200220CelfinNutresa

Transcript of 200220CelfinNutresa

8/3/2019 200220CelfinNutresa

http://slidepdf.com/reader/full/200220celfinnutresa 1/2

Earnings Preview

4Q: profit up 59% on lower COGS, non-ops

Earnings Preview | Colombia

Grupo Nutresa | Consumption

– Revenues up, raw materials downGrupo Nutresa17 February 2012

Jairo Agudelo [email protected]+574 320 4102

We expect Nutresa to report for 4Q11 on February 27. We forecast net profit up 59.3%YoY, at COP118,669mn (COP257.9/share), based on (i) lower costs of raw materials, and (ii)lower non-operational expenses, on lower financial expenses following the capital increase ofJuly 2011.

We expect 4Q revenues to be up 15.1% YoY , on the recovery of domestic demand, thecontinued strengthening of the Central American market and the market in the Southeast ofthe USA, and inclusion of Helados Bon in the results.

tthe USA, and inclusion of Helados Bon in the results.

We expect to see Ebitda margin ~103bp higher YoY , at 12.5% in 4Q11, up from 11.5% in4Q10, on the stronger revenues, with dilution of fixed costs, and lower prices of some rawmaterials . One of the divisions in which we expect to see significant recovery in the quarter isthe cookies division, since we estimate the cost of wheat will be 15.6% lower YoY.

We expect to see Ebitda margin ~103bp higher YoY , at 12.5% in 4Q11, up from 11.5% in4Q10, on the stronger revenues, with dilution of fixed costs, and lower prices of some rawmaterials . One of the divisions in which we expect to see significant recovery in the quarter isthe cookies division, since we estimate the cost of wheat will be 15.6% lower YoY.

The raw materials in which prices have fallen include:The raw materials in which prices have fallen include:coffee (down 10.8% QoQ, though still up 3.9% YoY);wheat (down 23.8% QoQ, and 15.6%YoY); andcocoa (down 19.7% QoQ, and 16.4% YoY).

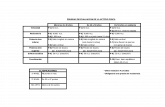

Nutresa: 4Q11 earnings preview summary (COPmn) Period 4Q11E 4Q10 %YoYSales 1,487,276 1,292,658 15.1

Gross profit 566,048 498,473 13.6Operational profit 143,943 117,298 22.7Ebitda 185,823 148,135 25.4Pretax profit 122,942 73,101 68.2Net profit 118,669 74,485 59.3EPS 257.9 171.18 50. Gross margin (%) 38.1 38.6Operational margin (%) 9.7 9.1Ebitda margin (%) 12.5 11.5Net margin (%) 8.0 5.8Sources: Nutresa, Celfin Capital.

verview ce (COP) 22,600ting BUY (COP/share) 29,400turn (%) 30.5ares (mn) 460Cap (US$mn) 5,919ker (BB) NUTRESA CB

recast (COPmn) 2012E 2013Evenue 5,522,334 5,989,824

itda 694,237 778,801t profit 392,455 458,244(x) 18.1 15.5

V/Ebitda (x) 10.3 8.9urce: Celfin Capital.

ck price performance

1,400

1,500

1,600

1,700

1,800

1,900

0,000

,000

,000

3,000

4,000

5,000

6,000

Feb /11 May /11 Aug/11 Nov/11

Nutr esa COL CAP

urces: Bloomberg, Celfin Capital

Food sales growth rates stable, potential for increaseColombia’s National Statistics Bureau (DANE) reports sales of food and non-alcoholicbeverages up 6.9% YoY in October, and up 5.0% YoY in November, in nominal terms.

This maintains a positive trend that supports organic growth for Nutresa ; but we see thisgrowth as very moderate compared to the current growth of other sectors of the Colombianeconomy, and we are expecting to see this growth rate higher in the coming quarters.

8/3/2019 200220CelfinNutresa

http://slidepdf.com/reader/full/200220celfinnutresa 2/2

Grupo Nutresa | Consumption

Research Team & Disclaimer

Celfin Capital Equity ResearchChile Peru Colombia

Cesar Perez-Novoa Isabel Darrigrandi Natalia AgudeloManaging Director: Strategy & Economics Senior Analyst: Metals & Mining Senior Analyst: Energy & Utilities

+562 490 5012 +562 490 5093 +574 320 [email protected] [email protected] [email protected]

Tomas Gonzalez Hedmond Rios Jairo AgudeloSenior Analyst: Electric & Water Utilities, TMT Economist Senior Analyst: Industrials & Consumer

+562 490 5034 +562 713 4807 +574 320 [email protected] [email protected] [email protected]

Alex Sadzawka Mario Arend Ruben ArismendySmall Caps Analyst: Industrials Chief Economist Analyst: Metals & Mining Exploration

+562 490 5448 +562 713 4903 +574 320 [email protected] [email protected] [email protected]

Jeanne Marie Benoit Juan Camilo DauderSmall Caps Analyst: Consumer Economist / Senior Banks Analyst

+562 490 5304 +574 320 4100 [email protected] [email protected]

Andres Cardona

Analyst: Industrials+574 320 [email protected]

DisclaimerThis document and its contents do not constitute an offer, invitation or solicitation to purchase or subscribe to any securities or other instruments, or to undertake or divestinvestments. Neither shall this document or its contents form the basis of any contract, commitment or decision of any kind. This material has no regard to the specific investmentobjectives, financial situation or particular needs of any recipient. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy orsell any securities or related financial instruments.

Before undertaking any transaction with these instruments, investors should be aware of their operation, as well as the rights, liabilities and risks implied by the same and theunderlying stocks. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments mayrise or fall. Any information relating to the tax status of financial instruments discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice.Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report, thus investors effectivelyassume currency risk. References to third parties are based on information obtained from sources believed to be reliable but are not guaranteed as being accurate. Celfin Capitalhas not independently verified such information and therefore no warranty, either express or implicit, is given regarding its accuracy, integrity or correctness. Recipients should notregard it as a substitute for the exercise of their own judgment.

Any opinions expressed in this material are subject to change without notice and Celfin Capital is not under any obligation to update or keep current the information containedherein. Celfin Capital may make purchases and/or sales as principal or agent of this security or provide corporate finance or other services to the issuer. However, Celfin Capital

does not trade for its own account.

Celfin Capital or any of its salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to its clients that reflect opinions thatare contrary to the opinions expressed herein. Furthermore, Celfin Capital or any of its affiliates' investing businesses may make investment decisions that are inconsistent with therecommendations expressed herein.

Celfin Capital accepts no liability of any type for any direct or indirect losses arising from the use of this document or its contents. All information is correct at the time ofpublication; additional information may be made available upon request.

Rating System: Ratings refer to a period of 12 months. Our ratings are classified in three categories:Buy = an absolute return of at least 15%;Hold = an absolute return between 15% and 5%;Sell = a return of 5% or lower in relation to its absolute valuation.

Under exceptional circumstances and for specific reasons, we may use UR – Rating under review.