Luxury - Starhill Global REITstarhillglobalreit.listedcompany.com/misc/ar/ar2013/ar2013.pdf ·...

-

Upload

truongkhanh -

Category

Documents

-

view

217 -

download

0

Transcript of Luxury - Starhill Global REITstarhillglobalreit.listedcompany.com/misc/ar/ar2013/ar2013.pdf ·...

Luxuryis in each

detailHUBERT DE GIVENCHY

STARHILL GLOBAL REITannual report

2013

DPU up 13.9%HIGHEsT aCHIEVED DPU sINCE lIsTING

Refining the portfolioYIElD-aCCRETIVE aCqUIsITIoN IN aUsTRalIa

aND DIVEsTmENT IN JaPaN

Corporate rating “BBB+”s&P UPGRaDED RaTING IN JUlY 2013

VisionTo be the most valued real estate investment trust in Singapore which is committed to delivering long-term superior returns to our Unitholders.

MissionTo create and deliver superior returns to our investors through growth and value creation in our assets, products and services, unconstrained by boundary and reach.

To be the landlord of choice for our tenants and shoppers and be committed in our delivery of quality products and services.

To be a forward-thinking real estate company with strong management expertise and provide fulfilment for our people.

ValuesThe values to which we aspire can be summarised under six principles:

• Integrity• Client commitment• Strive for profitability• Fulfilment for our people• Teamwork• Highest standards

COVERPhotography by skyy Wooart Direction by Raindance

Luxuryis in each

detailHUBERT DE GIVENCHY

IT’S ALL IN THE DETAILS

From our selection of prime properties for our portfolio, to the positioning of our malls with the

right tenant mix, and well-thought strategies against a backdrop of prudent capital

management – our attention to details is what makes Starhill Global REIT a luxe REIT.

3STARHILL GLOBAL REIT

annual report 2013

Financial Highlights

Financial Highlights 3Financial Summary 4Key Figures for 5 Years 5Our Geographical Reach 16Letter to Unitholders 18Trust Structure 21Significant Events in 2013 22Board of Directors 24Executive Officers 26 of REIT Manager

Executive Officers 28 of Property Manager

Property Highlights 30

Sustainability Environment 62 People 63 Community 64 Corporate Governance 65

Financial Statements 74Statistics of Unitholders 121Additional Information 123Disclosure Note 124Glossary 125Corporate Directory 127Notice of Annual General 128 Meeting and Proxy Form

Property Portfolio Summary 32Singapore Properties 36Malaysia Properties 43Australia Properties 47China Property 50Japan Properties 52Market Overview 54Financial Review 56Capital Management 58Risk Management 60Investor Relations 61 and Communications

OverviewStarhill Global REIT is a Singapore-based real estate investment trust investing primarily in realestate used for retail and office purposes, both in Singapore and overseas. Since its listing onthe Mainboard of the Singapore Exchange Securities Trading Limited on 20 September 2005,Starhill Global REIT has grown its initial portfolio from interests in two landmark properties onOrchard Road in Singapore to 13 properties in Singapore, Malaysia, Australia, China and Japan,valued at about S$2,854.4 million as at 31 December 2013.

These comprise interests in Wisma Atria and Ngee Ann City on Orchard Road in Singapore;Starhill Gallery and Lot 10 Property in Kuala Lumpur, Malaysia; the David Jones Building andPlaza Arcade in Perth, Australia; a retail property in Chengdu, China and six properties in the prime areas of Tokyo, Japan. Starhill Global REIT remains focused on sourcing attractiveproperty assets in Singapore and overseas, while driving organic growth from its existingportfolio through proactive leasing efforts and creative asset enhancements.

Starhill Global REIT is managed by an external manager, YTL Starhill Global REIT ManagementLimited. The Manager is a wholly owned subsidiary of YTL Starhill Global REIT ManagementHoldings Pte. Ltd. which is in turn an indirect subsidiary of YTL Corporation Berhad.

Contents

Note: Discrepancies in the tables and charts between the listed figures and totals thereof are due to rounding.

up 7.9%

s$200.6m

Revenue

99.4%

Strong Occupancy

s$157.9m

Net Property Income

up 6.3%

up 6.8%

s$2,010.1m

Net Asset Value

up 15.2%

s$110.9m

Income Available for Distribution

29.0%

Healthy Gearing

Financial Summary

Key Figures for 5 Years

FY 2013 FY 2012 Change (%)

Gross Revenue (million) S$200.6 S$186.0 7.9%

Net Property Income (million) S$157.9 S$148.4 6.3%

Income Available for Distribution (million) S$110.9 S$96.2 15.2%

Income to be Distributed to:

– Unitholders (million) S$104.8 S$85.3 22.8%

– CPU holder(s) (1) (million) S$3.1 S$9.2 (66.9%)

Distribution Per Unit (2) 5.00 cents (3) 4.39 cents 13.9%

Distribution Yield 6.37% 5.59% NM

(S$0.785) (4) (S$0.785) (4)

Total Return 5.9% 48.0% NM

Net Asset Value Per Unit S$0.93 S$0.97 (4.1%)

Net Asset Value Per Unit, assuming full conversion of CPU S$0.92 (5) S$0.86 (5) 7.0%

Total Assets (million) S$2,943.2 S$2,820.2 4.4%

Investment Properties

– Number of Properties 13 13

– Valuation (million) S$2,854.4 S$2,713.0 5.2%

Gearing 29.0% 30.3% NM

Notes:

(1) On 5 July 2013, 152,727,825 convertible preferred units (CPU) were converted into 210,195,189 ordinary units, based on a conversion price of S$0.7266 per unit. Total number of CPU in issue before and after the CPU conversion on 5 July 2013 is 173,062,575 and 20,334,750 respectively.

(2) The computation of DPU for FY 2013 is based on number of units entitled to distributions comprising 1,943,023,078 units in issue for 1Q 2013 and number of units post-CPU conversion on 5 July 2013 of 2,153,218,267 units for 2Q, 3Q and 4Q 2013 (2012: 1,943,023,078 units).

(3) Including one-time DPU payout of 0.19 cents per unit due to the receipt of accumulated rental arrears from Toshin master lease (net of expenses) in 1Q 2013.

(4) Based on the last traded price for the year.

(5) For illustrative purposes, the net asset value per unit has assumed the full conversion of the 20,334,750 CPU outstanding into 27,986,168 ordinary units as at end of the period (2012: 238,181,358 ordinary units).

s$200.6FY 2013

Revenue

(million)

5.00FY 2013

DPU

(cents)

s$110.9FY 2013

Income Available for Distribution

(million)

CAGR +10.5% CAGR +10.1%

99.4%as at 31 Dec 2013

Occupancy Rate

CAGR +7.1% Resilient Portfolio

FY09

FY10

FY11

FY12

s$75

.5

s$82

.5

s$90

.8

s$96

.2

FY13

s$11

0.9

FY09

FY10

FY11

FY12

FY13

s$13

4.6

s$16

5.7

s$18

0.1

s$18

6.0

s$20

0.6

FY09

FY10

FY11

FY12

3.80 3.90 4.

12 4.39

FY13

5.00

s$157.9FY 2013

Net Property Income

(million)

s$2,943.2as at 31 Dec 2013

Total Assets

(million)

CAGR +10.2%

CAGR +6.2%

FY09

FY10

FY11

FY12

s$10

6.9

s$13

0.5

s$14

3.6

s$14

8.4

FY13

s$15

7.9

Dec09

Dec10

Dec11

Dec12

s$2,

312.

3

s$2,

786.

6

s$2,

839.

1

s$2,

820.

2

Dec13

s$2,

943.

2

Dec09

Dec 10

Dec11

Dec12

95.4

%

98.2

%

98.7

%

99.4

%

Dec13

99.4

%

5STARHILL GLOBAL REIT

annual report 2013

Uni

t Pric

e *

(S$) Volum

e (‘000)

Starhill Global REITUnit Price & Daily Volume(1 Jan 2009 – 31 Dec 2013)

From 1 January to 31 December 2013

Opening Price (2 Jan 2013) S$0.785Closing Price (31 Dec 2013) S$0.785High (29 Apr 2013) S$0.985Low (12 Dec 2013) S$0.755Volume traded (in million units) 633.65

Volume Unit Price

4STARHILL GLOBAL REIT

annual report 2013

1.20

1.00

0.80

0.60

0.40

0.20

0.00

25,000

20,000

15,000

10,000

5,000

0Jan09

Mar09

Sep09

Dec09

Jun09

Sep10

Mar10

Dec10

Jun10

Sep11

Mar11

Dec11

Jun11

Sep12

Mar12

Dec12

Jun12

Sep13

Mar13

Dec13

Jun13

* Starhill Global REIT issued 963,724,106 rights units pursuant to the rights issue completed in August 2009.

Note:

DPU in 1Q and 2Q 2009 have been restated to include the 963,724,106 rights units issued in August 2009.

7STARHILL GLOBAL REIT

annual report 2013

6STARHILL GLOBAL REIT

annual report 2013

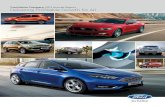

Engineered to deliver outstanding performance like a beautiful, precisely-crafted masterpiece.

PerformancesINGaPoRE & malaYsIa- CENTRIC PERFoRmaNCE

Like fine timepieces, we deliver outstanding performance by putting the best components together, and with precision.

During the year, our core assets in Singapore and Malaysia have powered our organic growth.

In Singapore, we are buoyed by robust occupancies, asset repositioning of Wisma Atria,

positive rental reversions and upward rent reviews for

master tenant Toshin.

In Malaysia, higher rents from our master tenant lifted us. Today,

our Singapore and Malaysia properties account for 86%

of our total asset value.

9STARHILL GLOBAL REIT

annual report 2013

8STARHILL GLOBAL REIT

annual report 2013

Clearly, the vision to spot trends and opportunities ahead of time sets us apart.

VisionPRoaCTIVE

With eyes trained on the future, we act ahead of the curve, whether it is in anticipating market trends or introducing new-to-market brands.

Vision and imagination inspired the bold repositioning of

Wisma Atria as the home of flagship stores for international retailers.

Meanwhile our foresight in introducing new luxury labels and the upgrading of our existing key premium tenants’ boutiques has

further entrenched Starhill Gallery as a luxury shopping haven.

We have successfully secured refinancing commitment ahead of maturity, staggered our debt

maturity profile and reduced encumbered assets. We have

also received a rating upgrade from Standard & Poor’s.

Sunglasses courtesy of TAG Heuer Singapore

11STARHILL GLOBAL REIT

annual report 2013

10STARHILL GLOBAL REIT

annual report 2013

maintaining the perfect balance in our portfolio keeps us always a step ahead.

BalancesTRaTEGIC REFINING

oF PoRTFolIo

Balance is a key stepping stone to our success.

This is evident through strategic divestment of Roppongi Primo in Tokyo, Japan at an attractive

price and the yield-accretive acquisition of Plaza Arcade in Perth,

Australia – located next to our David Jones Building.

13STARHILL GLOBAL REIT

annual report 2013

12STARHILL GLOBAL REIT

annual report 2013

We’ve got the future in the bag, with premium locations sought

after by international brands.

QualityPRImE RETaIl ExPosURE IN

kEY asIa PaCIFIC CITIEs

Established luxury labels like Louis Vuitton, Chanel, Christian

Louboutin, Dior, Coach, Tory Burch and TAG Heuer are drawn to our

distinctively valuable assets in key Asia Pacific cities.

Our portfolio consists of top-tier retail spaces in premium

shopping districts in key Asia Pacific cities.

Our Singapore properties boast a 190-metre prime Orchard Road

street frontage that is linked directly to the Orchard MRT Station.

In Malaysia, our properties are located in the premier Bukit Bintang shopping district in Kuala Lumpur,

close to the Bukit Bintang monorail station and an upcoming MRT station.

15STARHILL GLOBAL REIT

annual report 2013

14STARHILL GLOBAL REIT

annual report 2013

It’s clear-cut: We are strong through and through.

StrengthsUsTaINaBIlITY oF

INComE sTREam

Like a diamond, our strengths as a REIT shine bright and clear.

Our proactive management of capital and assets and the quality

of our portfolio have yielded results.

Each year since our listing, we have posted sustainable and stable growth. Our portfolio has also

proven to be as robust as a diamond, with highly resilient occupancy rate

since our listing in 2005.

Master tenancies and long-term leases, coupled with actively managed

short- to medium-term leases, generate a balanced income stream.

Our strength is also reflected in our healthy balance sheet,

which boasts a gearing ratio of 29.0% and interest cover ratio

of 5.4 times for FY 2013.

Our sponsor, YTL Corporation, is one of the largest companies by market capitalisation listed on Bursa Malaysia, with assets of approximately US$17 billion.

Tokyo, Japan

Singapore

Perth, Australia

Chengdu, China Kuala Lumpur, Malaysia

1. Renhe Spring Zongbei Property Retail

Chengdu

1. Starhill Gallery Retail (1)

2. Lot 10 Property Retail (1)

Kuala Lumpur

1. Wisma Atria Property Retail and Office

2. Ngee Ann City Property Retail and Office

Singapore

1. David Jones Building Retail

2. Plaza Arcade Retail (2)

Perth

Our GeographicalReachStarhill Global REIT's portfolio comprises mainly retail assets which include 13 mid- to high-end properties over five countries. Singapore and Malaysia make up approximately 86% of the total asset value as at 31 December 2013.

s$2,854.4mstarhill Global REIT’s

property value

1.62m sq ftretail and office space

13properties

5asia Pacific countries

1. Daikanyama Retail

2. Ebisu Fort Retail (1)

3. Harajyuku Secondo Retail

Tokyo

4. Holon L Retail

5. Nakameguro Retail

6. Roppongi Terzo Retail

(1) Largely retail with a small office component.

(2) Plaza Arcade was acquired in March 2013.

19STARHILL GLOBAL REIT

annual report 2013

18STARHILL GLOBAL REIT

annual report 2013

DEAR UNITHOLDERS

n behalf of the Board of YTL Starhill Global REIT Management Limited, the Manager of Starhill

Global REIT, we are pleased to present the report and audited financial statements of Starhill Global REIT for the financial year ended 31 December 2013 (FY 2013).

Highest DPU Achieved Since ListingFY 2013 was a successful year for Starhill Global REIT with robust distribution per unit (DPU) growth driven by solid net property income (NPI) from its core Singapore assets and an added revenue stream from the acquisition of Plaza Arcade in Australia during the year. DPU grew by 13.9% over FY 2012 to 5.00 cents in FY 2013, representing the highest DPU(1) achieved since listing in 2005. The DPU included a one-time payout of 0.19 cents due to accumulated rental arrears net of expenses from Toshin, our master tenant at Ngee Ann City Property, following the rent review exercise. Based on Starhill Global REIT’s closing price of 78.5 cents on 31 December 2013, the DPU translates to an implied yield of 6.37%.

Gross revenue increased 7.9% to S$200.6 million in FY 2013 mainly due to higher contributions from the Singapore portfolio as well as our Australian acquisition. NPI grew 6.3% to S$157.9 million in FY 2013 while net asset value per unit was 93 cents as at 31 December 2013. Despite weak equity market conditions in Singapore

Letter to Unitholders

FY 2013 was a successful year for Starhill Global REIT, driven mainly by our Singapore portfolio and yield-accretive acquisition of Plaza Arcade in Perth,

Australia. YTL Group converted 152.7 million convertible preferred units (CPU) into 210.2 million new ordinary units in July 2013, reaffirming our sponsor’s

commitment to Starhill Global REIT. The CPU conversion coupled with our strong financial standing led Standard & Poor’s to upgrade

our corporate rating by one notch to “BBB+”.

O

and the sharp correction in the FTSE ST Real Estate Investment Trust Index, Starhill Global REIT kept its unit price steady at 78.5 cents from one year ago.

In July 2013, the YTL Group raised its stake in Starhill Global REIT to 36.27% following the conversion of 152.7 million convertible preferred units into 210.2 million new ordinary units, reaffirming our sponsor’s commitment to Starhill Global REIT. The CPU conversion coupled with Starhill Global REIT’s strong financial standing led Standard and Poor’s to upgrade our corporate rating by one notch to “BBB+” in July 2013. Correspondingly, our medium term note programme and notes were also upgraded to “BBB+”.

Solid Performance by Core PortfolioSingapore was the top performer in our portfolio with 13.1% yoy NPI growth to S$102.6 million in FY 2013. The strong performance was underpinned by the rental uplift from the master tenant at Ngee Ann City Property, positive rental reversions at Wisma Atria Property mall following the asset redevelopment, and healthy demand for office space in Orchard Road.

For Ngee Ann City Property, the Manager successfully concluded two rental increases with Toshin during the year, namely a 10.0% increase in base rent from the outstanding 2011 rent review exercise and a 6.7% increase in base rent for the 2013 rent renewal exercise. The former resulted

left

Tan Sri Dato’ (Dr) Francis Yeoh Sock PingExecutive Chairman

right

Mr Ho SingChief Executive Officer

& Executive Director

in a one-time payment of approximately S$3.8 million which was distributed to Unitholders in FY 2013. The two rental reversions translate into a revenue uplift of approximately S$6.0 million per annum.

We continue to reap the benefits from our asset enhancement at Wisma Atria Property mall. In FY 2013, we achieved robust rental reversion of 8.1% on the back of strong tenant sales growth of 20.0%. The mall had completed an asset redevelopment in 3Q 2012, and, with its new 96-metre prime Orchard Road frontage, attracts international retailers seeking a strategic presence along Southeast Asia’s most prominent shopping belt. In 2013, established brands such as Liu.Jo, Etam, Victoria’s Secret and i.t. opened stores at Wisma Atria Property.

Our office portfolio in Singapore performed well as NPI rose 8.4% yoy driven by higher occupancy and positive rental reversion of 12.3% for leases committed in FY 2013. Our unique location coupled with limited new supply of office space in Orchard Road continues to draw strong interest from retailers, medical institutions and the services industry.

Our Malaysian portfolio, comprising Starhill Gallery and Lot 10 Property, secured a 7.2% rental reversion effective 28 June 2013 in accordance with its master leases. This has a fixed term of 3+3 years with a put and call option by landlord and master tenant respectively to extend tenancies for a further three-year period from June 2016.

Note:

(1) The REIT’s DPUs from 2005 to 2Q 2009 have been restated to take into account 963,724,106 rights units issued in August 2009.

20STARHILL GLOBAL REIT

annual report 2013

Letter to Unitholders

has also enjoyed high occupancy of 99.3%. Demand for retail space in Perth’s central business district (CBD) is expected to rise as new-to-market international brands expand their footprint in Australia.

Refining the PortfolioIn 2013, we took the opportunity to streamline our portfolio and focus on our strengths. We sold Roppongi Primo at an attractive yield of 3.2% and on par with December 2012’s valuation of JPY700.0 million. With this divestment in February 2013, Starhill Global REIT has reduced its Japan exposure to approximately 2.8% of FY 2013 gross revenue.

In March 2013, we acquired Plaza Arcade in Perth, Australia, for A$48.0 million at an attractive yield of 7.8%. With this acquisition, our exposure to Australia now stands at 9.3% of FY 2013 gross revenue.

Located in Perth’s prime city centre shopping belt and adjcacent to our existing asset, David Jones Building, there is potential to enhance yield. We are exploring future asset enhancements, including options to refurbish the Murray Street store units to accommodate anchor tenants. With Starhill Global REIT’s two Australian assets occupying a prominent stretch in Perth's key retail pedestrian stretch of Hay and Murray Streets, we are better positioned to attract the growing number of international retailers seeking a presence in the city.

Prudent Capital ManagementWe remain prudent and proactive in our capital management strategy. In April 2013, we secured commitment with eight banks to refinance approximately S$513 million of mainly secured debts ahead of maturity. The successful completion of the above refinancing in September 2013 through drawing down on the new unsecured JPY7 billion and S$600 million facilities have raised Starhill Global REIT’s unencumbered asset ratio to 79% from 42% and staggered its debt maturity profile. In February 2014, we issued S$100 million seven-year unsecured fixed rate notes at 3.5% coupon per annum, which will be used to pay down our existing borrowings and for working capital purposes. This further extended Starhill Global REIT’s

Trust Structure

Unitholders

Trustee

REIT Manager

The Properties

(2)

Property Manager

(1)

Acts on behalf of Unitholders

Hold Units

Net Property Income

Management Services

Trustee Fees

Distributions

Ownership of Assets

Management Fees

Property Management Fees

21STARHILL GLOBAL REIT

annual report 2013

Property Management Services

Starhill Gallery upholds its status as Malaysia’s premier shopping destination for luxury retailers, fine timepieces and jewellery. In January 2014, key tenant Louis Vuitton tripled its presence in the mall with the opening of its first global boutique in Malaysia standing at approximately 16,000 sq ft in size. Dior is currently renovating to double its store size to approximately 6,200 sq ft. Other internationally-renowned luxury tenants that have set up their boutiques exclusively at Starhill Gallery include Garrard, the world’s oldest jewellery house; upscale gentlemen’s groomer Truefitt & Hill from the United Kingdom; and Damiani, the Italian jewellery boutique.

Improved transport connectivity in the area is anticipated to increase shopper traffic. Bukit Bintang Central Station, a new Mass Rapid Transit (MRT) station located directly opposite Lot 10, is under construction and completion expected by 2017. Serving a corridor with a population of 1.2 million in the Klang Valley, the Sungai Buloh-Kajang Line is expected to transform the Bukit Bintang shopping district into Malaysia’s premier retail centre.

Highly Sought-After Prime Retail Space Overall occupancy of our portfolio remains high at 99.4% with a weighted average lease term (by net lettable area) of 6.4 years as at 31 December 2013.

Our Singapore portfolio continues to benefit from strong demand for prime retail and office space in Orchard Road with near full occupancy at 99.5% achieved as at 31 December 2013. Retailers have benefited from steady consumer spending buoyed by a healthy economy and growth in tourist arrivals. These positive macroeconomic factors maintain Singapore’s attraction to international brands seeking a presence in Asia.

In Malaysia, Starhill Gallery and Lot 10 Property in Kuala Lumpur enjoyed full occupancy as the properties are under a master tenancy with a subsidiary of YTL Corporation Berhad. Our Australia portfolio, comprising David Jones Building and the recently-acquired Plaza Arcade,

average debt maturity to approximately 3.5 years while improving the financial flexibility and diversifying funding sources.

Post the issuance of the seven-year notes in February 2014, the REIT’s borrowings have been fully hedged via fixed rate debt and derivatives including interest rate swaps and caps. Starhill Global REIT has no refinancing requirement until June 2015.

Positive Outlook for Asia Remains As we move into 2014, Asia should benefit from positive knock-on effects from the turnaround in the United States and European economies as well as tourism growth and rising consumption in the Asian region. In its January 2014 report, the International Monetary Fund has projected that Asia’s emerging economies will grow 6.7% in 2014, outpacing the 5.1% expansion of the developing nations around the world and 2.1% for advanced countries.

Against this backdrop of positive macroeconomic factors, we will leverage on our portfolio’s quality and balance sheet strength to refine the portfolio. Our focus is to deliver stable long-term returns to Unitholders by pursuing yield-accretive growth opportunities and creating value by managing our existing assets well.

AcknowledgementsThe Board and Management would like to thank our directors for their invaluable contribution and guidance, our colleagues for their hard work and dedication, and our tenants, business partners and investors for their continued trust and support. We would also like to thank you, our Unitholders, for your support and confidence in Starhill Global REIT.

Tan Sri Dato’ (Dr) Francis Yeoh Sock PingPSM, CBE, FICE, SIMP, DPMS, DPMP, JMN, JP

Executive Chairman

Ho SingChief Executive Officer and Executive Director

28 February 2014

Notes:

(1) The Property Manager manages the Singapore Properties. The overseas properties are managed by third party property managers.

(2) The Singapore Properties are held by the Trustee. Starhill Global REIT’s interest in the Portfolio (other than Singapore Properties) is held through its subsidiaries or special purpose vehicles.

23STARHILL GLOBAL REIT

annual report 2013

22STARHILL GLOBAL REIT

annual report 2013

January Entered into an unsecured multicurrency revolving credit facility agreement of up to S$55 million maturing in July 2014.

February Roppongi Primo in Tokyo, Japan was divested on 1 February 2013 for JPY700.0 million at valuation.

Secured 10.0% increase in base rent for the master lease with Toshin in Ngee Ann City Property (Retail), effective for the term commencing 8 June 2011. The accumulated rental arrears net of expenses amounting to approximately S$3.8 million was distributed to Unitholders, together with the distributable income for 1Q 2013.

MarchCompleted the acquisition of Plaza Arcade in Perth, Australia on 1 March 2013 for A$48.0 million. The asset contributed positively to the Group’s revenue and NPI for FY 2013.

Starhill Gallery held its annual Starhill Gallery Fashion Week, which featured previews of collections by McQ by Alexander McQueen, Debenhams, Valentino, Kenzo, M Missoni, Red Valentino and more throughout the four-day event.

AprilEntered into an unsecured facility agreement with a club of eight banks comprising three-year term loan facilities of JPY7 billion and S$100 million, and five-year term loan and revolving credit facilities of S$500 million, mainly to refinance its maturing debts in FY 2013.

Starhill Global REIT MTN Pte Ltd’s S$2 billion multicurrency MTN programme rating (including outstanding notes issued under the programme) was upgraded to “BBB” from ”BBB-“ by Standard & Poor’s.

MayEtam, the French lingerie brand, opened its first Southeast Asia store in Wisma Atria, while Lacoste unveiled its new and largest concept store in Singapore.

Starhill Gallery welcomed new tenant Truefitt & Hill, the British upmarket men’s grooming brand, while existing tenants Richard Mille and Sergio Rossi reopened after completion of their store expansions.

JuneSecured 6.7% base rent increase with Toshin in Ngee Ann City Property (Retail), upon the renewal of its master lease for a period of 12 years.

Our Malaysian portfolio secured a 7.2% rental reversion effective 28 June 2013 as part of its master leases. The leases have a fixed term of 3+3 years with a put and call option by landlord and master tenant respectively to extend tenancies for a further three-year period from June 2016.

Hong Kong multi-brand label boutique, i.t., hosting cutting-edge fashion labels, opened its Singapore flagship store at Wisma Atria.

JulyYTL Group converted 152,727,825 convertible preferred units issued on 28 June 2010 into 210,195,189 Units, raising its stake in Starhill Global REIT to 36.27%.

Standard & Poor’s upgraded Starhill Global REIT’s corporate rating to ”BBB+“ from ”BBB”, with a stable outlook. Correspondingly,

the S$2 billion multicurrency MTN programme rating and notes were upgraded to ”BBB+“.

Ngee Ann City was voted the most popular shopping place during Great Singapore Sale 2013 in a poll by travel website, TripAdvisor.

Coach celebrated the first anniversary of its Singapore flagship store at Wisma Atria with exciting in-store promotions and activities including an exclusive Coach milkshake cart outside which gave out milkshakes to shoppers.

Italian fashion brand Liu.Jo opened its first Singapore store in Wisma Atria.

SeptemberCompleted the refinancing of its secured debts upon maturity by drawing down on the unsecured loan facilities obtained in April 2013. Following the refinancing, the existing securities on Ngee Ann City Property were discharged.

F1 driver Romain Grosjean graced a private event held at TAG Heuer's world's largest flagship boutique in Wisma Atria, during Singapore Grand Prix racing season.

At Starhill Gallery, existing tenants Rolex unveiled its new street-fronting facade, and Mouawad refurbished and reopened its boutique. New tenant, Italian watch and jeweller, Damiani opened its boutique.

Starhill Gallery hosted the press conference organised by the British High Commission Kuala Lumpur and UK Trade and Investment for the Great British Retail Fashion Campaign – a promotion of British fashion brands in Malaysia.

October Wisma Atria welcomed the founder of the Tory Burch line of clothing, the fashion designer Tory Burch herself, to an exclusive private event at the flagship store to celebrate the brand’s growing presence in the region.

NovemberStarhill Gallery hosted Asia’s grandest luxury watch and jewellery showcase, “A Journey Through Time VII”, for the seventh consecutive year. Over 120 leading brands participated in the event, including Rolex, Franck Muller, Richard Mille, Chopard, Van Cleef & Arpels, Jaeger-LeCoultre, Omega and Hublot. The event included demonstrations by skilled and world-renowned Swiss watchmakers and an auction of over 200 of the world’s rarest timepieces.

Victoria’s Secret held its first holiday pop-up store and showcased its new holiday fragrances and gift sets at Wisma Atria.

DecemberSony’s latest gaming console, the PlayStation 4 (PS4), was officially launched in Singapore at Wisma Atria.

Häagen-Dazs showcased its limited-edition Champagne truffle ice cream macaroons at the Christmas House of Häagen-Dazs pop-up store at Wisma Atria.

Attracted shopper traffic of 26 million to the Wisma Atria Property in 2013.

Starhill Global REIT’s property portfolio was valued at S$2,854.4 million as at 31 December 2013.

Significant Events in 2013

6

1. Starhill Gallery Fashion Week was marked with a four-day event.

2. Coach's first anniversary celebration of its Singapore flagship store at Wisma Atria.

3. Häagen-Dazs Christmas pop-up store at Wisma Atria.

4. The Great British Retail Fashion Campaign at Starhill Gallery.

5. Fashion designer Tory Burch (second from right) visited the Tory Burch flagship store at Wisma Atria.

6. A Journey Through Time VII held at Starhill Gallery.

1 2

3 4 5

25STARHILL GLOBAL REIT

annual report 2013

24STARHILL GLOBAL REIT

annual report 2013

TD

DM

r Hong Hai joined the Board on 18 July 2005 and is a member of the Audit Committee. He is

Adjunct Professor at Nanyang Business School, and Senior Fellow, Institute of Advanced Studies at Nanyang Technological University (NTU) in Singapore. He is a director of Poh Tiong Choon Logistics Ltd and China Merchant Holdings (Pacific) Ltd. He was previously Dean and Professor at the College of Business, NTU (2003 – 2007), and President and Chief Executive Officer of Haw Par Corporation Limited (1990 – 2003), and has taught at the Kellogg School of Management in Chicago and the National University of Singapore. His past principal directorships in the preceding three years include Luye Pharma Ltd.

He holds a first class honours degree in Electrical Engineering from the

ato’ Yeoh Seok Kian joined the Board on 31 December 2008. He has been an Executive Director

of YTL Corp since 1984. He is currently the Deputy Managing Director of YTL Corp and YTL Power International Berhad, and the Executive Director of YTL Land & Development Berhad, all listed on the Main Market of Bursa Malaysia Securities Berhad.

Dato’ Yeoh Seok Kian also serves on the board of several other public companies such as YTL Cement Berhad, YTL Industries Berhad and The Kuala Lumpur Performing Arts Centre, and private utilities company, Wessex Water Limited in England and Wales and YTL PowerSeraya Pte Limited in Singapore. He is also an Executive Director of Pintar Projek Sdn Bhd, the manager of YTL Hospitality REIT (formerly known as Starhill Real Estate Investment Trust).

Dato’ Yeoh Seok Kian holds a Bachelor of Science (Honours) degree in Building from Heriot-Watt University, Edinburgh, United Kingdom and is a Fellow of the Faculty of Building, United Kingdom, as well as a Member of the Chartered Institute of Building (United Kingdom).

r Hwang joined the Board on 1 January 2006 and is a member of the Audit Committee. He was

formerly a Judicial Commissioner of the Supreme Court of Singapore and one of the first 12 Senior Counsel appointed in Singapore. Mr Hwang now practices as an independent barrister and international arbitrator and also serves as the Chief Justice of the Dubai International Financial Centre Courts. Currently, Mr Hwang also sits on the board of various companies, including Singapore Dance Theatre Ltd, Linyi Investments Pte Ltd and Religare Health Trust Trustee Manager Pte Ltd, the trustee-manager of Religare Health Trust.

Mr Hwang was a partner and Head of the Litigation and Arbitration Department of Allen & Gledhill LLP from 1993 to 2002. His past appointments include being Singapore’s Non-Resident Ambassador to Switzerland, a Commissioner of UN Compensation Commission, President of the Law Society of Singapore, Vice President of the ICC International Court of Arbitration, Member of the Permanent Court of Arbitration at the Hague and a teaching fellow at the University of Sydney. Mr Hwang advised the Real Estate Developers’ Association of Singapore for many years, including preparations for the establishment of REITs in Singapore. He has served on the boards of several publicly listed companies including The Straits Trading Company Ltd, Del Monte Pacific Limited, The Hour Glass Limited as well as PSA Corporation Ltd (and its predecessor the Port of Singapore Authority).

Mr Hwang holds undergraduate and post-graduate law degrees from the University of Oxford.

an Sri Dato’ (Dr) Francis Yeoh joined the Board on 31 December 2008. Tan Sri Francis studied at Kingston

University, UK, where he obtained a Bachelor of Science (Hons) in Civil Engineering and was conferred an Honorary Doctorate of Engineering in 2004. He was appointed as an Executive Director of YTL Corp in 1984 and has been the Managing Director of YTL Group since 1988. Under his stewardship, YTL Corp has grown from a single listed entity into a force comprising five listed entities, i.e. YTL Corp, YTL Power International Berhad, YTL Land & Development Berhad, YTL e-Solutions Berhad and YTL Hospitality REIT (formerly known as Starhill Real Estate Investment Trust).

He is presently the Managing Director of YTL Corp, YTL Power International Berhad

and YTL Land & Development Berhad, all listed on the Main Market of Bursa Malaysia Securities Berhad. Tan Sri Francis is also the Executive Chairman and Managing Director of YTL e-Solutions Berhad which is listed on the ACE Market of Bursa Malaysia Securities Berhad. Besides the listed entities in YTL Group, Tan Sri Francis also sits on the board of several public companies such as YTL Cement Berhad and YTL Industries Berhad, and private utilities companies including Wessex Water Limited and Wessex Water Services Limited in England and Wales, and YTL PowerSeraya Pte Limited in Singapore. He also sits on the board of trustee(s) of YTL Foundation. Tan Sri Francis is also an Independent Non-Executive Director of The Hongkong and Shanghai Banking Corporation Limited, and is a director and Chief Executive Officer of Pintar Projek Sdn Bhd, the manager of YTL Hospitality REIT (formerly known as Starhill Real Estate Investment Trust).

He is a Founder Member of the Malaysian Business Council and The Capital Markets Advisory Council. He is also a member of

Mr Ho holds a Bachelor of Science degree in Aerospace Engineering from the University of Texas, Austin, USA. He completed the Stanford Executive Program at Stanford University in 2002.

University of Canterbury, Masters degrees from Harvard and Cambridge Universities, and PHDs from Carnegie-Mellon University and the London School of Economics. He is an Honorary Council Member of the Singapore Chinese Chamber of Commerce & Industry.

Tan Sri Dato’ (Dr) Francis Yeoh Sock Ping

Executive Chairman

1

Mr Ho joined the Board on 20 April 2010. He is the Chief Executive Officer of the Manager. He assists

the Executive Chairman and the Board in formulating strategies for Starhill Global REIT and is responsible for the day-to-day operations of Starhill Global REIT. He has over 15 years of leadership and management experience with multi-national companies in engineering, medical, infrastructure, and real estate. These included senior positions in the Singapore Technologies Group, Dornier Medical, Sembcorp Industries and Guocoland Limited. He is currently an Independent Non-Executive Director of Daiman Development Berhad, a company listed on the Main Market of Bursa Malaysia Securities Berhad.

Mr Ho SingExecutive Director

2

Dato’ Yeoh Seok KianNon-Executive Director

3

Mr Tay joined the Board on 1 October 2007 and is the Chairman of the Audit Committee.

He is the Chairman of Stirling Coleman Capital Limited and a Board Member of the Singapore International Chamber of Commerce (of which he was a past Chairman). In addition, Mr Tay also serves on the boards of several other companies listed on the SGX-ST, viz, FJ Benjamin Holdings Ltd, SATS Limited, Singapore

Mr Keith Tay Ah KeeLead Independent Director

4

Mr Michael HwangIndependent Director

6

Dr Hong HaiIndependent Director

5

Board of Directors

The Nature Conservancy Asia Pacific Council, the Asia Business Council, Trustee of the Asia Society and Chairman for South East Asia of the International Friends of the Louvre. He is also a member of the Advisory Council of London Business School, Wharton School and INSEAD. He served as a member of Barclays Asia-Pacific Advisory Committee from 2005 to 2012.

In 2006, he was awarded the Commander of the Most Excellent Order of the British Empire (CBE) by Her Majesty Queen Elizabeth II, and received a prestigious professional accolade when made a fellow of the Institute of Civil Engineers in London in 2008. He was named one of Asia’s Top Executives in 2008 by Asiamoney.

He is the Primus Inter Pares Honouree of the 2010 Oslo Business for Peace Award, for his advocacy of socially responsible business ethics and practices. The Award was conferred by a panel of Nobel Laureates in Oslo, home of the Nobel Peace Prize. He also received the Corporate Social Responsibility Award at CNBC’s 9th Asia Business Leaders Awards 2010.

Tan Sri Francis is responsible for charting the strategic direction and growth of Starhill Global REIT in consultation with the Board and monitoring the translation of Board decisions into executive actions and the overall management of Starhill Global REIT’s business and operations.

Post Limited, Rotary Engineering Limited and Singapore Reinsurance Corporation Ltd., and AMVIG Holdings Limited, a company listed on the Stock Exchange of Hong Kong Limited. He was the Chairman and Managing Partner of KPMG Peat Marwick Singapore from 1984 to 1993 and President of the Institute of Certified Public Accountants of Singapore from 1982 to 1992.

Mr Tay qualified as a Chartered Accountant in London, UK. He was conferred the BBM – Public Service Star in 1990 by the President of the Republic of Singapore. In 1988, he was conferred the First International Award by the Institute of Chartered Accountants in England & Wales for outstanding contributions to the profession. The Institute of Certified Public Accountants of Singapore conferred upon Mr Tay the Gold Medal for distinguished service to the profession and made him an Honorary Fellow in 1993.

His past principal directorships and appointments in the preceding three years include Singapore Institute of Directors, Singapore Power Limited, Pokka Corporate (Singapore) Limited, Aviva Limited and Allgreen Properties Ltd.

1

5

3 4

2

6

27STARHILL GLOBAL REIT

annual report 2013

26STARHILL GLOBAL REIT

annual report 2013

Executive Officers of REIT Manager

Mr Ho assists the Executive Chairman and the Board in formulating strategies for Starhill Global REIT.

He works closely with other members of the Manager and the Property Manager to ensure these strategies are implemented. He is also responsible for the day-to-day operations of Starhill Global REIT.

Mr Ho holds a Bachelor of Science degree in Aerospace Engineering from the University of Texas, Austin, USA. He completed the Stanford Executive Program at Stanford University in 2002.

Mr Ho SingChief Executive Officer

1

M

Ms Alice CheongChief Financial Officer

2

Mr Yeo is responsible for assisting the Chief Financial Officer in the finance and accounting

matters of Starhill Global REIT including financial reporting, taxation, treasury, corporate finance and capital management. He has more than 10 years of experience in audit, accounting, statutory reporting, compliance and tax in Singapore and China. From 2000 to 2006, Mr Yeo was an auditor with Deloitte & Touche. Prior to joining the Manager, he was the financial controller of Sunshine Holding Limited, a China-based real estate developer listed on the Mainboard of the SGX-ST.

Mr Yeo holds a Bachelor of Accountancy degree from Nanyang Technological University in Singapore. He is also a non-practising member of the Institute of Singapore Chartered Accountants.

Mr Stephen YeoSenior Vice President, Finance & Accounting

3

Ms Ong is responsible for the management of the REIT’s portfolio and properties.

She has more than 10 years of asset management, leasing and business development experience at property funds and developers in the Asia Pacific region. Her property experience covers the retail, office and industrial segments in Singapore, Malaysia, China, Japan and Australia. Prior to this, she was General Manager at YTL Starhill Global Property Management Pte. Ltd. where she led the leasing, property operations, marketing, finance and human resource functions. She was also previously Vice President, Asset Management with YTL Starhill

Ms Ong Mei-LynnSenior Vice President, Head of Asset Management

4

Ms Koh has more than 10 years of experience in corporate finance, advisory

and mergers and acquisitions (M&A) including nine years in real estate. Ms Koh is responsible for the sourcing, structuring and execution of acquisitions and disposals for Starhill Global REIT. She was involved in Starhill Global REIT’s IPO and its acquisitions in Japan, Australia and Malaysia, and Japan disposal. Prior to joining the Manager, she was with MEAG Pacific Star Asia Pte Ltd’s investments team, and spent four years with HSBC investment bank in the execution of regional M&A and advisory transactions.

Ms Koh holds a Bachelor of Commerce from the University of Western Australia.

Ms Clare KohSenior Vice President, Head of Investments

5

Mr Lam is responsible for legal, compliance and company secretarial matters of the Manager

and Starhill Global REIT. His legal career spans private practice in the litigation field before moving on to in-house legal counsel roles within SGX-ST listed companies and a REIT. His broad experience includes corporate commercial matters in various industries including real estate, cross-border acquisitions and divestments as well as financing and joint ventures.

Mr Lam holds a Bachelor of Law (Honours) degree from the National University of Singapore.

Mr Lam Chee KinSenior Vice President, Legal &

Compliance and Company Secretary

6

Mr Kuah is responsible for strategic communication with Unitholders, potential investors, analysts and

media. He has about 20 years of experience in the financial industry, including six years in the real estate industry. Prior to joining the Manager, he spent five years with CapitaLand Limited as VP of Investor Relations. Mr Kuah has also held corporate banking positions at HSBC and Crédit Agricole Corporate & Investment Bank as well as investment analyst positions at various brokerages. Mr Kuah is currently a Management Committee member at Chinese Swimming Club and Chairman of its F&B Committee. He also sits on the Board for Investor Relations Professionals Association (Singapore).

Mr Kuah holds a Bachelor of Science in Business Administration (Finance) from California State University, Long Beach, USA.

Mr Jonathan KuahSenior Vice President, Investor Relations

& Corporate Communications

7

Global REIT Management Limited. Ms Ong’s former experience included asset management of logistics assets under Mapletree Logistics Trust, as well as leasing head managing commercial assets under the United Engineers group.

She holds a Bachelor of Arts from the National University of Singapore and a Master of Business Administration from Imperial College, London.

1

3

5 7

2

4

6

s Cheong oversees the Finance and Accounting, as well

as the Investor Relations and Corporate Communications functions. Ms Cheong has more than 19 years of financial advisory, mergers and acquisitions and corporate finance experience, including 10 years in the real estate sector. Prior to joining YTL Starhill Global REIT Management Limited, she was a vice president in MEAG Pacific

Star Asia Pte Ltd involved in real estate acquisitions in Asia. Ms Cheong had nine years of investment banking experience with HSBC, NM Rothschild & Sons and Hong Leong Bank in Singapore.

Ms Cheong graduated from Warwick University in the UK with a Bachelor of Science degree in Management Science. She is also a Chartered Financial Analyst (CFA Institute).

29STARHILL GLOBAL REIT

annual report 2013

28STARHILL GLOBAL REIT

annual report 2013

s Parameshvari, with more than 20 years’ experience in the audit and finance industry,

is responsible for finance, accounting and tax functions. Prior to joining the Property Manager, she was with Wisma Development Pte Ltd (WDPL) from 1986 to 2002 where she was responsible for its finance, accounting and tax functions and served as the chairman, treasurer, secretary and a council member (representing WDPL) of the Wisma Atria Management Corporation. She also worked in the audit department of Ernst and Young from 1979 to 1986.

s De Souza is responsible for all leasing operations and tenant relationships

for the Wisma Atria Property and Ngee Ann City Property. She has over 20 years of experience in leasing in the property management industry. She was previously the Assistant Manager at Raffles City for 18 years from 1987 to 2002 and from 2003 to 2006.

Ms De Souza holds a Diploma in Sales & Marketing from the Marketing Institute of Singapore.

r Tan is responsible for the overall property management of the Wisma Atria Property

and Ngee Ann City Property, including Leasing, Marketing, Property Operations, Finance and Human Resources. Mr Tan has more than 13 years of management experience in the luxury sector covering retail management, marketing and distribution of international brands in Southeast Asia and Greater China. Prior to this, he was the General Manager

Executive Officers of Property Manager

M– Marketing, for Li & Fung Trinity Management Limited, a subsidiary of the Li & Fung Group, where he was responsible for the marketing of international brands acquired by the Group. Mr Tan’s brand management experience includes international brands such as Tiffany & Co., Burberry and Ermenegildo Zegna.

Mr Tan holds a Bachelor of Hospitality Management from Griffith University in Australia.

Mr Tan Boon PiinGeneral Manager

1

Ms Lee is responsible for the full gamut of human resource management

and office administration functions, including staffing, compensation and benefits, employee engagement and providing both strategic and tactical execution of all HR related programmes. She has over 20 years of HR and administration experience in real estate and construction related industries.

Ms Sandra Lee Senior Vice President,

Human Resource & Administration

2

Ms Chan is responsible for conceptualising and implementing marketing

programmes to attract shoppers and increase tenants’ sales turnover at the Wisma Atria Property and Level 5 of the Ngee Ann City Property. Ms Chan has more than 10 years of marketing experience. From 2001 to 2002, she was with Wisma Development Pte Ltd where she was responsible for the advertising and promotional activities for the Wisma Atria Property. Prior to that, Ms Chan worked with Seiyu Department Store where she was in charge of implementing marketing programmes for their chain outlets.

Ms Chan holds a Bachelor of Arts from the National University of Singapore.

Ms Chan Shuk LingVice President, Marketing

4

Ms Kulanthalvelu ParameshvariVice President, Finance

5

Mr Tan is responsible for the building operations of the Wisma Atria Property and

the Ngee Ann City Property. Mr Tan has more than 10 years of experience in the property management industry. He was a project manager at Orchard Square Development Corporation (OSDC), a joint developer of Ngee Ann City, from 1997 to 2003, before joining the Property Manager. Prior to OSDC, he was the project manager managing construction activities, addition & alteration works and maintenance programmes at Metrobilt Construction, Kmart- Singapore and Omni Marco Polo Hotel Singapore.

Mr Tan holds a Bachelor of Science in Facilities Management from Heriot-Watt University, Edinburgh, United Kingdom.

Mr Tan How SongVice President, Property Operations

6

Ms Shereen Bernadette De SouzaHead, Leasing

3

Prior to this, she was HR and Administration Manager for Al Khaleej Investments (S) Pte Ltd (former owners of Wisma Atria and Forum The Shopping Mall) from 1987 to 2002 where she was involved in organisation change management and integration activities.

Ms Lee holds a BBBA (major in Human Resource Management) from the Royal Melbourne Institute of Technology, Australia and a Diploma in Management Studies from the Singapore Institute of Management.

Ms Parameshvari is a Bachelor of Science graduate from the University of Madras. She is also a member of the Association of Chartered Certified Accountants and the Institute of Singapore Chartered Accountants.

5

1

3

6

2

4

M

M

Name Address Description NLA Title Number Purchase Market Committed Major Tenants and Brands Revenue NPI (sq ft) of Tenants Price Valuation Occupancy (S$ million) (S$ million) (as at 31 Dec 2013) (as at 31 Dec 2013) (S$ million) (as at 31 Dec 2013) (as at 31 Dec 2013) (as at 31 Dec 2012) FY 2013 FY 2012 FY 2013 FY 2012

Wisma Atria Property 435 Orchard Road, 257 strata lots in Wisma Atria Retail: 127,241 Leasehold estate of 125 663.0 961.5 Retail: 99.6% Retail: 99.5% Coach, Tory Burch, TAG Heuer, 65.8 61.8 49.3 46.4 Singapore 238877 representing 74.23% of the total Office: 98,889 99 years, expiring on Office: 100.0% Office: 98.7% Cortina Watch Pte. Ltd., Cotton On, share value of the strata lots 31 March 2061 FJ Benjamin Lifestyle Pte. Ltd., in Wisma Atria Wing Tai Retail Management Pte. Ltd., BreadTalk Group

Ngee Ann City Property 391/391B Orchard Road, Four strata lots in Ngee Ann City Retail: 255,021 (1) Leasehold estate of 54 640.0 1,074.0 Retail: 100.0% Retail: 100.0% Toshin Development Singapore 66.3 54.9 53.4 44.4 Singapore 238874 representing 27.23% of the total Office: 139,165 69 years, expiring on Office: 98.3% Office: 98.0% Pte. Ltd. (master tenant), share value of the strata lots in 31 March 2072 DBS Treasures Centre, Ngee Ann City Statoil Asia Pacific Pte Ltd

Starhill Gallery (2) 181 Jalan Bukit Bintang, Shopping centre comprising part 306,113* Freehold 1 271.3 (2) 262.3 (3) 100.0% 100.0% Katagreen Development Sdn Bhd 18.7 19.2 18.3 18.7 55100 Kuala Lumpur, of a seven-storey building with five (master tenant) Malaysia basements and a 12-storey annex building with three basements

Lot 10 Property (2) 50 Jalan Sultan Ismail, 137 strata parcels and two 256,811* Leasehold estate of 1 173.0 (2) 165.6 (3) 100.0% 100.0% Katagreen Development Sdn Bhd 11.5 11.7 11.1 11.3 50250 Kuala Lumpur, accessory parcels within 99 years, expiring on (master tenant) Malaysia Lot 10 shopping centre 29 July 2076

David Jones Building (4) 622-648 Hay Street Mall, Four-storey heritage-listed 259,082 (GLA) Freehold 8 145.7 (4) 150.6 (5) 100.0% 100.0% David Jones Limited, Jeanswest, 13.8 14.7 11.2 12.1 Perth, Australia building for retail use Pandora, Betts, Bodyshop

Plaza Arcade (6) 650 Hay Street Mall & Three-storey heritage-listed 24,212 (GLA) Freehold 34 61.0 (6) 57.5 (5) 91.7% NA Billabong, Just Jeans, Lush, 4.9 NA 3.5 NA 185-191 Murray Street Mall, building for retail use Virgin Mobile Perth, Australia

Renhe Spring No. 19, Renminnan Road, A four-storey plus mezzanine 100,854 (GFA) Leasehold estate of 91 70.6 (7) 81.7 (8) 100.0% 100.0% Ermenegildo Zegna, 13.9 16.0 8.3 9.9 Zongbei Property (7) Chengdu, China level retail department store 40 years, expiring on Alfred Dunhill, Bally, Hugo Boss, forming part of a mixed use 27 December 2035 Armani Collezioni commercial development

Daikanyama (9) 1-31-12 Ebisu Nishi, Three-storey building for retail 8,087 Freehold 4 22.8 (9) 14.2 (10) 74.1% 74.1% Good Design Company, 0.6 0.9 0.3 0.7 Shibuya-ku, Tokyo, Japan and F&B use Zwiesel, Humans Brain, World Service Innovator

Ebisu Fort (9) 1-24-2 Ebisu Minami, Seven-storey building for office 18,816* Freehold 6 71.3 (9) 37.3 (10) 100.0% 100.0% Lime Members, Defence Associates, 1.8 2.3 1.4 1.7 Shibuya-ku, Tokyo, Japan and retail use Non Pi, Style Create, Plug-In

Harajyuku Secondo (9) 1-19-1 Jingumae, Three-storey building for 2,249 Freehold 1 6.1 (9) 3.8 (10) 37.9% 100.0% I-care 0.2 0.3 0.1 0.2 Shibuya-ku, Tokyo, Japan retail use

Holon L (9) 3-12-13 Kita Aoyama, Three-storey building for 5,046 Freehold 3 20.4 (9) 11.7 (10) 100.0% 100.0% Alberobello, Fujimaru, 0.7 0.9 0.5 0.5 Minato-ku, Tokyo, Japan retail use M and W Japan

Nakameguro (9) 1-20-2 Aobadai, Four-storey building for 3,526 Freehold 2 7.1 (9) 4.9 (10) 48.2% 74.3% Ad Universe, Hataya 0.3 0.3 0.2 0.2 Meguro-ku, Tokyo, Japan retail use0.3

Roppongi Terzo (9) 7-13-7 Roppongi, Five-storey building for F&B 14,452 Freehold 1 38.9 (9) 29.4 (10) 100.0% 100.0% Feria Tokyo 2.1 2.5 0.3 2.0 Minato-ku, Tokyo, Japan and entertainment use

Property Highlights

30STARHILL GLOBAL REIT

annual report 2013

31STARHILL GLOBAL REIT

annual report 2013

Notes:

(1) Includes 225,969 sq ft of gross lettable area leased to Toshin Development Singapore Pte. Ltd. on a master tenant basis.

(2) Lot 10 Property and Starhill Gallery were acquired on 28 June 2010 and based on the exchange rate of RM2.32:S$1 at acquisition.

(3) Based on the exchange rate of RM2.59:S$1 at 31 December 2013.

(4) David Jones Building was acquired on 20 January 2010 and based on the exchange rate of A$0.79:S$1 at acquisition.

(9) Roppongi Terzo, Holon L, Harajyuku Secondo, Daikanyama and Nakameguro were acquired on 30 May 2007 while Ebisu Fort was acquired on 26 September 2007 and based on the exchange rate of JPY79.97:S$1 at acquisition.

(10) Based on the exchange rate of JPY83.03:S$1 at 31 December 2013.

* Largely retail with some office component. (5) Based on the exchange rate of A$0.89:S$1 at 31 December 2013.

(6) Plaza Arcade was acquired on 1 March 2013 and based on the exchange rate of A$0.79:S$1 at acquisition.

(7) Renhe Spring Zongbei Property was acquired on 28 August 2007 and based on the exchange rate of RMB4.96:S$1 at acquisition.

(8) Based on the exchange rate of RMB4.79:S$1 at 31 December 2013.

Property Portfolio Summary

Diversified Retail And Office Portfoliohe Portfolio’s gross revenue is diversified across Singapore (65.8%), Malaysia (15.1%), Australia (9.3%), China (7.0%) and Japan (2.8%) for 2013. The retail

and office components contributed 87.7% and 12.3% to the Portfolio’s 2013 revenue respectively.

For December 2013, the top 10 tenants of the Portfolio contributed 54.3% of the Portfolio’s gross rent. The top three tenants were

Starhill Global REIT’s current portfolio comprises 13 prime properties (Portfolio) in Singapore, Malaysia, Australia, China and Japan. These comprise interests in Wisma Atria and Ngee Ann City

on Orchard Road in Singapore; Starhill Gallery and Lot 10 Property in Kuala Lumpur, Malaysia; the David Jones Building and Plaza Arcade in Perth, Australia; the Renhe Spring Zongbei Property

in Chengdu, China and six properties in Tokyo, Japan.

Toshin Development Singapore Pte. Ltd. (Toshin), YTL Group and David Jones Limited, accounting for 21.2%, 16.8% and 4.0% of the Portfolio’s gross rent respectively. No other tenant accounted for more than 4%.

Resilient Lease ProfileThe Portfolio has several master leases and long-term leases, providing rental income stability. In February 2013, the Toshin rent review exercise due in June 2011 was concluded with a

Gross Revenue by CountryFY 2013

Singapore 65.8% Malaysia 15.1% Australia 9.3% China 7.0% Japan 2.8%

Gross Revenue by Retail and OfficeFY 2013

Retail 87.7% Office 12.3%

% of Portfolio Tenant Name Property Gross Rent (1),(2)

Toshin Development Singapore Pte. Ltd. Ngee Ann City Property, Singapore 21.2%

YTL Group (3) Ngee Ann City Property, Singapore 16.8%

Wisma Atria Property, Singapore Starhill Gallery, Malaysia Lot 10 Property, Malaysia

David Jones Limited David Jones Building, Australia 4.0%

Cortina Watch Pte Ltd Ngee Ann City Property, Singapore 2.3% Wisma Atria Property, Singapore

Cotton On Singapore Pte. Ltd. Wisma Atria Property, Singapore 2.1%

FJ Benjamin Lifestyle Pte. Ltd. Wisma Atria Property, Singapore 2.0%

Wing Tai Retail Management Pte. Ltd. Wisma Atria Property, Singapore 1.8%

BreadTalk Group Wisma Atria Property, Singapore 1.8%

Coach Singapore Pte. Ltd. Ngee Ann City Property, Singapore 1.2% Wisma Atria Property, Singapore

Charles & Keith Group Wisma Atria Property, Singapore 1.1%

Total 54.3%

Notes:

(1) Portfolio lease expiry schedule includes Starhill Global REIT’s properties in Singapore, Malaysia, Australia and Japan but excludes Renhe Spring Zongbei Property, China which operates as a department store with short-term concessionaire leases running three-12 months in general.

(2) Lease expiry schedule based on committed leases as at 31 December 2013.

(3) Includes the master tenant leases in Malaysia that enjoy fixed rental escalation and have an option to be renewed for a further three-year term.

(4) Includes the Toshin master lease that has exercised the option to renew for a further 12-year term and the long-term lease in Australia that enjoys fixed rental escalation.

Portfolio Trade MixBy Gross Rental Contribution (For Dec 2013)

Master Tenancies & 40.8% Long-Term Leases

Fashion 20.7% Office 13.2% Jewellery & Watches 6.2% F&B 5.5% Shoes & Accessories 5.2% Beauty & Wellness 4.3% General Trade 1.9% Services 1.6% Others 0.6%

By NLA By Gross Rent

Portfolio Lease Expiry (as at 31 Dec 2013) (1), (2)

50

40

30

20

10

0

(%)

2014 2015 2016 2017 Beyond2017

6.8 8.

4

45.9

(3)

30.3

(3)

4.9

34.0

(4)

32.0

(4)

10.9

19.3

7.5

10.0% increase in base rent. Toshin also exercised its option to renew the master lease for Ngee Ann City Property for another term of 12 years from June 2013, which incorporates a rent review every three years. The first rent review was conducted at the point of renewal, increasing the base rent by 6.7%. Both Malaysia Properties are under master leases with Katagreen Development Sdn Bhd for a fixed term of 3+3 years commencing on 28 June 2010. The landlord and the master tenant have a put and call option respectively to extend the lease for a further three years upon expiry of the second term. The David Jones Building in Perth, Australia has a long-term lease expiring in 2032 with David Jones Limited, the anchor tenant. Collectively, these master leases and long-term leases accounted for 40.8% of the Portfolio’s gross rent for December 2013.

The Manager actively manages the remaining leases of the Portfolio, which are on a short- to medium-term basis. For the Singapore Properties, besides the Toshin master lease, earnings are derived from retail leases in Wisma Atria Property and Ngee Ann City Level 5, as well as office leases which are generally contracted for a two- to three-year period.

The Japan Properties generally have tenancies with two- to five-year lease terms while the specialty retail units in the David Jones Building and Plaza Arcade in Perth generally have one- to five-year lease terms. The Renhe Spring Zongbei Property in Chengdu operates as a department store with mostly short-term concessionaire leases running from three to 12 months.

33STARHILL GLOBAL REIT

annual report 2013

32STARHILL GLOBAL REIT

annual report 2013

Notes:

(1) For the month of December 2013.

(2) The total portfolio gross rent is based on the gross rent of all the properties including Renhe Spring Zongbei Property.

(3) Consists of Katagreen Development Sdn Bhd, YTL Singapore Pte. Ltd., YTL Starhill Global REIT Management Limited and YTL Starhill Global Property Management Pte. Ltd.

T

Property Portfolio Summary

As at 31 December 2013, the weighted average lease term expiry (by NLA) of the Portfolio is 6.4 years.

Strong Performance for the Singapore PropertiesThe Singapore Properties consist of both retail and office spaces, which enjoy a combined occupancy of 99.5% as at 31 December 2013. Prime retail spaces including Wisma Atria and Ngee Ann City enjoy strong demand from international retailers and new-to-market brands looking to launch their products in the region. Growth in tourism arrivals to Singapore and positive consumer sentiments improved tenant sales at Wisma Atria Property (Retail) by 20.0% yoy to S$209.7 million in FY 2013, coupled with positive rental reversions of 8.1% in FY 2013.

The office properties in the Portfolio achieved a positive rental reversion of 12.3% for leases committed in FY 2013. The strong performance of the office properties can be attributed to their premier location, which appeals especially to tenants from the fashion retail, medical and services industries. According to CBRE, Singapore office market demand was strong in 4Q 2013, with a positive net absorption of 1.27 million sq ft in the quarter.

Weakening Growth in China’s Luxury Retail MarketIn China, GDP growth continued to ease from 7.8% in 2012 to 7.7% in 2013. Chengdu’s GDP growth slowed down to 10.2% in 2013, down from 13.0% in 2012 but still outpacing the national level. As the ongoing austerity drive which started in 2012 continues to impact the high-end luxury market, Chengdu’s retail sales growth slowed from 16.0% in 2012 to 13.1% in 2013. With the influx of retail supply in recent and future years, the retail market in Chengdu continues to remain challenging. The Renhe Spring Zongbei Property continued to enhance its tenant mix and focus on VIP customers to maintain competitiveness in the market.

ValuationStarhill Global REIT’s property portfolio was valued at S$2,854.4 million as at 31 December 2013, an increase of S$141.4 million compared to the previous valuation as at 31 December 2012. The increase was mainly driven by the Singapore Properties, and refining of the portfolio over the past 12 months. Roppongi Primo in Tokyo, Japan was

divested in February 2013 while Plaza Arcade in Perth, Australia was acquired in March 2013.

As at 31 December 2013, the combined valuation of the Wisma Atria Property and the Ngee Ann City Property increased by S$132.5 million yoy, driven by the lower retail cap rates and higher rents secured for the office components.

The Malaysia Properties were valued at RM1,108.5 million (approximately S$427.8 million). The valuation for Lot 10 Property increased marginally while the valuation for Starhill Gallery saw a marginal decrease from the previous valuation. The higher annual property tax assumption for both properties was mitigated by compression of cap rates. The valuation of the Malaysia Properties in Singapore dollar terms was also affected by the weaker Malaysian ringgit as compared to 2012.

The combined valuation of the Australia Properties was A$184.5 million (approximately S$208.1 million), increasing from that as at 31 December 2012 due to the acquisition of Plaza Arcade and lower cap rates to reflect recent transacted yields for retail properties in Perth. This increase was partially offset by the weaker Australian dollar in Singapore dollar terms.

The valuation of Renhe Spring Zongbei Property declined by RMB29.0 million yoy due to lower income assumed. The Chinese government launched a series of austerity campaigns which impacted sales. The entry of new retail malls in Chengdu has also reduced shopper traffic at the Renhe Spring Zongbei Property.

The Japan Properties were valued at JPY8,412.0 million (approximately S$101.3 million), a decrease of 11.1% in local currency terms from the previous valuation as at 31 December 2012 mainly due to the divestment of Roppongi Primo. The net decrease for the remaining six properties was 4.0%. While the introduction of Abenomics contributed to a moderate recovery of the Japanese economy, consumer and business sentiments remain cautious. Furthermore, the depreciation of the Japanese yen caused the value of the remaining six Japanese properties to decrease by 18.6% yoy in Singapore dollar terms. The Japan Properties are fully hedged by yen denominated loans.

35STARHILL GLOBAL REIT

annual report 2013

34STARHILL GLOBAL REIT

annual report 2013

31 Dec 2013 31 Dec 2012 Change Change Property (S$ million) (S$ million) (S$ million) (%)

Wisma Atria Property 961.5 902.0 59.5 6.6%

Ngee Ann City Property 1,074.0 1,001.0 73.0 7.3%

Malaysia Properties (1) 427.8 444.7 (16.9) (3.8%)

Australia Properties (2) 208.1 148.5 59.6 40.2%

Renhe Spring Zongbei Property (3) 81.7 82.4 (0.7) (0.9%)

Japan Properties (4) 101.3 134.4 (33.1) (24.6%)

Total 2,854.4 2,713.0 141.4 5.2%

Notes:

(1) Translated on 31 December 2013 at RM2.59:S$1 (31 December 2012: RM2.50:S$1).

(2) Translated on 31 December 2013 at A$0.89:S$1 (31 December 2012: A$0.79:S$1).

(3) Translated on 31 December 2013 at RMB4.79:S$1 (31 December 2012: RMB5.10:S$1).

(4) Translated on 31 December 2013 at JPY83.03:S$1 (31 December 2012: JPY70.44:S$1).

(S$ million)

3,000

2,500

2,000

1,500

1,000

500

0Sep 05 Dec 05 Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 Dec 12 Dec 13

1,303 1,327

2,2092,103

2,654

S$1,551 million uplift since IPO

1,982

Wisma Atria Property Ngee Ann City Property Malaysia Properties Australia Properties

Renhe Spring Zongbei Property Japan Properties Total

1,498

2,713 2,854

Portfolio Valuation

2,710

ollowing Wisma Atria Property’s S$31 million asset redevelopment in 2012, the property continued its asset positioning of mid- to premium positioning with

the entries of new-to-market international retailers including French lingerie brand Etam, popular multi-label Hong Kong fashion house i.t., and Italian ladies fashion label, Liu.Jo.

The Wisma Atria Property comprises 257 strata lots representing 74.23% of the total share value of strata lots in Wisma Atria. These strata lots represent retail areas (excluding the space occupied by Isetan (Singapore) Limited and common area property) and the office tower.

Strategic Location, Iconic Property Strategically located along the most prime stretch of Orchard Road between ION Orchard and Ngee Ann City, Wisma Atria enjoys almost 100 metres of prime street frontage and is one of the most popular malls with an

established following among locals and tourists. It comprises a retail podium with four levels and one basement, three levels of car park and an office tower with 13 levels of office space. The mall enjoys high pedestrian flow from Orchard Road at street level and its underground pedestrian linkway which connects Wisma Atria to the Orchard MRT station and Ngee Ann City. In 2013, Wisma Atria Property attracted shopper traffic of 26 million.

Wisma Atria continues to offer a wide variety of tenants to cater to shoppers’ needs, hosting the flagship stores of international retailers including Coach, Dickson Watch & Jewellery and Timewise by Cortina Watch. It is home to the first Tory Burch boutique in Singapore and the largest TAG Heuer boutique in the world.

Its positioning as a fashionista's haven is maintained with a good mix of international brands such as Cotton On,

Singapore Properties

WismaAtria

Property

PROFILE SNAPSHOT

257strata lots representing 74.23% of

the total share value in Wisma atria

Address435 orchard Road,singapore 238877

Tenureleasehold estate of

99 years,expiring on 31 march 2061

Total NLA

226,130 sq ftNLA (Retail)

127,241 sq ftNLA (Office)

98,889 sq ftNumber of tenants

125Purchase Price

s$663.0mMarket Valuation (as at 31 Dec 2013)

s$961.5m

Strategically located along the most prime stretch of Orchard Road between ION Orchard and Ngee Ann City, Wisma Atria Property enjoys almost 100 metres of prime street frontage and is one of the most popular malls with

an established following among locals and tourists.

F

Retail & Office Mixby gross revenue(FY 2013)

Retail

84.2%Office

15.8%

Retail Trade Mixby gross rental contribution (for Dec 2013)

F&BJewellery& Watches

Fashion

Shoes & Accessories

Health & Beauty

GeneralTrade

14.8% 17.2% 45.0% 13.4% 5.6% 4.0%

37STARHILL GLOBAL REIT

annual report 2013

lee Hwa Diamond Gallery store at Wisma atria Property

38STARHILL GLOBAL REIT

annual report 2013

39STARHILL GLOBAL REIT

annual report 2013

Dorothy Perkins, Forever New, Seafolly, Miss Selfridge and Victoria's Secret, and local labels such as Lee Hwa Jewellery and Charles & Keith. It also boasts various food & beverage selections, including Paris Baguette, Häagen-Dazs, Starbucks and Food Republic with its mouth-watering local delights.

The Wisma Atria Property’s office tower is especially attractive to tenants from the fashion retail and services sector due to its proximity to the retail stores and boutiques along Orchard Road. Among these tenants are Ermenegildo Zegna, Lane Crawford, L’Occitane and Melcher’s Time. Besides the prestigious Orchard Road address, tenants also enjoy convenient amenities such as gyms, restaurants and healthcare providers just a stone’s throw away. As at 31 December 2013, Wisma Atria Property (Retail) was 99.6% occupied and Wisma Atria Property (Office) enjoyed 100.0% occupancy.

Diversified Tenant MixFor FY 2013, retail tenants contributed 84.2% of the Wisma Atria Property’s gross revenue while office tenants contributed 15.8%. The Wisma Atria Property benefits from a diversified tenant base from various sectors.

Improved Sales EfficiencyContinuous tenant remix efforts following the property’s asset development, coupled with strategic marketing campaigns, helped the mall to continue its strong performance and improved sales efficiency. For 2013, gross tenant sales were S$209.7 million, representing a 20.0% increase from 2012.

Advertising and PromotionWisma Atria rolled out a robust marketing calendar of promotions and events during the year to encourage repeat visits and increase customer spending.

Singapore PropertiesWisma Atria Property

The mall’s outdoor atrium was a venue of many “first-in-Singapore” pop-up stores throughout the year. LG had a pop-up store with their very own Korean Little Psy making a special appearance in March and Samsung launched their new Galaxy S4 mobile in April. Victoria’s Secret had their very first holiday pop-up store in November, showcasing their new holiday fragrances, gift sets and instant photo booth. In December, the Christmas House of Häagen-Dazs showcased limited-edition Champagne truffle ice cream macaroons and Sony's latest gaming console, the PlayStation 4 (PS4) was officially launched. Wisma Atria also rolled out a series of fashion-focused brand advertisements in September complemented with a new website to reinforce the fashion positioning and spectrum of fashion offerings within the mall. There were also tactical promotions with attractive giveaways and exclusive shopping privilege tie-ups

with credit cards to drive customer spend. During the Great Singapore Sale in June, the newly-launched Samsung Galaxy S4 mobile was given out weekly. During the Christmas campaign, 12 pairs of air tickets to fashion destinations around the world were given out. The mall also commissioned three European artists to create 3-D Christmas art where shoppers could interact and take photos.

Asset Repositioning Since the successful launch of Wisma Atria's asset redevelopment in September 2012, the mall has welcomed international retailers such as Coach, Tory Burch, TAG Heuer and new-to-market tenants. Tenant sales increased 20.0% yoy to S$209.7 million in FY 2013, which translated to an improved sales efficiency of S$138 psf, as the mall continued its strong performance after its asset redevelopment and continuous tenant remix.

2013 2012 2011

Shopper Traffic

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0

Visitors (million)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Centre Sales

26

24

22

20

18

16

14

12

10

(S$ million)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Office Trade Mixby gross rental contribution (for Dec 2013) Real Estate & 20.6%

Property Services Fashion Retail 15.4% Trading 12.4% Medical 10.7% Consultancy/Services 10.1% Others 8.9% Aerospace 7.5% Petroleum Related 6.3% Beauty/Health 4.3% Government related 2.5% Investments 1.3%

Occupancy Rate

95.8% 98.7% 100.0%Office Office Office

94.8% 99.5% 99.6%Retail Retail Retail

31 Dec 2011 31 Dec 2012 31 Dec 2013

38STARHILL GLOBAL REIT

annual report 2013

World's largest TaG Heuer boutique at Wisma atria Property

Tory Burch's first flagship store in Southeast Asia

Coach's flagship store in Singapore at Wisma Atria Property

41STARHILL GLOBAL REIT

annual report 2013

40STARHILL GLOBAL REIT

annual report 2013

ocated on the prime stretch of the bustling Orchard Road, Ngee Ann City is easily accessible to locals and tourists alike. It enjoys connectivity

to Orchard MRT station through the underground pedestrian linkway to Wisma Atria and other parts of Orchard Road through the underpasses. With its depth and diversity of retail offerings, Ngee Ann City remains the mall of choice on Orchard Road.

The Ngee Ann City Property consists of four strata lots representing 27.23% of the total share value of strata lots in Ngee Ann City. These lots include retail and office spaces which feature major brands such as Chanel, Louis Vuitton, Piaget and Roger Vivier.

As at 31 December 2013, Ngee Ann City Property (Retail) was 100.0% occupied and Ngee Ann City Property (Office) was 98.3% occupied.

Distinctive Landmark PropertyThe distinctive architecture of Ngee Ann City makes it one of the most prominent landmarks along Orchard Road. Ngee Ann City comprises a podium with five levels and two basement levels of retail space and three levels of

car parking space. Its twin towers host 18 levels of office space each. Besides attracting the affluent, young and family crowd, the outstanding retailers and dining places draw tourists and business travellers from many nearby hotels.

Strong and Stable Positioning Ngee Ann City is popular amongst retailers and shoppers. Affluent shoppers are attracted to the mall’s stable of luxury retailers such as Goyard, Christian Louboutin and Berluti; the young and trendy enjoy Zara, Massimo Dutti and Guess; and families look out for inter-generational favourites such as Books Kinokuniya.