Freight & Trading Weekly Feature FTW Western Cape

description

Transcript of Freight & Trading Weekly Feature FTW Western Cape

WESTERN CAPE SPECIAL fEATuRE

MARCH 2010fREIGHT & TRADING WEEKLY

DON’T expect port productivity to improve … as Cape upgrades are delayed for a year

How Distell co-ordinates its exports to 100 countriesDanie Smith’s balancing act

juice up sea and airfreight volumesPERISHABLES

FTW4575

Nachi Mendelow Marketing representative

Jonathan Davis Product managerfinancial systems

Arnold GarberExecutive Chairman

Compu-Clearing Outsourcing

Tel: 011 882 7300 www.compu-clearing.co.za

Taking the freight industry to new heights

Advanced systems for the freight industry

Emille Kamffer Assistant warehousing

solutions manager

Moshe Zulberg Marketing representative

email: [email protected] www.sebenza.co.za Customer Careline 0800 20 1600FTW4422

London Tel: +44 1753 68-7093 Fax:+44 1753 68-5368

Johannesburg Tel: 011 571-0600 Fax: 011 970-3638

Midrand Tel: 011 314-0747 Fax: 011 314-0746

Cape Town Tel: 021 505-9300 Fax: 021 535-5215

Durban Tel: 031 459-5000 Fax: 031 461-1282

Port Elizabeth Tel: 041 484-2480 Fax: 041 484-2487

East London Tel: 043 742-2216 Fax: 043 742-2666

Offering a personalised service to customers and negotiating better rates

to make them more competitive

Our customers know that we act in their interests – Eddie Kruger, branch manager, Cape Town

MARCH 2010 | 1

Editor Joy OrlekConsulting Editor Alan PeatAssistant Editor Liesl Venter Advertising Carmel Levinrad (Manager)

Yolande Langenhoven Gwen Spangenberg Jodi Haigh Division Head Anton MarshManaging Editor David Marsh

CorrespondentsDurban Terry Hutson

Tel: (031) 466 1683Cape Town Ray Smuts

Tel: (021) 434 1636 Carrie Curzon Tel: (021) 674 6935Port Elizabeth Ed Richardson

Tel: (041) 582 3750Swaziland James Hall

Advertising Co-ordinators Tracie Barnett, Paula SnellLayout & design Dirk VoorneveldCirculation [email protected] by JUKA Printing (Pty) Ltd

Annual subscriptions RSA – R485.00 (full price)

R890.00 (Africa neighbouring)R1 160.00 (foreign).

Publisher: NOW MEDIAPhone + 27 11 327 4062

Fax + 27 11 327 4094E-mail [email protected]

Web www.cargoinfo.co.za

Now Media Centre 32 Fricker Road, Illovo Boulevard,

Illovo, Johannesburg. PO Box 55251, Northlands,

2116, South Africa.

Page 2Exporting to 100 countries demands fastidious execution

Page 4CFR Freight opens licensed depot

Antarctic-bound timber demands specialist expertise

Page 5CT terminal upgrade delayed for a year

Page 6World Cup fast-tracks infrastructure upgrades

Reopening of CT office a strategic move

Page 7Reefer Express service returns with CT call

Page 8‘Low staff morale at the root of port inefficiency’

Page 9Closure of Sans Fibres impacts CT volumes

Page 10Perishables keep SAA flying high

Page 11Airlink creates wide network opportunity for Cape shippers

Breakbulk service going strong

Page 12Food and beverage keeps business buoyant

Page 13Core Freight sets up CT office

Page 14Keeping down costs for African shippers

Page 15‘Leaning toward the bullish side’

Page 16Competitive option on Far East-CT route

Fuelling more than ocean-bound vessels

While the Fifa World Cup may have fast-tracked some infrastructure upgrades in the Mother City, issues like port productivity continue to burden the freight industry.

With major upgrades at the port delayed for a year, an early resolution is unlikely.

FTW’s Cape Town correspondent Ray Smuts takes a closer look.

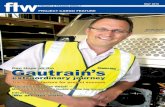

Cover photo: Danie Smith, Distell’s group GM international logistics.

FTW1884SD

2 | MARCH 2010

ROBERTSON FREIGHT

❏ Customs Clearing & Forwarding❏ Sea & Air Freight ❏ Marine Insurance❏ Ships Agents ❏ Warehousing❏ Transport & Logistics Consultants

tel: +27 (0)21 421-0222/3/4/5 fax: +27 (0)21 421-0404/5email: [email protected] us @ www.robertson-cpt.co.za

With collectively, more than 100 years of freight experience among our staff, we can confi dently say: – “We are Your freight specialists”

FTW1146SD

Hazardous Non Hazardous FoodgradeTank Containers Flexi Tanks

HANS CALITZ 021 9393144 [email protected] central-logistics.co.za braidco.com

JOHN CONNOLLY 031 7763628 [email protected]

FTW4596b

Exporting to 100 countries demands fastidious executionOperational prognosis spans 13 weeks

By Ray Smuts

There lies a simile between the intricate, unfettered movements of a successful

global shipper and a precision Swiss timepiece – and no need to look further for fastidious execution than Distell, one of Africa’s leading marketers of wine, spirits, ciders and ready-to-drinks.

Functioning in perfect harmony, much like that precision-made wristwatch, requires the utmost care and attention to planning detail.

Success is dependent on the input of many players but logistics is unquestionably a key cog in the mechanism of any successful business.

That much is acknowledged by JSE-listed Distell, a group that continues to deepen its global footprint.

Not only is it the major player in Africa, but active in 100 countries, with a global staff complement of

some 4 000 people.“Logistics is absolutely crucial

to Distell and we have built a very reliable service to enable us to deliver on our promise to customers,” says Danie Smith, group GM, international logistics.

It involves the integration of information, transportation, inventory, warehousing, material-handling and packaging.

Distell’s international logistics division is responsible for export stock planning and sales forecasting co-ordination, operating at three levels – an operational prognosis over 13 weeks, an 18-month tactical forecast and a five-year strategic level outlook.

“That is where we start, to enable us to carry out material and stock planning, followed by the receipt of production orders and handling all shipping and load planning detail, on top of product finishing,” says Smith, whose portfolio embraces much of Africa (excluding South

Africa, Namibia, Swaziland, Botswana and Lesotho) and the rest of the world.

Product finishing is, in itself, an exacting routine, given global customers and international governments have very specific, often varying, import requirements – so too South Africa in the export context.

By way of example, Smith explains that whereas one “12-pack” of 750ml bottles of Nederburg Cabernet Sauvignon might be par for the course in South Africa, certain international customers require “six-packs” of the same product, with either corks or screw top closures (the latter gaining favour these days) and a stipulation by some foreign governments that labelling include the importer’s address.

All wines exported have to be analysed by the Department of Agriculture and tasted by Sawis (S A Wine Industry Information

and Systems) and each and every line item exported must have an (export) certificate as well as a lot number detailing the link to the production plant, production line and date of the wine’s production.

“That has to be very carefully controlled, otherwise you could be in trouble as penalties in some recipient countries are extremely harsh. A single digit error could cost a company millions of rand.”

Distell has to be mindful that product pricing and export delivery routing remain ever-important to the customer.

To this end, it has appointed J F Hillebrand as its main freight forwarder but relies on more than two dozen others given Hillebrand does not have representation all over the world.

For shipping, the group relies in the main on the Saecs container line grouping (Maersk, Safmarine, MOL and DAL) and a dozen or so other carriers, including MSC,

simpler • better • smarter

Software for Freight Forwarding & Customs Clearing Agents

+27 11 706 3545 www.corefreight.com

“Value beyond a bill of entry, a comprehensive management system for Imports & Exports”

FTW1891SD

MARCH 2010 | 3

FTW1882SD

Hapag-Lloyd and Macs.Much like creating a fine piece

of furniture or work of art, Distell practises brand crafting, once more commonly known as brand-building, to develop and grow its impressive range of products.

That encompasses a portfolio of 32 wines, including Nederburg, Two Oceans, Chateau Libertas, Drostdy-Hof, and top international seller Amarula, the creamy liqueur made from the fruit of the marula tree for which elephants and humans alike have a particular penchant.

Also up there are perennial favourites Tassenberg red (Born 1936), for years a “soul mate” to thousands of university students,

Klipdrift brandy, Savanna Dry and Hunters Dry cider, Count Pushkin vodka and Bisquit cognac.

Distell’s top-ranking six sellers in Africa and the rest of the world are Savanna, Two Oceans, Drostdy-Hof, Nederburg, Amarula and Obikwa wine.

The Stellenbosch-based group, in common with so many other global players in these harsh economic times, is wary of crystal ball-like predictions as to what the future holds, but Smith remains optimistic.

“Competition is extremely tough worldwide and though we are relatively small outside of Africa, there are still many opportunities for us.”

The forerunner to Distell was Stellenbosch Farmers’ Winery (SFW), established in 1925 with a modest £2 000 investment by partners Charles Winshaw and Susanna Elizabeth Krige.

More than 75 years later, it has emerged as a giant, with an asset value of R972 million and annual turnover of R2 billion.

The Distell Group came into being in 2000 through a merger of the SFW Group. and Distillers Corporation (SA).

Last year total sales volumes grew 10.8%, international revenue was up 36.9%, total revenue up 15.5% to nearly R11 billion (R10 863 728) and operating profit up 4.8%, to R1 411 006.

Distell is one of Africa’s leading marketers of fine wines and spirits, ciders and ready-to-drinks, attributing key strengths to local market leadership, high brand awareness levels, an extensive distribution set-up, strong trade

relationships and established international marketing and trading networks.

Subsidiaries include Distell Limited (100% owned), Stellenbosch Farmers’ Winery (100%), Nederburg Wines (100%) and Lomond Wine Estates (100%).

A 15% ordinary shareholding is held by BEE grouping, Wiphold Beverages.

Outside of South Africa, Distell has 100% ownership in wholesale distributors Distell Botswana, Distell Namibia, Distell Swaziland, Distell Wine Masters, Kenya, and a 35% stake in Tanzania Distilleries.

The group says in its most recent overview: “Consumer branding is at the heart of everything we do and starts with our marketing strategies as the driver of business change.

“Our long-term success depends on our ability to build and develop brands to satisfy customer needs.”

Smith has the final word:”We will never stop trying to satisfy.”

Precision operation ... Success is dependent on the input of many players but logistics is unquestionably a key cog.

4 | MARCH 2010

ANGOLA / SOUTH LINE

For further information, please contact:

FTW2495

SA GENERAL AGENTContainerised service including reefer containersCalling Angola portsPrompt, efficient serviceSpecialise in breakbulk & project cargo

Cape Town (General Agents)Contact: Richard Fortune/ Duncan KensleyTel: +27 21 440 5400 • Fax: +27 21 419 8952E-Mail: [email protected] E-Mail: [email protected]

Johannesburg Contact: Jillian ApplebyTel: +27 11 616 0595Fax: +27 11 616 0596E-Mail: [email protected]

Walvis Bay Contact: Piet ReichertTel: +264 64 205859Fax: +264 64 20651E-Mail: [email protected]

DurbanContact: Richard FortuneTel: +27 21 440 5400 • Fax: +27 21 419 8952Email: [email protected]

General Shipping Services (Pty) LtdA well established independent company specialising in Container and General Cargo Transport services in Southern Africa

• Local and Overborder movement of containers, abnormal loads and breakbulk cargo• Independent container surveys throughout South Africa • Nationwide• Representing “Container Applications International” (CAI) in Africa & Indian Ocean Islands• Full logistics service to importers and exporters including accredited customs agency clearing

Transport and Cabotage Container Surveying Container Rentals and Sales Container LeasingClearing and Forwarding

Tel : (031) 332-2577 Fax : (031) 337-5297 Email : [email protected]

CFR opens licensed depot Joint venture agreement signed

Independent neutral consolidator CFR Freight has made significant strides in the Western Cape,

adding a range of new services to its growing portfolio.

Following the signing of a joint venture agreement with Zacpak Warehousing to form Zacpak Cape Town Depot, the company has just been granted an unpack depot licence by SA Revenue Service.

“This will enable us to offer a neutral container unpack facility to the forwarding fraternity as well as handle our own import and export groupages,” Zacpak Cape Town Depot director and

shareholder, Sean Menzies, told FTW. “In addition to this we have the benefits of Zacpak expertise in handling wine and general export packing.”

It’s a major milestone for CFR Freight which is always on the lookout for value-added services to add to its growing logistics offering.

Apart from the regular weekly seafreight import services from all main ports around the globe, the company now also offers direct services from Hong Kong, Shanghai, Qingdao, Ningbo and Tianjin. Growth in the export market has seen the addition of Buenos Aires and Hong

Kong to the standard direct export destinations.

And while Menzies is upbeat about seafreight growth in the Western Cape market, the company is also focused on airfreight opportunities flowing from its membership of the Air Cargo Group, an international consortium of neutral airfreight wholesale providers.

“We aim to leverage and develop opportunities out of this association, and in order to do this we will be growing our Cape Town airfreight division this year with the appointment of an airfreight manager to oversee its growth and development,” he said.Sean Menzies … major milestone.

Antarctic-bound timber demands specialist expertiseThe loading of 10 800 cubes of breakbulk cargo into Igaka, a Russian ship bound for the Antarctic, was all in a day’s work for Cape Crating. The company's expertise in timber shoring was critical since heavy weather was expected.

An entirely South African project from start to finish, the cargo of building modules was manufactured in South Africa and packaged, transferred and loaded onto the ship

by Cape Crating. The modules will be

re-assembled on site at a scientific research station in the Antarctic.

It required specialised stowing and securing in the hold for the estimated sailing time of two to three weeks.

Stowed and secured … part of the shipment of breakbulk cargo loaded onto the Igaka bound for the Antarctic.

MARCH 2010 | 5

Simple solutions start with quality training

FTW4515

•CargoSecurityPart108•AirCargoSecurity(X-RayScreening&Interpretation)•DangerousGoodsAllCategories•Cargo1•Cargo2•LiveAnimalRegulations•PerishableCargoHandlingProcedures•CargoManagement•ForkliftTraining

CAA Approved & Accredited ATO – CAA/0192

Tel:+27119274114Fax:+27119272917E-mail:[email protected]

CT terminal upgrade delayed for a yearEconomic pressures force change of plan

By Ray Smuts

Like it or not, and no one will, but Cape Town Container Terminal’s

R4.5 billion facelift will not be a reality by 2012. The upgrade has been delayed by up to a year due to economic pressures and the resultant need to spend money expeditiously.

This first revelation will come as a shock to the shipping industry but it comes straight from the horse’s mouth – Cape Town NPA port manager, Sanjay Govan, who says all will probably be done and dusted during the latter half of 2013.

He is not about to enter into fine detail, but FTW understands the delay has much to do with ongoing negotiations for more favourable, project-related rates.

Govan jokingly suggests, in reflecting on the port’s performance last year, that while some may consider NPA spending on the frugal side, he believes they have done extremely well in their cost-cutting initiatives.

“The disappointment was in sectors beyond our control – higher costs related to electricity, water, rates and repairs and maintenance, the latter through the roof in some instances, but we have not exceeded our budget, which has more or less balanced out.”

A year ago Govan predicted volume-generated revenues would be down at least 10% but it has in fact been about 6% for the nine months to December.

Shipping customers have been incapacitated for some years by the massive terminal upgrade which has taken 25% out of major berthing capacity at any given time.

First came quay wall construction and installation of new Liebherr super post-panamax cranes at Berth 601; 602 is currently under way in likewise fashion and the remaining two berths will follow in the run-up to what was to have been 2012.

“The flipside to not having all four berths functional is that turnabout times at 601 have improved.

“The terminal was never

designed to handle all four berths simultaneously as ships have tended to arrive in staggered format.

“Only when we have factors like inclement weather do vessels bunch up and put pressure on all four berths, but the loss of one berth is compensated by the gains effected by the new equipment.”

The MPT has alleviated much pressure on the container terminal through accommodating up to two smaller – around 2 000 TEU – vessels at a time.

Govan says the lines remain very concerned at the high cost of wind-related hold-ups and while by no means a fait accompli, the possibility exists cargo may be diverted to other ports in future.

FTW1889SD

Sanjay Govan ... ‘Only when we have factors like inclement weather do vessels bunch up and put pressure on all four berths.’

FTW1895SD

6 | MARCH 2010

FTW1875SD

Specialists in the handling of

cargoDRYUnit A1, Octo Place, Techno Park, Stellenbosch, 7600Telephone: +27 21 880 9950 E-mail: [email protected]

FTW4588

ProfessionalPersonalisedAttention to detail

Imports & Exports

World Cup fast-tracks infrastructure upgradesUPS is optimistic about

the positive impact of infrastructure upgrades in the

Western Cape, undertaken ahead of the 2010 Fifa World Cup.

“Many of the major highways have been completely refurbished, and while these improvements may have caused some delays, once the construction is completed, the roads are expected to alleviate traffic jams and streamline the transport system,” says Mauro Meneghetti, branch manager for UPS South Africa’s

Western Cape division.And Meneghetti is keen to see

all existing transport infrastructure – ports, roads and rail – constantly monitored and upgraded.

“Cape Town’s harbour is a good example of how upgrades can lead to efficiency,” he said.

“One of the most significant improvements in the Western Cape’s port infrastructure was the implementation of the Navis System in the container and multi-purpose terminal. The fully automated system

allows for the import release of goods as they arrive at the harbour.

“It has significantly streamlined the releasing process of containers at the harbour and has favourably impacted efficiency in our businesses. However, the fully automated system does occasionally experience down time and no backups have been put in place to continue operations while it is being repaired. This can cause major delays and could negatively influence our delivery time.”

There is no doubt, says Meneghetti,

that with the massive improvements to major highways, airports, rail and various transport routes soon coming to fruition, the Western Cape is set to take advantage of the opportunities coming its way.

“Since global economies tumbled, trade in the Western Cape experienced a slight pull-back. However, with the markets recovering and the World Cup on our doorstep, UPS is ready to take advantage of the increase in business this historical sporting event will bring.”

Reopening of CT office a strategic moveBy Alan Peat

The freight system specialist Compu-Clearing reappeared on the business stage in the Western Cape last year after a lengthy absence, and MD Mario Acosta-Alarcon described it as “of high strategic importance in the national context”.

So much so, he added, that Compu-Clearing had been able to double its training sessions compared to previous years, had

acquired numerous new clients (including such power-houses as Damco and Langeberg & Ashton), and expected to triple the number of employees on this location this financial year.

Acosta-Alarcon described the re-opening of the Cape Town office as an “event met with great excitement from all the Compu-Clearing base community and prospective clients alike”.

“We opened it with the launch of a trade-and-track, Web-based

system – http://www.compu-clearing.co.za/ProductDetail.aspx?productid=4 – during which all clients were invited to attend presentations,” he told FTW.

Also, he described the new administrative centre at Airport Industria as being equipped with a state-of-the-art training room and fitted with video conferencing equipment.

“This,” said Acosta-Alarcon, “enables us to provide face-to-face as well as internet-based training.”

[ CBC ]Cross border and domestic

FCL & LCL • Warehousing • Project CargoOvernight Express by air and road

Your Access to Africa

CPT: Tel: 021 982 8761 Fax: 021 982 8828

JHB: Tel: 011 397 2889 Fax: 011 397 7775

www.crossbordercargo.co.zaFTW4276

Angola • Zimbabwe • Malawi • Zambia • Mozambique DRC • Botswana • Lesotho • Namibia • Swaziland

Mario Acosta-Alarcon ... big benefits.

MARCH 2010 | 7

FTW0016SP

Reefer Express service returns with Cape Town call

The Saecs Reefer Express (REX) service – introduced for the first time last year

– resumed sailings last month (February) as the 2010 Western Cape fruit export season got off to a strong start.

The REX service is an additional ‘purely reefer’ container service designed to provide added capacity for refrigerated exports during the peak reefer season months of February to August.

According to Safmarine’s SA trades executive Alex de Bruyn, this year’s REX service is an improved product, offering increased capacity compared to the inaugural 2009 service.

“The Saecs member lines decided to adjust plug capacity for 2010 in line with the anticipated increased seasonal demand and we believe this year’s REX service will go a long way to alleviating capacity shortages by providing an additional 100 or more reefer plugs on a weekly basis.”

Port rotation will be Cape Town, Rotterdam, Tilbury, Cape Town with Lisbon subject to

inducement on the northbound leg. Port Elizabeth will be added as a second South African port of call when the citrus fruit season starts in April.

The specialised service will initially deploy three vessels, although more will be added later in the season. The addition of the vessel would be subject to demand.

De Bruyn says that although several local fruit exporters initially expressed concern that a stronger rand would negatively impact early 2010 export volumes, Safmarine’s reefer volumes to date for 2010 have been up on the 2009 volumes for the same period and all indications are that this will be a good season for the fruit export industry.

”Demand for reefer space and equipment has been high since the start of the year. The investment made by the Saecs member lines in providing this service for South African fruit shippers is proof of our long-term commitment to supporting South Africa’s fruit export industry.”

The Safmarine Mafadi which currently operates on the Europe route ... REX is an additional purely reefer service.

8 | MARCH 2010

‘Low staff morale at the root of port inefficiency’By Ray Smuts

Bring back the old guard and revitalise the flagging morale of those in the field… that

is what it requires to restore Cape Town Container Terminal to true efficiency, says John Berry, chairman of the Cape Town Harbour Carriers’ Association.

He has seen it all during an eventful 32-year freight career. He was one of the very first cartage drivers involved in containers when they were introduced into South Africa in the mid-1970s, so he’s well able to separate the wheat from the chaff and he and his fellow association members do not like what they see.

Forget, if you will, concerns over lengthy downtime of the new Navis system, still hiccupping four months after implementation, as Berry focuses on other problems – not least of which is “widespread” low staff morale affecting all stakeholders

“In the old (Portnet) days a bus would pick up off-duty operators right at their cranes and deliver their

replacements at the same time to start work immediately.

“Nowadays operators sometimes arrive late, resulting in cranes standing unattended for 30 minutes or even longer. That is not on and needs to be sorted out soonest.

There was a time, he well remembers, that terminal morale was very good. Indeed, quayside teams took pride in what they were doing and worked hard to outdo each other.

Many of the experienced old hands, frustrated over what they saw as a bleak future within TPT, accepted retirement packages and their skills and knowledge were lost as a result.

Berry believes there is no substitute for experience, an essential ingredient sorely lacking at the terminal. So why, he asks, not re-recruit some of those with the know-how?

Back to problematical Navis and the gremlins in the previous Cosmos system. “I don’t know from whom Transnet has purchased these systems but were they previously tried and tested in other ports around the world?” he asks.

“If so, surely problems would have been ironed out before implementation in Cape Town and elsewhere in the country.”

Berry wonders whether TPT fully grasps the implication of all the Navis downtime – up to six hours a day is not unique, hence the association lodging a complaint and receiving two extra free days rather than the one initially allowed following the most recent failure when trucks were

prevented from entering the port from 3pm till mid-morning the following day.

“Customers are forced to go into overtime by paying more for casual labour, cranes, forklifts and other equipment, a real financial burden, but it is not only they who are suffering. It’s the cartage drivers, the clearing and forwarding agents, everybody at the end of the day, so the terminal has to get its act together.”

Time for Cape Town Container Terminal to get its act together, says Cape Town Harbour Carriers’ Association chairman, John Berry.

FTW1638SD

FTW1888SD

MARCH 2010 | 9

By Ray Smuts

The port of Cape Town handled around two million tonnes of cargo of all commodities

(containerised and conventional) last year, with export fruit a key player, reflecting an overall 2008/09 volume decline of some 34%.

Zurayda Christians, NPA’s research manager for Cape Town, says the impact on growth is due largely to two factors.

First, given the local maize crop is doing very well, imports of around 600 000 tonnes did not materialise last year.

“We have also seen fewer petroleum-finished imports due to lower demand and also decreased petroleum exports because we are now supplying our local markets.”

Another major blow to the Western Cape has been the closure of the Sans Fibres plant in Bellville, hence fewer chemicals being imported.

Her job, as part of the three-member marketing team, calls for monitoring of all imports and exports in order to “look at the reasons why we are doing what we are doing.”

Though much of the data captured remains sacrosanct to customers, regular customer interaction is top of the agenda.

Her research focus is on the performance of around ten commodities such as petroleum, fruit, bulk and breakbulk.

Major commodities imported by the port in 2009/10 were petroleum and related products (46%), agricultural products (19%), wheat and fertilisers (8% each), miscellaneous (7%) and other (12%).

Major commodities exported during the same period were petroleum products (69%), other (24%) citrus (7%)

and deciduous (3%).The port accommodated 2 226 vessels

during the year in question, including 703 container, 172 reefer, 232 bulk and 208 general cargo ships.

It handled upwards of 500 000 TEUs, down considerably on close to 800 0000 TEUs the previous year.

The split between containerised and conventional cargo is ever-widening, the latter accounting for perhaps only 4% of the total two million pallets shipped last year.

NPA’s Sanjay Govan is not a man given to boastful outlooks but says his own “gut feel” is that Transnet NPA Cape Town will manage to sustain itself and witness slight volume growth this year.

“It’s not just about Cape Town but the way we move forward overall. We have done extremely well with our training

programmes, pilots and tug masters in particular but still have a lot of work to do in turning out future marine engineers and harbour masters.”

Govan celebrates his tenth anniversary as Cape Town port manager in April, 2010, but emphasises he would be reluctant to quit for another posting.

“I owe these past nine years to my management team – their calibre has truly made the difference, and I continue to hold the strong view we need to be very customer-orientated and do everything possible to assist them”

His is a job fraught with pressures but after-hours quality time is spent with his family and ownership of a Mowbray pizzeria.

Needless to say, the strict vegetarian has become rather good at turning out Focaccias, Margheritas, Porchettas and other Italian tasties.

www.hartrodt.com

Johannesburg: Tel: (011) 929 4900 Fax: (011) 397 4221 e-Mail: [email protected] Cape Town: Tel: (021) 380 5860 Fax: (021) 386 2498 e-Mail: [email protected] Port Elizabeth: Tel: (041) 581 0696 Fax: (041) 581 0715 e-Mail: [email protected] Durban: Tel: (031) 584 6381 Fax: (031) 584 6380 e-Mail: [email protected]

Big enough to cover the world and the whole range of servicesSmall enough to serve every customer individually and most flexibly

World-wide Transport and Logistics Management with over 950 employees in more than 80 countries

✔ World-wide Sea and Air-Transport✔ Customs Clearance✔ Supply Chain Management✔ Wine Logistics✔ Project Forwarding✔ IT Management✔ Tracking & Tracing✔ Logistics & Distribution✔ Consultancy

TRANSPORT IS OUR BUSINESS

FTW2933

Closure of Sans Fibres impacts CT volumes

Zurayda Christians ... Fewer petroleum-finished imports.

TEUS HAndled AT CT TerminAl

1000

800

600

400

200

0

Thousands

2008 2009

10 | MARCH 2010

FTW1754SD

Perishableskeep SAA flying highBy Alan Peat

The air cargo market in the Cape is only bettered by the SAA Cargo hub at OR Tambo International

Airport (Ortia) in Johannesburg, according to Ronel Mendes, national sales manager for SAA Cargo (SAAC).

Examining the relevance of the Cape Town market for SAAC, Mendes told FTW that it had always, and would continue to be, one of the airline’s key export markets as well as a very

important second hub for its domestic cargo.

“After Johannesburg,” she said, “the Cape Town domestic volumes remain the second largest – with those of the other domestic routes following.

“Apart from the normal domestic markets we have a massive support from the perishable community in Cape Town, and thus it is a very strategic hub for SAAC.”

The main products moving from Cape Town into the domestic market are many and varied, but perishables remain the core for the airline’s international services.

“On the local scene,” said Mendes, “cargo types really vary – with a thorough mix of courier shipments, perishable consignments and a range of high- and low-value commodities.

“Internationally, of course, we are mainly supported by perishables. But with our current rate structure being common-rated we are also feeding smaller general cargo shipments to Africa.”

The perishable demand is also somewhat dependent on the destination, according to Mendes. She pointed

out that fish (mostly tuna and fresh hake) was bound for both Europe and the USA, flowers and stone fruits for Europe, with lobsters the prime commodity heading for the currently third-place market of the Far East.

SAAC records show that domestic volumes in the Cape market have remained very consistent – although Mendes noted a slight increase in the books at the moment. “This,” she said, “is due to on-time departures for our freighters and consistent service improvement, as well as increased capacity from Mango and new flights being introduced from Cape Town direct to Bloemfontein.”

On the international front, London has always been a prime market, with the airline’s direct flight from Cape Town performing well. “With good export volumes in December, we increased tonnage in December by 200 tons compared to November.

“Apart from the perishable season blooming late last year,” Mendes added, “we have also recorded tremendous support for the Cape Town market from destinations like Hong Kong, New York and others.”

Effective capacity management is a critical factor in SAAC being able to provide the required space for its customers, according to Mendes.

Ronel Mendes … domestic volumes consistent.

FTW4315

Your fully independent consolidator

JOHANNESBURGTel: 011 450-4488Fax: 011 455-6160DURBANTel: 031 304-3733Fax: 031 304-3970CAPE TOWNTel: 021 386-5553 Fax: 021 386-5554

Loading up ... Thorough mix of courier shipments, perishable consignments and a range of high- and low-value commodities.

For FTW subscriptions, please contact Gladys Nhlapo 011 327 4062 ext 353 [email protected]

FTW4640

MARCH 2010 | 11

LEADERS IN PACKING AND SECURING CARGO

We provide you with crating, wrapping & packing, container loading and other logistic services

a level one B-BBEE company5 Carlisle Street | Paarden Eiland | T +27 (0)21 511 [email protected] www.capecrating.co.za

Visit www.capecrating.co.zaFREE QUOTE

FTW4600

Airlink creates wide network opportunity for Cape shippersReaching regional destinations not served by other airlines

By Joy Orlek

The Western Cape airfreight market is beginning to show signs of life, with Airlink Cargo finding

growing support for its niche market offering in the region.

“For us it’s a constant exercise in creating awareness of the many route options we can provide,” says Airlink Cargo MD Alwyn Rautenbach.

“We operate between Cape Town and Upington, Kimberley, Nelspruit and George and that enables us to route Cape Town cargo via these destinations to Durban or Johannesburg,” says Rautenbach.

“It also gives us the opportunity to reach regional destinations not served by other airlines like Bulawayo, Antananarivo, Ndola and Beira.”

No additional fees are charged for routing via another airport and it’s still a same-day or overnight service.

“With our pro-rate agreement with SAA, we would even route urgent cargo on SAA via Johannesburg.”

And the service is seamless, says

Rautenbach, with Airlink facilitating customs clearance for overborder cargo through agreements with freight forwarders.

“Because we service all these little routes we have a very wide network, so if you need to send something urgently to Maseru in Swaziland, or from George to Ndola, for example, we have the network to make it happen.”

While last year was, by all accounts, exceedingly grim, the market started picking up in November and December. “Things generally slow down in January, but we have seen the market picking up steam, and with the mining industry showing clear signs of life because of improved copper prices, our Zambia services are beginning to improve.”

With the Airlink fleet now at full throttle, the year ahead is looking exceedingly positive, says Rautenbach.

“Our fleet is now at full strength and Airlink has acquired four additional ERJ 135 aircraft.

“This means that certain destinations previously served by J41s, which are very small aircraft, will now be serviced

by Embraer jets, providing a little more cargo capacity.”

February 14 marked another milestone for the airline with the launch by TTA Airlink of a new daily service on the Johannesburg-Maputo route. The airline is a joint venture between Mozambican carrier TTA Airline and Airlink, with onward connections from Maputo to Beira, Tete and Nampula on the planning boards.

Alwyn Rautenbach ... seamless service.

Tailor-made Solutions to suit individual needs

JohannesburgTel +27-11-390 2371-4Fax +27-11-390 2375

Email: [email protected]

Cape TownTel +27-21-386 4043

Fax +27-21-386 4067Email: [email protected]

Accredited Regulated Agent with the Civil Aviation Authority in JNB & CPT

FTW4218

Breakbulk service going strongUnited Maritime Logistics (UML) last year added several features to its profile including a breakbulk service for out-of-gauge cargo through its Special Projects Division.

“We are seeing a lot more enquiries for this service as well as for open top containers and flat racks from the USA. We believe it is important to be able to cater to the needs of these clients whose cargo just won’t fit into the general all purpose container,” says UML director Claude Nuttall. These requests continue to stream in.

Keeping customers informed of changes to the system, of expected departures and arrivals and possible delays are key performance criteria, he added.

12 | MARCH 2010

Sea

& A

ir

0861 237 111www.cfrfreight.co.za

SEAFREIGHT OFFICES:Johannesburg

Tel: +27 11 574 0600 Fax: +27 11 574 0601

DurbanTel: +27 31 203 0100 Fax: +27 31 266 9323

Cape TownTel: +27 21 386 9000 Fax: +27 21 386 9009

Port ElizabethTel: +27 41 582 2307 Fax: +27 41 582 2838

AIRFREIGHT OFFICES:Johannesburg

Tel: +27 11 397 7799Fax: + 27 11 397 6648

DurbanTel: +27 31 408 1263 Fax: +27 86 660 4679

Cape TownTel: +27 21 386 9000 Fax: +27 21 386 9009

Port ElizabethTel: +27 41 582 2307 Fax: +27 41 582 2838

FTW3961

International Consolidation Services Sea & Air

SA (PTY) LTD

WAREHOUSINGBonded • Duty paid • General

DistributionContainer packing and unpacking

Specialised wine storage facility Johannesburg Cape TownTel +27 11 979 0853 +27 21 905 1250 Fax +27 11 979 0660 +27 21 905 0188

Email [email protected]

FTW4589

Specialists in software for Freight management

Shipping

Distribution

Warehousing

Logistics

FTW4232

Call ANTHEA +27 21 448 7203 Email: [email protected] www.macro.co.za

Food and beveragekeeps business buoyantLiaising with clients to stagger deliveries during Fifa World Cup

By Ray Smuts

Sugar, spice and all things nice remain indispensable to many, even in this economically

depressed day and age, but recovery signs are evident in burgeoning Africa, as Grant Barnard, Cape Town branch manager for international freight forwarder a hartrodt South Africa, can testify.

Food and beverage logistics plays a major role in the overall success of the 123-year-old company, its Cape Town branch featuring prominently in this particular sector.

“The company’s Cape Town food and beverage logistics division, established in 2006, has experienced 90% growth year-on-year,” says Barnard.

He joined the company 18 months ago, bringing 19 years’ shipping experience, some of it in Africa beyond this country’s borders. He says the Mother City’s F&B logistics division receives more than 400

estimate requests a year from all parts of the globe, 10% from sub-Saharan African countries.

“The main F&B commodity for us moving into Africa is wine and during 2009 we moved seafreight shipments to Nigeria, Benin, Kenya, and Angola, though the continent is an ever-growing market.”

Hartrodt Cape Town, one of four branches since the company was registered in 1981, eagerly anticipates further growth, even though Barnard is quick to stress this will be a “challenging year”, on the back of 2009.

The branch is located at Airport Industria, a stone’s throw from Cape Town International Airport – convenient given airfreight is a major player.

As to warehouse capacity of only 400 m2, Barnard comments: “A lot of people ask “why so small”? but the answer is we do not want to incur extra costs for our clients by going bigger.”

Hartrodt Cape Town, in anticipation of the Fifa 2010 World Cup, has been in touch with its 350-odd Western Cape client base regarding strategies of “staggered deliveries and collections”, cognisant of transport congestion during such major events.

As is commonplace throughout

hartrodt, honing skills through in-house training remains a priority. The Cape Town branch anticipates the Teta-accredited graduation next year of Rochelle Andrews and Clive Nduna.

She is a junior clerk in seafreight imports, he in a similar capacity in the customs section.

Grant Barnard … ‘F&B logistics division receives more than 400 estimate requests a year from all parts of the globe.’

MARCH 2010 | 13

FTW1868SD

FTW1887SD

between RSA & WindhoekQuality overnight roadfreight express service

● Own clearing offices at borders● Any size cargo● Refrigerated trucking

● 15 Years Experience● 3 Departures per day● Distribution in Namibia

Quality Airfreight Services & Road SpecialistsCape Town Windhoek JohannesburgTel: +27 21 951 7290 +264 61 247 250 +27 11 974 0377Fax: +27 21 951 7299 +264 61 247 243 +27 11 974 0370

CAPE TOWN WINDHOEK JOHANNESBURG

Core Freight sets up CT officeGregory Bruce appointed to grow the market

By Liesl Venter

Gregory Bruce, newly appointed representative of Core Freight Systems in the Western Cape,

is thinking big.“Not having been officially

represented in the province before there is a huge opportunity for the company to grow here and that is my goal in the next few months – to actively introduce and promote our product.”

Bruce’s extensive experience in the freight industry includes clearing operations, financial and IT management. “He has business and technical skill so that he’s able to provide real pragmatic advice to customers, be they existing users of our systems or new clients,” says Core Freight Systems’ Jonathan Sims.

According to Sims, the decision to appoint a representative in the Western Cape follows much deliberation. “Our system is of such a nature we can assist people remotely and in the past we found most of the head offices were based in Gauteng so it did not necessarily make sense to have a Cape Town office. But we believe that having

a representative in the Western Cape will enhance our interaction with our customers and add value to the service we already offer.”

Bruce agrees. “The Western Cape is a very closed network compared to the rest of South Africa. Face to face

meetings still count for a lot and being able to have someone on hand to give advice and support on systems goes a long way here.”

And ensuring systems and software are always up to date is as much part of business today as anything else.

“In the Western Cape many companies are limited to the systems they have always used just because they don’t know of any other, which potentially will bring greater efficiency to their supply chain. Introducing the Core Freight product to them and showing them what it can do for their business is definitely on our agenda,” says Bruce. “This is about promoting Core Freight as the supplier of choice in the freight industry.

“There is no doubt that our applications are different from the others in the market place as they are not only modern and more comprehensive but add to making the entire business more efficient. They are designed to provide a total forwarding and clearing systems solution, with the ability to interface with other third party suppliers and systems rather than being only built to make submissions to customs.”

Wine industry grows in statureThe growing importance of SA’s wine industry is reflected in the results of a recent study that reveals its annual impact on the national Gross Domestic Product (GDP) grew to R26.2bn in 2008.

According to the study, undertaken by Conningarth Economists for the South African Wine Industry Information and Systems (Sawis), this is a substantial increase – the figure stood at R22.5 bn in 2003.

The wine industry's contribution represents 2.2% of the total GDP.

Of the R26.2bn GDP created by the wine industry, about R14.2bn remained in the Western Cape where the industry supports employment opportunities to the tune of 275 606.

Source: wines.co.za

Gregory Bruce ... promoting the Core Freight product.

14 | MARCH 2010

FTW4403

Ship

ping general

ServiceS

T +27 11 873-4786 F +27 11 873-6066reganm@shippingandgeneral.co.zawww.shippingandgeneral.co.zaBEE ACCREDITED

Service is our priorityThe preferred neutral road transport supplier to clearing + forwarding agents, importers and exporters.

Nationwide Transport and Warehousing specialistsShipping & General Transport

FTW1035SD

JOHANNESBURG CAPE TOWN DURBAN

TEL: (011) 312-0446/0189 (021) 555-3238 (031) 461-4211/4066

FAX: (011) 805-1080 (021) 555-3750 (031) 461-5327

E-mail: [email protected] NATiONAL DiALiNG 0861/GENHiR

GENERATORS& Reefer container

power unitsUnderslung & clip on

Sound attenuated stationery units25kVA to 630kVA

● Fully established network of emergency plug-in power points

located across South Africa● Full service back-up

Keeping down costs for African shippersFairseas focuses on sea transport and intermodal solutions

By Liesl Venter

Cape-based shipping operation Fairseas International is rapidly

becoming an established entity on the local shipping scene.

Operating since 2006, Fairseas is a South African shipping and freight logistics company providing regional seafreight and landside services using predominantly self operated tonnage.

“The company provides efficient and cost-effective sea transport and intermodal solutions along the African seaboard and the Indian Ocean rim including the Indian Ocean Island areas,” says director Liam Mckenzie.

“Our core services are focused on seafreight chartering and brokering activities, freight management and logistics and providing consultancy services to cargo interests and parties invested in shipping activities. Amongst

our services we now operate a breakbulk and bulk liner service in the Walvis Bay to Mombasa range of ports with project and heavy lift capacity utilising a 9600mt dwt project vessel, as well as providing regular sailings for handy size shipments of bulk commodities into and ex the East African, Red Sea and sub continent areas.”

West Africa is additionally served as far north as Dakar and right around the continent to Djibouti in the North by voyage and space charters for project cargoes, with consignments accepted for overborder delivery into hinterland countries like Uganda and Burkino Faso. “Where appropriate, landside

logistics, barging and lightering are dovetailed with sea freight solutions, making for a seamless through service for our clients from contracted point of despatch to delivery. Mozambique is an area of present focus as well and Fairseas expects to have 25 vessel port calls there this year alone,” he added.

“We expect to handle up to half a million freight tons this year and are looking to further develop and focus on niche opportunities in the region and abroad with services structured to assist African shippers get their goods to market in the most effective and cost efficient manner .” says Mckenzie.” The African Maritime Charter has been promulgated at the right time and we will in future look to partner with other like- minded local parties in order to get more local cargoes off road and rail into ships and international cargoes into South African controlled bottoms.”

Positive perishable startBy James Hall

Despite some easing of airfreight rates over the past year, shippers of SA perishable products who have traditionally used sea transport are sticking to that mode.

Shipping firms contacted by FTW also report good volumes at the start of 2010 as they move SA fruits and meats northward.

“No, I can’t say I’ve seen a shift away from sea freight (to air). There are only a few products that are normally sent by air – flowers and special assignments that are time-sensitive or have to get to a remote spot,” said Revan Vos, veteran trader for Freshgold SA out of Cape Town.

Vos uses air for deliveries to some Indian Ocean islands served by his firm, and is presently shipping large volumes by sea to the Middle East. January was the peak month for plums and grapes, and the start of the pear export season.

‘Seamless through service for clients from contracted point of despatch to delivery.’

MARCH 2010 | 15

FREIGHT & TRADING WEEKLY

FTW4627

To promote your services contact CARMEL LEVINRAD on Tel:+27 11 214 7303or JoDI HAIgH at [email protected]

We will be visiting Zimbabwe later this year. Contact us today

if you would like to advertise or contribute to this feature.

FTW1721SD

‘Leaning toward the bullish side’

By Ray Smuts

As the shipping industry’s slow recovery begins, one of the big challenges right now is

returning to reasonable levels of profitability, says Safmarine’s Africa region executive, Jonathan Horn.

“We need to ensure we are remunerated fairly for the product and service we deliver.

“We are seeing rates lifting off the lows experienced in 2009 in many of the trades – but in many instances these are well below the levels they need to be,” he told FTW.

“Rates, which are clearly dependent on the level of competition, do need to go up in Africa (and other trades

too) and we need to ensure we achieve rate levels that will allow us to sustain and evolve the services we provide to our customers.”

Africa remains a core sector for the carrier, with trades touching the continent accounting for approximately 55% of its total global business.

“No question the recession has impacted on Safmarine’s Africa business although we’re still seeing growth in West Africa and to a lesser extent East Africa.

“The carriers have all felt the same pressure but my gut feel is we will certainly see an uptick during the second half of the year, so I would lean more toward the bullish side.”

Rate restoration a key priority

Jonathan Horn ... rates lifting.

UK prefers SA wine to FrenchLatest figures from market analysts AC Nielsen show sales of South African wines have overtaken French for the first time in the UK wine market.

According to Wines of South

Africa, South African wine sales grew 20% by volume to 12 270 000 9L cases, compared to a decline in French wine sales of 12% to 12 266 000 9L cases. South Africa is now the fourth largest selling country for

wine in the UK. Commenting on the news Jo

Mason, UK market manager, Wines of South Africa, said: “In 1994 our producers wouldn't have dreamt of selling more wine to the UK

than France, but now the wine landscape has changed completely. UK consumers no longer default to European wine and the quality of wine from South Africa is up there with the best in the world.”

16 | MARCH 2010

a. hartrodt 9 AAFSA – A Division of Bidair Services 5

Airlink Cargo Resources 5

Canadian States Africa Line (Mitchell Cotts Maritime) 6

Cape Crating 11

Central Logistics 2

CFR Freight 12

Core Freight 2

Compu-Clearing IFC

Cross Border Cargo 6

Edgin Logistic Solutions 15

Fairseas International 8

GAC Laser 8

General Shipping Services 4

Generator & Plant Hire 14

Globogistics and Services 6

International Liner Agencies 10

Kwela Logistics 12

Macro 2000 12

MACS Maritime Carrier Shipping IBC

Meihuizen Freight 4

MSC Logistics IBC

MSC Shipping 7

Quality Airfreight Services & Road Specialists 13

Robertson Freight 2

Safmarine 1

Sebenza Forwarding & Shipping IFC

Shipping & General Transport 14

Shipshape Software 13

Sky Services 11

South African Airways – Cargo 3

United Maritime Logistics 10

UPS OBC

World Groupage Services 5

World Groupage Services (Cape) 13

Advertisers' Index

Fuelling more than ocean-bound vessels

By Ray Smuts

Topping up the tanks of ocean-bound vessels may well be the mainstay of Cape Town-based

SMIT Amandla Marine’s business, but it remains ever-cognisant of “fuelling” the sea-going aspirations of young South Africans.

Since its formation in 2005, the black empowered company continues to invest in the country’s maritime sector, a commitment that is ongoing.

Its bunker delivery service is confined to the busy east coast ports of Durban, South Africa’s largest, and Richards Bay, known equally for coal exports as is Saldanha for iron ore exports.

The company operates two bunker barges in the port of Durban, the R60 million SMIT Lipuma, built in Durban in 2008, and the SMIT Energy (originally the Pentow Energy), double-hulled last year.

The Richards Bay bunker barge, SMIT Bongani, was also double hulled and refitted in 2009.

It delivers bunkers to vessels of all types, ranging from oil tankers to bulk carriers, cargo ships and cruise liners – what is effectively a 24-hour operation each day of the year.

Spokesperson Clare Gomes tells FTW SMIT Amandla Marine has been in the bunkering business since 1996,

prior to which ships would tie up at a special berth to take on fuels from a pipeline. Today no bunkering takes place via pipeline in the Port of Durban.

The days of children left free to roam ports and stare in awe at towering cranes and imposing ships – and possibly develop a yen for a career at sea – are long gone, thanks to

stringent security measures but interest has not flagged, with the country’s training schools reportedly very busy.

SMIT Amandla Marine recently welcomed six new cadets, all from previously disadvantaged communities. Since the inception of the company’s Cadet Training Programme in 2001, over 30 cadets have successfully been trained.

SMIT Lipuma … one of two bunker barges operated in the port of Durban.

Competitive option on Far East-CT routeWorld Groupage Services ties up with Macnels

Six new cadets put through their paces

By Liesl Venter

Volumes from the Far East continue to grow with the annual December peak season

already showing a 20% increase on last year’s volumes.

In fact, the peak season has yet to come to an end, says World Groupage Services (WGS) managing director Claude Nuttall. “The so-called December peak season has extended itself and continued into January and February – we have not seen volumes drop especially from the Far East.”

The Cape Town based groupage operator that specialises in the Far East last year concluded an agency agreement with Macnels in Singapore, a decision that has paid off well as the Far East continues to gain momentum.

“Macnels is one of the biggest NVOCCs operating from over 11 countries in South East Asia and

has been established on the South African route for many years,” says Nuttall.

With Macnels operating its own groupage containers from all over

South East Asia to Singapore for onward movement to Cape Town, the company is able to offer competitive rates, says Nuttall.

“We believe our LCL service is one of the fastest in the market as we route all cargo via Singapore for direct weekly consolidation to Cape Town with no transhipments.”

According to Nuttall, transhipping in Durban translates into slower transit times for Cape Town importers. “From port of load in South East Asia we fast track cargo to the Macnels ‘express hub’ in Singapore for direct consolidation to Cape Town.”

And as the quality of products from the Far East continues to improve it is a route that will continue to grow, says Nuttall. “It has become very competitive. Currently there is a massive demand for containers from the Far East – an indication of the importance of the route.”

Claude Nuttall ... speedy transit.

GR

APH

ITE

2526

FTW1213SD

FTW0972SD

P57522_UPS_297x210 2/28/05 2:32 PM Page 1

One planet.One contact.One deliverycompany.

www.ups.com

SHIPPING. SYNCHRONISED.

P575

22 0860 877 772FTW0721SD