WCAC Newsletter Jan - Mar 2015

-

Upload

bm-analysts -

Category

Documents

-

view

225 -

download

3

description

Transcript of WCAC Newsletter Jan - Mar 2015

SUPPLIER PERFORMANCEREVIEW

Feature Article

Jan - March2015

ABOUT US

About the Western Cape Automotive ClusterThe Western Cape Automotive Cluster (WCAC) is a largely privately-funded cluster focusing on developing the competitiveness of the automotive manufacturing industry in the Western Cape. This not for profit organisation is an industry driven initiative, drawing on the leadership and expertise of individuals from a broad range of member firms in the Western Cape.

For more information on the WCAC please visit www.wcac.co.za.

Powered by B&M AnalystsCluster facilitation services are provided by Benchmarking & Manufacturing Analysts SA (Pty) Ltd (B&M Analysts), an organisation that provides specialised services to en-hance sustainable industry development.

For more information on B&M Analysts please visit www.bmanalysts.com.

Our First NewsletterThe Western Cape Automotive Cluster is excited to release our first newsletter! The aim of the newsletters will be to provide members with an update of developments in the automotive industry and within the cluster.

The WCAC is fortunate enough to be affiliated with the South African Automotive Benchmarking Club which enables WCAC members to participate in SAABC activities. The WCAC newsletters will unpack key industry developments which emanate from the SAABC and will also include an update of recent WCAC activities and upcoming activities for member firms. We hope you will enjoy this first edition!

2014 Supplier Performance Review

Enabling Operational Excellence in 2015

Review of last quarter

What’s coming up

Become a member

Contents

04

06

12

16

19

WCAC January - March 2015 3

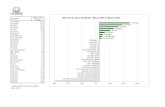

SUPPLIER PERFORMANCE REVIEWBy Douglas Comrie

The latest analysis of benchmarking data from 153 suppliers (47 in South African, 85 in developed countries and a further 21 in devel-oping countries) provides critical insights into the performance of the South African automo-tive industry in 2014 relative to key economies that we compete against in terms of localisa-tion, exports and investment.

Key findings• A status quo assessment finds that South

African suppliers retain a cost competitive-ness disadvantage relative to both Thai and Indian suppliers – supply bases that should be considered the primary competitors in the important Light Commercial Vehicle (LCV) and small vehicle segments respec-tively. Two inter-linked drivers of this are comparatively higher employment costs and lower levels of productivity.

• More positively, some progress is evident over the past year in important areas such as operational practices (waste), productiv-ity (Value Add [VA] per unit of employee cost), skills development (expenditure as a % of remuneration) and even investment (capital investment as a % of sales).

• It is however evident that South African suppliers are likely to struggle to maintain their competitiveness position in the ab-sence of volume growth, creating some ur-gency in terms of identifying new growth prospects for suppliers (in terms of either localisation or OEM production volumes) as well as accelerating the competitiveness improvement progress evident in some measures.

2014

January - March 2015 WCAC4

What does this mean for the industry? Given the magnitude of the competitiveness challenges facing the industry the following areas require consideration:

• Growth - Local and regional production strategies that are aligned with domestic market demand but avoid (or defer) direct competition with ‘ultra low cost production locations’ such as India and Thailand.

• Skills - Accelerate expenditure and improve effectiveness of expenditure on training to above the benchmark level of developing countries.

• Technology - Identify mechanisms for increasing capex (specifically process related) to above the benchmark level of developing countries.

How can members make use of this information?

These aggregate findings are explored in detail with members at regional industry workshops so that industry and key stakeholders are able to use these findings to inform industry support activities.

Over the next several months, individual member firms will also benefit from an enterprise-level analysis that will profile performance and prioritise major improvement opportunities that have the potential to better position the member relative to global competitors.

WCAC January - March 2015 5

By Douglas Comrie

PREAMBLE

The WCAC is affiliated with the SAABC and this article represents the SAABC’s new strategic vision for 2015.

The SAABC has a solid 17-year track record of service delivery and a well-es-tablished membership base. In addition, it has access to a set of well-established benchmarking methodologies, consider-able continuous improvement network facilitation experience and access to extensive data and knowledge resources. These together have enabled the SAABC to foster a collaborative inter-firm cul-ture to the benefit of all members.

However, the SAABC recognises the significance of the important changes in the automotive industry development landscape with:

• The emergence of regional support customers that operate largely in parallel with the SAABC regional chapters - specifically the Durban Automotive Cluster (DAC) and the

Western Cape Automotive Cluster (WCAC).

• The creation of a national steer-ing committee to oversee all supply chain competitiveness improvement activities in the country, namely the Automotive Supply Chain Competi-tiveness Initiative (ASCCI).

Critically, the SAABC Executive Com-mittee is keenly aware of the fact that industry continues to face significant competitiveness challenges and with this in mind it has approved a new strategy that will align with these devel-opments while simultaneously enhanc-ing the effectiveness of the SAABC as a continuous improvement network for the automotive industry in South Af-rica.

ENABLING OPERATIONAL EXCELLENCE IN 2015

January - March 2015 WCAC6

Enable the

competitiveness

of the South

African automotive

manufacturing

supply base.

Increased supplier

competitiveness

(Manufacturing

Value Add [MVA]

per unit of

employee cost

ratio).

To use benchmarking as a platform for firm, cluster and

industry-level continuous improvement activities

OBJECTIVEMISSION

VISION

VISION

MISSION

OBJECTIVE

VISION, MISSION AND OBJECTIVE

WCAC January - March 2015 7

January - March 2015 WCAC8

WCAC January - March 2015 9

STRATEGIC FRAMEWORKThe strategy comprises four components as outlined below. While the first component should be viewed as foundational in nature, the remaining three components should be viewed as strategic pillars. Further, the successful execution of this strategy will be associated with:

• The DAC becoming the de facto KwaZulu-Natal (KZN) chapter of the SAABC at the cost of only the prevailing DAC membership fee (i.e. one DAC fee for current suppliers that are members of both and free SAABC membership to all other DAC supplier members).

• WCAC becoming the de facto Western Cape chapter of the SAABC at the cost of only the pre-vailing WCAC membership fee (i.e. as per the DAC arrangement).

• ASCCI Supplier Capability beneficiary firms being provided with free access to the non-bench-marking-related activities of the SAABC such as the best practice workshops (applicable for the duration of their participation on the ASCCI intervention).

WHAT DOES THIS REALLY MEAN FOR WCAC?Importantly, this also means that WCAC members will access all benefits open to SAABC members and those that are currently members of both industry support bodies will no longer have to pay an additional SAABC membership fee. Tangible benefits to WCAC members include annual benchmarking assessments, strategy development support and access to the national capacity building programme.

3.VALUE

ADDITION

Want to schedule your benchmark or find out more about the work-shop and capacity building activities planned for 2015?

January - March 2015 WCAC10

1.COST

REDUCTION

- 4%Average reduction in membership fees for members in Eastern Cape and Gauteng.

- 100%Average reduction in membership fees for members in KZN and Western Cape (included in standard DAC and WCAC fees).

142% projected increase participation (from 36 to 87 members)

87% increase in access to network resources (from R800k p.a. to R1,500k p.a.).

++ Enhanced support to existing regional industry clusters and ability to support future such initiatives.

++ Enhanced ability to provide objective insight to key na-tional role-players on industry performance and associated industry devel-opment challenges

300% + Planned increase in strategy, best practice & related workshop activities (from 4 to 15) with members being able to access any of 4 KZN, 2 in Gauteng, 4 in Western Cape, 2 in East London and 3 in Port Elizabeth.

2.GROWTH

3.VALUE

ADDITION

WCAC January - March 2015 11

REVIEW OF THE LAST QUARTER FEEDBACK ON RECENT ACTIVITIES

Team Leader Training

Team leaders are the first line of leadership in a firm with key responsibilities of ensuring ef-ficient and effective production on the shop floor and implementing a culture of continuously improving the way the business works. To build meaningful change, the Team Leader training focuses first on understanding theoretical principles and basic implementation processes of WCM in the workplace before applying them in the production environment. The focus here is to ensure that the skills are translated directly into the organisation’s operational competitive-ness and efficiency.

Taking place over a three week period, the Team Leader programme was completed in Febru-ary 2015. 25 Team leaders from six member firms completed the programme which included a management sensitisation briefing and thereafter three modules covering Lean, 5S and Con-tinuous improvement and Problem Solving. To ensure that Team Leaders got maximum benefit from the training, the programme included:

• Theoretical training for each module, each of which were held onsite at Atlantis Foundries, Torre Automotive and Senior Flexonics respectively. Each module also included a test that participants needed to successfully complete

• • Weekly onsite individual mentoring by expert trainer, Nils Wikstrom to ensure that the

theoretical content was being implemented onsite

Overall, the training was highly successful for the Team Leaders that attended.

The course will be aligned to the TRACE programme with the medium term objective being that should the WCAC be able to access additional funding, participants will be able to com-plete the additional TRACE modules and production controller learnership.

January - March 2015 WCAC12

Graduate Development Programme

The cluster is facilitating a Graduate Development Programme which is aimed at addressing the critical shortage of engineering skills within the local automotive industry. The Programme is intended for recent graduates with engineering degrees or diplomas in either mechanical or industrial engineering, with the objective of further developing competencies in line with the industry’s requirements. The cluster hosted their third GDP group training session at Atlantis Foundries on 26 March 2015. The session comprised a group discussion led by programme Mentor, George Ruthven on the key learnings from the Commercial module which includes a closer look at Requests for Quotations, Sourcing and Supplier management, External logistics and Costing. The day ended on a very positive note with a tour of the Atlantis Foundries facil-ity. We would like to thank Cordell Rautenbach and his team for being such gracious hosts on the day.

WCAC January - March 2015 13

State of the automotive industry with Douglas Comrie

WCAC hosted a State of the Automotive Industry workshop on 20 March 2015 at Creative Graphics International. Presented by automotive expert Douglas Comrie, the session unpacked the automotive component industry performance in 2014 and provided valuable insight into the OEM perception of the component manufacturers’ performance over this period. The presentation highlighted a number of operational challenges facing the local automotive indus-try and laid the foundation for a healthy group discussion on what these findings mean for the industry in light of the current state of the automotive industry globally. The presentation slides covering the benchmark findings and overviews of the global and South African automotive industries were distributed to all those in attendance and will undoubtedly be used as a useful reference to help inform strategic and operational improvements throughout the course of the year.

The workshop also included an introductory presentation and factory tour of the host com-pany, Creative Graphics International, which proved immensely informative for a little known segment of the local value chain. We would just like to extend our gratitude to Shaun Rosen-stein (Operations Director) and his team for being such warm hosts on the day.

LEVERAGING INVESTMENT IN PEOPLE - A KEY PILLAR OF PRODUCTIVITY IMPROVEMENTThe only certainty about manufacturing requirements is that they will become more onerous. Goal posts are continually shifting and new demands emerging.

January - March 2015 WCAC14

State of the Automotive Industry Workshop at CGIUnless firms adapt to these changes and their associated challenges, they will fall behind competitors. Whether firms fail, or grasp opportunities afforded by these demands depends on their effective use of all of their resources, with there being four dimensions to this - Machines, Materials, Methods and Manpower. While all are important, the most important of these is Manpower, underlying a firm’s ability to effective manager its people. In addition, this dimension is the only independent variable.

Aligned with effectively manage manpower; a study tour took place in KZN with the focus being “Leveraging investment in people - A key pillar of productivity improvement”. Firms were invited to visit three operations that have made progress in this critical area, namely Smiths Manufacturing, Hesto Harnesses and Celrose Clothing. The theoretical training as well as factory tours proved to be very beneficial for participants, allowing for broader perspective on manufacturing industry.

As a result of the tour, numerous lessons emerged from the three firms visited. In addition, all those in attendance identified clear improvements opportunities for their own firms. Overall, the major findings from the tour noted:

1. A need for a HR Strategy to provide a framework within which to manage people.

2. The importance of having a formal practical training function in place such as a Dojo or practical training centre.

3. The adoption of the necessary lean systems, for example an effective Kanban system.

4. Robust measurement.

These four items were confirmed as being crucial to any firm wishing to leverage their investment in people and ultimately achieve ongoing productivity improvements.

“I will definitely implement / improve on activities highlighted on tour”

“I acknowledged a lot from this training, learning from how different companies operate”

January - March 2015 WCAC 15

WHAT’S COMING UP OPERATIONAL COMPETITIVENESS

Firm level benchmarkingOne of the primary activities of the Western Cape Automotive Cluster is firm-level benchmarking to support operational competitiveness. Firm-level benchmarking is being increasingly viewed by the local auto industry, including the OEMs, as being crucial to establishing world class standards amongst local suppliers.

The benchmarking process represents an important continuous improvement mechanism intended to objectively inform management decisions on competitiveness and sustainability challenges. The findings, conclusions and recommendations contained in the benchmarking report are considered to provide important inputs into the company’s strategic and operational decision-making processes. Benchmarking is intended to be an annual activity whereby a firm reviews its performance on annual bases.

Each cluster member firm will receive their annual benchmark during the course of the period April to June 2015. This is the second wave of benchmarking since the cluster’s inception and we look forward to ensuring the benchmark programme remains a cornerstone of operational and strategic improvement for our member firms.

DIARISE NOW! STUDY TOURS AND TRAININGThe WCAC in collaboration with the SAABC has a jam packed study tour programme planned for 2015! The study tours offer a unique opportunity for management in the automotive sector to expand their knowledge base. Attendees are able to explore the theoretical and practical implementation of various elements of World Class Manufacturing at other automotive component firms. Key focus areas for 2015 include: Leveraging investment in people; Optimising availability of capital investment and Lean management. These study tours are typically very popular and provide a fantastic platform for shared learning among industry peers, so please see the plan for the year below to plan your diaries accordingly. The remaining three workshops will be held in the second half of the year and you can expect to hear more details from the facilitation team closer to the time.

KZN GP WC EL PE

State of automotive industryPositioning of the SA supply basein relation to key trends shaping the global and national automotiveindustry Leveraging investment in peopleA key pillar of productivity improvement

Optimising availability of capitalinvestment Leveraging competitiveadvantage from TPM

Lean managementIdentifying and executing projects that enhance total organisational productivity and competitiveness

2015 BEST PRACTICE LEARNING THROUGH STUDY TOURS AND CAPACITY BUILDING SESSIONS

22 & 23April2015

July2015

Nov2015

03 Nov2015

04 Nov2015

15 & 16July

2015

13 April2015

15August

2015

12 & 13May 2015

22 & 23Sept2015

01 & 02Dec

2015

11 & 12August

2015

21 January

13 April

20March

10February

9February

To join us for this workshop, please confirm your attendance via email ([email protected]).

WCAC January - March 2015 17

OPTIMISING AVAILABILITY OF CAPITAL INVESTMENT – LEVERAGING COMPETITIVE ADVANTAGE FROM TPM

As part of the 2015 Best Practice Learning Sessions, a lean training session will be taking place in East London on 12 May 2015. The jam packed day will focus on Optimising Availability of Capital Investment – Leveraging competitive advantage from TPM, looking at both the necessary theory and best practice concepts.

The day will include a focus on the key areas of improving the effectiveness of capital by targeting major losses, the importance of involving operators in the maintenance process and the necessary training to better support maintenance, opportunities to improve maintenance efficiency and effectiveness at firms, and the area of life-cycle equipment management and maintenance prevention design.

For more information and to join us for this workshop, please contact [email protected].

BECOME A MEMBER!

We welcome membership enquiries from automotive manufacturing companies

with operations in South Africa.

For further information please either call +27 (0) 21 552 0240 or email the

WCAC ([email protected]).

WCAC January - March 2015 19