97188606 Mutual Funds PPT

-

Upload

chethan-kumar -

Category

Documents

-

view

219 -

download

0

Transcript of 97188606 Mutual Funds PPT

-

7/31/2019 97188606 Mutual Funds PPT

1/22

1

-

7/31/2019 97188606 Mutual Funds PPT

2/22

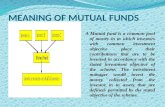

A Mutual Fund Is A Professionally-managed Firm Of

Collective Investments That Pools Money From Many

Investors And Invest It In Stocks, Bonds Etc.

Mutual Fund Have A Fund Manager Who Invests The

Money On Behalf Of The Investors By Buying/Selling

Stocks, Bonds Etc.

-

7/31/2019 97188606 Mutual Funds PPT

3/22

3

-

7/31/2019 97188606 Mutual Funds PPT

4/22

Professional Investment Management

Diversification

Small Investment Amounts

Lower Investment Cost

Liquidity

Transparency

Well Regulated- AMFI

4

-

7/31/2019 97188606 Mutual Funds PPT

5/22

The ownership of the mutual fund is in the hands of the Investors.

A Mutual Fund is managed by investment professional and other

Service providers

The pool of Funds is invested in a portfolio of marketable investments.

The investors share in the fund is denominated by units. The value of the units

changes with change in the portfolio value, every day.

The value of one unit of investment is called net asset value (NAV).

The investment portfolio of the mutual fund is created according to the stated

investment objectives of the Fund.

5

-

7/31/2019 97188606 Mutual Funds PPT

6/22

To provide an opportunity for lower income groups to acquire without

much difficulty, property in the form of shares.

To cater mainly of the need of individual investors who have limited

means.

To manage investors portfolio that provides regular income, growth,

safety, liquidity, tax advantage, professional management and

diversification.

6

-

7/31/2019 97188606 Mutual Funds PPT

7/22

Professional Management

Diversification of portfolio

Convenient Administration

Return Potential

Low Costs

Liquidity for some schemes

Transparency

Flexibility

Choice of schemes

Tax benefits

Well regulated

7

-

7/31/2019 97188606 Mutual Funds PPT

8/22

Two methods-

Lump sum or one time payment method

Systematic investment plan (SIP)

-

7/31/2019 97188606 Mutual Funds PPT

9/22

Under this a fixed sum is invested

each month on a fixed date of a month.

Payment is made through post dated

cheques or direct debit facilities.

The investor gets fewer units when the

NAV is high and more units when the

NAV is low.

-

7/31/2019 97188606 Mutual Funds PPT

10/22

MFs are subject to market fluctuation

No fixed return

Entry and exit load (abolish right now)

No Guarantees

Management Risk

10

-

7/31/2019 97188606 Mutual Funds PPT

11/2211

-

7/31/2019 97188606 Mutual Funds PPT

12/22

The Fund Sponsor

Any person or corporate body that establishes the Fund and registers itwith SEBI.

Forms a Trust and appoints a Board of Trustees.

Appoints a Custodian and Asset Management Company either directly orthrough Trust, in accordance with SEBI regulations.

SEBI regulations also define that a sponsor must contribute at least 40%to the net worth of the asset management company.

12

-

7/31/2019 97188606 Mutual Funds PPT

13/22

Trustees:

Created through a document called the Trust Deed that is executed by the Fund Sponsorand registered with SEBI.

The Trust i.e. the mutual fund may be managed by a Board of Trustees i.e. a body ofindividuals or a Trust Company i.e. a corporate body.

Protector of unit holders interests.

2/3 of the trustees shall be independent persons and shall not be associated with thesponsors.

Rights and Roles of Trustees:

Approve each of the schemes floated by the AMC.

The right to request any necessary information from the AMC.

May take corrective action if they believe that the conduct of the fund's business is not inaccordance with SEBI Regulations.

Have the right to dismiss the AMC

Ensure that, any shortfall in net worth of the AMC is made up. 13

-

7/31/2019 97188606 Mutual Funds PPT

14/22

FUND MANAGERS (OR) THE ASSET MANAGEMENT COMPANY (AMC)

AMC has to discharge mainly three functions as under:

1) Taking investment decisions and making investments of the funds through

market dealer/brokers in the secondary market securities or directly in theprimary capital market or money market instruments.

2) Realize fund position by taking account of all receivables and realizations,moving corporate actions involving declaration of dividends, etc to compensateinvestors for their investments in units.

3) Maintaining proper accounting and information for pricing the units and arrivingat net asset value (NAV), the information about the listed schemes and thetransactions of units in the secondary market. An AMC has to give feedback tothe trustees about its fund management operations and has to maintain aperfect information system.

14

-

7/31/2019 97188606 Mutual Funds PPT

15/22

CUSTODIANS OF MUTUAL FUNDS:-

A custodians role is safe keeping of physical securities and also keeping a tab on thecorporate actions like rights, bonus and dividends declared by the companies in which thefund has invested.

The Custodian is appointed by the Board of Trustees.

Mutual funds run by the subsidiaries of the nationalized banks have their respectivesponsor banks as custodians like Canara bank, SBI, PNB, etc.

Foreign banks with higher degree of automation in handling the securities have assumedthe role of custodians for mutual funds.

RESPONSIBILITY OF CUSTODIANS:-

Receipt and delivery of securities

Holding of securities.

Collecting income

Holding and processing cost

Corporate actions etc15

-

7/31/2019 97188606 Mutual Funds PPT

16/22

Association of Mutual Funds in India (AMFI) was incorporated on 22ndAugust 1995.

AMFI is an apex body of all Asset Management Companies (AMC) whichhas been registered with SEBI.

AMFI has brought down the IndianMutual Fund Industry to a professionaland healthy marketwith ethical lines enhancing and

maintaining standards.

It follows the principle of both protecting and promoting the interests ofmutual funds as well as their unit holders.

16

-

7/31/2019 97188606 Mutual Funds PPT

17/22

Promote the interests of the mutual funds and unit holders and interactwith regulators- SEBI/RBI/Govt./Regulators.

To set and maintain ethical, commercial and professional standards inthe industry and to recommend and promote best business practices

and code of conduct to be followed

To increase public awareness and understanding of the concept andworking of mutual funds in the country

To undertake investor awareness programmes and to disseminateinformation on the mutual fund industry.

To develop a cadre of well trained distributors and to implement aprogramme of training and certification for all intermediaries and othersengaged in the industry.

17

-

7/31/2019 97188606 Mutual Funds PPT

18/22

All mutual funds are regulated by the Securitiesand Exchanges Board of India (SEBI).It issued detailed guidelines for their setting upand operation on 20th January, 1993.

The following are the highlights of SEBI regulations:

Mutual funds are to be established in the form of a trust under theIndian Trusts Act, 1882 and operated by separate asset managementcompanies (AMC)

They have to set up a Board of Trustees and Trustee Companies andconstitute their Board of Directors.

The minimum net worth of AMCs is stipulated at Rs. 5 crore(laterincreased to Rs. 10 crore).

The AMCs and trustees are to be two separate legal entities and an

arms length relationship must be maintained between the two.18

-

7/31/2019 97188606 Mutual Funds PPT

19/22

An AMC or its affiliate cannot act as a manager in any other fund.

The AMCs are required to furnish SEBI their respective Memorandumand Articles of Association for approval.

Mutual funds dealing exclusively with money market instruments (Suchas CDs, CPs and bill discounting) are to be regulated by the ReserveBank of India.

All schemes floated by mutual funds are to be registered with SEBI.

There are some very detailed guidelines for disclosures in offerdocument, offer period, investment guidelines etc.

NAV to be declared everyday Disclose on website, AMFI, newspapers

Quarterly, Half-yearly results, annual reports Select Benchmark depending on scheme and compare 19

-

7/31/2019 97188606 Mutual Funds PPT

20/22

By Structure

Open-Ended anytime enter/exit

Close-Ended Schemes redemption after period of scheme is

over, listed.

20

-

7/31/2019 97188606 Mutual Funds PPT

21/22

Equity Diversified Schemes- Invest in equity

Sectors Schemes Focus on particular sectors

Index Schemes Invest in all Stocks comprising the index

Equity Tax saving Scheme Demand a lock in period of 3 years

Dynamic Funds Alter the exposure to different assets classes

based on market scenario

Debt Schemes Invest in medium and short term debts

Floating Rate Funds Invest in debt securities with floating

interest rates

21

-

7/31/2019 97188606 Mutual Funds PPT

22/22

Birla Mutual Fund

BOB Mutual Fund

Canara Bank Mutual Fund

Chola Mutual Fund

Deutsche Mutual Fund

DSP Merrill Lynch Mutual Fund

LIC Mutual Fund

Prudential ICICI Mutual Fund

Reliance Mutual Fund

SBI Mutual Fund

Franklin Templeton Investments

HDFC Mutual Fund

HSBC Mutual Fund

ING Vysya Mutual Fund

Kotak Mahindra Mutual Fund

Franklin Templeton Investments

HDFC Mutual Fund

HSBC Mutual Fund

ING Vysya Mutual Fund

Escorts Mutual Fund

22