Flexible Equity Euro Long-Short Strategy- Presentation

-

Upload

giuseppe-piazzolla -

Category

Economy & Finance

-

view

167 -

download

0

Transcript of Flexible Equity Euro Long-Short Strategy- Presentation

OVERVIEW

2

Executive Summary 3

Investment Strategy 4

Investment Process - Stock Picking & Portfolio Construction For The Long Portfolio 5-13

Why We Like This Strategy - Some Evidence 14

Performance 15

Bibliography and Glossary 16-17

EXECUTIVE

SUMMARY

Alpha strategy that aims to exploit pricing inefficiencies from the

underappreciation of the quality factor*

Target of mid to high single digit performance over a market cycle

with volatility half that of European equity indices

No material correlation to major market risk factors

Since inception achieved an average return of over 8% per annum

with 6.5 volatility and more than 53% of the days with positive

returns

INVESTMENT STRATEGY

A model-based approach to alpha generation through systematic stock selection

Strategy

Gross exposure

Net exposure (beta adjusted)

Investment Universe

Long-short equity (LONG a quality value portfolio, SHORT Futures Euro Stoxx)Market (Beta) Neutral by design

Maximum gross exposure designed for the strategy is 200%.

Generally in the range 150-180%

-10% > -- 0 -- < 10%

All caps - Mid cap biased

4

Correlations with major European indexes

Very low --> 0

INVESTMENT PROCESS -STOCK PICKING & PORTFOLIO CONSTRUCTION FOR THE LONG PORTFOLIO

All European stocks with at least 50 mln.€ market cap & 5Y of financial statements --> 2,400 availableCheck liquidity: at least 100.000 € avg. traded value --> 1,300 stocks availableFinancials excluded --> 1,200 available

INVESTABLE UNIVERSE

At least one ‘time-window’ (5 years, 6 years, …, 26 years) of 5% c.a.g.r. in tangible book value per share --> 1,000 stocks available

1ST FILTER:

TANGIBLE BOOK VALUE PER SHARE GROWTH

At least ‘5’ F (Piotroski) - score --> 750 stocks available2ND FILTER:

F-SCORE (PIOTROSKI)

Applying a weight to each measure (F- score, Roic, Fcfy) generates a rankWe focus on the 1st quintile --> 150 stocks availableRANKING

Selecting the best 50-70 stocksMinimizing industry concentrationDetermining weights (help via risk-parity)Check liquidityBULD A DIVERSIFIED PORTFOLIO

STOC

K P

ICK

ING

PORTFOLIO CONSTRUCTION

5

STOCK PICKING (i)

i. Filter based on a minimum threshold of 5% growth in tangible book value per share

‘Tangible book value per share’ = (Total equity – intangibles)/ Shares outstanding

We begin by selecting stocks of companies that have built ‘tangible book value per share’ growth (countingdividends) in at least one of these ‘time-window’): 5 years, 6 years, …, 26 years

Synthesis of the universe showed in the 1st filter

0%

5%

10%

15%

20%

25%

last

5 y

ears

last

6 y

ears

last

7 y

ears

last

8 y

ears

last

9 y

ears

last

10

year

s

last

11

year

s

last

12

year

s

last

13

year

s

last

14

year

s

last

15

year

s

last

16

year

s

last

17

year

s

last

18

year

s

last

19

year

s

last

20

year

s

last

21

year

s

last

22

year

s

last

23

year

s

last

24

year

s

last

25

year

s

last

26

year

s

NESN VX: c.a.g.r. in tangible book value per share

n Ticker Name Sub-Industry Name MktCap_€ count if

1 NESN VX Nestle Sa-Reg Packaged Foods & Meats 221 bln. € 22

2 ROG VX Roche Holding Ag Pharmaceuticals 209 bln. € 22

3 FP FP Total Sa Integrated Oil & Gas 114 bln. € 22… … … … … …

2,398 ABI BB Anheuser-Busch Inbev Brewers 204 bln. € 0

2,399 AIR FP Airbus Se Aerospace & Defense 54 bln. € 0

2,400 SHP LN Shire Plc Biotechnology 44 bln. € 0

ABI BB Intang. Hist.MktC. Nav Tbv/Sh. DVD.P.Sh. Int./Nav

2001 3,259 13,097 4,818 2.3 0.2 67.6%

2002 3,791 9,711 4,694 1.3 0.2 80.8%

2003 3,972 9,133 4,720 1.1 0.2 84.2%

2004 7,705 16,439 8,319 0.7 0.2 92.6%

2005 11,648 22,356 11,471 -0.2 0.3 101.5%

2006 13,570 30,563 12,262 -1.3 0.5 110.7%

2007 15,084 35,057 13,625 -1.5 1.5 110.7%

2008 52,950 26,568 16,084 -23.0 0.2 329.2%

2009 52,536 58,389 21,156 -19.6 0.3 248.3%

2010 56,754 68,702 26,380 -18.9 0.6 215.1%

2011 57,963 75,975 28,929 -18.1 1.1 200.4%

2012 57,693 105,630 31,184 -16.5 1.3 185.0%

2013 71,989 124,222 36,525 -22.1 1.6 197.1%

2014 83,207 150,950 41,299 -26.1 2.3 201.5%

2015 87,188 183,983 38,779 -30.1 3.5 224.8%

2016 171,709 204,145 67,639 -51.5 3.4 253.9%

Example of a stock that passes this test (NESN, on the left) and one that fails (ABI, on the right)

6

STOCK PICKING (ii)

ii. Filter based on ‘F-score’, designed by prof. Piotroski, whose value is derived from accounting data

Piotroski (2002) built a score with the objective to reduce the typical high drawdown and higher volatility of

the cheapest (in terms of price to book) quintile (the classical deep value strategy)

Financial stocks are not eligible

We, from our backtest and our live track record, can say that this score is useful to filter the stocks that we

like: quality stocks and/or companies whose fundamentals are improving. We’ll begin from a score of 5.

Piotroski’s F-score (see the definitions on the Glossary page) assign 1 (if the signal is GOOD) or 0 (if the signal is BAD) in each of the financial indicators

selected.

There are three groups of accounting based financial indicators:

4 based on ‘profitability’ (Roa >0, Roa1>Roa0, Cfo >0, Cfo> Net income)

3 based on ‘financial health’ (‘Lt debt’ reducing, ‘current ratio’ increasing, ‘shares outstanding’ not increasing)

2 based on ‘operating efficiency’ (‘gross margin’ increasing, ‘delta-turnover’ increasing)

Synthesis of the universe showed in the 2nd filter

7

0.5%2.5%

5.4%

16.5%

24.8% 24.5%

17.1%

7.0%

1.6%

0%

5%

10%

15%

20%

25%

30%

1 2 3 4 5 6 7 8 9

F-score (Piotroski)

distribution of F-score @ March '17

We Want To Hold At Least A ‘5’ Piotroski Score Stocks

STOCK PICKING (iii)

iii. Ranking. Now we are looking for the most ‘value’ inside a ‘higher quality’ group of stocks

Inspired by the J.Greenblatt’s ‘magic formula’ approach, we rank stocks based on (high!) ‘free cash flow yield

as a measure of value and then, as a measure of profitability, we use ‘roic’ that pays a critical role in order to

select the highest 'quality' possible stock.

Quality for us means stocks of companies that are safe (low leverage: low ‘net debt/ebit’, high interest

coverage: ‘ebit/interest expense’), well managed, so with a clear path to maximizing the spread between the

return on invested capital and average cost of capital, and, possibly, growing.

Free cash flow yield = (Total cash available for distribution to owners and creditors after funding all worthwhile investment activities) / (Market cap [or, better, Enterprise value ]);

Return on invested capital (Roic) = (EBIT * (1 - Tax rate)) / (Interest-bearing debt + Equity)

For a more complete calculation of Roic we refer to what is reported (as a good example) by Starbucks on theirs 10-k:ROIC = [adjusted net operating profit after taxes (adjusted for implied interest expense on operating leases)] / (average invested capital) where invested capital is calculated on a five-point average and includes shareholders equity, short- and long-term debt, all other long-term liabilities, and capitalized operating leases, less cash, cash equivalents and short- and long-term investments.

8

Synthesis of the universe showed in ‘Ranking’

Ticker Short Name GICS SubInd NameMarket Cap Prim Exch NmPiot Azs D/MKTCAPP/B FCFY-EV5y-Roics.gr.

CEY LN EquityCentamin Plc Gold 2,390,702,080 London 9 21.1 1.5 12.9 13.1 20.7

VBK GR EquityVerbio Vereini Oil & Gas Refini 878,133,248 Xetra 8 5.7 1 2.8 7.4 43.6 2.5

NESTE FH EquityNeste Oyj Oil & Gas Refini 9,237,948,416 Helsinki 8 4.5 16.8 2.3 8.8 9.9 18.7

FAE SM EquityFaes Farma Pharmaceuticals 952,047,488 Soc.Bol SIBE 8 12.4 0.4 3 4.7 14.6 14

AMS SM EquityAmadeus It Group Data Processing 21,010,444,288 Soc.Bol SIBE 8 7 12.2 7.1 6.1 15.0 13.9

STO3 GR EquitySto Se & Co.-Pfd Construction Mat 699,276,224 Xetra 8 4.5 8.7 1.7 8.6 11.6 3

PPB ID EquityPaddy Power Betf Casinos & Gaming 9,071,918,080 Dublin 7 17.5 2.5 0.8 2.3 37.1 37

PNDORA DC EquityPandora A/S Apparel, Accesso 13,991,121,920 Copenhagen 7 14.2 3.1 13.6 5.8 43.4 18.6

GSF NO EquityGrieg Seafood As Packaged Foods & 982,860,224 Oslo 8 4.9 22.6 2.6 7.0 7.7 69.6

RRS LN EquityRandgold Res Ltd Gold 7,944,398,336 London 8 15.1 2.2 4.5 9.5 25.7

SOW GR EquitySoftware Ag Systems Software 3,025,542,144 Xetra 9 6 10.5 2.2 7.2 10.0 1.6

ATCOA SS EquityAtlas Copco-A Industrial Machi 40,301,686,784 Stockholm 8 6.6 6.8 6.8 4.6 20.9 12.3

TOM NO EquityTomra Systems As Environmental & 1,612,484,736 Oslo 8 6.9 5.5 3.3 7.6 12.8 0.7

BESI NA EquityBe Semiconductor Semiconductor Eq 1,582,787,584 EN Amsterdam7 6.1 9.1 4.3 7.1 14.1 17.6

CWC GR EquityCewe Stiftung & Diversified Supp 620,293,888 Xetra 8 6.2 2.1 3.1 6.7 12.6 2.1

MYCR SS EquityMycronic Ab Electronic Equip 1,032,701,184 Stockholm 6 8.6 6.4 17.1 18.0 57.1

FORN SW EquityForbo Holdin-Reg Home Furnishings 2,695,272,960 SIX-SW 8 6.3 4.1 5.1 15.7 4.7

MHG NO EquityMarine Harvest Packaged Foods & 7,373,577,216 Oslo 8 4.4 14.2 3.3 5.9 10.3 19.7

MMT FP EquityM6-Metropole Tel Broadcasting 2,686,389,504 EN Paris 7 4.6 0.1 4.1 11.0 21.7 1.4

OUR EXPERIENCE: 1st EXAMPLE OF A NICE STOCK SELECTION

Kingspan Group PLC has been selected since the beginning of our European equity strategy

From the end of November ‘14 to the end of February ‘17 the stock has grown 133% return vs 5% for the EuroStoxx

We selected it because, at that time, it showed a high Piotroski score (8), a relatively high free cash flow yield(5%), a very healthy and improving trend in return on invested capital

9

KSP ID Roic Fcfy

2009 S2 5.8% 13.9%

2010 S1 6.3% 9.4%

2010 S2 6.6% 2.8%

2011 S1 7.3% 3.8%

2011 S2 7.8% 7.0%

2012 S1 8.3% 5.6%

2012 S2 8.1% 6.6%

2013 S1 7.9% 5.0%

2013 S2 8.8% 3.3%

2014 S1 9.6% 4.4%

2014 S2 9.9% 3.9%

2015 S1 12.0% 4.6%

2015 S2 13.6% 6.1%

2016 S1 14.3% 7.0%

2016 S2 14.0% 3.7%

OUR EXPERIENCE: 2nd EXAMPLE OF A NICE STOCK SELECTION

Actelion Ltd: on 01/26/2017 Johnson & Johnson announced an acquisition of Actelion per sh.

We initiated a position after the summer of ’16

We selected it because, at that time, it showed a high Piotroski score (8), a high free cash flow yield (8%), avery high return on invested capital and, finally, a very healthy balance sheet.

5 5

6 6

4 4

5

8

7

4

6

5 5

4

6 6

5 5 5 5

6

8

7 7

0

1

2

3

4

5

6

7

8

9

0%

2%

4%

6%

8%

10%

12%

2005 S1 2008 S2 2012 S1 2015 S2

Pio

tro

ski

Sco

re

Fre

e C

ash

Flo

w Y

ield

Historical Piotroski score and free cash flow yield

Piotr.

Fcfy

10

ATLN VX Equity Roic Fcfy

2009 S2 21.1% 4.4%

2010 S1 23.3% 4.8%

2010 S2 23.7% 3.1%

2011 S1 -7.3% 5.4%

2011 S2 -5.0% 8.4%

2012 S1 20.2% 9.9%

2012 S2 21.1% 11.0%

2013 S1 21.4% 9.4%

2013 S2 28.7% 6.8%

2014 S1 39.4% 0.6%

2014 S2 33.8% 1.0%

2015 S1 24.8% 4.2%

2015 S2 30.4% 4.4%

2016 S1 38.0% 4.6%

2016 S2 50.1% 3.0%

OUR EXPERIENCE: EXAMPLE OF A BAD STOCK SELECTION

IG Group Holdings PLC : we initiated a position in September ‘16

Primarily a financial spread betting company, on 8th December lost 38% on the news of regulatory tighteningon binary products.

We selected it because, at that time, it showed a high Piotroski score (7), a high free cash flow yield (6%), anaverage roic of 25% … but we know this is not enough (in the short term). We continue to like it because it hasa good balance sheet with 680 mln. GBP in equity and no debt

11

IGG LN Equity Roic Fcfy

2010 S1 25.4% 16.8%

2010 S2 23.9% 6.2%

2011 S1 -8.1% 2.8%

2011 S2 -5.3% 4.8%

2012 S1 35.3% 10.0%

2012 S2 37.3% 11.6%

2013 S1 30.4% -0.1%

2013 S2 32.6% 0.8%

2014 S1 34.1% 5.8%

2014 S2 30.1% 5.9%

2015 S1 28.6% 9.5%

2015 S2 23.9% 5.8%

2016 S1 22.8% 3.4%

2016 S2 28.4% 6.1%

2017 S1 28.0% 6.5%

PORTFOLIO CONSTRUCTION

Number of stocks

How we’ll assign the weights

Sector - Industry representation

Portfolio turnover**

Between 50-80

While we’ll use risk-parity as a guide, we’ll monitor carefully liquidity of the entire portfolio.Max single stock weight --> 6%. Max Gics Industry Group weight: 20%

We won’t invest in ALL the stocks that are part of the 1st quintile of the ‘ranked’ universe: when there are too many stocks in the same industry group (max 15-20%), we’ll select the best one and skip to the next ranked stock of another industry. We won’t invest in banks (since F-score score works only for an ‘industrial’ type of company) but inside the Financials sector there may be space for stocks of ‘Asset Management’, ‘Multi-Sector Holdings’ and ‘Exchanges’ companies.

2017: 33% 2016: 102% 2015: 150% 2014: 11%

12** Accounting data, particularly in Europe, are updated in many cases every six months. We use Bloomberg and between financials published by the companies and data publication there is a delay of a few days for the major traded stocks to weeks for less owned stocks. So our experience is for an average 4-5 portfolio rebalancing a year, mainly on March and on September

PORTFOLIO CONSTRUCTION

13** Accounting data, particularly in Europe, are updated in many cases every six months. We use Bloomberg and between financials published by the companies and data publication there is a delay of a few days for the major traded stocks to weeks for less owned stocks. So our experience is for an average 4-5 portfolio rebalancing a year, mainly on March and on September

AT THE END OF THE DAY, OUR (LONG) PORTFOLIO WILL SHOW HIGHER QUALITY AND, MORE OFTEN

THAN NOT, LOWER VOLATILITY THAN THE INDEX BUT SURELY WE’LL STAY PATIENT BECAUSE …

… what if we disaggregate the implicit short on EuroStoxxEquity Exposure by Gics SectorIndustry Groups Long Short Tot.Gr. Tot.NetConsumer Discretionary 25.1% -6.7% 31.8% 18.4%Financials 2.3% -14.2% 16.5% -11.9%Materials 11.7% -3.7% 15.4% 8.0%Industrials 17.1% -9.8% 26.9% 7.2%Health Care 10.2% -5.8% 16.0% 4.5%Consumer Staples 9.4% -5.5% 14.8% 3.9%Energy 2.2% -4.7% 6.9% -2.5%Telecommunication Services 1.9% -3.7% 5.6% -1.8%Utilities 1.2% -3.1% 4.3% -1.8%Real Estate 0.0% -0.6% 0.6% -0.6%Information Technology 4.8% -4.8% 9.6% 0.1%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

11/

14

12/

14

01/

15

02/

15

03/

15

04/

15

05/

15

06/

15

07/

15

08/

15

09/

15

10/

15

11/

15

12/

15

01/

16

02/

16

03/

16

04/

16

05/

16

06/

16

07/

16

08/

16

09/

16

10/

16

11/

16

12/

16

01/

17

02/

17

Historical GICS Industry Group Allocation (1st 10 industry for the LONG port.)

Capital Goods Automobiles & Co Materials Consumer Durable Pharmaceuticals,

Household & Pers Commercial & Pro Media Retailing Diversified Fina

WHY WE LIKE THIS STRATEGY - SOME EVIDENCE

W.Buffett has built a great performance by buying low volatility and high quality stocks …“(…) Berkshire Hathaway has realized a Sharpe ratio of 0.76, higher than any other stock or mutual fund with a history of

more than 30 years, and Berkshire has a significant alpha to traditional risk factors. However, we find that the alpha becomes insignificant

when controlling for exposures to Betting-Against-Beta and Quality-Minus-Junk factors. Further, we estimate that Buffett's leverage is

about 1.6-to-1 on average. Buffett's returns appear to be neither luck nor magic, but, rather, reward for the use of leverage combined with

a focus on cheap, safe, quality stocks (...)” ‘Buffett's Alpha’ [A.Frazzini - 2013]

… and recent studies show that being different and low turnover has high probability of success“(…) Among high Active Share portfolios - whose holdings differ substantially from their benchmark - only those with patient

investment strategies (with holding durations of over 2 years) on average outperform, over 2% per year. Funds trading frequently generally

underperform, including those with high Active Share (...)”

‘Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently’ [M.Cremers - 2015]

Furthermore, this was the answer Ben Graham gave to a FAJ interview:

“(…) What general approach to portfolio formation do you advocate?“Essentially, a highly simplified one that applies a single criteria or perhaps two criteria to the price to assure that full value is

present and that relies for its results on the performance of the portfolio as a whole--i.e., on the group results--rather than on the

expectations for individual issues.”

14

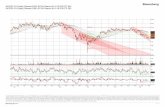

PERFORMANCE

15Live data: we are taking the performance of the sub-portfolio of a mutual fund (LU1043166203 - Eurizon PB Flexible Macro) managed with this long short market neutral strategy (short futures Euro Stoxx).

-1.0-0.8-0.6-0.4-0.20.00.20.40.60.81.0

-2

-1

0

1

2

3

4

05/15 08/15 11/15 02/16 05/16 08/16 11/16 02/17

CO

RR

ELA

TIO

N

SHA

RP

E R

ATI

OS

Rolling 6m. Sharpe & Correlation (with SX5E)

Corr. Sh.R.

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD2017 1.02 2.16 - - - - - - - - - - 3.202016 -1.40 1.90 1.62 -0.64 1.24 -1.20 1.57 0.14 0.98 -2.33 0.54 -2.09 0.192015 1.54 0.78 -0.49 1.87 2.06 0.18 -0.33 2.87 1.11 -0.09 0.99 2.27 13.492014 - - - - - - - - - - - 3.19 3.19

MONTHLY RETURNS (%)

Year 1M YTD 3M 1YR 2YR S. INC.Port. 2.16 3.20 1.04 2.91 7.06 8.86

Peers* 0.08 0.47 0.45 -0.74 0.80 1.74* Composite that tracks the total return of an equal weighted index of market neutral fundsInception date: 28/11/14

PERFORMANCE SUMMARY (%)Annualised STATISTICS SUMMARY (%)

St.Dev. Sharpe Correl Beta

Port. 7.0 1.1 -0.3 -0.1

BIBLIOGRAPHY

Financial Analysts Journal, 1976 'A Conversation with Benjamin Graham' www.cfapubs.org/toc/faj/1976/32/6

J.D. Piotroski, 2002, Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Loser

J. Greenblatt, 2010, The Little Book That Still Beats the Market

A.Frazzini et al., 2011, ‘Betting Against Beta’. “We present a model with leverage and margin constraints that vary across investors and time. We find evidence consistent with each of the model’s five central predictions: (1) Since constrained investors bid up high-beta assets, high beta is associated with low alpha (...) (2) A betting-against-beta (BAB) factor, which is long leveraged low beta assets and short high-beta assets, produces significant positive risk-adjusted returns; (3) When funding constraints tighten, the return of the BAB factor is low; (4) Increased funding liquidity risk compresses betas toward one; (5) More constrained investors hold riskier assets (…)”.

A.Frazzini et al., 2013, ‘Buffett's Alpha’

C.S.Asness et al., 2014

W. R. Gray, 2015, Simple Methods to Improve the Piotroski F-Score

M.Cremers, 2015, ‘Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently’

16

GLOSSARY

Below we show the 9 measures used to calculate the F- Piotroski score.

Financial performance signals: ProfitabilityROA --> net income before extraordinary items scaled by beginning of the year total assets (if ROA > 0, 1, 0)CFO --> cash flow from operations scaled by beginning of the year total assets (if CFO > 0, 1, 0)F_ROA --> ROA this year - ROA previous year (if F_ROA > 0, 1, 0)F_ ACCRUAL --> (if CFO > ROA, 1, 0)

Earnings contain a lot of non cash earnings which is called accruals. Sloan (1996) shows that when profits are greater than cash flow from operations is a bad signal about future profitability and returns.

Financial performance signals: Leverage, liquidity, and source of fundst_Lev --> change in LT debt to Tot.Assets (if LT-d/T.A. increase, 1, 0)t_Liq --> change in current ratio (if curr.ratio increase, 1, 0)t_Sh.O. --> change shares outstand (if shares outst. increase, 0, 1)

Financial performance signals: Operating efficiencyt-G. --> if % gross margin t > % gross margin t-1, 1, 0t-A. --> if asset turnover t > asset turnover t - 1, 1, 0

17

BRE IM EquityInc(L.)_b Cfo Tot.Ass. ROA CFO F_ROA F_CFO Roa Cfro t_R Acc Long Cur.R.Shares t_Le t_Li t_Sh Sales, GPCDt_A. t_G. Piot A.Tu Gm

2006 S2 20 82 774 5.9% 11.4% -1.2% 5.5% 1 1 0 1 31 1.2 66.8 1 0 0.5 392 0 0 4.5 1.1 9.9%

2007 S1 26 10 842 6.0% 11.8% -0.3% 5.8% 1 1 0 1 27 1.2 66.8 1 1 0.5 457 0 0 5.5 1.1 9.4%

2007 S2 35 79 898 7.6% 10.9% 1.3% 3.3% 1 1 1 1 38 1.1 66.4 0 0 1 455 0 1 6 1.2 9.7%

2008 S1 30 -11 1,034 7.5% 7.8% 0.3% 0.3% 1 1 1 1 146 1.1 65.5 0 0 1 568 0 0 5 1.2 9.3%

2008 S2 6 67 955 3.7% 5.9% -3.1% 2.1% 1 1 0 1 108 1.1 65.3 1 1 1 493 0 0 6 1.2 7.0%

2009 S1 -1 74 874 0.5% 14.2% -3.4% 13.7% 1 1 0 1 191 1.1 65.3 0 0 1 404 0 0 4 0.9 3.7%

2009 S2 11 64 854 1.0% 15.0% -0.2% 14.0% 1 1 0 1 122 1.0 65.3 1 0 0.5 422 0 0 4.5 0.9 2.7%

2010 S1 18 35 958 3.4% 11.5% 2.0% 8.1% 1 1 1 1 177 1.1 65.3 0 1 0.5 532 0 1 6.5 1.1 4.7%

2010 S2 13 64 967 3.5% 10.9% 0.6% 7.4% 1 1 1 1 225 1.3 65.3 0 1 0.5 544 0 1 6.5 1.3 5.2%

2011 S1 25 60 1,052 4.0% 12.8% 0.4% 8.8% 1 1 1 1 256 1.3 65.3 0 1 0.5 633 0 1 6.5 1.2 5.7%

2011 S2 18 61 1,133 4.3% 12.0% 0.3% 7.7% 1 1 1 1 255 1.1 65.0 1 0 1 622 0 1 7 1.3 5.8%

2012 S1 35 49 1,255 4.9% 10.1% 0.6% 5.2% 1 1 1 1 268 1.1 65.0 1 0 0.5 703 0 1 6.5 1.3 6.0%

2012 S2 42 96 1,220 6.5% 12.2% 1.4% 5.7% 1 1 1 1 270 1.1 65.0 1 1 0.5 686 0 1 7.5 1.2 6.4%

2013 S1 43 48 1,316 6.9% 11.6% 0.6% 4.8% 1 1 1 1 305 1.1 65.0 0 1 0.5 763 0 1 6.5 1.2 6.6%

2013 S2 46 119 1,299 7.0% 13.2% 0.2% 6.1% 1 1 1 1 259 1.1 65.0 1 0 0.5 803 0 1 6.5 1.3 7.8%

2014 S1 64 87 1,471 8.4% 15.8% 1.2% 7.3% 1 1 1 1 305 1.2 65.0 0 1 0.5 902 0 1 6.5 1.3 9.2%

2014 S2 65 125 1,502 9.3% 15.3% 1.0% 6.0% 1 1 1 1 277 1.3 65.0 1 1 0.5 902 0 1 7.5 1.4 9.5%

2015 S1 91 114 1,567 10.4% 16.1% 1.1% 5.6% 1 1 1 1 235 1.2 65.0 1 0 0.5 1,039 0 1 6.5 1.3 10.2%

2015 S2 95 199 1,585 12.1% 20.4% 1.6% 8.2% 1 1 1 1 215 1.3 65.0 1 1 0.5 1,034 0 1 7.5 1.4 11.7%

2016 S1 127 145 1,842 14.1% 21.8% 2.0% 7.7% 1 1 1 1 232 1.1 65.0 0 0 0.5 1,147 1 1 6.5 1.4 13.4%

Here an example of Brembo’s historicalPiotroski score