Daily Trade Journal - 09.01

Transcript of Daily Trade Journal - 09.01

-

7/30/2019 Daily Trade Journal - 09.01

1/13

q

q

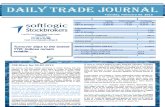

Today's Turnover (LKR mn)

Annual Average Daily Turnover (LKR mn)

Volume (mn)

Annual Average Daily Volume (mn)

Market Capitalization (LKR bn)

Net Foreign Inflow / (Outflow) [LKR mn]

- Foreign Buying (LKR mn)

- Foreign Selling (LKR mn)

YTD Net Foreign Inflow / (Outflow) [LKR bn]

1.8%

1.2%

ASPI

S&P SL 20 Index

- 6.83

- 3.1

5,745.10

3,120.87

ASPI

Wednesday, January 09, 2013

900.8

% ChangePoint ChangeToday

33.2

497.2

-0.12 %

-0.10 %

2,206.8

YTD Performance

S&P SL 20 Index

41.1

-31.4

0.1

139.3

170.7

Level 23, East Tower, World Trade Centre,

Colombo 01

Tel: +94 11 727 7000,

Fax: +94 11 727 7099

Email: [email protected]

CSE Diary for 09.01.2013

Bourse extended its stagnant pace following hefty gains made

during previous two weeks as the benchmark index closed broadly

flat following marginal intra-day swings between gains and losses.

The S&P SL20 also moved in tandem to close with a 3 point dip at

3,120.9 points. The days turnover weakened from yesterday to

register LKR497.2 mn compared with an annual average of c.LKR1.2

bn.

The stagnation of indices is likely to sustain for few more trading days

justified by the +200 points rally witnessed over the previous two

trading weeks. We consider the current breather as a healthy sign,

where the sentiments are likely to gather strength with the flow of

4Q2012 earnings numbers. However, the critical factor would be the

contribution from local investors who are still to make a strong come

back. We advise the value driven investors to identify and pick on

the counters where real value lies, rather than buying the market.

Strong renewed play in Dialog Axiata led the counter to record a

series of large on-board deals as it saw a total of c.13.2 mn shares

being traded during the day. The deals weighed more towards the

selling side as the heavy index closed flat at LKR8.4. Following

yesterdays strategic deal in Asiri Central Hospitals, institutional

interest extended in its related companies as Asiri Hospital Holdings

and its subsidiary Asiri Surgical Hospitals registered a crossing eachduring the days trading. The former saw a block of 4 mn sharesbeing dealt at its 52-week low (off-market) price of LKR11.4, whilst the

latter recorded a parcel of c.2.7 mn shares taken at its 52-week high

price (off-market) of LKR9.5.

Renewed interest was notable in CT Holdings as the counter saw

several large trades on-board including 125k & 100k share parcels.

Similar interest was witnessed in Softlogic Holdings as it closed flat at

LKR11.5. Distilleries, Ceylon Tobacco, Lion Brewery continued to

trade on their respective 52-week high prices, whilst another food &

beverage sector playerCeylon Cold Stores renewed its 52-week high

price at LKR134.7 today as it advanced 0.8% at its close of LKR134.0.

Interest stayed in John Keells Holdings, Lanka Orix Leasing Company,

Chevron Lubricants and Commercial Bank whilst retail & high networth play was evident in Lanka IOC, ACL Cables and Touchwood.

European Stocks Advance on US Earnings Optimism: European stocks

advanced as Alcoa Inc. began the US earnings season by posting

sales that beat estimates and investors awaited German industrial-

output data. US index futures and Asian shares also climbed. The

Stoxx Europe 600 Index increased 0.4% to 287.44 at 8:23 a.m. in

London.Oil Fluctuates on Signs US Crude, Fuel Stockpiles Increasing: Oil

fluctuated in New York after an industry report showed rising

stockpiles in the US, the worlds biggest crude-consuming nation.

Crude for February delivery was at USD92.96 a barrel, down 19 cents,

in electronic trading on the New York Mercantile Exchange at 4:01

p.m. Singapore time.

-

7/30/2019 Daily Trade Journal - 09.01

2/13

Statistical Look Up

Treasury Bill (%) 04.01.2013

9.88

10.81

11.35

14.26

Inflation (%) Dec-12 9.2

7.6

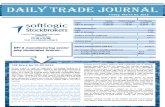

All Share Price Index q

S&P SL20 Index q

Turnover (LKR mn)

Turnover (USD mn)Volume (mn shares)

Traded Entities

Market Capitalization (LKR bn)

Foreign Purchases (LKR mn)

Foreign Sales (LKR mn)

Net Foreign Inflow (LKR mn)

Market PER (X)

Market PBV (X)

Market Dividend Yield

SECTOR INDICES

Banks, Finance & Insurance q

Beverage, Food & Tobacco p

Construction & Engineering p

Diversified p

Healthcare q

Hotels & Travels q

Land & Property q

Manufacturing p

Plantation p

Telecom q

598.6 599.6 -0.16% 19,748.6 -96.97%

829.9 829.8 0.02% 22,504.2 -96.31%

15,758.5

591.3

-0.27%

3,548.9

507.4

0.47%2,650.5

3 months

6 months

12 months

YoY Change

Annual Avg

AWPLR

Excess Liquidity (LKR 'bn) as at 09.01.2013

Today

-4.85

164.9

2.3

2,663.0

16,420.7

2,715.3

1,856.0

12,624.2

Pre Day

0.00%

165.3 16,972.4-0.24%

16,009.5

16,362.3

1,853.8

3,557.2

508.8

-0.23%

7,353.4

826.0

-0.63%

0.36%

0.14%

0.12%

2,711.4

2,694.1

2,641.0

476.0

885.3

-409.3

Change %

5,751.9

3,124.0

2.3

-0.12% 16.0

Pre Day

Week ending

-63.07%

-27.24%

-0.83%

1.08%

0.97%

1.08%

240

2,183.3

5,683.8

3,090.9

45.6

0.89%

0.00%

-0.10%

2,206.8

2.3

139.3

-60.96%

-60.96%88.37%

-7.03%

3.933.2

238

3,120.9

1,273.6

10.0

256

497.2

-0.12%

-70.75%

-80.72%

Today

-31.4

2.1

170.7

16.3

5,745.1

2,209.4

17.6

-70.35%

-70.35%

% WoW

ChangeLast Week

1,676.9

13.2

-21.15%

509.52%

-0.12%

-99.03%

124.70%

500.16%

-80.79%

% WoW

ChangeLast Week

1.31%

-90.22%

-88.16%

83.28%

1,424.1

-83.10%

2.1

1,441.3

-17.2

12,704.5

% Change

-0.12%2.1

-92.32%

16.3

5200

5300

5400

5500

5600

5700

5800

Index

ASPI

2850

2900

2950

3000

3050

3100

3150

Index

S&P SL20

0.0

10.0

20.0

30.0

40.0

50.0

60.0

0

500

1,000

1,500

2,000

2,500

3,000

Volume('mn)

TurnoverLKR('mn)

Turnover Volume

Page | 2.

-

7/30/2019 Daily Trade Journal - 09.01

3/13

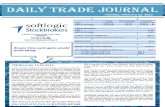

High Index Calibre USD350 Mn

Price Gainers Price Losers

Top 05 Performers for the Day

DIALOG

ASIRI

C T HOLDINGS

COMMERCIAL BANK

ASIRI SURG

Most Active

17.50 + 1.80 11.46% SELINSING 1,120.00 - 152.50 -11.98%

-5.70%

-6.61%

-10.87%

-9.95%

6.40

35.90

22.10

+ 0.40

11.50

Today Pre Day

8.40

11.40

9.10

+ 4.50

DISTILLERIES

4,321

27,125

DIALOG 8.40

Company

110,353

284,764

2

ODEL PLC

LIGHTHOUSE HOTEL

Company Today

1.5%

CEYLON LEATHER [W0014]

RAMBODA FALLS

281,698

510.29

0.29

9,542 8,104.75

1.5%

Change

49.70

Company% of

Mkt CapVolume

149.09

0.00%

0.51%

11.50

1.64%

1.5%

2.1%

Change

- 18.30

- 18.30

- 2.90

- 4.90

% Change

203.00

105.10

9.10

128.00

SINHAPUTHRA FIN

+ 2.30

INFRASTRUCTURE

74.10

117.60

1,631.10

105.40

440.001,650.00

260.11

18,729.93

3.7%

2.2%

1.3%

755

13,212,162

1,800

153

4.0%

171.00

60.40

3.1%

170.00

60.10

439.90

3.6%

63.70

1,630.00

105.40

18.57

8.34

LOLC

AITKEN SPENCE 121.90

2.3% 147.22

1,061.09

147.50

1,193.89315.63

9.382.48

430.00

688.00

8.50

JOHN KEELLS HOLDINGS 84,603

SAMPATH BANK

ASIAN HOTELS & PROPERTIES 6,250

1.4%

2,716193

24,325

8.6%

7.2%CEYLON TOBACCO

CARSON CUMBERBATCHNESTLE LANKA

SRI LANKA TELECOM

COMMERCIAL BANK [V]

3.9%

3.2%BUKIT DARAH

DIALOG AXIATA

HNB [V]

DFCC BANK

CARGILLS

Turnover

USD ('000)

150.009.96%

Intraday

Low (LKR)

Turnover

LKR ('000)

29,580.81

17,078.05

232.51

4.06

845.00

18,967.40

Intraday

High (LKR)

224.50

0.15

117.50

201.10

120.00

167.00

43.90

8.30

% Change

463.00

2.04

516.35

110,982.48

134.24

Today

6.67%

Turnover

(LKR)

146.50

872.34

0.00

105.00

57.40

146.50

43.00

5,467.69

76.00

202.00

142.50

43.80

680.00

74.00

41.00

81.00

TodayCompany

146.50

CDB

165.60

42.98

3.64

52,695,200

26,631,604

4.01

RICH PIERIS EXP

CEYLON GUARDIAN

Pre Day

0.00%8.40 5.0%13.21

Volume (mn)% Change

6.85%

+ 1.70 8.33%

8.40

CompanyContribution to

Total T/O

119.00

1.2%

0.8%

2.80

13.21

4.62

19.50

0.88%11.40

0.26

0.280.29%

0.85

0.00%

0.88%

1.10%

1.3%

1.2%

2.4%

Contribution to

Total T/O

16,616,054

1.10%

11.50

LANKA IOC 19.60

130.10

105.40

9.20

ASIRI SURG 9.20

ASIRI 11.50

% Change

SOFTLOGIC

110,982,481

29,580,814

26,631,604

52,695,200

34,349,247

1.75

4.62

2.80

0.9% 20,119,613

110,982,481

2.4%

Volume (mn)

5.0%

Turnover

(LKR)

1.6%

143.40

121.30

688.00

8.40

859.00

Close

224.00

849.40

223.00

Page | 3.

-

7/30/2019 Daily Trade Journal - 09.01

4/13

Currency Board Announcements

Local - Indicative Rate against LKR Dividends

Dollar No Announcements

Yuan 0

Euro 0

Rupee 0

Yen 0

Ringgit 0

Rouble 0

Riyal 0

Dollar Rights Issues / Scrip Dividend / Sub division / Capitalization

Franc Company

Baht No Announcements

Pound 0

Dollar 0Source: www.cbsl.gov.lk

Global Markets

q

q

p

p

p

p

* Time is as at ET Source: www.bloomberg.com

Commodit Markets

Crude Oil (Brent) q

Crude Oil (WTI) q

ICE Cotton #2 p

CBOT Wheat p

COMEX Gold p

COMEX Silver q

COMEX Copper p

* Time is as at ET Source: www.bloomberg.com

Australia

1,663.10 0.80

METALS

ENERGY

Commodity

23,218.5

Units

0

2.8

Proportion

00-Jan-00

00-Jan-00

0.00

0.00

-0.41%

-0.32%

-55.4

Russia

Saudi Arabia

Japan

368.80

USD/t oz.

USD/t oz. -0.03

750.00

1.60

30.44

Index

Dow Jones Industrial Average

S&P 500 Index

EUROPE

EURO STOXX 50 Price EUR

10,578.6

Value

13,328.9

1,457.2

USD/bbl.

USd/lb.

USd/lb.

AMERICA

0.75

-4.7

Change

0.37%0.28

0

-0.14

Change %

0.44%

Change %

0.10%

-0.08%

-0.11%

-0.15%

0.67%

0.46%

0.05%

05:58

05:59

05:59

0-Jan

0-Jan

05:53

05:52

Time*

05:58

05:59

05:58

0.30%

05:58

Company

00-Jan-00

1/0/1900

1/0/1900

6,071.6

Singapore

Switzerland

Thailand

UK

-0.12

107.3

0

2,694.2

137.58

1/0/1900

1/0/1900

4.18

USA

01:28

18.0

1/0/1900

Change

0.10%

70.5

03:01

0

Payment DateDPS (LKR) XD Date

204.12

0.00

0.00 0

0

127.22

0.0033.92

Malaysia

4.19

133.54

20.44

2.32

1.45

41.81

India

Currency

166.33

Indicative Rate

09.01.2013

China

0

USd/bu.

75.40

Price

111.85

93.02

USD/bbl.

103.60

AGRICULTURE

Hong Kong Hang Seng Index

Nikkei 225

ASIA

FTSE 100 Index

EU

00-Jan-00

1/0/1900

1/0/1900

00-Jan-00

Description

0.00

0.00

0 1/0/1900

0

XR Date

00-Jan-00

00-Jan-00

00-Jan-0000-Jan-00

Renunciation

00-Jan-00

0.00

Time*

00-Jan-00

Page | 4.

-

7/30/2019 Daily Trade Journal - 09.01

5/13

Softlogic Equity Research Page | 5

CSE Announcements

Chilaw Finance [CFL: LKR14.7]: Pursuant to allotment of new shares ofthe company on 8

thJan 2013, the ordinary shares of the company have been

indexed on 9th

Jan 2013.

Ceylon Tobacco [CTC: LKR859.0]: Ms. Marie Premila Perera has beenappointed as a Director of the company with effect from 7th Jan 2013. Asiri Hospital Holdings [ASIR: LKR11.5]: The company informs that it

bought a 10.07% stake or 2.25 mn shares of its subsidiary Asiri Central [ASHA: LKR250.0] from Actis

Investment Holdings at LKR562.5 mn increasing its total stake to 98.55% of the company.

Softlogic Finance [CRL : LKR28.5]: Mr.Mayura Fernando has tendered resignation as both CEO and Directorof the company with effect from 31

stJan 2013 while Mr.Nalin Wijekoon will succeed him for both positions.

Disclosure on Related party dealings:

Local News

CB projects 18.5% credit growth for 2013: Following the lifting of the 18% credit ceiling with the ending of2012, the Central Bank recently gave a clear indication of its commitment to maintain the amount of the

credit to the private sector at 18.5% during 2013. There will not be a fresh ceiling on credit, but we will keep

a close watch on the situation to avoid an undue increase in credit expansion. Banks are now provided with

the freedom to self-manage the situation and decide on their amount of credit, stressed Central BankGovernor, urging the banking sector to be watchful of the situation, ensuring that credit remains at a healthy

level without fuelling demand-driven inflation. The credit granted by commercial banks to the private sector

rose by LKR24.1 bn in November 2012 to reach LKR2,348.5 bn in first eleven months with a 20% Year-On-

Year growth. Indicating a further relaxation of monetary policy during the year, he said that it might be

warranted if inflation eased economic growth remained below potential, aggregate demand low and the

monetary and credit expansion at lower rates than projected.

[Source: www.dailymirror.lk]

Rubber industry poised for growth: Due to the latest auction prices evoking a glimmer of hope to the SriLankan rubber industry, Director of Forbes and Walker Commodity Brokers said that there had been a rise of

LKR25 to LKR30 per kilo, compared to the auction prices in December 2012. He said that he expected thissituation to last for a further considerably time. "The international markets were improving, thus auction

prices were also improving. Most of the improvements in auction prices were due to the demand from Japan

and regional markets,"he said. Though improvements on auction prices may seem marginal compared year

on year, according to him, there had been an improvement throughout last week and he expects it to last

throughout the first quarter of the year. The month of March may be a bit of a bleak month, as it was the

winter season and the supply would tend to cause difficulties, however this is not unexpected, this was a

pattern that continues year after year. According to reports, Latex Crepe 1x traded at an average price of

LKR400 per kilogram, which had been a significant increase from December's LKR382 per kilogram.

[Source: www.dailynews.lk]

Sri Lanka's largest lender aims for trillion rupee deposit base: Sri Lanka's state-run Bank of Ceylon, thecountry's largest commercial bank by assets is aiming for a trillion rupees in deposits, newly appointed

general manager said. "We reached the target of a trillion rupees in assets last year ahead of schedule," he

said after taking over duties Tuesday. "We are now aiming at a trillion rupees in deposits, which will also

increase savings in the country."He said the bank already had deposits LKR700 bn and the target could be

Company Name Relationship Transaction Quantity Price (LKR) Date

PC House [PCH : LKR5.3] S H M Rishan Parent Company Sale 800,912 5.1-5.67 12.12.2012- 03.01.2013

-

7/30/2019 Daily Trade Journal - 09.01

6/13

Softlogic Equity Research Page | 6

reached in about two years. He said the bank would also focus on developing its international franchise. It

had a subsidiary in London and branch operations in India. "We want to expand Indian operations,"he said.

[Source: www.lbo.lk]

SCB tips Lanka to revisit USD bond market; says IMF program will boost confidence: Despite theGovernment in its Budget 2013 indicating there will be zero foreign commercial borrowing, Standard

Chartered Bank said yesterday Sri Lanka was likely to return to the US Dollar market and noted a fresh IMFprogram would boost confidence. We expect USD10.25 bn of hard-currency issuance by Asian sovereigns in

2013 (slightly higher than 2012), with Indonesia and the Philippines dominating, as usual. Sri Lanka and

Mongolia will likely revisit the USD market. Issuance from Thailand and potentially Bangladesh could make

the Asian space more interesting for investors, Standard Chartered Bank (SCB) said in its latest credit alert

on Asia. Maintaining a stable credit outlook on Sri Lanka, SCB said Sri Lanka undertook various policy

initiatives in early 2012 (abandoning the de facto currency peg, tightening monetary and credit policy),

which helped to restore macroeconomic stability. Looking ahead, political stability will help the authorities

to push through reforms, while gradual fiscal consolidation is underway.

[Source: www.ft.lk]

Sri Lanka rupee strengthens in early trade: Sri Lanka's rupee gained about against the US dollar in mid-morning trade Wednesday to 126.25/55 levels in the spot market on expectations of foreign purchases ofrupee bonds, dealers said. The rupee opened around 127.00/25 levels to the US dollar after closing at

127.15/20 levels Tuesday. Dealers said there was dollar selling on expectations of foreign investor purchases

in a bond auction Thursday where LKR40 bn rupees of gilts are on offer. Market participants expect strong

foreign interest up to LKR20 bn at the auction.

[Source: www.ft.lk]

NDB fuels growth of Sri Lankan tea industry: National Development Bank [NDB: LKR141.5] with a 30 yearheritage of commitment towards SME development has assisted a large number of small and medium scale

tea factories, tea exporters, small scale tea cultivation projects and tea plantations in all parts of the country.

Having understood the significance of the tea industry and foreseen its limitless prospects, the bank hascontinuously extended its unwavering support via financial assistance to this sector, which makes up 4.5% of

NDBs total lending portfolio. The bank supports the industry by providing financial assistance to meet

capital expenditure of numerous start-up projects and funding working capital needs to sustain ongoing

projects. NDB is well equipped with an in-house product development team that shares customised financial

expertise coupled with industry know-how to empower the small and medium scale tea manufacturers and

exporters. Having made the tea industry a focal point in its lending agenda, NDB has developed several

industry focused finance solutions to meet the specific needs of the sector. The bank has also advanced its

efforts to support the sector by developing a customised working capital loan product for tea factories, a

first in the industry.

[Source: www.ft.lk]

Global News

Malaysia Exports Rebounded in November on Electronics, Petroleum: Malaysias exports rebounded at astronger pace than economists estimated in November as shipments of electronics and petroleum products

increased. Overseas shipments gained 3.3% from a year earlier after declining 3.2% in October, the Trade

Ministry said in a statement today. The median of 16 estimates in a Bloomberg News survey was for 2.3%

growth. The World Bank last month raised its outlook for emerging East Asia nations, citing Chinas recovery,

even as the export- dependent region faces risks from Europes protracted sovereign debt crisis. Malaysias

economic growth has exceeded 5% in the five quarters through September, underscoring the central banks

decision to keep interest rates unchanged since July 2011.

[Source: www.bloomberg.com]

BOJ may ease again, double inflation target: The Bank of Japan will consider easing monetary policy againthis month while also mulling a doubling of its inflation target to 2%, sources say, as the economy's

weakness threatens to delay its escape from two decades of deflation. Any easing will likely take the form of

-

7/30/2019 Daily Trade Journal - 09.01

7/13

Softlogic Equity Research Page | 7

another increase in the BOJ's 101 trillion yen (USD1.2 trillion) asset buying and lending programme, mostly

for purchases of government bonds and treasury discount bills, sources familiar with its thinking say. Under

intense pressure from new Prime Minister Shinzo Abe, the BOJ will likely adopt a 2% inflation target at its

January 21-22 rate review, double its current goal, and issue a statement with the government pledging to

pursue bold monetary easing steps, the sources say.

[Source: www.reuters.com]

China Loan Share at Record Low Shows Financing Risks: Chinas bank loans as a share of funding in theeconomy may have fallen to a record low, highlighting the growth of alternative financing channels that have

prompted warnings of rising credit risks. New yuan loans probably dropped 14% last month from a year

earlier, according to the median projection in a Bloomberg News survey of 37 analysts ahead of data due by

Jan. 15. That would give bank lending a 55% share of aggregate financing for 2012, based on UBS AG

estimates, the least in figures dating to 2002. The decline underscores the waning ability of official loan data

to capture the scale of debt in the worlds second-largest economy as borrowers and investors turn to less-

regulated, higher-return shadow-banking products. The Peoples Bank of China is putting greater emphasis

on aggregate financing and the International Monetary Fund says the growth of nonbank credit poses new

challenges to financial stability.

[Source: www.bloomberg.com]

South Korea Adds Workers as December Jobless Rate Holds at 3%: South Koreas workforce expanded lastmonth, with the unemployment rate unchanged from November as jobs increased in manufacturing and in

the service sector. The jobless rate was at 3% in December, Statistics Korea said in an e-mailed statement

from Sejong, south of Seoul. The median estimate in a Bloomberg News survey of 11 economists was for a

rate of 3%. The number of employed people increased by 277,000, or 1.1%, to 24.4 mn last month from a

year earlier. Incoming President Park Geun Hye has vowed to make it more difficult for companies to fire

employees and to increase assistance for low-income workers burdened with record household debt. The

nation will create 320,000 jobs this year, the Finance Ministry said in a Dec. 27 report, down from an

estimated 440,000 mn new positions in 2012.[Source: www.bloomberg.com]

-

7/30/2019 Daily Trade Journal - 09.01

8/13

Softlogic Equity Research Page | 8

Daily Stock MovementsTicker Counter Open High Low Close Trades Volume Turnover

AAF -N-0000 ASIA ASSET 2.90 2.90 2.80 2.80 31 78,353 222,854

AAIC-N-0000 ASIAN ALLIANCE 0.00 0.00 0.00 90.10 0 0 0

ABAN-N-0000 ABANS 0.00 0.00 0.00 97.30 0 0 0

ACAP-N-0000 ASIA CAPITAL 30.20 30.30 30.20 30.30 5 5,520 167,104

ACL -N-0000 ACL 66.50 68.00 66.50 68.00 4 125,600 8,353,300ACME-N-0000 ACME 14.40 15.00 14.40 14.90 13 18,800 278,390

AEL -N-0000 ACCESS ENG SL 19.00 19.00 18.70 18.70 12 8,200 155,501

AFSL-N-0000 ABANS FINANCIAL 37.70 37.70 37.70 37.70 2 50 1,885

AGAL-N-0000 AGALAWATTE 32.50 32.50 31.40 32.50 2 204 6,626

AGST-N-0000 AGSTARFERTILIZER 0.00 0.00 0.00 6.00 0 0 0

AGST-X-0000 AGSTARFERTILIZER[NON VOTING] 0.00 0.00 0.00 15.00 0 0 0

AHPL-N-0000 AHOT PROPERTIES 76.00 76.00 74.00 74.10 3 6,250 463,000

AHUN-N-0000 A.SPEN.HOT.HOLD. 72.20 73.40 72.00 72.10 11 4,288 308,961

ALLI-N-0000 ALLIANCE 0.00 0.00 0.00 711.10 0 0 0

ALUF-N-0000 ALUFAB 21.60 22.40 21.60 22.40 7 4,940 108,386

AMCL-N-0000 CAPITAL LEASING 0.00 0.00 0.00 22.40 0 0 0

AMF -N-0000 AMF CO LTD 0.00 0.00 0.00 424.00 0 0 0

AMSL-N-0000 ASIRI SURG 9.30 9.30 9.00 9.20 11 2,804,837 26,631,604

APLA-N-0000 ACL PLASTICS 100.00 100.00 97.50 97.50 2 2 198

ARPI-N-0000 ARPICO 0.00 0.00 0.00 80.50 0 0 0

ASCO-N-0000 ASCOT HOLDINGS 0.00 0.00 0.00 180.00 0 0 0

ASHA-N-0000 ASIRI CENTRAL 248.00 248.00 248.00 248.00 1 28 6,944

ASHO-N-0000 LANKA ASHOK 1720.00 1735.00 1720.00 1735.00 2 6 10,395

ASIR-N-0000 ASIRI 11.30 11.50 11.00 11.50 45 4,620,775 52,695,200

ASIY-N-0000 ASIA SIYAKA 4.90 4.90 4.90 4.90 12 7,982 39,112

ASPH-N-0000 INDUSTRIAL ASPH. 220.00 233.00 217.00 218.00 15 535 116,524

ATL -N-0000 AMANA TAKAFUL 1.60 1.70 1.60 1.60 17 53,983 86,393

AUTO-N-0000 AUTODROME 0.00 0.00 0.00 899.90 0 0 0

BALA-N-0000 BALANGODA 39.00 40.00 38.50 38.50 9 906 35,731

BBH -N-0000 BROWNS BEACH 18.70 18.80 18.50 18.70 10 2,501 46,479

BERU-N-0000 BERUWALA RESORTS 2.60 2.70 2.60 2.60 8 7,402 19,355

BFL -N-0000 BAIRAHA FARMS 150.50 150.60 150.00 150.00 11 1,139 171,209

BIL -N-0000 BROWNS INVSTMNTS 3.90 4.00 3.80 3.90 33 172,369 672,169

BINN-N-0000 BERUWELA WALKINN 74.00 74.00 74.00 74.00 2 51 3,774

BLI -N-0000 BIMPUTH FINANCE 18.00 18.00 18.00 18.00 6 910 16,380

BLI -R-0000 BIMPUTH FINANCE[RIGHTS] 4.30 4.50 4.30 4.50 5 570 2,532BLUE-N-0000 BLUE DIAMONDS 4.10 4.20 4.10 4.10 11 392,724 1,610,169

BLUE-X-0000 BLUE DIAMONDS[NON VOTING] 1.80 1.90 1.80 1.80 15 161,770 291,692

BOGA-N-0000 BOGALA GRAPHITE 24.30 26.40 24.30 26.40 2 125 3,248

BOPL-N-0000 BOGAWANTALAWA 12.60 12.60 12.60 12.60 2 2 25

BREW-N-0000 CEYLON BEVERAGE 499.00 499.00 499.00 499.00 1 1 499

BRWN-N-0000 BROWNS 123.50 123.70 123.00 123.50 12 2,800 345,800

BUKI-N-0000 BUKIT DARAH 682.00 688.00 680.00 688.00 9 755 516,348

CABO-N-0000 CARGO BOAT 84.40 84.40 84.40 84.40 1 50 4,220

CALF-N-0000 CAL FINANCE 20.40 20.40 20.00 20.30 20 37,572 757,640

CARE-N-0000 PRINTCARE PLC 31.00 31.00 30.00 30.10 8 2,600 78,651

CARG-N-0000 CARGILLS 146.50 146.50 146.50 146.50 2 2 293

CARS-N-0000 CARSONS 430.00 440.00 430.00 439.90 9 2,716 1,193,890

CCS -N-0000 COLD STORES 133.00 134.70 133.00 134.00 14 31,530 4,196,803

CDB -N-0000 CDB 40.20 43.90 40.00 41.00 11 32,143 1,315,861

CDB -X-0000 CDB[NON VOTING] 30.80 33.00 30.80 31.90 3 196 6,256CDIC-N-0000 N D B CAPITAL 499.90 500.00 485.00 500.00 25 749 367,120

CERA-N-0000 LANKA CERAMIC 66.00 66.00 66.00 66.00 1 50 3,300

CFI -N-0000 CFI 0.00 0.00 0.00 107.00 0 0 0

CFIN-N-0000 CENTRAL FINANCE 172.00 174.80 172.00 172.40 9 31,345 5,391,720

CFL -N-0000 CHILAW FINANCE 14.20 14.70 14.20 14.30 8 3,773 53,713

CFLB-N-0000 FORT LAND 35.00 35.00 34.30 34.90 13 24,781 865,217

CFT -N-0000 CFT 6.00 6.00 6.00 6.00 4 7,285 43,710

CFVF-N-0000 FIRST CAPITAL 12.10 12.20 12.10 12.10 9 30,400 367,850

CHL -N-0000 DURDANS 100.00 100.00 100.00 100.00 5 754 75,400

CHL -X-0000 DURDANS[NON VOTING] 72.00 72.00 70.00 70.00 6 262 18,346

CHMX-N-0000 CHEMANEX 80.00 80.00 80.00 80.00 1 42 3,360

CHOT-N-0000 HOTELS CORP. 21.10 21.70 21.00 21.00 8 990 20,817

CHOU-N-0000 CITY HOUSING 15.30 15.70 15.10 15.40 12 15,700 238,910

CIC -N-0000 CIC 65.00 65.00 63.50 63.50 2 52 3,377

CIC -X-0000 CIC[NON VOTING] 54.30 54.30 54.20 54.20 4 100 5,424CIFL-N-0000 CIFL 4.60 4.60 4.50 4.50 66 133,310 602,454

CIND-N-0000 CENTRAL IND. 69.00 69.00 67.00 68.40 8 1,825 124,942

CINS-N-0000 CEYLINCO INS. 0.00 0.00 0.00 930.00 0 0 0

CINS-X-0000 CEYLINCO INS.[NON VOTING] 0.00 0.00 0.00 338.90 0 0 0

CINV-N-0000 CEYLON INV. 85.50 86.00 85.50 86.00 5 989 84,900

-

7/30/2019 Daily Trade Journal - 09.01

9/13

Softlogic Equity Research Page | 9

Ticker Counter Open High Low Close Trades Volume Turnover

CIT -N-0000 CIT 0.00 0.00 0.00 164.20 0 0 0

CITH-N-0000 CITRUS HIKKADUWA 0.00 0.00 0.00 21.80 0 0 0

CITK-N-0000 CITRUS KALPITIYA 7.10 7.10 6.90 6.90 24 101,651 701,412

CITW-N-0000 CITRUS WASKADUWA 6.40 6.50 6.30 6.40 21 32,931 210,358

CLC -N-0000 COMM LEASE & FIN 4.00 4.00 3.80 3.80 5 8,505 33,169

CLND-N-0000 COLOMBO LAND 35.00 35.50 35.00 35.20 24 37,029 1,301,200

CLPL-N-0000 CEYLON LEATHER 81.00 81.00 81.00 81.00 1 50 4,050

CLPL-W-0012 CEYLON LEATHER[WARRANTS] 0.00 0.00 0.00 1.80 0 0 0

CLPL-W-0013 CEYLON LEATHER[WARRANTS] 6.50 6.50 6.30 6.50 11 3,322 20,973

CLPL-W-0014 CEYLON LEATHER[WARRANTS] 6.00 6.50 6.00 6.40 9 2,152 13,557

COCO-N-0000 RENUKA SHAW 20.00 20.00 18.30 18.60 46 8,863 171,241

COCO-X-0000 RENUKA SHAW[NON VOTING] 15.00 16.90 14.00 14.00 35 6,172 93,018

COCR-N-0000 COM.CREDIT 16.80 16.80 16.40 16.40 8 5,215 85,531

COLO-N-0000 COLONIAL MTR 145.00 145.00 145.00 145.00 1 100 14,500

COMB-N-0000 COMMERCIAL BANK 105.10 105.40 105.00 105.40 42 281,698 29,580,814

COMB-P-0005 COMMERCIAL BANK 0.00 0.00 0.00 9.00 0 0 0

COMB-X-0000 COMMERCIAL BANK[NON VOTING] 93.00 93.00 92.50 92.50 22 5,394 500,737

COMD-N-0000 COMMERCIAL DEV. 67.00 68.90 67.00 67.30 3 340 22,875

CONN-N-0000 AMAYA LEISURE 80.00 80.00 80.00 80.00 1 400 32,000

CPRT-N-0000 CEYLON PRINTERS 0.00 0.00 0.00 2000.00 0 0 0

CRL -N-0000 SOFTLOGIC FIN 27.00 28.90 27.00 28.30 10 3,154 87,750

CSD -N-0000 SEYLAN DEVTS 9.80 9.80 9.50 9.50 16 120,147 1,158,504

CSEC-N-0000 DUNAMIS CAPITAL 12.00 12.00 11.70 11.80 13 30,851 364,038

CSF -N-0000 NATION LANKA 10.60 10.60 10.40 10.50 104 367,434 3,847,918

CSF -W-0021 NATION LANKA[WARRANTS] 2.10 2.10 2.00 2.00 16 28,005 57,270

CTBL-N-0000 CEYLON TEA BRKRS 5.90 5.90 5.80 5.90 11 25,811 152,255

CTC -N-0000 CEYLON TOBACCO 845.00 859.00 845.00 849.40 18 9,542 8,104,748

CTCE-N-0000 AVIVA N D B 332.90 332.90 318.00 329.00 5 178 57,315

CTEA-N-0000 TEA SERVICES 655.00 675.00 655.00 675.00 3 125 83,875

CTHR-N-0000 C T HOLDINGS 126.00 139.90 126.00 130.10 23 264,556 34,349,247

CTLD-N-0000 C T LAND 25.90 25.90 25.50 25.90 6 402 10,292

CWM -N-0000 C.W.MACKIE 72.50 75.90 72.50 75.70 5 302 22,228

DFCC-N-0000 DFCC BANK 118.10 119.00 117.50 117.60 15 4,321 510,286

DIAL-N-0000 DIALOG 8.40 8.50 8.30 8.40 176 13,212,162 110,982,481

DIMO-N-0000 DIMO 600.00 610.00 600.00 602.00 5 8,195 4,927,156

DIPD-N-0000 DIPPED PRODUCTS 0.00 0.00 0.00 109.00 0 0 0

DIST-N-0000 DISTILLERIES 167.00 171.00 167.00 170.00 52 110,353 18,729,931

DOCK-N-0000 DOCKYARD 225.50 225.50 225.50 225.50 3 585 131,918DPL -N-0000 DANKOTUWA PORCEL 17.00 17.00 16.50 16.80 15 8,181 137,581

EAST-N-0000 EAST WEST 15.20 15.40 15.00 15.30 27 49,313 752,490

EBCR-N-0000 E B CREASY 0.00 0.00 0.00 1039.90 0 0 0

ECL -N-0000 E - CHANNELLING 6.20 6.20 6.20 6.20 9 31,249 193,744

EDEN-N-0000 EDEN HOTEL LANKA 35.00 36.40 35.00 36.00 6 2,000 70,740

ELPL-N-0000 ELPITIYA 18.00 19.30 18.00 18.10 6 2,139 38,802

EMER-N-0000 EASTERN MERCHANT 11.30 11.30 11.20 11.20 10 3,708 41,840

EQIT-N-0000 EQUITY 32.00 32.00 30.00 30.10 9 520 15,874

ESL -N-0000 ENTRUST SEC 20.40 21.00 20.00 21.00 6 9,198 184,858

ETWO-N-0000 EQUITY TWO PLC 25.00 27.40 23.40 25.50 10 6,410 160,129

EXPO-N-0000 EXPOLANKA 7.10 7.10 6.90 7.00 27 63,910 447,237

FLCH-N-0000 FREE LANKA 2.70 2.70 2.50 2.60 51 753,902 1,958,945

GEST-N-0000 GESTETNER 0.00 0.00 0.00 205.10 0 0 0

GHLL-N-0000 GALADARI 14.00 14.30 14.00 14.00 4 2,701 37,814

GLAS-N-0000 PIRAMAL GLASS 6.00 6.10 6.00 6.00 24 211,700 1,270,300GOOD-N-0000 GOOD HOPE 0.00 0.00 0.00 1350.00 0 0 0

GRAN-N-0000 GRAIN ELEVATORS 56.60 56.90 55.10 56.00 23 10,216 570,144

GREG-N-0000 ENVI. RESOURCES 15.80 15.80 15.40 15.60 30 85,300 1,334,750

GREG-P-0002 ENVI. RESOURCES 0.00 0.00 0.00 0.00 0 0 0

GREG-W-0002 ENVI. RESOURCES[WARRANTS] 0.00 0.00 0.00 2.90 0 0 0

GREG-W-0003 ENVI. RESOURCES[WARRANTS] 4.10 4.30 4.10 4.20 43 430,920 1,768,654

GREG-W-0006 ENVI. RESOURCES[WARRANTS] 4.50 4.50 4.30 4.40 45 85,624 378,605

GSF -N-0000 G S FINANCE 0.00 0.00 0.00 600.00 0 0 0

GUAR-N-0000 CEYLON GUARDIAN 165.60 165.60 165.60 165.60 2 100 16,560

HAPU-N-0000 HAPUGASTENNE 39.00 39.00 39.00 39.00 3 91 3,549

HARI-N-0000 HARISCHANDRA 0.00 0.00 0.00 2695.00 0 0 0

HASU-N-0000 HNB ASSURANCE 48.60 50.90 48.60 50.90 6 4,120 200,347

HAYC-N-0000 HAYCARB 0.00 0.00 0.00 178.00 0 0 0

HAYL-N-0000 HAYLEYS 300.00 300.00 300.00 300.00 1 1 300

HDEV-N-0000 HOTEL DEVELOPERS 0.00 0.00 0.00 94.80 0 0 0HDFC-N-0000 HDFC 51.00 51.00 49.50 49.80 18 3,195 159,793

HEXP-N-0000 HAYLEYS FIBRE 32.00 32.00 32.00 32.00 3 759 24,288

HHL -N-0000 HEMAS HOLDINGS 28.30 28.80 28.00 28.60 31 209,630 5,870,605

HNB -N-0000 HNB 147.40 147.50 142.50 143.40 9 1,800 260,112

HNB -X-0000 HNB[NON VOTING] 114.10 114.10 113.00 113.00 18 10,116 1,143,389

HOPL-N-0000 HORANA 25.40 25.40 25.00 25.10 5 3,199 80,025

-

7/30/2019 Daily Trade Journal - 09.01

10/13

Softlogic Equity Research Page | 10

Ticker Counter Open High Low Close Trades Volume Turnover

HPFL-N-0000 HYDRO POWER 7.10 7.10 7.00 7.00 3 770 5,392

HPWR-N-0000 HEMAS POWER 24.00 24.50 24.00 24.00 13 10,000 240,222

HSIG-N-0000 HOTEL SIGIRIYA 84.70 84.80 84.70 84.70 2 48 4,066

HUEJ-N-0000 HUEJAY 78.80 78.80 78.80 78.80 1 50 3,940

HUNA-N-0000 HUNAS FALLS 59.90 60.00 59.90 60.00 7 2,050 122,915

HUNT-N-0000 HUNTERS 0.00 0.00 0.00 334.00 0 0 0

HVA -N-0000 HVA FOODS 13.80 13.80 13.30 13.40 60 55,348 741,761

IDL -N-0000 INFRASTRUCTURE 150.00 150.10 150.00 150.00 3 950 142,500

INDO-N-0000 INDO MALAY 0.00 0.00 0.00 1450.00 0 0 0

JFIN-N-0000 FINLAYS COLOMBO 0.00 0.00 0.00 280.00 0 0 0

JINS-N-0000 JANASHAKTHI INS. 11.20 11.30 11.00 11.00 34 349,341 3,846,053

JKH -N-0000 JKH 224.00 224.50 223.00 224.00 94 84,603 18,967,402

JKL -N-0000 JOHN KEELLS 63.00 63.00 63.00 63.00 2 300 18,900

KAHA-N-0000 KAHAWATTE 36.90 38.00 35.00 35.10 23 11,910 419,417

KAPI-N-0000 MTD WALKERS 28.00 28.20 27.50 27.50 38 22,303 623,675

KCAB-N-0000 KELANI CABLES 71.00 71.00 69.00 71.00 7 6,050 426,450

KDL -N-0000 KELSEY 15.30 16.00 13.50 15.00 7 1,352 19,551

KFP -N-0000 KEELLS FOOD 76.90 76.90 70.50 70.50 3 51 3,916

KGAL-N-0000 KEGALLE 104.10 104.10 104.10 104.10 7 1,100 114,510

KHC -N-0000 KANDY HOTELS 9.50 9.50 9.40 9.40 2 650 6,115

KHC -P-0002 KANDY HOTELS 0.00 0.00 0.00 0.00 0 0 0

KHL -N-0000 KEELLS HOTELS 13.70 13.80 13.60 13.70 15 27,501 376,850

KOTA-N-0000 KOTAGALA 75.90 75.90 75.00 75.00 3 218 16,364

KURU-N-0000 KURUWITA TEXTILE 20.90 21.00 20.90 21.00 2 100 2,097

KVAL-N-0000 KELANI VALLEY 85.90 86.00 80.10 84.90 22 3,397 290,053

KZOO-N-0000 KALAMAZOO 2200.00 2200.00 2200.00 2200.00 1 4 8,800

LALU-N-0000 LANKA ALUMINIUM 36.00 36.00 36.00 36.00 3 2,100 75,600

LAMB-N-0000 KOTMALE HOLDINGS 37.30 38.50 37.20 38.40 4 630 23,632

LCEM-N-0000 LANKA CEMENT 9.80 10.00 9.20 10.00 8 4,991 48,953

LCEY-N-0000 LANKEM CEYLON 0.00 0.00 0.00 170.00 0 0 0

LDEV-N-0000 LANKEM DEV. 7.30 7.50 7.30 7.50 7 3,001 22,157

LFIN-N-0000 LB FINANCE 153.00 153.00 146.00 146.10 10 10,003 1,460,947

LGL -N-0000 LAUGFS GAS 27.80 28.50 27.00 27.80 76 101,128 2,802,987

LGL -X-0000 LAUGFS GAS[NON VOTING] 19.10 19.50 18.60 19.20 160 268,959 5,177,330

LHCL-N-0000 LANKA HOSPITALS 39.70 39.70 39.10 39.20 28 9,606 377,004

LHL -N-0000 LIGHTHOUSE HOTEL 49.70 49.70 49.70 49.70 1 95 4,722

LIOC-N-0000 LANKA IOC 19.50 19.70 19.50 19.60 26 851,842 16,616,054

LION-N-0000 LION BREWERY 295.00 305.00 295.00 300.00 11 1,612 481,863LITE-N-0000 LAXAPANA 6.70 6.70 6.70 6.70 3 1,000 6,700

LLUB-N-0000 CHEVRON 210.00 211.10 210.00 211.00 35 60,601 12,740,420

LMF -N-0000 LMF 98.00 100.50 98.00 100.00 21 27,028 2,702,650

LOFC-N-0000 LANKAORIXFINANCE 3.90 4.10 3.90 3.90 28 81,581 322,836

LOLC-N-0000 LOLC 59.50 60.40 57.40 60.10 265 284,764 17,078,054

LPRT-N-0000 LAKE HOUSE PRIN. 0.00 0.00 0.00 105.00 0 0 0

LVEN-N-0000 LANKA VENTURES 33.00 33.00 33.00 33.00 1 100 3,300

LWL -N-0000 LANKA WALLTILE 60.00 62.50 60.00 62.50 4 310 18,850

MADU-N-0000 MADULSIMA 15.50 15.50 15.50 15.50 5 15,100 234,050

MAL -N-0000 MALWATTE 5.00 5.10 4.90 5.00 23 15,106 75,541

MAL -X-0000 MALWATTE[NON VOTING] 4.50 4.50 4.50 4.50 3 1,030 4,635

MARA-N-0000 MARAWILA RESORTS 7.40 7.40 7.40 7.40 4 493 3,648

MASK-N-0000 MASKELIYA 12.50 13.00 12.50 12.90 7 311 3,906

MBSL-N-0000 MERCHANT BANK 20.50 20.50 20.10 20.10 9 1,912 38,576

MEL -N-0000 MACKWOODS ENERGY 0.00 0.00 0.00 12.90 0 0 0MERC-N-0000 MERCANTILE INV 0.00 0.00 0.00 2200.00 0 0 0

MFL -N-0000 MULTI FINANCE 28.40 28.40 28.40 28.40 1 50 1,420

MGT -N-0000 HAYLEYS - MGT 12.00 12.00 12.00 12.00 1 10 120

MIRA-N-0000 MIRAMAR 0.00 0.00 0.00 94.60 0 0 0

MORI-N-0000 MORISONS 0.00 0.00 0.00 194.90 0 0 0

MORI-X-0000 MORISONS[NON VOTING] 0.00 0.00 0.00 116.00 0 0 0

MPRH-N-0000 MET. RES. HOL. 23.00 23.00 23.00 23.00 3 1,100 25,300

MRH -N-0000 MAHAWELI REACH 20.90 20.90 20.90 20.90 2 300 6,270

MSL -N-0000 MERC. SHIPPING 0.00 0.00 0.00 197.00 0 0 0

MULL-N-0000 MULLERS 1.70 1.80 1.70 1.70 13 113,926 193,677

NAMU-N-0000 NAMUNUKULA 75.40 79.00 75.40 78.90 6 566 44,091

NAVF-U-0000 NAMAL ACUITY VF 0.00 0.00 0.00 69.40 0 0 0

NDB -N-0000 NAT. DEV. BANK 142.00 143.20 141.00 141.50 34 31,815 4,507,060

NEH -N-0000 NUWARA ELIYA 0.00 0.00 0.00 1449.80 0 0 0

NEST-N-0000 NESTLE 1650.00 1650.00 1630.00 1631.10 13 193 315,628NHL -N-0000 NAWALOKA 3.10 3.10 3.00 3.00 18 134,350 403,145

NIFL-N-0000 NANDA FINANCE 6.70 6.90 6.70 6.90 3 547 3,730

NTB -N-0000 NATIONS TRUST 59.00 59.10 58.70 59.00 23 39,090 2,305,493

ODEL-N-0000 ODEL PLC 21.00 22.30 21.00 22.10 79 82,975 1,809,765

OFEQ-N-0000 OFFICE EQUIPMENT 0.00 0.00 0.00 3000.00 0 0 0

OGL -N-0000 ORIENT GARMENTS 13.60 13.60 13.60 13.60 1 500 6,800

-

7/30/2019 Daily Trade Journal - 09.01

11/13

Softlogic Equity Research Page | 11

Ticker Counter Open High Low Close Trades Volume Turnover

ONAL-N-0000 ON'ALLY 55.00 55.50 55.00 55.00 3 711 39,111

ORIN-N-0000 ORIENT FINANCE 16.90 16.90 16.90 16.90 1 100 1,690

OSEA-N-0000 OVERSEAS REALTY 14.50 14.60 14.50 14.50 4 15,100 218,960

PABC-N-0000 PAN ASIA 18.80 19.00 18.70 18.80 29 34,826 658,975

PALM-N-0000 PALM GARDEN HOTL 0.00 0.00 0.00 140.00 0 0 0

PAP -N-0000 PANASIAN POWER 2.90 2.90 2.80 2.90 56 610,334 1,769,869

PARA-N-0000 PARAGON 0.00 0.00 0.00 1190.00 0 0 0

PARQ-N-0000 SWISSTEK 14.20 14.50 14.20 14.50 3 2,267 32,805

PCH -N-0000 PC HOUSE 5.40 5.50 5.30 5.40 26 43,900 237,420

PCHH-N-0000 PCH HOLDINGS 0.00 0.00 0.00 7.50 0 0 0

PCP -N-0000 PC PHARMA 0.00 0.00 0.00 9.60 0 0 0

PDL -N-0000 PDL 46.00 46.00 46.00 46.00 2 259 11,914

PEG -N-0000 PEGASUS HOTELS 42.80 42.80 40.30 40.30 3 54 2,301

PHAR-N-0000 COL PHARMACY 510.00 524.00 500.00 502.70 20 381 191,626

PLC -N-0000 PEOPLES LEASING 14.10 14.30 14.10 14.10 59 166,429 2,361,123

PMB -N-0000 PEOPLE'S MERCH 14.80 15.00 14.80 15.00 2 596 8,841

RAL -N-0000 RENUKA AGRI 4.70 4.70 4.60 4.60 22 60,200 276,940

RCL -N-0000 ROYAL CERAMIC 96.00 99.00 96.00 96.00 11 18,099 1,738,374

REEF-N-0000 CITRUS LEISURE 25.60 25.90 25.60 25.60 12 8,548 219,273

REEF-W-0017 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 32.90 0 0 0

REEF-W-0018 CITRUS LEISURE[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0

REEF-W-0019 CITRUS LEISURE[WARRANTS] 4.20 4.20 4.10 4.20 10 40,707 168,969

REG -N-0000 REGNIS 61.90 61.90 59.60 59.70 3 257 15,353

RENU-N-0000 RENUKA CITY HOT. 240.00 240.00 230.10 239.90 25 1,119 263,634

REXP-N-0000 RICH PIERIS EXP 33.60 35.90 33.60 35.90 3 2,696 90,816

RFL -N-0000 RAMBODA FALLS 17.30 23.00 17.00 17.50 12 2,200 38,560

RGEM-N-0000 RADIANT GEMS 58.30 60.00 58.30 60.00 2 150 8,830

RHL -N-0000 RENUKA HOLDINGS 38.90 38.90 37.00 37.00 3 201 7,629

RHL -X-0000 RENUKA HOLDINGS[NON VOTING] 24.90 24.90 24.90 24.90 1 1,300 32,370

RHTL-N-0000 FORTRESS RESORTS 16.50 16.50 16.50 16.50 4 1,101 18,167

RICH-N-0000 RICHARD PIERIS 7.80 7.90 7.80 7.80 21 102,445 799,081

RPBH-N-0000 ROYAL PALMS 46.00 47.50 46.00 47.30 10 54 2,553

RWSL-N-0000 RAIGAM SALTERNS 2.70 2.70 2.60 2.60 5 1,103 2,868

SAMP-N-0000 SAMPATH 202.10 203.00 201.10 202.00 34 27,125 5,467,693

SCAP-N-0000 SOFTLOGIC CAP 6.90 7.10 6.90 6.90 8 49,895 346,195

SDB -N-0000 SANASA DEV. BANK 76.50 77.00 76.10 76.10 37 2,640 201,462

SELI-N-0000 SELINSING 1120.00 1120.00 1120.00 1120.00 1 2 2,240

SEMB-N-0000 S M B LEASING 1.00 1.00 0.90 1.00 8 8,701 8,501SEMB-W-0015 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.70 0 0 0

SEMB-W-0016 S M B LEASING[WARRANTS] 0.00 0.00 0.00 0.10 0 0 0

SEMB-X-0000 S M B LEASING[NON VOTING] 0.40 0.50 0.40 0.50 11 128,510 51,405

SERV-N-0000 HOTEL SERVICES 17.00 17.10 17.00 17.10 10 31,470 535,000

SEYB-N-0000 SEYLAN BANK 60.00 60.00 59.00 59.80 12 7,034 417,853

SEYB-X-0000 SEYLAN BANK[NON VOTING] 35.40 35.50 34.60 34.80 19 33,973 1,193,329

SFCL-N-0000 SENKADAGALA 0.00 0.00 0.00 50.00 0 0 0

SFIN-N-0000 SINGER FINANCE 13.90 13.90 13.60 13.70 28 18,752 256,988

SFL -N-0000 SINHAPUTHRA FIN 81.00 81.00 81.00 81.00 1 1 81

SFS -N-0000 SWARNAMAHAL FIN 3.50 3.60 3.50 3.50 46 87,076 305,220

SHAL-N-0000 SHALIMAR 0.00 0.00 0.00 900.00 0 0 0

SHAW-N-0000 SHAW WALLACE 269.00 274.00 269.00 274.00 2 110 30,090

SHL -N-0000 SOFTLOGIC 11.50 11.60 11.10 11.50 100 1,753,211 20,119,613

SHOT-N-0000 SERENDIB HOTELS 24.50 24.80 23.90 24.00 12 46,700 1,155,001

SHOT-X-0000 SERENDIB HOTELS[NON VOTING] 19.20 19.20 18.10 18.10 5 12,800 245,430SIGV-N-0000 SIGIRIYA VILLAGE 70.00 70.00 70.00 70.00 2 50 3,500

SIL -N-0000 SAMSON INTERNAT. 85.00 85.00 82.50 83.10 2 394 32,740

SING-N-0000 SINGALANKA 94.90 94.90 90.00 90.00 2 6 545

SINI-N-0000 SINGER IND. 135.50 135.60 135.50 135.60 5 300 40,660

SINS-N-0000 SINGER SRI LANKA 99.00 99.00 98.00 98.00 7 2,900 285,630

SIRA-N-0000 SIERRA CABL 2.70 2.70 2.50 2.60 26 71,407 185,658

SLND-N-0000 SERENDIB LAND 0.00 0.00 0.00 1697.90 0 0 0

SLTL-N-0000 SLT 43.90 43.90 43.00 43.80 21 24,325 1,061,090

SMLL-N-0000 PEOPLE'S FIN 38.50 38.50 37.70 38.00 52 23,420 888,422

SMLL-W-0020 PEOPLE'S FIN[WARRANTS] 0.00 0.00 0.00 3.70 0 0 0

SMOT-N-0000 SATHOSA MOTORS 218.00 218.00 218.00 218.00 2 2 436

SOY -N-0000 CONVENIENCE FOOD 135.00 144.90 130.30 136.00 12 716 96,633

SPEN-N-0000 AITKEN SPENCE 120.00 121.90 120.00 121.30 5 153 18,565

STAF-N-0000 DOLPHIN HOTELS 35.50 35.80 34.00 35.40 20 8,784 307,816

SUGA-N-0000 PELWATTE 0.00 0.00 0.00 23.50 0 0 0SUN -N-0000 SUNSHINE HOLDING 27.50 27.50 27.10 27.50 7 5,651 155,215

SWAD-N-0000 SWADESHI 0.00 0.00 0.00 8200.00 0 0 0

TAFL-N-0000 THREE ACRE FARMS 51.00 51.30 50.00 51.20 19 6,850 345,995

TAJ -N-0000 TAJ LANKA 29.10 29.70 29.10 29.70 4 300 8,850

TANG-N-0000 TANGERINE 84.00 84.00 84.00 84.00 1 50 4,200

TAP -N-0000 TAPROBANE 5.10 5.10 5.10 5.10 1 50 255

-

7/30/2019 Daily Trade Journal - 09.01

12/13

Softlogic Equity Research Page | 12

Ticker Counter Open High Low Close Trades Volume Turnover

TESS-N-0000 TESS AGRO 2.60 2.60 2.50 2.60 12 11,060 28,206

TFC -N-0000 THE FINANCE CO. 19.00 19.00 18.10 18.20 10 1,016 18,561

TFC -X-0000 THE FINANCE CO.[NON VOTING] 6.50 6.50 6.20 6.40 58 431,638 2,803,063

TFIL-N-0000 TRADE FINANCE 13.50 13.60 13.30 13.50 15 11,001 149,071

TILE-N-0000 LANKA FLOORTILES 67.00 67.00 67.00 67.00 2 51 3,417

TJL -N-0000 TEXTURED JERSEY 9.10 9.10 9.00 9.00 15 44,584 404,814

TKYO-N-0000 TOKYO CEMENT 27.50 27.50 27.50 27.50 1 100 2,750

TKYO-X-0000 TOKYO CEMENT[NON VOTING] 19.00 19.40 19.00 19.40 6 1,350 26,070

TPL -N-0000 TALAWAKELLE 26.60 27.40 26.10 27.20 27 10,791 294,621

TRAN-N-0000 TRANS ASIA 76.00 76.00 76.00 76.00 1 50 3,800

TSML-N-0000 TEA SMALLHOLDER 48.00 48.00 48.00 48.00 1 50 2,400

TWOD-N-0000 TOUCHWOOD 9.20 9.20 8.90 9.00 137 491,396 4,416,094

TYRE-N-0000 KELANI TYRES 36.00 37.40 35.90 36.00 28 28,728 1,037,477

UAL -N-0000 UNION ASSURANCE 87.00 87.00 86.00 86.30 3 70 6,040

UBC -N-0000 UNION BANK 13.70 13.80 13.50 13.60 46 38,405 523,369

UCAR-N-0000 UNION CHEMICALS 0.00 0.00 0.00 499.00 0 0 0

UDPL-N-0000 UDAPUSSELLAWA 28.20 28.20 28.20 28.20 1 100 2,820

UML -N-0000 UNITED MOTORS 99.00 99.00 97.20 99.00 4 401 39,159

VANI-N-0000 VANIK INCORP LTD 0.00 0.00 0.00 0.80 0 0 0

VANI-X-0000 VANIK INCORP LTD[NON VOTING] 0.00 0.00 0.00 0.80 0 0 0

VFIN-N-0000 VALLIBEL FINANCE 31.10 31.50 31.00 31.10 5 1,100 34,210

VLL -N-0000 VIDULLANKA 3.80 3.90 3.80 3.80 12 24,400 92,870

VONE-N-0000 VALLIBEL ONE 18.50 18.80 18.40 18.50 88 235,300 4,361,740

VPEL-N-0000 VALLIBEL 6.50 6.60 6.50 6.50 8 93,001 604,807

WAPO-N-0000 GUARDIAN CAPITAL 50.40 52.00 50.40 50.50 15 2,062 105,379

WATA-N-0000 WATAWALA 12.00 12.20 12.00 12.00 10 15,660 188,620

YORK-N-0000 YORK ARCADE 17.40 17.40 17.20 17.30 7 300 5,191

-

7/30/2019 Daily Trade Journal - 09.01

13/13

S f l i E i R h

Softlogic Equity ResearchDimantha Mathew

[email protected]+94 11 7277030

Akeela Imthinam Rasheed

+94 11 7277032

Crishani Perera

+94 11 7277031

Imalka Hettiarachchi

+94 11 7277004

Softlogic Equity SalesBranches

Horana

Madushanka Rathnayaka

No. 101, 1/1, Aguruwathota Road, Horana

+94 34 7451000, +94 77 3566465

Negambo

Krishan Williams

No. 121, St. Joseph Street Negambo

+94 31 2224714-5, +94 77 3569827

Kurunegala

Bandula Lansakara

No.13, Rajapihilla Mawatha, Kurunegala

+94 37 2232875, +94 77 3615790

MataraLalith Rajapaksha

No.8A, 2nd

Floor, FN Building, Station Road, Matara

+94 41 7451000, +94 77 3031159

Dihan Dedigama

+94 11 7277010, +94 77 7689933

Chandima Kariyawasam

+94 11 7277058, +94 77 7885778

Shafraz Basheer

+94 11 7277054, +94 77 2333233

Sonali Abayasekera

+94 11 7277059, +94 77 7736059

Thanuja De Silva

[email protected]+94 11 7277053, +94 77 3120018

The report has been prepared by Softlogic Stockbrokers (Pvt) Ltd. The information and opinions contained herein has been compiled or arrived at based upon

information obtained from sources believed to be reliable and in good faith. Such information has not been independently veri fied and no guaranty, representation

or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This

document is for information purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and

this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Softlogic Stockbrokers (Pvt) Ltd may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which

they are based before the materialized disseminated to their customers. Not all customers will receive the material at the same time. Softlogic Stockbrokers, their

respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers, may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer t o make a purchase and/or sale of any

such securities or other financial instruments from time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers

may make markets in securities or other financial instruments described in this publication, in securities of issuers described here in or in securities underlying or

related to such securities. Softlogic Stockbrokers (Pvt) Ltd may have recently underwritten the securities of an issuer mentioned herein. This document may not be

reproduced, distributed, or published for any purposes.

![[Adm] 09.01. Licitação](https://static.fdocuments.net/doc/165x107/55cf85a0550346484b900d3c/adm-0901-licitacao.jpg)