Finance StrategiesFinance Strategies StrategiesFinance Strategies ... project level) Source: Bose et...

Transcript of Finance StrategiesFinance Strategies StrategiesFinance Strategies ... project level) Source: Bose et...

Finance StrategiesFinance StrategiesFinance StrategiesFinance StrategiesMethods and Perspectives Methods and Perspectives

Arnab Bose; [email protected]

ContentContent

• Understanding Finance: Perspectives– Global Financial architecture– Global investment risk perceptions

U d t di Fi M th d• Understanding Finance: Methods – A framework to assess different forms of

financial(cash) flows going to a programme or project: Financial Gradients

– A tool for project appraisal suitable for climate investments: Real Optionsp

Arnab Bose

Global Financial architectureGlobal Financial architecture

Policy sideAgents that link the

policy and Investment sidePolicy side

• Governments• Central banks

policy and investment side

• International Monetary Fund (IMF)

Investment side

• Industry • Commercial banks

• Bodies of global governance including UN agencies

(IMF)• World Bank• World Trade

OrganizationI i l

• Financial institutions (including Private Equity, Pension F d )• International

Finance Reporting Systems

• Banking norms (e g; Basel III)

Funds…)

(e.g; Basel III)• Rating agencies

Source: self Arnab Bose

Global investment risk perceptions

Source: Global Risks Report, World Economic Forum, 2013 Arnab Bose

Continued..Continued..• Most severe concern was for Environmental risk in the• Most severe concern was for Environmental risk in the

backdrop of Macro-ececonomic imbalances• The risk of failure of climate adaptation measuresThe risk of failure of climate adaptation measures

Arnab Bose

Methods in FinancingMethods in Financing• Financial frameworks to measure the domain• Financial frameworks to measure the domain

particularly public private partnerships - Framework for PPPs

• Better project appraisal system within the given paradigm for a low carbon development pathway - Real Options for investment decisions

Issue Tool Audience

How can various sources of finance be combined without friction

Financial gradients applied to PPPs

Development banks, government departments, private sector

Lack of evaluationmethods for investments in sustainability

Real options methods of investment analysis

Development banks, government departments, private sectory p

Arnab Bose

Historic PerspectiveHistoric Perspective

First Energy Transformation

Intellectual property respected as a right (Mokyr 2009)Extinguished monopolies, abolished

t ti l i d

Second Energy Transformation

Oil and gas – propagated as an Third Energy Transformationrent-generating exclusions and privilèges (Mokyr 2009)James Watt’s steam engine – 1795 Financing through investment in patent

Oil and gas propagated as an alternative to whale oil for lighting 1863 - John D Rockefeller , a bookkeeper, starts Standard Oil Company Innovation in risk financing like self

gy

Electricity for light and power Westinghouse registers and buys large number of patents, including those of TeslaMatthew Boulton - debt repayment

in kind

Innovation in risk financing like self-insurance– propels him to market leader within 15 years in USA

those of TeslaL.L. Nunn’s National Bank of Telluride finances George Westinghouse’s power operations in Colorado – commercially propels hydroelectric powerhydroelectric power

Arnab Bose

Financial Gradients: Approach

Source: Bose 2011, Bose et al 2012 Arnab Bose

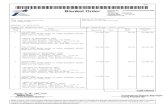

Financial Gradients: MatrixFinancial Gradients: Matrix

Project level Program level

Businessmodel(products) Business(products)

model(strategy) Simpler management for business processes for climate action

Financial Model (long term cash

Financialmodel (finance at (long term, cash

flow)model(financeat

projectlevel)

Source: Bose et al, 2012 Arnab Bose

Financial Gradients: Matrix for LaBL

Arnab Bose

Case: LaBL

Arnab Bose

REAL OptionsREAL Options

An alternative or choice that becomes available with a business investment opportunity. Real options can include opportunities to expand and cease projects if certainopportunities to expand and cease projects if certain conditions arise, amongst other options. They are referred to as "real" because they usually pertain to tangible assets y y p gsuch as capital equipment, rather than financial instruments. Taking into account real options can greatly ff h l i f i l i Of iaffect the valuation of potential investments. Oftentimes,

however, valuation methods, such as NPV, do not include the benefits that real options providethe benefits that real options provide.

Source: investopedia.com

Note: The slides for Real Options is derived from Bose et al(2013), lecture notes Pindyck, MIT (2008); and Simon Benninga (2008) Arnab Bose

REAL OptionsREAL Options

G t th t i t th t th l f th fi ’ ti t• Greater the uncertainty, the greater the value of the firm’s options to invest, and the greater the incentive to keep these options open

• Note that value of a firm is value of its capital in place plus the value of its gro th optionsgrowth options

• keep options alive: gives far more flexibility to manage and cope with uncertaintyi th b f i t t d t b fi i l i t• increases the number of investment grade assets: beneficial impact on global macro-economics

• reduces dependency on Public Finance; reduces fiscal deficit• increases employment: India needs 200 million jobs to be created• option alive model of business increases labour intensity • Will make better suggestion of accounting and banking rules• Creates a better interface with different sources of finance

sustainability needs jobs, jobs need sustainability, therefore.. Arnab Bosesustainability needs jobs, jobs need sustainability, therefore..

REAL Options !!

REAL Options: WhyREAL Options: Why

• Why not the standard NPV/IRR rule?– With uncertainty and irreversibility, NPV rule is often

wrong; very wrong !! O ti th i b tt– Option theory gives better answers

(Pindyck 2008)I ti th l f fl ibilit• Incorporating the value of flexibility

• Real Options and Sustainability: Importance in Mitigation Adaptation Low Carbon growth pathwaysMitigation, Adaptation, Low Carbon growth pathways (Bose et al 2013)

Arnab Bose

REAL Options : Why.. continuedy

O ti th h i t i t d t t it tl (NPV l ft• Option theory emphasizes uncertainty and treats it correctly (NPV rule often doesn’t.) Helps to focus attention on nature of uncertainty and its implications.

• Managers ask: “What will happen (to fuel prices, to power demand, to interest rates,...)?” Usually, these are the wrong questions. The right question is: “What could happen (to fuel prices, to...), and what would it

/ h t ti d t k ?”mean/what action do we take?”• Managers often underestimate or ignore the extent of uncertainty and its

implications.• Option theory forces managers to address uncertainty

Source: (Pindyck, 2008)

Arnab Bose

REAL Options: examplesREAL Options: examplesClimate Project: Expected Cash Flows

Discount rate 25%Growth 10%

Year Stage Cost Income Net Probability Expectedcash flow

0 Discovery -1,000 0 -1,000 1 -1,000 <-- =F6*E61 Clinical -2 000 0 -2 000 0 5 -1 000 <-- =F7*E71 Clinical -2,000 0 -2,000 0.5 -1,000 <-- =F7 E72 Clinical -2,000 0 -2,000 0.5 -1,0003 Marketing -15,000 20,000 5,000 0.15 7504 Marketing -15,000 22,000 7,000 0.15 1,050

M k i 1 000 24 200 9 200 0 1 1 3805 Marketing -15,000 24,200 9,200 0.15 1,3806 Marketing -15,000 26,620 11,620 0.15 1,7437 Marketing -15,000 29,282 14,282 0.15 2,142

Project NPV -268 <-- =G6+NPV(B2,G7:G13)

Cli t P j t O ti dj t d Bi i l t f thClimate Project: Options adjusted Binomial tree for the cash flows

Arnab Bose

Marketing phase, Initial revenue 20,000 The expected return and variance of returnMarketing, annual cost 15,000 is given by:Clinical annual cost 2,000 Expected 10%Initial, annual cost 1,000 Sigma 100%

Up 300%Up 300%Down 41%

State prices qu 0.2816 qd 0.6618

Net cash flows 1,614,017 <-- =B2*B7^4-B3527,253

165,500 205,464 <-- =B2*B7^3*B8-B345,083 58,386

5,000 9,428 14,836 <-- =B2*B7^2*B8 2-B3

-2,000

-2,000

-1,000

Time line 1 2 3 4 5 6 7Time line 1 2 3 4 5 6 7

State prices (to start of market phase) 0.0001 <-- =B11 J270.0005

0.0018 0.0010 <-- =B11^6*B12*(COMBIN(4,3)-1)0.0063 0.0059

0 0223 0 0167 0 0047 <-- =B11^5*B12*2*(COMBIN(4 1)-2)0.0223 0.0167 0.0047 <-- =B11 5 B12 2 (COMBIN(4,1)-2)

0.079316

0.2816

11

Binomial tree valuation 229 <-- =SUMPRODUCT(B14:J25,B30:J41)

Arnab Bose

Arnab Bose

For CommunitiesFor Communities

Arnab Bose

Real options for communitiesReal options for communities

Arnab Bose

Real options for communitiesReal options for communities

Arnab Bose

Real options for communitiesReal options for communities

Arnab Bose

MehrauliMehrauliMehrauli

Pareto Optimal

Arnab Bose

Arnab Bose

Arnab Bose

Arnab Bose

![[XLS] · Web view0.4 1 3 8 0.1 0.1 1 2 0.1 0.1 1 3 0.1 0.15 1 4 0.1 0.15 1 4 0.1 0.15 1 4 0.1 0.1 1 2 0.1 0.15 1 4 0.1 0.1 1 3 0.1 0.1 1 3 0.1 0.1 1 3 0.1 0.15 1 4 0.1 0.1 1 3 0.1](https://static.fdocuments.net/doc/165x107/5ab00b917f8b9a3a038e2f4f/xls-view04-1-3-8-01-01-1-2-01-01-1-3-01-015-1-4-01-015-1-4-01-015-1.jpg)