Multinational Bank Slogans

-

Upload

sachin-sahoo -

Category

Documents

-

view

241 -

download

0

description

Transcript of Multinational Bank Slogans

INDIAN FINANCIAL SYSTEM CODE(IFSC CODE):TheIndian Financial System Code(IFSC Code) is analphanumeric codethat uniquely identifies a bank-branch participating in the two mainElectronic Funds Settlement Systemsin India: the Real Time Gross Settlement (RTGS) and the National Electronic Funds Transfer (NEFT) Systems.This is an 11-character code with the first fouralphabeticcharacters representing the bank name, and the last six characters (usually numeric, but can be alphabetic) representing the branch. The fifth character is 0 (zero) and reserved for future use. IFSC Code is used by the NEFT & RTGS systems to route the messages to the destination banks/branches. Format of IFSC Code is mentioned below1234567891011

Bank Code0Branch Code

The code consists of 11 Characters : (e.g ICIC0000438)First 4 characters represent the entity (ICIC0000438)Fifth position has been defaulted with a '0' (Zero) for future use (ICIC0000438)Last 6 character denotes the branch identity (ICIC0000438)IFSC Codes

IFSCmeansIndian Financial System Code. The Indian online payment systems likeNEFTandRTGSrequires IFSC code to locate the branch in which transaction is to be done. These code are directly used by RBI (Reserve Bank of India) to facilitate various interbank transactions. A IFSC Code contains 11 characters for example ICIC0001245

Explanation of various elements of IFSC Code1. The first 4 characters represent the bank or entity (ICIC0001245) In this case it is ICICI Bank2. Fifth position is right now unused and is left of future use. The default value is 0.3. Last 6 characters are digits and identify the branch ( ICIC0001245) In this case it is Worli, Mumbai branch of ICICI Bank

RuPay Indias answer to Visa and Mastercard

RuPayis the brand of domestic card scheme floated by National Payments Corporation of India (NPCI). RuPay is a portmanteau word formed by the combination of Rupee and Payment and it also sounds very similar to Hindi pronunciation of Rupees. Currently, all the card payments are routed through Visa or MasterCard which are world leaders in this area and these transactions are processed outside the country. After launching RuPay, the same process will be replaced by processing within the country. In simple words, Rupay is a domestic alternative to the global real time payment firms like Mastercard and Visa. RuPay is expected to be used by all commercial banks after March 2012.What exactly is happening now?As there is no domestic card, banks do not have an option but to tie up with Visa or MasterCard for connectivity between cardholders, merchants and issuing banks across the globe. Every transaction done using a debit or credit card issued by a domestic bank is routed through network switches owned by Visa or MasterCard, which are based outside the country. All these transactions involve some charges which goes into the pockets of Visa and Mastercard for providing these services. On an average, banks pay around Rs 300 crore every year to Visa and MasterCard for processing all debit and credit card payments.How Rupay works?The Rupay initiative imposes the setting up of a network switch, which acts as a payment gateway that connects all the ATMs and points-of-sale terminals. The domestic system will eventually displace payment settlement providers like MasterCard and Visa.To support financial inclusion, NPCI is offering Aadhar-enabled Rupay cards to public sector banks for their no-frill account holders. NPCI is also in talks with state owned lenders to issue cards to regional rural banks (RRBs). Using an Aadhar-enabled RuPay card, a customer can withdraw money from both, normal and micro ATMs, with the help of biometric technology. So far, NPCI has offered such cards to Bank of India, Corporation Bank and Union Bank of India.Benefits of RuPay Rupay will reduce the cost for both banks and customers. Rupay will approximately charge Rs 15 per card as processing fee to a single bank against Rs 25 of the other providers, a 40% reduction in service cost for Rupay compared with other providers.

Issuer Identification Number (IIN)What is Banks IIN?IIN mean Issuer Identification Number. This number identifies the Bank to which you the Aadhaar number is mapped. IIN is a six digit number and will be used for making AEPS (Aadhaar Enabled Payment System) transaction. In most banks BC customer service points, this number would be represented on the terminal by the banks logo or name and hence this number is not to be remembered by the customer, however, it is recommended that the customer be aware of their bank IIN to ensure a successful AEPS transaction.Bank NameBanks IIN

Bank of India9999013

ICICI Bank9999229

Union Bank of India9999026

NEFT UTR NumberThe termUTR No.meansUnique Trasaction Reference Numberand it is generally used in association with NEFT transactions done through bank. For every successfulNEFTtransaction, your Bank will provide a UTR number (Unique Transaction Reference No.). For example, if you do the a NEFT transaction with a branch of Union Bank of India, the Union Bank of India will provide the UTR No. to you which can be used to track the transaction later. So, UTR number is a unique code for identifying the NEFT transaction.

Swift Codes for Banks in IndiaSwift Code(also called SWIFT-BIC, BIC code, SWIFT ID) is a standard format of Business Identifier Codes (BIC). It is used in international payment transactions and this code is issued by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) to banks which enables banks worldwide to be identified without the need to specify an address or bank number. These swift codes are used when transferring money between banks, generally for international wire transfers. You can find the Swift Codes for banks in india which can be used to transfer money from abroad to India. Please verify the code with the bank before making any transaction.IMPS Interbank Mobile Payment ServiceInterbank Mobile Payment Service (IMPS) is an instant interbank electronic fund transfer service through mobile phones. IMPS facilitate customers to use mobile instruments as a channel for accessing their banks accounts and remitting funds therefrom. Various banks are providing remittance facility through their mobile banking platforms. The interbank remittance request initiated from a mobile is processed by the beneficiary bank as a National Electronic Fund Transfer (NEFT) transaction. The status of such payment request is therefore not known instantly because NEFT payments are processed in batches from 9 am to 7 pm. The NEFT transactions are charged by banks and charges vary from bank to bank

Mobile Money Identifier (MMID)is a seven digit random number issued by the bank upon registration. Remitter (customer who wants to send money) and Beneficiary (customer who wants to receive the money) should have this MMID for doing this interbank funds transfer.

Banks Recurring Deposit SchemesRecurring deposit account is generally opened for a purpose to be served at a future date. Generally it is opened to finance pre-planned future purposes like, wedding expenses of daughter, purchase of costly items like land, luxury car and refrigerator or air conditioner.Eligibility of Recurring Deposit accountRecurring deposit account is opened by those who want to save regularly for a certain period of time and earn a higher interest rate. Recurring Deposit scheme is offered by almost all banks (RD schemes of SBI, PNB, ICICI Bank, HDFC Bank, IDBI Bank, Bank of India, Bank of Baroda, Corporation Bank) in one form or the other. Recurring Deposit is very popular among the salaried class, especially who can afford to save only few hindered or say few thousand rupees per month.This scheme is a boon for people who do not have a large amount of savings and thus cannot use the Fixed Deposit scheme of the banks. Under this scheme, the customer deposits a minimum amount (normally fixed) every month and bank pays the interest at the pre-determined rates (which is usually the same as applicable to fixed deposits).At the end of the period i.e. on maturity date, the customer is paid the maturity value i.e. principle deposited and the interest payable. In recurring deposit account certain fixed amount is accepted every month for a specified period and the total amount is repaid with interest at the end of the particular fixed period.Features of Recurring Deposit AccountThe main features of recurring deposit account are as follows:- The main objective of recurring deposit account is to develop regular savings habit among the public. In India, minimum amount that can be deposited is Rs.10 at regular intervals. The period of deposit is minimum six months and maximum ten years. Higher rate of interest is charged by the bank. No withdrawals are allowed. However, the bank may allow closing the account before the maturity period. The bank provides the loan facility. The loan can be given up to 75% of the amount standing to the credit of the account holder.Advantage of Recurring Deposit AccountThe advantages of recurring deposit account are as follows:-1. Recurring deposit encourages regular savings habit among the people.2. Recurring deposit account holder can get a loan facility.3. The bank can utilize such funds for lending to businessmen.4. The bank may also invest such funds in profitable areas.

Demat Account in BanksDemat accountis short form ofdematerialised account. Demat account is similar to a bank account where real money is replaced by shares. Just like a bank account is required to save money or make cheque payments, we need a demat account in order to buy or sell shares. A Demat Account holds portfolio of shares in electronic form and removes the need of holding shares in physical form. The account offers a secure and convenient way to keep track of shares and investments without the hassle of handling physical documents that get mutilated or lost in transit.Lets assume you have 100 shares of ICICI bank, 50 shares of Axis Bank, 100 shares of SBI. These shares will be shown in your demat account and you can trade them at any time without any physical paperwork or delivery through exchanges like NSE and BSE.Is it necessary to have a demat account?The Securities and Exchange Board of India (SEBI) mandates a demat account for share trading involving more than 500 shares.Main Benefits of Demat Account1. Reduces brokerage charges2. Eliminates risks associated with physical certificates such as bad delivery, fake securities, delays, forgery, counterfeiting, thefts and loss due to fire.3. Reduction in paperwork involved in transfer of securities4. Enables quick ownership of securities on settlement thereby resulting in increased liquidity5. There is no odd lot problem. Even one share can be bought or sold.6. Demat account obviates the need to pay stamp duty (in case of physical shares, 0.5 per cent stamp duty is payable).7. Pledging/Hypothecation of shares is easierHow to open a Demat AccountYou can open a demat account with a bank or a depository participant (DP). Banks usually give preference to those customers who have a savings or current account with the bank. Most of the banks provide demat accounts to their customers. However, banks usually charge higher brokerage than the regular brokerage houses. Following documents are required to open a demat account:1. Identity proof2. Address proof3. Copy of PAN card (mandatory)4. 2-3 Photographs of the applicant.5. Cancelled MICR cheque for bank account linkingHow to dematerialise physical sharesFor dematerialization of physical share certificate(s) you have to first fill the demat request form (DRF). The form can be obtained from the DP with whom your demat account is opened. Deface the share certificate(s) by writing across Surrendered for dematerialisation. Submit the DRF & share certificate(s) to DP. DP would forward them to the issuer. After dematerialisation, your depository account would be credited with the dematerialised securities. It is quite a simple process and is taken care by most of the good brokerage houses.

Fixed Deposits in BanksBank Fixed Depositsare also calledTerm Depositsin India. Popularly, it is just calledBank FD or simply FD.In a Fixed Deposit Account, a certain sum of money is deposited in the bank for a fixed time period with a fixed rate of interest and hence it is called a fixed deposit. The rate of interest for Bank Fixed Deposits depends on the maturity period or the term period. It is higher in case of longer maturity period but nowadays sometimes banks offer higher rates for certain shorter periods also to be more liquid/cash rich at the end of year etc. There are large number of options in maturity period and it ranges from 15days to 5 years. The interest rate can be compounded quaterly, half-yearly or annually and varies from bank to bank. There is no upper limit but most banks have minimum deposit amount of Rs 1000/- . Most banks also offer loan / overdraft facility against fixed deposits. Premature withdrawal is permissible but it involves loss of some interest and some extra fees.Things You Should Remember/Ask Before Opening a FD AccountBefore opening a fixed deposit account1. Check the financial position of the bank. Try to go for the most popular/big banks.2. Try to check the rates of interest for different banks for different periods.3. Always check for the fees for early withdrawal. Also, instead of putting a big amount in one fixed deposit, keep the amount in five or ten small deposits. This way, in case of any premature withdrawal of partial amount, then only one or two deposits may need to be prematurely encashed. Thus, the loss of interest will be less than if a single big deposit were to be encashed.4. Check deposit receipts carefully to ensure that all details have been properly and accurately filled in. Do not leave the renewal column unfilled. Otherwise, on maturity the fixed deposit amount will go back into an FD.5. Before investing in a FD it is important to consider the rate of interest and the inflation rate. A high inflation rate can eat into your real returns. So, it is vital to have a look at the inflation rate before arriving at the real rate of interest.Advantages of Fixed Deposit1. Safety:Fixed deposits with the banks in india are nearly 100% safe as all the banks operating in the country, whether nationalised, private, or foreign, are governed by the RBIs rules and regulations which are among the most stringent rules in the world. Till recently, all bank deposits were insured under the Deposit Insurance & Credit Guarantee Scheme of India, which has now been made optional. Nonetheless, bank fixed deposits are among the safest modes of investment.2. Loans against FD:You can also get loans up to 75- 90% of the deposit amount from banks against fixed deposit receipts. Please note that the interest charged will be slightly more than the interest earned by the deposit but this option can be availed if you need loan for a shorter period.Tax Implications1. Fixed Deposits (FDs) with a maturity period of 5 years or more in a Scheduled bank is eligible for tax deduction under section 80C. However, the interest earned on the deposit is taxable.2. Tax will be deducted at the source (TDS), if the interest income on a fixed deposit (FD) per annum exceeds Rs.10000.How To Open a Bank Fixed Deposit AccountYou can open a Fixed Deposit(FD) account with any bank, be it nationalized, private or foreign and make the deposit. However, some banks insist that you open a savings account with them to operate a FD.

What is Mobile Money?Mobile payment is completely a different domain and generally refers to payment of services operated under financial regulation and performed from or via a mobile device. It is also referred to as mobile money, mobile banking, mobile money transfer and mobile wallet.Mobile payment is an alternative payment method. Instead of paying with cash, check, or credit cards, a consumer can use a mobile phone to pay for a wide range of services and digital or hard goods such as: Music, videos, ringtones, online game subscription or items, wallpapers and other digital goods. Transportation fare (bus, subway or train), parking meters and other services Books, magazines, tickets and other hard goods.Theprimary benefitof mobile money is the empowerment of such segments of people who doesnt have their bank accounts. They can start using this facility by registering with the entity by fulfilling the KYC (Know your customer) norms.This service has been already successful in Indonesia, Kenya, Japan, Africa etc. but inIndiathis system has not yet received encouraging response because of many reasons, some of them are: The keyobstaclesfaced for full deployment of mobile money in India is theConsumer awareness. Because of adjustment with the current ecosystem as it is not ready to accept such changes. Also mainly due to theRegulatory restrictions of the Government. Though these restrictions has been removed to some extent but that too on conditional basis. There is one more hurdle that the other party to whom the payment is to be made doesnt have this mobile facility.According to current figures, around 90% of people in India make cash payments for their purchases. All business and finance people is looking it as a positive sign because they believe these transactions can be made with the help of mobile phones as many people dont have debit cards, credit cards or even bank accounts. Current figures also reveal that 240 million people in India have bank accounts and on the other hand 990 million people have mobile phones. So, its a good opportunity for the business and finance people.Nowadays approximately around 3% of the population of India uses mobile as a wallet but it is expected that this percentage of people using mobile as a wallet facility will grow to 20-25% in next 2-3 years.Current trends in Mobile money:In India, a partnership model is evolving where banks, telecom operators and other service providers are expected to work together that will help in proliferation of mobile money services. This model is expected to tie in technology, distribution, and other pieces and enable the ecosystem to grow that will ultimately benefit the consumer.Further, from a technology standpoint, Near Field Communication (NFC) in which a mobile and a merchant (where the customer has to pay) device can talk in a closed area of network where there is no need for internet facility. This NFC is expected to revolutionize the way proximity payments are conducted. Consumers can make payments with the simple tap of their mobile phones, very much like a credit/debit card. Consumers will no longer be required to carry their wallet for making payments. Another way is that this facility can be used with the help of SMS (short messaging service) so here also there is no need for internet facility.AIRTEL MONEY:Airtel has launched a new service Airtel Money. With the help of Airtel Money one can easily get money into your mobile. To use Airtel Money you have to register for it. One will be asked to choose a mPin which will be needed to make the transfer of money. This facility is available across 300 key cities in India,airtel moneyis afast, simple and secure servicethat allows its users to load cash on their mobile devices and spend it to pay utility bills and recharges, shop at 7,000-plus merchant outlets and transact online,One should not set mPins which can be guessed easily (like your house number/ year of birth/ 1111 etc) since every transaction in ones account is authenticated by this mPin.Best part of recharging mobile by Airtel money is that one gets 5% cash back. Many other companies are offering discount on paying bills by Airtel Money.One can easily pay Airtel Bill, recharge the friends airtel mobile, and pay BSNL and MTNL bills and purchase tickets for movies. Also one can even deposit money to any bank account. It takes only 1 business day to get cash into Bank account for which money is deposited.To register a account for Airtel Money one should be 18 years old .One person can have only one Airtel Money account.There are three types of accounts under the Airtel Money service Express account;Under the Express service, pay for all utilities including:a) Airtel prepaid mobile and digital TV recharge.b) Airtel mobile and fixed line bills.c) Electricity, gas, insurance etc.Load cash and spend up to Rs 10000 daily**Airtel customers all over India except Jammu and Kashmir can register for express account.Power account;Under Power Account, pay for all airtel money services including:a) Utilities (all express account features)b) Movie ticketsc) Restaurants, spas and shopping.Load Cash and spend up to Rs. 50,000 daily**Transactions done by dialing *400# have a limit of Rs 5,000 per transaction.*Airtel customers all over India (except Jammu and Kashmir) can register for power account.Super account:Under Super Account:a) Send and receive money from other airtel money super account customers.b) Withdraw money from any airtel money- super account outlet.c) Earn interest on balance amount @ 4% p.a.Load cash, send and withdraw upto Rs. 25000 daily*This account will be available only in Mumbai, Delhi, Bihar and Uttar Pradesh.

CBS Core Banking SolutionWhat is Core Banking Solution (CBS) ?Core Banking Solution (CBS) is networking of branches, which enables Customers to operate their accounts, and avail banking services from any branch of the Bank on CBS network, regardless of where he maintains his account. The customer is no more the customer of a Branch. He becomes the Banks Customer. Thus CBS is a step towards enhancing customer convenience through Anywhere and Anytime Banking.How shall CBS help Customers?All CBS branches are inter-connected with each other. Therefore, Customers of CBS branches can avail various banking facilities from any other CBS branch located any where in the world. These services* are: To make enquiries about the balance; debit or credit entries in the account. To obtain cash payment out of his account by tendering a cheque. To deposit a cheque for credit into his account. To deposit cash into the account. To deposit cheques / cash into account of some other person who has account in a CBS branch. To get statement of account. To transfer funds from his account to some other account his own or of third party, provided both accounts are in CBS branches. To obtain Demand Drafts or Bankers Cheques from any branch on CBS amount shall be online debited to his account. Customers can continue to use ATMs and other Delivery Channels, which are also interfaced with CBS platform.

Certificate of Deposit in IndiaCDs are negotiable money market instrument issued in demat form or as a Usance Promissory Notes. CDs issued by banks should not have the maturity less than seven days and not more than one year. Financial Institutions are allowed to issue CDs for a period between 1 year and up to 3 years.CDs are like bank term deposits but unlike traditional time deposits these are freely negotiable and are often referred to as Negotiable Certificates of Deposit. CDs normally give a higher return than Bank term deposit. CDs are rated by approved rating agencies (e.g. CARE, ICRA, CRISIL, and FITCH) which considerably enhance their tradability in the secondary market, depending upon demand. SBI DFHI is an active player in secondary market of CDs.Features of CD All scheduled banks (except RRBs and Co-operative banks) are eligible to issue CDs. They can be issued to individuals, corporations, trusts, funds and associations. NRIs can also subscribe to CDs, but on non-repatriable basis only. In secondary market such CDs cannot be endorsed to another NRI. They are issued at a discount rate freely determined by the issuer and the market/investors. CDs issued in physical form are freely transferable by endorsement and delivery. Procedure of transfer of dematted CDs is similar to that of any other demat securities. For CDs there is no lock-in period.CDs are issued in denominations of Rs.1 Lac and in the multiples of Rs. 1 Lac thereafter. Discount/Coupon rate of CD is determined by the issuing bank/FI.Loans cannot be granted against CDs and Banks/FIs cannot buy back their own CDs before maturity.

What is a Nostro Account?Ans.A Nostro account is a bank account established in a foreign country usually in the currency of that country for the purpose of carrying out transactions there. For example most commercial banks maintain US dollar accounts with their correspondent banks in USA in order to facilitate settlement of interbank and customer transactions in US dollar.

Gilt FundsGilt funds, as they are conveniently called, are mutual fund schemes floated by asset management companies (AMCs) with exclusive investments in government securities. The schemes are also referred to as mutual funds dedicated exclusively to investments in government securities. Government securities mean and include central government dated securities, state government securities and treasury bills. The gilt funds provide to the investors the safety of investments made in government securities and better returns than direct investments in these securities through investing in a variety of government securities yielding varying rate of returns gilt funds, however, do run the risk.. The first gilt fund in India was set up in December 1998.Facilities from Reserve Bank of IndiaThe Reserve Bank provides liquidity support and other facilities, such as, SGL and current accounts, transfer of funds through the Reserve Banks Remittance Facility Scheme and access to call money market to dedicated gilt funds. These facilities are provided to encourage gilt funds to create a wider investor base for government securities market. The facilities provided to gilt funds include:i. Liquidity support: The objective of extending liquidity support to dedicated gilt funds is to support short-term liquidity requirements of such mutual funds. The Reserve Bank of India provides liquidity support to gilt funds by way of reverse repurchase agreements (reverse repos). Reverse repos are done in government of India dated securities eligible for repo transactions and treasury bills of all maturities. The quantum of liquidity support on any day is up to 20 per cent of the outstanding stock of government securities, including treasury bills, held by the gilt funds as at the end of the previous working day.ii.SGL and current accounts: The Reserve Bank opens one subsidiary general ledger (SGL) account and one current account for gilt funds own transactions at all centers of the Reserve Bank wherever desired by the gilt funds.iii. Funds transfer facility: The gilt funds are given the facility of transfer of funds from one center to another under the Remittance Facility Scheme of the Reserve Bank. The gilt funds are also given the facility of clearing of cheques arising out of government securities transactions, tendered at the Reserve Bank counters.iv.Access to call market: Gilt funds can access the call money market as lenders.v. Ready forwards: The Reserve Bank of India will also recommend to the Government of India to permit the gilt funds to undertake ready forward transactions in Government securities market.

Electronic Clearing Service (ECS), IndiaQ.1. What is Electronic Clearing Service (ECS)?Ans : ECS is an electronic mode of payment / receipt for transactions that are repetitive and periodic in nature. ECS is used by institutions for making bulk payment of amounts towards distribution of dividend, interest, salary, pension, etc., or for bulk collection of amounts towards telephone / electricity / water dues, cess / tax collections, loan installment repayments, periodic investments in mutual funds, etc. Essentially, ECS facilitates bulk transfer of monies from one bank account to many bank accounts or vice versa using the services of a ECS Centre at a ECS location.Q.2. What are the variants of ECS? In what way are they different from each other?Ans : Primarily, there are two variants of ECS ECS CreditandECS Debit.ECS Creditis used for affording credit to a large number of beneficiaries having accounts with bank branches at various locations within the jurisdiction of a ECS Centre by raising a single debit to an account of a bank (that maintains the account of the user institution). ECS Credit enables payment of amounts towards distribution of dividend, interest, salary, pension, etc., of the user institution.ECS Debitis used for raising debits to a large number of accounts maintained with bank branches at various locations within the jurisdiction of a ECS Centre for single credit to an account of a bank (that maintains the account of the user institution). ECS Debit is useful for payment of telephone / electricity / water bills, cess / tax collections, loan installment repayments, periodic investments in mutual funds, etc., that are periodic or repetitive in nature and payable to the user institution..

Exchange torned, soiled, mutilated and damaged BanknotesThis FAQ describes how and where to exchange torned, soiled, mutilated and damaged BanknotesWhat are soiled, mutilated and imperfect banknotes?(i) Soiled banknotes are banknotes, which have become dirty and limp due to excessive use. A single numbered banknote cut into two pieces but on which the number is intact is now treated as soiled banknote. A double numbered banknote cut into two pieces but on which both the numbers are intact is now treated as soiled banknote.(ii) Mutilated banknote is a banknote, of which a portion is missing or which is composed of more than two pieces.(iii) Imperfect banknote means any banknote, which is wholly or partially, obliterated, shrunk, washed, altered or indecipherable but does not include a mutilated banknote.Can soiled and mutilated banknotes be exchanged for value?Yes. Such banknotes can be exchanged for value.Where are soiled/mutilated banknotes accepted for exchange?All banks are authorized to accept soiled banknotes for full value. They are expected to extend the facility of exchange of soiled notes even to non-customers. All currency chest branches of commercial banks are authorised to adjudicate mutilated banknotes and pay value for these, in terms of the Reserve Bank of India (Note Refund) Rules, 2009How much value would one get in exchange of soiled banknotes?Soiled banknotes are exchanged for full value.How much value would one get in exchange of mutilated banknotes?A mutilated banknote can be exchanged for full value if,(i) For denominations of Re. 1, Rs. 2, Rs. 5, Rs. 10 and Rs. 20, the area of the single largest undivided piece of the note presented is more than 50 percent of the area of respective denomination, rounded off to the next complete square centimeter.(ii) For denominations of Rs. 50, Rs.100, Rs. 500 and Rs. 1000, the area of the single largest undivided piece of the note presented is more than 65 percent of the area of respective denomination, rounded off to the next complete square centimetre.Banknotes in denominations of Re. 1, Rs. 2, Rs. 5, Rs. 10 and Rs. 20, cannot be exchanged for half value.A mutilated banknote in denominations of Rs.50, Rs.100, Rs.500 or Rs.1000, can be exchanged for half value if,The undivided area of the single largest piece of the note presented is equal to or more than 40 percent and less than or equal to 65 percent of the area of respective denomination, rounded off to the next complete square centimetre.How much value would one get in exchange of imperfect banknotes?The value of an imperfect note may be paid for full value / half value under rules as specified for mutilated notes if,(i) the matter, which is printed on the note has not become totally illegible, and(ii) it can be satisfied that it is a genuine note.Major Investment Banks in IndiaAn investment bankis a financial institution that assists individuals, corporations and governments in raising capital by underwriting and/or acting as the clients agent in the issuance of securities eg: IPO/ FPO work is handled by investment banks. An investment bank also assist companies in mergers and acquisitions, and provide ancillary services such as market making, trading of derivatives, fixed income instruments, foreign exchange, commodities, and equity securities.The following is the list ofmajor indian investment banksbased out of India.AvendusAvendus is an investment bank based in India with offices in Mumbai and Bangalore. The firm was founded in 1999 by three investment bankers Ranu Vohra, Gaurav Deepak and Kaushal Kumar, who had worked for large global financial institutions and wanted to offer knowledge and research oriented capital raising and M&A solutions to international firms with a strong India connection.website url :http://www.avendus.comBajaj CapitalBajaj Capitals Investment Banking Service is a step ahead in that direction.Bajaj Capital offers you unparalleled capital raising solutions for your business. With over 120 offices in 50 cities all over the country and a network of over 10,000 Advisor Associates, we can connect you to potential investors all over the country.website url :http://www.bajajcapital.comBarclays IndiaBarclays unveiled its Global Retail and Commercial Banking division in India over the past year as part of its plan to be a leading global bank. In a very short time, Barclays is already making waves in one of the worlds fastest growing countries.web site url :http://www.barclays.inCholamandalam Investment & Finance CompanyCholamandalam Investment & Finance Company Limited is the financial services arm of the USD 880 million Murugappa Group. Incorporated in 1978, it is one of the leading Financial Services Company in the country. The products and services include vehicle finance, capital market finance, mutual funds, securities broking, depository services, and insurance and distribution services.web site url :http://www.cholamandalam.com/ICICI Securities LtdA subsidiary of ICICI Bank the largest and most recognized private bank in India ICICI Securities Ltd is premier Indian Investment Bank, with a dominant position in its core segments of its operations Corporate Finance including Equity Capital Markets Advisory Services, Institutional Equities, Retail and Financial Product Distribution.web site url :http://www.icicisecurities.com/ICRA LimitedICRA Limited (an Associate of Moodys Investors Service) was incorporated in 1991 as an independent and professional company. ICRA is a leading provider of investment information and credit rating services in India. ICRAs major shareholders include Moodys Investors Service and leading Indian financial institutions and banks.web site url :http://www.icra.inIDFCIDFCs mission is to be the financier and advisor of choice for infrastructure in India. IDFC is positioned as a special financial institution which is focused on project finance and investment banking activities in infrastructure. Going forward, IDFC will focus on establishing stable fee revenues from innovative infrastructure initiatives in financial markets, asset management, project development and advisory along with growing its balance sheet at a significant pace.web site url :http://www.idfc.com/IDFC Private EquityIDFC Private Equity (IDFC PE) was set up in 2002 as a 100% subsidiary of the Infrastructure Development Finance Company (IDFC). IDFC PE manages two funds with a current corpus of INR 1,734 crore (USD 400 million). India Development Fund and IDFC Private Equity Fund II. Both these funds provide growth capital to promising enterprises in the area of infrastructure in India.web site url :http://www.idfcpe.com/Industrial Development Bank of IndiaThe Industrial Development Bank of India (IDBI) was established in 1964 under an Act of Parliament. It was initially set up as a wholly owned subsidiary of the Reserve Bank of India (RBI) with a mandate of providing credit and other facilities for balanced industrial development. In 1976, the ownership of IDBI was transferred to the Government of India and it was accorded the status of principal financial institution in the country for co-ordinating the working of institutions, engaged in financing, promoting and developing industry, and also assisting in the development of such institutions. Following amendment to IDBI Act in October 1994 to permit public ownership up to 49% of its issued capital, IDBI went in for a public issue in July 1995. The shareholding of Government of India in IDBI currently stands at 58.47%.web site url :http://www.idbi.com/Industrial Finance Corporation of India (IFCI)IFCI, the first Development Finance Institution in India, was set up in 1948, as a Statutory Corporation, to pioneer institutional credit to medium and large industries IFCI was also the first institution in the financial sector to be converted into a Public Limited Company. IFCIs record of performance has broadly run parallel to the course of industrial and economic development of the nation. IFCIs principal operations include Project financing, Financial services & Comprehensive corporate advisory services.web site url :http://www.ifciltd.com/Kotak Investing BankingKotak Mahindra Capital Company (KMCC) helps leading Indian corporations, banks, financial institutions and government companies access domestic and international capital markets. KMCC has the most current understanding of investor appetite, having been the leading book runner/lead manager in public equity offerings in the period FY 2002-06.web site url :http://www.kmcc.co.inKotak Mahindra Capital CompanyAs a full service Investment Bank, Kotak Investment Bankings core business areas include Equity Issuances, Mergers & Acquisitions, Advisory Services and Fixed Income Securities and Principal Business.web site url :http://www.kmcc.co.in/SBI Capital MarketsSBI Capital Markets Ltd. is amongst the oldest players in the Indian Capital Market, offering an entire range of Investment Banking Services. With strong fund mobilization strengths, we are one of the leading players in the areas of fund raising through Capital Market Issues / Private Placement.web site url :http://www.sbicaps.com/S.E Investments LimitedSEILs philosophy on corporate governance envisages commitment to ensure customer satisfaction through better services. The company is committed to good corporate governance & continuously reviews various relationship measures with a view to enhance shareholders value. SEILprovides detailed information on various issues concerning the companys business and financial performance. SEIL respects the rights of its share holders to information on performance of the company and believes that the best corporate governance promotes transparency and helps mitigate the risks associated with the business.web site url :http://www.seil.inSmall Industries Development Bank of IndiaSmall Industries Development Bank of India (SIDBI) was established in April 1990 under an Act of Indian Parliament. SIDBI has completed 12 years of service to the small scale sector. Consequent upon, amendment in the SIDBI Act, the Bank has been delinked from SIDBI with effect from March 27, 2000. The SIDBI (Amendment) Act, 2000 has changed the provisions relating to capital structure, share holding pattern, management, business, borrowings, etc. The amended Act provides for divesting of 51% of the equity share capital of Rs.4.5 billion Subscribed and held by IDBI in favour of Life Insurance Corporation of India, General Insurance Corporation of India, Public Sector Banks and other Institutions owned or controlled by the Government of India.web site url :http://www.sidbi.com/SSKI GroupSSKI is a leading India-based financial services group that offers Institutional Equities and Investment Banking services. SSKI Investment Banking is a full-service investment bank with a strong research bias. Our team members bring deep domain knowledge, spanning a number of sectors, that we are able to leverage to meet the varied corporate finance needs of our clients. We provide a full range of services, from private placements of equity and debt, public offerings, project advisory to mergers and acquisitions.web site url :http://www.sski.co.in/Tata Investment Corporation Limited (TICL)TICL is a non-banking financial company (NBFC) registered with the Reserve Bank of India under the Investment Company category. The companys activities comprise primarily of investing in long-term investments in equity shares and other securities of companies in a wide range of industries. The major sources of income for the company consist of dividend income and profit on sale of investments.web site url :http://www.tata.com/tata_investment/UTI Securities LtdUTI Securities Ltd., was promoted as an independant professional entity in June 1994. With the repealing of Unit Trust of India (UTI) Act, the entire share capital of UTISEL is now held by Administrator of specified undertaking of Unit Trust of India since 1st February 2003. UTISEL has been providing all kinds of Investment related activities which include investment banking and corporate advisory services.web site url :http://www.usectrade.com/Yes BankYes Banks Investment Banking group is involved in the identification, structuring and execution of transactions for our clients in diverse industries and geographies. Some of the typical transactions include mergers & acquisitions, divestitures, private equity syndication and IPO advisory.

What is a currency chest?To facilitate the distribution of banknotes and rupee coins, the Reserve Bank has authorised select branches of scheduled banks to establish currency chests. These are actually storehouses where banknotes and rupee coins are stocked on behalf of the Reserve Bank. As on December 31, 2013, there were 4209 currency chests. The currency chest branches are expected to distribute banknotes and rupee coins to other bank branches in their area of operation.What is a small coin depot?Some bank branches are authorised to establish Small Coin Depots to stock small coins i.e. coins below Rupee one. The Small Coin Depots also distribute small coins to other bank branches in their area of operation. As on December 31, 2013, there were 3966 small coin depots.Soiled and Mutilated BanknotesWhat are soiled, mutilated and imperfect banknotes?(i) "soiled note:" means a note which, has become dirty due to usage and also includes a two piece note pasted together wherein both the pieces presented belong to the same note, and form the entire note.(ii) Mutilated banknote is a banknote, of which a portion is missing or which is composed of more than two pieces.(iii) Imperfect banknote means any banknote, which is wholly or partially, obliterated, shrunk, washed, altered or indecipherable but does not include a mutilated banknote.Can soiled and mutilated banknotes be exchanged for value?Yes. Such banknotes can be exchanged for value.Where are soiled/mutilated banknotes accepted for exchange?All banks are authorized to accept soiled banknotes for full value. They are expected to extend the facility of exchange of soiled notes even to non-customers. All branches of commercial banks are authorised to adjudicate mutilated banknotes and pay value for these, in terms of the Reserve Bank of India (Note Refund) Rules, 2009What is a Non-Banking Financial Company (NBFC)?A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property. A non-banking institution which is a company and has principal business of receiving deposits under any scheme or arrangement in one lump sum or in installments by way of contributions or in any other manner, is also a non-banking financial company (Residuary non-banking company).2. NBFCs are doing functions similar to banks. What is difference between banks & NBFCs ?NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few differences as given below:i. NBFC cannot accept demand deposits;ii. NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;iii. deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.What are the different types/categories of NBFCs registered with RBI?NBFCs are categorized a) in terms of the type of liabilities into Deposit and Non-Deposit accepting NBFCs, b) non deposit taking NBFCs by their size into systemically important and other non-deposit holding companies (NBFC-NDSI and NBFC-ND) and c) by the kind of activity they conduct. Within this broad categorization the different types of NBFCs are as follows:i. Asset Finance Company(AFC): An AFC is a company which is a financial institution carrying on as its principal business the financing of physical assets supporting productive/economic activity, such as automobiles, tractors, lathe machines, generator sets, earth moving and material handling equipments, moving on own power and general purpose industrial machines. Principal business for this purpose is defined as aggregate of financing real/physical assets supporting economic activity and income arising therefrom is not less than 60% of its total assets and total income respectively.ii. Investment Company (IC): IC means any company which is a financial institution carrying on as its principal business the acquisition of securities,iii. Loan Company (LC):LC means any company which is a financial institution carrying on as its principal business the providing of finance whether by making loans or advances or otherwise for any activity other than its own but does not include an Asset Finance Company.iv. Infrastructure Finance Company (IFC):IFC is a non-banking finance company a) which deploys at least 75 per cent of its total assets in infrastructure loans, b) has a minimum Net Owned Funds of Rs. 300 crore, c) has a minimum credit rating of A or equivalent d) and a CRAR of 15%.v. Systemically Important Core Investment Company (CIC-ND-SI):CIC-ND-SI is an NBFC carrying on the business of acquisition of shares and securities which satisfies the following conditions:-

(a) it holds not less than 90% of its Total Assets in the form of investment in equity shares, preference shares, debt or loans in group companies;

(b) its investments in the equity shares (including instruments compulsorily convertible into equity shares within a period not exceeding 10 years from the date of issue) in group companies constitutes not less than 60% of its Total Assets;

(c) it does not trade in its investments in shares, debt or loans in group companies except through block sale for the purpose of dilution or disinvestment;

(d) it does not carry on any other financial activity referred to in Section 45I(c) and 45I(f) of the RBI act, 1934 except investment in bank deposits, money market instruments, government securities, loans to and investments in debt issuances of group companies or guarantees issued on behalf of group companies.

(e) Its asset size is Rs 100 crore or above and

(f) It accepts public fundsvi. Infrastructure Debt Fund:Non- Banking Financial Company (IDF-NBFC) : IDF-NBFC is a company registered as NBFC to facilitate the flow of long term debt into infrastructure projects. IDF-NBFC raise resources through issue of Rupee or Dollar denominated bonds of minimum 5 year maturity. Only Infrastructure Finance Companies (IFC) can sponsor IDF-NBFCs.vii. Non-Banking Financial Company - Micro Finance Institution (NBFC-MFI):NBFC-MFI is a non-deposit taking NBFC having not less than 85%of its assets in the nature of qualifying assets which satisfy the following criteria:

a. loan disbursed by an NBFC-MFI to a borrower with a rural household annual income not exceeding Rs. 60,000 or urban and semi-urban household income not exceeding Rs. 1,20,000;

b. loan amount does not exceed Rs. 35,000 in the first cycle and Rs. 50,000 in subsequent cycles;

c. total indebtedness of the borrower does not exceed Rs. 50,000;

d. tenure of the loan not to be less than 24 months for loan amount in excess of Rs. 15,000 with prepayment without penalty;

e. loan to be extended without collateral;

f. aggregate amount of loans, given for income generation, is not less than 75 per cent of the total loans given by the MFIs;

g. loan is repayable on weekly, fortnightly or monthly instalments at the choice of the borrowerviii. Non-Banking Financial Company Factors (NBFC-Factors):NBFC-Factor is a non-deposit taking NBFC engaged in the principal business of factoring. The financial assets in the factoring business should constitute at least 75 percent of its total assets and its income derived from factoring business should not be less than 75 percent of its gross income.

Q. No. 1: How many types of cards are available to a customer?Ans: Cards can be classified on the basis of their issuance, usage and payment by the card holder. There are three types of cards (a) debit cards (b) credit cards and (c) prepaid cards.Q. No. 2: Who issues these cards?Ans: Debit cards are issued by banks and are linked to a bank account. Credit cards are issued by banks / other entities approved by RBI. The credit limits sanctioned to a card holder is in the form of a revolving line of credit (similar to a loan sanctioned by the issuer) and may or may not be linked to a bank account. Prepaid cards are issued by the banks / non-banks against the value paid in advance by the cardholder and stored in such cards which can be issued as smart cards or chip cards, magnetic stripe cards, internet accounts, internet wallets, mobile accounts, mobile wallets, paper vouchers, etc.Q. No. 3: What are the usages of debit cards?Ans: The debit cards are used to withdraw cash from an ATM, purchase of goods and services at Point of Sale (POS)/E-commerce (online purchase) both domestically and internationally (provided it is enabled for international use). However, it can be used only for domestic fund transfer from one person to another.Q. No. 4: What are the usages of credit cards?Ans: The credit cards are used for purchase of goods and services at Point of Sale (POS) and E-commerce (online purchase)/ through Interactive Voice Response (IVR)/Recurring transactions/ Mail Order Telephone Order (MOTO). These cards can be used domestically and internationally (provided it is enabled for international use). The credit cards can be used to withdraw cash from an ATM and for transferring funds to bank accounts, debit cards, credit cards and prepaid cards within the country.Q. No. 5: What are the usages of prepaid cards?Ans: The usage of prepaid cards depends on who has issued these cards. The prepaid cards issued by the banks can be used to withdraw cash from an ATM, purchase of goods and services at Point of Sale (POS)/E-commerce (online purchase) and for domestic fund transfer from one person to another. Such prepaid cards are known as open system prepaid cards. However, the prepaid cards issued by authorised non-bank entities can be used only for purchase of goods and services at Point of Sale (POS)/E-commerce (online purchase) and for domestic fund transfer from one person to another. Such prepaid cards are known as semi-closed system prepaid cards. These cards can be used only domestically.Q. No. 6: Is there any limit on the value stored in a prepaid card?Ans: Yes, as per extant instructions, the maximum value that can be stored in any prepaid card (issued by banks and authorised non-bank entities) at any point of time is Rs 50,000/-

Q1. What is RTGS System?Ans. The acronym 'RTGS' stands for Real Time Gross Settlement, which can be defined as the continuous (real-time) settlement of funds transfers individually on an order by order basis (without netting). 'Real Time' means the processing of instructions at the time they are received rather than at some later time; 'Gross Settlement' means the settlement of funds transfer instructions occurs individually (on an instruction by instruction basis). Considering that the funds settlement takes place in the books of the Reserve Bank of India, the payments are final and irrevocable.Q2. How RTGS is different from National Electronics Funds Transfer System (NEFT)?Ans. NEFT is an electronic fund transfer system that operates on a Deferred Net Settlement (DNS) basis which settles transactions in batches. In DNS, the settlement takes place with all transactions received till the particular cut-off time. These transactions are netted (payable and receivables) in NEFT whereas in RTGS the transactions are settled individually. For example, currently, NEFT operates in hourly batches. [There are twelve settlements from 8 am to 7 pm on week days and six settlements from 8 am to 1 pm on Saturdays.] Any transaction initiated after a designated settlement time would have to wait till the next designated settlement time Contrary to this, in the RTGS transactions are processed continuously throughout the RTGS business hours.Q3. Is there any minimum / maximum amount stipulation for RTGS transactions?Ans. The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is`2 lakh. There is no upper ceiling for RTGS transactions.Q4. What is the time taken for effecting funds transfer from one account to another under RTGS?Ans. Under normal circumstances the beneficiary branches are expected to receive the funds in real time as soon as funds are transferred by the remitting bank. The beneficiary bank has to credit the beneficiary's account within 30 minutes of receiving the funds transfer message.Q5. Would the remitting customer receive an acknowledgement of money credited to the beneficiary's account?Ans. The remitting bank receives a message from the Reserve Bank that money has been credited to the receiving bank. Based on this the remitting bank can advise the remitting customer through SMS that money has been credited to the receiving bank.Q6. Would the remitting customer get back the money if it is not credited to the beneficiary's account? When?Ans. Yes. Funds, received by a RTGS member for the credit to a beneficiary customers account, will be returned to the originating RTGS member within one hour of the receipt of the payment at the PI of the recipient bank or before the end of the RTGS Business day, whichever is earlier, if it is not possible to credit the funds to the beneficiary customers account for any reason e.g. account does not exist, account frozen, etc. Once the money is received back by the remitting bank, the original debit entry in the customer's account is reversed.Q7. Till what time RTGS service window is available?Ans. The RTGS service window for customer's transactions is available to banks from 9.00 hours to 16.30 hours on week days and from 9.00 hours to 14:00 hours on Saturdays for settlement at the RBI end. However, the timings that the banks follow may vary depending on the customer timings of the bank branches.Q8. What about Processing Charges / Service Charges for RTGS transactions?Ans With a view to rationalize the service charges levied by banks for offering funds transfer through RTGS system, a broad framework has been mandated as under:a) Inward transactions Free, no charge to be levied.b) Outward transactions `2 lakh to`5 lakh - not exceeding`30.00 per transaction;Above`5 lakh not exceeding`55.00 per transaction.

RTGS:The acronym RTGS stands for real time gross settlement. The Reserve Bank ofIndia (Indias Central Bank) maintains this payment network. RTGS system is a funds transfer mechanism where transfer of money takes place from one bank to another on a real time and on gross basis. This is the fastest possible money transfer system through the banking channel. Settlement in real time means payment transaction is not subjected to any waiting period. The transactions are settled as soon as they are processed. Gross settlement means the transaction is settled on one to one basis without bunching with any other transaction. Considering that money transfer takes place in the books of the Reserve Bank of India, the payment is taken as final and irrevocable.NEFT:The national electronic fund transfer (NEFT) system is a nation-wide system that facilitates individuals, firms and corporate to electronically transfer funds from any bank branch to any individual, firm or corporate having an account with any other bank branch in the country.What is the difference between RTGS & NEFT? In RTGS payment transaction will not involve any waiting period which is the true meaning of real time settlement. NEFT functions on a deferred net settlement (DNS) basis where transactions are completed in batches at specific times. Another significant factor that differentiates RTGS and NEFT is fixing a floor limit. RTGS is an exclusive message based transfer mechanism for an amount over Rs 2 lakhs i.e the minimum amount to be remitted through RTGS is Rs.2 lakhs. There is no upper ceiling for RTGS transactions. Contrary to that, NEFT is used mainly to transfer funds below Rs 2 lakhs, and this system is most commonly used for smaller value transactions involving smaller sum of money i.e from an amount as minute as one rupee. However, there is no maximum limit for transfers through NEFT.MAGNETIC INK CHARACTER RECOGNITION CODE(MICR CODE):Magnetic Ink Character Recognition Code(MICR Code) is a character-recognition technology used mainly by the banking industry to ease the processing and clearance of cheques and other documents. The MICR encoding, called theMICR line, is at the bottom of cheques and other vouchers and typically includes the document-type indicator,bank code,bank account number, cheque number, cheque amount, and a control indicator. The technology allows MICR readers to scan and read the information directly into a data-collection device. Unlikebarcodesand similar technologies, MICR characters can be read easily by humans. The MICR E-13B font has been adopted as the international standard inISO1004:1995,but the CMC-7 font is widely used in Europe, Brazil and Mexico.

UTR NUMBER: The termUTR No.means Unique Trasaction Reference Numberand it is generally used in association with NEFT transactions done through bank. For every successfulNEFTtransaction, your Bank will provide a UTR number (Unique Transaction Reference No.). For example, if you do the a NEFT transaction with a branch of Union Bank of India, the Union Bank of India will provide the UTR No. to you which can be used to track the transaction later. So, UTR number is a unique code for identifying the NEFT transaction. 16 digits UTR Number of RTGS denotes -First 4 digits for Bank : SBINNext 1 digit for Server : N or HNext 2 digits for year : 12(for 2012)Next 3 digits for julian date : 365(for 31 december)Next 6 digits : Unique reference Numberfollowed by the banks. To follow this banks need to focus on how to reach customers efficiently instead of thinking of new branches.AMUTUAL FUNDis an investment vehicle that is made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets whereas aFIXED DEPOSIT(FD) is afinancial instrumentprovided by banks which provides investors with a higher rate ofinterestthan a regularsavings account, until the given maturity date. It may or may not require the creation of a separate account. It is known as aterm depositortime depositinCanada,Australia,New Zealand, and theUS, and as abond in theUnited Kingdom. They are considered to be very safe investments.What are Mutual Funds? A mutual fund is a group of investors operating through a fundmanagerto purchase a diverse portfolio of stocks or bonds. There are myriad kinds of mutual funds, each with its own goals and methodologies. Whether or not a mutual fund is a good investment is a matter of much public debate, with many claiming they are excellent for the average person, and others saying they are simply a poor way to invest. A mutual fund may be either an actively managed fund or an indexed mutual fund. Actively managed funds are changed on a regular basis by afund managerin the attempt to maximize their profitability. The fund manager looks at the market and the sectors a fund invests in and redistributes the fund accordingly. An indexed fund simply takes one of the major indexes and buys according to that index. Indexed funds change much less frequently than actively managed funds, but in theory an active fund has more potential for profit. Many critics of mutual funds point out that scarcely over 20% of mutual funds outperform the Standard and Poors 500 Index. This means that nearly 80% of the time, an investor would have been more profitable by simply buying equalsharesin all 500 of the companies currently on theS&P 500. Supporters point out that for most people the complications involved in traditional investment are simply not worth the effort. A mutual fund offers an easy way to invest in something with a higher return than, say, interest earned at the bank, while keeping funds somewhat fluid. It also eliminates the need to track the market oneself.

What are Fixed Deposits?Fixed deposits are loan arrangements where a specific amount of funds is placed on deposit under the name of the account holder. The money placed on deposit earns a fixed rate of interest, according to the terms and conditions that govern the account. The actual amount of the fixed rate can be influenced by such factors at the type of currency involved in the deposit, the duration set in place for the deposit, and the location where the deposit is made.

What are Asset Reconstruction Companies?IntroductionAssetreconstructionis the handling of distressed assets to attempt to recover their value and clear them from the books.The problem of non performing loan/assets is a global one and has been receiving attention of banks, economist, regulators and public, alike. Internationally Asset Reconstruction Companies (ARCs) have been created to bring about a system for cleaning up Non Performing Assets (NPAs) from the books of secured lenders and bring the locked assets in circulation into the economy.The word asset reconstruction company is a typical used in India. Globally the equivalent phrase used is asset management companies. The word asset reconstruction in India were used in Narsimham I report where it was envisaged for the setting up of a central Asset Reconstruction Fund with money contributed by the Central Government, which was to be used by banks to shore up their balance sheets to clean up their non-performing loans. However, this never saw the light of the day and later on Narsimham II floated the idea asset reconstruction companies..Accordingly, Asset Reconstruction Company (Securitization Company / Reconstruction Company) is a company registered under Section 3 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SRFAESI) Act, 2002. It is regulated by Reserve Bank of India as an Non Banking Financial Company ( u/s 45I ( f ) (iii) of RBI Act, 1934).RBI has exempted ARCs from the compliances under section 45-IA, 45-IB and 45-IC of the Reserve Bank Act, 1934. ARC functions like an AMC within the guidelines issued by RBI.ARC has been set up to provide a focused approach to Non-Performing Loans resolution issue by:-(a) isolating Non Performing Loans (NPLs) from the Financial System (FS),(b) freeing the financial system to focus on their core activities and(c) Facilitating development of market for distressed assets.Functions of ARC :(i) Acquisition of financial assets (as defined u/s 2(L) of SRFAESI Act, 2002)(ii) Change or take over of Management / Sale or Lease of Business of the Borrower(iii) Rescheduling of Debts(iv) Enforcement of Security Interest (as per section 13(4) of SRFAESI Act, 2002)(v) Settlement of dues payable by the borrowerBenefits Relieving banks of the burden of NPAs would allow them to focus better on managing the core business including new business opportunities. The transfer should help restore depositor and investor confidence by ensuring the lenders financial health. ARCs are meant to maximise recovery value while minimizing costs. ARCs can also help build industry expertise in loan resolution, besides serving as a catalyst for important legal reforms in bankruptcy procedures and loan collection. ARCs can play an important role in developing capital markets through secondary asset instruments.How Does ARC actually Works:ARC functions more or less like a Mutual Fund. It transfers the acquired assets to one or more trusts (set up u/s 7(1) and 7(2) of SRFAESI Act, 2002) at the price at which the financial assets were acquired from the originator (Banks/FIs).Then, the trusts issues Security Receipts to Qualified Institutional Buyers [as defined u/s 2(u) of SRFAESI Act, 2002]. The trusteeship of such trusts shall vest with the ARC. ARC will get only management fee from the trusts. Any upside in between acquired price and realized price will be shared with the beneficiary of the trusts (Banks/FIs) and ARC. Any downside in between acquired price and realized price will be borne by the beneficiary of the trusts (Banks/FIs).What is ARCIL?ARCIL is the first asset reconstruction company (ARC) in the country to commence the business of resolution of non-performing loans (NPLs) acquired from Indian banks and financial institutions. It commenced business consequent to the enactment of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (Securitisation Act, 2002). As the first ARC, Arcil played a pioneering role in setting standards for the industry in India. It has been spearheading the drive to recreate value out of NPLs and in doing so, it continues to play a proactive role in reenergizing the Indian industry through critical times.What is BCSBI ?It is an independent and autonomous watch dog to monitor and ensure that the Banking Codes and Standards adopted by the banks are adhered to in true spirit while delivering their services.Definition:- In these Rules, unless the context requires otherwise:a. Act means the Societies Registration Act, 1860 in its application to the State of Maharashtra.b. Chairman means the Chairman of the Governing Council referred to in Rule 6 or 7.c. Chief Executive Officer means the Chief Executive Officer of the Society referred to in Rule 13, or as the as may be, in Rule 14d. Memorandum means the Memorandum of Association of the Society.e. Representative means an officer of the member bank, nominated by that bank to represent it.f. Society meansTHE BANKING CODES AND STANDARDS BOARD OF INDIAAbout BCSBI :-In November 2003, RBI constituted the Committee on Procedures and Performance Audit of Public Services under the Chairmanship of Shri S.S.Tarapore (former Deputy Governor) to address the issues relating to availability of adequate Banking Services to common man. The mandate to the Committee included identification of factors that inhibited the attainment of best customer services and suggesting steps to improve the quality of banking services to individual customers. The Committee felt that in an effort to continuously upgrade the package of services that banks offered to their customers there was a need of benchmarking of such services. After in depth study at the grass root level the Committee concluded that there was an institutional gap for measuring the performance of banks against a bench mark reflecting the best practices (Code and Standards). Therefore, the Committee recommended setting up of the Banking Codes and Standards Board of India broadly on the lines of Banking Codes and Standards Board functioning in U.K.

What Is Core Banking System ?The wordCore Bankingis used to describe the various services being offered by the banking system to its customers and this is done by the whole banking core branches. This facility makes it possible for the banks to get transfer their funds and other transactions to other core branch offices in a very easy and quick manner. Now, there is no need to get deposit and withdrawal of your cash in the same branch. You can deposit from any branch and get it withdrawal easily from the other branch.This facility of core banking has been developed few years back and had led to the tremendous change in the banking system structure. It gives the freedom of choice to the customer to get done the transactions completed in his own way. The person is not bound to anyone. There are various and most bolded facilities offered by the core banking system solutions are described below: Automatic teller machine or ATM Electronic fund Transfers Tele-banking Internet banking Branch clearing facility for banking branch offices

Kisan Vikas PatraKisan Vikas Patra, also popularly known asKVPis one of a very good investment scheme with high interest rates. KVP has the following main features Money doubles in 8 years and 7 months. Rate of interest 8.40% compounded annually. Minimum Investment Rs. 500/- No maximum limit. Two adults, Individuals and minor through guardian can purchase. Companies, Trusts, Societies and any other Institution not eligible to purchase. Non-Resident Indian/HUF are not eligible to purchase. Facility of encashment from 2 years. Maturity proceeds not drawn are eligible to Post office Savings account interest for amaximum period of two years. Facility of reinvestment on maturity. Patras can be pledged as security against a loan to Banks/Govt. Institutions. Patras are encashable at any Post office before maturity by way of transfer to desiredPost office. Patras are transferable to any Post office in India. Patras are transferable from one person to another person before maturity Duplicate can be issued for lost, stolen, destroyed, mutilated and defaced patras. Nomination facility available. Facility of purchase/payment of Kisan vikas Patras to the holder of Power of attorney. Rebate under section 80 C not admissible. Interest income taxable but no TDS Deposits are exempt from Wealth tax.

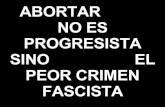

Multinational Bank Slogans/ Punch lines

Bank NameSlogan/Punch line

CITI Bank Lets get it done

Standard Chartered BankYour Right Partner

HSBC BankThe Worlds Local Bank

Royal Bank of ScotlandMake it happen

BNP Paribas The bank for a changing world

JPMorgan Chase BankThe right relationship is everything

Deutsche BankA passion to perform

Scotia Bank Youre richer than you think

American Express Bank Do more

Barclays Bank Fluent in finance

DBS Bank Living, Breathing Asia

Slogans of Banks in India

Name of the BankSlogan/Bank Slogan

Allahabad BankA tradition of trust

Andhra BankMuch more to do. With YOU in focus

Bank of BarodaIndias International Bank

Bank of IndiaRelationships beyond Banking

Bank of MaharashtraOne Family One Bank

Bank of RajasthanTogether we Prosper

Canara BankIts easy to change for those who you love, Together we Can

Central Bank of IndiaBuild A Better Life Around Us, Central to you since 1911

Corporation BankProsperity for all

Dena BankTrusted Family Bank

Federal BankYour Perfect Banking Partner

HDFC BankWe Understand Your World

HSBCWorlds Local Bank

ICICI BankHum Hai na

IDBI BankBanking for all; Aao Sochein Bada

Indian BankTaking Banking Technology to Common Man, Your Tech-friendly bank

Indian Overseas BankGood people to grow with

J & K BankServing to Empower

Karur Vysya BankSmart way to Bank

Lakshmi Vilas BankThe Changing Face of Prosperity

Oriental Bank of CommerceWhere every individual is committed

Punjab and Sindh BankWhere series is a way of life

Punjab National BankThe Name you can Bank Upon

State Bank of IndiaThe Nation banks on us; Pure Banking Nothing Else; With you all the way

State Bank of HyderabadYou can always bank on us

State Bank of MysoreWorking for a better tomorrow

State Bank of PatialaBlending Modernity with Tradition

State Bank of TravancoreA Long Tradition of Trust

South Indian BankExperience Next Generation Banking

Syndicate Bank Your Faithful And Friendly Financial Partner

The Economic TimesKnowledge is Power

UCO BankHonors Your Trust

Union Bank of IndiaGood people to bank with

United Bank of IndiaThe Bank that begins with U

Vijaya BankA Friend You can Bank Upon

Yes BankExperience our expertise

List of Public sector banks in India and their headquartersS.No.Public Sector BankHeadquarter

1Allahabad BankKolkata

2Andhra BankHyderabad

3Bank of BarodaMumbai

4Bank of IndiaMumbai

5Bank of MaharashtraPune

6Canara BankBangalore

7Central Bank of IndiaMumbai

8Corporation BankMangalore

9Dena BankMumbai

10IDBI BankMumbai

11Indian BankChennai

12Indian Overseas BankChennai

13Oriental Bank of CommerceNew Delhi

14Punjab National BankNew Delhi

15Punjab and Sind BankNew Delhi

16State Bank of IndiaMumbai

16.1State Bank of Bikaner and JaipurJaipur

16.2State Bank of HyderabadHyderabad

16.3State Bank of MysoreBangalore

16.4State Bank of PatialaPatiala

16.5State Bank of TravancoreThiruvananthapuram

17Syndicate BankKarnataka

18UCO BankKolkata

19Union Bank of IndiaMumbai

20United Bank of IndiaCalcutta

21Vijaya BankBangalore

ESTABLISHED YEAR OF NATIONALIZED BANKS IN INDIAName of the Bank Established Year

Allahabad Bank 1865

Andhra Bank20 November, 1923

Bank of Baroda 20 July, 1908

Bank of India 7 September, 1906

Bank of Maharashtra 1935

Canara Bank 1969

Central Bank of India 21 December, 1911

Corporation Bank 1906

Dena Bank 1938

Indian Bank 1938

Indian Overseas Bank 10 February , 1937

Oriental Bank of Commerce 19 February , 1943

Punjab and Sindh Bank 1908

Punjab National Bank 1895

Syndicate Bank 1925

Union Bank of India 1969

United Bank of India 1950

UCO Bank 6 January , 1943

Vijaya Bank 1931

Bharatiya Mahila Bank 19 November 2013

BANKING ACTS1.Negotiable instrument act-18812.The bankers book evidence act-18913.The reserve bank of India act-19344.The industrial finance corporation of India act-19485.The banking companies(Legal practitioner clients Account)act-19496.The industrial s disputes(Banking and insurance companies)act-19497.The banking regulation act-19498.The state financial corporation act-19519.The reserve bank of India(Amendment and Misc.provision act)-195310.The Industrial disputes(Banking companies decision act)-195511.The state bank of India act-195512.The state bank of India subsidiary banks act-195913.The subsidiary banks general regulation-195914.The deposit insurance and credit Guarantee corporation act-196115.The banking companies(Acquisition and Transfer of Undertakings) act-1970List of Nationalized Banks Logos and Founder Name

Bank Name : State Bank of IndiaFounder Name : British Government ( In form of Imperial Bank of India )Established Year : July 1, 1955

Bank Name : State Bank of Bikaner and JaipurFounder Name :Established Year : 1963

Bank Name : State Bank of HyderabadFounder Name : Nawab Amer Usman Ali KhanEstablished Year : August 8 , 1941

Bank Name : State Bank of MysoreFounder Name : Mokshagundam VisvesvarayaEstablished Year : October 2, 1913

Bank Name : State Bank of TravancoreFounder Name : C.P. Ramaswamy Iyer ( Diwan of Travancore )Established Year : September 12, 1945

Bank Name : Allahabad BankFounder Name : By group of British citizensEstablish Year : April 24, 1865

Bank Name : Bank of BarodaFounder Name : Maharaja Sayajirao GaekwadEstablish Year : July 20, 1908

Bank Name : Bank of IndiaFounder Name : Sassoon J DavidEstablished Year : September 7, 1906

Bank Name : Canara BankFounder Name : Ammembal Subba Rao PaiEstablished Year : July 1, 1906

Bank Name : Bank of MaharashtraFounder Name : V. G. Kale and D. K. SatheEstablished Year : September 16, 1935

Bank Name : Andhra BankFounder Name : Dr.Bhogaraju Pattabhi SitaramayyaEstablished Year : November 20, 1923

Bank Name : Central Bank of IndiaFounder Name : Sir Sohrabji PokhchanawallaEstablished Year : December 21, 1911

Bank Name : Corporation BankFounder Name : Khan Bahadur Haji Abdullah Haji Kasim Saheb BahadurEstablished Year : March 12, 1906

Bank Name : Indian BankFounder Name : Annamalai Chettiar and Ramaswami ChettiarEstablished Year : March 5, 1907

Bank Name : Indian Overseas BankFounder Name : M.Chidambaram ChettyarEstablished Year : February 10, 1937

Bank Name : Punjab National BankFounder Name : Lala Lajpat RaiEstablished Year : 1985

Bank Name : Dena BankFounder Name : Devkaran NanjeeEstablished Year : May 26, 1938

Bank Name : Oriental Bank of CommerceFounder Name : Rai Bahadur Lala Sohan LalEstablished Year : February 19, 1943

Bank Name : Punjab and Sind BankFounder Name : Bhai Vir Singh, Sir Sunder Singh Majitha and Sardar Tarlochan SinghEstablished Year : June 24, 1908

Bank Name : Syndicate BankFounder Name : Upendra Ananth Pai , Vaman Kudva and Dr.T M A PaiEstablished Year : 1925

Bank Name : United Bank of IndiaFounder Name : Narendra Chandra DuttaEstablished Year : 1914

Bank Name : Union Bank of IndiaFounder Name :Established Year : November 11, 1919

Bank Name : UCO BankFounder Name : Ghanshyam Das BirlaEstablished Year : January 6, 1943

Bank Name : Vijaya BankFounder Name : Attavar Balakrishna ShettyEstablished Year : October 23, 1931

Bank Name : Bharatiya Mahila BankFounder Name : Indian GovernmentEstablished Year : November 19, 2013