Real Estate Law Real Estate Brokers Real Estate Law Real Estate Brokers.

RETURN OF REIT AND EXPECTED INCOME GROWTH OF REAL ESTATE ASSET Sherry Y.S. Xu Department of Real...

-

Upload

edmund-hodge -

Category

Documents

-

view

222 -

download

0

Transcript of RETURN OF REIT AND EXPECTED INCOME GROWTH OF REAL ESTATE ASSET Sherry Y.S. Xu Department of Real...

RETURN OF REIT AND RETURN OF REIT AND EXPECTED INCOME EXPECTED INCOME GROWTH OF REAL ESTATE GROWTH OF REAL ESTATE ASSETASSET

Sherry Y.S. XuDepartment of Real Estate and ConstructionFaculty of ArchitectureThe University of Hong Kong

RESEARCH QUESTIONSRESEARCH QUESTIONS

Is there relationship between REITs and real estate market?

Which elements of the two markets can be linked?

How would these elements relate to each other?

PROPOSITIONSPROPOSITIONSAs the underlying portfolio of

REIT, the real estate asset would has certain relations to its return.

Though actual rent growth cannot reflect the return of REIT, it would have dependence on the expected rent growth of underlying real estate assets.

RESEARCH OBJECTIVESRESEARCH OBJECTIVES

Dependent variable: total return of REITs

Independent variables: 1) stock market factor ---- stock market price

index 2) economic factor ---- real interest rate 3) real estate market factor ---- expected income

(rent) growth of real estate asset

what is expected income what is expected income growth?growth?

The expected income growth can be defined as the rate at which the cash-flow of certain asset will grow over a period of time

For real estate asset, the expected income growth can be regarded as the rent

growth of the property in the investors’ expectation.

where does expected income where does expected income growth come from?growth come from?

DCF Model first formally expressed in Fisher (1930) and Williams

(1938)’s work

• Gordon Growth Model a variant of DCF model was derived by Gordon (1959)

Here, P, D, g, k represent the asset’s value, income, expected income growth and required return rate respectively.

what is expected income what is expected income growth usually used for?growth usually used for?

Evaluation of the asset’s pricePrediction of the asset’s return *in most of the previous research, the assets are

almost stocks, REITs and real estate assets.

Several very important relationships:

expected income growth

expected return

Income yield

price

Previous literatures on the application of Previous literatures on the application of expected income growthexpected income growth

Article Assets examined

Applications Data Testing Methods Time period

Chen et al. (2004) Real estate to evaluate the real estate asset as one of several factors in the model

NOI index by NCREIF OLS Model 1982 – 2003

Hung and Glascock (2008)

REITs to find out the momentum return of REITs when dividend yield is shock

REITs’ returns from the CRSP database

VAR Model 1997 – 2000

Johnson (2002) Equities to test the momentum effects in stock returns under condition that the expected dividend growth varying over time

Equity (especially real estate stocks) returns from the CRSP database

VAR Model 1993 – 2000

Plazzi et al. (2008) Commercial real estate

to measure the risk of commercial real estate investment

Returns and growth in rents of commercial real estate on metropolitan areas

VAR Model 1986 – 2002

Shilling and Sing (2007)

Real estate to predict the return of real estate asset

Return from NEREIF data base and ex-ante return from Korparz Survey

VAR Model 1988 – 2006

Sing et al. (2007) Property and property stock

to predict the returns of both property and property stock

Real estate return (URA of Singapore) and property stock return (SGX-PTYS)

VAR Model 1988 – 2006

Some of the recent research adopting expected income growth

What are the common What are the common methods to get the expected methods to get the expected income growthincome growththe conventional estimating method :VAR model (Vector Auto Regressive)

(first applied in Campbell and Shiller (1988a,b)’s research)

based on different datasets

1) historical income growths

2) historical income yields

Previous literatures making estimation of Previous literatures making estimation of expected income (dividend) growthexpected income (dividend) growth

Article Assets examined

Estimating method(s) Data Time period

Ang and Bekaert (2007) Equities auto-regressive model S&P 500 stock price return and total return

1935 – 2001

Ang and Liu (2007) Equities auto-regressive model S&P 500 return data 1935 – 2001

Bansal and Yaron (2004) Equities auto-regressive model Equity prices and realized consumption growth data

1929 – 1999

Chiang (2008) REITs auto-regressive model Center for Research in Security Prices (CRSP) / Ziman Real Estate Database for REITs’ returns

1980 – 2006

Fama (1990) Equities auto-regressive model Annual NYSE value-weighted returns

1953 – 1987

Fama and French (2001) Equities auto-regressive model CRSP and Compustat 1926 – 1999

Lettau and Ludvigson (2005) Equities auto-regressive model Stock dividend and return from CRSP

1947 – 2001

Menzly et al. (2004) Equities auto-regressive model CRSP value-weighted stock market index

1948 – 2001

Schwert (1990) Equities auto-regressive model NYSE value-weighted returns

1889 – 1988

Some of the recent research estimating expected income growth

Why to construct a new Why to construct a new modelmodel

1) VAR model can be a good forecasting model, but in a sense it is an atheoretical model.

2)The problem of the predictability of the expected income growth.

Deviation of the new Deviation of the new modelmodelBased on Gordon Growth Model, we further assume that the required rate of return (i) would change with constant growth (G) as well, then we get the variant of GGM:

tt

t

Gi

gD

Gi

gD

Gi

gD

i

DP

))1(1(

)1(

))1(1(

)1(

))1(1(

)1(

)1( 1

1

32

2

2

Here, P = price of asset, D = income of asset, g=expected income growth, i=required rate of return, G = the growth of required rate of return

(1)

How to find out growth of How to find out growth of required rate of returnrequired rate of return

Required rate of return (i) = cost of capital = risk-free return rate=yield of government bond

growth of i growth of bond yieldis equal to

spread of bond yield (S) = longest-period bond yield (iL) – shortest-period bond yield (i0)

iiS 30

i

iiG

2

1129 i

SG (2)

the expected income growth the expected income growth modelmodel

302929

29

3229

2

229 )))11(1(1(

)1(

)))11(1(1(

)1(

)))11(1(1(

)1(

)1(

1

i

Si

g

i

Si

g

i

Si

g

iD

P

Combining equation (1) and (2), we can get the model for capturing the expected income growth of certain asset as followed:

Solving the function above with Newton-Raphson Method, the expected income growth of asset (g) can be calculated

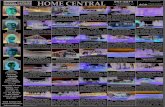

Study in Hong Kong marketStudy in Hong Kong market

Source: Rating and Valuation Department, Hong Kong SAR & Hong Kong Monetary Authority

Study in Hong Kong market Study in Hong Kong market (continued)(continued)

Source: Rating and Valuation Department, Hong Kong SAR & Hong Kong Monetary Authority

EMPIRICAL TESTEMPIRICAL TEST

Empirical model:

ittttit ERGINFINTHSIR )(

Here, Rit and ERGit refer to the total return and weighted expected income growth of certain portfolio of the ith REIT at time t respectively; HSIt, INTt, INFt represent the Hang Seng Index, Interest rate and Inflation rate in Hong Kong at time t respectively.

Empirical results:①Return of all REITs in Hong Kong

show strong positive dependence on the stock market factor;

②Three of them show significant negative relationship with real interest rate;

③One of them shows significant positive dependence on the expected rent growth of its underlying real estate asset.

EMPIRICAL TEST EMPIRICAL TEST (continued)(continued)

ConclusionsConclusions

The contributions of this study:

combining the government bond market with asset market to find out the change of time value of the money;

capturing the expected income growth based on a mathematical model other than forecasting investigation or econometrics model;

finding out the relationship between REITs market and direct real estate market.

ReferencesReferences ANG, A. & BEKAERT, G. (2007) Stock Return Predictability: Is it There? Review of Financial Studies, 20, 57.

ANG, A. & LIU, J. (2007) Risk, return, and dividends. The Journal of Financial Economics, 85, 38.

BANSAL, R. & YARON, A. (2004) Risks for the Long Run: A Potential Resolution of Asset Pricing Puzzles. Journal of Finance, 59, 29.

CAMPBELL, J. Y. (1991) A Variance Decomposition for Stock Returns. The Economic Journal, 101, 23.

CAMPBELL, J. Y. & SHILLER, R. J. (1988a) The dividend-price ratio, and expectations of future dividends and discount factors. The Review of Financial Studies, 1, 34.

CAMPBELL, J. Y. & SHILLER, R. J. (1988b) Stock prices, earnings, and expected dividends. Journal of Finance, 43, 16.

CAMPBELL, J. Y. & YOGO, M. (2006) Efficient tests of stock return predictability. Journal of Financial Economics, 81, 34.

CHEN, J., HUDSON-WILSON, S. & NORDBY, H. (2004) Real Estate Pricing: Spreads & Sensibilities: Why Real Estate Pricing Is Rational. Journal of Real Estate Portfolio Management, 10, 21.

CHIANG, K. C. H. (2008) High dividend yield does predict lower dividend growth: a natural experiment. Burlington, University of Vermont.

FAIR, R. C. & SHILLER, R. J. (1990) Comparing information in forecasts from econometrics models. The American Economic Review, 80, 15.

FAMA, E. F. (1990) Stock Returns, Expected Returns, and Real Activity. The Journal of Finance, 45, 20.

FAMA, E. F. & FRENCH, K. R. (1988) Dividend yields and expected stock returns. Journal of Financial Economics, 22, 19.

FAMA, E. F. & FRENCH, K. R. (2001) Disappearing dividends: changing firm characteristics or lower propensity to pay? Journal of Financial Economics, 60, 41.

FISHER, I. (1930) The Theory of Interest as Determined by Impatience to Spend Income and Opportunity to Invest it, New York, The Macmillan Company.

GORDON, M. J. (1959) Dividends, Earnings and Stock Prices. Review of Economics and Statistics 41, 99--105.

HODRICK, R. J. (1992) Dividend Yields and Expected Stock Returns: Alternative Procedures for Inference and Measurement. the Review of Financial Studies, 5, 30.

HUNG, S.-Y. K. & GLASCOCK, J. L. (2008) Momentum Profitability and Market Trend: Evidence from REITs Journal of Real Estate Finance and Economics, 37, 19.

JOHNSON, T. C. (2002) Rational momentum effects. Journal of Finance, 57, 24.

KEIM, D. B. & STAMBAUGH, R. F. (1986) Predicting returns in the stock and bond markets. The Journal of Financial Economics, 17, 34.

KOTHARI, S. P. & SHANKEN, J. (1992) Stock return variation and expected dividends : A time-series and cross-sectional analysis. Journal of Financial Economics, 31, 34.

KOTHARI, S. P. & SHANKEN, J. (1997) Book-to-market, dividend yield, and expected market returns: a time-series analysis. Journal of Financial Economics, 44, 35.

LETTAU, M. & LUDVIGSON, S. C. (2005) Expected returns and expected dividend growth. Journal of Financial Economics, 76, 44.

MENZLY, L., SANTOS, T. & VERONESI, P. (2004) Understanding Predictability The Journal of Political Economy, 112, 47.

PLAZZI, A., TOROUS, W. & VALKANOV, R. (2004) Expected Return and the Expected Growth in Rents of Commercial Real Estate. Los Angeles, UCLA.

PLAZZI, A., TOROUS, W. & VALKANOV, R. (2008) The cross-sectional dispersion of commercial real estate returns and rent growth: time variation and economic fluctuations. Real Estate Economics, 36, 37.

POTERBA, J. M. & SUMMERS, L. H. (1988) Mean reversion in stock prices : Evidence and Implications. The Journal of Financial Economics, 22, 33.

ROZEFF, M. S. (1984) Dividend Yields Are Equity Risk Premiums. Journal of Portfolio Management, 11, 8.

SCHWERT, G. W. (1990) Stock Returns and Real Activity: A Century of Evidence The Journal of Finance, 45, 21.

SHILLING, J. D. & SING, T. F. (2007) Do institutional real estate investors have rational expectations. Asian Real Estate Society Conference. Macau, AsRES.

SING, T. F., DENG, L. & WANG, H. (2007) Tests of common real estate risk premia in a time-varying expected return framework. Journal of Property Investment & Finance, 25, 11.

WILLIAMS, J. B. (1938) The Theory of Investment Value, Harvard University Press.