Modelling Pillar II in CAPRI Wolfgang Britz Institute for Food and Resource Economics, University...

-

Upload

elvin-whitehead -

Category

Documents

-

view

221 -

download

1

Transcript of Modelling Pillar II in CAPRI Wolfgang Britz Institute for Food and Resource Economics, University...

Modelling Pillar II in CAPRI

Wolfgang BritzInstitute for Food and Resource Economics, University Bonn

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Content

Data General approach Implementation Running a scenario Result analysis

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Underlying data

Assembled by team of Janet Dwyer, from DG-AGRI sources, huge investment especially ex-post

Different definitions:• Planned spend planned allocation of budget to different measures• Actual spend

Spenders (“matching funds”, co-financing with fixed shares depending on region and measure)• EU budget• National co-financing• Private (e.g. in case of investment aid)

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Underlying data

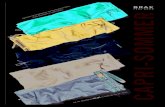

Data on € spend on certain measures by year and NUTS2

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Underlying data

Data now in GDX after final cleansing by Torbjoern:

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

General idea

Existing data only provide a very rough idea how the money was spent Impossible (at least for us) to get detailed information how the measures are

exactly implemented in the different MS and regions CGEs are rather aggregated (only one agricultural sector), detailed modeling

is thus not possible=> Develop a list of “shocks” which can be seen as archetypical for Pillar II

interventions:

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

General idea

Janet, Ben Allen, Peter, Kazia and other have assigned the RD measures to these shocks (http://www.ilr.uni-bonn.de/agpo/rsrch/capri-rd/docs/d3.1.2.pdf)

….

Shocks will change parameters in the model: behavioral parameters of government or parameters in the production

function tax rates

Size of shock is proportional to the money spent and relative to what is shocked (e.g. amount of land subsidies related to return to land)

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Human capital agriculture

Good example for the overall logic:1. Where does the money end?

2. What is the effect of spending the money?

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Human capital rest

Exercise:• Make a small flow chart showing how that type of shock affects the

different elements of the CGE Similar:

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Investment in agriculture

Increase capital stock in agriculture …. and assume that new capital is more productive …

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Human capital rest

Exercise:• As before: make a small flow chart showing how that type of shock

affects the different elements of the CGE

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Increase gov demand for construction

… and the implementation of the shock

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Land subsidies for agriculture

And the shock implementation

Note: these measures are modeled in CAPMOD, so if the PE_LINK is used,no shock in CGE …

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Land subsidies for agriculture

But the story is more complex …. If the shocks becomes to large, the model might freak out …

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Land subsidies for forestry

Shock implementation is identical to agriculture

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Subsidies to service sector

Straightforward: reduction of production taxes …

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Downstream subsidies

and/or decrease tax rate

Plus some vintage effect (more productive new capital)

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Capital subsidies agriculture and forestry

Same story as for downstream industries:• Part expands capital stocks• Remaining part subsidizes investments• Vintage effects

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Income subsidies

Effect not clear … and only one household type

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Shock logic

Beware, normally, in a CGE, there are only two ways to make society better off• Technical progress => produce more from given endowments• Remove distortions which reduce allocational inefficiencies

Our shock logic links certain government actions (= which require taxes to be financed and thus are distortive) directly to a TFP change depending on the size of the TFP multiplier, government intervention can be beneficial => some leeway for wishful thinking, welfare analysis can be dubious

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Reporting and shock logic

The SAM does already comprise the measures ….• e.g.: land taxes / subsidies for agriculture as reported in the SAM

comprise the single farm payment, LFA, land taxes …• That is different from the CAPMOD logic where we define all the

premiums That means for the CGE, a no change in policy means no shock … and we

simulate the effect of Pillar II by removing it …

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Running a scenario

An existing scenario Selection of MS

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Running a scenario

Definition of the baseline of CAPRI used

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Running a scenario

Closure rules and other settings

Britz: CAP post 2013 – Quantitative Analysis with CAPRI

Own analysis

Run for DK:• cge_no_shock (= baseline calibration shock)• Cge_rd_minus100 (= remove pillar II)

Load the results in the interface Report the key changes in policies (budget, main measures) What happens to the agriculture sector (factor use, output, price)? Welfare analysis