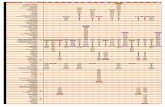

WM Skills Brokerage Model

-

Upload

policyworks-associates-ltd -

Category

Documents

-

view

223 -

download

0

description

Transcript of WM Skills Brokerage Model

An evaluation of West Midlands Social Care Skills Brokerage Programme

Brokering change

July 2009

About the evaluation

Policyworks Associates Ltd. were commissioned by Skills for Care West Midlands to carry out an evaluation of the West Midlands social care skills brokerage programme. The evaluation has three broad aims:

• to describe the programme, its origins, implementation and operation,

• to analyse the performance and impact of the programme to date, and

• to make recommendations to strengthen the programme going forward.

The evaluation is based on six distinct research components:

• a web-based survey of current and active skills brokers,

• a telephone survey of a sample of social care employers who have benefited from the brokerage programme,

• analysis of programme activity and management statistics,

• a series of semi-structured interviews with key actors involved with the design and delivery of the brokerage programme,

• observation of skills brokers through attendance at regular broker network meetings, and

• review of key documents associated with the skills brokerage programme

A full methodology is contained within Appendix One.

The evaluation and accompanying report should be of interest to all involved in workforce development in the social care sector as well as other other sectors where specialist skills brokers may have the potential to increase the uptake and impact of investment in training.

Acknowledgments

The evaluation team at Policyworks Associates Ltd. wish to thank a range of individuals and organisations whose kind co-operation has made this evaluation possible. Particular thanks are due to Jerry Conway from the Learning and Skills Council West Midlands, Robert Cirin and Kate Murphy from the Learning and Skills Council National Research Team, Helen Fortune and Fred Bentley from Business Link West Midlands and Ruth Beard, Stuart Baird and Chris Pearson from Skills for Care West Midlands. The contribution of the sixteen specialist skills brokers from sub-regional care partnerships across the West Midlands was both generous and vitally important to the evaluation, as was the contribution of the many social care employers who gave their time and shared their considered opinions of the brokerage service and its impact on their businesses.

Brokers and brokerage: a note on terminology

The term “brokerage” has an established meaning in the social care context which differs from its use within this report.

The commonly understood concept of brokerage within the social care field emerged first in North America in the 1970s to refer to intermediary support used by self-directed care consumers1 to assist them in identifying and procuring appropriate care services. The concept of care brokerage and the availability of appropriate brokers is seen within the independent living movement as being important to the personalisation of care services and the attainability of independent living2. As self-directed care becomes a more significant feature of the mixed economy of social care consumption within the UK the role of care brokers is likely to become more important3.

The use of the term “brokerage” in this report refers exclusively to service provided by skills brokers to social care employers as part of the Train to Gain skills development initiative.

Brokering Change 2An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Contents

Executive summary 4

Recommendation 6

The case for brokerage 11The context: Social care and skills policy! 13

The West Midlands Social Care Skills Brokerage Programme 17Describing the programme! 19

Brokers and the brokerage role! 22

Programme performance 27Programme activity! 29

Broker and programme productivity! 31

Employer profile! 33

Programme impact! 35

Employer engagement and ongoing relationships! 38

Employer priorities and satisfaction! 41

Conclusions 49Training, skills and performance; future directions for social care skills brokerage! 50

Appendices 55Appendix One: Methodology! 56

Appendix Two: Recommendations Cost/Benefit Matrix! 57

Appendix Three: Endnotes! 58

3 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Exe

cuti

ve s

umm

ary About the programme

As the employer-led authority on the training and development needs of England’s adult social care workforce, Skills for Care works in partnership with employers and training providers to ensure that the nation’s social care workers have the skills to deliver improved care. As well as directly investing more than £25 million per annum in workforce training and development, Skills for Care has sought to attract more widely held resources into the social care sector. As part of this commitment, Skills for Care in the West Midlands has (uniquely amongst sector skills councils) designed and implemented a specialist “skills brokerage” model to support social care employers by assessing their organisations training needs and matching those needs against available training and development resources.

The West Midlands social care skills brokerage programme borrows and builds upon the design of the generic Train to Gain4 brokerage model. The programme uses a number of specially trained skills brokers, operating out of the seven sub-regional care partnerships which cover the West Midlands region. As with the generic Train to Gain brokerage model, skills brokers undertake Organisational Needs Assessments (ONAs) with employers which are then used to match training and development needs with appropriate training and development opportunities. Unlike the generic model, where brokers may not share the particular sectoral specialism of the employers they support, all of the brokers involved in the West Midlands programme have extensive professional experience in the social care field and retain a substantive post within their respective social care partnerships in addition to their responsibilities as a skills broker.

The programme is built on the theory that the specialist sectoral knowledge of the skills brokers will add value to the ONA process by allowing training and development needs and opportunities to be identified more effectively and intuitively than would be possible for a sectorally generic skills broker. The skills brokerage programme is also seen by Skills for Care West Midlands as an important component in widening and deepening the engagement between social care employers and sub-regional care partnerships across the West Midlands.

Impact of the programme

From its commencement in February 2008 to up to April 2009 5 the skills brokerage programme had delivered almost 500 organisational needs analyses to social care organisations across the West Midlands. During this period the programme brokers identified requirements for approximately 6,400 NVQ level qualifications and 19,300 other qualifications. On average brokers identified 12.7 indicative NVQ learners per supported organisation and 38.7 indicative learners for other qualifications6.

Our survey of employers revealed that;

• 45 per cent of employers involved in the skills brokerage programme had trained more staff than they would otherwise have done,

• 40 per cent of employers had trained staff who had not previously received training,

• 35 per cent of employers were able to provide better quality training than they would otherwise have been able to do,

• 35 per cent of employers had trained staff to a level which would not have been attained otherwise, and

• 85 per cent of employers told us that their investment in workforce development through the skills brokerage programme had resulted in and improved company culture.

Less easy to quantify, but of comparable importance, is the impact of the skills brokerage programme in securing the engagement of employers with the ongoing work of sub-regional care partnerships. Responses to the employer survey suggest that employers see brokerage as part of an ongoing relationship with their care partnership. Almost three quarters of employers told us that they would re-connect with their skills brokers in the future for support with workforce development. In comparison less than half of employers responding to national Train to Gain evaluation indicated that they would reconnect with their skills broker in the future.

Brokering Change 4An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Satisfaction with the brokerage service

Employer satisfaction with the programme brokerage service is extremely high. On every measure we tested, employer satisfaction with the West Midlands programme outstripped comparable satisfaction levels as assessed by the national evaluation of Train to Gain brokerage services. The table below shows comparative satisfaction with the West Midlands and National Train to Gain across a range of measures.

West Midlands social care skills brokerage programme

Train to Gain brokerage services national average

Relative performance of the West Midlands programme

Relative performance of the West Midlands programme

Percentage of employers satisfied that the skills broker understood their training needs 92% 73% 19% ▲

Percentage of employers satisfied that the skills broker understood their specific sectoral context 90% 79% 11% ▲

Percentage of employers satisfied that the skills broker gave impartial advice 89% 80% 9% ▲

Percentage of employers satisfied that the skills broker translated their needs into an action plan 88% 73% 15% ▲

Percentage of employers satisfied with range of training providers signposted by the skills broker 87% 72% 15% ▲

We uncovered evidence that the reputation of the programme brokerage service in some areas was such that it had driven new employers to specify that they wanted to work with a “Skills for Care” broker rather than a generic Train to Gain broker. One employer from a small residential care home commented that:

“[broker name] was the fourth broker who had approached us. The others had come from private training companies and we wanted to support a public project. We also knew the Skills for Care name and we’d attended some [sub-regional care partnership] events which had all been very good. And I think it was a good decision because [broker name] has been absolutely fabulous.”

Future opportunities and challenges

As well as proving an effective means effective for increasing the take up of training, the skills brokerage programme has also proved effective in strengthening the relationship between social care employers and sub-regional care partnerships. There are many elements of the programme in which Skills for Care and its partners can take great satisfaction and many lessons which other sectors and sector skills councils could valuably learn.

Looking to the future, Skills for Care and its partners will need to consider the next stage in the life of the programme and its capacity for development. Through the evaluation we have identified scope for a range of improvements to enhance the efficiency and effectiveness of the programme in its current form. We offer a range of recommendations to deliver these improvements. Beyond these marginal gains, a more fundamental set of questions exist about potential of the brokerage programme to impact not just on the take up of skills, but the impact of that net increase in the skills on the quality and performance of social care provision.

In the concluding chapter we challenge Skills for Care and its partners to consider ways in which the brokerage programme could be deve loped to s t rengthen the presently indeterminate link between p rov i de r- l e ve l i n ves tmen t i n wo rk f o rce deve l opmen t and i m p ro v e m e n t o r g a n i s a t i o n a l performance and quality of care. We outline a range of evidence-based recommendations which we believe may be helpful in supporting the West Midlands Social Care Skills Brokerage programme to achieve this step change.

5 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Rec

om

men

dat

ions

Our recommendations are, rather unusually, split across two different sections of this report.

In this section we offer a range of recommendations to improve the performance and efficiency of the current skills brokerage programme. The theory underpinning these recommendations is simply to support brokers to work more efficiently to ensure that a greater proportion of their time can be spent on programme activities which add the greatest value.

A second and rather more bold set of recommendations can be found within the concluding section, from page 49 onwards. These recommendations identify some possibilities for more systemic enhancement to the brokerage programme. Taking the present brokerage engagement model as their starting point, these recommendation seek to look beyond simple supply-side skills intervention to suggest ways in which the present engagement model might be developed to support Skill for Care to deliver broader social care objectives within the region. In particular we suggest a range of ways in which the skills brokerage programme might be adapted to help social care employers utilise the skills of trained staff more effectively in order to forge a more convincing link between investment in training and improved care quality and outcomes.

We present our recommendations in tabular format. Appendix Two contains a cost/benefit matrix showing the relative cost/benefit of each of the recommendations.

Improving output and productivity

Skills for Care’s management of the first phase of the skills brokerage programme has been measured, appropriate and effective. The facilitative approach taken by Skills for Care has allowed the brokerage programme to become established and to develop organically; with each sub-regional care partnership shaping employer engagement and ONA delivery in a way which compliments pre-existing local arrangements. This local hybridsation of the brokerage model and the integration of skills brokerage into a wider gamut of care partnership support was identified by a number of employers

surveyed as being critical to their continuing engagement with the care partnership. On the basis of the evidence we have gathered we would suggest that such positive outcomes may not have been realised under a more directive programme management regime.

Whilst Skills for Care’s relatively “hands-off” approach to the management of the programme has been positive and provided a good base for development we cannot disregard the fact that the programme has underperformed relative to its contractual target in its first 18 months of operation. A key challenge for Skills for Care and for brokers and care partnerships in taking the brokerage programme to the next stage in its development will be to raise its output to the level required by the Business Link contract whilst maintaining the quality and flexibility of the service as experienced by employers.

Our analysis suggests that the productivity of individual brokers is key to the performance of the programme as a whole. At present broker productivity varies from 1.6 to 0.1 ONAs per week, with brokers completing an average of 0.7 ONAs per week. An important determinant of productivity (but not the sole determinant) appears to be the number of hours per week that each broker spends on brokerage related activities with productivity highest where individual brokers spend upwards of 15 hours on brokerage tasks. Care partnerships and Skills for Care may wish to consider the implication of this when placing staff in broker roles or allocating resources for the training of additional brokers. Closely related to productivity is the length of time it takes brokers to write up ONAs after meeting with employers and submit them to Business Link; with submission lag times ranging from seven to twenty-seven days. Analysis of the data shows a strong inverse correlation between broker productivity and completion to submission lag time; indicating that more productive brokers submit their ONAs in a shorter time. Data also shows some evidence of a positive correlation between broker productivity and employer satisfaction with their brokerage experience.

We offer a number of recommendations to strengthen the output and productivity of the programme:

Brokering Change 6An Evaluation of the West Midlands Social Care Skills Brokerage Programme

1 Skills for Care should clarify and communicate to care partnerships and brokers its expectations with regard to the productivity of individual brokers and particularly with regard to the lag time between completing ONA visits with employers and submitting to Business Link. A target of one ONA per broker per week and completion to submission lag time of not more than ten days seems reasonable standard to set at this stage.

2 Skills for Care should define and monitor a small number of key performance metrics for the brokerage programme, working with Business Link to ensure that monitoring data is available for periodic (quarterly) analysis. Broker productivity should be one of these key performance metrics.

3 Skills for Care should work with Business Link to improve performance reporting to care partnerships. A simple template-based periodic reporting sent confidentially to each care partnership illustrating key performance metrics for that care partnership and for the programme as a whole is likely to be an effective spur to improvement of programme output and productivity.

4 Skills for Care should seek undertakings from care partnerships that new candidates for skills brokerage roles will be able to commit to an average of at least 15 hours brokerage activity per week.

5 Skills for Care should seek undertakings from care partnerships with regard to the provision of basic administrative support for brokers to ensure that brokers are freed to spend their brokerage time in the most valuable way.

Improving data collection and securing more value from programme data

Through the organisational needs analysis process, the skills brokerage programme gathers a large volume of strategically valuable intelligence on the state of private, voluntary and independent providers within the social care sector in the West Midlands. A number of small, specific investments in the way that this data is gathered and processed could deliver real benefits for strategic workforce planning and market development both locally and regionally.

At present the way in which the data is collected and managed makes analysis time consuming and costly7. Although we understand that improvements to the current

system of data capture and management are planned, we offer a number of low-cost fixes to ensure that better use can be made of this valuable data in the medium-term:

6 Skills for Care should work with brokers to ensure that employer data collected through the ONA process (and specifically typologies used within that data) are consistent with other larger social care data sets, in particular the National Minimum Data Set for Social Care (NMDS-SC) to aid comparison between ONA data and NMDS-SC data.

7 Skills for Care should work with brokers to develop a short (single page) data collection pro-forma to be use alongside ONAs and (where appropriate) non-ONA employer visits. The pro-forma should record, as a minimum, the employers NMDS-SC reference number together with details on the fundable training requirement, the unfunded training required. This data will assist Skills for Care in understanding the nature of unmet training need across the region.

8 Skills for Care should work with care partnerships to ensure that effective systems are in place for ongoing monitoring of employer satisfaction with the brokerage service, with the objective of harmonising methods and content of satisfaction monitoring systems across the sub-regional care partnerships. Opportunities exist for Skills for Care to implement a rolling programme of telephone-based satisfaction and quality monitoring.

Engagement with social care organisations large and small

The quality of engagement achieved between social care employers and sub regional care partnerships through the skills brokerage programme stands out as one of the real strengths of the programme. For many employers the question of who made the first contacted with whom - broker or employer - was a fairly moot point. In practice we found that majority of employers were aware of the activities of their respective care partnership and the nature of the service on offer from the skills broker(s) well in advance of any approach to, or from the broker. This meant when the first formal contact with the broker did occur it was neither exploratory (if made by the employer) nor was it unexpected or unwelcome (if made by the broker).

Whilst this effective pre-selling of the brokerage programme by care partnerships and brokers has likely improved take up of the brokerage service, it does raise some

7 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

questions around the extent to which the benefits of the brokerage programme have been enjoyed disproportionately by social care employers who were already relatively closely engaged with the work of the care partnership. Certainly, when we examine the size of employers who benefited from the brokerage programme we find that these employers had an average headcount of 37 employees in comparison to regional average of 28 8. If we take the number of employees as a proxy for organisational capacity, we can hypothesise that, to date, the brokerage programme has engaged with employers who have greater than average capacity.

Having demonstrated that the brokerage model works in practice, a challenge for Skills for Care, for care partnerships and for brokers for the next stage in the development of the programme will be to use skills brokerage as a means of reaching out beyond those social care employers who are already effectively engaged with care partnerships. Smaller employers are likely to have less capacity to train staff than larger employers and therefore have relatively greater need for support from the brokerage programme and the other supports on offer from sub-regional care partnerships.

Data gathered during the evaluation also suggested that relatively larger (and relatively more capable) social care employers who had engaged with the programme were somewhat less satisfied than smaller employers with the service they had recieved. We found that the training needs of these larger employers had generally moved beyond compliance with regulatory requirements, and were more concerned with using training to address specific business challenges. This suggests that the skills and knowledge of brokers is currently geared to meeting the needs of employers with basic, compliance orientated training needs rather than larger employers with more complex training needs. Addressing this issue is not straightforward. The expansion and nature of social care suggests that the sector will continue to be dominated by a preponderance of smaller organisations, and the evidence we have from this evaluation suggest that the brokerage programme is very well geared to supporting such organisations. At the same time, however, the growing demand for social care and the need to deliver social care services efficiently suggests that there will be some consolidation amongst mid-sized social care organisations. Meeting the needs of these larger organisations will be a challenge that is likely to become more pressing in future years.

9 Skills for Care should encourage care partnerships to develop clear employer engagement strategies; outlining the way in which employers are to be targeted in order to provide the maximum public benefit. Strategies should include specific provisions for the engagement of small employers (i.e. those below the 28 employee average), engagement of micro-employers (i.e. those with between 5 and 10 employees) and the engagement of larger employers (i.e. those with more than 60 employees and/or employees across multiple sites).

10 Skills for Care should work with care partnerships to consider how best the brokerage programme should engage with and support the needs of social care employers operating across different care partnership boundaries.

11 Skills for Care should work with care partnerships to consider how best the brokerage programme should support the needs of social care employers with non-standard, or post-compliance training or workforce development needs. Opportunities to consider may include the creation of specialist brokers post(s) working full-time on a regional basis (rather than the current part-time, generalist broker model) or the involvement of brokers from the wider Business Link network with specific business development expertise rather than specific social care expertise.

We consider this definition to exclude Direct Payments employers. Specific recommendations to meet the training and development needs of the employees of Direct Payment employers are set out in POLICYWORKS ASSOCIATES LTD. (2009). I’m safe because they’ve been trained correctly: Exploring the attitudes of direct payment employes in the West Midlands towards the training and development of Personal Assistants. Birmingham: Skills for Care West Midlands with the Learning and Skills Council.

Supporting broker research and knowledge sharing activities

Carrying out regular professional research is an extremely important part of the skills broker’s role. The brokers involved with the West Midlands programme are conscientious researchers, and are also keen and active in sharing their knowledge with their broker colleagues. On average brokers report spending two hours per week of their brokerage time (over 15 per cent of the average weekly brokerage commitment) engaged in research and knowledge sharing activities. Anecdotal evidence from brokers suggests that they are likely spend at least as long again carrying out professional research in their own personal time.

Brokering Change 8An Evaluation of the West Midlands Social Care Skills Brokerage Programme

When asked which elements of their brokerage role were either increasing or decreasing in importance, 85 per cent of brokers reported that the proportion of the time they were spending on research and knowledge sharing activities was increasing (and the remaining 15 per cent of brokers said it was neither increasing nor decreasing). In many respects this a positive outcome as it indicates that the knowledge of brokers and the knowledge utilisation of the brokerage service is on the increase. However time spent carrying out research and knowledge sharing is time which cannot be spent interfacing with social care employers.

Opportunities exist - through training and professional development - to support brokers to become more effective researchers. But opportunities also exist to support brokers to manage and share their knowledge more effectively. We have observed instances of duplication in research effort; with multiple brokers searching for essentially the same piece of information. We have also observed potential for “junk mail” effects as a result of the way that knowledge resources are currently shared via circular emails.

We believe there is scope to use a web-based “wiki” engine to add considerable value to broker research by managing broker-to-broker and programme-to-broker knowledge sharing activities. This would be an extremely innovative solution allowing members of the broker network (and anyone else whom the network members wished to invite) to share, discuss, edit and organise knowledge resources in simplified Wikipedia-style online environment. Whilst Wiki- and forum-based collaboration can often be difficult to encourage and sustain, we believe that the maturity of the existing brokers network will mean that the Wiki will simply represent an enabling extension of processes and operations which already exist.

12 Skills for Care should identify opportunities to provide research training for skills brokers. Training to carry out efficient web-based searches of professional literature and broker resources would be particularly valuable.

13 Skills for Care should develop a simple, secure Wiki- website to allow specialist skills brokers to post, discuss, edit and organise knowledge resources. Skills for Care should use the Wiki to disseminate information and resources to the broker network and should aim for the Wiki to become the first port of call for brokers with research queries.

Moderating risks to the programme

The West Midlands social care skills brokerage programme is a model of effective network service delivery. Its existence and effectiveness is rooted in the co-operation of a range of organisations whose loose common interests are well served by their collaboration in the task of upskilling the social care workforce in the West Midlands. Like many network enterprises, however, it is the very collaborative nature of the brokerage programme which presents the most serious risks to its continuity.

At present Skills for Care bears much of the contractual and reputational liability for the performance of the programme, and yet holds relatively few levers to shape the that performance. During the evaluation a number of instances came to light of brokers being re-called from their care partnership or redeployed to other duties by their local authority employers. Despite the direct and potentially detrimental impact upon the programme Skills for Care found itself powerless to influence these decisions. To manage and mitigate such risks Skills for Care needs to strengthen its relationships with social care commissioners and other influencers and decision-makers in local authorities and NHS organisations across the region. Skills for Care should aim to ensure that the contribution of skills brokerage is understood more widely and that the programme can call upon a larger coalition of support.

14 Skills for Care should, as part of its internal management processes, identify and regularly assess the risks faced by the skills brokerage programme.

15 Skills for Care should map and prioritise the key decision-makers and influencers shaping the social care agenda and the work of each sub-regional care partnerships across the West Midlands. Skills for Care should then develop an engagement strategy to ensure it has effective access to the most important individuals.

9 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

5. The case for brokerage

The case for brokerage

Section one:

The

Brokering Change 12An Evaluation of the West Midlands Social Care Skills Brokerage Programme

1. The context: Social care and skills policy

As the demographic ageing of the UK population drives demand for social care to unprecedented levels over the coming decades, the care workforce will need to grow significantly to keep pace9. In the West Midlands this growth will see social care become the largest source of employment growth in the regional economy; adding over 50,000 jobs by 201410. Rising to this numerical challenge and, at the same time, driving up standards of care quality and satisfying the needs of increasingly expectant care consumers will require significant investment in workforce and development.

The scale of social care challenge will be compounded by the changing shape of the economy of care provision. Between 2006-07 and 2007-08 the social care workforce in England grew by 8 per cent but in the same period social care roles in local authorities - traditionally the largest employer within the sector - fell by 3 per cent11. The general trend we can observe is one of shrinking direct provision from public agencies and increasing provision through a larger number of smaller providers in the private, voluntary, independent sectors. Supporting and developing employers and workers in this increasingly mixed economy calls for effective and sustainable engagement and support mechanisms for employers and their workers.

Train to Gain: A new direction in skills policy

For the past three decades skills policy in the UK has focused almost exclusively on increasing the supply of qualified workers through the promotion of education and training. The argument put forward by policy-makers throughout this period has been a straightforward one. The persistent ‘skills gap’ between UK workers and those in other countries is, it has been argued, the corollary to the equally persistent gap in competitiveness between the UK and its international competitors; so by resolving the supply-side skills deficit you also resolve the national competitiveness deficit12.

The results of these supply-side interventions could, at best, be characterised as mixed. The skills level of the UK workforce has risen over the period; with significant increases in the percentage of working age adults qualified to level 4 or above (figure 1.1, right) and significant reductions in the percentage of the working age population with no qualifications (figure 1.2, right)13.

The eagerly anticipated gains to competitiveness have been not, however, been realised14; with no sustained change observed in the relative competitiveness of the UK over the period15. At the same time, three decades of centrally-driven policy has resulted in two wholly unwelcome effects. First, the proliferation of skills-focused agencies and initiatives has resulted in a complex but well-intentioned ‘landscape’ of support which is, in practice, too confusing for the average employer to navigate let alone influence. Second, the unrelenting emphasis on training workers with very little steer from employers has resulted in large numbers of employees (over half in a recent nationwide survey16) reporting that the skills they possessed were significantly higher than those required to do their current job. This consequence carries with it the incumbent risk that employees become frustrated, not so much with their current job or employer but with their apparently wasted investment in skills and development, and so become less likely to take up training again.

Launched in 2006, Train to Gain is the governments flagship programme for workplace-based training. The emphasis of Train to Gain is markedly different from

Figure 1.1 Change in the percentage of working age adults qualified to level four or above, 1994-2005

1994

2005

0% 5% 10% 15% 20% 25% 30%

29%

21%

Percentage

Figure 1.2 Change in the percentage of working age adults with no qualifications, 1994-2005

1994

2005

0% 5% 10% 15% 20% 25% 30%

13%

22%

Percentage

13 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

earlier generations of skills policies. Whereas past approaches had effectively written the employer out of the process, Train to Gain places the employer and their business at the centre. By using specially trained individuals working with employers as “skills brokers”, Train to Gain ensures that the developmental needs of the business are identified first, and that any investment in training for employees is guided by these needs. Where training is identified as an appropriate means of achieving a business objective, the Train to Gain broker will put together a training proposal for the employer, funded either fully or in part through the Train to Gain scheme.

Train to Gain performance in the West Midlands has been strong, and particularly so within the health and social care sector; where the the statutory requirement for workforce training17 has been a significant factor in driving demand for Train to Gain. Between April 2006 and January 2009 Train to Gain funded just under 132,000 training starts across the West Midlands region. Of this total, some 19,000 starts - over 14 per cent - were NVQ qualifications in Health and Social Care at levels two, three and four18. During this period the level two NVQ in Health and Social Care was the most common qualification undertaken through Train to Gain in the region. Figure 1.3, below, shows the breakdown of Train to Gain-funded qualifications in Health and Social Care from 2006 to 2009.

Figure 1.3 Breakdown, by level, of NVQ Health and Social Care starts funded by Train to Gain across the West Midlands, 2006-2009

1%

27%

72%

Level 2Level 3Level 4

What is brokerage?

Whether searching for employment, buying or selling produce, resolving a dispute or sourcing training, recourse to some form of broker is a universal human experience. In essence the act and processes of brokerage involves an intermediary facilitating a transaction between multiple actors who lack either sufficient knowledge of, sufficient access to, or sufficient trust in one another to complete the transaction efficiently19. Brokers, put simply, are a means to make sense of and succeed in a complex world. Given the important role that brokers and brokerage plays in so many transactions, it is not surprising to discover that almost every conceivable field of human study, from political science20 and anthropology21 to disaster management22, and innovation studies23 has examined the impact of brokerage within its domain.

The value of brokerage is effectively illustrated by the so-called ‘principal - agent problem’. In a principal - agent scenario a principal engages an agent to provide a service. The problem in the principal - agent relationship arrises from the fact that information between the two parties is either incomplete (so that there are unknowns on both sides) or asymmetrical (where one party has information which may be beneficial but remains undisclosed to the other).

A common example of the principal -agent problem in action is the job applicant who overstates their experience. The candidates deception constitutes an information asymmetry between the candidate (the agent) and their prospective employer (the principal); with the employer being led to believe that the candidate is more experienced than is actually the case. Aware that a potentially damaging information asymmetry such as this may hypothetically exist, the principal seeks to ameliorate the problem by approaching multiple agents and putting in place a selection process to weed out those who overstate their experience. The problem with this strategy is that the transaction costs incurred by the principal escalate proportionate to the number of potential agents approached. For the principal to approach one potential agent, as in figure 1.4 below, is simple and cheap but highly risky. For the principal to approach many potential agents, as in figure 1.5, may give greater assurance but also implies much higher costs.

Brokering Change 14An Evaluation of the West Midlands Social Care Skills Brokerage Programme

The solution for the employer in the example, and for many other actors faced with such a problem, is to engage a broker to ‘make sense’ of the market for whatever good or service they require. The brokerage function, as shown in figure 1.6, exists

Figure 1.4 The principal/agent relationship with only one agent

Principal Agent

Figure 1.5 The principal/agent relationship with multiple agents

Agent

Principal

Agent

Agent

AgentAgent

AgentAgent

Agent

Agent

Agent

Agent

Agent

Agent

between the principal and the mass of potential agents ‘out there’ in the marketplace. Through their superior knowledge of the market, their ability to engage with the principal and understand the principal’s needs and to frame these needs in the context of their market knowledge the broker is able to identify an appropriate solution on behalf of the principal.

The primary benefits for the principal of using a broker are twofold. Firstly, having co-opted the superior knowledge of the broker, the search process is likely to lead the principal to identify a more appropriate selection of (or a selection of more appropriate) potential agents than if the principal had engaged with the market unaided. Secondly, engaging a broker, rather than engaging the whole market, means that the principal only has to bear one set of transactions costs (the cost of engaging with the broker) rather than the multiple exploratory transactions costs which an unaided engagement with the market would necessarily imply.

Translating this principal/agent metaphor to the Train to Gain programme we can see that the employer (and to some extent the employees they wish to train) are the principals, the brokerage function is provided by the Train to Gain skills broker and the agents are training providers.

Figure 1.6 The brokered principal/agent relationship

Agent

PrincipalBrokerage

Function

Agent

Agent

AgentAgent

AgentAgent

Agent

Agent

Agent

Agent

Agent

Agent

15 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

5. The West Midlands Social Care Skills Brokerage Programme

The West Midlands Skills Brokerage Programme

Section two:

6.

Brokering Change 18An Evaluation of the West Midlands Social Care Skills Brokerage Programme

2. Describing the programme

The West Midlands social care skills brokerage programme is a unique and innovative initiative developed by Skills for Care West Midlands in partnership with Business Link West Midlands and the seven sub-regional social care partnerships that operate across the region.

The programme takes the generic Train to Gain brokerage support concept as its starting point, but unlike the generic Train to Gain model (which uses specialist brokers to support employers across different sectors) the West Midlands social care skills brokerage programme uses social care professionals as skills brokers and only supports employers within the social care sector. These specialist skills brokers undertake brokerage activities on a part-time basis; fitting brokerage activities around a substantive post within one of the sub-regional care partnerships. At the time of the evaluation the programme had seventeen active skills brokers operating across the region; sixteen of whom were based within sub-regional care partnerships and one of whom was based within the Skills for Care regional office. The distribution of brokers across the sub-regional care partnerships is shown in figure 2.1, right.

In much the same way as generic Train to Gain brokers operate, the programmes specialist skills brokers meet with social care employers within their sub-region to carry out detailed organisational needs analyses on the employer’s business and workforce. Identified needs are then matched, by Business Link West Midlands, against a wide range of training and development opportunities. Business Link then goes back to the employer with a training proposal based on the needs the broker has identified.

As well as supporting social care employers to access valuable training and development resources through the Train to Gain initiative, the sector-specific knowledge of the brokers lends, it is hoped, a level of credibility in the eyes of employers. This professional credibility allows brokers to perform a valuable outreach function; strengthening engagement between care partnerships and employers and facilitating important processes such as data collection for the National Minimum Data Set for Social Care (NMDS-SC).

Figure 2.1 Sub-regional care partnerships and specialist social care skills brokers within the West Midlands

Solihull Workforce in

Care Development

Association

Coventry and

Warwickshire

Partnership for Care

Black Country

Partnership for Care

Birmingham Care

Development Agency

Shropshire Care

Workforce

Development

Partnership

Staffordshire Social

Care Workforce

Development

Partnership

ACT Herefordshire

and Worcestershire

Skills for Care

West Midlands

Regional Team

19 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

The theory underpinning the design of the programme

The theory of change underpinning the programme is a fairly simple one; predicated on the notion that the inherently personal tacit knowledge24 possessed by social care professionals and amassed by them over the course of years is harder-gained and therefore more valuable than the readily transferable explicit knowledge involved in the training of skills brokers.

The social care sector, the programme theory argues, is complex such that tacit knowledge is needed to navigate it successfully and to enable more productive interaction with other participants (i.e. employers). Therefore, by training experienced and tacitly knowledgable social care professionals as skills brokers it is theorised that brokerage outcomes will be more effective than if brokerage was provided by experienced skills brokers who only possessed a rudimentary knowledge of the social care sector.

Four key relationships

The design and operation of the skills brokerage programme can be described effectively in terms of five key relationships;

• a contractual relationship between Business Link West Midlands and Skills for Care West Midlands,

• a programme management relationship between Skills for Care West Midlands and the seven sub-regional care partnerships to deliver the contract,

• an employer interface relationship between specialist skills brokers from each of the sub-regional care partnerships and social care employers within that sub-regional care partnership area, and

• a training proposal development relationship between skills brokers and Business Link Skills Relationship Managers, and then between the Skills Relationship Manager and the social care employer

Figure 2.2, below, illustrates these relationships.

The contractual relationship

The contractual relationship exists between Business Link West Midlands and Skills for Care West Midlands.

Business Link West Midlands25 holds the contract to deliver Train to Gain within the West Midlands on behalf of Advantage West Midlands, the regional development agency26. As a sub-contractor to Business Link, Skills for Care West Midlands undertakes to deliver an agreed number of units of Organisational Needs Analysis (ONAs) with social care employers within the region. The original agreement between between the two parties committed Skills for Care to deliver 100 ONAs by the end of March 2008 by way of a pilot. Building on the pilot phase a second contract was entered into to deliver 800 ONAs to the end of March 2009. A third contract, committing Skills for Care to deliver a further 500 ONA units by the end of March 2010 commenced in April 2009.

Figure 2.2 Key relationships at work in the Skills Brokerage Programme

Training Proposal

Development

Relationship

Sub-Regional Care

Partnerships

Skills for Care

West Midlands

Social Care

Employers

Contractual

Relationship

Business Link

West Midlands

1

4

Programme

Management

Relationship

2

Employer

Interface

Relationship

3

Brokering Change 20An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Skills for Care West Midlands receives remuneration from Business Link on the basis of each completed ONA. Ninety-one percent of this income is paid on to the respective sub-regional care partnership whilst the residual nine per cent is retained by Skills for Care as a contribution towards the management of the brokerage programme, including the provision of the mandatory NVQ level 4 training required by skills brokers.

The programme management relationship

The effective management of the skills brokerage programme is governed by programme management relationship between Skills for Care West Midlands and the seven sub-regional care partnerships and their respective skills brokers.

To manage the programme Skills for Care uses a project manager working on a part time basis and a more junior project co-ordinator working on a full time basis. The project manager oversees the contractual relationship with Business Link and some of the higher-level negotiations with care partnerships whilst the project co-ordinator oversee the day to day management of communications with care partnerships and with the broker network.

Skills for Care have taken an informal, facilitative approach to the management of the skills brokerage programme. Having negotiated ONA delivery targets with each sub-regional care partnership and provided training for skills brokers, Skills for Care has left much of the detail of planning and delivery to care partnerships and brokers themselves. This non-prescriptive approach is intended to allow care partnerships to fit brokerage activity in to their wider programme of support for the social care sector in a way that makes sense within their own local and institutional context.

Skills for Care provides direct, ongoing support for skills brokers through a regular bi-monthly network meeting. These meetings are intended as an opportunity to share with brokers new developments and good practice in the field of social care and training and development. The bi-monthly meetings, chaired by the Skills for Care project manager, also presents an opportunity for brokers to network and share their own learning with their broker colleagues.

The employer interface relationship

The key determinant of effectiveness of the brokerage model and the effectiveness of the brokerage programme in practice is the quality of engagement between care partnerships, skills brokers and social care employers.

At its simplest the employer interface relationship implied by the skills brokerage model requires skills brokers to contact employers and successfully carry out an Organisational Needs Analysis, leading to the generation of a training proposal. In practice however the process of effectively developing the relationship between care partnerships, skills brokers and employers is seen to be a good deal more involved than this simple rendering suggests. Anecdotal evidence from brokers gathered in the course of the evaluation suggests that for many social care employers, and particularly smaller employers with relatively less capacity to develop (yet with relatively greater organisational development needs) there may be the need for significant relationship building and pre-investment before the organisation is ‘ready’ for the formal ONA process.

Examining the conception and quality of the relationship between employers and brokers will be a key element of the evaluation research.

The training proposal development relationship

Having carried out and written up the Organisational Needs Analysis with an employer, the skills broker then forwards the completed ONA pro-forma on to a Business Link West Midlands Skills Relationship Manager. Business Link process the ONA and cross reference the identified needs against their database of raining opportunities. Business Link then go back to the employer with a training proposal detailing the funded and unfunded training available to meet that employer’s needs as outlined within the ONA document. On the basis of the training proposal, employers then contact training providers to arrange for training to take place.

21 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

3. Brokers and the brokerage role

As the custodians of the employer interface relationship, the specialist skills brokers are critical to the viability and effectiveness of the West Midlands social care skills brokerage programme. To gather information on the brokers and their role we carried out a web-based survey of all active brokers.

Professional experience

As discussed, the design theory underpinning the skills brokerage programme places a premium upon the skills brokers’ tacit knowledge, and the relationship between this tacit knowledge and the effectiveness of the programme. To explore the knowledge and experience of brokers in some detail we asked a range of questions about their professional experience and qualifications.

Brokers reported an average of 12 years of professional experience working in the social care sector and an average of 25 years total work experience in total. This suggests that, on average, brokers have spent some 48 per cent of their total working lives within the social care sector.

Figure 2.3 Work experience of specialist skills brokers; years n=13

Total Years

Years in Social Care

0 9 18 27 36 45

41

44

12

25

2

5

Years of Experience

Minimum Reported Average Maximum Reported

The majority of brokers surveyed reported having worked with their current care partnership between two and eight years. The distribution of length of service is shown in figure 2.4, below. The relatively long service of brokers with their respective care partnerships (in most cases predating the skills brokerage programme) means that many brokers have pre-existing relationships with social care employers which, as we see later in the report, appears to have had a positive effect on the employer take up of brokerage services.

Further questioning to explore the range of professional experience revealed a range of interesting insights. As figure 2.5, below, illustrates brokers reported a very wide variety of experience across sectors and specialisms. We found evidence of particularly strong experience in the delivery of frontline services (especially in the area of education and training) and back-office support services across sectors and specialisms. We suspect that the high incidence of experience in support service roles is reflective of the age profile and gender profile of brokers. We also see evidence of a good balance between experience in the private and statutory sectors, although relatively less experience of work within third sector organisations

Areas of relative experiential weakness include delivery experience in the field of business consultancy. This relative weakness may become a more significant impediment as the skills brokerage programme develops over future years and the developmental needs of social care employers become more complex.

Figure 2.4 Length of service with current care partnership n=13

< 1 year

1-2 years

2-4 years

5-6 years

7-8 years

9-10 years

> 10 years

0% 5% 10% 15% 20% 25% 30% 35%

0%

0%

8%

31%

31%

0%

31%

Brokering Change 22An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Given their long and varied work experience, it is not surprising to find that brokers are a well qualified cohort. Reported qualifications are skewed towards the higher end of the qualifications scale and over 70 per cent of brokers holding a qualification at level five or above. The very high percentage of reported level four qualifications is likely attributable to the fact that all brokers must hold a level four NVQ qualification in business support and advice27 in order to be licensed as skills brokers.

All brokers surveyed felt that their professional experience and qualifications had prepared them either ‘well’ or ‘very well’ for their work as a specialist skills broker. This result is very positive. Although we did not specifically explore the hypothetical question of what alternative professional experience or qualifications might have constituted a better preparation for brokerage work, anecdotal evidence gathered through conversations with brokers suggests that more experience in the area of business consultancy, and specifically diagnostic analysis of organisations and organisational problems would be valuable in the broker role.

Figure 2.5 Work experience of specialist skills brokers; occupations n=13

Adult social care

Children and young people's social care

Skills, education and training

Business consultancy

Statutory sector

Private sector

Third sector

0% 20% 40% 60% 80% 100%

1

0

2

2

0

2

0

16

0

8

0

4

7

12

41

42

38

53

31

49

23

16

8

8

9

19

14

27

8

17

15

18

15

7

19

16

33

30

18

31

21

19

Frontline delivery experience Frontline management experienceStrategic management experience Support service experienceVolunteer experience No experience

Figure 2.6 Reported qualifications of skills brokers n=13

Entry Level

Level One

Level Two

Level Three

Level Four

Level Five

Level Six

Level Seven

Level Eight

Professional qual.

0% 10% 20% 30% 40% 50% 60% 70%

8%

0%

15%

23%

31%

69%

23%

15%

8%

0%

Figure 2.7 Effectiveness of professional experience as a preparation for skills broker roles

n=13

54%46%

Very wellWellNeither well nor poorlyPoorlyVery poorly

23 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Tenure and Salary

The majority of brokers were not employed directly by a sub-regional care partnership, but by a third-party organisation who then seconded them into the care partnership. This has fairly clear risk implications for the delivery of the skills brokerage programme, and indeed during the course of the evaluation a number of brokers were withdrawn from their work with the care partnership (and therefore from brokerage activities) at the behest of their employer.

Where the employer was not the care partnership we see (figure 2.9) that the employer in the majority of cases was a local authority and in a minority of cases an NHS organisation such as a primary care trust.

Figure 2.10, below, shows the breakdown of salaries of specialist skills brokers. Given the average broker salary of £27,000 per annum28 and the current total of seventeen brokers, a level of 42 per cent utilisation (figure 2.11, below) suggests that skills partnerships and broker employers are contributing somewhere in the region of £200k per annum to the skills brokerage programme in terms of staff contribution.

Figure 2.8 Employing organisation n=13

77%

23%

I am employed by the care partnershipI am employed by another organisation

Figure 2.9 Employing organisation, where not the care partnership n=10

20%

80%

A local authorityA non-statutoryorganisationAn NHS organisationA social enterpriseA private, for-profit companyI am a self-employed contractor

Figure 2.10 Reported annual salaries of specialist skills brokers n=12

£10 - £15k

£16 - £20k

£21 - £25k

£26 - £30k

£31 - £35k

£36 - £40k

£41 - £45k

0% 10% 20% 30%

0%

8%

23%

31%

8%

23%

0%

Brokering Change 24An Evaluation of the West Midlands Social Care Skills Brokerage Programme

What do brokers do?

Broker respondents suggest that they spend, on average, 42 per cent of their working time on brokerage related activities with the remainder being spent on activities within their care partnership not explicitly related to brokerage.

To better understand the way in which brokers spend their time on brokerage related activities we asked brokers to identify the number of hours during the course of an ‘average’ week that they might expect to spend on a range of seven brokerage tasks. Our findings, shown in figure 2.12, are generally consistent with what we might optimistically expect; namely that brokers tend to spend a greater proportion of their time working on relatively more valuable activities such as completing and writing up ONAs and a smaller proportion of their time on relatively less valuable activities such as administrative tasks. As Skills for Care, care partnerships and brokers move forward with the brokerage programme, ensuring that the time spent by brokers on brokerage tasks is proportionate to the relative public value of those tasks should be an important principle to guide change and improvement.

Figure 2.11 Balance of brokerage and non-brokerage activities for skills brokers

n=13

42%

58%

Non-Brokerage ActivitiesBrokerage Activities

To explore the way in which the role of brokers is changing as the brokerage programme matures, we asked brokers how the time they spent on a range of seven brokerage-related tasks was changing.

Figure 2.12 Hours per week spent on a range of brokerage tasks n=13

Travelling to and from employer meetings

Meeting with employers

Completing ONAs with employers

Writing up ONAs for submission

General administrative tasks

Research and information-sharing

Other brokerage-related activities

0 2 4 6 8

2.0

4.0

4.0

5.0

8.0

8.0

8.0

1.5

2.0

2.2

3.2

3.8

2.0

3.3

0

1.0

1.0

1.0

1.0

0

1.0

Minimum Reported Average Maximum Reported

25 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Through this analysis, illustrated in figure 2.13 below29, we discover a number of interesting things. For the majority of brokers the core business of brokerage - meeting with employers, completing ONAs and writing up ONAs - is on the increase, however for a small minority the opposite is true. More than half of brokers consider that the time they spend on administrative tasks is increasing. A very high proportion of brokers suggest that ‘other brokerage related activities’ are on the increase. This latter finding suggests that the nature of brokerage as understood by the programme management team (and defined in terms of the range of brokerage-related tasks outlined here) may be changing subtly but profoundly at the care partnership level. Further research with brokers to explore what exactly ‘other brokerage related activities’ consist of would be useful.

The only category of brokerage-related tasks in which respondents unanimously felt that either staying about the same or increasing (i.e. not decreasing) was the field of professional research and information sharing. In many respects this is a very positive finding; reflecting the commitment of brokers and their recognition that continuing professional development is critical to their effectiveness as brokers. We believe, based on our work with brokers and observations made during the evaluation, that there is the potential to make improvements and realise efficiencies in the way that brokers carry out professional research and information sharing.

Figure 2.13 Change in time commitment to a range of brokerage tasks n=13

Travelling to and from employers

Meeting with employers

Completing ONAs with employers

Writing up ONAs for submission

General administrative tasks

Research and information-sharing

Other brokerage-related activities

Your "day job"

-30% -15% 0% 15% 30% 45% 60% 75% 90%

-8

-8

0

-15

-15

-23

-15

-8

69%

77%

85%

54%

62%

62%

46%

46%

Increase Decrease

Brokering Change 26An Evaluation of the West Midlands Social Care Skills Brokerage Programme

5. Programme performance

Programme performance

Section three:

6.

Brokering Change 28An Evaluation of the West Midlands Social Care Skills Brokerage Programme

4. Programme activity

Between February 2008 and the end of March 2009 the Social Care Skills Brokerage programme delivered a total of 498 Organisational Needs Analyses (ONAs) to private, voluntary and independent social care providers in the West Midlands at an average of 35.6 ONAs per month30. Figure 3.1, below, shows the variation in monthly output of the programme over the period in question.

Figure 3.2, below, shows the distribution of ONA delivery by sub-regional care partnership area

Figure 3.1 ONA output of the Social Care Skills Brokerage programme, February 2008 - March 2008

0

10

20

30

40

50

60

70

80

Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09

4

44

28

38

24

30

24

40

46

36

22

54

75

33

ON

A c

omp

letio

ns p

er m

onth

ONAs by Month Average number of ONA completions per month (35.6)

The variation31 in total ONA output between care partnerships suggests that there are a number of factors at work influencing output. A simple explanation might be the number of brokers operating out of each partnership where we might expect partnerships with more brokers to deliver more ONAs. We can disprove this hypothesis fairly conclusively by examining the rank correlation between the number of brokers in a given partnership and its output of ONAs. As figure 3.3, below, shows there is no effective correlation between the number of brokers and ONA output. This insight is extremely important as it suggests that growing the number of brokers is not likely, in itself, to be an effective means of growing the delivery capacity of the programme.

Figure 3.2 ONA output of the Social Care Skills Brokerage programme broken down by care partnership sub-regions February 2008 - March 2008

Shropshire

Staffordshire

Black Country

Coventry and Warwickshire

Birmingham

Herefordshire and Worcestershire

Solihull

0 20 40 60 80 100 120

3

61

64

76

91

99

104

29 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

Figure 3.3 Rank correlation between the number of brokers within a care partnership and its ONA output

0

1

2

3

4

5

6

7

0 1 2 3 4 5 6 7

R² = 0.1138

Num

ber

of B

roke

rs (R

ank)

Output (Rank)

Figure 3.4 Rank correlation between the proportion of broker time spent on brokerage activities and ONA output

0

2

4

6

8

10

12

0 2 4 6 8 10 12

R² = 0.4552

Hou

rs p

er w

eek

spen

t on

bro

kera

ge u

ctiv

ity (R

ank)

Output (Rank)

Exploring the data further, we find the only significant correlation occurs between the proportion of total working hours that brokers spend working on brokerage activities and their output (figure 3.4). The conclusion to draw from this is that the most productive brokerage model is likely to be one in which brokers are relatively more dedicated (in terms of time commitment) to brokerage activities and have fewer other responsibilities within the care partnership.

Further variations in partnership output and productivity are likely to be attributable to local hybridisation of the basic skills brokerage model (reflecting the differing priorities which different partnerships attach to brokerage) and the fact that different care partnerships are at different stages of maturity in terms of integrating brokerage into their wide programme of activity. Although we did not examine local hybridisation of the brokerage model in great detail it is possible, from data and from observations, to discern four broad hybrid models of brokerage:

• the developmental broker model, where the work of brokers developing but appears to not yet be well integrated with the rest of partnership activity

• the integrated broker model, where multiple brokers spend a moderate proportion of their time working on brokerage activities and where brokerage appears to be well integrated with the wider programme of care partnership activity

• the senior/junior broker model, where a more senior but less active broker operates as a manager to a junior broker working effectively full-time on brokerage activities.

• the champion broker model, where a small number of brokers are working effectively full-time on brokerage activities and setting the pace for the care partnership as a whole.

Whilst we do not advocate any “one-best-model” of brokerage support we do observe that integrated broker model generates good employer satisfaction whilst the senior/junior model yields high ONA output. The champion broker model gives both good output and good employer satisfaction but requires an high-level of partnership commitment and broker aptitude to achieve.

Brokering Change 30An Evaluation of the West Midlands Social Care Skills Brokerage Programme

5. Broker and programme productivity

Using the programme activity data provided by Business Link West Midlands and data from the survey of brokers we have been able to construct a simple measure of broker and care partnership productivity32. Figure 3.5, below shows the productivity of each of the brokers involved in the programme expressed in terms of the average number of ONAs they have delivered for each week that that have been active as brokers. This measure allows for straightforward comparison between brokers (including brokers outside the Skills for Care programme) regardless of how long they have been active as brokers and allows for benchmarking of change in broker performance over time.

Figure 3.5 Broker productivity expressed as the average number of ONAs completions per week, February 2008 - March 2008

Broker K

Broker L

Broker O

Broker M

Broker J

Broker Q

Broker I

Broker G

Broker E

Broker N

Broker F

Broker H

Broker B

Broker A

Broker D

0 0.2 0.5 0.7 0.9 1.1 1.4 1.6 1.8

0.12

0.16

0.24

0.31

0.50

0.54

0.57

0.58

0.69

0.87

0.89

1.03

1.06

1.35

1.61

Figure 3.6, below, shows the productivity levels for each of the sub-regional care partnership areas expressed in terms of the average number of ONAs delivered per broker per week.

This fairly rudimentary analysis of broker and care partnership productivity reveals significant variations in the relative productivity of care partnership and brokers. This reinforces our assertion above (p.30) that there are likely to be a number of local hybridisations of the basic skills brokerage model. Whilst we are hesitant to suggest that one model is optimal, the output emphasis of the programme does suggests that models where brokers are more productive are generally considered to be perfoming better.

A similarly significant variation was found in the programme data in the lag times between completing an ONA visit with an employer and submitting the completed ONA proforma to Business Link for further processing. Here lag times varied between

Figure 3.6 Care partnership productivity in ONAs per broker per week, February 2008 - March 2008

Coventry and Warwickshire

Shropshire

Staffordshire

Herefordshire and Worcestershire

Black Country

Birmingham

Solihull

0 0.2 0.4 0.6 0.8 1.0 1.2 1.4

0.12

0.46

0.52

0.86

0.88

1.06

1.35

31 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

seven and 37 days with an average time of 14 days. Results are illustrated in figure 3.7, below.

Investigating broker productivity and transmission lag data further we examined the correlation between the two variables by plotting them together (figure 3.8). We discovered, when removing extreme outliner data points, that the correlation generated an R-squared value of 0.80. This means that 80 per cent of the variation in one data set can be accounted by variation in the other and the negative correlation in the data indicated that as lag time increases, productivity decreases, and vice versa. The specific programme management insight to draw form this is that less productive

Figure 3.7 Individual broker lag between completing ONA visit with employer and transmission onto Business Link for processing

Broker K

Broker L

Broker O

Broker A

Broker H

Broker Q

Broker M

Broker I

Broker J

Broker E

Broker G

Broker N

Broker F

Broker D

Broker B

0 days 5 days 10 days 15 days 20 days 25 days 30 days 35 days 40 days

37 days

20 days

17 days

16 days

16 days

15 days

15 days

14 days

13 days

10 days

8 days

7 days

7 days

7 days

7 days

brokers take longer to get their completed ONA paperwork to Business Link and therefore by stipulating a transmission lag target time the productivity of the programme would more than likely be driven up. Where brokers experience persistent difficulty in meeting this lag time target there are likely to be significant and readily identifiable underlying causes such as too much time spent researching training solutions, inadequate time dedicated to brokerage, absence of administrative support.

Figure 3.8 Correlation between broker productivity and transmission lag time for currently active brokers

0

0.5

1.0

1.5

2.0

0d 10d 20d 30d 40d

R² = 0.8062

Bro

ker

Pro

duc

tivity

(ON

As

per

wee

k)

Lag Time

Brokering Change 32An Evaluation of the West Midlands Social Care Skills Brokerage Programme

6. Employer profile

Figure 3.9, below, shows the size of a sample33 of 70 employers who have benefited from the West Midlands Skills Brokerage programme. With almost 37 employees, the average size of employers involved with the programme is somewhat larger than the average headcount of 28 employees for all social care providers across the region.

Figure 3.9 Employee headcounts of employers engaged in the West Midlands Social Care Skills Brokerage Project, January 2008 - March 2008

0

20

40

60

80

100

120

140

160

180

Em

plo

yee

head

coun

t

Sampled Employers

Average size of employers engaged in the social care skills brokerage programmeAverage size of social care employers in the West Midlands

If we take the size of employee headcount as a proxy for organisational capacity (i.e. we assume that larger organisations are likely to be more capable) then we can suggest that the skills brokerage programme is tending to engage relatively more capable organisations. There are a number of plausible explanations for this;

• There may be an element of selection bias - introduced either implicitly or explicitly - on the part of care partnership and brokers when marketing the skills brokerage service leading brokers to contact organisations whom they perceive to be more capable and more able to engage effectively in the brokerage process.

• There may be a self-selection bias as a result of pre-existing engagement with sub-regional care partnerships wherein larger and more capable organisations are more likely to already be engaged with the care partnership and its networks.

• There may be a self-selection bias due to larger and more capable social care employers having a better appreciation of the benefit of training and workforce development on their business.

• There may be a negative selection bias (where smaller care providers actively avoid engagement with the brokerage programme) due to their relatively lower capacity and the associated real and/or perceived problems of releasing staff for training.

Whether to view this apparent selection bias positively or negatively is a rather moot point with arguments both for and against.

There is a strong utilitarian public value argument which suggests that engaging with larger and more capable employers will result in the greatest net improvement in the state of the sector and therefore the greatest net improvement in the state of social care within the region. The rejoinder to this argument is that a relatively more capable social care provider will develop their workforce and service as a result of market and regulatory drivers and so providing a publicly-funded skills brokerage service simply constitutes corporate welfare for these more capable employers.

There is some likelyhood, given the relative newness of the programme and the high-levels of pre-engagement between care partnerships and involved employers, that the programme has essentially been involved to date in harvesting the “low hanging fruit” of social care organisations who are positively predisposed to participating in a programme of this kind. The question of what types of employers the programme

33 Brokering Change An Evaluation of the West Midlands Social Care Skills Brokerage Programme

should target in coming years will be an important for all of the partners involved in the design and deliver of the programme.

Skills brokerage and self-directed employers

In addition to supporting 498 conventional social care employers the skills brokerage programme also delivered a very small number of ONAs- less than five 34 - to individuals in receipt of a direct payment in their capacity as employers of personal assistants35.