MARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTIC

-

Upload

mansukh-investment-trading-solutions -

Category

Documents

-

view

219 -

download

0

Transcript of MARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTIC

8/6/2019 MARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTIC

http://slidepdf.com/reader/full/market-outlook-for-11-july-cautiously-optimistic 1/5

make more, for surMorning Note 11 JULY 2011

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

FIRST LIGHT HEADINGS

MARKET INSIGHT

On Friday 08 July 2011

The BSE S ensex lost 220.16 points or 1.15% and settled at 18,858.04

On the global front,

On Friday, the group of ministers headed by Finance Minister Pranab Mukherjee

,Local bourses entered the correction phase and lost more than half of th

previous session gains. Investigation related to the telecom scams coupled with GoM approved Dr

Mines & Minerals Development & Regulation Bill were the issues that rocked the markets tod

Further, even bottom line pressure woes marred the sentiment at Dalal Street, thereby leading pro

booking well before the corporate earnings season formally kicks in. However, HDFC and IndusI

bank were the stocks that caught investor's eye on reported their Q1FY12 numbers. HDFC lost ov1% on reporting lower than estimated earnings. The company reported 22% in its profit after tax

the quarter ended June 30, 2011 at Rs 844.53 crore as compared to Rs 694.59 crore for the quarter end

June 30, 2010. On the other hand, IndusInd Bank's stocks rose over 0.50%; amusing the street with

number. The bank's net profit for the quarter ended June 30, 2011 surged by 51.99% at Rs 180.18 cr

as compared to Rs 118.55 crore for the quarter ended June 30, 2010.

d NSE Nifty also lost 68

points or 1.19% and closed at 5660.65. Other two BSE broader indices BSE Mid-cap index lost 0.6

while Small-cap index was down by 0.86%. On the BSE Sectoral front, Realty up 2.08% was the on

gainers. On the flip side, Metal down 2.99%, PSU down 1.72%, FMCG down 1.14%, Oil&Gas dow

1.13% and Capital Goods down 0.93% were the top losers.

US stocks marched higher on Thursday, as encouraging news about both

employment and retail sales drove investors into risky assets. Investors were heartened by Ju

private-sector jobs gains that comfortably outstripped economists' forecasts. Meanwhile, As

shares too tailing the upbeat US employment data ended mostly higher on improved risk appeti

The European shares were on the track for a ninth gain in 10 sessions, boosted by Wall Street and A

stocks, and ahead of key US labour data that may confirm the strength of the recovery in the worl

biggest economy.

gave a

ahead to the draft bill for the mining sector, which makes it mandatory for coal miners to share 26%

their net profits with project-affected people. The bill also proposed companies mining oth

resources to pay 100% of the royalty on their production to the original inhabitants of the project s

On the other hand, Meanwhile, on the back of increased demand from western markets Indi

exports for June increased by 46.4% to $29.2 billion, on the other hand, imports too registered

growth of 42.4% to $36.9 billion, leaving a trade deficit of $7.7 billion for the month of June. In the fi

quarter of current financial year, exports grew by 45.7% to $79 billion and imports increased by 36.2

to 110.6 billion, however, trade deficit for the first quarter stood at $31.6 billion.

an

INDEX Close %Chg

Sensex 18858 -1.15

Nifty 5661 -1.19

Midcap 6996 -0.63

Smallcap 8375 -0.86

VALUE T RAD ED (Rs Crs) % Chg

BSE 3214 -8.01

NSE 12269 2.04

F& O Total 101598 -0.98

Total Volume 113868 -3.60

NET INFLOWS (Rs Crs) %Chg

FIIs 517.3 -40.47

DIIs (389.7) 142.05

FI I O PEN I NT EREST (Crs) % Chg

FII Index Futures 12712 0.22

FII Index Options 35369 4.73

FII Stock Futures 31265 0.37

FII Stock Options 780 9.13

%Chg

Dow Jones 12657 -0.49

Nasdaq 2860 -0.45

FTSE 100 5991 -1.06

Commodity %Chg

Crude (US$/bl) 118.3 0.48

Gold (US$/oz) 1544.6 0.88

Top 5 Movers Close Price % Chg

SIEMENS 916 2.6

RANBAXY 551 1.43

ONGC 276.85 0.69

CAIRN 323.35 0.61

BHARTIARTL 400 0.5

Top 5 Loser Close Price %Chg

SESAGOA 281.6 -4.4

SAIL 136.2 -4.08

GRASIM 2150.5 -4.04

HINDALCO 188 -3.91

STER 163.65 -3.85

DATA MATRIX OF LAST S ESSION

World Indices

8/6/2019 MARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTIC

http://slidepdf.com/reader/full/market-outlook-for-11-july-cautiously-optimistic 2/5

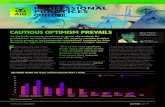

MARKET OUTLOOK- CAUTIOUSLY OPTIMISTIC

make more, for sur

Index Support 2 Support 1 Previous Close Resistance 1 Resistance 2 TrendSENSEX 18675 18760 18858 18953 19050 Rangebound

NIFTY 5590 5630 5661 5695 5730 Rangebound

TOD AY'S MARK ET LEVELS

QUANTITATIVE ANALYSIS

FAVORED S CENARIO:

VARIED S CENARIO: HAPPY TRADING.....

:

Exactly to our expectation spot index shown some consolidation around 5670-5680 level in the last session though we feelmerely a sign of tiredness and still spot index have the potential to reach 5750-5760 level (200 DMA) where we might see momentum shifting. Thereffor the upcoming week possibility of range bound scenario between 5500-5800 could be more visible at this stage. Any closing above 5800-5810 wsubstantial volumes may reap indices towards 5960-6000 where traders are advised to create short positions.

On the flip side any break down below 5500-5480 may further spoils the sentiment and we might see some sharp sell off near5300-5330 where suggestive buying opportunities may arise

Investor's lacking conviction pocketed profits mostly towards the fag end of the trade, thereby leading tbourses end with heavy losses. The 30-scrip sensitive index (Sensex) of the Bombay Stock Exchange (BSE) breached its 19k level, with a lossover 200 points. Similarly, the 50-scrip S&P CNX Nifty of the National Stock Exchange tanked over 50 points and ended below the 5700 level. Tbroader indices too following the larger peers, ended lower with loss of over 0.50% each. The market breadth on the BSE ended negativadvances and declining stocks were in a ratio of 1168:1690 while 147 scrips remained unchanged while India VIX, a gauge for market's short teexpectation of volatility gained 0.27% at 18.67 from its previous close of 18.62 on Thursday.

.

Index Support 2 Support 1 Previous Close Resistance 1 Resistance 2 Trend

BANK NIFTY 11015 11150 11285 11420 11555 Rangebound

Morning Note

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

8/6/2019 MARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTIC

http://slidepdf.com/reader/full/market-outlook-for-11-july-cautiously-optimistic 3/5

INTRA DAY TECHNICAL RECOMMENDATIONS

make more, for sur

Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend

KSE 225 220 215 225 230 Rangebound

Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend

DHANUS 14.25 14.2 14 14.4 14.6 Rangebound

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Morning Note

8/6/2019 MARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTIC

http://slidepdf.com/reader/full/market-outlook-for-11-july-cautiously-optimistic 4/5

make more, for sur

Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend

KGL 13 12.75 12.5 13 13.25 Rangebound

INTRA DAY TECHNICAL RECOMMENDATIONS

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Morning Note

Scrip CMP Sell Near Stop Loss Target 1 Target 2 Trend

POLARIND 7.25 7.3 7.5 7.1 6.9 Rangebound

8/6/2019 MARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTIC

http://slidepdf.com/reader/full/market-outlook-for-11-july-cautiously-optimistic 5/5

Note: Please refer our Derivative Report for recommendation on OPTION STRATEGIES.

For more copies or other information, please send your query at [email protected]

dditional Information with respect to the securities referred in our derivative calls is uploaded on our website.lease note that our technical calls are totally independent of our fundamental calls. Technical Trends calls are based on momentu

nvestors/Traders are requested to observe following discipline to take maximum advantage of the products.

Entry/exit will be on the basis of price or time priorityUse strict stop loss at 15% from your average acquisition price

his report is prepared for the exclusive use of Mansukh Group clients only and should not be reproduced, recirculated, published in aedia, website or otherwise, in any form or manner, in part or as a whole, without the express consent in writing of Mansukh Securities a

inance Ltd. Any unauthorized use, disclosure or public dissemination of information contained herein is prohibited.

his data sheet is for private circulation only and the said document does not constitute an offer to buy or sell any securities mentioned herehile utmost care has been taken in preparing the above, we claim no responsibility for its accuracy. We shall not be liable for any direct

ndirect losses arising from the use thereof and the investors are requested to use the information contained herein at their own risk.

make more, for sur

NAME DESIGNATION E-MAIL

Varun Gupta Head - Research [email protected]

Pashupati Nat h Jha Research Analyst [email protected]

Vikram Singh Research Analyst [email protected]

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238Mansukh Securities and Finance LtdOffice: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: [email protected]: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB23078143

PMS Regn No. INP00000238

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Morning Note