PT Mega Manunggal Property...

Transcript of PT Mega Manunggal Property...

PT Mega Manunggal Property Tbk

9

Bonny Budi SetiawanPresident Director

Has has been the Company’s Director since 2015 and appointed as the President Director in January 2017. Earneda Bachelor of Business Administration in Accounting and Finance from Simon Fraser University, Canada (1997).Previously served as Executive Director of PT UBS Securities Indonesia (2011-2015); Senior Vice President of PTDanareksa Sekuritas, Jakarta (2010 - 2011); Vice President of Research Division of PT Danareksa Sekuritas in Jakarta(2009 - 2010); Vice President of Research Division of Merrill Lynch, Jakarta (2007 - 2009); Vice President ofResearch Division of PT CIMB-GK Securities, Assistant Vice President of research division of PT Danareksa Sekuritas(2005 - 2007); Supervisor Consultant Financial Advisory Services (FAS) of Prijohandojo Boentoro & Co. (2003 -2005); Research Analyst of PT Panin Sekuritas (2002 - 2003) and Export Supervisor of PT Pabrik Kertas Tjiwi Kimia(1998-2000).

Loa Siong LieDirector

Has been appointed as the Independent Director since 2017. He is in charge of technical and construction. Heearned Civil Engineering Bachelor’s degree from University of Tarumanegara, Jakarta in 1996. He was ProjectManager for PT Sinar Menara Deli (2016 – 2017), Project Manager for PT Supra Megah Utama ( 2012 - 2016), SiteManager for PT Pradani Sukses Abadi (2010 – 2012), Site Manager for PT Intersatria Budi Karya Pratama (2007 –2010). Construction Manager for PT Praga Artamida ( 1996 – 2007).

PT Mega Manunggal Property Tbk

118,199 139,811 163,911 163,911

230,370

300,680 300,680

2013 2014 2015 2016 2017 2018 1Q 2019

14

PT Mega Manunggal Property Tbk

BEST

DKI

Jakarta

(Cimanggis)

Jawa Barat

(Jatiwarana)

Operational

In construction

Negotiation/tender

Contract signed

16

PT Mega Manunggal Property Tbk

25

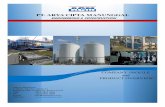

Location : Delta Silicon III, Cikarang, Bekasi

Land area : 100,000 m2

Net leasable area : 67,000 m2

Tenant : DHL

Lease period : 10 years

Estimated full completion : 4Q 2020

PT Mega Manunggal Property Tbk

26

71k 103k 130k

230k

301k

403k

122k

k

100k

200k

300k

400k

500k

600k

700k

2017 2018 2019

Under construction Completed Pipelines

PT Mega Manunggal Property Tbk

27

15.2%

17.1%17.6%

13.3%

12.4% 13.8%

7.8%8.7% 8.4%

7.5% 7.5%

8.3%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2014 2015 2016 2017 2018 Q1 2019

IP at cost IP at fair value Yield to cost Yield to fair value

PT Mega Manunggal Property Tbk

The logistics sector in Indonesia remains nascent in comparison to other markets in the region, particularly compared to more

mature markets such as Singapore and Australia.

Notwithstanding this, the growth potential is huge and there are signs of a fundamental imbalance between available supply and

demand for modern logistics warehousing space. We expect to see the Indonesian logistics market evolve into a modern

logistics hub in the same way the sector has evolved in other markets regionally and globally.

29

PT Mega Manunggal Property Tbk

Economic Growth and Scale

Recent disruptions in the commodities markets hit

the Indonesian economy hard, but government

spending began to pick up in 2015, economic growth

started to improve and Indonesia remains the largest

economy in Southeast Asia or 16th globally.

Annual GDP growth has averaged 5.8% over the

past 10 years and historically, domestic consumption

has driven the national economy. Indonesia

weathered the global economic turmoil in 2008 better

than most neighboring countries due to domestic

demand. The current administration is now

spearheading a shift to further stimulate growth

through investment.

32

PT Mega Manunggal Property Tbk

36

MERAK

-TANGERANG

TOLLROAD

TELUK NAGA -SEDYATMO

KUNCIRAN

- SERPONG

TOLLROAD

SERPONG

-CINERE

TOLLROAD

CIBITUNG -CILINCING

TJ. PRIOK ACCESS

BOGOR

RINGROAD

PASAR MINGGU

TANAH ABANG

TMII

KP. MELAYU

PULO GEBANG

1

ULUJAMI

- DEPOK TOLLROAD

JAKARTA

- CIKAMPEK

TOLLROAD

2

3

4CINERE

- JAGORAWI TOLLROAD

5CIMANGGIS

- CIBITUNG

TOLLROAD

6

ANTASARI 7

8

9

10

RAWA 1BUAYA

23 4

5

6

11

JabodetabekToll Road

Number Link Length(Km)

1 Semanan - Sunter 20,23

2 Sunter –PuloGebang 9,44

3 DuriPulo –KampungMelayu 12,65

4 Kemayoran –KampungMelayu 9,60

5 Ulujami –TanahAbang 8,70

6 Pasar Minggu –Casablanca 9,16

TOTAL 69,77

6 LINKS OF DKI JAKARTA TOLLROAD

Number Link Length(Km)

1 Cengkareng – Batu– Ceper– Kunciran 14.19

2 Sunter–PuloGebang 11.19

3 Serpong –Cinere 10.14

4 Cinere – jagorawi 14.84

5 Cimanggis – Cibitung 25.39

6 Cibitung – Cilincing 34.02

7 Depok – Antasari 21.54

8 Bekasi – Cawang – Kp Melayu 21.04

9 Bogor Ring Road 11.00

10 6 Project Tol DKI Jakarta 69.77

11 Serpong – Balaraja 30

TOTAL 263.12

PT Mega Manunggal Property Tbk

36

BANDAACEH

MEDAN

PEKANBARU

BANDAR LAMPUNG

JAMBIPADANG

PALEMBANG

PANGKAL PINANG

BENGKULU

BANDUNG

SEMARANG

SURABAYA

DENPASAR

MATARAM

UJUNGPANDANG

KENDARIBANJARMASIN

MAMUJ U

PALU

SAMARINDA

PALANGKARAYA

PONTIANAK

AMBON

MENADO

SORONG MANOKWARI

W AMENA

JAYAPURA

MERAUKE

KENDARI

KUPAN

G

BALIKPAPAN

1

2

56

3JAKAR4TA

87

YOGYAKARTA

LinkNumber 1 2 3 4 5 6 7 8

LinkName Semarang-Demak

Probolinggo-Banyuwangi

Serang-Panimbang (Segment Cileles-

Panimbang)

Jakarta Cikampek 2 Selatan*

Jembatan Suramadu

Cileunyi-Tasik-Cilacap*)

Cilacap-Jogja-Solo*)

Jogja-Bawen

PT Mega Manunggal Property Tbk

Toll Roads AirportsRailways

This will positively affect the process of delivering goods and services for tenant companies,

which becomes competitive advantage for warehouse investment

37

PT Mega Manunggal Property Tbk

Tanjung Perak Port

Juanda air Port

In the near future, Gresik, Sidoarjo, and Surabaya will become our expansion target

21 Km

22 Km

In terms of land prices and availability, Gresik and Sidoarjo seem potential for warehouse location. It offers

effective route to airport and port which could be added value for our future tenant.

35 Km

6 Km

Key Industry Served :FMCG, FnB, Electronic,

Chemicals

Greater Surabaya

38

PT Mega Manunggal Property Tbk

Healthy Growth in FMCGs and Retail

Urbanisation and growing wealth is already translating into

growth in the FMCG sector and retail sales. This will

increase the appeal of the logistics real estate market to a

broader spectrum of modern international logistics players.

Indonesia has a robust manufacturing sector

Indonesia has a large manufacturing base driven by a large

domestic consumer market and low labour costs. The robust

manufacturing sector is another major driver of demand for

logistics services and associated real estate. In 2015,

manufacturing accounted for 22% of GDP.

39

PT Mega Manunggal Property Tbk

Indonesia Manufacturing Industry Snapshot

647 725812

9101,020

1,143

2015 2016 2017 2018 2019 2020

9.00%

Food and Beverage Manufacturing Sector

GDP Value, 2015-2020, IDR Trillions

2,405 2,622 2,858 3,115 3,3953,700

2015 2016 2017 2018 2019 2020

1. Positive demographics profile

2. Robust economic growth

3. Large number of middle income class

4. High degree of consumption

Growth Drivers Market Restraints

1. Slowing in global economy

2. Poor logistics infrastructure

3. High logistics cost

4. Regulation

Manufacturing Industry GDP Value,

2015-2020, IDR Trillions

The growing economy will further amplify the manufacturing industry,

especially food & beverages that will create bigger demand of warehousing

40

PT Mega Manunggal Property Tbk

1. Positive demographics profile

2. Robust economic growth

3. High ICT adoption

4. Large number of local players

Growth Drivers Market Restraints

1. Poor logistics infrastructure

2. Large unbanked population

3. Low adoption of cashless payment

4. Limited ICT competency

7501,100

1,350

1,850

2,400

2,950

3,800

2013 2014 2015 2016 2017 2018 2019

31.1%

Indonesia e-Commerce Market Size, 2015-2019, USD Millions

41

PT Mega Manunggal Property Tbk

IDR 257.64

Tn

Construction13%

Mining & quarrying,

7.6%

Wholesale,Retail17%

Processing Industry

14%

Financial Service and Insurance

10%

Communication, 3.5%

Other Services , 39%

• Wholesale, retail, and automotive sector was 17.0 percent of 2015 GDRP equivalent to IDR 304.65 Trillion

• Investment in existing infrastructure, mainly on toll roads, will further amplify logistics efficiency for wholesale and

retail companies in Indonesia, which include time and cost reducing

Greater Jakarta GDRP by Key Industries, 2015

(% of GDRP)

42

PT Mega Manunggal Property Tbk

Government investment plan and initiatives on

infrastructure sector are expected to reach IDR 313

trillion in 2016, approximately 8.0% increase from

2015.

GDP’s share for transport, storage and courier is

estimated grow around 38.0 percent in 2016 at

IDR 798 trillion. where 23 share percent accounts for

warehousing

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

2011 2012 2013 2014 2015 2016(e)

Services Transportation, storage and courier

Source: World Bank, Indonesian Statistical Agency, Frost & Sullivan

Growth of Service Segment 2011- 2016 (f)

43

PT Mega Manunggal Property Tbk

High growth, large domestic

market

Low growth, small

domestic market

Low growth, small domestic

market

Low growth, large domestic market

Indonesia continues to be an attractive target for FDI

Competitive wages and large domestic market makes Indonesia to be an attractive target for FDI in ASEAN

• Jakarta minimum wage increased 17.9% per year on average,

which will imply in higher labour cost due to higher inflation rate.

Productivity issue is assumed to be constant.

• Abundant amount of working-age population will increase labour

availability in the long-term. The composition also shows that

male workers are dominating in working-age population.

Resilient economy growth and large domestic market are expected to boost investment in Indonesia

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

2011 2012 2013 2014 2015Minimum Wage Increase in PMW

Rp

Jakarta’s Historical Minimum Wage 2011 - 2015

Source: JLL

2012 2020

Indonesian population is becoming wealthier and consumption is

expected to increase. By 2020, more than half of the population

is expected to be middle class or above

30%Middle and above

70%Below middle 53%

Middle and above

47%Below middle

44

PT Mega Manunggal Property Tbk

This shows that demand for warehouse complex in Jabodetabek area is still growing, which this will be great opportunity to invest in the area.

Stable land prices over the year encourages acquisition of new lands to satisfy the growing demand in the industry property.

Source: Central Bank of Indonesia; Frost & Sullivan Analysis

94.00

96.00

98.00

100.00

102.00

104.00

106.00

108.00

110.00

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4e

2014 2015 2016

Warehouse Demand Index, 2014-2016

(Quarterly)

0

50

100

150

200

250

2011 2012 2013 2014 2015U

SD/s

qm

Greater Jakarta Industrial Land Price

Bogor Bekasi Tangerang Karawang

Increase 9% in

Q4 2016 from

Q1 2014

Source: Analysis by Frost & Sullivan

45

PT Mega Manunggal Property Tbk

While the e-commerce phenomenon has taken hold in many

other markets in the region, the sector is still in its infancy in

Indonesia and the potential future growth also presents an

opportunity.

The Indonesian population has a large online presence.

Internet and mobile internet traffic has increased significantly.

46

PT Mega Manunggal Property Tbk

48

139,811 158,137 163,911 163,911

230,370

300,680 300,680

96.8%

97.8%

97.2%

100.0% 99.9%

99.4% 99.2%

95.0%

96.0%

97.0%

98.0%

99.0%

100.0%

101.0%

2013 2014 2015 2016 2017 2018 3M19

-

50,000

100,000

150,000

200,000

250,000

300,000

350,000

PT Mega Manunggal Property Tbk

(Rp bn) 2015 2016 2017 2018 Q1 ‘19 Q1 ‘18 YoY (%)

Revenues 163.5 175.3 208.8 299.2 81.1 68.0

Operating profit 121.7 117.7 142.4216.3

63.8 49.5

Finance Costs (51.8) (46.8) (52.3) (47.5) (12.7) (10.5)

Forex gain / loss – net (28.9) 3.3 (0.8) (9.2) 1.7 (2.1)

Changes of IP fair value 64.8 323.0 217.2 144.3 - -

Profit before tax 131.0 416.6 314.1 281.3 52.4 40.9

Income tax (16.3) (17.6) (20.9) (30.0) (8.1) (6.6)

Net income (loss) 114.4 342.2 293.1 251.3 44.2 34.1

49

IDR

mili

ar

15.2%17.1% 17.6%

13.3%12.4% 13.8%

7.8% 8.7% 8.4% 7.5% 7.5%8.3%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2014 2015 2016 2017 2018 Q1 2019

IP at cost IP at fair value Yield to cost Yield to fair value

PT Mega Manunggal Property Tbk

(Rp bn) 2014 2015 2016 2017 2018 Q1 ’19

Cash & cash equivalent 11 383 105 201 152 210

Current asset (a) 82 519 200 390 398 484

Investment properties 2,037 2,388 3,319 4,592 5,270 5,560

Non current asset (b) 2,056 2,685 3,766 4,972 5,693 5,873

Total asset (a+b) 2,139 3,204 3,966 5,363 6,091 6,358

Short term liabilities (c) 137 176 235 294 297 487

Long term liabilities (d) 554 478 446 399 486 518

Debt 597 587 520 526 579 684

Total liabilities (c+d) 691 653 682 693 783 1,005

Paid in capital 400 571 571 689 689 689

Retained earnings 816 932 1,273 1,525 1,572 1,572

Total equity 1,448 2,551 3,284 4,670 5,308 5,352

50

0.41x

0.23x

0.16x

0.11x 0.11x0.13x

0.00x

0.05x

0.10x

0.15x

0.20x

0.25x

0.30x

0.35x

0.40x

0.45x

-

1,000

2,000

3,000

4,000

5,000

6,000

2014 2015 2016 2017 2018 Q1' 19

Investment Porperty Debt Equity Debt-to-Equity

PT Mega Manunggal Property Tbk

51

141.9 163.5 175.3

208.8

299.2

81.1 68.0

2014 2015 2016 2017 2018 Q1 19 Q1 18

Revenues

115.1 122.9 120.8 145.9

220.2

63.2 68.0

-

50.0

100.0

150.0

200.0

250.0

2014 2015 2016 2017 2018 Q1 19 Q1 18

EBITDA

1,447.50

2,551

3,284

4,670

5,308 5,352 5,308

0.00

1,000.00

2,000.00

3,000.00

4,000.00

5,000.00

6,000.00

2014 2015 2016 2017 2018 Q1' 19 Q1 '18

Equity

(Rp bn)

753

986

527

172

307

2016 2017 2018 Q1 '19 Q1 '18

Capex

2014 2015 2016 2017 2018 1Q 19

Operational metric

Net Leasable Area, m2

Built to suit 111,900 117,520 117,520 185,355 185,355 185,355

Multi tenants 46,237 52,011 46,391 45,015 115,325 115,325

Total, m2 158,137 163,911 163,911 230,370 300,680 300,680

Occupancy rate, %

Built to suit 98% 97% 100% 100% 100% 100%

Multi tenants 98% 97% 100% 99% 99% 98%

Average occupancy rate, % 98.0% 97.0% 99.9% 99.9% 99.4% 99.2%

Average remaining lease term, years 6.5 6.0 5.4 5.4 4.4 4.1

Revenue by segment

Revenue, Rp bn

Rental built to suit 99,160 99,922 106,313 137,015 188.718 48,063

Rental multi tenants 42,758 63,570 69,006 72,452 110.516 23,191

Total revenues, Rp bn 141,918 163,492 175,320 209,467 299,234 71,254

52

Built To Suit62%

Multi Tenant38%

PT Mega Manunggal Property Tbk

54

Tanjung Priok

Seaport Industrial Estate

Ex pansion Area

Halim PK Airport

Pondok Ungu warehouse

Lazada Warehouse

Cileungsi Warehouse

Intirub Business Park

JababekaMM2100Cibatu Warehouse

Block AE Warehouse

LF WarehouseSelayar Warehouse

Unilever WarehouseBlock H Warehouse

Delta Silicon

Airport warehouse

Soekarno-Hatta

Int’ l Airport

Toll Road in operation Toll Road under construction

PT Mega Manunggal Property Tbk

Tanjung Perak Port

Juanda Air Port

Toll RoadsIn Operation

Under construction

Planning

In (Km) Manyar Warehouse

Distance to Surabaya 31

Distance to Airport 52

Distance to Tanjung Perak Port 29

MMP properties

55

PT Mega Manunggal Property Tbk

Year to Mar 31, Rp mn 2014 2015 2016 2017

Cash and Equivalents 11,311 382,973 104,683 201,516 152,175 37.8%

Other current assets 57,381 127,100 92,962 189,163 245,981 11.5%

Property & equipment 2,107 13,483 13,342 12,327 11,917 -6.2%

Investment properties 2,036,806 2,388,400 3,318,776 4,592,009 411,671

Other non-current assets 17,183 283,590 433,700 368,645 5,693,167 -26.5%

Total assets 2,138,502 3,204,321 3,965,769 5,363,669 6,091,323

ST unearned revenue 23,528 25,281 42,641 25,398 47,993 237.1%

Bank loans - short term 35,636 124,911 89,859 164,117 159,905 30.0%

Other current liabilities 77,433 25,276 102,648 104,997 88,742 32.3%

Bank loan 541,288 460,646 427,901 361,161 419,068

LT unearned revenue - - 2,743 10,725 35,656

Other long term liabilities 12,762 17,180 15,717 27,081 31,731

Total Liabilities 690,647 653,294 681,509 693,479 783,096

Minority interest 2,673 2,916 393,675 885,106 1,302,443

Equity (exc. Minority) 1,445,182 2,548,111 2,890,585 3,785,083 4,005,784

66

*) : Unaudited

PT Mega Manunggal Property Tbk

Year to Dec 31, Rp mn 2014 2015 2016 2017

Revenue 141,918 163,492 175,320 208,794

Cost of revenue 13,084 16,059 18,444 20,146

Gross profit 128,834 147,432 156,875 188,647

G&A 14,616 25,754 39,143 46,202

Operating profit 114,218 121,677 117,732 142,445

EBITDA 115,031 122,852 120,756 145,984

Net interest income (expense) (42,818) (23,640) (29,262) (47,363)

Increase in fair value Invt Prop 261,127 64,787 323,288 217,211

Other items (23,165) 31,822 5,073 (1,272)

Profit before tax 309,363 131,003 416,831 314,051

Tax (14,192) (16,349) (17,624) (20,986)

Proforma adjustment (8,482) - -

Net income (after NCI) 286,404 114,415 342,166 252,262

67*) : Unaudited

PT Mega Manunggal Property Tbk

Rp mn 2016 2017

Cash flow from operating activities

Cash Receipt from Customer

Payment to Supplier and Others

Tax paid

Interest paid

Net cash provided by operating activities

Cash flow from investing activities

Acquisition of Investment Properties

Other investment activities

Net Cash Used in Investing Activities

Cash flow from financing activities

Loan Receipts from Bank

Payment to Bank Loan

Receipt from Paid in Capital

Others

Net Cash provided by Financing Activities

Net increase (decrease) in cash and cash equivalents

Effect of foreign exchange, net (4)

Cash and cash equivalent of subsidiaries - before acquisition

Cash and cash equivalent, beginning balance

Cash and cash equivalent ending balance

68*) : Unaudited