August 2019 | Week 33 34€¦ · 1 23 Aug ±¨ ±% BDI 2,168 S 80 3.8% BCI 3,991 S 165 4.3% BPI...

Transcript of August 2019 | Week 33 34€¦ · 1 23 Aug ±¨ ±% BDI 2,168 S 80 3.8% BCI 3,991 S 165 4.3% BPI...

1

23 Aug ±∆ ±%BDI 2,168 p 80 3.8%

BCI 3,991 p 165 4.3%

BPI 2,196 p 27 1.2%

BSI 1,249 p 131 11.7%

BHSI 619 p 59 10.5%

W-O-W change

Being almost at the end of the summer period, has the dry bulk sector recovery

shown us all its glitter so far? A tricky question, even trickier however may well be the

answer. We witnessed the collapse of the market at the early part of the year, under-

lying emphatically the "hidden" risks involved, even when most other "known" indica-

tors suggest holding a long position. Of course, the prolonged improving market fun-

damentals came forward and shook up a recovery in an even more emphatic way.

However, seeing the downward correction at the latest part of the previous month,

few would expect August to be closing in on a BDI average of around 1,911bp. Nev-

ertheless, it is difficult to evaluate whether the current state is a mere reflection of the

market trying to rebalance itself, or as a result of an "amassed" buying spree.

Certainly, we must wait to see if the market will be "on time" to the overall catch-up

attitude of late and succeed the overall returns attuned with those of the last couple

of years (on average). On the other hand, with year-to-date volatility being in almost

double figures this year, how truthful is a mere average figure when describing the

actual market that we experienced this year?

Let's start with the positive side. We witnessed a considerable boost on a m-o-m basis

in FFA contracts for all main segments for contracts not exceeding an end date be-

yond this year. Given the rather surprisingly "good" freight market noted during Au-

gust, the upward correction can be seen as nothing less than logical. However, the

interesting part isn't the actual quoted levels, but the underlining trends behind these.

As we move forward and look at contracts with more distant end dates, we notice a

rather significant "discount" in the closing numbers. Some could point out that this is

as part of the increased uncertainty and perceived risk. Apart from those, where is

the typical seasonality effect of a "firm" final quarter, or the theoretical, as it seems so

far, bullish sentiment being built as of late? If this bearish attitude isn't evident, let's

have a look again at what similar contracts were doing during the same time frame

last year, where the freight market was in an overall upward mode as well. At that

point the trajectory of forward contracts was upward, indicating a market that was

still improving (or at least showing potential). Yet beyond all this how do we explain

the y-o-y discount in long-term FFA contracts? The current perplexed “feeling” would

justify a softening for the next year or so, but how would we explain the y-o-y de-

crease of 2,000 US$/day or so on average for forward annual FFA contracts in the

BCI – 5TC in a more macroeconomic perspective. The reversal noted this year in iron

ore seaborne trade growth has influenced this a fair bit but given the discount noted

in similar FFA contracts for the BPI – TCA index, it looks as though the dry bulk sector

as a whole has becomes an ever more puzzling scene with regards to its future.

All-in-all, the current situation of the market seems rather bizarre, with much of a

noise in-between, amidst an overall complex scene. Year-to-date the positive skew-

ness observed in the BDI's distribution seems to have created a false impression that

due to these periodical extreme positive rallies, we are on an upward trajectory path,

whereas the reality may well be that the market is now stuck in a state of limbo. It will

likely be difficult for us to see moving forward, such an accumulated appetite for car-

goes emerging in such a narrow time span, as was noted this summer, to be able to

constantly pull us out of similar market dips in the future.

Thomas Chasapis

Research Analyst

12th - 23th August 2019 | Week 33-34

Dry Bulk Freight Market

Secondhand Market

Newbuilding Market

Demolition Market

Economic Indicators

Tanker Freight Market

23 Aug ±∆ ±%BDTI 662 p 16 2.5%

BCTI 469 p 16 3.5%

W-O-W change

Avg Price Index (main 5 regions)

23 Aug ±∆ ±%Dry 270 q -5 -1.8%

Wet 284 q -5 -1.7%

W-O-W change

Aggregate Price Index

23 Aug ±∆ ±%Bulkers 100 u 0 0.0%

Cont 94 u 0 0.0%

Tankers 101 u 0 0.0%

Gas 91 u 0 0.0%

M-O-M change

23 Aug ±∆ ±%Gold $ 1,503 p 82 5.8%

Oil WTI $ 53 q -2 -3.2%

Oil Brent $ 58 q -4 -5.7%

Iron Ore 89 q -33 -27.0%

Coal 58 q -9 -13.5%

M-O-M change

Aggregate Price Index

23 Aug ±∆ ±%Capesize 60 u 0 0.0%

Panamax 60 q -1 -0.9%

Supramax 63 u 0 0.0%

Handysize 70 q -1 -2.1%

M-O-M change

VLCC 96 q 0 -0.2%

Suezmax 86 p 2 2.0%

Aframax 100 u 0 0.0%

MR 117 u 0 0.0%

2

2018 2019

12th - 23th August 2019

Capesize – The steady flow of trading volumes noted lately in the iron ore market

has helped rates move much higher compared to the beginning of the year. Dur-

ing the last couple of weeks, the upward movement resumed, with the BCI climb-

ing to 3,991bp, increased by around 24%. Healthier demand figures were noted

during that period in both Atlantic and Pacific basins, where increased interest

from charterers overpassed currently open tonnage lists.

Panamax – With available tonnage being diminished in both Atlantic and Pacific,

demand boosted freight rates higher in these past two weeks. South Pacific was

again one of the key regions of the Panamax segment, where cargoes seem to be

abundant. The BPI increased by around 16% in the two weeks period, reaching

the 2,196bp.

Supramax – An impressive two weeks period for the segment, as the BSI closed at

1,249bp, approximately 29% higher than two weeks before. However, a slight

decrease of enquiry noted lately in the Atlantic, but this was not enough to affect

upward movement of freight rates. It is worth mentioning that the S3 route post-

ed an impressive 41% rise in this two-week period.

Handysize – Along with the larger segments, earnings here too were also im-

proved in the last two weeks. The persistent improvement noted lately in the de-

mand from charterers has led to much fewer open units in the two basins, boost-

ing the whole market. The BHSI rose during the past two weeks by around 18%,

reaching at 619bp.

0

10

20

30

40'000 US$/day

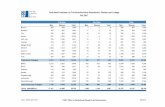

23 Aug 16 Aug ±% 2019 2018

Baltic Dry IndexBDI 2,168 2,088 3.8% 1,132 1,349

CapesizeBCI 3,991 3,826 4.3% 1,713 2,096

BCI 5TC $ 30,437 $ 29,624 2.7% $ 14,112 $ 16,457ATLANTIC RV $ 30,900 $ 31,625 -2.3% $ 14,181 $ 16,589

Cont / FEast $ 52,245 $ 50,291 3.9% $ 28,958 $ 30,755PACIFIC RV $ 29,683 $ 29,329 1.2% $ 13,414 $ 16,240

FEast / ECSA $ 29,036 $ 26,877 8.0% $ 13,929 $ 16,315Panamax

BPI 2,196 2,169 1.2% 1,250 1,451BPI - TCA $ 17,583 $ 17,359 1.3% $ 10,012 $ 11,641

ATLANTIC RV $ 19,715 $ 20,060 -1.7% $ 10,005 $ 12,029Cont / FEast $ 29,026 $ 28,570 1.6% $ 17,784 $ 19,051PACIFIC RV $ 15,307 $ 14,654 4.5% $ 9,056 $ 10,753

FEast / Cont $ 6,282 $ 6,150 2.1% $ 3,202 $ 4,731Supramax

BSI 1,249 1,118 11.7% 787 1,030BSI - TCA $ 14,113 $ 12,753 10.7% $ 8,912 $ 11,485

USG / FEast $ 28,949 $ 26,722 8.3% $ 18,957 $ 23,089Med / Feast $ 27,521 $ 26,171 5.2% $ 15,968 $ 19,519PACIFIC RV $ 11,850 $ 10,736 10.4% $ 8,150 $ 10,240

FEast / Cont $ 6,110 $ 5,070 20.5% $ 4,296 $ 6,467USG / Skaw $ 20,551 $ 18,463 11.3% $ 13,054 $ 18,607Skaw / USG $ 12,519 $ 10,969 14.1% $ 6,184 $ 8,140

HandysizeBHSI 619 560 10.5% 434 597

BHSI - TCA $ 9,056 $ 8,210 10.3% $ 6,398 $ 8,704Skaw / Rio $ 8,180 $ 7,090 15.4% $ 4,927 $ 7,558

Skaw / Boston $ 8,400 $ 7,325 14.7% $ 5,422 $ 7,509Rio / Skaw $ 14,883 $ 13,872 7.3% $ 9,608 $ 11,858

USG / Skaw $ 9,900 $ 9,364 5.7% $ 7,023 $ 10,664SEAsia / Aus / Jap $ 7,986 $ 7,179 11.2% $ 6,122 $ 8,032

PACIFIC RV $ 7,557 $ 6,836 10.5% $ 5,978 $ 7,988

Spot market rates & indices Average

0

1,000

2,000

3,000

4,000

5,000

BDI BCI BPI BSI BHSI

0

5

10

15

20'000 US$/day

0

5

10

15'000 US$/day

0

3

6

9

12

15'000 US$/day

3

2018 2019

Crude Oil Carriers – A bullish two weeks period overall for the crude oil market,

with the BDTI rising during these past two weeks by around 5.6%. A significant

improvement has been noted lately in the VL market, as fresh enquiries and sev-

eral high profile deals noted in the market have helped freight rates to move up-

wards. In the Suezmax front, the much higher demand being witnessed in the

WAF these past two weeks pushed earnings up here as well. In contrast with the

rest of crude oil market, Aframax owners saw freight rates deteriorating during

the last two weeks, as activity during this period was relatively subdued, leaving

several vessels without open cargoes.

Oil Products – On the DPP front, some fresh enquiry noted in the last few days

in the Med and Black Sea, decreasing the number of open vessels in the region

and giving a push to freight rates. On the other hand, activity in North Europe

remained subdued. On the CPP front, the increased interest noted in the Atlantic

and MEG helped gains in the segment to be maintained.

12th - 23th August 2019

23 Aug 16 Aug ±% 2019 2018

Baltic Tanker IndicesBDTI 662 646 2.5% 713 805BCTI 469 453 3.5% 569 583

VLCCWS 29.73 27.23 9.2% 22.55 24.20

$/day $ 6,476 $ 5,619 15.3% -$ 4,866 -$ 8,894WS 66.92 61.96 8.0% 49.72 57.66

$/day $ 43,543 $ 40,753 6.8% $ 23,370 $ 30,942WS 65.92 61.25 7.6% 48.93 56.96

$/day $ 41,509 $ 38,679 7.3% $ 20,650 $ 19,167WS 65.00 54.00 20.4% 48.13 57.12

$/day $ 74,910 $ 58,387 28.3% $ 44,571 $ 57,289SUEZMAX

WS 56.50 55.00 2.7% 64.78 74.28$/day $ 25,545 $ 24,417 4.6% $ 28,457 $ 35,009

WS 71.61 68.81 4.1% 84.17 96.08$/day $ 11,710 $ 11,273 3.9% $ 16,943 $ 17,261

AFRAMAXWS 84.72 84.72 0.0% 97.55 112.83

$/day $ 3,692 $ 3,759 -1.8% $ 10,247 $ 9,431WS 103.56 103.61 0.0% 107.56 107.15

$/day $ 12,884 $ 14,698 -12.3% $ 12,256 $ 6,495WS 74.38 75.63 -1.7% 102.45 134.08

$/day $ 3,122 $ 4,618 -32.4% $ 9,867 $ 12,485WS 57.22 56.11 2.0% 77.94 90.31

$/day $ 3,167 $ 2,581 22.7% $ 13,852 $ 13,541DPP

WS 114.50 110.00 4.1% 135.80 131.14$/day $ 21,081 $ 19,625 7.4% $ 25,415 $ 23,505

WS 90.94 94.06 -3.3% 106.39 114.67$/day $ 6,801 $ 8,424 -19.3% $ 9,014 $ 9,614

WS 87.63 87.50 0.1% 99.27 103.44$/day $ 11,048 $ 12,449 -11.3% $ 13,441 $ 9,525

WS 79.17 73.33 8.0% 95.81 114.77$/day $ 6,816 $ 5,485 24.3% $ 11,335 $ 11,902

CPPWS 112.31 106.88 5.1% 105.48 106.16

$/day $ 17,665 $ 17,498 1.0% $ 14,334 $ 9,310WS 95.28 90.00 5.9% 129.58 133.64

$/day $ 4,542 $ 4,051 12.1% $ 9,487 $ 5,830WS 117.00 117.00 0.0% 125.35 135.20

$/day $ 16,619 $ 16,619 0.0% $ 17,274 $ 19,126WS 90.71 82.50 10.0% 90.12 103.87

$/day $ 4,558 $ 3,743 21.8% $ 2,941 $ 1,952

MED-MED

CONT-USAC

USG-CONT

MEG-USG

MEG-SPORE

WAF-USG

BSEA-MED

MEG-SPORE

MEG-JAPAN

WAF-USAC

NSEA-CONT

CARIBS-USG

CARIBS-USAC

SEASIA-AUS

MEG-JAPAN

CARIBS-USAC

BALTIC-UKC

ARA-USG

Spot market rates & indices Average

0

500

1,000

1,500

BDTI BCTI

-100

1020304050

'000 US$/day

0102030405060

'000 US$/day

0

10

20

30

40

50'000 US$/day

5

10

15

20

25

30'000 US$/day

4

last 5 years

23 Aug 19 Jul ±% Min Avg Max

VLCC

$ 36,750 $ 33,500 9.7% $ 19,000 $ 32,628 $ 57,750

$ 30,000 $ 31,000 -3.2% $ 23,500 $ 31,692 $ 45,000

Suezmax

$ 25,000 $ 24,500 2.0% $ 15,500 $ 24,383 $ 42,500

$ 22,750 $ 22,750 0.0% $ 18,000 $ 24,944 $ 35,000

Aframax

$ 21,500 $ 21,500 0.0% $ 13,250 $ 19,472 $ 30,000

$ 20,000 $ 20,000 0.0% $ 15,500 $ 19,593 $ 27,000

MR

$ 14,750 $ 14,750 0.0% $ 12,000 $ 14,725 $ 21,000

$ 14,500 $ 14,500 0.0% $ 14,000 $ 15,039 $ 18,250

12 months

36 months

12 months

36 months

Tanker period market TC rates

12 months

36 months

12 months

36 months

last 5 years

23 Aug 19 Jul ±% Min Avg Max

Capesize

$ 22,000 $ 21,500 2.3% $ 6,200 $ 15,210 $ 31,450

$ 16,750 $ 17,250 -2.9% $ 6,950 $ 15,034 $ 25,200

Panamax

$ 14,500 $ 14,500 0.0% $ 4,950 $ 10,297 $ 15,450

$ 12,500 $ 12,500 0.0% $ 6,200 $ 10,551 $ 15,325

Supramax

$ 12,500 $ 11,750 6.4% $ 4,450 $ 9,829 $ 13,950

$ 10,250 $ 10,250 0.0% $ 6,200 $ 9,756 $ 13,700

Handysize

$ 9,250 $ 9,500 -2.6% $ 4,450 $ 8,177 $ 11,200

$ 8,500 $ 9,000 -5.6% $ 5,450 $ 8,231 $ 10,450

12 months

Dry Bulk period market TC rates

12 months

36 months

36 months

12 months

36 months

12 months

36 months

12th - 23th August 2019

Latest indicative Dry Bulk Period Fixtures

Latest indicative Tanker Period Fixtures

7

9

11

13

15

17

19

21

23

5

7

9

11

13

15

56789

1011121314

4

5

6

7

8

9

10

11

17

22

27

32

37

42

15

17

19

21

23

25

27

12

14

16

18

20

22

24

11

12

13

14

15

16M/T ''DESIRADE'', 300000 dwt, built 2016, $37,500, for 1 year trading, to

KOCH

M/T ''NEW VISION'', 157000 dwt, built 2018, $27,000, for 8 months

trading, to Trafigura

M/T ''ARIZONA LADY'', 112000 dwt, built 2019, $22,000, for 15 months

trading, to KOCH

M/T ''BOWFIN'', 75000 dwt, built 2008, $16,700, for 6 months trading, to

ALASKA TANKER

M/T ''NORD SUPERIOR'', 50000 dwt, built 2015, $17,950, for 3 years

trading, to Trafigura

M/V ''CL GRACE'', 81563 dwt, built 2012, dely Tianjin 22/30 Aug, $14,500,

for about 4 to 6 months, to Aquavita

M/V ''MIN SHENG 1'', 81563 dwt, built 2012, dely Tianjin 25/26 Aug,

$15,000, for about 5 to 8 months, to Norden

M/V ''MEDI HAKATA'', 58078 dwt, built 2014, dely Tianjin 23/24 Aug,

$13,000, for 3/5 months, to Trafigura

M/V ''MEDI CHIBA'', 82003 dwt, built 2016, dely Zhoushan 25/28 Aug ,

$15,500, for abt 11 to 13 mos, to Daiichi

M/V ''CANEA'', 75356 dwt, built 2007, dely Pasir Gudang 28/31 Aug ,

$14,750, for abt 6 to 8 mos, to Chart Not Rep

5

Reported Transactions

Despite the persistent improvement of the dry bulk freight market,

newbuilding activity for this sector has remained subdued in the last

few weeks, with not much interest from buyers being witnessed. The

estimated orderbook for the sector seems to be still in slight decline

during the last three months. However, it is important to remember

that earlier in the year we had seen several orders being added in the

orderbook, and thus the recent silence may be justified partially by

the typical summer seasonal lull. It will be interesting to see if this

subdued interest for new orders will be reversed in the final quarter

of the year, as buyers have already been enticed by the higher earn-

ings noted of late. On the tanker front, activity has been much more

stable over the past few weeks, with an impressive new order of 15

units being reported by Sinokor during this past week. Buyers seem

to remain optimistic overall, with freight rates improving compared

to the levels that were being noted a year back, but seem to be still

missing the mark against the initial expectations that were being

expressed earlier in the year. It is expected that a steady flow of new

contracts will continue to be seen over the following weeks, with

further escalation likely during the last quarter of the year.

12th - 23th August 2019

10

20

30

40

50

60

Capesize Panamax Supramax Handysize

US$ million

30405060708090

100VLCC Suezmax Aframax LR1 MR

US$ million

Indicative Dry NB Prices (US$ million) last 5 years

23 Aug 19 Jul ±% Min Avg Max

Dry Bulkers

Capesize (180,000dwt) 53.0 53.0 0.0% 41.8 48.4 58.0

Kamsarmax (82,000dwt) 34.0 34.0 0.0% 24.3 28.4 34.0

Panamax (77,000dwt) 33.0 33.0 0.0% 23.8 27.5 33.0

Ultramax (64,000dwt) 32.0 32.0 0.0% 22.3 26.2 32.0

Handysize (37,000dwt) 26.0 26.0 0.0% 19.5 22.5 26.0

Container

Post Panamax (9,000teu) 82.5 82.5 0.0% 82.5 85.0 91.0

Panamax (5,200teu) 48.5 48.5 0.0% 48.0 52.2 58.5

Sub Panamax (2,500teu) 27.0 27.0 0.0% 26.0 28.8 33.0

Feeder (1,700teu) 21.5 21.5 0.0% 21.5 23.6 27.0

Indicative Wet NB Prices (US$ million) last 5 years

23 Aug 19 Jul ±% Min Avg Max

Tankers

VLCC (300,000dwt) 93.0 93.0 0.0% 80.0 90.8 101.0

Suezmax (160,000dwt) 61.5 61.5 0.0% 53.0 60.3 66.0

Aframax (115,000dwt) 51.0 51.0 0.0% 43.0 49.6 55.0

LR1 (75,000dwt) 48.5 48.5 0.0% 42.0 45.2 48.5

MR (56,000dwt) 36.5 36.5 0.0% 32.5 35.3 37.3

Gas

LNG 175k cbm 185.5 185.5 0.0% 184.0 192.8 200.0

LPG LGC 80k cbm 70.0 70.0 0.0% 70.0 73.6 80.0

LPG MGC 55k cbm 62.0 62.0 0.0% 62.0 64.5 68.5

LPG SGC 25k cbm 40.0 40.0 0.0% 40.0 42.2 45.5

Type Units Shipbuilder Price Buyer Delivery Comments

TANKER 10 + 5 113,000 dwt Samsung SB, S. Korea N/A Sinokor, S. Korea 2021/2022 T/C to Shell

TANKER 2 8,400 dwt Eregli Shipyard, Turkey N/A Geos Group, UK 2020

TANKER 1 2,999 dwt Zhejiang Shenzhou, China N/A Nathalin Co. Ltd., Thailand 2020

CONT 6 23,000 teu Samsung SB, S. Korea N/A Evergreen Marine, Taiwan 2022

GAS 1 174,000 cbm Hyundai, S. Korea $ 185.0m Tsakos Shipping, Greece 2021 XDF propulsion

GAS 1 174,000 cbm Samsung SB, S. Korea $ 185.0m Undisclosed, Undisclosed 2021

GAS 1 174,000 cbm DMSE, S. Korea N/A Maran Gas Maritime, Greece 2021

GAS 1 38,000 cbm Hyundai Mipo, S. Korea $ 50.0m Undisclosed, Undisclosed 2021

GAS 1 9,500 cbm Huangpu Wenchong, China N/ATianjin Southwest Maritime,

China2021 LNG dual fuelled

CRUISE 1 280 pax Huanghai SB, China N/APolynesienne Maritime,

Tahiti2022

PASS 1 930 pax Dae Sun Shipbuilding, S. Korea N/A Hyunsung MCT, S. Korea 2021

Size

6

Indicative Dry Bulk Values (US$ million)

23 Aug 19 Jul ±% Min Avg Max

Capesize180k dwt Resale 52.25 52.25 0.0% 34.5 47.6 65.0180k dwt 5 year old 31.00 31.00 0.0% 23.0 33.8 53.0170k dwt 10 year old 24.00 24.00 0.0% 12.0 22.7 38.0150k dwt 15 year old 14.50 14.50 0.0% 6.5 13.7 25.0Panamax82k dwt Resale 31.50 31.50 0.0% 22.5 28.9 34.082k dwt 5 year old 24.00 24.50 -2.0% 11.5 20.1 28.076k dwt 10 year old 14.00 14.50 -3.4% 7.3 13.4 23.074k dwt 15 year old 9.50 9.25 2.7% 3.5 8.6 14.5Supramax62k dwt Resale 28.50 28.50 0.0% 19.0 26.8 33.058k dwt 5 year old 17.50 17.50 0.0% 11.0 17.4 27.056k dwt 10 year old 13.50 13.50 0.0% 6.0 12.6 22.052k dwt 15 year old 8.00 8.00 0.0% 3.5 8.1 13.5Handysize37k dwt Resale 24.00 24.00 0.0% 17.0 21.9 26.037k dwt 5 year old 17.50 17.50 0.0% 7.8 14.4 21.032k dwt 10 year old 10.00 11.00 -9.1% 6.0 10.1 16.028k dwt 15 year old 6.50 6.50 0.0% 3.5 6.2 11.0

last 5 years

12th - 23th August 2019

On the dry bulk side, interest remained robust during these past two

weeks, with improved freight earnings affecting appetite amongst

buyers. Several transactions were noted these past few days across

different size and age units, as firm rates are being seen across all

segments. The current encouraging activity figures is expected to

continue over the following weeks, as appetite looks to be steadily

on the rise as we enter the autumn period.

On the tankers side, further escalation of interest was witnessed

amongst buyers, as many new deals came into the spotlight during

the past couple of weeks. The most notable transaction was the sale

of 10 Suezmax units from Trafigura to Frontline, including a cash and

shares deal. Other than that, product tankers continue to hold a

protagonist role here, as buyers are still focusing on these units, driv-

en by the positive market outlook still holding.

+0%

-2% -2%

-17%-18%

-16%

-14%

-12%

-10%

-8%

-6%

-4%

-2%

0%

1 month diff 3 months diff6 months diff 12 months diff

-2% -2%

-4%

+4%

-5%

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

1 month diff 3 months diff6 months diff 12 months diff

+0% +0% +0%

-5%-6%

-5%

-4%

-3%

-2%

-1%

0%

1 month diff 3 months diff6 months diff 12 months diff

+0% +0% +0%

+9%

0%1%2%3%4%5%6%7%8%9%

10%

1 month diff 3 months diff6 months diff 12 months diff

+0%

+1% +1%

+11%

0%

2%

4%

6%

8%

10%

12%

1 month diff 3 months diff6 months diff 12 months diff

+0%+1%

+0%

+14%

0%

2%

4%

6%

8%

10%

12%

14%

16%

1 month diff 3 months diff6 months diff 12 months diff

+0%

+6%

+9%

+19%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

1 month diff 3 months diff6 months diff 12 months diff

+0%

+5% +5%

+13%

0%

2%

4%

6%

8%

10%

12%

14%

1 month diff 3 months diff6 months diff 12 months diff

Indicative Tanker Values (US$ million)

23 Aug 19 Jul ±% Min Avg Max

VLCC310k dwt Resale 96.00 96.00 0.0% 82.0 93.7 105.0310k dwt 5 year old 71.00 71.00 0.0% 60.0 70.3 84.0250k dwt 10 year old 47.00 47.50 -1.1% 38.0 46.9 59.0250k dwt 15 year old 32.00 32.00 0.0% 21.5 28.9 41.0Suezmax160k dwt Resale 67.00 67.00 0.0% 54.0 63.6 73.0150k dwt 5 year old 50.00 50.00 0.0% 40.0 49.1 62.0150k dwt 10 year old 36.00 34.00 5.9% 25.0 33.4 44.5150k dwt 15 year old 19.50 19.00 2.6% 15.0 19.2 23.0Aframax110k dwt Resale 53.00 53.00 0.0% 43.5 49.9 57.0110k dwt 5 year old 38.00 38.00 0.0% 29.5 36.6 47.5105k dwt 10 year old 25.00 25.00 0.0% 18.0 23.9 33.0105k dwt 15 year old 13.00 13.00 0.0% 11.0 13.8 20.0MR52k dwt Resale 39.00 39.00 0.0% 33.0 36.3 39.052k dwt 5 year old 30.00 30.00 0.0% 23.0 26.5 31.045k dwt 10 year old 19.00 19.00 0.0% 14.5 17.6 21.045k dwt 15 year old 10.00 10.00 0.0% 9.0 10.8 13.5

last 5 years

7

12th - 23th August 2019

Size Name Dwt Built Shipbuilder M/E Coating Price Buyers Comments

VLCC ORIENTAL JADE 306,352 2004 MITSUBISHI

NAGASAKI, JapanMitsubishi $ 28.5m

Greek - Hellenic

TankersSS/DD due Oct '19

VLCC CERIGO 299,089 2000 DAEWOO HEAVY,

S. KoreaSulzer $ 25.0m

VLCC KALYMNOS 299,089 2000 DAEWOO HEAVY,

S. KoreaSulzer $ 25.0m

SUEZ MARLIN SIENA 158,032 2019 HYUNDAI SAMHO,

S. KoreaMAN-B&W

SUEZ MARLIN SAVANNAH 158,032 2018 HYUNDAI HEAVY

INDUSTRI, S. KoreaMAN-B&W

SUEZ MARLIN SPARTA 158,032 2019 HYUNDAI SAMHO,

S. KoreaMAN-B&W

SUEZ MARLIN SANTIAGO 158,032 2019 HYUNDAI HEAVY

INDUSTRI, S. KoreaMAN-B&W

SUEZ MARLIN SHANGHAI 158,032 2019 HYUNDAI SAMHO,

S. KoreaMAN-B&W

SUEZ MARLIN SUEZ 158,032 2018 HYUNDAI HEAVY

INDUSTRI, S. KoreaMAN-B&W

SUEZ MARLIN SAMARA 158,032 2019 HYUNDAI SAMHO,

S. KoreaMAN-B&W

SUEZ MARLIN SINGAPORE 158,032 2018 HYUNDAI SAMHO,

S. KoreaMAN-B&W

SUEZ MARLIN SILKEBORG 158,032 2018 HYUNDAI SAMHO,

S. KoreaMAN-B&W

SUEZ MARLIN SEOUL 149,999 2019 HYUNDAI HEAVY

INDUSTRI, S. KoreaMAN-B&W

LR1 BREEZY VICTORIA 74,998 2007 MINAMI-NIPPON

USUKI, JapanMAN-B&W EPOXY $ 13.6m Greek DD due Nov '19, uncoiled

LR1 NAVE CIELO 74,896 2007 STX, S. Korea MAN-B&W EPOXY

LR1 NAVE ARIADNE 74,875 2007 STX, S. Korea MAN-B&W EPOXY

LR1 NAVE ATROPOS 74,695 2013 SUNGDONG, S.

KoreaMAN-B&W EPOXY

MR NAVE EQUATOR 49,999 2009 SPP SHBLDG CO

LTD - TO, S. KoreaMAN-B&W EPOXY

MR NAVE PYXIS 49,998 2014

DAE SUN

SHIPBUILDING &,

S. Korea

MAN-B&WEPOXY

PHEN

MR BOUGAINVILLE 50,626 2013 STX OFFSHORE &

SHBLDG, S. KoreaMAN-B&W

EPOXY

PHEN

MR NAVE PULSAR 50,922 2007 STX, S. Korea MAN-B&WEPOXY

PHEN$ 15.0m Japanese 5-yr leaseback structure

MR NAVE EQUINOX 50,922 2007 STX, S. Korea MAN-B&WEPOXY

PHEN

MR NAVE VELOCITY 49,999 2015

SPP

SHIPBUILDING -

GOS, S. Korea

MAN-B&WEPOXY

PHEN

MR NAVE ORBIT 49,999 2009 SPP SHBLDG CO

LTD - TO, S. KoreaMAN-B&W EPOXY

sale & leaseback dealChinese

Chinese sale & leaseback deal$ 47.2m

en bloc

$ 90.8m

en bloc

Tankers

scrubber fitted, cash &

shares deal, incl 3yr TC to

Trafigura for 5 vessels at a

daily rate of US$ 28,400

with 50% profit share

above the base rate, 2+2

options for additional

vessels within September

under similar structure

Norwegian - Frontline

$ rgn

675.0m en

bloc

Middle Eastern for conversion

8

12th - 23th August 2019

Size Name Dwt Built Shipbuilder M/E Coating Price Buyers Comments

MR ATLANTIC LEO 49,999 2008 HYUNDAI MIPO, S.

KoreaMAN-B&W EPOXY

MR ATLANTIC AQUARIUS 49,999 2008 HYUNDAI MIPO, S.

KoreaMAN-B&W EPOXY

MR TORM TORINO 49,768 2016 SUNGDONG, S.

KoreaMAN-B&W EPOXY $ 35.0m

MR TORM TITAN 49,757 2016 SUNGDONG, S.

KoreaMAN-B&W EPOXY $ 35.0m

MR FPMC 19 46,851 2009 JINLING, China MAN-B&WEPOXY

PHEN$ 11.3m Greek - Centrofin SS/DD due Nov '19

MR TAMBOURIN 46,764 2004 BRODOTROGIR,

CroatiaMaK EPOXY $ 8.7m undisclosed

MR ALICE 39,316 2013

GUANGZHOU

INTERNATIONA,

China

MAN-B&WEPOXY

PHEN$ 20.0m

MR AMI 39,310 2012

GUANGZHOU

INTERNATIONA,

China

MAN-B&WEPOXY

PHEN$ 20.0m

PROD/

CHEMFOLK BEAUTY 15,091 2010

STX RO

OFFSHORE

BRAILA, Romania

MANEPOXY

PHENN/A South East Asian auction sale

PROD/

CHEMCAPE ESMERALDA 12,842 2004

SAMHO SHIP

TONGYONG, S.

Korea

MAN-B&WEPOXY

PHEN

PROD/

CHEMCAPE EGMONT 12,791 2003

SAMHO SHIP

TONGYONG, S.

Korea

MAN-B&WEPOXY

PHEN

PROD/

CHEMSUN CARNATION 12,705 2004

HAKATA HAKATA,

JapanMAN-B&W StSt $ 7.5m S. Korean

Size Name Dwt Built Shipbuilder M/E Gear Price Buyers Comments

POST

PMAXLILY FORTUNE 91,439 2000

OSHIMA

SHIPBUILDING,

Japan

Mitsubishi $ 7.0m Chinese

POST

PMAXALAM PERMAI 87,052 2005

IHI MARINE

UNITED - YO,

Japan

Sulzer $ 10.8m Chinese

KMAX BAHIA I 82,250 2012

TSUNEISHI

SHBLDG - TDT,

Japan

MAN-B&W $ 19.3m Far EasternDD due Nov '19, BWTS

fitted

KMAX KEY PACIFICO 81,812 2015

TSUNEISHI

SHBLDG - FKY,

Japan

MAN-B&W $ 24.0m Japanese

incl charter to NYK, ECO

type, BWTS fitted,

declaration of purchase

option

PMAX CLIPPER VICTORY 77,119 2015 IMABARI

MARUGAME, JapanMAN-B&W

xs $

20.0mGreek

PMAX VAMOS 76,824 2004 TSUNEISHI CORP

NUMAKUM, JapanB&W $ 9.5m Middle Eastern

PMAX VITAGRACE 75,921 2001 KANASASHI HEAVY

TOYOHA, JapanB&W $ 6.5m Chinese DD due Aug ' 19

PMAX UNDERDOG 74,444 2006

HUDONG-

ZHONGHUA

SHIPBU, China

MAN-B&W $ 8.5m undisclosed

PMAX BERGEN 60,319 2015 JAPAN MARINE

UTD - KUR, JapanWartsila

4 X 30t

CRANES$ 21.8m Greek

$ 32.2m

undisclosed$ 6.0m

Tankers - continued

Bulk Carriers

IMO II/III, bss long-term

employment to ENI

Italian - Amoretti

Armatori

bss long-term BBBackJapanese - Leasing

Company

Greek - Velos IMO II/III

9

12th - 23th August 2019

Size Name Dwt Built Shipbuilder M/E Gear Price Buyers Comments

SMAX ACHAT 56,969 2010 HANTONG SHIP

HEAVY IND, ChinaMAN-B&W

4 X 35t

CRANES$ 10.3m undisclosed

SMAX LADY MARY 52,027 2001 TSUNEISHI CEBU,

PhilippinesB&W

4 X 30t

CRANES$ 5.5m Chinese DD due Sep '19

HANDY SAM PHOENIX 34,264 2011

ZHEJIANG

JINGANG SHBLD,

China

MAN-B&W4 X 30t

CRANES$ 8.2m Greek

HANDY C. S. STAR 33,171 2011 KANDA KAWAJIRI,

JapanMitsubishi

4 X 30,5t

CRANES$ 10.3m Greek

HANDY GENCO CHALLENGER 28,428 2003 IMABARI IMABARI,

JapanMAN-B&W

4 X 30,5t

CRANES$ 5.5m undisclosed

HANDY TEAM TANGO 23,573 2001 SHIN KURUSHIMA

AKITSU, JapanMitsubishi

4 X 30,5t

CRANES$ 4.5m undisclosed

Type Name Dwt Built Shipbuilder M/E Gear Price Buyers Comments

General

CargoPAZ NAVIGATOR 7,840 2000

BODEWES' BV,

NetherlandsMaK

2 X 40t

CRANESN/A undisclosed

General

Cargo

DONG FANG YANG

MING6,452 2006

YUEQING

JIANGHAI SHIPY,

China

Daihatsu N/A Chinese auction sale

Size Name TEU Built Shipbuilder M/E Gear Price Buyers Comments

FEEDER HERM 750 2004

DAEWOO-

MANGALIA,

Romania

MaKlow $

2.0mDutch - JR Shipping

Size Name Dwt Built Shipbuilder M/E CBM Price Buyers Comments

LPG GEORGE N 43,601 2009 HYUNDAI HEAVY

INDUSTRI, S. KoreaMAN-B&W 59,016

LPG ERNEST N 43,563 2009 HYUNDAI HEAVY

INDUSTRI, S. KoreaMAN-B&W 59,085

LPG JENNY N 43,538 2009 HYUNDAI HEAVY

INDUSTRI, S. KoreaMAN-B&W 59,038

N/ASingaporean - Eastern

Pacific

Bulk Carriers - continued

Gen. Cargo

Containers

Gas Carriers

10

Despite the end of Eid holidays, activity did not ramp up in the Indian

Sub-Continent, with few units being recycled during these past two

weeks. In Bangladesh, hopes that cash-buyers interest will intensify

again after the holiday period did not materialized. In addition, the

monsoon period delayed activity in the region holding back stock and

putting extra pressure on local ship breakers. With steel place prices

holding steady though, there are many domestic players that expect

offered price levels to improve soon, likely attracting more units.

Meanwhile, the poor fundamentals and the uncertainty dominating

the Indian market has curbed any fresh interest and as such leading

to a lack in activity being seen. In addition to unattractive prices, the

weaker Indian Rupee has also played its part in the current disap-

pointing demand figures. In Pakistan, despite the few new transac-

tions that came to light during the few past weeks, overall interest

for seems to be remaining relatively low. The discouraging price lev-

els and the generally poor conditions prevailing in the local market

seem to have delayed any reversal in cash buyers’ appetite for the

time being.

12th - 23th August 2019

Reported Transactions

150200250300350400450500

Bangladesh India Pakistan China Turkey

US$/ldt

150200250300350400450500

Bangladesh India Pakistan China Turkey

US$/ldt

Indicative Wet Prices ($/ldt) last 5 years

23 Aug 16 Aug ±% Min Avg Max

Indian Sub Continent

Bangladesh 395 400 -1.3% 245 397 490

India 370 380 -2.6% 250 396 510

Pakistan 380 390 -2.6% 245 395 500

Far East Asia

China - - 120 230 350

Mediterranean

Turkey 275 275 0.0% 150 258 355

Indicative Dry Prices ($/ldt) last 5 years

23 Aug 16 Aug ±% Min Avg Max

Indian Sub Continent

Bangladesh 375 380 -1.3% 220 378 475

India 350 360 -2.8% 225 378 500

Pakistan 360 370 -2.7% 220 376 475

Far East Asia

China - - 110 214 340

Mediterranean

Turkey 265 265 0.0% 145 248 355

Type Vessel's Name Dwt Built Country Built Ldt US$/ldt Buyer Sale Comments

Bulker ATLANTIC MERCHANT 238,819 1992 Japan 36,166 $ 405/Ldt undisclosed 907 tons IFO/378 tons MGO

Bulker JUPITER 38,692 1996 Japan 7,846 $ 375/Ldt Pakistani

Bulker HTK HOPE 24,835 1984 Japan 5,740 $ 385/Ldt Bangladeshi

Gen.

CargoAMR R 6,070 1977 Russia 3,940 N/A Turkish

Offsh MYSTIC VIKING 2,647 1983 Canada 2,424 N/A other

Tanker CRYSTAL SAMBU 4,367 1989 S. Korea 1,728 N/A Pakistani

Gen.

CargoAYATT 4,244 1972 Germany - N/A Turkish

Lvstck PHOENIX 1 3,089 1971 Spain - N/A Turkish

Gen.

CargoSTAR FUJI 40,850 1985 S. Korea - N/A Turkish

Bulker STADACONA 32,452 1984 Japan - N/A Turkish

11

25

35

45

55

65

75

85

95

12th - 23th August 2019

US Dollar per Euro Yen per US Dollar

Iron Ore (TSI) Coal Price Index

Yuan per US Dollar US Dollar INDEX

Oil WTI $ Oil Brent $

Shipping equities took a tumble today amid latest blows between US

and China in an escalating trade war that has gone on since early

2018. Beijing announced 5% and 10% tariffs on $75bn in US imports

on 1 September and 15 December, reacting to US' plan for a 25% tax

on $300bn in Chinese goods on those dates. President Donald Trump

responded to China's latest jab by demanding US companies stop trad-

ing with China and saying he will up that 25% tariff to 30% on 1 Octo-

ber.

Of 34 New York-listed shipping stocks, only three ended the day in

the green. The rest of them took losses — a third of them falling at

least 5% by the time the closing bell rang on Wall Street. The Dow

Jones Industrial Average fell 623 points to 25,629. Danish tanker

owner Torm dropped 10% to $8.62 while Greek LNG carrier owner

Stealth Gas fell 8.6% to $3.19. US-based Eagle Bulk Shipping took an

8.5% hit to land at $4.20, and Safe Bulkers slid 7.9% to $1.76. Boxship

equities were also negatively affected. US-based Matson dipped 5.6%

to $34.75 while Greece's Diana Shipping went down 4.4% to $0.87.

Source: Tradewinds

1.00

1.05

1.10

1.15

1.20

100.00

102.00

104.00

106.00

108.00

110.00

112.00

114.00

116.00

6.00

6.20

6.40

6.60

6.80

7.00

7.20

94.00

95.00

96.00

97.00

98.00

99.00

45.00

55.00

65.00

75.00

85.00

95.00

60.00

70.00

80.00

90.00

100.00

110.00

120.00

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

80.00

23 Aug 19 Jul ±% Min Avg Max

Markets

10year US Bond 1.53 2.05 -25.4% 0.00 2.58 3.23

S&P 500 2,847.1 2,976.6 -4.4% 2,351 2,807 3,026

Nasdaq 7,751.8 8,146.5 -4.8% 6,193 7,615 8,330

Dow Jones 25,628.9 27,154.2 -5.6% 21,792 25,644 27,359

FTSE 100 7,095.0 7,508.7 -5.5% 0 7,182 7,687

FTSE All-Share UK 3,898.6 4,098.3 -4.9% 3,596 3,950 4,194

CAC40 5,326.9 5,552.3 -4.1% 4,599 5,241 5,621

Xetra Dax 11,611.5 12,260.1 -5.3% 10,382 11,706 12,630

Nikkei 20,710.9 21,467.0 -3.5% 19,156 21,580 24,271

Hang Seng 26,179.3 28,765.4 -9.0% 2,619 27,395 30,157

DJ US Maritime 231.5 249.0 -7.1% 204.5 250.3 288.9

Currencies

$ per € 1.11 1.12 -1.4% 1.10 1.13 1.18

$ per ₤ 1.22 1.25 -2.4% 1.21 1.28 1.33

₤ per € 0.91 0.90 1.0% 0.85 0.88 0.93

¥ per $ 106.5 107.6 -1.1% 105.2 110.5 114.1

$ per Au$ 0.68 0.71 -4.4% 0.67 0.71 0.74

$ per NoK 0.11 0.12 -4.8% 0.11 0.12 0.12

$ per SFr 0.98 0.98 0.2% 0.96 0.99 1.02

Yuan per $ 7.09 6.88 3.1% 6.68 6.85 7.09

Won per $ 1,211.8 1,176.3 3.0% 1,106.5 1,145.4 1,219.3

$ INDEX 97.6 97.2 0.5% 93.9 96.7 98.5

Commoditites

Gold $ 1,503.0 1,421.3 5.8% 1,180.0 1,292.8 1,518.3

Oil WTI $ 53.2 55.0 -3.2% 44.4 58.1 74.9

Oil Brent $ 58.3 61.8 -5.7% 52.5 66.5 84.3

Palm Oil - - - 562.0 562.0 562.0

Iron Ore 89.0 121.9 -27.0% 64.7 86.7 126.4

Coal Price Index 57.8 66.8 -13.5% 55.0 80.5 102.0

White Sugar 310.5 315.2 -1.5% 305.7 336.0 387.1

last 12 months

12

AERAKIS GEORGEMOBILE: +30 6946 04 57 37

BOLIS ILIASMOBILE: +30 6937 02 65 00

DASKALAKIS GEORGEMOBILE: +30 6932 24 80 07

DRAKOGIANNOPOULOS STAVROSMOBILE: +30 6932 20 15 65

DRAKOGIANNOPOULOS SAKISMOBILE: +30 6944 88 58 08

FRANGOS HARRISMOBILE: +30 6936 57 67 00

KLONIZAKIS JOHNMOBILE: +30 6948 50 55 81

KOSTOYANNIS JOHNMOBILE: +30 6932 43 39 99

MANOLAS NIKOLASMOBILE: +30 6940 63 22 56

MOISSOGLOU THEODOROSMOBILE: +30 6932 45 52 41

PAPAIOANNOU ANTONISMOBILE: +30 6936 54 80 22

PAPOUIS THASSOSMOBILE: +30 6944 29 49 89

PRACHALIAS ARGIRISMOBILE: +30 6947 62 82 62

STASSINAKIS JOHNMOBILE: +30 6972 60 92 09

TSALPATOUROS COSTISMOBILE: +30 6932 20 15 63

VARVAROS PLUTONMOBILE: +30 6937 25 15 15

Maritime Research & ValuationsCHASAPIS THOMAS

MOBILE: +30 6947 82 91 72LAZARIDIS GEORGE

MOBILE: +30 6946 95 69 40VAMVAKAS YIANNIS

MOBILE: +30 6942 94 71 87

Sale & Purchase

ALLIED SHIPBROKING INC. 48, Aigialeias Street, 4th Floor, Maroussi 151 25, Greece Tel: +30 210 45 24 500 Fax: +30 210 45 25 017/ 019 E-mail: [email protected]

ALLIED CHARTERING S.A. 48, Aigialeias Street, 4th Floor, Maroussi 151 25, Greece Tel : +30 210 42 88 100 Fax: +30 210 45 24 201

E-mail: [email protected]

E-mail: [email protected]

12th - 23th August 2019 | Week 33-34

ALEXOPOULOS PANOS MOBILE: +30 6944 34 66 15

ARGYRI MARINAMOBILE: +30 6983 11 32 98

FLOURIS DIMITRISMOBILE: +30 6937 81 32 39

KAILAS VAGGELISMOBILE: +30 6942 48 05 69

KANELLOS DIMITRIS MOBILE: +30 6945 07 47 85

KAPPA ANGELIKI MOBILE: +30 6975 85 60 84

KARAMANIS COSTASMOBILE: +30 6941 54 14 65

PATELIS DIMITRIS MOBILE: +30 6944 04 43 61

THEODOTOS ARISTOFANIS MOBILE: +30 6951 79 82 89

TSALPATOUROU ANASTASIAMOBILE: +30 6951 79 82 91

TSALPATOUROU MARGARITA MOBILE: +30 6934 74 22 16

Tanker CharteringFLOURIS JOHN

MOBILE: +30 6955 80 15 03 PAPANTONOPOULOS NICOLAS

MOBILE: +30 6945 23 21 88STERGIOPOULOS ALEXANDROS

MOBILE: +30 6951 79 82 91

Dry Cargo Chartering

13

Disclaimer

The information contained within this report has been provided by Allied Shipbroking Inc. and Allied Chartering S.A. for general information

purposes.

All the information is compiled through Allied Shipbroking Inc. and Allied Chartering S.A. databases, as well as from other market sources. De-

spite having taken reasonable care in the gathering, filtering and auditing of this information and believing that the information is accurate and

correct, it may still contain errors, as a lot of the views regarding market levels are partially derived from estimates and/or subject judgments

while the reported transaction activity is gathered from several sources and rumors, some of which are sometimes hard to validate in full their

accuracy and truthfulness. As such we advise that the information be taken cautiously, while advising that this information does not obviate the

need to also make further enquiries and seek further information in order to obtain a more accurate outlook. As we make no warranties of any

kind, both expressed or implied, as to the completeness, accuracy, reliability or completeness of the information herein, Allied Shipbroking Inc.

and its connected persons shall not be held liable to any loss or damage of any kind, including direct, indirect and/or consequential damages

caused by negligence of any kind on our part.

Any choice to rely on this information provided is strictly at the recipient’s own risk.

This report and its information is confidential and solely for the internal use of its recipients, while any re-production or re-distribution of the

report and its material is strictly prohibited without prior permission from Allied Shipbroking Inc.

If you wish to subscribe to this or any other report we produce, please contact us directly.

Appendix

Aggregate Price Index quoted on the first page for both Newbuilding and Secondhand relates to the current average prices levels compared to

where they stood at 1st January 2010 (i.e. index 100 = 01/01/2010)

Demolition market average price index refers to the combination of the average prices currently offered in the Indian Sub-Continent, Far East

and Mediterranean.

Period rates currently relate to Capesize of 180,000dwt, Panamax of 76,000dwt, Supramax of 56,000dwt and Handysize of 33,000dwt on the

Dry Bulk side and VLCC of 250,000dwt, Suezmax of 150,000dwt, Aframax of 115,000dwt and MR of 52,000dwt on the Tankers side respec-

tively.

In terms of Secondhand Asset Prices their levels are quoted based on following description:

All vessels built to European specifications by top Japanese shipbuilders, with dwt size based on the below table.

12th - 23th August 2019 | Week 33-34

Resale 5 year old 10 year old 15 year old

Capesize 180,000dwt 180,000dwt 170,000dwt 150,000dwt

Panamax 82,000dwt 82,000dwt 76,000dwt 74,000dwt

Supramax 62,000dwt 58,000dwt 56,000dwt 52,000dwt

Handysize 37,000dwt 32,000dwt 32,000dwt 28,000dwt

VLCC 310,000dwt 310,000dwt 250,000dwt 250,000dwt

Suezmax 160,000dwt 150,000dwt 150,000dwt 150,000dwt

Aframax 110,000dwt 110,000dwt 105,000dwt 95,000dwt

MR 52,000dwt 45,000dwt 45,000dwt 45,000dwt

![ITD Cementation wins INR 2,168 crore order for Dredging & Reclamation works for Container Terminal 4 at JNP, Mumbai [Company Update]](https://static.fdocuments.net/doc/165x107/577cb48a1a28aba7118c80a8/itd-cementation-wins-inr-2168-crore-order-for-dredging-reclamation-works.jpg)

![VC,[ ;]gGT J HDFVT V[8,[ D:,S[ VFc,F ChZT · s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s s T T s s](https://static.fdocuments.net/doc/165x107/5f0d1d827e708231d438c0d8/vc-ggt-j-hdfvt-v8-ds-vfcf-chzt-s-s-s-s-s-s-s-s-s-s-s-s-s-s-s-s-s-s-s.jpg)