointed as a Director of CTC witheffect from the 1 st February 2013.

Lanka Orix Finance [LOFC: LKR3.6]: A portfolio of credit facilities with a net value of LKR3.15 bn waspurchased from LOLC Factors Limited (Factors) on 31' January 2013, in addition to a portfolio of facilities tothe value of LKR881 Mn which was purchased from LOLC on 31st September 2012 consequent to LOLC

relinquishing its specialized leasing license. Factors is a wholly owned subsidiary of LOLC, which is asignificant shareholder of LOFC. The transaction with Factors was entered into due to the excess liquiditysituation of LOFC.

Local News

Sri Lanka's Commercial Bank [COMB.N : LKR106.8, COMB.X : LKR92.8] gets USD75 mn from IFC capital fund: International Finance Corporation, a unit of the World Bank has injected USD75 mn (LKR9.6 bn) as asubordinated loan to COMB which will boost its debt capital. The funds will be used to fund 16,000 smallbusinesses which may create up to 170,000 direct and indirect job opportunities, Commercial Bank said in a

statement. "This investment by IFC is much more than a milestone for Sri Lanka and Commercial Bank, saidRavi Dias, managing director of Commercial Bank said in a statement. It will be a noteworthy infusion in tothe national economy, given the significance of the SME sector. As Sri Lankas largest private bank,Commercial Bank is fully committed to exploring every possible opportunity to support post-conflict growth inthe country." The subordinated debt, qualify as Tier II capital under Sri Lanka's regulations, an IFC officialsaid. Jin-Yong Cai, IFC executive vice president and chief executive said the money will help the bank expandfinancing options to the underserved which is a key focus of the agency's work in South Asia.

[Source: www.lbo.lk]

Sri Lanka hydro generation recovers in November, demand flat: Sri Lanka's hydro power generation hasdoubled in November 2012 on improving rains allowing the utility to cut thermal generation by 25%, while

demand remained flat, official data shows. Sri Lanka has generated 959 mn units of electricity (GigaWatthours) in November 2012 barely changed from 958 GWh a year earlier, data from state-run Ceylon ElectricityBoard released by Sri Lanka's central bank shows. Hydro power generation in the month rose 114% to396GWh from a year earlier while thermal generation fell 25.2% to 184 GWh. But in December Sri Lanka alsoraised furnace oil prices by about 25%, which was being sold below cost to the power utility. One grade of furnace oil was raised to LKR90 from LKR65 and another from LKR75 to LLKR100 a litre, officials said at thetime. CEB has sought a tariff revision from the regulator. Purchases from power from the private producersfell 27% to 387GWh. Non-conventional renewable energy purchases -, mostly made up of private mini-hydros - surged to 10GWh from 2GWh. In the 11 months to November 2012 total power generation was up2.6% to 10.8 GWh with hydro falling 43% to 2,203 and thermal rising 52% to 3,346 GWh. The CEB's hydrostorage rose to over 80 percent of capacity by the end of the north east monsoon rains and has started ease

with the onset of the dry season in February. [Source: www.lbo.lk]

LOLC invests USD16 mn in new power plant: LOLC group [LOLC: LKR65.9] will invest USD16 mn to build apower plant to be fired by gliricidia, Ishara Nanayakkara, Deputy Chairman of the LOLC Group told Daily

No. of Applications received 114No. of Debentures Appli ed 1,191,755Value of Debentures applied (LKR) 119,175,500

-

7/29/2019 Daily Trade Journal - 05.02

6/13

Softlogic Equity Research Page | 6

News Business. The plant is expected to be commissioned in mid-2014 and according to Nanayakkara theelectricity generated will be sold to Ceylon Electricity Board under the power purchasing agreement signedbetween LOLC group and CEB. Even though the company has already selected two strategic locations namelyAmbalantota and Gonoruwa for the project, it has not still finalized the exact location to build the proposedpower plant. The company is also planning to cultivate gliricidia in barren lands in the large plantation sectorwith the support of rural community and all stakeholders. Nanayakkara also said Gliricidia leaves can be fed

to cattle or used as fertilizer.[Source: www.dailynews.lk]

Koreas Hana Bank plans to open in SL : One of the largest banks in South Korea, Hana Bank will open one of their branches in Sri Lanka this year. According to a coordinator of this project, a business delegation fromKorea is expected next week in Sri Lanka. A financial source said the Koran bank would also be included inthis team. She said that increasing trading between the two countries and the rapid development takingplace in Sri Lanka were the main reasons for Hana to enter Sri Lanka. In addition the increased number of SriLanka expatriate presence in Korea and the higher number of students going for education too were otherreasons for this bank to stamp its presence in Sri Lanka. In addition several leading Korean companies andenterprises have expressed their keeness to invest in Sri Lanka in several areas including motor industry,

power generation and infrastructure development. Meanwhile Hana Bank has also singed a MoU withNational Savings Bank to facilitate Sri Lankans working in Korea to remit their earnings to Sri Lanka. Thetriple A rating that was maintained by the NSB for over a decade was the main reason for Hana Bank tosingle out the NBS. Hana Bank through the Korean Post too has presence all over Korea and this move helpsSri Lanka expat workers in money remittance activities in a big way.

[Source: www.dailynews.lk]

Sri Lanka signs DTA agreement with Luxemburg: An Agreement on Avoidance of Double Taxation (DTA)between Sri Lanka and Luxembourg was signed on January 31 in Luxembourg. The signing of the DTA tookplace following the presentation of the Letters of Credence by Ambassador Amza, to Grand Duchy of Luxemburg on January 30. Speaking at the event, Finance Minister Luc Frienden stated that the business

community from both countries should make use of the benefits generated by signing this Agreement.Ambassador Amza reciprocating similar sentiments and recalling that in 1982, the two countries agreed andsigned an Investment Promotion and Protection Agreement, said that the businesses in both countries coulduse both these legal instruments on trade to enhance the flow of trade and business activities.

[Source: www.dailymirror.lk]

IFC facilitates loan access to small businesses: IFC, a member of the World Bank Group, is working with SriLankas Credit Information Bureau (CRIB) to make it easier for up to 37,000 micro and small businesses toaccess loans and other forms of financing using movable assets as collateral. IFC will provide advice andassistance to CRIB to support the legal framework which will enhance financing for firms against movableassets such as inventory and equipment. Expanding the collateral registry to include non-fixed assets, all of

which are more readily available to small businesses, makes it easier for them to obtain financing evenwithout traditional mortgages like land or property. [Source: www.dailymirror.lk]

Global News

Indonesias Economy Grows at Slowest Pace in Over Two Years : Indonesias economy grew at the slowestpace in more than two years last quarter as an export slump countered gains in domestic consumption,increasing pressure on policy makers to add stimulus to bolster growth. Gross Domestic Product increased6.11% in the three months through December from a year earlier, the Central Bureau of Statistics said inJakarta today, compared with a revised 6.16% for the third quarter. The median of 20 economists surveyedby Bloomberg News was 6.2%. The economy grew 6.2% in 2012. Slowing growth may compound challengesfor an economy that is already contending with a weakening rupiah, declining exports and a wideningcurrent account deficit. While a global recovery is brightening the outlook for Asia, President faces growing

-

7/29/2019 Daily Trade Journal - 05.02

7/13

Softlogic Equity Research Page | 7

pressure to raise fuel prices and curb oil imports as currency risks persist and the window to act narrowsahead of elections due in 2014.

[Source: www.bloomberg.com]

World Risks Perfect Storm on Capital Flows, Carstens Says : A perfect storm may be forming in the worldeconomy as signs of a recovery spur capital flows to emerging markets and some advanced nations that may

lead to asset bubbles, Banco de Mexico Governor Agustin Carstens said. Risk appetite among investors hasreturned and the search for yield is in full force, Carstens said in a speech in Singapore today. Concerns of asset- price bubbles fed by credit booms are starting to appear. The risk of a currency war has surfaced asmonetary easing from Japan to the US spurs demand for higher-yielding assets and boosts inflows intoemerging markets. Russia warned last month that Japans currency -weakening policies may lead toreciprocal action as nations try to protect their export industries, while South Korea and the Philippines havesaid theyll consider how to reduce the impact of such funds.

[Source: www.bloomberg.com]

UK Economy Faces Risk of Prolonged Stagnation: NIESR: Britains economy will grow more slowly this yearthan previously forecast and stagnation may persist, according to the National Institute of Economic and

Social Research. The institute sees the economy expanding 0.7% this year instead of the 1.1% forecast inNovember, and 1.5% in 2014, it said in a report published in London today. It also said Chancellor of theExchequer George Osborne should relax his fiscal squeeze to help the recovery. The economy shrank 0.3%in the fourth quarter and is facing the threat of a triple-dip recession. With Gross Domestic Product morethan 3% below its 2008 peak, NIESR said the UK is in the slowest post-recession recovery in 100 years and itdoesnt expect GDP to regain its previous peak until 2015.

[Source: www.bloomberg.com]

China Services Industries Expand at Faster Pace, HSBC Says: Chinas services industries expanded at thefastest pace in four months in January, a private survey found, supporting a recovery in the worlds second -biggest economy. The services Purchasing Managers Index released by HSBC Holdings Plc and MarkitEconomics today rose to 54 from 51.7 in December. A reading above 50 indicates expansion. A separategovernment-backed survey published on Feb. 3 showed services industries expanded at the fastest pacesince August. Todays report adds to signs that growth will accelerate for a second quarter after an almosttwo-year slowdown. The government is counting on expansion of services and domestic demand to becomea bigger part of the economy as it tries to reduce the reliance on exports and investment spending.

[Source: www.bloomberg.com]

-

7/29/2019 Daily Trade Journal - 05.02

8/13

Softlogic Equity Research Page | 8

Daily Stock Movements

Ticker Counter Open High Low Close Trades Volume Turnover

AAF -N-0000 ASIA ASSET 2.60 2.70 2.60 2.70 27 181,996 478,190AAIC-N-0000 ASIAN ALLIANCE 85.00 85.00 83.00 83.00 3 105 8,911ABAN-N-0000 ABANS 95.50 100.00 95.50 98.60 16 2,000 197,179

ACAP-N-0000 ASIA CAPITAL 30.00 30.00 29.90 29.90 5 602 18,060ACL -N-0000 ACL 68.00 68.00 67.00 67.00 2 150 10,150ACME-N-0000 ACME 14.20 14.20 14.00 14.00 12 5,539 77,774AEL -N-0000 ACCESS ENG SL 19.80 20.40 19.80 20.00 169 1,049,962 21,009,581AFSL-N-0000 ABANS FINANCIAL 37.40 37.40 37.40 37.40 1 1 37AGAL-N-0000 AGALAWATTE 32.40 32.50 30.80 31.00 10 1,150 35,864AGST-N-0000 AGSTARFERTILIZER 0.00 0.00 0.00 6.30 0 0 0AGST-X-0000 AGSTARFERTILIZER[NON VOTING] 0.00 0.00 0.00 15.00 0 0 0AHPL-N-0000 AHOT PROPERTIES 73.10 73.20 72.50 72.80 14 11,630 846,464AHUN-N-0000 A.SPEN.HOT.HOLD. 72.00 73.00 72.00 72.10 16 63,593 4,579,555ALLI-N-0000 ALLIANCE 725.00 725.00 720.00 721.70 3 62 44,750ALUF-N-0000 ALUFAB 21.70 21.70 20.00 20.40 29 13,100 267,865AMCL-N-0000 CAPITAL LEASING 0.00 0.00 0.00 22.40 0 0 0AMF -N-0000 AMF CO LTD 0.00 0.00 0.00 399.00 0 0 0AMSL-N-0000 ASIRI SURG 9.00 9.00 9.00 9.00 2 2,012 18,108

APLA-N-0000 ACL PLASTICS 96.00 96.00 96.00 96.00 1 100 9,600ARPI-N-0000 ARPICO 84.70 84.70 82.00 82.00 6 121 10,111ASCO-N-0000 ASCOT HOLDINGS 169.90 169.90 162.00 162.00 7 1,024 173,867ASHA-N-0000 ASIRI CENTRAL 230.00 230.00 230.00 230.00 1 10 2,300ASHO-N-0000 LANKA ASHOK 1850.00 1860.00 1850.00 1860.00 3 26 48,110ASIR-N-0000 ASIRI 12.50 12.50 12.40 12.50 34 281,949 3,524,263ASIY-N-0000 ASIA SIYAKA 4.40 4.40 4.30 4.30 4 319 1,384ASPH-N-0000 INDUSTRIAL ASPH. 212.00 212.00 212.00 212.00 1 20 4,240ATL -N-0000 AMANA TAKAFUL 1.60 1.60 1.50 1.50 29 79,788 122,572AUTO-N-0000 AUTODROME 897.90 897.90 897.90 897.90 2 101 90,688BALA-N-0000 BALANGODA 37.00 37.00 35.00 36.40 13 3,911 142,607BBH -N-0000 BROWNS BEACH 20.10 20.10 19.10 19.60 16 9,003 175,821BERU-N-0000 BERUWALA RESORTS 2.60 2.60 2.40 2.40 26 76,373 186,433BFL -N-0000 BAIRAHA FARMS 149.00 149.00 149.00 149.00 8 2,971 442,679BIL -N-0000 BROWNS INVSTMNTS 3.50 3.60 3.40 3.50 20 54,756 191,473

BINN-N-0000 BERUWELA WALKINN 0.00 0.00 0.00 79.00 0 0 0BLI -N-0000 BIMPUTH FINANCE 18.10 18.80 18.00 18.10 10 816 14,697BLUE-N-0000 BLUE DIAMONDS 3.80 3.80 3.70 3.70 24 59,424 221,541BLUE-X-0000 BLUE DIAMONDS[NON VOTING] 1.80 1.80 1.60 1.70 23 127,212 216,423BOGA-N-0000 BOGALA GRAPHITE 25.00 25.00 23.70 23.80 10 1,442 34,303BOPL-N-0000 BOGAWANTALAWA 13.00 13.60 12.80 12.90 34 13,303 175,965BREW-N-0000 CEYLON BEVERAGE 0.00 0.00 0.00 475.30 0 0 0BRWN-N-0000 BROWNS 124.50 124.50 124.50 124.50 2 250 31,125BUKI-N-0000 BUKIT DARAH 702.00 704.90 702.00 704.50 14 1,166 818,590CABO-N-0000 CARGO BOAT 0.00 0.00 0.00 82.00 0 0 0CALF-N-0000 CAL FINANCE 19.90 19.90 19.50 19.50 2 51 995CARE-N-0000 PRINTCARE PLC 29.50 29.50 29.50 29.50 2 1,500 44,250CARG-N-0000 CARGILLS 150.00 150.50 150.00 150.00 11 4,946 743,866CARS-N-0000 CARSONS 450.20 452.00 450.10 450.30 10 4,450 2,004,688CCS -N-0000 COLD STORES 138.00 138.50 138.00 138.50 8 1,884 260,002CDB -N-0000 CDB 43.00 44.90 43.00 44.00 13 10,008 436,085CDB -X-0000 CDB[NON VOTING] 0.00 0.00 0.00 31.00 0 0 0CDIC-N-0000 N D B CAPITAL 490.00 490.00 490.00 490.00 1 5 2,450CERA-N-0000 LANKA CERAMIC 67.90 67.90 67.90 67.90 1 5 340CFI -N-0000 CFI 106.00 106.00 106.00 106.00 2 200 21,200CFIN-N-0000 CENTRAL FINANCE 183.00 183.00 179.00 180.00 8 4,183 751,990CFL -N-0000 CHILAW FINANCE 14.00 14.00 14.00 14.00 6 4,292 60,088CFLB-N-0000 FORT LAND 32.50 32.50 32.00 32.10 17 20,500 658,464CFT -N-0000 CFT 5.80 5.90 5.80 5.90 3 4,400 25,660CFVF-N-0000 FIRST CAPITAL 11.10 11.30 11.00 11.10 15 13,430 147,940CHL -N-0000 DURDANS 0.00 0.00 0.00 97.00 0 0 0CHL -X-0000 DURDANS[NON VOTING] 72.00 72.00 72.00 72.00 3 3,500 252,000CHMX-N-0000 CHEMANEX 82.60 82.90 80.00 81.60 14 325 26,836CHOT-N-0000 HOTELS CORP. 21.00 21.20 20.00 20.10 28 1,016 20,631CHOU-N-0000 CITY HOUSING 14.20 14.30 14.20 14.30 7 2,600 37,138CIC -N-0000 CIC 66.90 66.90 66.80 66.90 2 86 5,749CIC -X-0000 CIC[NON VOTING] 52.00 52.00 52.00 52.00 1 190 9,880CIFL-N-0000 CIFL 4.10 4.20 4.00 4.10 85 260,862 1,066,454CIND-N-0000 CENTRAL IND. 67.10 67.10 67.00 67.00 7 2,055 137,685CINS-N-0000 CEYLINCO INS. 895.10 909.50 895.10 902.70 9 1,002 902,015CINS-X-0000 CEYLINCO INS.[NON VOTING] 315.00 320.00 311.00 320.00 7 1,605 512,696CINV-N-0000 CEYLON INV. 83.00 83.00 83.00 83.00 3 500 41,500

-

7/29/2019 Daily Trade Journal - 05.02

9/13

Softlogic Equity Research Page | 9

Ticker Counter Open High Low Close Trades Volume Turnover

CIT -N-0000 CIT 0.00 0.00 0.00 125.20 0 0 0CITH-N-0000 CITRUS HIKKADUWA 21.00 21.00 20.90 20.90 2 5,001 104,521CITK-N-0000 CITRUS KALPITIYA 6.30 6.50 6.30 6.30 18 16,600 105,000CITW-N-0000 CITRUS WASKADUWA 6.20 6.20 6.20 6.20 1 3,000 18,600CLC -N-0000 COMM LEASE & FIN 3.80 3.80 3.60 3.60 4 3,615 13,114CLND-N-0000 COLOMBO LAND 34.30 34.90 33.10 33.70 18 10,219 345,380CLPL-N-0000 CEYLON LEATHER 75.00 75.00 75.00 75.00 2 2,859 214,425CLPL-W-0012 CEYLON LEATHER[WARRANTS] 0.00 0.00 0.00 1.80 0 0 0CLPL-W-0013 CEYLON LEATHER[WARRANTS] 0.00 0.00 0.00 6.80 0 0 0CLPL-W-0014 CEYLON LEATHER[WARRANTS] 6.00 6.00 6.00 6.00 3 10,001 60,006COCO-N-0000 RENUKA SHAW 20.00 20.30 19.80 20.00 39 91,518 1,830,333COCO-X-0000 RENUKA SHAW[NON VOTING] 0.00 0.00 0.00 15.80 0 0 0COCR-N-0000 COM.CREDIT 15.00 15.00 14.70 14.80 9 2,536 37,431COLO-N-0000 COLONIAL MTR 149.00 149.00 142.00 142.30 11 362 51,684COMB-N-0000 COMMERCIAL BANK 106.00 107.50 106.00 106.80 117 1,117,721 119,194,882COMB-P-0005 COMMERCIAL BANK 0.00 0.00 0.00 9.00 0 0 0COMB-X-0000 COMMERCIAL BANK[NON VOTING] 92.50 93.00 92.50 92.80 18 11,469 1,063,031COMD-N-0000 COMMERCIAL DEV. 64.10 64.10 64.10 64.10 1 60 3,846CONN-N-0000 AMAYA LEISURE 83.00 83.00 83.00 83.00 3 404 33,532CPRT-N-0000 CEYLON PRINTERS 1849.00 1849.00 1849.00 1849.00 2 2 3,698CRL -N-0000 SOFTLOGIC FIN 28.00 28.00 28.00 28.00 2 501 14,028CSD -N-0000 SEYLAN DEVTS 9.10 9.20 9.00 9.00 30 92,513 838,617CSEC-N-0000 DUNAMIS CAPITAL 11.60 11.60 11.40 11.40 5 1,125 12,870CSF -N-0000 NATION LANKA 10.00 10.10 9.90 9.90 59 170,853 1,695,846CSF -W-0021 NATION LANKA[WARRANTS] 1.90 1.90 1.90 1.90 9 85,388 162,237CTBL-N-0000 CEYLON TEA BRKRS 5.30 5.70 5.30 5.50 35 13,579 74,064CTC -N-0000 CEYLON TOBACCO 839.00 839.00 830.00 830.10 24 1,041 865,148CTCE-N-0000 AVIVA N D B 308.00 308.00 303.00 304.90 12 8,652 2,639,723CTEA-N-0000 TEA SERVICES 650.00 650.00 650.00 650.00 2 101 65,650CTHR-N-0000 C T HOLDINGS 144.00 144.00 144.00 144.00 14 144,147 20,757,168CTLD-N-0000 C T LAND 27.90 28.20 27.00 27.00 19 17,901 491,128CWM -N-0000 C.W.MACKIE 66.80 66.80 66.80 66.80 3 472 31,530DFCC-N-0000 DFCC BANK 125.50 125.50 124.20 124.50 15 25,337 3,169,081DIAL-N-0000 DIALOG 8.80 9.00 8.80 8.80 37 106,476 937,676DIMO-N-0000 DIMO 595.10 610.00 595.10 600.80 4 214 129,470DIPD-N-0000 DIPPED PRODUCTS 108.00 108.00 108.00 108.00 4 6,127 661,716DIST-N-0000 DISTILLERIES 181.00 184.00 181.00 183.50 41 34,974 6,404,505

DOCK-N-0000 DOCKYARD 227.10 227.10 227.10 227.10 1 10 2,271DPL -N-0000 DANKOTUWA PORCEL 17.40 17.40 16.80 16.80 21 5,471 92,697EAST-N-0000 EAST WEST 14.60 14.60 14.50 14.50 14 14,700 213,650EBCR-N-0000 E B CREASY 0.00 0.00 0.00 1033.00 0 0 0ECL -N-0000 E - CHANNELLING 6.50 6.70 6.50 6.60 55 472,015 3,115,749EDEN-N-0000 EDEN HOTEL LANKA 35.40 35.40 34.50 34.50 3 500 17,251ELPL-N-0000 ELPITIYA 17.90 18.90 17.90 18.60 12 811 14,728EMER-N-0000 EASTERN MERCHANT 11.00 11.00 10.90 10.90 3 1,300 14,200EQIT-N-0000 EQUITY 33.50 33.50 33.50 33.50 1 1 34ESL -N-0000 ENTRUST SEC 20.10 20.10 20.00 20.00 5 2,742 54,940ETWO-N-0000 EQUITY TWO PLC 27.40 27.40 25.00 25.00 2 501 12,527EXPO-N-0000 EXPOLANKA 7.00 7.10 6.80 7.00 33 201,220 1,404,771FLCH-N-0000 FREE LANKA 2.40 2.50 2.40 2.40 45 641,522 1,540,713GEST-N-0000 GESTETNER 0.00 0.00 0.00 219.60 0 0 0GHLL-N-0000 GALADARI 13.50 13.50 13.00 13.00 32 14,662 191,529

GLAS-N-0000 PIRAMAL GLASS 6.10 6.30 6.10 6.20 14 91,107 564,834GOOD-N-0000 GOOD HOPE 0.00 0.00 0.00 1350.00 0 0 0GRAN-N-0000 GRAIN ELEVATORS 51.30 52.00 51.20 51.50 29 11,894 612,949GREG-N-0000 ENVI. RESOURCES 17.80 17.80 17.00 17.00 64 106,248 1,841,927GREG-P-0002 ENVI. RESOURCES 0.00 0.00 0.00 0.00 0 0 0GREG-W-0002 ENVI. RESOURCES[WARRANTS] 0.00 0.00 0.00 2.90 0 0 0GREG-W-0003 ENVI. RESOURCES[WARRANTS] 3.50 3.50 3.30 3.30 12 12,119 40,093GREG-W-0006 ENVI. RESOURCES[WARRANTS] 3.80 3.90 3.70 3.70 29 77,379 292,562GSF -N-0000 G S FINANCE 575.20 575.30 575.20 575.30 5 7 4,027GUAR-N-0000 CEYLON GUARDIAN 0.00 0.00 0.00 177.90 0 0 0HAPU-N-0000 HAPUGASTENNE 41.30 41.30 41.30 41.30 1 1 41HARI-N-0000 HARISCHANDRA 0.00 0.00 0.00 2450.90 0 0 0HASU-N-0000 HNB ASSURANCE 50.00 50.00 48.00 48.30 13 3,216 155,433HAYC-N-0000 HAYCARB 181.00 181.00 179.90 180.00 13 7,469 1,345,305HAYL-N-0000 HAYLEYS 297.50 297.50 297.10 297.10 5 410 121,851

HDEV-N-0000 HOTEL DEVELOPERS 0.00 0.00 0.00 94.80 0 0 0HDFC-N-0000 HDFC 49.00 49.60 49.00 49.50 5 162 7,986HEXP-N-0000 HAYLEYS FIBRE 32.20 32.20 32.20 32.20 1 1 32HHL -N-0000 HEMAS HOLDINGS 28.10 28.10 27.80 28.00 10 16,290 455,473HNB -N-0000 HNB 145.00 146.00 145.00 145.10 13 10,532 1,527,532HNB -X-0000 HNB[NON VOTING] 112.50 113.50 112.50 113.00 16 80,101 9,020,251HOPL-N-0000 HORANA 25.00 26.70 25.00 25.90 48 48,489 1,257,863

-

7/29/2019 Daily Trade Journal - 05.02

10/13

Softlogic Equity Research Page | 10

Ticker Counter Open High Low Close Trades Volume Turnover

HPFL-N-0000 HYDRO POWER 7.00 7.20 7.00 7.00 6 9,147 64,229HPWR-N-0000 HEMAS POWER 23.00 23.00 22.70 23.00 3 202 4,586HSIG-N-0000 HOTEL SIGIRIYA 81.20 81.20 81.20 81.20 2 20 1,624HUEJ-N-0000 HUEJAY 0.00 0.00 0.00 79.90 0 0 0HUNA-N-0000 HUNAS FALLS 57.20 57.20 57.10 57.10 8 900 51,393HUNT-N-0000 HUNTERS 0.00 0.00 0.00 353.80 0 0 0HVA -N-0000 HVA FOODS 13.60 13.70 13.20 13.30 64 60,350 812,965IDL -N-0000 INFRASTRUCTURE 164.90 164.90 164.90 164.90 1 3,000 494,700INDO-N-0000 INDO MALAY 0.00 0.00 0.00 1500.00 0 0 0JFIN-N-0000 FINLAYS COLOMBO 0.00 0.00 0.00 316.20 0 0 0JINS-N-0000 JANASHAKTHI INS. 10.80 10.80 10.70 10.70 10 7,788 83,602JKH -N-0000 JKH 229.00 229.50 228.00 229.10 49 332,235 76,087,492JKL -N-0000 JOHN KEELLS 66.90 67.00 66.00 66.00 12 2,830 186,826KAHA-N-0000 KAHAWATTE 32.00 32.00 32.00 32.00 2 101 3,232KAPI-N-0000 MTD WALKERS 25.60 26.50 25.60 26.00 4 301 7,787KCAB-N-0000 KELANI CABLES 0.00 0.00 0.00 68.10 0 0 0KDL -N-0000 KELSEY 15.20 15.50 15.00 15.20 5 3,501 52,607KFP -N-0000 KEELLS FOOD 71.00 71.00 70.60 70.60 2 198 13,983KGAL-N-0000 KEGALLE 109.00 109.90 105.10 105.20 7 2,057 217,261KHC -N-0000 KANDY HOTELS 10.00 10.10 10.00 10.00 21 90,221 902,215KHC -P-0002 KANDY HOTELS 0.00 0.00 0.00 0.00 0 0 0KHL -N-0000 KEELLS HOTELS 13.70 13.80 13.60 13.70 26 413,294 5,662,158KOTA-N-0000 KOTAGALA 57.00 58.90 57.00 58.00 14 19,410 1,106,720KURU-N-0000 KURUWITA TEXTILE 20.20 20.20 20.20 20.20 1 34 687KVAL-N-0000 KELANI VALLEY 0.00 0.00 0.00 83.00 0 0 0KZOO-N-0000 KALAMAZOO 0.00 0.00 0.00 2200.00 0 0 0LALU-N-0000 LANKA ALUMINIUM 35.00 35.00 32.00 32.00 7 1,521 49,075LAMB-N-0000 KOTMALE HOLDINGS 37.10 37.10 36.90 37.00 7 7,670 283,777LCEM-N-0000 LANKA CEMENT 9.30 9.30 9.20 9.20 5 10,700 98,470LCEY-N-0000 LANKEM CEYLON 159.90 164.40 157.00 164.40 4 159 25,162LDEV-N-0000 LANKEM DEV. 6.90 6.90 6.70 6.70 11 17,650 120,235LFIN-N-0000 LB FINANCE 147.50 147.50 140.10 140.60 5 2,102 309,337LGL -N-0000 LAUGFS GAS 26.20 26.20 25.20 25.90 28 25,545 657,905LGL -X-0000 LAUGFS GAS[NON VOTING] 18.40 18.50 18.10 18.20 51 93,189 1,702,530LHCL-N-0000 LANKA HOSPITALS 38.00 38.00 37.30 37.50 16 14,302 536,266LHL -N-0000 LIGHTHOUSE HOTEL 47.00 47.00 42.10 42.30 8 201 8,503LIOC-N-0000 LANKA IOC 20.00 20.30 20.00 20.00 26 84,870 1,699,136

LION-N-0000 LION BREWERY 310.00 310.10 310.00 310.00 5 2,402 744,620LITE-N-0000 LAXAPANA 6.40 6.40 6.30 6.30 3 8,000 50,500LLUB-N-0000 CHEVRON 215.40 217.90 215.00 215.00 12 6,301 1,355,817LMF -N-0000 LMF 116.00 116.00 115.00 116.00 8 10,015 1,151,741LOFC-N-0000 LANKAORIXFINANCE 3.50 3.70 3.50 3.60 25 58,508 210,600LOLC-N-0000 LOLC 68.00 68.00 65.00 65.90 40 27,907 1,857,930LPRT-N-0000 LAKE HOUSE PRIN. 100.00 100.00 100.00 100.00 2 72 7,200LVEN-N-0000 LANKA VENTURES 0.00 0.00 0.00 32.00 0 0 0LWL -N-0000 LANKA WALLTILE 59.00 60.00 59.00 60.00 3 181 10,859MADU-N-0000 MADULSIMA 14.10 14.10 13.00 13.50 14 10,118 137,107MAL -N-0000 MALWATTE 5.00 5.00 4.70 4.80 30 28,708 137,796MAL -X-0000 MALWATTE[NON VOTING] 4.80 4.80 4.80 4.80 1 1 5MARA-N-0000 MARAWILA RESORTS 7.00 7.00 6.80 6.80 18 28,901 198,282MASK-N-0000 MASKELIYA 13.00 13.00 12.50 12.50 15 10,800 136,210MBSL-N-0000 MERCHANT BANK 20.30 20.30 19.70 19.80 23 12,173 241,084

MEL -N-0000 MACKWOODS ENERGY 12.00 12.00 12.00 12.00 2 500 6,000MERC-N-0000 MERCANTILE INV 0.00 0.00 0.00 2200.00 0 0 0MFL -N-0000 MULTI FINANCE 28.80 28.80 28.80 28.80 1 1 29MGT -N-0000 HAYLEYS - MGT 11.10 11.10 10.90 11.00 8 1,867 20,531MIRA-N-0000 MIRAMAR 89.00 89.00 89.00 89.00 1 1 89MORI-N-0000 MORISONS 170.20 170.20 170.00 170.00 3 420 71,403MORI-X-0000 MORISONS[NON VOTING] 108.00 109.50 108.00 109.40 3 5,000 546,955MPRH-N-0000 MET. RES. HOL. 22.00 22.00 20.40 22.00 7 861 18,619MRH -N-0000 MAHAWELI REACH 21.50 22.00 21.30 21.70 35 25,273 550,537MSL -N-0000 MERC. SHIPPING 165.00 165.00 165.00 165.00 1 12 1,980MULL-N-0000 MULLERS 1.60 1.60 1.60 1.60 17 86,200 137,920NAMU-N-0000 NAMUNUKULA 72.30 72.30 72.30 72.30 1 12 868NAVF-U-0000 NAMAL ACUITY VF 67.90 67.90 65.00 65.00 3 500 32,506NDB -N-0000 NAT. DEV. BANK 144.40 145.00 144.20 145.00 9 3,652 527,919NEH -N-0000 NUWARA ELIYA 0.00 0.00 0.00 1399.00 0 0 0

NEST-N-0000 NESTLE 1598.00 1600.00 1598.00 1599.80 6 1,706 2,729,300NHL -N-0000 NAWALOKA 3.10 3.10 3.00 3.00 10 59,300 178,210NIFL-N-0000 NANDA FINANCE 6.80 6.80 6.30 6.70 16 108,960 730,030NTB -N-0000 NATIONS TRUST 57.50 57.90 57.50 57.90 15 8,886 512,945ODEL-N-0000 ODEL PLC 22.90 22.90 22.00 22.00 7 1,246 27,609OFEQ-N-0000 OFFICE EQUIPMENT 0.00 0.00 0.00 3000.00 0 0 0OGL -N-0000 ORIENT GARMENTS 12.20 12.20 11.70 11.80 23 36,260 430,259

-

7/29/2019 Daily Trade Journal - 05.02

11/13

Softlogic Equity Research Page | 11

Ticker Counter Open High Low Close Trades Volume Turnover

ONAL-N-0000 ON'ALLY 55.50 55.50 55.50 55.50 1 1 56ORIN-N-0000 ORIENT FINANCE 0.00 0.00 0.00 14.90 0 0 0OSEA-N-0000 OVERSEAS REALTY 13.90 14.10 13.90 14.00 15 46,016 644,219PABC-N-0000 PAN ASIA 19.00 19.00 18.50 18.90 59 159,685 2,993,599PALM-N-0000 PALM GARDEN HOTL 125.00 130.00 125.00 126.00 7 5,599 720,337PAP -N-0000 PANASIAN POWER 2.70 2.80 2.70 2.70 22 164,658 444,602PARA-N-0000 PARAGON 0.00 0.00 0.00 1055.00 0 0 0PARQ-N-0000 SWISSTEK 14.50 14.50 14.50 14.50 4 999 14,486PCH -N-0000 PC HOUSE 5.10 5.20 5.00 5.00 69 322,879 1,615,941PCHH-N-0000 PCH HOLDINGS 0.00 0.00 0.00 7.30 0 0 0PCP -N-0000 PC PHARMA 0.00 0.00 0.00 9.10 0 0 0PDL -N-0000 PDL 45.80 45.80 42.10 42.40 4 500 21,224PEG -N-0000 PEGASUS HOTELS 42.50 42.50 42.40 42.40 3 22 935PHAR-N-0000 COL PHARMACY 522.10 523.00 522.00 522.00 7 102 53,246PLC -N-0000 PEOPLES LEASING 13.40 13.40 12.90 13.00 98 193,497 2,523,778PMB -N-0000 PEOPLE'S MERCH 13.60 13.80 13.50 13.80 15 11,750 159,080RAL -N-0000 RENUKA AGRI 4.80 4.90 4.80 4.80 10 20,801 100,345RCL -N-0000 ROYAL CERAMIC 100.50 100.50 98.00 99.00 10 5,606 561,093REEF-N-0000 CITRUS LEISURE 23.90 23.90 23.00 23.00 31 39,153 906,402REEF-W-0017 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 32.90 0 0 0REEF-W-0018 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0REEF-W-0019 CITRUS LEISURE[WARRANTS] 3.70 3.80 3.70 3.70 22 209,546 775,440REG -N-0000 REGNIS 59.10 61.00 59.00 60.00 18 16,001 945,300RENU-N-0000 RENUKA CITY HOT. 235.00 235.00 235.00 235.00 1 2 470REXP-N-0000 RICH PIERIS EXP 33.90 33.90 33.60 33.60 5 1,618 54,815RFL -N-0000 RAMBODA FALLS 15.90 15.90 15.90 15.90 1 1 16RGEM-N-0000 RADIANT GEMS 59.80 59.80 56.60 58.60 6 6,002 346,591RHL -N-0000 RENUKA HOLDINGS 36.40 36.40 34.00 34.10 12 7,832 266,342RHL -X-0000 RENUKA HOLDINGS[NON VOTING] 23.90 24.00 23.90 23.90 3 700 16,734RHTL-N-0000 FORTRESS RESORTS 16.00 16.00 15.90 15.90 16 2,671 42,470RICH-N-0000 RICHARD PIERIS 7.90 8.10 7.90 7.90 31 74,113 588,837RPBH-N-0000 ROYAL PALMS 42.50 42.50 42.50 42.50 3 400 17,000RWSL-N-0000 RAIGAM SALTERNS 2.70 2.70 2.50 2.50 14 10,543 26,412SAMP-N-0000 SAMPATH 220.10 221.40 220.10 221.30 78 71,571 15,789,245SCAP-N-0000 SOFTLOGIC CAP 6.70 6.70 6.40 6.40 2 401 2,567SDB -N-0000 SANASA DEV. BANK 73.60 75.00 73.50 73.90 44 3,694 271,943SELI-N-0000 SELINSING 1110.00 1110.00 1100.00 1102.50 3 40 44,100

SEMB-N-0000 S M B LEASING 0.90 1.00 0.80 0.90 95 5,615,070 5,053,559SEMB-W-0015 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.70 0 0 0SEMB-W-0016 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0SEMB-X-0000 S M B LEASING[NON VOTING] 0.40 0.50 0.40 0.40 26 1,181,425 472,583SERV-N-0000 HOTEL SERVICES 16.60 16.60 16.50 16.50 3 2,101 34,667SEYB-N-0000 SEYLAN BANK 58.20 59.00 58.10 59.00 14 6,700 392,387SEYB-X-0000 SEYLAN BANK[NON VOTING] 34.60 35.00 34.00 34.20 28 26,680 912,632SFCL-N-0000 SENKADAGALA 0.00 0.00 0.00 50.00 0 0 0SFIN-N-0000 SINGER FINANCE 13.50 13.50 13.40 13.40 19 26,880 362,245SFL -N-0000 SINHAPUTHRA FIN 0.00 0.00 0.00 79.10 0 0 0SFS -N-0000 SWARNAMAHAL FIN 3.40 3.40 3.30 3.30 36 114,355 377,380SHAL-N-0000 SHALIMAR 900.00 900.00 900.00 900.00 2 110 99,000SHAW-N-0000 LEE HEDGES 0.00 0.00 0.00 252.50 0 0 0SHL -N-0000 SOFTLOGIC 12.00 12.00 11.60 11.60 27 88,023 1,026,747SHOT-N-0000 SERENDIB HOTELS 24.90 24.90 24.30 24.70 5 1,101 27,235

SHOT-X-0000 SERENDIB HOTELS[NON VOTING] 0.00 0.00 0.00 18.90 0 0 0SIGV-N-0000 SIGIRIYA VILLAGE 0.00 0.00 0.00 70.50 0 0 0SIL -N-0000 SAMSON INTERNAT. 93.00 93.00 93.00 93.00 1 15 1,395SING-N-0000 SINGALANKA 85.10 85.10 85.10 85.10 1 8 681SINI-N-0000 SINGER IND. 133.00 133.00 133.00 133.00 3 700 93,100SINS-N-0000 SINGER SRI LANKA 0.00 0.00 0.00 100.20 0 0 0SIRA-N-0000 SIERRA CABL 2.50 2.50 2.30 2.40 80 1,056,805 2,441,512SLND-N-0000 SERENDIB LAND 0.00 0.00 0.00 1494.30 0 0 0SLTL-N-0000 SLT 45.00 45.00 44.00 44.00 8 8,920 392,840SMLL-N-0000 PEOPLE'S FIN 40.00 41.10 40.00 40.90 53 52,098 2,125,163SMLL-W-0020 PEOPLE'S FIN[WARRANTS] 0.00 0.00 0.00 3.70 0 0 0SMOT-N-0000 SATHOSA MOTORS 0.00 0.00 0.00 233.90 0 0 0SOY -N-0000 CONVENIENCE FOOD 130.00 130.00 130.00 130.00 1 60 7,800SPEN-N-0000 AITKEN SPENCE 126.00 126.00 124.00 125.00 12 417,991 52,248,795STAF-N-0000 DOLPHIN HOTELS 36.20 36.20 35.00 35.00 6 8,880 310,822

SUGA-N-0000 PELWATTE 0.00 0.00 0.00 23.50 0 0 0SUN -N-0000 SUNSHINE HOLDING 26.50 26.50 26.00 26.00 11 6,300 163,871SWAD-N-0000 SWADESHI 0.00 0.00 0.00 8200.00 0 0 0TAFL-N-0000 THREE ACRE FARMS 49.00 50.00 49.00 49.50 15 10,072 493,538TAJ -N-0000 TAJ LANKA 29.00 29.00 28.60 28.60 15 454 13,019TANG-N-0000 TANGERINE 0.00 0.00 0.00 81.00 0 0 0TAP -N-0000 TAPROBANE 4.80 4.80 4.80 4.80 1 20 96

-

7/29/2019 Daily Trade Journal - 05.02

12/13

Softlogic Equity Research Page | 12

Ticker Counter Open High Low Close Trades Volume Turnover

TESS-N-0000 TESS AGRO 2.40 2.40 2.40 2.40 21 251,910 604,584TFC -N-0000 THE FINANCE CO. 18.00 18.00 17.40 17.40 12 1,119 19,556TFC -X-0000 THE FINANCE CO.[NON VOTING] 6.00 6.00 5.50 5.60 28 38,804 217,624TFIL-N-0000 TRADE FINANCE 13.10 13.40 13.10 13.40 5 8,621 112,935TILE-N-0000 LANKA FLOORTILES 65.00 65.00 65.00 65.00 2 1,450 94,250TJL -N-0000 TEXTURED JERSEY 9.40 9.40 9.20 9.30 16 55,502 515,879TKYO-N-0000 TOKYO CEMENT 27.00 27.00 26.00 26.00 23 93,517 2,432,063TKYO-X-0000 TOKYO CEMENT[NON VOTING] 19.00 19.00 18.80 18.80 9 7,701 145,219TPL -N-0000 TALAWAKELLE 25.50 27.90 25.50 27.90 20 20,027 510,691TRAN-N-0000 TRANS ASIA 77.00 79.90 77.00 79.60 4 500 39,798TSML-N-0000 TEA SMALLHOLDER 49.00 49.00 49.00 49.00 5 541 26,509TWOD-N-0000 TOUCHWOOD 8.40 8.40 8.00 8.20 96 82,923 683,939TYRE-N-0000 KELANI TYRES 34.40 34.40 33.30 33.50 7 2,001 66,973UAL -N-0000 UNION ASSURANCE 89.90 90.00 89.80 89.80 4 600 53,939UBC -N-0000 UNION BANK 15.10 15.60 15.00 15.40 239 710,465 10,918,932UCAR-N-0000 UNION CHEMICALS 0.00 0.00 0.00 460.00 0 0 0UDPL-N-0000 UDAPUSSELLAWA 28.80 29.00 28.80 28.90 5 150 4,330UML -N-0000 UNITED MOTORS 96.00 98.00 96.00 96.10 9 252 24,402VANI-N-0000 VANIK INCORP LTD 0.00 0.00 0.00 0.80 0 0 0VANI-X-0000 VANIK INCORP LTD[NON VOTING] 0.00 0.00 0.00 0.80 0 0 0VFIN-N-0000 VALLIBEL FINANCE 31.50 31.50 30.50 30.70 17 6,408 197,002VLL -N-0000 VIDULLANKA 3.70 3.70 3.70 3.70 10 15,889 58,789VONE-N-0000 VALLIBEL ONE 18.10 18.10 17.70 17.80 18 22,702 407,056VPEL-N-0000 VALLIBEL 6.80 6.80 6.70 6.70 22 28,694 192,669WAPO-N-0000 GUARDIAN CAPITAL 49.70 49.70 47.30 47.40 8 700 33,217WATA-N-0000 WATAWALA 12.40 12.50 12.30 12.40 44 44,039 545,334YORK-N-0000 YORK ARCADE 16.70 16.70 16.50 16.50 5 3,601 59,577

-

7/29/2019 Daily Trade Journal - 05.02

13/13

Softlogic Equity Research

Dimantha Mathew

[email protected]+94 11 7277030

Akeela Imthinam [email protected]+94 11 7277032

Crishani [email protected]+94 11 7277031

Imalka [email protected]+94 11 7277004

Softlogic Equity Sales Branches

HoranaMadushanka Rathnayaka No. 101, 1/1, Aguruwathota Road, [email protected]+94 34 7451000, +94 77 3566465

NegamboKrishan Williams No. 121, St. Joseph Street [email protected]+94 31 2224714-5, +94 77 3569827

KurunegalaBandula Lansakara No.13, Rajapihilla Mawatha, [email protected]+94 37 2232875, +94 77 3615790

MataraLalith Rajapaksha No.8A, 2 nd Floor, FN Building, Station Road, [email protected]+94 41 7451000, +94 77 3031159

Dihan [email protected]+94 11 7277010, +94 77 7689933

Chandima [email protected]+94 11 7277058, +94 77 7885778

Shafraz [email protected]+94 11 7277054, +94 77 2333233

Sonali [email protected]+94 11 7277059, +94 77 7736059

Thanuja De [email protected]+94 11 7277053, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based uponinformation obtained from sources believed to be reliable and in good faith. Such information has not been independently veri fied and no guaranty, representationor warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Thisdocument is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete andthis document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in whichthey are based before the materialized disseminated to their customers. Not all customers will receive the material at the same time. Softlogic Stockbrokers, theirrespective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities orother financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer t o make a purchase and/or sale of anysuch securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokersmay make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying orrelated to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not bereproduced, distributed, or published for any purposes.