Form 941 for 2014: Employer’s QUARTERLY Federal Tax … · Form 941 for 2014: (Rev. January 2014)...

-

Upload

hoangkhanh -

Category

Documents

-

view

236 -

download

0

Transcript of Form 941 for 2014: Employer’s QUARTERLY Federal Tax … · Form 941 for 2014: (Rev. January 2014)...

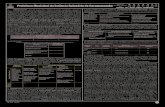

Form 941 for 2014:(Rev. January 2014)

Employer’s QUARTERLY Federal Tax ReturnDepartment of the Treasury — Internal Revenue Service

950114OMB No. 1545-0029

E mployer identific ation number (E IN)—

Name (not your trade name)

Trade name (if any)

AddressNumber Street Suite or room number

City State ZIP code

Foreign country name Foreign province/county Foreign postal code

Report for this Quarter of 2014 (Check one.)

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Instructions and prior year forms are available at www.irs.gov/form941.

Read the separate instructions before you complete Form 941. Type or print within the boxes.

Part 1: Answer these questions for this quarter.

1

Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 1

2 Wages, tips, and other compensation . . . . . . . . . . . . . . . . . 2 .3 Federal income tax withheld from wages, tips, and other compensation . . . . . . 3 .4 If no wages, tips, and other compensation are subject to social security or Medicare tax Check and go to line 6.

Column 1 Column 2

5a Taxable social security wages . . . × .124 = .5b Taxable social security tips . . . . × .124 = .5c Taxable Medicare wages & tips . . . × .029 = .5d Taxable wages & tips subject to

Additional Medicare Tax withholding . × .009 = .5e Add Column 2 from lines 5a, 5b, 5c, and 5d . . . . . . . . . . . . . . . 5e .5f Section 3121(q) Notice and Demand—Tax due on unreported tips (see instructions) . . 5f .6 Total taxes before adjustments. Add lines 3, 5e, and 5f . . . . . . . . . . . . 6 .7 Current quarter’s adjustment for fractions of cents . . . . . . . . . . . . . 7 .8 Current quarter’s adjustment for sick pay . . . . . . . . . . . . . . . . 8 .9 Current quarter’s adjustments for tips and group-term life insurance . . . . . . . 9 .

10 Total taxes after adjustments. Combine lines 6 through 9 . . . . . . . . . . . 10 .11 Total deposits for this quarter, including overpayment applied from a prior quarter and

overpayments applied from Form 941-X, 941-X (PR), 944-X, 944-X (PR), or 944-X (SP) �led in the current quarter . . . . . . . . . . . . . . . . . . . . . . . 11 .

12 Balance due. If line 10 is more than line 11, enter the di�erence and see instructions . . . 12 .13 Overpayment. If line 11 is more than line 10, enter the di�erence . Check one: Apply to next return. Send a refund.

� You MUST complete both pages of Form 941 and SIGN it. Next � �

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Cat. No. 17001Z Form 941 (Rev. 1-2014)

0 0 0 0 0 0 0 0 0

Any Business, Inc.

114 Dover Street

Any Town YZ 00000

3

12,600 00

00450

12,600 000

12,600 00

1,562

365

40

400

0 0

1,927 80

0

2,377 80

0

0

0

2,377 80

2,377 80

0

950214Name (not your trade name) Employer identi�cation number (EIN)

Part 2: Tell us about your deposit schedule and tax liability for this quarter.

If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see Pub. 15 (Circular E), section 11.

14 Check one: Line 10 on this return is less than $2,500 or line 10 on the return for the prior quarter was less than $2,500, and you did not incur a $100,000 next-day deposit obligation during the current quarter. If line 10 for the prior quarter was less than $2,500 but line 10 on this return is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule depositor, complete the deposit schedule below; if you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3.

You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter, then go to Part 3.

Tax liability: Month 1 .Month 2 .Month 3 .

Total liability for quarter . Total must equal line 10.

You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941.

Tell us about your business. If a question does NOT apply to your business, leave it blank.Part 3:

15 If your business has closed or you stopped paying wages . . . . . . . . . . . . . . . Check here, and

enter the �nal date you paid wages / / .

16 If you are a seasonal employer and you do not have to �le a return for every quarter of the year . . Check here.

May we speak with your third-party designee?Part 4:

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details.

Yes. Designee’s name and phone number

Select a 5-digit Personal Identi�cation Number (PIN) to use when talking to the IRS.

No.

Sign here. You MUST complete both pages of Form 941 and SIGN it.Part 5:

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

� Sign your name here

Print your name here

Print your title here

Date / / Best daytime phone

Paid Preparer Use Only Check if you are self-employed . . .

Preparer’s name

Preparer’s signature

Firm’s name (or yours if self-employed)

Address

City State

PTIN

Date / /

EIN

Phone

ZIP code

Page 2 Form 941 (Rev. 1-2014)

Any Business, Inc. 00 - 0000000

Form 941-V, Payment Voucher

Purpose of FormComplete Form 941-V, Payment Voucher, if you are making a payment with Form 941, Employer’s QUARTERLY Federal Tax Return. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

Making Payments With Form 941To avoid a penalty, make your payment with Form 941 only if:• Your total taxes after adjustments for either the current quarter or the preceding quarter (Form 941, line 10) are less than $2,500, you did not incur a $100,000 next-day deposit obligation during the current quarter, and you are paying in full with a timely �led return, or

• You are a monthly schedule depositor making a payment in accordance with the Accuracy of Deposits Rule. See section 11 of Pub. 15 (Circular E), Employer's Tax Guide, for details. In this case, the amount of your payment may be $2,500 or more.

Otherwise, you must make deposits by electronic funds transfer. See section 11 of Pub. 15 (Circular E) for deposit instructions. Do not use Form 941-V to make federal tax deposits.Caution. Use Form 941-V when making any payment with Form 941. However, if you pay an amount with Form 941 that should have been deposited, you may be subject to a penalty. See Deposit Penalties in section 11 of Pub. 15 (Circular E).

Speci�c InstructionsBox 1—Employer identi�cation number (EIN). If you do not have an EIN, you may apply for one online. Go to IRS.gov and click on the Apply for an EIN Online link under Tools . You may also apply for an EIN by faxing or mailing Form SS-4, Application for Employer Identi�cation Number, to the IRS. If you have not received your EIN by the due date of Form 941, write “Applied For” and the date you applied in this entry space.Box 2—Amount paid. Enter the amount paid with Form 941.Box 3—Tax period. Darken the circle identifying the quarter for which the payment is made. Darken only one circle.Box 4—Name and address. Enter your name and address as shown on Form 941.• Enclose your check or money order made payable to the "United States Treasury." Be sure to enter your EIN, "Form 941," and the tax period on your check or money order. Do not send cash. Do not staple Form 941-V or your payment to Form 941 (or to each other).• Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions for Form 941.Note. You must also complete the entity information above Part 1 on Form 941.

� � Detach Here and Mail With Your Payment and Form 941. �

Form 941-V

Department of the Treasury Internal Revenue Service

Payment Voucher� Do not staple this voucher or your payment to Form 941.

OMB No. 1545-0029

20 141 Enter your employer identi�cation

number (EIN).2

Enter the amount of your payment. �

Make your check or money order payable to “United States Treasury”

Dollars Cents

3 Tax Period

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

4 Enter your business name (individual name if sole proprietor).

Enter your address.

Enter your city, state, and ZIP code or your city, foreign country name, foreign province/county, and foreign postal code.

�

Form 941 (Rev. 1-2014)

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on Form 941 to carry out the Internal Revenue laws of the United States. We need it to �gure and collect the right amount of tax. Subtitle C, Employment Taxes, of the Internal Revenue Code imposes employment taxes on wages and provides for income tax withholding. Form 941 is used to determine the amount of taxes that you owe. Section 6011 requires you to provide the requested information if the tax is applicable to you. Section 6109 requires you to provide your identi�cation number. If you fail to provide this information in a timely manner, or provide false or fraudulent information, you may be subject to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are con�dential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose your tax information to the Department of

Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and �le Form 941 will vary depending on individual circumstances. The estimated average time is:Recordkeeping . . . . . . . . . . . . . 11 hr.Learning about the law or the form . . . . 47 min.Preparing, copying, assembling, and sending the form to the IRS . . . . . . . . 1 hr.

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 941 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/formspubs . Click on More Information and then click on Comment on Tax Forms and Publications. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send Form 941 to this address. Instead, see Where Should You File? in the Instructions for Form 941.

22222 Voida Employee’s social security number For O�cial Use Only �

OMB No. 1545-0008

b Employer identi�cation number (EIN)

c Employer’s name, address, and ZIP code

d Control number

e Employee’s �rst name and initial Last name Su�.

f Employee’s address and ZIP code

1 Wages, tips, other compensation 2 Federal income tax withheld

3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld

7 Social security tips 8 Allocated tips

9 10 Dependent care bene�ts

11 Nonquali�ed plans 12a See instructions for box 12Co d e

12bCo d e

12cCo d e

12dCo d e

13 Statutory employee

Retirement plan

Third-party sick pay

14 Other

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form W-2 Wage and Tax Statement 2014Copy A For Social Security Administration — Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable.

Department of the Treasury—Internal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 10134D

Do Not Cut, Fold, or Staple Forms on This Page

1,326.00

1,051.02

245.80

00 - 0000000

Any Business, Inc.114 Dover StreetAny Town, USA 00000

Joseph R. Barnes

003 -00 -0000

234 Dover StreetAny Town, USA 00000

XZ 00 - 0000000 16,952.00 0.00 0.0016,952.00

16,952.00

16,952.00

16,952.00

22222 Voida Employee’s social security number For O�cial Use Only �

OMB No. 1545-0008

b Employer identi�cation number (EIN)

c Employer’s name, address, and ZIP code

d Control number

e Employee’s �rst name and initial Last name Su�.

f Employee’s address and ZIP code

1 Wages, tips, other compensation 2 Federal income tax withheld

3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld

7 Social security tips 8 Allocated tips

9 10 Dependent care bene�ts

11 Nonquali�ed plans 12a See instructions for box 12Co d e

12bCo d e

12cCo d e

12dCo d e

13 Statutory employee

Retirement plan

Third-party sick pay

14 Other

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form W-2 Wage and Tax Statement 2014Copy A For Social Security Administration — Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable.

Department of the Treasury—Internal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 10134D

Do Not Cut, Fold, or Staple Forms on This Page

156.00

1,160.64

271.44

00 - 0000000

Any Business, Inc.114 Dover StreetAny Town, USA 00000

William F. Boudreau

005 -32 -0000

236 Dover StreetAny Town, USA 00000

XZ 00 - 0000000 18,720.00 0.00 0.0018,720.00

18,720.00

18,720.00

18,720.00

22222 Voida Employee’s social security number For O�cial Use Only �

OMB No. 1545-0008

b Employer identi�cation number (EIN)

c Employer’s name, address, and ZIP code

d Control number

e Employee’s �rst name and initial Last name Su�.

f Employee’s address and ZIP code

1 Wages, tips, other compensation 2 Federal income tax withheld

3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld

7 Social security tips 8 Allocated tips

9 10 Dependent care bene�ts

11 Nonquali�ed plans 12a See instructions for box 12Co d e

12bCo d e

12cCo d e

12dCo d e

13 Statutory employee

Retirement plan

Third-party sick pay

14 Other

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form W-2 Wage and Tax Statement 2014Copy A For Social Security Administration — Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable.

Department of the Treasury—Internal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 10134D

Do Not Cut, Fold, or Staple Forms on This Page

468.00

1,173.54

274.46

00 - 0000000

Any Business, Inc.114 Dover StreetAny Town, USA 00000

Sara C. Lawton

555 -00 -0000

238 Dover StreetAny Town, USA 00000

XZ 00 - 0000000 18,928.00 0.00 0.0018,928.00

18,928.00

18,928.00

18,928.00

DO NOT STAPLE OR FOLD

33333a Control number For O�cial Use Only �

OMB No. 1545-0008

b Kind of Payer (Check one)

� 941-SS Military 943 944

Hshld. emp.

Medicare govt. emp.

Kind of Employer (Check one)

� None apply 501c non-govt.

State/local non-501c State/local 501c Federal govt.

Third-party sick pay

(Check if

applicable)

c Total number of Forms W-2 d Establishment number

e Employer identi�cation number (EIN)

f Employer’s name

g Employer’s address and ZIP code

h Other EIN used this year

1 Wages, tips, other compensation 2 Income tax withheld

3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld

7 Social security tips 8

9 10

11 Nonquali�ed plans 12a Deferred compensation

12b13 For third-party sick pay use only

14 Income tax withheld by payer of third-party sick pay15 Employer’s territorial ID number

18 Check the appropriate box

Type of Form � W-2AS W-2CM W-2GU W-2VI

Employer's contact person Employer's telephone number

Employer's fax number Employer's email address

For O�cial Use Only

Copy A—For Social Security AdministrationUnder penalties of perjury, I declare that I have examined this return and accompanying documents, and, to the best of my knowledge and belief, they are true, correct, and complete.

Signature � Title � Date �

Form W-3SS Transmittal of Wage and Tax Statements 2015 Department of the Treasury Internal Revenue Service

Send this entire page with the entire Copy A page of Form(s) W-2AS, W-2CM, W-2GU, or W-2VI to the Social Security Administration (SSA). Photocopies are not acceptable. Do not send Form W-3SS if you �led electronically with the SSA. Do not send any payment (cash, checks, money orders, etc.) with Form(s) W-2AS, W-2CM, W-2GU, W-2VI, and W-3SS.

ReminderSeparate instructions. See the 2015 General Instructions for Forms W-2 and W-3 for information on completing this form. Do not �le Form W-3SS for Form(s) W-2AS, W-2CM, W-2GU, or W-2VI that were submitted electronically to the SSA.

Purpose of Form A Form W-3SS Transmittal is completed only when paper Copy A of Form(s) W-2AS, W-2CM, W-2GU, or W-2VI is being �led. Do not �le Form W-3SS alone. All paper forms must comply with IRS standards and be machine readable. Photocopies are not acceptable. Use a Form W-3SS even if only one paper Form W-2AS, W-2CM, W-2GU, or W-2VI is being �led. Make sure both the Form W-3SS and Form(s) W-2AS, W-2CM, W-2GU, or W-2VI show the correct tax year and Employer Identi�cation Number (EIN). Make a copy of this form and keep it with Copy D (For Employer) of Form(s) W-2AS, W-2CM, W-2GU, or W-2VI for your records. The IRS recommends retaining copies of these forms for four years.

E-FilingThe SSA strongly suggests employers report Form W-3SS and Form(s) W-2AS, W-2CM, W-2GU, or W-2VI Copy A electronically instead of on paper. The SSA provides two free e-�ling options on its Business Services Online (BSO) website:• W-2 Online. Use �ll-in forms to create, save, print, and submit up to 50 Forms W-2AS, W-2CM, W-2GU, or W-2VI at a time to the SSA.

• File Upload. Upload wage �les to the SSA you have created using payroll or tax software that formats the �les according to the SSA's Speci�cations for Filing Forms W-2 Electronically (EFW2).

W-2 Online �ll-in forms or �le uploads will be on time if submitted by March 31, 2016. For more information, go to www.socialsecurity.gov/employer. First time �lers, select “Go to Register”; returning �lers select “Go To Log In.”

When To File Mail Copy A of Form W-3SS with Copy A of Form(s) W-2AS, W-2CM, W-2GU, or W-2VI by February 29, 2016.

Where To File Paper FormsSend this entire page with the entire Copy A page of Form(s) W-2AS, W-2CM, W-2GU, or W-2VI to:

Social Security Administration Data Operations Center Wilkes-Barre, PA 18769-0001

Note. If you use “Certi�ed Mail” to �le, change the ZIP code to “18769-0002.” If you use an IRS-approved private delivery service, add “ATTN: W-2 Process, 1150 E. Mountain Dr.” to the address and change the ZIP code to “18702-7997.” See Pub. 15 (Circular E), Employer’s Tax Guide, for a list of IRS-approved private delivery services.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 10117S

x

3

DO NOT STAPLE OR FOLD

33333a Control number For O�cial Use Only �

OMB No. 1545-0008

b Kind of Payer (Check one)

� 941-SS Military 943 944

Hshld. emp.

Medicare govt. emp.

Kind of Employer (Check one)

� None apply 501c non-govt.

State/local non-501c State/local 501c Federal govt.

Third-party sick pay

(Check if

applicable)

c Total number of Forms W-2 d Establishment number

e Employer identi�cation number (EIN)

f Employer’s name

g Employer’s address and ZIP code

h Other EIN used this year

1 Wages, tips, other compensation 2 Income tax withheld

3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld

7 Social security tips 8

9 10

11 Nonquali�ed plans 12a Deferred compensation

12b13 For third-party sick pay use only

14 Income tax withheld by payer of third-party sick pay15 Employer’s territorial ID number

Employer's contact person Employer's telephone number

Employer's fax number Employer's email address

For O�cial Use Only

Copy 1—For Local Tax Department Under penalties of perjury, I declare that I have examined this return and accompanying documents, and, to the best of my knowledge and belief, they are true, correct, and complete.

Signature � Title � Date �

Form W-3SS Transmittal of Wage and Tax Statements Department of the Treasury Internal Revenue Service

Where To FileFor more information about where to �le Copy 1, contact your state, city, or local tax department.

American Samoa. File Copy 1 of Form W-3SS and Forms W-2AS at the following address.American Samoa Tax O�ce Executive O�ce Building First Floor Pago Pago, AS 96799

Guam. File Copy 1 of Form W-3SS and Forms W-2GU at the following address.

Guam Department of Revenue and Taxation P.O. Box 23607 GMF, GU 96921

U.S. Virgin Islands. File Copy 1 of Form W-3SS and Forms W-2VI at the following address.Virgin Islands Bureau of Internal Revenue 6115 Estate Smith Bay Suite 225 St. Thomas, VI 00802

Commonwealth of the Northern Mariana Islands. File Form OS-3710 and Copy 1 of Forms W-2CM at the following address.

Division of Revenue and Taxation Commonwealth of the Northern Mariana Islands P.O. Box 5234 CHRB Saipan, MP 96950

x

3

00 - 0000000

Any Business, Inc.114 Dover StreetAny Town, USA 00000

54, 600.00

54, 600.00

54, 600.00

1, 950.00

3, 385.20

791.70

Accountant

555-555-0000

555-555-0001

Form 940 for 2014: Employer's Annual Federal Unemployment (FUTA) Tax ReturnDepartment of the Treasury — Internal Revenue Service

850113OMB No. 1545-0028

Employer identi�cation number

(EIN) —

Name (not your trade name)

Trade name (if any)

AddressNumber Street Suite or room number

City State ZIP code

Foreign country name Foreign province/county Foreign postal code

Read the separate instructions before you complete this form. Please type or print within the boxes.

Type of Return (Check all that apply.)

a. Amended

b. Successor employer

c. No payments to employees in 2014

d. Final: Business closed or stopped paying wages

Instructions and prior-year forms are available at www.irs.gov/form940.

Part 1: Tell us about your return. If any line does NOT apply, leave it blank.

1a If you had to pay state unemployment tax in one state only, enter the state abbreviation . 1a 1b If you had to pay state unemployment tax in more than one state, you are a multi-state

employer . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b Check here. Complete Schedule A (Form 940).

2 If you paid wages in a state that is subject to CREDIT REDUCTION . . . . . . . . 2 Check here. Complete Schedule A (Form 940).

Part 2: Determine your FUTA tax before adjustments for 2014. If any line does NOT apply, leave it blank.

3 Total payments to all employees . . . . . . . . . . . . . . . . . . . 3 .4 Payments exempt from FUTA tax . . . . . . . 4 .

Check all that apply: 4a Fringe bene�ts 4b Group-term life insurance

4c Retirement/Pension 4d Dependent care

4e Other

5 Total of payments made to each employee in excess of $7,000 . . . . . . . . . . . . . . . . 5 .

6 Subtotal (line 4 + line 5 = line 6) . . . . . . . . . . . . . . . . . . . . 6 .7 Total taxable FUTA wages (line 3 – line 6 = line 7) (see instructions) . . . . . . . . 7 .8 FUTA tax before adjustments (line 7 x .006 = line 8) . . . . . . . . . . . . . 8 .

Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax,

multiply line 7 by .054 (line 7 × .054 = line 9). Go to line 12 . . . . . . . . . . . 9 .10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax,

OR you paid ANY state unemployment tax late (after the due date for �ling Form 940), complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet . . 10 .

11 If credit reduction applies, enter the total from Schedule A (Form 940) . . . . . . . 11 .Part 4: Determine your FUTA tax and balance due or overpayment for 2014. If any line does NOT apply, leave it blank.

12 Total FUTA tax after adjustments (lines 8 + 9 + 10 + 11 = line 12) . . . . . . . . . 12 .13 FUTA tax deposited for the year, including any overpayment applied from a prior year . 13 .14 Balance due (If line 12 is more than line 13, enter the excess on line 14.)

• If line 14 is more than $500, you must deposit your tax. • If line 14 is $500 or less, you may pay with this return. (see instructions) . . . . . . . 14 .

15 Overpayment (If line 13 is more than line 12, enter the excess on line 15 and check a box below.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 .� You MUST complete both pages of this form and SIGN it. Check one: Apply to next return. Send a refund.

Next � �

For Privacy Act and Paperwork Reduction Act Notice, see the back of Form 940-V, Payment Voucher. Cat. No. 11234O Form 940 (2014)

0 0 0 0 0 0 0 0 0

Any Business, Inc.

114 Dover Street

Any City Any 00000

54, 600 00

33, 600 00

0021, 000

126 00

000

33, 600 00

126 00

000

126 00

850212Name (not your trade name) Employer identi�cation number (EIN)

Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6.

16

Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability fora quarter, leave the line blank.

16a 1st quarter (January 1 – March 31) . . . . . . . . . 16a .16b 2nd quarter (April 1 – June 30) . . . . . . . . . . 16b .16c 3rd quarter (July 1 – September 30) . . . . . . . . 16c .16d 4th quarter (October 1 – December 31) . . . . . . . 16d .

17 Total tax liability for the year (lines 16a + 16b + 16c + 16d = line 17) 17 . Total must equal line 12.

Part 6: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details.

Yes. Designee’s name and phone number

Select a 5-digit Personal Identi�cation Number (PIN) to use when talking to IRS

No.

Part 7: Sign here. You MUST complete both pages of this form and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

� Sign your name here

Date / /

Print your name here

Print your title here

Best daytime phone

Paid Preparer Use Only Check if you are self-employed .

Preparer’s name

Preparer’s signature

Firm’s name (or yours if self-employed)

Address

City State

PTIN

Date / /

EIN

Phone

ZIP code

Page 2 Form 940 (2014)

Any Business, Inc. 00 - 0000000

126 00

126 00

x Accountant

0 0 0 00

Form 940-V, Payment Voucher

Purpose of Form Complete Form 940-V, Payment Voucher, if you are making a payment with Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

Making Payments With Form 940 To avoid a penalty, make your payment with your 2014 Form 940 only if your FUTA tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. If your total FUTA tax after adjustments (Form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. See When Must You Deposit Your FUTA Tax? in the Instructions for Form 940. Also see sections 11 and 14 of Pub. 15 (Circular E), Employer's Tax Guide, for more information about deposits.

Caution. Use Form 940-V when making any payment with Form 940. However, if you pay an amount with Form 940 that should have been deposited, you may be subject to a penalty. See Deposit Penalties in section 11 of Pub. 15 (Circular E).

Speci�c InstructionsBox 1—Employer Identi�cation Number (EIN). If you do not have an EIN, you may apply for one online. Go to IRS.gov and type “EIN” in the search box. You may also apply for an EIN by faxing or mailing Form SS-4, Application for Employer Identi�cation Number, to the IRS. If you have not received your EIN by the due date of Form 940, write “Applied For” and the date you applied in this entry space.Box 2—Amount paid. Enter the amount paid with Form 940. Box 3—Name and address. Enter your name and address as shown on Form 940.• Enclose your check or money order made payable to the “United States Treasury.” Be sure to enter your EIN, “Form 940,” and “2014” on your check or money order. Do not send cash. Do not staple Form 940-V or your payment to Form 940 (or to each other).• Detach Form 940-V and send it with your payment and Form 940 to the address provided in the Instructions for Form 940.Note. You must also complete the entity information above Part 1 on Form 940.

� � Detach Here and Mail With Your Payment and Form 940. �

�

Form 940-V

Department of the Treasury Internal Revenue Service

Payment Voucher� Do not staple or attach this voucher to your payment.

OMB No. 1545-0028

20 141 Enter your employer identi�cation number (EIN). 2

Enter the amount of your payment. � Make your check or money order payable to “United States Treasury”

Dollars Cents

3 Enter your business name (individual name if sole proprietor).

Enter your address.

Enter your city, state, and ZIP code or your city, foreign country name, foreign province/county, and foreign postal code.

00 - 0000000 126 00

Any Business, Inc.

114 Dover Street

Any City, USA 00000

Form 940 (2014)

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Chapter 23, Federal Unemployment Tax Act, of Subtitle C, Employment Taxes, of the Internal Revenue Code imposes a tax on employers with respect to employees. This form is used to determine the amount of the tax that you owe. Section 6011 requires you to provide the requested information if you are liable for FUTA tax under section 3301. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner or provide a false or fraudulent form, you may be subject to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose

your tax information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions to administer their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal non-tax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . . . . . . . 10 hr., 2 min.

Learning about the law or the form . . 1 hr., 45 min.

Preparing, copying, assembling, and sending the form to the IRS . . . . . 3 hr., 11 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 940 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/formspubs. Click on More Information and then click on Give us feedback. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Avenue, NW, IR-6526, Washington, DC 20224. Do not send Form 940 to this address. Instead, see Where Do You File? in the Instructions for Form 940.

POSTREF.

Oct. 16 CP10 7 5 00 7 5 00

19 CP10 7 5 00 0 00

30 CP10 7 5 00 7 5 00

31 CP10 7 5 00 0 00

Nov. 14 CP11 7 5 00 7 5 00

18 CP11 7 5 00 0 00

27 CP11 7 5 00 7 5 00

30 CP11 7 5 00 0 00

Dec. 11 CP12 7 5 00 7 5 00

15 CP12 7 5 00 0 00

26 CP13 7 5 00 7 5 00

Jan. 10 CP13 7 5 00 0 00

POSTREF.

Oct. 16 CP10 1 6 0 65 1 6 0 65

19 CP10 1 6 0 65 0 00

30 CP10 1 6 0 65 1 6 0 65

31 CP10 1 6 0 65 0 00

Nov. 14 CP11 1 6 0 65 1 6 0 65

18 CP11 1 6 0 65 0 00

27 CP11 1 6 0 65 1 6 0 65

30 CP11 1 6 0 65 0 00

Dec. 11 CP12 1 6 0 65 1 6 0 65

15 CP12 1 6 0 65 0 00

26 CP13 1 6 0 65 1 6 0 65

Jan. 10 CP13 1 6 0 65 0 00

GENERAL LEDGER

ACCOUNT Employee Income Tax Payable ACCOUNT NO. 2120

DATE ITEM DEBIT CREDITBALANCE

DEBIT CREDIT

GENERAL LEDGER

ACCOUNT FICA Tax Payable ACCOUNT NO. 2130

DATE ITEM DEBIT CREDITBALANCE

DEBIT CREDIT

POST

REF.

Oct. 16 CP10 4 0 00 4 0 00

30 CP10 2 0 00 6 0 00

Nov. 14 CP11 4 0 00 1 0 0 00

27 CP11 2 0 00 1 2 0 00

Dec. 11 CP12 4 0 00 1 6 0 00

26 CP13 2 0 00 1 8 0 00

Jan. 10 CP13 1 8 0 00 0 00

POST

REF.

Oct. 16 CP10 5 00 5 00

30 CP10 1 0 00 1 5 00

Nov. 14 CP11 5 00 2 0 00

27 CP11 1 0 00 3 0 00

Dec. 11 CP12 5 00 3 5 00

26 CP13 1 0 00 4 5 00

Jan. 10 CP13 4 5 00 0 00

POSTREF.

Oct. 30 CP10 1 5 00 1 5 00

Nov. 27 CP11 1 5 00 3 0 00

Dec. 26 CP13 1 5 00 4 5 00

Jan. 10 CP13 4 5 00 0 00

GENERAL LEDGER

ACCOUNT Health Insurance Premiums Payable ACCOUNT NO. 2150

DATE ITEM DEBIT CREDITBALANCE

DEBIT CREDIT

GENERAL LEDGER

ACCOUNT United Way Donations Payable ACCOUNT NO. 2160

DATE ITEM DEBIT CREDITBALANCE

DEBIT CREDIT

GENERAL LEDGER

CREDITBALANCE

DEBIT CREDIT

ACCOUNT U.S. Savings Bonds Payable ACCOUNT NO. 2170

DATE ITEM DEBIT

POST

REF.

Sep. 30 3 2 1 6 00

Jan. 10 CP13 1 6 0 65 3 3 7 6 65

10 CP13 1 2 6 00 3 5 0 2 65

POST

REF.

Oct. 16 CP10 2 1 0 0 00 2 1 0 0 00

30 CP10 2 1 0 0 00 4 2 0 0 00

Nov. 14 CP11 2 1 0 0 00 6 3 0 0 00

27 CP11 2 1 0 0 00 8 4 0 0 00

Dec. 11 CP12 2 1 0 0 00 10 5 0 0 00

26 CP13 2 1 0 0 00 12 6 0 0 00

Balance

DATE ITEM DEBIT CREDITBALANCE

DEBIT CREDIT

GENERAL LEDGER

ACCOUNT Payroll Tax Expense ACCOUNT NO. 6135

DATE ITEM DEBIT CREDITBALANCE

DEBIT CREDIT

GENERAL LEDGER

ACCOUNT Salary Expense ACCOUNT NO. 6145

1 Dec. 26 511 6145 2 1 0 0 00 1 8 1 9 35 1

2 2120 7 5 00 2

3 2130 1 6 0 65 3

4 2150 2 0 00 4

5 2160 1 0 00 5

6 2170 1 5 00 6

7 Jan. 10 EFP 2120 7 5 00 3 9 6 30 7

8 2130 1 6 0 65 8

9 6135 1 6 0 65 9

10 Jan. 10 512 6135 1 2 6 00 1 2 6 00 10

11 10 513 2150 1 8 0 00 1 8 0 00 11

12 10 514 2160 4 5 00 4 5 00 12

13 10 U.S. Savings Bonds Payable/U.S. Treasury 515 2170 4 5 00 4 5 00 13

14 31 2 8 9 2 30 2 8 0 65 2 6 1 1 65 14

DATE ACCOUNT TITLE CK. NO. POST REF.

CASH PAYMENTS JOURNAL PAGE 13

GENERAL ACCOUNTS PAYABLE DEBIT

PURCHASES DISCOUNT CREDIT

CASHDEBIT CREDIT CREDIT

Salary Expense

Employee Income Tax Payable

FICA Tax Payable

Health Insurance Premiums Payable

United Way Donations Payable

U.S. Savings Bonds Payable

Employee Income Tax Payable

FICA Tax Payable

Payroll Tax Expense

Payroll Tax Expense

Health Insurance Premiums Payable/Pioneer Insurance Company

United Way Donations Payable/United Way Inc.

Totals