Initiation Report Axis Bank

-

Upload

pham-thai-binh -

Category

Documents

-

view

221 -

download

0

Transcript of Initiation Report Axis Bank

-

7/31/2019 Initiation Report Axis Bank

1/13

Page 1

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Initiation report

: Axis Bank Ltd. (Axis Bank) is

expected to achieve loan portfolio growth, going forward, by expanding its

already wide distribution network (861 branches as of June 2009), and by

expanding into mid-sized cities, which are still relatively underpenetrated.

Axis Banks non-core banking

businesses (such as Cash Management Services), its status as an 'agency

bank' and high cross-selling potential are all expected to drive growth in

fee income, going forward. Moreover, we expect tie-ups (such as an online

securities trading partnership with Geojit and a wealth management

partnership with Rothschild) to drive up other income, boosting earnings.

Axis Banks efficiency

ratio is currently the strongest among the peers we have considered.

Although we anticipate cost efficiency pressure over the near term, the

efficiency ratio is set for long term improvement as newly opened

branches become profitable from FY 2014 onwards.

Axis Banks Capital Adequacy

Ratio (CAR) stood at a healthy 15.28% in 1Q 10, giving the firm a solid

financial bill of health, scope for ramping up its lending and the ability to

absorb provisions for bad loans as needed. In addition, the bank plans to

raise capital through the issue of approximately 71 mn shares, placing it

in a strong position to benefit from the anticipated economic upturn.

Axis Bank has one of

the lowest levels of Non-Performing Loans (NPL) among its peer group.

Although we anticipate heightened pressure in asset quality over the near

term, we are encouraged by Management's decision to implement stricter

credit criteria, which should limit growth in bad assets.

We initiate coverage on Axis Bank with aHOLD, based on a weighted average target price of INR825.52. Our ERE

valuation is based on a COE of 14.1% and perpetual growth rate of 3.0%,

while our relative valuation is based on a target P/E multiple of 17.80x

and a target P/BV multiple of 2.15x.

Superior asset quality and risk management underpin long term growth potential

RATING: HOLD

Target price: INR825.52

Reuters ticker: AXBK.BO

Bloomberg ticker: AXSB IB

Analyst: Vishal Narnolia

Editor: James Smithies

Global Research Director: Satish Betadpur, CFA

Price

52 week range

Shares outstanding (mn)

Market capitalization (mn)

Average daily volumes

Dividend yield

Face value INR10

Promoter and promoter group

Domestic financial institutions (DFI)

Foreign Shareholding

Others

Sector

Country of incorporation

Head office location

Principal areas of operation

Company website

Next news dueStock performance

3 M 6 M 12 M

Axis Bank 40.5% 111.9% 16.1%

BSE 100 26.4% 61.4% (1.0%)

Source: Bloomberg, Company data

www.axisbank.com

2Q 10 results, Oct 2009

Company details

Financial

India

Stock data as of 10 August 2009

INR840.50

INR969.00 - INR278.50

359.87

303,478.94

1,059,793

2.41%

Mumbai

Shareholding pattern as of 30 June 2009

India

42.41%

11.30%

32.90%

13.50%

-

7/31/2019 Initiation Report Axis Bank

2/13

Page 2

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Axis Bank offers a wide range of banking and financial products and services to retail and corporate

clients, including retail/corporate credit, forex/trade finance services, investment banking, depository

services and investment advisory services. Formerly known as UTI Bank Limited (and renamed on 30

July 2007), the firm was established by the Specified Undertaking of the Unit Trust of India (SUUTI), the

Life Insurance Corporation of India (LIC) and the General Insurance Corporation (GIC), all acting as

promoters. SUUTI is the largest shareholder, with a stake of 27.08%. Axis Bank began operating in

1994, and is currently the third largest private bank in India, with a balance sheet weighing in at

INR1.5 tn (as of 31 March 2009). As of June 2009, Axis Bank operated a network of 861

branches/extension counters and 3,723 ATMs, throughout 30 states and 4 union territories in India.

The company also has branches in Singapore, Hong Kong and Dubai, as well as a representative office

in Shanghai. In FY 2009, total deposits and advances stood at INR1,173.7 bn and INR815.6 bn

respectively, with a healthy Cash and Savings Accounts (CASA) ratio of 43.15%, indicating low fundingcosts. Axis Bank raised INR15 bn through subordinated debt in November 2008, bringing its CAR to

15.28% as of 30 June 2009; this is well above the Reserve Bank of India's (RBI) minimum requirement

of 9%.

Shareholding pattern (December 2008)

42.4%

11.3%

32.9%

13.5%

Promoters Domestic Financial Institutions

Foreign Shareholding Others

Source: Company data

Breakdown of advances (FY 2008) Breakdown of advances (FY 2009)

49%

9%

19%

23%

Large- and mid-si zed corporates SMEs Agr icul tural Retai l

50%10%

20%

20%

Large- and mid-si zed corporates SMEs Agr icul tural Retai l

Source: Company data

Axis Bank is the third-

largest private bank in

India, with a balance

sheet of INR1.5 tn

-

7/31/2019 Initiation Report Axis Bank

3/13

Page 3

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Retail Banking

Retail advances represented 19.7% of the bank's total loan portfolio in FY 2009 (22.8% in FY 2008)

(21.0% in 1Q 10), reflecting a shift towards a healthier loan portfolio mix. Despite this, retail advances

increased by 18.1% y-o-y to INR160.5 bn in FY 2009, reflecting the banks large network (including 64

Retail Asset Centres, or RACs, which are retail-oriented outlets aimed at driving growth while

maintaining credit quality). The banks retail portfolio is skewed towards secured loans, with housing

and automotive loans forming 79% of the retail lending portfolio; unsecured lending (personal loans

and credit cards) accounts for just 16%. Axis Bank offers a wide array of retail products, catering to

groups ranging from high net worth individuals, affluent senior citizens, salaried workers and

trusts/not-for-profits. Axis Bank enjoys 'agency status' for government transactions, which allows it to

profit from the holding period between receipt of funds and disbursement to beneficiaries. This lowers

the bank's funding costs and enhances NIM. Axis Bank processes direct, excise and service taxes, and

distributes civilian and military pensions through its branches.

Retail deposits increased by 35.2% y-o-y to INR425.0 bn in FY 2009, with low-cost savings deposits

growing by 29.2% y-o-y to INR258.2 bn. Retail savings account increased 26.3% y-o-y in FY 2009 to

7.6 mn. The is also leading the market in new banking channels, including ATM usage, and roll-out of

internet banking, mobile banking (Axis Bank has the highest uptake of mobile banking in India) and

telephone banking. It offers 4 products in the card category (credit cards, debit cards, pre-paid cards

and merchant cards), and has the third-largest debit card client base in the country. The bank was also

the first in the country to launch travel currency cards, remittance cards and meal cards.

Corporate Banking

Axis Bank has 2 divisions serving this market, targeting large and mid-sized companies. This segment

accounted for 50.5% of the company's total advances in FY 2009. In addition to lending services

(which include trade finance, working capital and long term lending for infrastructure andmanufacturing), this segment offers deposits, foreign exchange, and a range of other fee- &

commission-based products (including advisory services). The bank uses advanced customer relations

software to integrate its product lines and maximize cross-selling potential.

Agriculture & MSMEs

Lending to agriculture and Micro-, Small- and Medium-Sized Enterprises (MSMEs) accounted for 29.8%

of total advances in FY 2009. Considering the economically underdeveloped state of smaller towns

and rural areas, and the accompanying growth potential for banking services in these areas, the bank

considers this segment to be strategically important. The company's wide geographic reach puts it in a

solid position to serve these markets, with an emphasis on empowerment of women. The bank has

developed special 'advances cells' (similar to RACs, these are tailored branches dedicated to rural

markets) in strategic locations. The micro-finance business had a client base of around 1.9 mn as of

March 2009.

Others

The bank's capital market activities cover both equity and debt markets, and it maintains investment

and proprietary trading books. As a SEBI-registered merchant banker, Axis Bank also provides

investment banking services, which are a major source of fee income. During FY 2009, Axis Bank

syndicated INR690.6 bn through private placements of bonds, debentures and term loans, placing it

first in the loan syndication market.

The Wealth Management division is also a large source of fee income, providing financial and

investment planning services to customers. It is one of the leading distributors of mutual funds in

India. The bank has also teamed up with MetLife India Insurance and Bajaj Allianz General Insurance

to market insurance products. Meanwhile, the Cash Management Services (CMS) business is a key

source of low-cost funding for the company, offering an array of products and services to private- andpublic-sector entities, including state and central government, aimed at optimizing cash flow.

Retail lending

accounted for just

19.7% of the total loan

portfolio in FY 2009

Investment banking,

wealth management

and CMS are the main

contributors of fees

-

7/31/2019 Initiation Report Axis Bank

4/13

Page 4

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Brief financial overview

Axis bank reported a top-line CAGR of 54.8% between FY 2005 and FY 2009, reflecting strong growth

both in the loan portfolio as well as non-interest income. Total loan CAGR was 51.2%, leading to an 88

bps improvement in Net Interest Margin (NIM) over the same period. Furthermore, despite this rapid

loan growth, the bank achieved steady improvement in its NPL ratio; the NPL ratio stood at just 0.40%

in FY 2009 (versus 1.39% in FY 2005). Non-interest income also grew strongly over the last 4 years,

with a CAGR of 62.5%, reflecting higher fee income (including treasury, cross-selling and CMS fees).

Earnings rose at a CAGR of 52.6%, maintaining a solid net margin throughout.

Total deposits increased at a CAGR of 38.7%, while total low-cost deposits (demand and savings

deposits) averaged around 41% of total deposits. The loan-to-deposit ratio rose steadily over the over

same 4-year period, reflecting healthy growth, but remains below the industry average which gives the

bank plenty of room to ramp up its lending without straining liquidity. The CAR has remained well

above the RBI's requirement of 9% throughout the period.

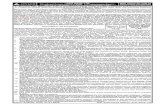

Historical figures

All figures in INR mn, unless specified FY 2005 FY 2006 FY 2007 FY 2008 FY 2009

Net interest income 7,312 10,782 14,683 25,854 36,862

Non-interest income 4,158 7,296 10,101 17,955 28,969

Total revenues 11,470 18,079 24,784 43,808 65,831

Operating expenses (including provisions) 6,433 10,766 14,822 27,346 37,979

Net income 3,346 4,851 6,590 10,710 18,154

Net margin 29.17% 26.83% 26.59% 24.45% 27.58%

NIM 2.08% 2.61% 2.49% 2.93% 2.96%

Efficiency ratio 50.69% 45.03% 49.01% 49.19% 43.42%

NPL ratio 1.39% 0.99% 0.72% 0.42% 0.40%

Loan-to-deposit ratio 49.20% 55.63% 62.73% 68.09% 69.48%

CAR 12.66% 11.08% 11.57% 13.73% 13.69%

Total loans 156,029 223,142 368,765 596,611 815,568

Total deposits 317,120 401,135 587,856 876,262 1,173,741

Total equity 24,216 28,856 34,022 87,707 102,148

Source: Company data, IIIR estimates

India's central bank, the Reserve Bank of India (RBI) oversees the country's banking sector. In April

2007, the RBI released guidelines for adopting Basel II in the country and for enhancing riskmanagement and increasing frequency of supervisory reporting to the RBI from monthly to fortnightly.

As a result, Indian banks must now maintain a minimum CAR of 9.0% at all times.

After growing at an average of 8.9% between FY 2004 and FY 2008, the Indian economy grew by 6.7%

in FY 2009, reflecting the impact of the global economic meltdown. Wholesale Price Index (WPI)

inflation hit a high of 12.91% on 02 August 2008, but had eased to 0.26% as of 31 March 2009

(compared to 7.75% a year earlier). Slowing GDP and lower inflation have prompted the RBI to cut its

repo rate in 6 stages to 4.75% and its reverse repo rate in 4 stages to 3.25%. The RBI has also cut its

Cash Reserve Ratio and Statutory Liquidity Ratio to 5% and 24%, respectively, in an effort to reinforce

liquidity and boost credit growth. Finally, the Indian government has attempted to support job creation

through a range of stimulus packages since December 2008. In the first quarter review of monetary

policy (announced on 28 July 2009), the RBI maintained its benchmark rates.

Net income grew at a

CAGR of 52.6% during

FY 2005-FY 2009

The RBI and the Indian

government have

made a concerted

effort to support

economic growth

-

7/31/2019 Initiation Report Axis Bank

5/13

Page 5

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Repo and reverse repo trend Inflation and GDP growth trend

0%

2%

4%

6%

8%

10%

FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 FY 2009

Repo rate Reverse repo rate

0%

2%

4%

6%

8%

10%

12%

FY 2005 FY 2006 FY 2007 FY 2008 FY 2009

0%

2%

4%

6%

8%

10%

GDP growth (lhs) Inflation (rhs)

Source: Economic Survey 2007-08 and concerned Ministry/Department Publications

Lending rates trended upwards during the first half of FY 2009, but have fallen since then reflecting

easing by the RBI. Deposit rates have followed a similar pattern, although short term deposit rates fell

much faster than rates for 3-year maturities. Rates for term deposits did not begin falling until 4Q 09.

Meanwhile, provisions and contingencies rose to 17.7% in FY 2008, up from 16.6% in FY 2007 and

the industry's NPL ratio (NPL as a % of gross advances) improved from 2.5% in FY 2007 to 2.3% in FY

2008. The industry CAR reached 13.1% at the end of 3Q 09, up from 13.0% in FY 2008.

The Indian banking industry has grown robustly over the last 4 years, with advances growing at a CAGR

of 20.5%, reflecting healthy GDP growth over the same period. However, we expect FY 2010 to be amoderate year, with India's GDP growth coming under pressure and recovery expected to take hold

only from FY 2011. However, the Indian economy benefits from a favorable demographic profile, low

inflation and a high savings rate (30.7% in FY 2008). Moreover, monetary easing by the RBI and

government stimulus packages should help to absorb some of the downward pressure on credit

growth through the downturn. We expect the Indian banking industry to grow by 17% in terms of

advances during FY 2010, and by a further 21% in FY 2011, based on our GDP growth forecast of

6.25% for FY 2010 and 7.25% growth in FY 2011.

Industry loan and deposit trend

0

20,000

40,000

60,000

80,000

100,000

FY 2009 FY 2010 FY 2011 FY 2012 FY 2013

INRb

n

0%

2%

4%

6%

8%

10%

Loans Deposits GDP growth

Source: RBI

We expect FY 2010 tobe a weak year for

Indian banking, with

GDP growth expected

to slow down

-

7/31/2019 Initiation Report Axis Bank

6/13

Page 6

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

The Indian banking industry is highly regulated and Public Sector Banks (PSBs) account for nearly 70%

of total advances. However, in our opinion Axis Bank is well-placed to compete given its wide

distribution network and leadership in new banking platforms (such as internet banking), as well as its

agency status in India. Axis Bank competes with large local players such as ICICI Bank and State Bank

of India (SBI). It also competes with a number of mid-sized players such as Kotak Mahindra Bank

(Kotak Bank), as well as smaller firms such as IndusInd Bank Ltd. (IndusInd). Axis' competition is

based on parameters like PLR, reach, deposit rates, and facilities.

The Indian banking sector has become increasingly focused on growing other income (principally fee

income), which has emerged as a major contributor to the sector's bottom-line. Axis Bank has a large

distribution network and client base, as well as a sophisticated customer management platform to

maximize cross-selling potential and capture growing demand for financial services in the country. Inaddition, new regulation has come into effect as of 01 April 2009, mandating free access to any ATM

for customers; this should benefit Axis Bank considering its large ATM network, by generating inter-

usage fees from other banks with less widespread ATM networks.

For this comparison, we are considering Kotak Bank, IndusInd and ICICI Bank from the private sector,

along with Bank of India (BOI) from the public sector.

Kotak Bank is the youngest private bank in the group, having received its banking license in 2003.

Currently, it has 217 branches and 394 ATMs. The company is one of India's leading financial

conglomerates, offering a wide range of solutions, from commercial banking to stock broking, mutual

funds, life insurance and investment banking. It enjoys the highest CAR and NIM among the peer

group, although its high NPL and loan-to-deposit ratio are grounds for concern.

ICICI Bank is the largest private bank in India, with a balance sheet of INR4.0 tn (FY 2009) and 1,438

branches. It also has the best efficiency ratio of the group, mainly as a result of the high share of non-

interest income on its income statement. Moreover, its healthy CAR is encouraging, and should provide

a solid buffer against deteriorating asset quality (as reflected in its high NPL ratio).

BOI is one of the leading mid-size public sector banks in India, operating 3,031 branches. It enjoys a

relatively healthy net margin and NPL ratio, although relatively weak CAR and NIM could hamper future

growth.

IndusInd is the smallest firm in the peer group, with just 180 branches. It suffers from low margins and

a relatively weak CAR. However, the bank is attempting to stimulate growth by opening new branches,

which should lift its performance indicators over the coming period.

Axis Bank outperformed its peers in terms of asset quality, NIM and CAR. It has the lowest NPL ratio of

the peer group, highlighting its strength in risk management. Its NIM is second only to KMBL, but there

is room for improvement given the firm's low loan-to-deposit ratio. Meanwhile, its relatively high CAR is

encouraging.

Other income,

specifically fee income,is becoming more

important in terms of

earnings in the Indian

banking sector

Axis Bank outperforms

its peers in terms of

asset quality and NIM

-

7/31/2019 Initiation Report Axis Bank

7/13

Page 7

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Peer comparison (FY 2009, INR mn)

Axis Kotak Indusind BOI

Net interest income 36,862 15,185 4,590 54,989 83,670

Non-interest income 28,969 3,679 4,562 30,519 76,040

Total revenues 65,831 18,864 9,153 85,508 159,710

Operating expenses (including provisions)37,979 14,603 5,611 55,435 108,534

Net income 18,154 2,761 1,483 30,037 37,581

Net margin 27.58% 14.64% 16.21% 35.13% 23.53%

NIM 3.33% 5.59% 1.80% 2.97% 2.40%

Efficiency ratio 43.42% 63.42% 59.76% 36.18% 43.40%

NPL ratio 0.40% 2.39% 1.14% 0.44% 1.96%

Loan-to-deposit ratio 69.48% 106.27% 71.33% 76.29% 99.98%

CAR 13.69% 19.90% 12.33% 13.01% 15.50%

Total loans 815,568 166,253 157,706 1,447,316 2,183,110

Total deposits 1,173,741 156,449 221,103 1,897,085 2,183,480

Total equity 102,148 N/A 16,644 134,949 495,330

Source: Company data , IIIR estimates

ICICI Bank

(standalone)

Axis Bank's loan portfolio has grown at a CAGR of 39% over the last 4 years, handily outperforming the

sector while maintaining its asset quality. This reflects the firm's large banking network (861 branches

as of June 2009, compared to 339 in March 2005). However, we expect credit offtake to moderate

over the near-to-medium term, in line with an industry slowdown, as a result of faltering GDP growth

amid the global economic downturn. Nevertheless, we expect Axis Bank's market share to continue to

grow (but at a slower pace) as a result of Management's efforts to maintain branch expansion,

including its focus on mid-sized cities and the agricultural / micro-finance sectors.

We expect NIM to come under pressure in 1H 10, driven by lower interest rates and slowing credit

offtake. Moreover, we expect relatively high cost borrowings accepted over the last few quarters to

negatively impact NIM, with favorable repricing of liabilities having a positive impact only from 3Q 10.

Over the longer term, however, network expansion and the firm's 'agency bank' status should continueto provide it with access to low-cost deposits, supporting NIM. Deposits are expected to grow by a

CAGR of 25.0% during FY 2009-FY 2013, but we also expect the loan-to-deposit ratio to rise from

69.5% in FY 2009 to 71.9% by FY 2013. We expect Axis Bank to continue to enjoy a CASA ratio of

around 40% which, in turn, should support NIM. Finally, we would expect the bank to ramp up its

exposure to the retail sector (currently at 21% of advances) once the economy begins to recover,

which drive further growth in NIM over the medium-to-long term.

Axis Bank has reported strong growth in fee income over the past few years. However, in the near

term, we expect growth in fees to fall, reflecting the impact of the economic downturn as well as an

end to the recent trend of falling bond yields (which has boosted trading income). Nevertheless, we

believe that the CMS business, the firm's 'agency bank' status and healthy cross-selling potential will

lift other income. Moreover, new regulations concerning ATM sharing should favor Axis Bank, given its

sizeable ATM network. On balance, we expect fee income to grow at a CAGR of 19% during FY 2010-FY

2013, with other income to average around 40% of total income (versus around 42% in the previous 4

years).

We expect Axis Bank's

advances to grow at a

CAGR of 24.1% during

FY 2009-FY 2013

Low interest rates and

weaker demand for

credit are expected toconstrain NIM during

1H 10

-

7/31/2019 Initiation Report Axis Bank

8/13

Page 8

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Axis Bank enjoys a relatively favorable cost-to-income ratio, reflecting healthy top-line in recent years.

However, in our view this is not sustainable, and we anticipate slowing top-line growth and branch

expansion plans to inflate the ratio over the near-to-medium term. However, over the long term, we

expect cost efficiency to improve as new branches begin to break even (25% of its branches are less

than 14 months old) and the economy recovers. Meanwhile, cross-selling potential and Managements

cost-cutting initiatives (including cuts to variable compensation and administrative costs) should lend

further momentum. Going forward, we expect the efficiency ratio to stand at around 45.8% in FY 2010

and 48.6% in FY 2011, deteriorating to 49.0% in FY 2013 on account of new branches opening over

the period. However, we believe that the banks efficiency will improve after FY 2014 as the newly

opened branches will become profitable.

After raising INR15 bn in subordinated debt in November 2008, Axis Bank had a CAR of 13.69% as of

31 March 2009 and 15.3% in 1Q 10) which is roughly in line with the Indian banking sector and well

above the RBI's requirement of 9%. This position is a sign of sound financial health and an ability to

absorb further provisions for bad debts if necessary. In addition, on 05 August 2009, Management

announced a plan to raise capital through the issue of approximately 71 mn shares through Global

Depositary Receipts (GDR) or Qualified institutional placement (QIP). Although it has not yet indicated a

date for the placement, it is planned to occur during FY 2010 , which will impact the banks EPS.

However, we expect that in the long term it will enable the bank to expand its loan portfolio and benefit

from the anticipated recovery in the economy. Going forward, we expect Managements efforts to

focus on asset quality will help Axis Bank to maintain a healthy CAR.

Reflecting that half of Axis Bank's loan portfolio is made up of large and mid-sized corporate assets,

the firm has the lowest NPL ratio of its peer group. Going forward, we expect asset quality to

deteriorate, reflecting the challenges present in the current economic environment and strong recent

loan growth (Axis Bank has restructured loans of approximately INR9.96 bn in 1Q 10). However, we

are encouraged by risk management practices (such as internal rating systems and dedicated SME

scrutiny centers) and the firm's selective lending policies (such as avoiding motorcycle loans,

restricting personal loans and focusing on existing customers with an established relationship).

Consequently, we expect NPL to rise to 1.3% (gross NPA to total loans) in FY 2010 and 1.1% in FY

2011 (0.96% in FY 2009).

Strengths Opportunities

Healthy CAR

Superior IT system can facilitate cross-selling

Extensive geographical reach

Effective risk management systems

Relatively strong GDP growth

Untapped potential in rural banking

Cross-selling of financial products

Foreign lenders scaling back their lending to local

firms

Weaknesses Threats

Pressure on margins and the efficiency ratio

Exposure to troubled sectors could erode

earnings amid the economic downturn

Slowing economy could have a significant impact

on the banking industry

Possibility of further growth in NPLHigh degree of competition

Going forward, we

expect the efficiency

ratio to improve as

new branches

become profitable

The bank has

announced plans to

raise additional

capital

-

7/31/2019 Initiation Report Axis Bank

9/13

Page 9

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Loan growth expected to revive with anticipated recovery in GDP in FY 2011

Axis Bank's share of total industry advances has grown strongly in recent years, with a 42 bps y-o-y rise

in market share to 2.94% in FY 2009. This growth reflects expansion in the bank's branch network. We

expect the number of branches to increase by 150 to just over 1,000 in total during FY 2010 (the

company forecasts 200 new branches during the year). Going forward, considering our expectations

for industry loan growth and market share, we expect Axis Bank's loan portfolio to grow at a CAGR of

20% during FY 2010-FY 2013.

NIM expansion to support top-line from FY 2011 onwards

Going forward, we anticipate a 96 bps fall in yields on average interest-earning assets in FY 2010,

reflecting a slowdown in loan growth, a low interest rate scenario and lower income from investments.

We also anticipate a 98 bps fall in yields on average interest-bearing liabilities in FY 2010, as re-

pricing of liabilities is likely to outpace asset repricing, considering that a large portion of deposits are

set to mature in 2Q 10. From FY 2011 onwards, we expect NIM to rise as the economy recovers.

All figures in INR mn, unless specified FY 2009 FY 2010E FY 2011E FY 2012E FY 2013E

Industry advances 27,700,120 31,400,891 37,053,051 44,463,662 53,356,394

y-o-y growth 17.28% 13.36% 18.00% 20.00% 20.00%

Axis Bank advances 815,570 989,128 1,241,277 1,578,460 1,931,501

y-o-y growth 42.00% 21.28% 25.49% 27.16% 22.37%

Market share 2.94% 3.15% 3.35% 3.55% 3.62%

Total interest income 108,355 121,388 155,621 203,079 252,667

y-o-y growth 54.68% 12.03% 28.20% 30.50% 24.42%

Total interest expenses 71,493 77,330 105,315 140,145 174,852

y-o-y growth 61.7% 8.2% 36.2% 33.1% 24.8%

Net interest income 36,862 44,058 50,305 62,934 77,816

y-o-y growth 42.6% 19.5% 14.2% 25.1% 23.6%

Average interest-earning assets 1,243,874 1,579,074 1,915,322 2,406,561 2,952,944

NIM 2.96% 2.79% 2.63% 2.62% 2.64%

NIM forecast

Source: IIIR estimates,RBI, Company data

Loan and deposit trend

0

500

1,000

1,500

2,000

2,500

3,000

FY 2009 FY 2010 FY 2011 FY 2012 FY 2013

INRb

n

64%

65%

66%

67%

68%

69%

70%

Loans Deposits Loan-to-deposit ratio

Source: RBI

NIM is set to improve

from FY 2011 as the

economy recovers

-

7/31/2019 Initiation Report Axis Bank

10/13

Page 10

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Forecast income statement

All figures in INR mn, unless specified FY 2009A 1Q 10A 2Q 10E 3Q 10E 4Q 10E FY 2010E FY 2011E

Net interest income 36,862 10,456 10,659 11,124 11,818 44,058 50,305

Non-interest income 28,969 9,586 8,171 8,364 8,616 34,005 39,338

Total revenues 65,831 20,042 18,830 19,488 20,435 78,063 89,643

Operating cost (including provisions) 37,979 11,431 11,348 11,762 12,626 47,167 54,717

Net income 18,154 5,620 4,938 5,176 5,232 20,235 22,875

EPS (diluted) 50.27 15.50 13.62 14.28 14.43 46.62 52.71

Source: Company data, IIIR estimates

Forecast balance sheet

All figures in INR mn, unless specified FY 2009A FY 2010E FY 2011E FY 2012E FY 2013E

Total cash and bank balances 150,169 183,983 237,527 345,603 388,500

Investments 463,304 555,996 622,733 787,521 874,301

Advances 815,568 989,128 1,241,277 1,578,460 1,931,501

Fixed assets 10,729 14,051 15,239 18,934 23,104

Other assets 37,451 40,593 48,407 55,688 67,953

Total assets 1,477,220 1,783,750 2,165,185 2,786,206 3,285,360

Deposits 1,173,741 1,465,443 1,871,465 2,374,824 2,865,277

Borrowings 155,199 175,853 215,218 273,105 315,180

Other liabilities and provisions 46,133 -24,870 -105,979 -68,440 -128,846

Total liabilities 1,375,072 1,616,426 1,980,704 2,579,489 3,051,612

Equity capital 102,148 167,324 184,480 206,717 233,748

Total liabilities and equity 1,477,220 1,783,750 2,165,185 2,786,206 3,285,360

Source: C ompany d ata, IIIR estim ates

Ratio analysis

All figures in INR mn, unless specified FY 2009A FY 2010E FY 2011E FY 2012E FY 2013E

Net interest margin 2.96% 2.79% 2.63% 2.62% 2.64%

Non-interest margin 44.0% 43.6% 43.9% 43.5% 42.7%

Efficiency ratio 43.4% 45.9% 48.6% 48.8% 49.1%

Net margin 27.6% 25.9% 25.5% 26.6% 26.5%

Balance sheet growth 34.81% 20.75% 21.38% 28.68% 17.92%

Return on equity 19.12% 15.02% 13.00% 15.16% 16.36%

Return on assets 1.41% 1.24% 1.16% 1.20% 1.19%

Loan-to-deposit ratio 69.48% 67.50% 66.33% 66.47% 67.41%

Source: Company data, IIIR estimates Valuation

Our Excess Returns to Equity (ERE) model contains explicit return on equity projections through FY

2018, after which we have assumed a terminal value. Based on a Cost of Equity of 14.1% and a

perpetual growth rate of 3%, we arrive at an ERE fair value of INR822.94 for the Axis Bank stock.

The common stock currently trades at a 17.2% discount to the peer group P/E average. We have

assigned a target P/E multiple of 17.8x to value the company, which is towards the lower side of its 3-

year range, as we expect a slowdown in lending growth and a rise in provisioning expenses to dampen

earnings growth. We have also factored in the dilution impact of planned additional capital raising.Applying this multiple to our FY 2010 earnings estimate, we arrive at a target price of INR829.89.

Axis Bank currently trades at a 20.9% premium to the peer group P/BV average of 2.45x. We have

assigned a target P/BV multiple of 2.15x, which is towards the lower side of the stock's 3-year range,

Based on a target P/E

multiple of 17.80x, we

value the common

stock at INR829.89

-

7/31/2019 Initiation Report Axis Bank

11/13

Page 11

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

for the reasons discussed above. Applying this target multiple to our FY 2010 sales estimate, we

derive a target price of INR828.90.

Based on these valuations, we derive a weighted average 12-month target price of INR825.52 for the

Axis Bank common stock, which implies a potential downside of 2% from current levels. Therefore, we

rate the Axis Bank common stock a HOLD.

Relative valuation: P/E approach

Axis Bank 8.08 - 53.07 8.08 - 23.54 15.25 16.63 18.03

Kotak 7.29 - 83.81 7.29 - 39.47 19.13 38.07 28.06IndusInd 7.44 - 55.42 7.44 - 27.47 16.58 20.14 14.29

BOI 3.69 - 18.74 3.69 - 7.39 5.80 5.46 5.35

ICICI Bank 8.05 - 45.07 8.05 - 24.49 15.77 22.38 20.64

Peer group average 14.19 20.08 16.43

Source: Bloomberg, IIIR estimates

Company

3 yr P/E trading

range

TTM P/E trading

range TTM P/E average Current P/E

Forward FY 2010

P/E

Relative valuation: P/BV approach

Axis Bank 1.13 - 10.26 1.13 - 3.36 2.22 2.96 2.18

Kotak 1.27 - 13.92 1.27 - 3.90 2.51 3.76 3.23

IndusInd 0.64 - 3.88 0.64 - 2.02 1.12 1.84 1.58

BOI 0.83 - 3.45 0.83 - 1.45 1.19 1.23 1.25

ICICI Bank 0.64 - 5.23 0.64 - 1.89 1.24 1.71 1.59

Peer group average 1.76 2.45 2.06

Source: Bloomberg, IIIR estimates

Forward FY 2010

P/BV

3 yr P/BV trading

rangeCompany TTM P/BV average

TTM P/BV trading

range Current P/BV

Weighted average target price (INR)

Methodologies Weight assigned Target price

Weighted

average price

Target price using ERE approach 60% 822.94 493.76

Target price using P/E approach 20% 829.89 165.98

Target price using P/BV approach 20% 828.90 165.78

Weighted average common stock target price

Current common stock price 840.50

Upside/(downside) from current levels (2%)

Source: IIIR estimates

Axis Bank operates in an industry which is sensitive to the general health of the economy.Although we have accounted for a slowdown in GDP, any greater-than-anticipated downturn

could pose a downside risk to our rating.

Axis Bank has a high degree of exposure to the SME, agriculture and retail sectors, whichcould lead to a decline in credit quality (as well as growth in delinquent assets) as these

loans tend to be riskier than corporate or government lending. Although we have accounted

for deterioration in asset quality in our model, any unexpectedly sharp increase in

delinquencies could pose a downside risk to our rating, as provision charges may be

significantly higher than anticipated.

Any sharp contraction

in GDP would pose a

significant downside

risk to our rating

-

7/31/2019 Initiation Report Axis Bank

12/13

Page 12

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Page 1: Investment Summary - Healthy CAR to provide leverage for growth

At the request of Management we have deleted data identifying the anticipated approximate amount of capital to be raised through its planned share issue

from our original report and instead identified the number of shares proposed to be issued throughout our report.

Page 4: Historical figures

We have amended an incorrect figure showing in the table.

Company contact information:Axis Bank Limited,

131, Maker Tower - F,

Cuffe Parade,

Colaba,

Mumbai - 400 005.

Telephone: +91 022 67074407

Fax: +91 022 22181429

-

7/31/2019 Initiation Report Axis Bank

13/13

Axis Bank Ltd. 11 August 2009

www.iirgroup.com

Regulated and

authorised byFax +44 (0)20 7232 3099

Tel. +44 (0)20 7232 3090

Guide to IIIRs research approach

We apply one absolute valuation methodology and two relative valuation methodologies to triangulate the fair value for the stock assessed fundamentally.

The following are the most frequently used valuation methodologies in our research:

DCF: The Discounted Cash Flow (DCF) method values an estimated stream of future free cash flows discounted to the present day, using a companys

WACC or cost of equity. This method is used to estimate the attractiveness of an investment opportunity and as such provides a good measure of the

companys value in absolute terms. There are several approaches to discounted cash flow analysis, including Free Cash Flow to Firm (FCFF), Free Cash

Flow to Equity (FCFE) and the Dividend Discount Model (DDM). The selection of a particular approach depends on the particular company being researched

and valued.

ERE: The Excess Return to Equity (ERE) method takes into consideration the absolute value of a companys return to equity in excess of its cost of equity

discounted to the present day using the cost of equity. This methodology is more appropriate for valuing banking stocks than FCFF or FCFE methodologies.

Relative valuation: In relative valuation, various comparative multiples or ratios including Price/Earnings, Price/Sales, EV/Sales, EV/EBITDA, Price/BookValue are used to assess the relative worth of companies which operate in the same industry/industries and are thereby in the same peer group. Generally

our approach involves the use of two multiples to estimate the relative valuation of a stock.

Other methodologies such as DuPont Analysis, CFROI, NAV and Sum-of-the-Parts (SOTP) are applied where appropriate.

The target price derived from each methodology is then weighted, based on industry characteristics, to provide a weighted average target or fair value for

the stock.

Buy recommendations are expected to improve, based on consideration of the fundamental view and the currency impact (where applicable) by at least

10%.

Hold recommendations assume that value is fully reflected in the current share price or that the overall view on the stock is fully compensated by the

currency impact (where applicable).

Sell recommendations are expected to deteriorate, based on consideration of the fundamental view and the currency impact (where applicable) by at least

10%.

Disclaimer

Independent International Investment Research PLC supplies this research via Pronet Analytics.com Ltd. ('Pronet'). Pronet is Regulated and Authorized by

the Financial Services Authority (FSA) and registered with the Securities Exchange Commission (SEC). You are reminded that investment advice provided by

Pronet is for your general information and use and is not intended to address your particular requirements. Any advice or recommendations contained in

this report may not be suitable for you and are not intended to be relied upon by you in the making (or refraining from making) any specific investment or

other decision. Such decisions should only be made on the basis of independent advice from an appropriately qualified adviser. Pronet Analytics.com Ltd.

and Independent Financial Markets Research Ltd. are subsidiaries of Independent International Investment Research PLC (the 'Group'). Research analysts

working for the Group are subject to stringent confidentiality and security policies and are located in secure-access premises which may be in the proximity

of professionals conducting similar work for other firms. The Group is not nor has been nor will be engaged in investment banking and does not make

markets in any of the securities covered in this report or have any investment banking relationship with the firm whose security is covered in this report. No

employee or contractor of the Group is permitted to personally buy or sell stock in the company covered in this report, and neither the analysts responsible

for this report nor any related household members are officers, directors, or advisory board members of any covered company. No one at a covered

company is on the Board of Directors of the Group or any of its affiliates. This report is not a solicitation to buy or sell any security and past performance is

no guarantee of future results.

Copyright 2009 Independent International Investment Research PLC. All rights reserved.