UON SERVICES LIMITED - Parliament of NSW · and to achieve excellence in service provision....

Transcript of UON SERVICES LIMITED - Parliament of NSW · and to achieve excellence in service provision....

UON SERVICES LIMITED

ABN 22 121 393 306

Financial Report for the year ended 31 December 2013

UON SERVICES LIMITED

Contents For the year ended 31 December 2013

Financial Statements

Directors' Report

Income statement

Statement of comprehensive income

Statement of financial position

Statement of changes in equity

Statement of cash flows

Notes to the financial statements

Directors' declaration

Independent Audit report

')

Page

1

4

5

6

7

8

9

31

32

UON SERVICES LIMITED

Directors' Report For the year ended 31 December 2013

Directors The following persons were Directors of UoN Services Limited during the whole of the year and up to the date of this report:

Sharon Waterhouse (Independent Director and Chair) ian Baker (University Council Appointed Director) Sam Barker (Student Director ) - appointed 1 April 201 3 Peter Cockbain (University Council Appointed Director) Lara Field (Student Director) Kelly Lofberg (Independent Director) - ceased 18 October 2013 Andrew Parfitt (University Executive Director)- appointed 1 April 2013 Kristen Perry (Independent Director)- ceased 25 November 2013 Liam Saunders (Student Director) - ceased 31 March 2013 Tim Shanley (Independent Director) Emily Wood (Student Director)

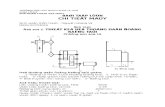

Board Meetings The numbers of meetings of the Board of Directors held during the year ended 31 December 2013, and the numbers of meetings attended by each director were:

Number of Number of meetings attended Meetings held

Sharon Waterhouse 9 11 ian Baker 10 11

Sam Barker 6 9 Peter Cockbain 10 11 Lara Field 7 11 Kelly Lofberg 5 8 Andrew Parfitt 4 9 Kristen Perry 5 10 Liam Sanders 0 2

Tim Shanley 10 11 Emily Wood 11 11

Objectives The mission and vision of the Company is to provide a vibrant and engaging student experience and campus life for students and to achieve excellence in service provision.

Strategies for achieving the objectives The Company strives to enhance the student experience through a variety of programs, service offerings and activities. It is similarly focused on providing excellence and sustainability in the provision of these services and amenities to students, whilst building and maintaining a strong, resilient and capable organisation.

Contributions on winding up In the event of the company being wound up, members are required to contribute a maximum of $20 each. The total amount that members of the company are liable to contribute if the company is wound up is $1 .00, based on 1 current member.

Auditor's independence declaration A copy of the Auditor's Independence Declaration as required under section 307C of the Corporations Act 2001 is attached to this report.

Principal Activities The principal activities of the company during the financial year were to enhance the shared University experience for students through excellence and sustainability in the provision of services and amenities; and to provide a vibrant and engaging student experience and campus life. Through a commitment to open communication, collaboration, efficiency, accountability and continuous improvement the Company continued to be a strong, resilient and capable organisation.

Performance measures and key performance indicators The company had 64 key performance indicators (KPI's) that they were set to achieve for 2013. 62 of these KPI's were completely or partly achieved this year. The company exceeded its budgeted operating result for the year.

UON SERVICES LIMITED

Directors' Report For the ye~r ended 31 December 2013

Information on directors Name: Title: Qualifications: Experience & expertise:

Name: Title: Qualifications: Experience & expertise:

Name: Title: Qualifications: Experience & expertise:

Name: Title: Qualifications: Experience & expertise:

Name: Title: Qualifications: Experience & expertise:

Name: Title: Qualifications: Experience & expertise:

Name: Title: Qualifications: Experience & expertise:

Name: Title: Qualifications: Experience & expertise:

Sharon Waterhouse Chair and Independent Director BEe, FFIN, MBA, MA, GAICD Sharon Waterhouse is an innovative and results focused leader with extensive experience across a diverse range of senior executive and non-executive director roles. She has an outstanding record of success in leading both commercial and not for profit organisations. With strong leadership and project management skills, Sharon has an exceptional ability to harness talent to drive business results, hold teams accountable and implement innovative initiatives.

Kelly Lofberg Independent Director Cert IV in Business Marketing Management, Cert IV in Finance and Banking, MAICD As an engagement special ist working in the field of public affairs for more than a decade, Kelly has a strong background in advocating for policy change in both the public and private sectors, across industries and states. She has proven experience in building strategic campaigns that shift community understanding and sentiment.

Kristen Perry Independent Director BA, LLB, MBA, Law Kristen Perry founded her own law firm, Perry Legal, in December 2004. A practising solicitor, Kirsten has expertise in dispute resolution and commercial litigation, and advises on a broad range of legal business services.

Tim Shanley Independent Director B.Sc (Photonics), CDC Diploma An experienced director with over 7 years' service on the Board of UoN Services Limited, Tim possesses a detailed understanding of the history of the company and its operations. Tim is currently the Pacific Reseller Operations Business Analytics, Reporting & Training Manager at Apple. Tim has extensive financial experience and possesses strong strategic and analytical thinking.

Andrew Parfitt University Executive Director BE and PhD in Electrical and Electronic Engineering Professor Andrew Parfitt is the Deputy Vice-Chancellor (Academic) at the University of Newcastle. He is an experienced academic leader with strong national and international credentials. With an emphasis on the student experience, Professor Parfitt has championed innovative academic approaches and practices, particularly in the areas of multi-disciplinary program development, the delivery of high quality online learning and working to ensure course design meets the needs of graduate employers. An experienced director, Andrew has over 1 0 years of Board experience in the higher education sector, private enterprise and not-for-profit sector.

Peter Cockbain University Council Appointed Director BScEng(Hon), FIE Aust, CPEng, FIPENZ, FTSE Peter Cockbain is the Technical Director and co-founder of Ampcontrol, a preeminent national and international manufacturer of electrical and electronic products to the power, energy and mining sectors. In 2010 Peter was named by Engineers Australia Magazine as one of Australia's top 100 influential engineers for his commitment to innovation. He is a leader, innovator and influential mentor in the electrical engineering field . Peter is a Member of the University of Newcastle Council and Chair of the University's Controlled & Associated Entities Sub-Committee of Council.

lan Baker University Council Appointed Director Adv Cert in Hospitality Management lan Baker is the CEO I Secretary of the Newcastle Club and is a highly experienced executive manager in the hospitality and tourism industries. With a strong commercial acumen, lan has expertise in hospitality management, accommodation management and strategic planning.

Emily Wood Student Director Certificate in Governance Essentials for Not-for-Profit Directors, AICD Emily Wood is a 3rd year student at the University of Newcastle, and is studying the Bachelor of

2

UON SERVICES LIMITED

Directors' Report For the year ended 31 December 2013

Name: Title: Qualifications:

Experience & expertise:

Name: Tile: Qualifications: Experience & expertise:

Environmental Science and Management. Emily is the Vice-President of the University Student Environmental Club, a student club with over 250 members.

Lara Field Student Director Cert Ill in IT- Software Development, Certificate in Governance Essentials for Not-for-Profit Directors, AICD Lara Field is a 4th year stadent at the University of Newcastle, and is studying a Bachelor of Teaching (secondary)/Bachelor of Arts. Lara is an engaged member of the University's student community, and an active member of a number of student clubs and societies including Newcastle University Student Association, Medieval Society, Quidditch Society, Unaffordable Wine and Other Alcohol Appreciation Society, Queer and Allies and the UoN Services U Crew (volunteer program).

Sam Barker Student Director Certificate in Governance Essentials for Not-for-Profit Directors, AICD Sam Barker is a 5th year student at the University of Newcastle, and is studying the Bachelor of Business I Bachelor of Commerce. Sam is the Treasurer of the University Snow Sports Club, a student club with over 120 members.

Significant changes in state of affairs During the year there was no significant change in the state of the affairs of the company.

Matters subsequent to the end of the financial year There has not been any matter or circumstance, other that referred to in the financial statements and notes following, that has arisen, significantly affected, or may significantly affect, the operations of the Company, the results of those operations, or the state of affairs in future financial years.

Likely development and expected results of operations There are no likely developments in the operations of the Company that were not finalised at the date of this report.

Environmental regulation During the year there were no significant environmental regulations applicable to the Company other than that referred to in the financial statements and notes following.

Insurance of officers University of Newcastle maintains comprehensive insurance policies in relation to Directors and Officers, Industrial Special Risk, Professional Indemnity, Motor Vehicle and Personal Accident (including travel) .

All of these policies include the Company as an insured party and are current.

Directors' and Officers' Liability insurance covers damages (not fines and penalties) and legal expenses incurred due to a breach or alleged breach of duty, misleading statement or wrongful act by a director or officer acting in that capacity.

Directors' and Officers' Supplementary Legal Expenses covers legal expenses on behalf of directors, employees and organisations defending against actions which are not covered in the standard Directors' and Officers' Liability Policy.

Proceedings on behalf of the Company There are no legal proceedings in process.

This report is made in accordance with the resolution of the Board of Directors of the Company.

¥~ ~~~~ Newcastle 31 March 2014

3

UON SERVICES LIMITED

Income statement For the year ended 31 December 2013

Revenue from continuing operations Sale of goods

Investment revenue

Rental revenue

Contributions - related entities

Other revenue

Total revenue from continuing operations

Total revenue and income from continuing operations

Expenses from continuing operations Cost of goods sold

Employee related benefits

Depreciation and amortisation

Repairs and maintenance

Other expenses

Total expenses from continuing operations

Operating result from continuing operations

Operating result for the year

Operating result attributable to members of UoN Services Ltd

Note

2

3

4 5

6

7 8 9

2013 $

2,110,839

209,519

1,552,263

5,251,654

697,614

9,821,889

9,821,889

900,105

3,795,856

212,309

454,468

3,921,397

9,284,135

537,754

537,754

537,754

The above income statement should be read in conjunction with the accompanying notes.

2012 $

1,857,573

237,279

1,436,991

3,341,630

635,433

7,508,906

7,508,906

742,573

3,057,281

185,927

342,153

2,540,536

6,868,470

640,437

640,437

640,437

4

UON SERVICES LIMITED

Statement of comprehensive income For the year ended 31 December 2013

Operating result for the year

Other comprehensive income

Total other comprehensive income for the year, net of tax

Total comprehensive income for the year

Total comprehensive income attributable to:

Members of UoN Services Ltd

2013 2012 $ $

537,754 640,437

537,754 640,437

537,754 640,437

The above statement of comprehensive income should be read in conjunction with the accompanying notes. 5

UON SERVICES LIMITED

Statement of financial position As at 31 December 2013

2013 2012 Note $ $

ASSETS

Current assets Cash and cash equivalents 10 328,246 576,120

Trade and other receivables 11 762,566 709,782

Inventories 12 103,038 148,008

Other financial assets 13 3,400,000 3,900,000

Total current assets 4 ,593,850 5,333,910

Non-current assets Other financial assets 13 1,201 ,000 1,000

Property, plant and equipment 14 2,091 ,906 1,822,057

Intangible assets 15 18,453 39,904

Total non-current assets 3,311 ,359 1,862,961

Total assets 7,905,209 7,196,871

LIABILITIES

Current liabilities Trade and other payables 16 766,639 666,493

Provisions 17 267,000 209,924

Other liabilities 18 113,070 113,808

Total current liabilities 1,146,709 990,225

Non-current liabilities Provisions 17 43,000 28,900

Total liabilities 1,189,709 1 ,019,125

Net assets 6,715,500 6,177,746

EQUITY Retained earnings 19 6,715,500 6,177,746

Total equity 6,715,500 6,177,746

The above statement of financial position should be read in conjunction with the accompanying notes. 6

UON SERVICES LIMITED

Statement of changes in equity For the year ended 31 December 2013

Retained Earnings Total

$ $

Balance at 1 January 2012 5,537,309 5,537,309

Operating result for the year 640,437 640,437

Other comprehensive income

Balance at 31 December 2012 6,177,746 6,177,746

Balance at 1 January 2013 6,1 77,746 6,1 77,746

Operating result for the year 537,754 537,734

Other comprehensive income

Balance at 31 December 2013 6,715,500 6,715,500

The above statement of changes in equity should be read in conjunction with the accompanying notes. 7

UON SERVICES LIMITED

Statement of cash flows For the year ended 31 December 2013

2013 2012 Note $ $

Cash flows from operating activities Receipts from customers 9,966,961 5,719,038

Interest received 228,190 175,938

Payments to suppliers and employees (inclusive of GST) (9,291,739) (5,212,018)

GST recovered (paid) (696) (99,261)

Net cash provided by (used in) operating activities 25 902,716 583,697

Cash flows from investing activities Payments for purchase of property, plant and equipment (450,590) (557,438)

Proceeds from redemption of held to maturity investments 8,900,000 8,100,000

Payments for purchase of held to maturity investments (9,600,000) (7,800,000)

Net cash provided by (used in) investing activities (1 ,150,590) (257,438)

Net increase (decrease) in cash and cash equivalents held (247,874) 326,259

Cash and cash equivalents at beginning of year 576,120 249,861

Cash and cash equivalents at end of financial year 10 328,246 576,120

The above statement of cash flows should be read in conjunction with the accompanying notes. 8

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

UoN Services Limited {the Company) is a registered company limited by guarantee and is a controlled entity of the University of Newcastle.

The principal accounting policies adopted in the preparation of the financial report are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated. The Company has its domicile in Australia. The principal place of business is:

Level 5, Shortland Building University of Newcastle University Drive Callaghan NSW 2308

The principal activities of the Company are to enhance the shared University experience and academic pursuits of the University community through the commercially responsible provision of facilities and services.

(a) Basis of preparation

The annual financial statements represent the aud ited general purpose financial statements of the Company. They have been prepared on an accrual basis in accordance with Australian Accounting Standards and the Corporations Act 2001.

Additiona lly the statements have been prepared in accordance with the following statutory requirements:

• Higher Education Support Act 2003 (Cwth) (Financial Statement Guidelines)

• Public Finance and Audit Act 1983 (NSW), the requirements of the Department of Education and other State/Australian Government legislative requirements.

The Company is a not-for-profit entity and these statements have been prepared on that basis. Some of the requirements for not-for-profit entities are inconsistent with the I FRS requirements.

Date of authorisation for issue

The financial statements were authorised for issue by the members of the Company on 31 March 2014.

Historical cost convention

These financial statements have been prepared under the historical cost convention, as modified by the revaluation of available-for-sale financial assets, financial assets and liabilities (including derivative instruments) at fair value through profit or loss.

Critical accounting estimates

The preparation of financial statements in conformity with Australian Accounting Standards requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Company's accounting policies. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial statements are disclosed below:

Impairment of Investments and other financial assets - The Company assesses at each reporting date, whether there is objective evidence that a financial asset or group of financial assets is impaired as outl ined in note 1 (i).

Employee benefits- long service leave - the liability for long service leave is measured at the present va lue of the expected future payments to be made in respect of services provided by employees up to the reporting date as outlined in note 1 p (ii).

Useful lives of property, plant and equipment- depreciation of property, plant and equipment is calculated over the assets estimated useful lives as outlined in note 1 (1).

9

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(b) Revenue recognition

Revenue is measured at the fair value of the consideration received or receivable. Amounts disclosed as revenue are net of returns, trade allowances rebates and amounts collected on behalf of third parties.

The Company recognises revenue when the amount of revenue can be reliably measured, it is probable that future economic benefits will flow to the Company and specific criteria have been met for each of the Company's activities as described below. The amount of revenue is not considered to be reliably measurable until all contingencies relating to the sale have been resolved. The Company bases its estimates on historical results, taking into consideration the type of customer, the type of transaction and the specifics of each arrangement.

Revenue is recognised for the major business activities as follows

(i) Trading income Food and beverage, and retail income are recognised as income in the year of receipt.

(ii) Contributions - Related Entities University Contribution to student services and capital expenditure are recognised at their fair value when the Company obtains control of the right to receive the contribution, it is probable that economic benefits will flow to the Company and it can be reliably measured.

(iii) Rental income Leasing contracts are recognised as income in the year they relate to, except to the extent that they relate to future periods. Such income is treated as income in advance in liabilities.

(iv) Interest Interest income is recognised as it accrues.

(v) Other revenue Other revenue is recognised when it is received or when the right to receive payment is established.

(c) Income Tax

The Company is exempt from income tax under subdivision 50-B of the Income Tax Assessment Act 1997.

(d) Leases

Leases in which a significant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases (note 23). Payments made under operating leases (net of any incentives received from the lessor) are charged to the income statement on a straight-line basis over the period of the lease.

(e) Impairment of assets

Goodwill and intangible assets that have an indefinite useful life are not subject to amortisation and are tested annually for imp<;~irment or more frequently if events or changes in circumstances indicate that they might be impaired. Other assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the asset's carrying amount exceeds its recoverable amount. The recoverable amount is the higher of an asset's fair value less costs of disposal and value in use. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows which are largely independent of the cash inflows from other assets or groups of assets (cash generating units). Non-financial assets other than goodwill that suffered an impairment are reviewed for possible reversal of the impairment at each reporting date.

10

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(f) Cash and cash equivalents

For statement of cash flows presentation purposes, cash and cash equivalents includes cash on hand, deposits held at call with financial institutions, other short-term, highly liquid investments with original maturities ofthree months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value, and bank overdrafts. Bank overdrafts are shown with interest bearing liabilities in current liabilities on the balance sheet.

(g) Trade receivables

Trade receivables are recognised initially at fair value and subsequently measured at amortised cost using the effective interest method, less provision for impairment. Trade receivables are due for settlement no more than 30 days after end of month from the date of recognition.

Collectability of trade receivables is reviewed on an ongoing basis. Debts which are known to be uncollectible are written off. A provision for impairment of receivables is established when there is objective evidence that the Company will not be able to collect all amounts due according to the original terms of receivables. Significant financial difficulties of the debtor, probability that the debtor will enter bankruptcy or financial reorganisation, and default or delinquency in payments (more than 30 days overdue) are considered indicators that the trade receivable is impaired. The amount of the provision is the difference between the asset's carrying amount and the present value of estimated future cash flows, discounted at the effective interest rate. Cash flows relating to short-term receivable are not discounted if the effect of discounting is immaterial. The amount of the provision is recognised in the income statement.

(h) Inventories

Beverage, food and retail are stated at the lower of average cost and net realisable value. Cost comprises direct materials. Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs necessary to make the sale.

(i) Non-current assets (or disposal groups) held for sale and discontinued operations

Non-current assets (or disposal groups) are classified as held for sale and stated at the lower of their carrying amount and fair value less costs of disposal, if their carrying amount will be recovered principally through a sale transaction rather than through continuing use.

An impairment loss is recognised for any initial or subsequent write down of the asset (or disposal group) to fair value less costs to sell. A gain is recognised for any subsequent increases in fair value less costs to sell of an asset (or disposal group), but not in excess of any cumulative impairment loss previously recognised. A gain or loss not previously recognised by the date of the sale of the non-current asset (or disposal group) is recognised at the date of derecognition.

Non-current assets (including those that are part of a disposal group) are not depreciated or amortised while they are classified as held for sale. Interest and other expenses attributable to the liabilities of a disposal group classified as held for sale continue to be recognised.

U) Investments and other financial assets

The Company classifies its investments and other financial assets in the following categories: financial assets at fair value through profit or loss, loans and receivables, held-to-maturity investments, and available-for-sale financial assets. The classification depends on the purpose for which the investments were acquired . Management determines the classification of its investments at initial recognition and, in the case of assets classified as held-to-maturity, re-evaluates this designation at each reporting date.

(i) Financial assets at fair value through profit or loss

Financial assets at fair value through profit or loss include financial assets held for trading. A financial asset is classified in this category if acquired principally for the purpose of selling in the short term. Derivatives are classified as held for trading unless they are designated as hedges. Assets in this category are classified as current assets.

11

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(j) Investments and other financial assets (continued)

(ii) Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are included in current assets, except for those with maturities greater than 12 months after the reporting date which are classified as non-current assets. Loans and receivables are included in receivables in the statement of financial position.

(iii) Held-to-maturity investments

Held-to-maturity investments are non-derivative financial assets with fixed or determinable payments and fixed maturities that management has the positive intention and ability to hold to maturity.

(iv) Available-for-sale financial assets

Available-for-sale financial assets are non-derivatives that are either designated in this category or are not classified in any of the other categories. They are included in non-current assets unless management intends to dispose of the investment within 12 months of the reporting date.

Initial recognition and derecognition

Regular purchases and sales of investments and other financial assets are recognised on trade-date, being the date on which the Company commits to purchase or sell the asset. Investments and other financial assets carried are fair value through profit or loss are initially recognised at fair value and transaction costs are expensed in the income statement. Investments and other financial assets are derecognised when the rights to receive cash flows from the investments and other financial assets have expired or have been transferred and the Company has transferred substantially all the risks and rewards of ownership.

When securities classified as available-for-sale are sold, the accumulated fair value adjustments recognised in other comprehensive income are included in the income statement as gains and losses from investment securities.

Subsequent measurement

Available-for-sale financial assets and financial assets at fair va lue though profit and loss are subsequently carried at fair value. Loans and receivables and held-to-maturity investments, are carried at amortised cost using the effective interest method. Gains or losses arising from changes in the fair value of the 'financial assets at fair value through profit or loss' category are included in the Income Statement within other income or other expenses in the period in which they arise.

Changes in the fair value of monetary security denominated in a foreign currency and classified as available-for-sale are analysed between translation differences resulting from changes in amortised cost of the security and other changes in the carrying amount of the security. The translation differences related to changes in the amortised cost are recognised in profit or loss, and other changes in carrying amount are recognised in equity. Changes in the fair value of other monetary and on monetary securities classified as available-for-sale are recognised in equity.

Fair value

The fair values of investments and other financial assets are based on quoted prices in an active market. If the market for a financial asset is not active (and for unlisted securities), the Company establishes fair value by using valuation techniques, that maximise the use of relevant data. These include reference to the estimated price in an orderly transaction that would take place between market participants at the measurement date. Other valuation techniques used are the cost approach and the income approach based on the characteristics of the asset and the assumptions made by market participants.

12

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

U) Investments and other financial assets (continued)

Impairment

The Company assesses at each reporting date whether there is objective evidence that a financial asset or group of financial assets is impaired. In the case of equity securities classified as available-for-sale, a significant or prolonged decline in the fair value of a security below its cost is considered in determining whether the security is impaired. If any such evidence exists for available-for-sale financial assets, the cumulative loss (measured as the difference between the acquisition cost and the current fair value, less any impairment loss on that financial asset previously recognised in profit or loss) is removed from equity and recognised in the income statement. Impairment losses recognised in the income statement on equity instruments are not reversed through the income statement.

(k) Fair value measurement

The fair value of assets and liabilities must be measured for recognition and disclosure purposes.

The Company classifies fair value measurements using a fair value hierarchy that reflects the significance of the inputs used in making the measurements.

The fair value of assets or liabilities traded in active markets (such as publicly traded derivatives, and trading and available-for-sale securities) is based on quoted market prices for identical assets or liabilities at the reporting date (level 1 ). The quoted market price used for assets held by the Company is the most representative of fair value in the circumstances within the bid-ask spread .

The fair value of assets or liabilities that are not traded in an active market (for example, over-the-counter-derivatives) is determined using valuation techniques. The Company uses a variety of methods and makes assumptions that are based on market conditions existing at each reporting date. Quoted market prices or dealer quotes for similar instruments (Level 2) are used for long-term debt instruments held. Other techniques that are not based on observable market data (Level 3) such as estimated discounted cash flows, are used to determine fair value for the remaining assets and liabilities. The fair value of interest-rate swaps is calculated as the present value of the estimated future cash flows. The fair value of forward exchange contracts is determined using forward exchange market rates at the reporting date. The level in the fair value hierarchy shall be determined on the basis of the lowest level input that is significant to the fair value measurement in its entirety.

Fair value measurement of non-financial assets is based on the highest and best use of the asset. The Company considers market participants use of, or purchase price of the asset, to use it in a manner that would be highest and best use.

The carrying value less impairment provision of trade receivables and payables are assumed to approximate their fair values due to their short-term nature. The fair value of financial liabilities for disclosure purposes is estimated by discounting the future contractual cash flows at the current market interest rate that is available to the Company for similar financial instruments.

(I) Property, Plant and Equipment

Property, plant and equipment are stated at historical cost less depreciation. Historical cost includes expenditure that is directly attributable to the acquisition of the items.

Subsequent costs are included in the asset's carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Company and the cost of the item can be measured reliably. All other repairs and maintenance are charged to the income statement during the financial period in which they are incurred.

Art works are not depreciated.

Depreciation on other assets is calculated using the straight line method to allocate their cost or revalued amounts , net of their residual values, over their estimated useful lives, is as follows:

13

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(I) Property, Plant and Equipment (continued)

Motor vehicles 7 years

Plant and equipment 3- 10 years

Leasehold improvements 40 years

The asset's residual values and useful lives are reviewed, and adjusted if appropriate, at each reporting date.

An asset's carrying amount is written down immediately to its recoverable amount if the asset's carrying amount is greater than its estimated recoverable amount.

(m) Intangible Assets

(iJ Software

Expenditure on software, being software that is not an integral part of the related hardware, is capitalised. Capitalised expenditure is stated at cost less accumulated amortisation. Amortisation is calculated using the straight-line method to allocate the cost over the period of the expected benefit, to a maximum of 5 years.

(n) Trade and other payables

These amounts represent liabilities for goods and services provided to the Company prior to the end of the financial year, which are unpaid. The amounts are unsecured and are usually paid within 30 days of recognition occurred.

(o) Provisions

Provisions for legal claims and service warranties are recognised when the Group has a present legal or constructive obligation as a result of past events; it is probable that an outflow of resources will be required to settle the obligation and the amount can be reliably estimated.

Provisions are not recognised for future operating losses.

Where there are a number of similar obligations, the likelihood that an outflow will be required in settlement is determined by considering the class of obligations as a whole. A provision is recognised even if the likelihood of an outflow with respect to any one item included in the same class of obligations may be small.

Provisions are measured at the present value of management's best estimate of the expenditure required to settle the present obligation at the reporting date. The discount rate used to determine the present value reflects current market assessments of the time value of money and the risks specific to the liability. The increase in the provision due to the passage of time is recognised as a finance cost.

(p) Employee benefits

(i) Short-term obligations

Liabilities for short-term employee benefits including wages and salaries, non-monetary benefits and profit-sharing bonuses are measured at the amount expected to be paid when the liability is settled, if it is expected to be settled wholly before twelve months after the end of the reporting period, and is recognised in other payables. Liabilities for non-accumulating sick leave are recognised when the leave is taken and measured at the rates payable.

14

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(p) Employee benefits (continued)

(ii) Other long-term obligations

The liability for other long-term employee benefits such as annual leave and long service leave is recognised in current provisions for employee benefits if it is not expected to be settled wholly before twelve months after the end of the reporting period. It is measured at the present value of expected future payments to be made in respect of services provided by employees up to the reporting date using the projected unit credit method. Consideration is given to expected future wage and salary levels, experience of employee departures and periods of service. Expected future payments are discounted using market yields at the reporting date on national government bonds with terms to maturity and currency that match, as closely as possible, the estimated future cash outflows. Regardless of the expected timing of settlements, provisions made in respect of employee benefits are classified as a current liability, unless there is an unconditional right to defer the settlement of the liability for at least 12 months after the reporting date, in which case it would be classified as a non-current liability.

(iii) Termination Benefits

Termination benefits are payable when employment is terminated before the normal retirement date, or when an employee accepts an offer of benefits in exchange for the termination of employment. The Group recognises termination benefits either when it can no longer withdraw the offer of those benefits or when it has recognised costs for restructuring within the scope of AASB137 that involves the payment of termination benefits when it is demonstrably committed to either terminating the employment of current employees according to a detailed formal plan without possibility of withdrawal or providing termination benefits as a result of an offer made to encourage voluntary redundancy. Benefits not expected to be settled wholly before 12 months after the end of the reporting period are discounted to present value.

(q) Goods and services tax (GST)

Revenues, expenses, assets and certain liabilities are recognised net of the amount of associated GST, except where the amount of GST incurred is not recoverable from the Australian Taxation Office. In this case, it is recognised as part of the cost of acquisition of the asset or part of the expense.

Receivables and payables are stated inclusive of the amount of GST receivable or payable. The net amount of GST recoverable from , or payable to, the taxation authority is included with other receivables or payables in the statement of financial position.

Cash flows are presented on a gross basis. The GST components of cash flows arising from investing or financing activities which are recoverable from, or payable to the taxation authority, ani presented as operating cash flows.

Commitments and contingences are disclosed net of the amount of GST recoverable from, or payable to, the tax authority.

(r) New Accounting Standards and Interpretations not yet mandatory or early adopted

Certain new Accounting Standards and Interpretations have been published that are not mandatory for 31 December 2013 reporting periods. The company's assessment of the impact of these new standards and interpretations is set out below:

• AASB 9 Financial instruments, AASB 2009-11 Amendments to Australian Accounting Standards arising from AASB 9, AASB 2010-7 Amendments to Australian Accounting Standards arising from AAB 9 (December 201 0), AASB 2012-6 Amendments to Australian Accounting Standards- Mandatory Effective Date of AASB 9 and Transition Disclosures (effective 1 January 2015)

15

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(r) New Accounting Standards and Interpretations not yet mandatory or early adopted (continued)

AASB 9 amends the requirements for classification and measurement of financial assets. The available-for-sale and held-to-maturity categories of financial assets in AASB 139 have been eliminated. Under AASB 9, there are three categories of financial assets:

1. Amortised cost 2. Fair value through profit or loss 3. Fair value through other comprehensive income.

The following requirements have generally been carried forward unchanged from AASB 139 Financial Instruments: Recognition and Measurement into AASB 9:

• Classification and measurement of financial liabilities; and • Derecognition requirements for financial assets and liabilities.

However, AASB 9 requires that gains or losses on financial liabilities measured at fair value are recognised in profit or loss, except that the effects of changes in the liability's credit risk are recognised in other comprehensive income.

The company does not have any financial liabilities measured at fair value through profit or loss. There will therefore be no impact on the financial statements when these amendments to AASB 9 are first adopted.

• Interpretation 21 Accounting for Levies (effective 1 January 2014)

Clarifies the circumstances under which a liability to pay a levy imposed by a government should be recognised, and whether that liability should be recognised in full at a specific date or progressively over a period of time.

The company is not liable to pay any government levies. There will therefore be no impact on the financial statements when this interpret~tion is first adopted.

(s) New, revised or amending Accounting Standards and Interpretations adopted

The company has applied all of the new, revised or amending Accounting Standards and Interpretations issued by the Australian Accounting Standards Boards ('AASB') that are mandatory for the current reporting year. The adoption of these Accounting Standards and Interpretations did not have any significant impact on the financial performance or position of the company.

The following Accounting Standards and Interpretations are most relevant to the company:

• AASB 13 Fair Value Measurement and AASB 2011-8 Amendments to Australian Accounting Standards arising from AASB 13

AASB 13 aims to improve consistency and reduce complexity by providing a precise definition of fair value and a single source of fair value measurement and disclosure requirements for use across Australian Accounting Standards. No differences were found in the valuation approach of financial instruments and therefore no adjustments to any of the carrying amounts in the financial statements are required as a result of the adoption of AASB 13. New disclosure requirements under AASB 13 are contained within the financial statements.

• AASB 119 Employee Benefits and AASB 2011-10 Amendments to Australian Accounting Standards arising from AASB 119

The company has applied AASB 119 and its consequential amendments from 1 January 2013. The standard changed the definition of short-term employee benefits, from 'due to' to 'expected to' to be settled within 12 months. Annual leave that is not expected to be wholly settled within 12 months is now discounted allowing for expected salary levels in the future period when the leave is expected to be taken. New disclosure requirements under AASB 119 are contained within the financial statements.

16

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

2 INVESTMENT REVENUE

Interest received

Total investment revenue

3 RENTAL REVENUE

Rental revenue

Hire income

Tenant outgoings

Total revenue income

4 CONTRIBUTIONS· RELATED ENTITIES

5

Service fees from The University of Newcastle

Total contributions· related entities

OTHER REVENUE

Advertising income

Commissions received

Event revenue

Merchandise

Rebates from unrelated parties

Student membership fees

Other revenue

Total other revenue

2013 2012 $ $

209,519 237,279

209,519 237,279

1,347,431 1,293,859 8,152 10,475

196,680 132,657

1,552,263 1,436,991

5,251 ,654 3,341,630

5,251 ,654 3,341,630

84,970 90,982 332,988 288,877

56,818 54,456 6,784

67,896 48,223 318 19,613

147,840 133,282

697,614 635,433

17

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

6 EMPLOYEE RELATED EXPENSES

2013 2012 $ $

Employee related expense -Trading Salaries 542,182 392,847

Contribution to funded superannuation 49,016 33,058

Worker's compensation 3,691 6,700

Long service leave expense 2,709 2,404

Annual leave 24,463 8,670

Total trading 622,061 443,679

Employee related expense - Other Salaries 2,614,052 2,145,662

Contribution to funded superannuation 262,437 211,410

Payroll tax 6,256 11 ,304

Worker's compensation 17,716 35,130

Long service leave expense 12,222 6,686

Annual leave 261,015 201 ,013

Maternity leave 97 2,397

Total non-academic- other 3,173,795 2,613,602

Total employee related expenses 3,795,856 3,057,281

7 DEPRECIATION AND AMORTISATION

Depreciation Leasehold improvements 34,247 31,856

Plant and equipment 156,611 133,352

Total depreciation 190,858 165,208

Amortisation Intangibles- computer software 21,451 20,719

Total amortisation 21,451 20,719

Total depreciation and amortisation 212,309 185,927

8 REPAIRS AND MAINTENANCE Buildings 29,193 44,254

Cleaning 266,180 218,498

Repairs and maintenance -general 159,095 79,401

Total repairs and maintenance 454,468 342,153

18

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

9 OTHER EXPENSES

Advertising, marketing and promotions

Donations

General consumables

Insurances

Minor equipment

Student support

Operating lease rental

Professional services

Scholarships, grants and prizes

Telecommunications

Travel, staff development and entertainment

Utilities

Other expenses

Total other expenses

10 CASH AND CASH EQUIVALENTS

Current Cash at bank and on hand

Total cash and cash equivalents

(a) Reconciliation to cash and cash equivalents at the end of the year in the statement of cash flows

2013 $

72,004

959

1,151,734

13,514

695,927

1,006,117

38,152

404,067

65,018

37,648

200,374

185,074

50,809

3,921,397

328,246

328,246

The above figures are reconciled to cash and cash equivalents at the end of the year as shown in the statement of cash flows as follows:

Balances as above 328,246

Balance as per cash flow statement 328,246

(b) Cash at bank

2012 $

104,414

1,052,400

(5,364)

157,915

551,595

25,665

168,479

118,647

45,045

87,033

182,725

51 ,982

2,540,536

576,120

576,120

576,120

576,120

Cash at bank is interest bearing with the floating rates being determined by the daily balance of funds held in the account. This was 2.26% for 2013 (2012: 2.56%).

11 TRADE AND OTHER RECEIVABLES

Current

Trade receivables 278,698 292,936

Prepayments 28,206 50 ,386

Related party receivables 421,834 358,661

Other receivables 33,828 7,799

Total trade and other receivables 762,566 709,782

19

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

11 TRADE AND OTHER RECEIVABLES (continued)

(a) Impaired trade receivables

As at 31 December 2013 current trade receivables of the Company with a nominal value of $nil (2012: $nil) were impaired. During 2013 the amount of the provision was $nil (2012: $nil).

(b) Past due but not impaired

12

13

As of 31 December 2013, trade receivables of $164,451 were past due but not impaired. These relate to a number of customers for whom there is no history of recent default or expectation of same.

The ageing of these receivables is:

Less than 3 months· 164,451 101 ,045

Over 3 months

164,451 101,045

INVENTORIES

Current

Retail inventory - at cost Retail stock on hand 103,038 148,008

Total inventories 103,038 148,008

OTHER FINANCIAL ASSETS

Current Held to maturity investments 3,400,000 3,900,000

Non-current Available for sale financial assets 1,000 1,000

Held to maturity investments 1,200,000

Total Non-current 1,201,000 1,000

Total other financial assets 4,601,000 3,901 ,000

20

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

14 PROPERTY, PLANT AND EQUIPMENT

Non Current

Leasehold improvements

At Cost

Accumulated impairment adjustment

Accumulated depreciation

Total leasehold improvements

Capital works in progress At cost

Total capital works in progress

Plant and equipment At Cost

Accumulated depreciation

Total plant and equipment

Artwork and Libraries At Cost

Accumulated depreciation

Total artworks and libraries

Total property, plant and equipment

2013 2012

$ $

10,641,343 10,376,809

(5,394,963) (5,394,963)

(3,853,128) (3,818,881)

1,393,252 1,162,965

15,933

15,933

1,470,270 1,258,163

(773,426) (616,814)

696,844 641 ,349

2,800 2,800

(990) (990)

1,810 1,810

2,091,906 1,822,057

Movement in the carrying amounts for each class of property, plant and equipment between the beginning and the end of the current year:

Capital Leasehold works in Plant and Artwork and

improvements progress equipment Libraries Total $ $ $ $ $

Balance at 1 January 2012 885,639 94,324 472,875 1,810 1,454,648

Additions 230,791 301 ,826 532,617

Transfers in (out) 78,391 (78,391)

Depreciation expense (31 ,856) (133,353) (165,208)

Balance at 31 December 2012 1,162,965 15,933 641 ,349 1,810 1,822,057

Balance at 1 January 2013 1,162,965 15,933 641,349 1,810 1,822,057

Additions 460,708 460,708

Transfers in (out) 264,534 (476,641) 212,107

Depreciation expense (34,247) (156,611) (190,858)

Balance at 31 December 2013 1,393,252 696,844 1,810 2,091,906

21

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

15 INTANGIBLE ASSETS

Non Current

Computer software

Cost Accumulated amortisation

Net carrying value

Total Intangibles

Movement in the carrying amounts of intangible assets between the beginning and the end of the current year:

Computer software Balance at the beginning of the year

Additions

Amortisation expense

Balance at the end of the year

16 TRADE AND OTHER PAY ABLES

Current Trade payables

Other current payables

Total current trade and other payables

17 PROVISIONS

Current provisions expected to be settled wholly within 12 months Employee Benefits

Annual leave

Long service leave

Short-term provisions

Parental leave

Current provisions expected to be settled wholly after more than 12 months

Employee benefits Annual leave

Long service leave

Total current provisions

Non-current provisions Employee benefits

Long service leave

Total non-current provisions

Total provisions

2013 2012 $ $

66,652

(48,199)

18,453

18,453

39,904

(21 ,451)

18,453

765,980

659

766,639

181,000

11,000

192,000

28,000

47,000

75,000

267,000

43,000

43,000

310,000

66,652

(26,748)

39,904

39,904

34,688

25,935

(20, 719)

39,904

666,255

238

666,493

110,012

11 '100

1,041

122,153

36,671

51 ' 100

87,771

209,924

28,900

28,900

238,824

22

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

17 PROVISIONS (continued)

Provision for annual leave

This provision is for outstanding annual leave liabilities that employees have not yet taken. It is assumed the leave will be taken in the next twelve months. The measurement and recognition criteria relating to employee benefits has been included in note 1 to these financial statements.

Provision for long service leave

This provision is for outstanding long service leave liabilities that employees have not yet taken. The measurement and recognition criteria relating to employee benefits has been included in note 1 these financial statements. The calculation of the present value of future cash flows in respect of long service being taken has been calculated by independent third parties based on historical data provided by the Company.

(a) Movements in provisions

(b)

Current Carrying amount at 1 January 2013

Additional provisions recognised

Amounts reversed

Amounts used

Balance at 31 December 2013

Movements in provisions • Non current

Non-current Opening balance at 1 January 2013

Additional provisions recognised

Balance at 31 December 2013

18 OTHER LIABILITIES

Current Income received in advance

Total current other liabilities

Annual leave

$

146,683

248,006

(185,689)

209,000

Long Parental service leave Leave Total

$ $ $

62,200 1,041 209,924

6,351 254,357

(1,041) (1,041)

(10,551) (196,240)

58,000 267,000

Long service leave Total

$ $

28,900

14,100

43,000

2013 $

113,070

113,070

28,900

14,100

43,000

2012 $

113,808

113,808

23

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

19 RETAINED EARNINGS

Movements in retained earnings were as follows: Balance at the beginning of the year

Operating result for the year

Retained earnings at the end of the year

20 KEY MANAGEMENT PERSONNEL DISCLOSURES

(a) Names of responsible persons and executive officers

2013 2012 $ $

6,177,746

537,754

6,715,500

5,537,309

640,437

6,177,746

The following persons were responsible persons and executive officers of the Company for the year, or part thereof:

Sharon Waterhouse

lan Baker Sam Barker- appointed 1 April 2013

Peter Cockbain

Lara Field Kelly Lofberg - ceased 18 October 2013 Andrew Parfitt- appointed 1 April2013

Kristen Perry- ceased 25 November 2013 Liam Sanders - ceased 31 March 2013 Tim Shanley

Emily Wood

(b) Other key management personnel

The following persons also had authority and responsibility for planning, directing and controlling the activities of the Company during the year:

Nat McGregor (Chief Executive Officer)- ceased 29 May 2013

Jennifer Smith (Acting Chief Executive Officer)- appointed 30 May 2013

(c) Remuneration of Board members and Executives

Nil

(d) Remuneration of other key management personnel

$110,000 to $119,999 $240,000 to $249,999

2013 Number

11

2

2012 Number

12

24

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

20 KEY MANAGEMENT PERSONNEL DISCLOSURES (continued)

(e) Key management personnel compensation

Short-term employee benefits

Total

21 REMUNERATION OF AUDITORS

2013 2012 $ $

227,253 240,921

227,253 240,921

During the year the following fees were paid or payable for services provided by the auditor of the Company, its related practices and non-related audit firms.

Audit services

Audit and review of financial statements

Audit Office of NSW

22 CONTINGENCIES

There were no contingent assets or liabilities at the end of the reporting period.

23 COMMITMENTS

Operating lease commitments (GST excl.)

(i) Operating Leases

Expenditure contracted for at the reporting date but not recognised as liabilities is as follows:

Operating lease commitments

Commitments for minimum lease payments in relation to non-cancellable operations leases are payable as follows: - within one year

- Later than one year but not later than five years

24 EVENTS OCCURRING AFTER REPORTING DATE

21 ,500

21,500

11,608

64,428

76,036

28,500

28,500

39,082

20,090

59,172

No matters or circumstances have arisen since the end of the year which significantly affected or could significantly affect the operations of the Company, the results of those operations, or the state of affairs of the Company in future years.

25

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

25 RECONCILIATION OF OPERATING RESULT TO NET CASH FLOWS FROM OPERATING ACTIVITIES

26

2013 2012 $ $

Operating result for the year 537,754 640,437

Depreciation and amortisation 212,309 185,927

Changes in operating assets and liabilities: (Increase) decrease in trade debtors 14,238 32,935

(Increase) decrease in related party receivables (63, 173) (352,660)

(Increase) decrease in inventories 44.971 (53,400)

(Increase) decrease in other operating assets (3,848) (40,699)

Increase (decrease) in trade creditors 100,146 (12,769)

(Increase) decrease in related party payables (364,055)

Increase (decrease) in other operating liabilities (10,857) 443,577

Increase (decrease) in other provisions 71,176 104,404

Net cash provided by operating activities 902,716 583,697

FINANCIAL RISK MANAGEMENT

The Company's activities expose it to a variety of financial risks: market risk (including currency risk , fair value interest rate risk, cash flow interest rate risk and price risk), credit risk and liquidity risk. The Company's overall risk management program focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the financial performance of the Company. The Company uses different methods to measure different types of risk to which it is exposed. These methods include sensitivity analysis in the case of interest rate and other price risks.

Risk management is carried out under direction by the Board of Directors. The Company has engaged the University of Newcastle's Treasury to administer, provide management services and engage expert consultants to maximise the returns on the Company's cash and other investments in accordance with the University's Investment Policy.

(a) Market risk

(i) Price risk

The Company does not have any investments in equity securities and as such is not exposed to price risk.

(ii) Cash flow and fair value interest rate risk

The Company's main interest rate risk arises from cash and cash equivalents and held to maturity investments. At 31 December 2013, if interest rates had changed by ± 1% from the year end rates with all other variables held constant, post-tax profit for the year would have been ± $49,282. (2012: ±$44, 761 ) .

26

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

26 FINANCIAL RISK MANAGEMENT (continued)

(a) Market risk (continued)

(iii) Summarised sensitivity analysis

The following table summarises the sensitivity of the Company's financial assets and financial liabilities to interest rate risk.

31 December 2013

Financial assets

Cash and cash equivalents

Financial assets - Held to maturity

Total increase (decrease)

31 December 2012

Financial assets

Cash and cash equivalents -at bank

Financial assets - Held to maturity

Total increase {decrease)

(b) Credit risk

Carrying -1% amount Result

$ $

328,24€ (3,282)

4,600,000 (46,000)

(49,282)

576,120 (5,761)

3,900,000 (39,000)

(44,761)

Interest rate risk +1%

Equity Result Equity $ $ $

(3,282 3,282 3,282

(46,000 46,000 46,000

(49,282 49,282 49,282

(5,761 5,761 5,761

(39,000 39,000 39,000

(44,761 44,761 44,761

Credit risk arises from cash and cash equivalents and deposits with banks and financial institutions, as well as outstanding receivables and committed transactions.

Credit risk management is carried out by the Company under appointment by the Board of Directors.

27

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

26 FINANCIAL RISK MANAGEMENT (continued)

(c) Liquidity risk

Prudent liquidity risk management implies maintaining sufficient cash and marketable securities, the availability of funding through an adequate amount of committed credit facilities and the ability to close out market positions. Due to the dynamic nature of the underlying businesses, the Company aims at maintaining flexibility in funding by keeping committed credit lines available.

The following tables summarise the maturity of the Company's financial assets and financial liabilities:

31 December 2013

Financial assets

Cash and cash equivalents

Trade and other receivables

Other financial assets

Total financial assets

Financial liabilities

Trade and other payables

Total financial liabilities

31 December 2012

Financial assets

Cash and cash equivalents

Trade and other receivables

Other financial assets

Total financial assets

Financial liabilities

Trade and other payables

Total financial liabilities

Average interest

rate %

2.3

2.6

5.9

Variable interest

rate $000

328

328

576

576

Greater Within 1 than 5

year 1 - 5 years years $000 $000 $000

3,400 1,200

3,400 1,200

3,900

3,900

Noninterest

$000

734

1

735

767

767

710 1

711

666

666

Total $000

328

734

4,601

5,663

767

767

576 710

3,901

5,187

666

666

28

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

27 FAIR VALUE MEASUREMENTS

(a) Fair value measurements

The fair value of financial assets and financial liabilities must be estimated for recognition and measurement or for disclosure purposes.

Due to the short-term nature of the current receivables, their carrying value is assumed to approximate their fair value and based on credit history it is expected that the receivables that are neither past due nor impaired will be received when due.

The carrying amounts and aggregate net fair values of financial assets and liabilities at reporting date are:

Carrying amount Fair value

2013 2012 2013 $000 $000 $000

Financial assets

Cash and cash equivalents 328 576 328

Trade and other receivables 763 710 763

Other financial assets

Available-for-sale 1 1

Held-to-maturity 4,600 3,900 4,600

Total financial assets 5,692 5,187 5,692

Financial liabilities

Trade and other payables 767 666 767

Total financial liabilities 767 666 767

The Company measures and recognises the following assets and liabilities at fair value on a recurring basis;

Available-for-sale financial assets

(b) Fair value hierarchy

2012 $000

576

710

3,900

5,187

666

666

The Company categorises assets and liabilities measured at fair value on a recurring basis into a hierarchy based on the level of inputs used in measurement.

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 - inputs other than quoted prices within level 1 that are observable for the asset or liability either directly or indirectly.

Level 3- inputs for the asset or liability that are not based on observable market data (unobservable inputs).

(i) Recognised fair value measurements

Fair value measurements recognised in the statement of financial position are categorised into the following levels at 31 December 2013.

29

UON SERVICES LIMITED

Notes to the financial statements For the year ended 31 December 2013

27 FAIR VALUE MEASUREMENTS (continued)

Fair value measurements at 31 December 2013 Recurring fair value measurements Financial assets

Note 2013 $000

Level 1 $000

Level 2 $000

Level3 $000

Other financial assets 13 Available-for-sale Total financial assets

Fair value measurements at 31 December 2012 Recurring fair value measurements Financial assets

Note 2012 $000

Level1 $000

Level 2 $000

Level3 $000

Other financial assets 13 Available-for-sale Total financial assets

There were no transfers between levels 1 and 2 for recurring fair value measurements during the year.

The Company's policy is to recognise transfers into and transfers out of fair value hierarchy levels as at the end of the reporting period.

(ii) Disclosed fair values

The Company has a number of assets and liabilities which are not measured ·at fair value, but for which the fair values are disclosed in the notes.

The fair value of assets or liabilities traded in active markets (such as publicly traded derivatives, and trading and available-for-sale securities) is based on quoted market prices for identical assets or liabilities at the reporting date (level 1 ). This is the most representative of fair value in the circumstances.

The fair values of held-to-maturity investments are disclosed in note 13 were determined by reference to published price quotations in an active market (level1 ).

The carrying value less impairment provision of trade receivables and payables is a reasonable approximation of their fair values due to the short term nature of trade receivables.

30

UON SERVICES LIMITED

Director's declaration

The directors of the company declare that;

1. The financial statements and notes are in accordance with the Corporations Act 2001 and:

a) comply with Accounting Standards and the Corporations Regulations 2001 ; and

b) comply with the Public Finance and Audit Act 1983 (NSW), and the Public Finance and Audit Regulation 2005 (NSW); and

c) give a true and fair view of the company's financial position as at 31 December 2013 and of its performance for the year ended on that date.

2. In the directors' opinion, there are reasonable grounds to believe that the company will be able to pay its debts as and when they become due and payable.

This declaration is made in accordance with a resolution of the Board of the Directors pursuant to s.41 C of the Public Finance and Audit Act 1983(NSW).

Director

Newcastle

Dated: 31 March 2014

31

,~oR-G€"-'V

~-Q & ~~ (" . . .. .., .... .. .. ....

INDEPENDENT AUDITOR'S REPORT

UoN Services Limited

To Members of the New South Wales Parliament and Members of UoN Services Limited

I have audited the accompanying financial statements of UoN Services Limited (the Company), which comprise the statement of financial position as at 31 December 2013, the income statement, statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, notes comprising a summary of significant accounting policies and other explanatory information and the directors' declaration.

Opinion

In my opinion the financial statements:

are in accordance with the Corporations Act 2001, including:

giving a true and fair view of the Company's financial position as at 31 December 2013 and its performance for the year ended on that date

complying with Australian Accounting Standards and the Corporations Regulations 2001

are in accordance with section 41 B of the Public Finance and Audit Act 1983 (the PF&A Act) and the Public Finance and Audit Regulation 2010.

My opinion should be read in conjunction with the rest of this report.

Directors' Responsibility for the Financial Statements

The directors of the Company are responsible for the preparation of the financial statements that give a true and fair view in accordance with Australian Accounting Standards, the PF&A Act and the Corporations Act 2001 and for such internal control as the directors determine is necessary to enable the preparation of the financial statements that give a true and fair view and that are free from material misstatement, whether due to fraud or error.

Auditor's Responsibility

My responsibility is to express an opinion on the financial statements based on my audit. I conducted my audit in accordance with Australian Auditing Standards. Those Standards require that I comply with relevant ethical requirements relating to audit engagements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgement, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company's preparation of the financial statements that give a true and fair view in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by the directors, as well as evaluating the overall presentation of the financia l statements.

Level15, 1 Margaret Street, Sydney NSW 2000 I GPO Box 12, Sydney NSW 2001 I t 02 9275 7101 I f 02 9275 7179 I e [email protected]\Y.gov.au I audit.nsw.9ov.au

I

I believe the audit evidence I have obtained is sufficient and appropriate to provide a basis for my audit opinion.

My opinion does not provide assurance:

about the future viability of the Company

that it has carried out its activities effectively, efficiently and economically

about the effectiveness of its internal control

about the security and controls over the electronic publication of the audited financial statements on any website where they may be presented

• about other information that may have been hyperlinked to/from the financial statements.

Independence

In conducting my audit, I have complied with the independence requirements of the Australian Auditing Standards, the Corporations Act 2001 and relevant ethical pronouncements. The PF&A Act further promotes independence by:

providing that only Parliament, and not the executive government, can remove an Auditor-General

mandating the Auditor-General as auditor of public sector agencies, but precluding the provision of non-audit services, thus ensuring the Auditor-General and the Audit Office of New South Wales are not compromised in their roles by the possibility of losing clients or income.

I confirm that the independence declaration required by the Corporations Act 2001, provided to the directors of the Company on 31 March 2014, would be in the same terms if provided to the directors as at the time of this auditor's report.

~~ Kheir Director, Financial Audit Services

1 Apri l 2014 SYDNEY

To the Directors UoN Services Limited

,:~oR-G~t\1

~-0 ~ ~~""9' r-~ .. <~.,,~ ...

Auditor's Independence Declaration

As auditor for the audit of the financial statements of UoN Services Limited for the year ended 31 December 2013, I declare, to the best of my knowledge and belief, there have been no contraventions of:

the auditor independence requirements of the Corporations Act 2001 in relation to the audit

any applicable code of professional conduct in relation to the audit.

J~k Kheir Director, Financial Audit Services

31 March 2014 SYDNEY

Level1 5, 1 Margaret Street, Sydney NSW 2000 I GPO Box 12, Sydney NSW 2001 I t 02 9275 7101 I 102 9275 7179 I e [email protected] I audit.nsw.gov.au