The Midtown

-

Upload

jimmylail -

Category

Economy & Finance

-

view

130 -

download

0

Transcript of The Midtown

Jimmy LailDavid Lail

Tyler Mainous08.06.07

Midland Developmen

t Analysis

Outline

I. Project Overview

II. Feasibility Analysis

III. Equity Capital Funding

IV. Sales Process

V. Investment Analysis

Project Overview

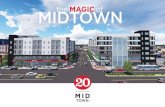

The Concept

100-unit luxury

condominium

development

with 1st floor

commercial

space.

Project Overview

The Amenities

Project Overview

Sample Floorplan

• 2 bedrooms, 2 full baths

• +/- 1200 square feet

• Hardwood floors

• Granite counter tops

• Stainless steel appliances

• Balcony

• Highest quality construction

Feasibility

Regional & City Analysis

• Lexington 2000 Population: 260,512

• Downtown Population: 5,000+

• Downtown Workforce Population: 12,000

• Approximately 1,000 Downtown Businesses

• 3 General Use Downtown Parks

• Home of the University of Kentucky and Transylvania University

• Major employers: U.K., Ashland Inc., Lexmark International, Inc., Toyota Motor Manufacturing, Link-Belt

• Lexington is experiencing rapid growth and redevelopment of its downtown

Feasibility

Location Analysis

• 2 minutes from Downtown Core

• 5 minutes from U.K.

• Easy access to Winchester Rd., Richmond Rd., I-75, and I-64

• Splits 2 historic residential neighborhoods

• Prime location for growth as Downtown Core expands

Feasibility

Site Analysis

DowntownMidland Avenue

3 rd Street

Lew

is S

tree

t

• Current zoning is I-1

• Future zoning is MU-2

• Existing structures: 3 commercial

• Traffic: 20,000 cars/day

Feasibility

Project Sales Price

Sale # Square Feet Price Price/sq. ft.1 1,365 353,710$ 259.13$ 2 1,495 364,800$ 244.01$ 3 1,271 307,500$ 241.94$ 4 1,354 282,986$ 209.00$ 5 1,470 285,230$ 194.03$ 6 1,655 303,710$ 183.51$ 7 1,655 293,710$ 177.47$ 8 1,170 206,690$ 176.66$

Comparable Lexington Condo Sales

High

$259.13

Low

$176.66

Mid

$217.90

• Pool• Fitness Center• Starbuck’s

• Dry Cleaning Service• Bar & Grill• Highest Quality Construction

$255

Equity Capital Funding

225 MidlandOwner: Will Dale Properties, LLC

Acreage: 0.43

Property Value: $455,000

265 MidlandOwner: SJM Properties, LLC

Acreage: 0.80

Property Value: $630,000

261 MidlandOwner: Brashear

Acreage: 0.12

Property Value: $500,000

EQUITY PARNTER

EQUITY PARNTER

OPPORTUNITY!

Equity Capital Funding

59.8%$2,355,001Soft Costs

11.5%$455,000225 Midland EQUITY PARTNER

12.7%$500,000261 Midland EQUITY PARTNER

100%$3,940,001TOTALS

16.0%$630,000265 Midland EQUITY PARTNER

% of TOTALAMOUNTINVESTOR

INVESTMENT OPPORTUNITY

Sales Process

• On-site sales center and agent

• Website

• Weekly newspaper ads

• Local PR campaign

• “Shopping the Bluegrass” TV segment

Sales & Marketing Strategy

Investment Analysis

Estimated Profit*

Sales Revenue $37,850,000

Less: Land Costs 1,585,000

Less: Construction Costs 25,835,013

Less: Soft Costs 2,355,001

Less: Realtor Costs 918,000

Profit $7,156,987

* Please see Excel sheet for greater detail

Investment Analysis

Share of Profit*

$3,216,986

$1,922,844

$371,505

$408,247

$925,600

Profit $

$7,156,987

$4,277,844

$826,505

$908,247

$1,444,391

$ OUT

100%

59.8%

11.5%

12.7%

16.0%

% Share of Profit

$2,355,001Soft Costs

$455,000225 Midland EQUITY PARTNER

$500,000261 Midland EQUITY PARTNER

$3,940,001TOTALS

$630,000265 Midland EQUITY PARTNER

$ ININVESTOR

* Please see Excel sheet for greater detail

Questions & Comments

?