MARKET OUTLOOK FOR 11 NOV- CAUTIOUSLY OPTIMISTIC

Transcript of MARKET OUTLOOK FOR 11 NOV- CAUTIOUSLY OPTIMISTIC

-

8/8/2019 MARKET OUTLOOK FOR 11 NOV- CAUTIOUSLY OPTIMISTIC

1/5

Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143PMS Regn No. INP00000238

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

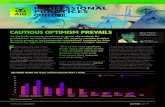

MARKET INSIGHTS: On Wedneday Nov 10, 2010,

The BSE Sensex lost 56.77 points or 0.27% to settle at 20,875.71

CD up 4.78%, Auto up 1.12% and IT up 0.73%, Teck up 0.31%

Asian markets ended mixed on Wednesday, as confidence

The domestic markets finally snappe

the sluggish day of trade on a negative note, the start of the markets was not very confident an

while Nifty made a slightly positive start the Sensex began the day in red, tracking the mixe

global cues as the US markets closed lower overnight and the Asian markets made a mixe

start on some renewed worries about the debt burden in Europe. Till the mid morning sessio

the domestic indices tried hard to recover but couldn't get success as the capital goods, metaand IT sector stocks kept dragging. In the noon session finally the markets saw the light o

green and edged higher though the markets continued missing the participation of the heav

weights, it was the action in broader indices that took the markets higher and the market

touched their high points of the day in noon session but profit booking once again emerged a

that very point and the markets slip into red and kept languishing their till the end. The on

stock that maintained its momentum throughout the day was Tata Motors , after announcing

better than expected September quarter numbers. On the same time metal behemoth

Hindalco Industries languished in red from the very beginning on reporting worse tha

expected numbers, though its main business Copper performed well its other businesse

performance were not in line with the market expectations.

(Provisional) while the S&

CNX Nifty declined 26.10 points or 0.41% to end at 6,275.45 (Provisionally). The BS

Sensex touched a high and a low of 20,970.91 and 20,849.92 respectively. There were 1advances against 18 declines on the index. The S&P CNX Nifty touched a high and a low

of 6,307.65 and 6,269.25, respectively (Provisional). There were 16 advances against 3

declines on the index. (Provisional)

were the only gainers on th

BSE sectoral space, while FMCG down 0.99%, Bankex down 0.76%, CG down 0.71%

Metal down 0.64% and Power down 0.57% remained the major laggards on the BS

sectoral space. The broader indices ended in positive region; the BSE Mid-cap inde

added 0.29% while the Small-cap index climbed 0.86%. There were 1802 advances again

1206 declines on the index. (Provisional)

was held back amids

speculation of Chinese efforts to cool inflation. Jakarta Composite was trading at 3,756.97

up by 19.48 points or 0.52%, KLSE Composite was trading at 1,528.01, up by 1.48 points o0.10%, Nikkei 225 was trading at 9,830.52, up by 136.03 points or 1.40%, Seoul Composit

was trading at 1,967.85, up by 20.39 points or 1.05% and Taiwan Weighted was trading a

8,450.63, up by 5 points or 0.06%. On the flip side, Shanghai Composite wastrading a

3,115.36, down by 19.64 points or 0.63%, Hang Seng was trading at 24,500.61, down b

209.99 points 0.85% and Straits Times was trading at 3,289.24, down by 24.37 points.

SCRIPS Open High Low Close Prev Close % Change Volume

M&M 785.9 809.85 780.9 808 781.05 3.45 3334959TATAMOTORS 1346 1348 1297.2 1301 1269.9 2.45 5687186BPCL 746.8 769.7 738.4 757.35 744.05 1.79 637830RPOWER 170.9 174.4 170.55 173.6 170.95 1.55 2660968

WIPRO 435 439 432 436.5 431.65 1.12 982088

SCRIPS Open High Low Close Prev Close % Change Volume

AMBUJACEM 163.25 164 159.8 160.95 164.7 -2.28 1790217BHARTIARTL 335 345.6 325.55 327 334.55 -2.26 10217605RANBAXY 616.2 617.05 601 604.05 617.3 -2.15 783972IDFC 207 208.25 201.5 203 207.35 -2.1 10800878CIPLA 349.1 350 342.05 343 349.95 -1.99 830584

INDEX TOP MOVERS

INDEX TOP SHAKERS

INDEX Close Chg Chg

Sensex 20876 -56 -0.27%

Nifty 6276 -26 -0.41%

Midcap 8730 25 0.29%

Smallcap 11244 96 0.86%

VALUE TRADED (Rs Crs) Chg

BSE 7.32%

NSE -5.82%

F&O Total -25.73%

NET INFLOWS (Rs Crs) Chg

FIIs -107%

DIIs -73%

FII OPEN INTEREST (Crs) Chg

FII Index Futures 3.80%

FII Index Options 0.79%

FII Stock Futures 0.88%

FII Stock Options -4.53%

Chg

Dow Jones 0.10%

Nasdaq 0.62%

FTSE 100 -0.99%

Commodity Chg

Crude Oil (US$/bl) 1.53%

Gold (US$/oz) 0.55%

17799

56395

44111

945

World Indices

11357

5817

89.4

1406.7

2579

DATA MATRIX OF LAST S ESSIO N

5850

16787

85327

-32.5

-143.7

Real life predictability is not so rewarding...

Predic t the Sensex w ith

& w in da ily c ash p rizes!MANSUKH

MORNING NOTE 11 NOV, 2010

make more, for sure.

http://www.facebook.com/Moneysukh?v=app_4949752878&ref=searchhttp://www.facebook.com/Moneysukh?v=app_4949752878&ref=searchhttp://www.facebook.com/Moneysukh?v=app_4949752878&ref=searchhttp://www.facebook.com/Moneysukh?v=app_4949752878&ref=searchhttp://www.facebook.com/Moneysukh?v=app_4949752878&ref=searchhttp://www.facebook.com/Moneysukh?v=app_4949752878&ref=searchhttp://www.linkedin.com/companies/815690http://twitter.com/moneysukhhttp://www.facebook.com/Moneysukh -

8/8/2019 MARKET OUTLOOK FOR 11 NOV- CAUTIOUSLY OPTIMISTIC

2/5

Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB230781431PMS Regn No. INP000002387

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

MARKET

HAPPTRADING....

and may continuing the same scenario in coming dayhowever we believe crucial support could be around 6220 level. The moving averages indicate positive signal as the price line hovering above all ththree 20, 50 and 200 DSMA moving averages however oscillators MACD, RSI and STOCHASTICS generate mixed signals .So traders and investo

have to be very cautious in taking their position at this level, every correction should be considered as a buying opportunity..

VIEW:The domestic markets finally snapped the sluggish day of trade on a negative note, the start of the markets was not very confident and while Niftmade a slightly positive start the Sensex began the day in red, tracking the mixed global cues as the US markets closed lower overnight and the Asiamarkets made a mixed start on some renewed worries about the debt burden in Europe

MARKET OUTLOOK- CAUTIOUSLY OPTIMISTIC

Index Support 2 Support 1 Previous Close Resistance 1 Resistance 2 Trend

SENSEX 20595 20745 20876 21125 21210 Rangebound

NIFTY 6170 6220 6276 6335 6365 Rangebound

TODAY'S MARKET LEVELS

Index Support 2 Support 1 Previous Close Resistance 1 Resistance 2 Trend

BANK NIFTY 12615 12705 13091 13300 13500 Rangebound

Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143PMS Regn No. INP00000238

Morning Notesmake more, for sure

-

8/8/2019 MARKET OUTLOOK FOR 11 NOV- CAUTIOUSLY OPTIMISTIC

3/5

Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143PMS Regn No. INP00000238

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

INTRA DAY TECHNICAL RECOMMENDATIONS

Morning Notes

Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend

3I INFOTECH 70.2 69.5 68.5 72 73 Rangebound

make more, for sure

Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend

KOLTE PATIL 69.5 69 68.5 70.5 71.5 Rangebound

-

8/8/2019 MARKET OUTLOOK FOR 11 NOV- CAUTIOUSLY OPTIMISTIC

4/5

Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143PMS Regn No. INP00000238

INTRA DAY TECHNICAL RECOMMENDATIONS

Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend

SMARTLINK 68.3 67.5 66.5 69 70 Rangebound

Morning Notesmake more, for sure

Scrip CMP Sell Near Stop Loss Target 1 Target 2 Trend

NITIN 80.05 81.5 83 79 78 Rangebound

-

8/8/2019 MARKET OUTLOOK FOR 11 NOV- CAUTIOUSLY OPTIMISTIC

5/5

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143PMS Regn No. INP00000238

Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143PMS Regn No. INP00000238

Note: Please refer our Derivative Report for recommendation on OPTION STRATEGIES .

For more copies or other information, please send your query at [email protected]

Additional Information with respect to the securities referred in our derivative calls is uploaded on our website.Please note that our technical calls are totally independent of our fundamental callsTechnical Trends calls are based on momentum, Investors/Traders are requested to observe following discipline to take maximum advantage of theproducts

-Entry/exit will be on the basis of price or time priority-Use strict stop loss at 15% from your average acquisition price

This report is prepared for the exclusive use of Mansukh Group clients only and should not be reproduced, recirculated,published in any media, websiteor otherwise, in any form or manner, in part or as a whole, without the express consent in writing of Mansukh Securities and Finance Ltd. Anyunauthorized use, disclosure or public dissemination of information contained herein is prohibited.

This data sheet is for private circulation only and the said document does not constitute an offer to buy or sell any securities mentioned herein. Whileutmost care has been taken in preparing the above, we claim no responsibility for its accuracy. We shall not be liable for any direct or indirect lossesarising from the use thereof and the investors are requested to use the information contained herein at their own risk.

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Morning Notes

NAME DESIGNATION E-MAIL

Varun Gupta Head - Research [email protected]

Pashupati Nath Jha Research Analyst [email protected] Singh Research Analyst [email protected]

make more, for sure