Daily Trade Journal - 11.12.2012

Transcript of Daily Trade Journal - 11.12.2012

-

7/30/2019 Daily Trade Journal - 11.12.2012

1/13

p

p

p

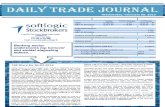

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

-10.8%

-6.0%

-4.5%

ASPI

MPI

S&P SL 20 Index

+ 12.92

+ 7.28

+ 5.10

5,417.78

4,913.42

2,963.21

ASPI

2,080.5

Tuesday, December 11, 2012

877.6

% ChangePoint ChangeToday

9.9

489.0

0.24 %

0.15 %

0.17 %

YTD Performance

MPI

S&P SL 20 Index

40.5

36.1

37.2

282.1

246.0

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099Email: [email protected]

CSE Diary for 11.12.2012

Bourse extended gains as the benchmark index touched a high of 5,431 (+27

points) mid-day, before losing some ground to close with a 13 point

advance. The S&P SL20 closed with a lesser 5.1 point gain at 2,963 points. The

heavyweights, Nestle Lanka, Ceylon Tobacco, Lion Brewery, Bukit Darah and

Dialog Axiata primarily contributed to the index advance. Few large off-

market deals assisted the turnover to register LKR488 mn, whilst the volume

traded was at 9.9 mn shares.Despite no signs of return of the local retail investor category amidst thefestive season, overseas investor participation has maintained momentum

which is clearly highlighted with the considerable interest into fundamentally

backed heavyweight players. Foreign investor play has assisted the

benchmark index to remain in the green during last four trading sessions. The

continued foreign investor buying is a strong eye-opener for the local

investor category who are waiting till the next bull run to convert their cash

allocations to equity.A single parcel carrying 1.2 mn shares in Hatton National Bank at LKR140.0

during final few minutes of trading drove it to spearhead the days turnover

list with a c.35% addition. The counter closed flat at LKR141.0. Interest heaved

up further in National Development Bank as the counter too recorded two

off-market deals totalling to 500k shares dealt at it 52-week high price of

LKR126.0.

Index heavy, Nestle Lanka, extended interest as a block of 37,252 shares

were crossed off at its 52-week high price of LKR1,500.0. The counter

renewed its 52-week high at LKR1,510.0 today, before closing at LKR1,504.7

(up 3.6%). Another heavyweight, John Keells Holdings, saw several large

trades being taken on-board as it closed with a marginal gain at LKR211.8.

Few large deals were also evident in Colombo Dockyard, whilst renewed

retail & high net worth play was observed in Ceylon Grain Elevators.

Following the continued accumulation by its parent in Peoples Leasing &

Finance, the large on-board deals extended in the counter as it closed flat

at LKR13.3. Another steady player in the finance sector, Central Finance also

extended interest amidst the large transactions taken in the market. The

counter closed with a marginal 0.6% appreciation at LKR160.0. Interest was

also visible in both the Voting & Non-Voting shares of Commercial Bank of

Ceylon. Furthermore, Ceylon Tobacco was seen trading at its 52-week high

of LKR779.0 amidst some buying interest as it advanced 1.3% at its close of

LKR759.7.Despite moving on thin volumes buying interest was evident in Lanka IOC,

Ceylinco Insurance and Sampath Bank.Stocks Rise a Seventh Day: European stocks rose for a seventh day as

German investor confidence rebounded and investors waited for progress

on US budget talks. The Stoxx Europe 600 Index added 0.3% at 10:30 a.m. in

London after closing yesterday at an 18-month high. Futures on the Standard

& Poors 500 Index rose 0.2%.Oil Trades Near One-Month Low as Fuel Stockpiles Seen Rising: Oil traded

near the lowest close in almost a month in New York on speculation that an

Energy Department report will show fuel stockpiles climbed in the US. Brent

for January settlement on the London-based ICE Futures Europe exchange

was at USD107.67 a barrel, up 34 cents.

-

7/30/2019 Daily Trade Journal - 11.12.2012

2/13

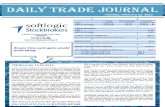

Statistical Look Up

Treasury Bill (%) 07.12.2012

10.79

12.10

12.86

14.30

Inflation (%) Nov-12 9.5

7.2

All Share Price Index p

Milanka Price Index p

S&P SL20 Index p

Turnover (LKR mn)Turnover (USD mn)

Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks & Finance q

Food & Beverage p

Construction q

Diversified p

Hotels q

Land Property q

Manufacturing p

Telecom p

Pre Day

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 11.12.2012

Today

1.04

159.1

2.4

2,507.0

14,926.6

2,470.6

1,767.8

11,804.3

Pre Day

0.00%

2,500.8

3,468.6

-0.32%

158.2

3,456.2

480.9

0.08%2,505.1

158.80.58%

14,712.5

1,766.6

3,492.4

482.4

-1.04%

2,496.8

1,760.8

-0.33%

1.46%

-0.10%

0.06%

2,473.2

14,026.1

482.7

0.24%

-39.23%

-15.19%

11,843.8

% Change

0.24%1.9

-79.27%

14.3

2.4

0.24% 14.1

11,654.6

Week ending

-1.05%

-84.16%

-1.78%

1.62%

1.19%

1.06%

1.62%

225

2,047.3

5,331.5

4,855.6

2,932.2

62.3

1.62%

0.00%

464.3

290.1

174.2

Change %

5,404.9

4,906.1

2,958.1

0.24%

0.15%

0.17%

2,080.5

2.4

282.1

-12.76%-12.76%

-68.05%

-7.14%

3.8

9.9

221

2,963.2

560.54.4

238

489.0

Today

36.1

1.9

246.0

14.4

5,417.8

4,913.4

0.39%

-0.36%

-0.39%

% WoW

ChangeLast Week

1.62%

-23.54%

15.72%

-76.90%

369.0

1.9

212.6

156.4

2,075.5

30.9

0.19%

0.25%

-3.27%-3.27%

% WoW

ChangeLast Week

505.53.9

1.28%

6.42%

4400

4600

4800

5000

5200

5400

5600

5800

Index

ASPI MPI

2850

2900

2950

3000

3050

3100

Index

S&P SL20

-100.0

0.0

100.0

200.0

300.0

400.0

500.0

0

1,000

2,000

3,000

4,000

5,000

Volume('mn)

TurnoverLKR('mn)

Turnover Volume

Page | 2.

-

7/30/2019 Daily Trade Journal - 11.12.2012

3/13

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

HNB

NESTLE

NAT. DEV. BANK

JKH

DOCKYARD

Most Active

3.7%

131.90

Today Pre Day

4.50

141.00

2.40

+ 294.50

LOLC

10,575

1,000

MALWATTE 4.60

Company

8,661

866

1,591

CFI

PARAGON

Company Today

1.4%

26,669

1,994.38

172.00

562 247.50

3.9%

Change

1,195.50

Company% of

Mkt CapVolume

283.73

-0.45%

0.00%

FREE LANKA

KELANI CABLES

-0.05%

132.50

SIERRA CABL 2.20

HNB 141.00

% Change

7.48%

1504.70

-0.45%

+ 4.80

1.7%

2.3%

Change

- 44.90

- 7.80

- 0.20

- 0.20

- 39.80

% Change

79.50

211.00

210.00

132.50

69.00

RAIGAM SALTERNS

N D B CAPITAL

+ 8.30

HUNTERS

42.30

8.10

672.0042.30

159.98

446.22

3.2%

2.2%

1.6%

6,848

1,208,619

1,372

548

3.7%

51.70

148.00

2.2%

1.93

41.60

8.10

84.96

72.79

CARGILLS

DISTILLERIES 156.00

1.2% 3.47

9,358.10

117.00

JOHN KEELLS HOLDINGS 172,251

ASIAN HOTELS & PROPERTIES

NESTLE LANKA 48,545

1.5%

234195

93,574

8.7%

4.2%CARSON CUMBERBATCH

BUKIT DARAHSRI LANKA TELECOM

COMMERCIAL BANK [V]

DIALOG AXIATA

3.3%

6.8%CEYLON TOBACCO

HNB [V]

AITKEN SPENCE

SAMPATH BANK

DFCC BANK

Turnover

USD ('000)

294.5032.69%

Intraday

Low (LKR)

Turnover

LKR ('000)

215.84

124.79

1.68

40.67

440.00

36,474.95

Intraday

High (LKR)

212.00

0.66

1,504.70

188.00

76.00

151.50

51.50

101.00

141.00

188.80

77.70

116.20

100.00

750.00

1,445.00

2.20

2.30

Today

156.788.18

1.220.06

77.69

1,510.00

779.00

143.00

0.60

566.13

Company

72,780.00

1.24

5,228.17

169,216.55

0.97

% Change

15.51

TEA SMALLHOLDER

KELANI VALLEY

Pre Day

0.00%141.00 8.1%1.21

Volume (mn)% Change

20.15%

+ 20.60 21.24%

141.00

CompanyContribution to

Total T/O

SIERRA CABL

460.00

78.20

2.40

49.50

117.60

+ 0.20

Today

9.09%

0.38%

0.50

2.22%

0.00%

-8.33%

BLUE DIAMONDS 3.80

NAT. DEV. BANK

169,216,548

1,401,135

109.00

189.00

0.1%

0.1%

0.62

1.24

1.21

3.80

131.90

211.80

3.56%1453.00

0.54

0.17

209.90

0.3%

Turnover

(LKR)

3.3%

1.8%

0.9%

Turnover

(LKR)

8.1%

Contribution to

Total T/O

5,712,561

3.5%

-8.00%

169,216,548

36,474,953

18,240,535

72,780,004

68,132,826

0.54

0.05

0.09

3.3% 68,132,826

1,852,878

Volume (mn)

-7.96%

116.40

151.50

51.60

144.00

108.60

1,316.27

1.34

441.90

8.00

144.00

108.00

670.00

100.00

670.00

-8.33%

Close

211.80

440.00

210.60

-13.23%

-9.07%

759.70

141.00

Page | 3.

-

7/30/2019 Daily Trade Journal - 11.12.2012

4/13

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar No Announcements

Yuan 0

Euro 0

Rupee 0

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht Chilaw Finance PLC

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

p

p

p

p

q

p

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) p

Crude Oil (WTI) p

ICE Cotton #2 p

CBOT Wheat q

COMEX Gold q

COMEX Silver q

COMEX Copper q

* Time is as at ET Source: www.bloomberg.com

Australia

1,711.10 -3.30

METALS

ENERGY

Commodity

22,323.9

Units

0

15.7

Proportion

00-Jan-00

00-Jan-00

0.00

0.00

0.11%

0.03%

14.8

Russia

Saudi Arabia

Japan

369.85

USD/t oz.

USD/t oz. -0.21

844.00

-0.75

33.17

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

9,525.3

Value

13,169.9

1,418.6

USD/bbl.

USd/lb.

USd/lb.

AMERICA

-4.75

-0.20%

Change %

-0.56%

-0.62%

0.61%

0.43%

0

-0.19%

0.5

Change

0.07%0.05

0

01:28

14.4

1/0/1900

Change

0.68%

-8.4

03:01

-0.09%

06:19

06:11

06:21

10-Dec

10-Dec

06:06

06:08

Time*

06:21

0.37

Malaysia

4.18

USA

134.59

20.63

2.36

1.56

41.96

India

Currency

166.31

Indicative Rate

11.12.2012

06:20

06:20

0.24%

06:20

Company

1/0/1900

1/0/1900

4.20

34.28

105.19

0

Change %

206.65

China

EU

00-Jan-00

1/0/1900

09-01-2013

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

128.56

0.00

0.21%

5,935.6

Singapore

Switzerland

Thailand

UK

0.66

47.2

1 for 17.777778621

2,613.7

137.71

USd/bu.

73.45

Price

107.99

85.93

USD/bbl.

DPS (LKR)

00-Jan-00

0.00

0.00 0

0

Payment DateXD Date

00-Jan-00

1/0/1900

1/0/1900

00-Jan-00

Description

0.00

0.00

Scrip Dividend 08-01-2013

0

XR Date

00-Jan-00

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

00-Jan-00

0.00

Time*

Page | 4.

-

7/30/2019 Daily Trade Journal - 11.12.2012

5/13

Softlogic Equity Research Page | 5

CSE Announcements

Employee Share Option Schemes:

Disclosures on Related Party Dealings:

Lanka Orix Leasing Company [LOLC : LKR51.6]: The company informs that Mr.Takuma Yamazaki hasresigned as Alternate Director to Mr.Hideo Ichida and Masaaki Kawano with effect from 3

rdDec 2012.

Mr.Hideo Ichida and Masaaki Kawano have resigned as Directors with effect from 10th

Dec 2012 and

Mr.Yuki Oshima and Mr.Harukazu Yamaguchi were as Directors with effect from the same date. Further

Mr. Shin Hamada was appointed as Alternative Director to Mr.Yuki Oshima and Mr.Shinji Yamana was

appointed as Alternative Director to Mr.Harukazu Yamaguchi with effect from 10th

Dec 2012.

Local News

An upward parallel shift on yield curve witnessed: The secondary bond market reflected some level ofactivity yesterday, mainly on the six-year duration as its yields edged up by around 12 basis points to an

intraday high of 13.47% from its opening levels of 13.35%. In line with this, yields on other duration along

the yield curve moved up as well, reflecting an upward parallel shift. Furthermore selling interest on illiquid

shorter maturities was evident above the liquid longer tenures which in turn continued the distortion of the

yield curve. However buying interest on secondary market bills continued, mainly for the 182 day and 364

day bills ahead of this weeks primary auction. The Public Debt Department (PDD) of the Central Bank

announced in total an amount of LKR.12bn on offer, down from its previous weeks offered amoun t of

LKR15.0bn with LKR1.0bn, LKR6.0 bn and LKR5.0 bn being on offer for the 91 day, 182 day and 364 day

maturities respectively. Overnight call money and repo rates remained mostly unchanged to average 10.54%

and 9.64% respectively as money market liquidity remained at a marginal surplus of LKR0.64 bn yesterday.

Central bank refrained from conducting any overnight OMO auctions for a second consecutive day as well.[Source: www.ft.lk]

India may ask Sri Lanka to cut automobile tariffs - report: India is mulling asking Sri Lanka to reduce importduties which had been raised twice last year hitting small car imports and three wheeler vehicles in

particular, a media report said. "India is mulling various options to deal with the situation,"India's The Hindu

newspaper quoted additional commerce secretary Rajeev Kher as saying. "One of the options is to approach

purely diplomatically, and request the Sri Lankan Government because it is a win-win situation if they cut

down the tariff."Small cars made in India and Malaysia had helped improve living standards of Sri Lankans.

The cars also brought billions of rupees in revenues to Sri Lanka's high spending state which runs large

deficits. The report quoted Society of Indian Automobile Manufacturers (SIAM) Director General Vishnu

Mathur as saying that last year out USD6.0 bn of auto exports from India, about USD800 mn worth went intoSri Lanka.

[Source: www.lbo.lk]

Company No. of Shares Stated Capital as at 30th Nov 2012

(LKR)

Commercial Bank [COMB.N: LKR100.0] 741,441 18,006,557,498

Hatton National Bank [HNB.N: LKR141.0] 40,888

Hatton National Bank [HNB.X: LKR109.0] 24,352

John Keells Holdings Voting [JKH: LKR212.0] 67,909 25,922,192,898

Sampath Bank [SAMP: LKR188.2] 65,228 3,559,114,376

12,579,478,000

Company Name Relationship Transaction Quantity Price (LKR) Date

People's Finance [SMLL : LKR34.5] People 's Leasing & Finance [PLC : LKR13.2] Parent Company Purchase 40,610 34.4-34.5 10.12.2012

People's Leasing & Finance [PLC : LKR13.2] People's Bank Parent Company Purchase 472,300 13.2-13.3 07.12.2012

People's Leasing & Finance [PLC : LKR13.2] People's Bank Parent Company Purchase 342,658 13.2-13.3 10.12.2012

-

7/30/2019 Daily Trade Journal - 11.12.2012

6/13

Softlogic Equity Research Page | 6

Fitch affirms HSBC Sri Lanka branch at AAA ; outlook stable : Fitch Ratings Lanka has affirmed HSBC SriLanka Branchs (HSBCSL) national long-term rating at AAA (lka).The outlook is stable. The rating reflects the

financial strength of parent The Hong Kong and Shanghai Banking Corporation Limited (HKSB) given that

HSBCSL is a branch of HKSB and part of the same legal entity as HKSB. Thus, Fitch believes that support from

HKSB would be forthcoming if required, subject to any regulatory constraints on remitting money into Sri

Lanka. HKSB is rated above Sri Lankas Issuer Default Rating (IDR) of BB which has a stable outlook.

HSBCSLs national long-term rating is at the highest end of the national rating scale. A downgrade ofHSBCSLs rating could result from HKSBs rating being downgraded below Sri Lankas IDR. Any changes to

Fitchs expectation of support from HKSB could also be negative for the rating. The affirmation of HSBCSLs

rating follows the downgrade of HKSBs IDR to AA-/Stable from AA/Negative on 7 December 2012.[Source: www.ft.lk]

Sri Lanka credit ceilings served their purpose- Deputy Governor: Credit ceilings imposed on Sri Lanka'sCommercial Banks had served their purpose and were part of the temporary measures to stabilize the

economy, Deputy Central Bank Governor Nandalal Weerasinghe said. In February 2012. Sri Lanka raised

interest rates, imposed an 18% cap on commercial bank credit growth and partially floated the rupee to drag

the monetary system back from a balance of payments crisis. The finance ministry also raised fuel prices to

reduce bank credit taken by state energy utilities which was the main trigger for the monetary system to slip

into a balance of payments crisis. Weerasinghe said the credit ceilings were able to deliver a punch and bring

quick results which would have taken longer if only interest rates had been relied upon. The recovery would

also be quicker he said. In later March 2012 however, the finance ministry also raised taxes on items like

automobiles, amid warnings that it would be an 'economic sanction' imposed on the country, depriving

revenue to the state. Lower revenues worsen credit pressure, forcing interest rates to be kept high longer

than necessary and delay any eventual recovery. Both the International Monetary Fund and LBOs economics

columnist columnist prematurely commended authorities for not imposing trade sanctions unlike in earlier

balance of payments crises when taxes were upped through a midnight gazette. Weerasinghe said especially

the larger banks had space of about 90bn rupees to lend and credit was now lower than the ceiling,

indicating that they could lend if they wanted to. Many small banks which had high growth rates had to

curtail loans. But finance companies which did not face credit ceilings were able to grow their loan books.

But industry officials say the ceiling acted indirectly on finance companies, especially the larger ones, as they

had a practice of borrowing wholesale from banks and lending retail to smaller and sometimes more riskier

customers.[Source : www.lbo.lk]

Com Bank links Sri Lankas first expressway to ATM network : Motorists who use the Southern Expresswaynow have access to Sri Lankas single largest automated cash dispensing network, following the

commissioning by the Commercial Bank of Ceylon [COMB.N : LKR100.0, COMB.X : LKR90.0]of two ATMs on

this popular artery. The Banks two new ATMs at the Canowin Arcade Rest and Recreation complex at

Welipenna became operational immediately after the opening of the complex by His Excellency President

Mahinda Rajapaksa. The ATMs are linked to all other ATMs of Commercial Bank in Sri Lanka, offering a 24-

hour, 365-day facility for cash withdrawals as well as settlement of utility bills and credit card dues.Commercial Bank ATMs also support the networks of MasterCard, Maestro, Cirrus, Visa, Plus, Amex,

Discover and Diners Club, thereby enabling tourists and other visitors using the expressway to Sri Lanka to

withdraw money from their overseas accounts. "We are pleased to provide this important facility to users of

the Southern Expressway,"said Ravi Dias - Managing Director/Chief Executive Officer of Commercial Bank.

"ATMs promote efficiency and productivity, and as the bank which operates the countrys single largest ATM

network, Commercial Bank is best able to serve the thousands of motorists using this route.

[Source : www.island.lk]

Global News

China New Loans Trail Forecasts in Sign of Slower Growth: Chinas new yuan loans trailed forecasts lastmonth, restraining the pace of recovery in the worlds second-biggest economy after a seven-quarterslowdown. Banks extended Yuan 522.9 bn (USD84 bn) of local- currency loans, the Peoples Bank of China

said today. That compares with a Yuan 550 bn median estimate in a Bloomberg News survey of 30

economists and Yuan 562.2 bn the same month last year. M2, the broadest measure of money supply, rose

-

7/30/2019 Daily Trade Journal - 11.12.2012

7/13

Softlogic Equity Research Page | 7

13.9% from a year earlier, below the median estimate of 14.1%.Todays data and Novembers weaker-than-

expected gains in exports contrast with industrial output and retail sales figures that both exceeded analyst

forecasts. Top economic officials may meet this month to map out policies for 2013 including a growth

target indicating the pace that the Communist Partys new leadership, headed by Xi Jinping, will tolerate.

The data point to a more subdued recovery going forward, said Dariusz Kowalczyk, senior economist and

strategist at Credit Agricole CIB in Hong Kong. The government seems comfortable with the pace of

economic growth and funding may expand more slowly this quarter, he said.[Source: www.bloomberg.com]

India Anti-Inflation Dividend From Retail Seen Delayed: Indias move to open its retail industry to theworlds biggest operators may take years to achieve the levels of investment that will reduce inflation, as

infrastructure gaps restrain store expansions. Prime Minister Manmohan Singhs government last week won

parliamentary endorsement for its September decision to allow foreign direct investment in supermarkets, a

move it says can help lower food prices should retailers like Wal-Mart-Store Inc. (WMT) and Carrefour SA

build warehouses and cold storage facilities to improve the supply chain. Overseas retailers will still be beset

by congested roads, erratic power supplies and an array of taxes that hamper the movement of goods

between 28 states. The likelihood that benefits from the retail opening will be delayed reinforces the need

for deeper policy changes to address transportation and energy bottlenecks that are handicapping growth.

It will take time for all the feasibility studies to be done for investment to come in , said Robert Prior -

Wandesforde, an economist in Singapore at Credit Suisse Group AG who has covered the Indian economy for

almost seven years. One shouldnt expect to see any effects for two years or so and even then it will be very

gradual. The nations benchmark BSE India Sensitive Index (SENSEX) has risen 3.9% in the past month,

holding near a 19-month high on speculation the government will take more steps to boost growth and

investment.[Source: www.bloomberg.com]

German Investor Confidence Jumps to 7-Month High: German investor confidence jumped more thaneconomists forecast to a seven-month high in December on speculation Europes largest economy will

gather momentum next year. The ZEW Center for European Economic Research in Mannheim said its index

of investor and analyst expectations, which aims to predict economic developments six months in advance,climbed to 6.9 from minus 15.7 in November. Economists predicted a gain to minus 11.5, according to the

median of 38 estimates in a Bloomberg News survey. The German economy will contract this quarter and

stagnate in the first three months of next year as the sovereign debt crisis curbs demand for its goods in the

euro area, the Bundesbank forecast last week. Still, the benchmark DAX share index has rallied more than 17

percent since the European Central Bank pledged on July 26 to save the euro and unveiled an unlimited

bond-purchase program. Business confidence unexpectedly rose in November.[Source: www.bloomberg.com]

-

7/30/2019 Daily Trade Journal - 11.12.2012

8/13

Softlogic Equity Research Page | 8

Daily Stock Movements

Ticker Counter Open High Low Close Trades Volume Turnover

AAF -N-0000 ASIA ASSET 2.30 2.40 2.30 2.40 2 2 5

AAIC-N-0000 ASIAN ALLIANCE 85.00 85.00 83.50 83.60 18 4,651 389,985

ABAN-N-0000 ABANS 90.00 92.00 88.00 88.90 24 6,592 585,776

ACAP-N-0000 ASIA CAPITAL 30.00 30.00 30.00 30.00 5 1,900 57,000ACL -N-0000 ACL 66.00 66.00 66.00 66.00 4 1,000 66,000

ACME-N-0000 ACME 13.80 13.90 13.30 13.30 6 3,400 45,430

AEL -N-0000 ACCESS ENG SL 17.50 17.50 16.60 16.80 18 16,164 271,503

AFSL-N-0000 ABANS FINANCIAL 0.00 0.00 0.00 38.40 0 0 0

AGAL-N-0000 AGALAWATTE 0.00 0.00 0.00 30.80 0 0 0

AGST-N-0000 AGSTARFERTILIZER 5.80 5.80 5.80 5.80 6 1,870 10,846

AGST-X-0000 AGSTARFERTILIZER[NON VOTING] 0.00 0.00 0.00 15.00 0 0 0

AHPL-N-0000 AHOT PROPERTIES 76.00 79.50 76.00 77.70 5 1,000 77,694

AHUN-N-0000 A.SPEN.HOT.HOLD. 71.00 73.20 71.00 71.00 3 489 34,730

ALLI-N-0000 ALLIANCE 711.00 711.00 711.00 711.00 1 2 1,422

ALUF-N-0000 ALUFAB 22.50 22.50 21.00 21.90 20 5,576 119,200

AMCL-N-0000 CAPITAL LEASING 0.00 0.00 0.00 22.40 0 0 0

AMF -N-0000 AMF CO LTD 0.00 0.00 0.00 335.00 0 0 0

AMSL-N-0000 ASIRI SURG 9.00 9.00 9.00 9.00 13 86,129 775,161

APLA-N-0000 ACL PLASTICS 0.00 0.00 0.00 90.00 0 0 0ARPI-N-0000 ARPICO 0.00 0.00 0.00 80.90 0 0 0

ASCO-N-0000 ASCOT HOLDINGS 189.50 189.50 189.50 189.50 2 20,000 3,790,000

ASHA-N-0000 ASIRI CENTRAL 0.00 0.00 0.00 254.00 0 0 0

ASHO-N-0000 LANKA ASHOK 1712.10 1712.10 1712.10 1712.10 1 1 1,712

ASIR-N-0000 ASIRI 11.10 11.10 10.90 11.00 12 65,455 724,004

ASIY-N-0000 ASIA SIYAKA 4.90 4.90 4.90 4.90 3 1,500 7,350

ASPH-N-0000 INDUSTRIAL ASPH. 224.90 238.80 216.00 216.10 16 887 191,893

ATL -N-0000 AMANA TAKAFUL 1.60 1.60 1.50 1.50 35 132,432 199,698

AUTO-N-0000 AUTODROME 0.00 0.00 0.00 774.30 0 0 0

BALA-N-0000 BALANGODA 36.00 36.90 34.00 34.00 9 2,103 75,613

BBH -N-0000 BROWNS BEACH 17.70 18.50 17.50 18.00 34 47,542 845,257

BERU-N-0000 BERUWALA RESORTS 2.40 2.40 2.30 2.40 19 6,075 14,480

BFL -N-0000 BAIRAHA FARMS 144.60 145.80 144.60 145.80 5 1,100 160,265

BHR -N-0000 RIVERINA HOTELS 0.00 0.00 0.00 96.70 0 0 0

BIL -N-0000 BROWNS INVSTMNTS 3.70 3.70 3.60 3.60 12 83,103 299,171BINN-N-0000 BERUWELA WALKINN 0.00 0.00 0.00 69.90 0 0 0

BLI -N-0000 BIMPUTH FINANCE 21.20 22.50 21.20 22.50 5 506 10,735

BLUE-N-0000 BLUE DIAMONDS 3.80 3.80 3.60 3.80 44 504,325 1,852,878

BLUE-X-0000 BLUE DIAMONDS[NON VOTING] 1.60 1.70 1.60 1.60 22 81,311 130,270

BOGA-N-0000 BOGALA GRAPHITE 21.20 21.20 21.00 21.20 9 2,412 51,074

BOPL-N-0000 BOGAWANTALAWA 11.90 11.90 11.70 11.70 4 900 10,550

BREW-N-0000 CEYLON BEVERAGE 420.00 420.00 420.00 420.00 1 1 420

BRWN-N-0000 BROWNS 118.00 118.10 117.80 117.90 10 6,111 720,545

BUKI-N-0000 BUKIT DARAH 670.00 672.00 670.00 670.00 9 234 156,784

CABO-N-0000 CARGO BOAT 78.10 81.60 78.10 81.60 2 2 160

CALF-N-0000 CAL FINANCE 18.50 18.50 17.00 17.60 60 82,568 1,414,316

CARE-N-0000 PRINTCARE PLC 0.00 0.00 0.00 29.10 0 0 0

CARG-N-0000 CARGILLS 148.00 148.00 144.00 144.00 7 866 124,785

CARS-N-0000 CARSONS 441.90 441.90 440.00 440.00 11 562 247,499

CCS -N-0000 COLD STORES 117.50 118.00 116.00 116.20 7 582 67,975

CDB -N-0000 CDB 40.00 40.00 40.00 40.00 1 500 20,000

CDB -X-0000 CDB[NON VOTING] 29.10 31.70 29.00 29.00 6 50,002 1,450,091

CDIC-N-0000 N D B CAPITAL 460.10 460.10 460.00 460.00 2 500 230,010

CERA-N-0000 LANKA CERAMIC 0.00 0.00 0.00 63.40 0 0 0

CFI -N-0000 CFI 105.00 118.90 105.00 117.60 2 1,090 128,211

CFIN-N-0000 CENTRAL FINANCE 159.10 162.00 159.10 160.00 42 101,665 16,257,423

CFL -N-0000 CHILAW FINANCE 14.00 14.10 13.80 14.10 11 17,678 245,808

CFLB-N-0000 FORT LAND 32.00 32.00 31.90 32.00 10 27,970 895,035

CFT -N-0000 CFT 5.40 5.40 5.10 5.20 21 80,109 410,631

CFVF-N-0000 FIRST CAPITAL 11.40 11.40 11.20 11.20 7 2,300 25,910

CHL -N-0000 DURDANS 91.00 91.00 91.00 91.00 2 200 18,200

CHL -X-0000 DURDANS[NON VOTING] 0.00 0.00 0.00 70.00 0 0 0

CHMX-N-0000 CHEMANEX 81.90 82.00 76.10 79.10 4 205 16,210

CHOT-N-0000 HOTELS CORP. 20.10 21.60 19.80 20.30 113 11,370 230,542

CHOU-N-0000 CITY HOUSING 15.20 15.20 15.00 15.00 12 11,654 175,275

CIC -N-0000 CIC 65.00 65.00 65.00 65.00 2 1,000 65,000CIC -X-0000 CIC[NON VOTING] 0.00 0.00 0.00 55.10 0 0 0

CIFL-N-0000 CIFL 3.80 3.90 3.70 3.70 29 51,862 196,390

CIND-N-0000 CENTRAL IND. 0.00 0.00 0.00 66.20 0 0 0

CINS-N-0000 CEYLINCO INS. 780.00 780.40 780.00 780.20 6 3,276 2,555,360

CINS-X-0000 CEYLINCO INS.[NON VOTING] 325.00 325.00 325.00 325.00 2 103 33,475

-

7/30/2019 Daily Trade Journal - 11.12.2012

9/13

Softlogic Equity Research Page | 9

Ticker Counter Open High Low Close Trades Volume Turnover

CINV-N-0000 CEYLON INV. 78.00 78.00 77.00 77.00 7 4,800 374,100

CIT -N-0000 CIT 0.00 0.00 0.00 129.00 0 0 0

CITK-N-0000 CITRUS KALPITIYA 6.30 6.30 6.00 6.10 24 30,836 188,111

CITW-N-0000 CITRUS WASKADUWA 6.00 6.00 6.00 6.00 9 4,079 24,474

CLC -N-0000 COMM LEASE & FIN 3.80 3.80 3.60 3.60 5 751 2,704

CLND-N-0000 COLOMBO LAND 33.10 34.00 33.00 33.10 10 9,753 322,651

CLPL-N-0000 CEYLON LEATHER 0.00 0.00 0.00 81.00 0 0 0

CLPL-W-0012 CEYLON LEATHER[WARRANTS] 0.00 0.00 0.00 1.80 0 0 0

CLPL-W-0013 CEYLON LEATHER[WARRANTS] 6.50 6.60 6.50 6.50 3 500 3,260

CLPL-W-0014 CEYLON LEATHER[WARRANTS] 5.90 5.90 5.90 5.90 1 1 6

COCO-N-0000 RENUKA SHAW 34.90 34.90 34.50 34.50 3 10,700 369,280

COCO-X-0000 RENUKA SHAW[NON VOTING] 27.10 28.00 27.10 28.00 2 54 1,471

COCR-N-0000 COM.CREDIT 14.90 15.10 14.90 14.90 33 146,361 2,184,051

COLO-N-0000 COLONIAL MTR 150.20 155.00 150.20 155.00 3 18,500 2,865,100

COMB-N-0000 COMMERCIAL BANK 100.00 101.00 100.00 100.00 35 93,574 9,358,100

COMB-P-0005 COMMERCIAL BANK 0.00 0.00 0.00 9.00 0 0 0

COMB-X-0000 COMMERCIAL BANK[NON VOTING] 89.90 90.00 89.80 90.00 25 28,451 2,559,892

COMD-N-0000 COMMERCIAL DEV. 63.10 66.80 63.00 65.40 10 1,300 83,800

CONN-N-0000 AMAYA LEISURE 0.00 0.00 0.00 80.00 0 0 0

CPRT-N-0000 CEYLON PRINTERS 0.00 0.00 0.00 1950.00 0 0 0

CRL -N-0000 SOFTLOGIC FIN 25.10 25.10 24.90 24.90 4 11,054 276,350

CSD -N-0000 SEYLAN DEVTS 7.90 8.10 7.90 8.00 21 34,612 276,807

CSEC-N-0000 DUNAMIS CAPITAL 12.60 12.60 12.60 12.60 1 50 630

CSF -N-0000 NATION LANKA 8.60 8.70 8.50 8.60 56 183,576 1,583,651

CSF -W-0021 NATION LANKA[WARRANTS] 1.80 1.90 1.80 1.90 7 38,000 68,750

CTBL-N-0000 CEYLON TEA BRKRS 5.40 5.60 5.40 5.60 28 30,487 165,860

CTC -N-0000 CEYLON TOBACCO 750.00 779.00 750.00 759.70 83 6,848 5,228,167

CTCE-N-0000 AVIVA N D B 0.00 0.00 0.00 318.00 0 0 0

CTEA-N-0000 TEA SERVICES 650.00 650.00 650.00 650.00 2 105 68,250

CTHR-N-0000 C T HOLDINGS 120.20 120.30 120.00 120.00 12 2,744 329,499

CTLD-N-0000 C T LAND 24.00 24.70 24.00 24.20 11 10,013 242,657

CWM -N-0000 C.W.MACKIE 0.00 0.00 0.00 72.00 0 0 0

DFCC-N-0000 DFCC BANK 108.00 109.00 108.00 108.60 9 1,591 172,000

DIAL-N-0000 DIALOG 8.00 8.10 8.00 8.10 23 26,669 215,839

DIMO-N-0000 DIMO 573.10 575.00 570.00 573.00 15 779 445,665

DIPD-N-0000 DIPPED PRODUCTS 103.00 103.00 103.00 103.00 2 960 98,880

DIST-N-0000 DISTILLERIES 154.90 156.00 151.50 151.50 8 548 84,960

DOCK-N-0000 DOCKYARD 210.00 212.90 209.00 209.90 31 86,887 18,240,535DPL -N-0000 DANKOTUWA PORCEL 14.20 14.20 14.00 14.10 14 10,050 142,107

EAST-N-0000 EAST WEST 13.10 13.80 13.10 13.50 9 18,700 246,900

EBCR-N-0000 E B CREASY 1099.00 1100.00 1099.00 1100.00 3 111 122,000

ECL -N-0000 E - CHANNELLING 5.30 5.40 5.20 5.40 18 117,011 620,068

EDEN-N-0000 EDEN HOTEL LANKA 34.20 34.20 34.20 34.20 3 2,812 96,170

ELPL-N-0000 ELPITIYA 18.00 18.00 16.70 16.80 16 3,019 50,890

EMER-N-0000 EASTERN MERCHANT 10.00 10.00 10.00 10.00 1 3,550 35,500

EQIT-N-0000 EQUITY 0.00 0.00 0.00 34.50 0 0 0

ESL -N-0000 ENTRUST SEC 16.40 16.40 16.10 16.20 5 6,000 96,962

ETWO-N-0000 EQUITY TWO PLC 27.00 27.00 27.00 27.00 2 1,500 40,500

EXPO-N-0000 EXPOLANKA 6.80 7.00 6.70 6.90 48 259,192 1,773,026

FLCH-N-0000 FREE LANKA 2.30 2.40 2.30 2.40 49 348,395 814,350

GEST-N-0000 GESTETNER 0.00 0.00 0.00 160.00 0 0 0

GHLL-N-0000 GALADARI 13.50 13.50 13.00 13.10 19 2,135 28,086

GLAS-N-0000 PIRAMAL GLASS 5.80 5.90 5.80 5.90 27 176,893 1,027,059GOOD-N-0000 GOOD HOPE 0.00 0.00 0.00 1190.00 0 0 0

GRAN-N-0000 GRAIN ELEVATORS 53.00 54.00 52.80 53.70 44 131,248 6,982,283

GREG-N-0000 ENVI. RESOURCES 14.90 15.00 14.70 14.70 25 37,061 545,507

GREG-P-0002 ENVI. RESOURCES 0.00 0.00 0.00 0.00 0 0 0

GREG-W-0002 ENVI. RESOURCES[WARRANTS] 0.00 0.00 0.00 2.90 0 0 0

GREG-W-0003 ENVI. RESOURCES[WARRANTS] 3.50 3.50 3.40 3.40 30 51,657 178,036

GREG-W-0006 ENVI. RESOURCES[WARRANTS] 4.00 4.10 3.90 4.00 25 31,328 122,362

GSF -N-0000 G S FINANCE 0.00 0.00 0.00 550.10 0 0 0

GUAR-N-0000 CEYLON GUARDIAN 178.00 178.00 168.50 170.00 6 224 38,195

HAPU-N-0000 HAPUGASTENNE 41.50 41.50 41.10 41.20 2 15 619

HARI-N-0000 HARISCHANDRA 0.00 0.00 0.00 2010.10 0 0 0

HASU-N-0000 HNB ASSURANCE 47.40 47.40 47.00 47.00 8 1,800 84,783

HAYC-N-0000 HAYCARB 169.00 170.00 169.00 169.80 6 294 49,884

HAYL-N-0000 HAYLEYS 290.00 290.00 280.00 285.00 12 2,754 784,400

HDEV-N-0000 HOTEL DEVELOPERS 0.00 0.00 0.00 94.80 0 0 0HDFC-N-0000 HDFC 47.40 47.70 47.40 47.40 3 106 5,026

HEXP-N-0000 HAYLEYS FIBRE 23.30 23.30 23.20 23.20 2 40 929

HHL -N-0000 HEMAS HOLDINGS 26.40 26.40 26.00 26.20 6 5,365 140,490

HNB -N-0000 HNB 141.00 143.00 141.00 141.00 22 1,208,619 169,216,548

HNB -X-0000 HNB[NON VOTING] 109.10 109.10 109.00 109.00 11 5,743 625,987

HOPL-N-0000 HORANA 23.00 23.50 22.00 22.10 13 2,889 63,879

-

7/30/2019 Daily Trade Journal - 11.12.2012

10/13

Softlogic Equity Research Page | 10

Ticker Counter Open High Low Close Trades Volume Turnover

HPFL-N-0000 HYDRO POWER 6.70 6.90 6.70 6.90 3 1,201 8,047

HPWR-N-0000 HEMAS POWER 21.00 21.00 20.10 20.50 8 6,400 131,400

HSIG-N-0000 HOTEL SIGIRIYA 79.50 79.50 79.20 79.30 7 265 21,013

HUEJ-N-0000 HUEJAY 71.10 79.00 71.00 79.00 7 579 41,123

HUNA-N-0000 HUNAS FALLS 0.00 0.00 0.00 61.80 0 0 0

HUNT-N-0000 HUNTERS 336.00 336.00 215.00 294.50 23 681 180,746

HVA -N-0000 HVA FOODS 11.40 11.50 11.10 11.20 39 22,125 248,695

IDL -N-0000 INFRASTRUCTURE 134.00 135.00 134.00 135.00 5 40 5,389

INDO-N-0000 INDO MALAY 0.00 0.00 0.00 1495.00 0 0 0

JFIN-N-0000 FINLAYS COLOMBO 0.00 0.00 0.00 225.00 0 0 0

JINS-N-0000 JANASHAKTHI INS. 10.20 10.30 10.20 10.30 7 16,580 169,364

JKH -N-0000 JKH 211.80 212.00 210.60 211.80 44 172,251 36,474,953

JKL -N-0000 JOHN KEELLS 60.50 60.50 60.50 60.50 2 200 12,100

KAHA-N-0000 KAHAWATTE 32.00 33.50 32.00 32.70 6 2,025 66,316

KAPI-N-0000 MTD WALKERS 24.00 24.00 24.00 24.00 1 500 12,000

KCAB-N-0000 KELANI CABLES 69.00 69.00 69.00 69.00 1 1 69

KDL -N-0000 KELSEY 14.60 14.60 14.60 14.60 1 2 29

KFP -N-0000 KEELLS FOOD 0.00 0.00 0.00 71.00 0 0 0

KGAL-N-0000 KEGALLE 101.00 101.00 101.00 101.00 2 157 15,857

KHC -N-0000 KANDY HOTELS 9.20 9.20 9.00 9.00 8 40 363

KHC -P-0002 KANDY HOTELS 0.00 0.00 0.00 0.00 0 0 0

KHL -N-0000 KEELLS HOTELS 13.50 13.50 13.20 13.30 10 230,921 3,070,725

KOTA-N-0000 KOTAGALA 69.40 69.40 69.40 69.40 4 300 20,820

KURU-N-0000 KURUWITA TEXTILE 19.90 19.90 19.90 19.90 1 1 20

KVAL-N-0000 KELANI VALLEY 86.00 86.00 77.30 78.20 20 13,344 1,043,704

KZOO-N-0000 KALAMAZOO 2295.00 2295.00 2295.00 2295.00 1 5 11,475

LALU-N-0000 LANKA ALUMINIUM 32.20 33.30 31.00 31.10 7 1,201 38,623

LAMB-N-0000 KOTMALE HOLDINGS 0.00 0.00 0.00 37.00 0 0 0

LCEM-N-0000 LANKA CEMENT 8.70 8.70 8.30 8.50 5 2,433 20,795

LCEY-N-0000 LANKEM CEYLON 146.30 146.30 146.30 146.30 1 1 146

LDEV-N-0000 LANKEM DEV. 6.90 6.90 6.70 6.70 19 16,975 114,230

LFIN-N-0000 LB FINANCE 0.00 0.00 0.00 149.50 0 0 0

LGL -N-0000 LAUGFS GAS 23.50 23.90 23.00 23.60 17 6,900 161,850

LGL -X-0000 LAUGFS GAS[NON VOTING] 15.70 16.10 15.70 16.00 46 38,855 616,155

LHCL-N-0000 LANKA HOSPITALS 36.50 39.00 36.50 37.50 18 8,710 324,964

LHL -N-0000 LIGHTHOUSE HOTEL 41.30 41.30 41.20 41.20 3 100 4,121

LIOC-N-0000 LANKA IOC 20.00 20.50 19.80 20.50 79 241,207 4,869,081

LION-N-0000 LION BREWERY 260.20 273.00 256.00 273.00 6 1,703 442,806LITE-N-0000 LAXAPANA 6.60 7.00 6.60 7.00 8 6,957 46,003

LLUB-N-0000 CHEVRON 190.20 195.00 190.20 194.50 17 9,231 1,784,505

LMF -N-0000 LMF 90.00 90.00 88.00 88.00 5 5,049 449,312

LOFC-N-0000 LANKAORIXFINANCE 3.40 3.50 3.40 3.50 7 5,670 19,455

LOLC-N-0000 LOLC 51.50 51.70 51.50 51.60 14 8,661 446,218

LPRT-N-0000 LAKE HOUSE PRIN. 0.00 0.00 0.00 95.00 0 0 0

LVEN-N-0000 LANKA VENTURES 31.00 31.00 31.00 31.00 1 100 3,100

LWL -N-0000 LANKA WALLTILE 59.00 59.00 59.00 59.00 3 730 43,070

MADU-N-0000 MADULSIMA 0.00 0.00 0.00 16.20 0 0 0

MAL -N-0000 MALWATTE 4.60 4.70 4.50 4.60 26 1,241,888 5,712,561

MAL -X-0000 MALWATTE[NON VOTING] 0.00 0.00 0.00 4.10 0 0 0

MARA-N-0000 MARAWILA RESORTS 7.00 7.20 7.00 7.00 8 30,180 211,284

MASK-N-0000 MASKELIYA 11.60 11.90 11.60 11.70 5 1,535 18,079

MBSL-N-0000 MERCHANT BANK 19.70 19.90 19.60 19.70 8 6,504 128,139

MEL -N-0000 MACKWOODS ENERGY 0.00 0.00 0.00 12.30 0 0 0MERC-N-0000 MERCANTILE INV 0.00 0.00 0.00 2200.00 0 0 0

MFL -N-0000 MULTI FINANCE 0.00 0.00 0.00 28.00 0 0 0

MGT -N-0000 HAYLEYS - MGT 0.00 0.00 0.00 10.00 0 0 0

MIRA-N-0000 MIRAMAR 0.00 0.00 0.00 94.70 0 0 0

MORI-N-0000 MORISONS 0.00 0.00 0.00 180.00 0 0 0

MORI-X-0000 MORISONS[NON VOTING] 0.00 0.00 0.00 107.00 0 0 0

MPRH-N-0000 MET. RES. HOL. 20.70 21.00 20.50 20.90 33 13,200 276,293

MRH -N-0000 MAHAWELI REACH 0.00 0.00 0.00 19.20 0 0 0

MSL -N-0000 MERC. SHIPPING 0.00 0.00 0.00 165.00 0 0 0

MULL-N-0000 MULLERS 1.60 1.60 1.60 1.60 5 48,200 77,120

NAMU-N-0000 NAMUNUKULA 71.50 71.50 71.50 71.50 4 2,290 163,735

NAVF-U-0000 NAMAL ACUITY VF 0.00 0.00 0.00 67.90 0 0 0

NDB -N-0000 NAT. DEV. BANK 133.00 133.00 131.10 131.90 40 538,775 68,132,826

NEH -N-0000 NUWARA ELIYA 0.00 0.00 0.00 1335.00 0 0 0

NEST-N-0000 NESTLE 1454.00 1510.00 1445.00 1504.70 88 48,545 72,780,004NHL -N-0000 NAWALOKA 3.10 3.10 3.00 3.10 8 18,920 56,782

NIFL-N-0000 NANDA FINANCE 6.90 6.90 6.80 6.80 11 12,300 83,690

NTB -N-0000 NATIONS TRUST 53.20 54.00 53.20 53.50 20 15,810 845,675

ODEL-N-0000 ODEL PLC 19.30 19.60 19.30 19.50 8 3,992 78,036

OFEQ-N-0000 OFFICE EQUIPMENT 0.00 0.00 0.00 3400.00 0 0 0

OGL -N-0000 ORIENT GARMENTS 13.50 13.50 13.50 13.50 2 539 7,277

-

7/30/2019 Daily Trade Journal - 11.12.2012

11/13

Softlogic Equity Research Page | 11

Ticker Counter Open High Low Close Trades Volume Turnover

ONAL-N-0000 ON'ALLY 52.20 59.00 52.20 55.90 8 5,100 284,848

ORIN-N-0000 ORIENT FINANCE 0.00 0.00 0.00 15.40 0 0 0

OSEA-N-0000 OVERSEAS REALTY 13.90 13.90 13.90 13.90 5 2,200 30,580

PABC-N-0000 PAN ASIA 18.20 18.30 18.00 18.20 20 45,300 823,120

PALM-N-0000 PALM GARDEN HOTL 140.00 140.00 140.00 140.00 4 230 32,200

PAP -N-0000 PANASIAN POWER 2.40 2.50 2.40 2.50 20 38,663 93,291

PARA-N-0000 PARAGON 1190.00 1200.00 1190.00 1195.50 15 21 25,100

PARQ-N-0000 SWISSTEK 12.70 12.70 12.50 12.70 9 10,784 136,640

PCH -N-0000 PC HOUSE 5.10 5.10 5.00 5.00 36 60,213 301,119

PCHH-N-0000 PCH HOLDINGS 0.00 0.00 0.00 7.00 0 0 0

PCP -N-0000 PC PHARMA 0.00 0.00 0.00 10.30 0 0 0

PDL -N-0000 PDL 41.00 41.90 41.00 41.90 4 1,249 51,299

PEG -N-0000 PEGASUS HOTELS 37.50 39.00 37.00 38.10 34 19,795 768,125

PHAR-N-0000 COL PHARMACY 460.00 460.10 458.00 458.70 7 356 163,360

PLC -N-0000 PEOPLES LEASING 13.40 13.50 13.20 13.30 169 444,385 5,901,605

PMB -N-0000 PEOPLE'S MERCH 14.80 14.80 14.80 14.80 6 3,490 51,652

RAL -N-0000 RENUKA AGRI 4.40 4.40 4.30 4.40 15 25,640 112,706

RCL -N-0000 ROYAL CERAMIC 90.00 91.90 90.00 91.90 5 340 30,790

REEF-N-0000 CITRUS LEISURE 24.50 24.60 24.00 24.00 12 4,300 104,378

REEF-W-0017 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 32.90 0 0 0

REEF-W-0018 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0

REEF-W-0019 CITRUS LEISURE[WARRANTS] 3.80 4.00 3.80 3.90 19 16,575 64,545

REG -N-0000 REGNIS 58.60 58.60 58.60 58.60 4 900 52,740

RENU-N-0000 RENUKA CITY HOT. 235.00 235.00 226.00 226.00 3 70 15,950

REXP-N-0000 RICH PIERIS EXP 0.00 0.00 0.00 32.20 0 0 0

RFL -N-0000 RAMBODA FALLS 15.00 15.80 14.60 14.60 8 8,295 127,463

RGEM-N-0000 RADIANT GEMS 0.00 0.00 0.00 55.00 0 0 0

RHL -N-0000 RENUKA HOLDINGS 38.00 38.00 34.30 34.70 21 13,190 456,045

RHL -X-0000 RENUKA HOLDINGS[NON VOTING] 0.00 0.00 0.00 25.00 0 0 0

RHTL-N-0000 FORTRESS RESORTS 15.50 15.50 15.00 15.00 14 20,793 313,954

RICH-N-0000 RICHARD PIERIS 7.60 7.60 7.40 7.50 52 118,550 890,181

RPBH-N-0000 ROYAL PALMS 0.00 0.00 0.00 45.30 0 0 0

RWSL-N-0000 RAIGAM SALTERNS 2.50 2.50 2.30 2.30 8 1,101 2,533

SAMP-N-0000 SAMPATH 189.00 189.00 188.00 188.80 22 10,575 1,994,376

SCAP-N-0000 SOFTLOGIC CAP 0.00 0.00 0.00 6.70 0 0 0

SDB -N-0000 SANASA DEV. BANK 76.00 77.00 76.00 76.00 36 5,293 402,892

SELI-N-0000 SELINSING 0.00 0.00 0.00 1102.00 0 0 0

SEMB-N-0000 S M B LEASING 1.00 1.00 0.90 0.90 12 51,069 45,984SEMB-W-0015 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.70 0 0 0

SEMB-W-0016 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0

SEMB-X-0000 S M B LEASING[NON VOTING] 0.30 0.40 0.30 0.40 7 21,611 6,583

SERV-N-0000 HOTEL SERVICES 16.70 16.70 16.50 16.60 10 37,490 625,640

SEYB-N-0000 SEYLAN BANK 55.60 55.60 55.60 55.60 3 1,403 78,007

SEYB-X-0000 SEYLAN BANK[NON VOTING] 34.10 34.10 34.00 34.00 13 4,715 160,348

SFCL-N-0000 SENKADAGALA 0.00 0.00 0.00 50.00 0 0 0

SFIN-N-0000 SINGER FINANCE 13.40 13.40 13.10 13.10 2 2,100 27,540

SFL -N-0000 SINHAPUTHRA FIN 0.00 0.00 0.00 88.00 0 0 0

SFS -N-0000 SWARNAMAHAL FIN 3.00 3.00 2.80 2.90 25 47,001 135,503

SHAL-N-0000 SHALIMAR 0.00 0.00 0.00 1000.00 0 0 0

SHAW-N-0000 SHAW WALLACE 0.00 0.00 0.00 265.00 0 0 0

SHL -N-0000 SOFTLOGIC 10.30 10.30 10.00 10.10 11 5,873 59,300

SHOT-N-0000 SERENDIB HOTELS 23.00 23.00 23.00 23.00 3 4,375 100,625

SHOT-X-0000 SERENDIB HOTELS[NON VOTING] 18.00 18.00 17.50 17.70 4 20,113 351,981SIGV-N-0000 SIGIRIYA VILLAGE 66.00 66.00 66.00 66.00 1 46 3,036

SIL -N-0000 SAMSON INTERNAT. 80.00 80.00 80.00 80.00 2 109 8,720

SING-N-0000 SINGALANKA 89.80 89.80 89.80 89.80 1 100 8,980

SINI-N-0000 SINGER IND. 139.00 143.90 134.60 134.70 6 500 69,154

SINS-N-0000 SINGER SRI LANKA 0.00 0.00 0.00 99.80 0 0 0

SIRA-N-0000 SIERRA CABL 2.40 2.40 2.20 2.20 65 622,951 1,401,135

SLND-N-0000 SERENDIB LAND 0.00 0.00 0.00 1391.70 0 0 0

SLTL-N-0000 SLT 41.60 42.30 41.60 42.30 2 195 8,179

SMLL-N-0000 PEOPLE'S FIN 34.50 34.50 34.50 34.50 22 28,626 987,597

SMLL-W-0020 PEOPLE'S FIN[WARRANTS] 0.00 0.00 0.00 3.70 0 0 0

SMOT-N-0000 SATHOSA MOTORS 0.00 0.00 0.00 184.00 0 0 0

SOY -N-0000 CONVENIENCE FOOD 131.10 135.00 131.00 135.00 3 42 5,544

SPEN-N-0000 AITKEN SPENCE 117.00 117.00 116.20 116.40 17 1,372 159,983

STAF-N-0000 DOLPHIN HOTELS 32.00 32.60 32.00 32.60 7 2,191 70,957

SUGA-N-0000 PELWATTE 0.00 0.00 0.00 23.50 0 0 0SUN -N-0000 SUNSHINE HOLDING 28.00 28.00 28.00 28.00 3 12,250 343,000

SWAD-N-0000 SWADESHI 0.00 0.00 0.00 8200.00 0 0 0

TAFL-N-0000 THREE ACRE FARMS 47.00 47.00 45.20 45.70 48 15,521 709,417

TAJ -N-0000 TAJ LANKA 29.80 29.80 29.10 29.20 11 6,660 194,188

TANG-N-0000 TANGERINE 0.00 0.00 0.00 66.60 0 0 0

TAP -N-0000 TAPROBANE 0.00 0.00 0.00 4.70 0 0 0

-

7/30/2019 Daily Trade Journal - 11.12.2012

12/13

Softlogic Equity Research Page | 12

Ticker Counter Open High Low Close Trades Volume Turnover

TESS-N-0000 TESS AGRO 2.20 2.20 2.10 2.20 19 206,702 453,744

TFC -N-0000 THE FINANCE CO. 16.70 17.00 16.30 17.00 10 2,760 45,665

TFC -X-0000 THE FINANCE CO.[NON VOTING] 5.30 5.40 5.10 5.20 7 14,080 72,544

TFIL-N-0000 TRADE FINANCE 11.30 11.60 11.10 11.20 8 4,770 53,709

TILE-N-0000 LANKA FLOORTILES 62.50 63.00 60.00 60.00 4 207 12,780

TJL -N-0000 TEXTURED JERSEY 8.50 8.70 8.40 8.60 33 79,068 672,866

TKYO-N-0000 TOKYO CEMENT 26.50 27.00 26.40 26.90 6 1,000 26,478

TKYO-X-0000 TOKYO CEMENT[NON VOTING] 19.20 19.20 19.00 19.10 20 18,072 345,925

TPL -N-0000 TALAWAKELLE 23.40 24.80 22.00 22.60 9 2,505 56,493

TRAN-N-0000 TRANS ASIA 70.00 70.00 69.00 69.00 7 247 17,240

TSML-N-0000 TEA SMALLHOLDER 49.50 49.50 49.50 49.50 1 2 99

TWOD-N-0000 TOUCHWOOD 8.80 8.80 8.60 8.70 44 64,727 564,208

TYRE-N-0000 KELANI TYRES 34.00 34.50 34.00 34.10 8 500 17,038

UAL -N-0000 UNION ASSURANCE 87.50 87.50 85.00 85.00 2 110 9,375

UBC -N-0000 UNION BANK 13.00 13.10 13.00 13.00 55 9,602 125,251

UCAR-N-0000 UNION CHEMICALS 448.00 450.00 446.50 446.50 3 34 15,228

UDPL-N-0000 UDAPUSSELLAWA 30.00 30.00 30.00 30.00 1 1 30

UML -N-0000 UNITED MOTORS 88.70 90.00 88.70 89.00 14 5,193 462,163

VANI-N-0000 VANIK INCORP LTD 0.00 0.00 0.00 0.80 0 0 0

VANI-X-0000 VANIK INCORP LTD[NON VOTING] 0.00 0.00 0.00 0.80 0 0 0

VFIN-N-0000 VALLIBEL FINANCE 31.00 31.00 30.90 30.90 3 1,200 37,180

VLL -N-0000 VIDULLANKA 3.70 3.70 3.60 3.60 6 87,927 325,320

VONE-N-0000 VALLIBEL ONE 17.50 17.80 17.50 17.60 60 46,050 809,995

VPEL-N-0000 VALLIBEL 6.40 6.50 6.40 6.40 4 28,350 181,470

WAPO-N-0000 GUARDIAN CAPITAL 45.00 45.00 44.00 44.10 9 2,009 88,919

WATA-N-0000 WATAWALA 11.80 12.00 11.70 11.80 7 2,930 34,501

YORK-N-0000 YORK ARCADE 15.60 15.60 15.60 15.60 2 300 4,680

-

7/30/2019 Daily Trade Journal - 11.12.2012

13/13

S f l i E i R h

Softlogic Equity ResearchDimantha Mathew

[email protected]+94 11 7277030

Akeela Imthinam Rasheed

+94 11 7277032

Crishani Perera

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277004

Softlogic Equity SalesBranches

Horana

Madushanka Rathnayaka

No. 101, 1/1, Aguruwathota Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

MataraLalith Rajapaksha

No.8A, 2nd

Floor, FN Building, Station Road, Matara

+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Shafraz Basheer

+94 11 7277054, +94 77 2333233

Sonali Abayasekera

+94 11 7277059, +94 77 7736059

Thanuja De Silva

[email protected]+94 11 7277053, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently veri fied and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customers. Not all customers will receive the material at the same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer t o make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying or

related to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not be

reproduced, distributed, or published for any purposes.