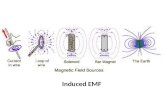

Induced EMF. EMF EMF - It is potential difference and is measured in volts (V ).

Sectoral Social Dialogue Committee on Steel Working Group Structural Change September 2008...

Transcript of Sectoral Social Dialogue Committee on Steel Working Group Structural Change September 2008...

Sectoral Social Dialogue Committee on Steel

Working Group Structural Change

September 2008

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

2

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

I. Characteristics and Challenges of the European Steel Industry

II. An integrated Approach to enhance the European Steel Industry’s

Competitiveness:

A. Energy policy

B. Climate Change

C. Integrated Pollution Prevention and Control (IPPC)

D. Social aspects

E. Innovation, Research and Development and Skills

F. External Relations and Trade Policies

3

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

I. Characteristics and Challenges of the European Steel Industry

Key characteristics:

• High capital and energy intensity (massive long-term investments)

• Dependence on the international markets for raw materials

Need for supportive and predictable EU policies and regulation

(effective competition in the energy markets, undistorted access to raw

materials, avoiding asymmetric environmental cost increases with

negative

impact on environment, employment and EU economy)

Challenges:

• Intensifying globalisation

• Growth of the world steel market driven by emerging economies

Need for a truly integrated European sectoral industrial policy

4

Steel ProductionRaw Materials Trade 1st Processors Finished Product

Iron Ore

Coke

Scrap

Electricity Steel Mills EquipmentComponents

• Processors

Automotive

Machinery

Steel industry - a vital contribution of value creation in European manufacturing

Characteristics of the Steel Industry

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

5

Challenges for the EU steel industry

Intensifying globalization and growing emerging economies to meet requirements of expanding industrialization and infrastructure

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

IISI

0

250

500

750

1000

1250

1500RoW

CIS

South America

India

China

Japan

NAFTA

EU-27

2007 2012 F

+3%

+3%

+3%

+37%

Regional steel consumption (MT)

+51%

+27%

+52%

+21%

1202

1518

(+26%)

World steel consumption (MT)

0

300

600

900

1200

1500

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008E

2009F

-2% 1% 8% 2%7%

7%10%

6%9%

7%7%

6%

SBB Steel Markets Europe 2008

+3%

6

II. An integrated Approach to Enhance the EU Steel Industry’s Competitiveness

A. Energy policy

1. Commission's Communication:

- Issues of rapid increase in gas and electricity prices and changes in securing long-

term supply contracts.

- Need for legislative action to create a truly competitive internal market for

electricity and gas, including separation of supply and production activities from

network operations (unbundling)

- Commission’s package of legislative proposals to ensure a real and effective choice

of supplier and improve market transparency, including on pricing (Sep

2007)

- Commission’s guidance on the compatibility of long term energy supply contracts

with Community law.

- Commission’s promotion of best energy saving practices within Metals Industries.

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

7

2. EMF-EUROFER joint position:

- Rapid rises in gas and electricity prices and challenges in securing long term supply

strongly impairing the cost competitiveness of the steel industry.

- Need for solution to interconnection infrastructures deficit for energy transport

(freedom and equality of election or access to all the sector companies)

- No scaling back of the objective of ensuring real and effective choice of supplier and

improved market (price) transparency (through legislative action and competition

rules) by transitional measures (member states) providing some

predictability of

energy costs.

- Examination of the possibility of long-term supply contracts to improve predictability

of

supply conditions.

A. Energy policy

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

8

3. Discussion:

A. Energy policy

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

Wholesale Electricity Prices

Forward market: Uk v Germany - Baseload (£ per MWh)Source: Ineos/Heren

20

30

40

50

60

70

80

90

100

Jul-0

8

Sep-0

8

Nov-08

Jan-0

9

Mar

-09

May

-09

Jul-0

9

Sep-0

9

Nov-09

Jan-1

0

Mar

-10

May

-10

UK

Germany

France(Tartam tariff)

9

B. Climate Change

1. Commission's Communication:

- Steel industry required to make a major contribution to climate change

mitigation to achieve high environmental performance and energy efficiency

without losing competitiveness.

- Recognition of the risk and negative environmental and economic consequences

of carbon leakage.

- Recognition of the specific situation of energy intensive industries.

- Determination of “industries exposed to significant risk of carbon leakage” and

possible adjustment measures in light of international negotiations of a global

climate change agreement (free allowances, inclusion of imported products in

EU

ETS)

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

10

B. Climate Change

2. EMF-EUROFER joint position:

- EU steel industry facing increased international competition.

- Asymmetric cost increase through improved EU ETS eliminating investment and

therefore job security.

- Need for consideration of:

- EU steel industry’s resource and energy efficiency performance already

achieved.

- Limits of current available technology for further reducing CO² emissions.

- Increasing international competition from non EU producers driving excess

production out of the domestic market towards the attractive EU market (no

carbon constraints).

- Need for early acceptance of steel industry as a sector at risk of carbon leakage.

- Sector-specific benchmark (100% free allowances)

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

11

B. Climate Change

3. Discussion: Comments on “Leakage-paper” of the Commission

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

- Use CO2-cost from direct and indirect emissions for leakage risk-evaluation.

- Grid-type risk-classification is a viable approach, but thresholds for risk-type separation in need of thorough analysis.

- Both mechanisms for short term leakage (indicator: prices) and long term leakage (profitability indicators) must be taken into account.

- Market size definition by "the sum of annual EU production and non-EU imports" is wrongly inflating the market size, due to inclusion of exports.

- Clear differentitation between unilaterally (e.g. CO2) and globally incurred (e.g. raw materials) cost is needed.

- Most robust quantification of trade barriers is sum of differences in production cost and transport costs.

- Markets will react differently to unilaterally imposed CO2 prices in cases where there already is significant international trade and where it is not. Both situations my give rise to leakage risk.

12

B. Climate Change

3. Discussion: Comments on “Leakage-paper” of the Commission

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

• Graph 1: degree of risk of carbon leakage

in some energy intensive (sub)sectors

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0% 20% 40% 60% 80% 100%

Price increase

No

n-E

U t

rad

e in

ten

sit

y

Recycled Aluminium

Rebar EAF-hot rolling

Hot rolled coil BOF

Primary Aluminium (EU average electricitymix)

Grey portland cement Dry process with multistage cyclone preheater and precalciner kilns(EU average clinker industry energy mix)

Primary Aluminium (Coal-lignite basedelectricity mix)

Clinker Dry process with multi stage cyclonepreheater and precalciner kilns (EU averageclinker industry energy mix)

13

C. Integrated Pollution Prevention and Control (IPPC)

1. Commission's Communication:

- Current EU legal framework on industrial emissions includes the IPPC and

“sectoral Directives”; Commission’ recast Directive on Industrial Emissions,

merging the IPPC and related “sectoral Directives” that strengthens the

role of “Best Available Techniques” (BAT) and of “Emerging Techniques”.

- Permitting requirements of IPPC Directive not always matched by equivalent

standards in third countries.

2. EMF-EUROFER joint position:

- Support for harmonization of IPPC Directive.

- Certification and operation of industrial plants taking into account individual

levels of technical performance.

- Avoid further legal demands without consideration of what is technically

possible.

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

14

3. Discussion:

C. Integrated Pollution Prevention and Control (IPPC)

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

- Full support for principles of current IPPC Directive (integrated approach,

deriving Emission Limit Values - ELV from Best Available Technique - BAT,

flexibility)

- Implementation period for the current IPPC Directive has only come to an end

on 30 October 2007.

-- Improve implementation (e.g. capacity building) but not radically change the

fundamentals of the current IPPC Directive.

- Need for transparency on how ELVs in a permit have been established in

relation to BAT.

- When establishing ELV's, the flexibility to deviate from BATAELs should

remain but this should be documented and justified by the permitting

authorities

15

C. Integrated Pollution Prevention and Control (IPPC)

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

EEMMIISSSSIIOONN

VVAALLUUEE

MARGIN 1

AVERAGE EMISSION PLANT 1

TIMETIME

ENVIRONMENTAL PERFORMANCE FOR AN INSTALLATION AND ENVIRONMENTAL PERFORMANCE FOR AN INSTALLATION AND IT'S ELVIT'S ELV

ELV 1

INSTALLATION 1

BA

T A

EL

AVERAGE EMISSION PLANT X

AVERAGE EMISSION PLANT Y

16

D. Social aspects

1. Commission's Communication:

- Major restructuring of the industry has led to massive reductions in employment

and the permanent closure of production plants was necessary to improving

labour productivity and competitiveness, new member states are particularly

hard-hit.

- A skilled and available workforce is a major strength of the industry.

- The European steel industry is today confronted with significant demographic

problems.

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

17

D. Social aspects

2. EMF-EUROFER joint position:

- Main challenges:

• Ageing workforce,

• Practicing an active equality and diversity policy,

• Need for new competencies including managerial skills and entrepreneurship,

• Mobility both at the level of executives and technicians,

• as well as climate change and globalisation

- Management of change must be socially responsible

- Urgently need European sectoral policies on training and life long learning

• Establishment of ENTRANCE network within the framework of ESTEP

3. Discussion

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

18

E. Innovation, Research and Development and Skills

1. Commission's Communication:

- Innovation is key driver in the competitiveness of the European steel sector.

- Long term projects pushing forward the R&D agenda should be promoted.

- Steel industry is finding it increasingly difficult to attract skilled workers:

• Ageing workforce.

- Need for better use of training structures and clusters between training and R&D.

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

19

E. Innovation, Research and Development and Skills

2. EMF-EUROFER joint position:

- Social partners welcome Commission encouragement to intensify R&D and

innovation.

- Integrated industrial policy must address the anticipation of skills needs in the steel

sector.

- Need to press forward work on education and training development in the steel

industry.

- Ageing workforce has quantitative and importantly qualitative implications.

- Need to address the currently disappointing results of the implementation of the

ESTEP’s strategic research agenda in the 7th framework programme.

3. Discussion

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

20

F. External Relations and Trade policies

1. Commission's Communication:

- Priority to the establishment of a level playing field both for metals and

their raw materials in trade policy.

- In the framework of multilateral and bi-lateral trade negotiations,

continuation of efforts to oppose the use of exports taxes on metals

and raw materials. Ensuring market access for FDI.

- To continue to use all existing instruments to address trade practices

in violation of international trade agreements.

- Maintain close industrial dialogue with key third countries.

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

21

F. External Relations and Trade policies

2. EMF-EUROFER joint position:

- Raw materials: adequate EU trade policy and a unique European voice to secure

supply of raw materials:

Level playing field for access to metallurgic raw materials

Competition rules ensuring genuine competition in key market of iron ore

- Steel products:

• To address unfair trade practices by using all instruments available, in

particular against those economies which do not have a genuine

comparative advantage (credible dialogue and effective trade defence

actions).

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

22

F. External Relations and Trade policies

3. Discussion: Raw materials

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

50

100

150

200

250

300

2005 2006 2007 Q1 07 Q2 07 Q3 07 Q4 07 M1 08 M2 08 M3 08

Scrap (Rotterdam, FOB)

Iron ore fine (contract Vale to Europe, FOB)

Iron ore (spot Indian ore, FOB)

Coke (Chinese exports, FOB)

Coking coal (contract, Australia to Japan, FOB)

FROM THIRD COUNT

RIES

0

0,2

0,4

0,6

0,8

1

1,2

1

0

0

0

1

1

1

1

0

100

200

300

400

500

600 Iron ore – need per main steel region

(2006)(million tonnes)

473

174132

8956 55 44

Domestic production Imports

58%

88%100%

100%

Iron ore – need per main steel region (2006)(Million tonnes)

23

F. External Relations and Trade policies

3. Discussion: China does not have a genuine comparative advantage

in steel making

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

369272

128 113

0

100

200

300

400

500

600

W.Europe Brazil Russia India-Integrated

Transport&Logistique

S,G&A

Supplies, consumables, other

Alloys

Maintenance

Labour

Raw materials

China

Slab cash costs for selected cost regions ($/ t)

369272

128 113

0

100

200

300

400

500

600

W.Europe Brazil Russia India-Integrated

Transport&Logistique

S,G&A

Supplies, consumables, other

Alloys

Maintenance

Labour

Raw materials

China

Slab cash costs for selected cost regions ($/ t)

24

F. External Relations and Trade policies

3. Discussion: China

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

Iron ore – need per main steel region

(2006)(million tonnes)

473

174132

8956 55 44

Raw Materials

Coke 14 MT 15% 14 MT 25% 14 MT 40%

Scrap

Ferro-alloys

…

Steel Products

Semis

Hot-rolled coils

Hot-dipped metallic coated

Wire rod / Rebar

…

export quota

VAT rebate export

export tax

restrictive export licensing

2007 January 2008 August 2008

10% (as of June) 10% 10%

15% 20% 20%

January 2007 April / June 2007 January 2008

8% 15% 25%

8% 5% 5%

8% 5% 5%

8% 10% 15%

25

F. External Relations and Trade policies

3. Discussion: China

EMF-EUROFER joint position on the Commission’s

Communication on Competitiveness of Metals Industries

Iron ore – need per main steel region

(2006)(million tonnes)

473

174132

8956 55 44

Grants, equity infusions and other preferential access

to capital

Government infusions (18 bn RMB Ma’anshan ‘93–’97)

Dept-equity swap (27.5 bn RMB Anshan, Baosteel, Lanzhou, Shougang, Taiyuan ’99)

Grants earmarket for steel facility upgrade (6 bn $ ’00)

‘In-kind’ contribution: government provides productive assets to another company through govenment-mandated merger (51% stake in 3 MT Ercheng to Wuhan at no cost)

Access to lending at favourable rates

Tax programmes

45 preferential tax programmes run by central government (40% of cost of new equipment deductible from income tax base Bengang 170 mio RMB tax savings per year ’06–’07)

Preferential access inputs, land and energy

Many steel mills have never paid anything for land, or extremely low prices (Baosteel, Anshang, Xinyu)

State-owned steel companies provide steel substrate (HR) to rerollers at significantly low price levels

47 companies benefited from preferential lending through State Key Technology Renovation Project fund including Anshan, Baosteel and Panzhihua (75 bn RMB ’99 –’01)

Low cost loans ($3.4 bn for major steel companies such as Baosteel, Wuhan, Anshan and Shougang)

China Development Bank committed to provide Anshan with 15 bn RMB loan including 10 bn at preferential rates, to promote strategic development of the company (2005)