Vol XXXII, No 10 October 2001 - OPEC...October 2001 1 Printed in Austria by Ueberreuter Print and...

Transcript of Vol XXXII, No 10 October 2001 - OPEC...October 2001 1 Printed in Austria by Ueberreuter Print and...

October 2001 1

Printed in Austria by Ueberreuter Print and Digimedia

P u b l i s h e r sOrganization of the PetroleumExporting Countries, Obere Donau-strasse 93, 1020 Vienna, Austria.

Telephone: +43 1 211 12/0;Telefax: +43 1 216 4320;Public Relations & InformationDepartment fax: +43 1 214 9827.E-mail: [email protected]: OPEC News Agency: [email protected] site: http://www.opec.org.Hard copy subscription: $70/12 issues.

M e m b e r s h i p a n d a i m sOPEC is a permanent, intergovernmental Or-ganization, established in Baghdad, September10–14, 1960, by IR Iran, Iraq, Kuwait, SaudiArabia and Venezuela. Its objective is to co-ordinate and unify petroleum policies amongMember Countries, in order to secure fair andstable prices for petroleum producers; an effi-cient, economic and regular supply of petro-leum to consuming nations; and a fair returnon capital to those investing in the industry.

The Organization comprises the fiveFounding Members and six other Full Mem-bers: Qatar (joined in 1961); Indonesia (1962);SP Libyan AJ (1962); United Arab Emirates(Abu Dhabi, 1967); Algeria (1969); andNigeria (1971). Ecuador joined the Organiza-tion in 1973 and left in 1992; Gabon joined in1975 and left in 1995.

S e c r e t a r i a t o f f i c i a l sSecretary General Dr Alí Rodríguez Araque

Director,Research Division Dr Adnan Shihab-Eldin

Head,Energy Studies Department Dr Rezki Lounnas

Head, Petroleum MarketAnalysis Department Javad Yarjani

Head, Data ServicesDepartment Dr Muhammad A Al Tayyeb

Head, PR & InformationDepartment Farouk U Muhammed, mni

Head, Administration &Human Resources Department Senussi J Senussi

Head, Office of theSecretary General Karin Chacin

Legal Officer Dolores Dobarro

W e b s i t eVisit the OPEC Web site for the latest news andinformation about the Organization and itsMember Countries. The URL is

http://www.opec.org

T h i s m o n t h ’ s c o v e r . . .shows the speakers at the closing session of the OPECSeminar on OPEC and the Global Energy Balance (seeOPEC Seminar beginning on page 12). Inset is Presi-dent Hugo Chávez of Venezuela during his visit to theOPEC Secretariat (see article on page 8).

2 N O T I C E B O A R DForthcoming conferences and other events

3 C O M M E N T A R YHarnessing global synergyWith the threat of a worldwide recession looming ever larger, thepoorer members of the global community should not be forgotten

4 F O R U MThe outlook for world oil prices and the impact on the gas industryBy Javad Yarjani, Head, OPEC’s Petroleum Market Analysis Dept

8 P R E S I D E N T I A L V I S I TVenezuelan President Hugo Chávez visits OPEC and OPEC Fund

12 O P E C S E M I N A ROPEC and the Global Energy Balance

20 P R E S S R E L E A S EResolutions of the 117th Meeting of the OPEC Conference

21 N E W S L I N EEnergy stories concerning OPEC and the Third World

31 M A R K E T R E V I E WOil market monitoring report for September 2001

48 M E M B E R C O U N T R Y F O C U SFinancial and development news about OPEC Countries

53 O P E C F U N D N E W SRecent loans and grants made by the OPEC Fund

55 A D V E R T I S I N G R A T E SHow to advertise in this magazine

56 O R D E R F O R MPublications: subscriptions and single orders

57 O P E C P U B L I C A T I O N SInformation available on the Organization

Indexed and abstracted in PAIS International

Vol XXXII, No 10 ISSN 0474-6279 October 2001

2 OPEC Bulletin

N O T I C E B O A R D

SP Libyan AJ appoints newChairman of theNational Oil Corporation

The SP Libyan AJ has appointed HE DrAbdulhafid Mahmoud Zlitni (pictured)

as the newChairman ofthe country’sNational OilCorporation(NOC). DrM a h m o u dZlitni, whotakes overfrom HEA h m e dAbdulkarim

Ahmed, was born in 1938 in the Libyancapital Tripoli. He holds a BSc in eco-nomics and commerce from the Univer-sity of Libya in Benghazi, and an MScand PhD in economics from the VictoriaUniversity of Manchester in the UK.The new NOC Chairman has held vari-ous high-level positions in Libya, includ-ing Minister of Education (1980-86),Co-Chairman of the Arab-African Un-ion (1986-87), Governor of the CentralBank (1990-95) and Minister of Na-tional Economy and Trade (1996-2000).Dr Mahmoud Zlitni, who has also heldseveral academic posts through his dis-tinguished career, is married with fivechildren.

Forthcoming events

London, UK, December 3–4, 2001, 16th

Annual Conference & Exhibition: Floating Pro-duction Systems. Details: Bookings Depart-ment, IBC Gulf Conferences, GilmooraHouse, 57–61 Mortimer Street, LondonW1N 8HS, UK. Tel: +44 (0)1932 893851;fax: +44 (0)1932 893893; e-mail:[email protected]; www.ibcfps.com.

Luanda, Angola, December 3–4, 2001, Oiland Gas in Angola 2001. Details: CWC Asso-ciates, 3 Tyers Gate, London SE1 3HX, UK.Tel: +44 (0)20 7089 4200; fax: +44 (0)207089 4201; e-mail: [email protected]; www.thecwcgroup.com.

Houston, USA, December 3–4, 2001, andTrinidad & Tobago, December 6–7, 2001,Buying and Selling Oil and Gas Assets. Details:Conference Connection Administrators PteLtd, 212A Telok Ayer Street, Singapore

Dhahran, Saudi ArabiaFebruary 4–7, 2002

SOPEC 20025th International Oil, Gas,Petrochemical and Power

Exhibition and Conference

Details: ITE Group PLC105 Salusbury RdLondon NW6 6RG, UKTel: +44 (0)20 7596 5092Fax: +44 (0)20 7596 5106E-mail: tariq.mohammed@ ite-exhibitions.comwww.ite-exhibitions.com

068645. Tel: +65 226 5280; fax: +65 2264117; e-mail: [email protected]; Website: www.cconnection.org/bsoahome.htm.

Trinidad & Tobago, December 3–5, 2001,Production Sharing Contracts and InternationalPetroleum Fiscal Systems. Details: ConferenceConnection Administrators Pte Ltd, 212ATelok Ayer Street, Singapore 068645. Tel:+65 226 5280; fax: +65 226 4117; e-mail:[email protected]; Web site:www.cconnection.org/pschome.htm.

Rome, Italy, December 3–5, 2001, WorldLNG Summit. Details: CWC Associates, 3Tyers Gate, London SE1 3HX, UK. Tel: +44(0)20 7089 4200; fax: +44 (0)20 7089 4201;e-mail: [email protected];www.thecwcgroup.com.

London, UK, December 6–7, 2001, TheIntegrated European Gas Network: Investmentsin Infrastructure. Details: Monica Gahlin,Energyforum.net. Tel: +46 8 20 90 95; fax:+46 8 20 90 73; e-mail: [email protected]; www.energyforum.net/gas.

Ankara, Turkey, December 6–9, 2001, 1st

International Energy Exhibition: Enexp Türkiye.Details: Farshid Bagherian, General Man-ager, Akart, 28/1, Ayten sok. Mebusevleri,Tandogan, Ankara, Turkey. Tel: +30 3122138530; fax: +90 312 2138532 or 4829372;e-mail: [email protected].

Oslo, Norway, December 10–11, 2001, Fi-nancial Mathematics and Energy Derivatives.Details: Energyforum.net, ChristopherWaldén. Tel: +46 8 20 90 95; fax: +46 8 2090 73; e-mail: [email protected].

London, UK, December 13–14, 2001,Training course on Custody Transfer of CrudeOil — Trading & Loss Control Issues. Details:IP Training, Institute of Petroleum, 61 NewCavendish Street, London W1G 7AR, UK.Tel: +44 (0)20 7467 7100; fax: +44 (0)20

Houston, TX, USADecember 3–4, 2001

Nigeria Oil and Gas Summit

Details: Bookings DepartmentIBC Gulf Conferences57–61 Mortimer StreetLondon W1N 8JX, UKTel: +44 (0)1932 893851Fax: +44 (0)1932 893893E-mail: [email protected]/nigeria

7255 1472; e-mail: [email protected].

New Delhi, India, January 14–16, 2002,Indian Oil and Gas Conference. Details:Conference Connection Administrators PteLtd, 212A Telok Ayer Street, Singapore068645. Tel: +65 226 5280; fax: +65 2264117; e-mail: [email protected]; Website: www.cconnection.org/iogchome.htm.

Dubai, UAE, January 20–23, 2001, Inter-national Oil Trading and Price Risk Manage-ment. Details: Conference ConnectionAdministrators Pte Ltd, 212A Telok AyerStreet, Singapore 068645. Tel: +65 226 5280;fax: +65 226 4117; e-mail: [email protected];www.cconnection. org/oiltradinghome.htm.

Singapore, January 24–25, 2002, and Dubai,UAE, January 27–28, 2002, Buying andSelling Oil and Gas Assets. Details: ConferenceConnection Administrators Pte Ltd, 212ATelok Ayer Street, Singapore 068645. Tel:+65 226 5280; fax: +65 226 4117; e-mail:[email protected]; www.cconnection.org/bsoahome.htm.

Madrid, Spain, January 28–29, 2002, In-vestment Opportunities in Spain’s Energy In-dustry. Details: CWC Associates, 3 TyersGate, London SE1 3HX, UK. Tel: +44 (0)207089 4200; fax: +44 (0)20 7089 4201; e-mail: [email protected];www.thecwcgroup.com.

London, UK, May 2–3, 2001, 3rd AnnualConference on Oil and Gas Investments inNigeria 2002. Details: CWC Associates, 3Tyers Gate, London SE1 3HX, UK. Tel: +44(0)20 7089 4200; fax: +44 (0)20 7089 4201;e-mail: [email protected];www.thecwcgroup.com.

October 2001 3

C O M M E N T A R Y

Harnessing global synergyWith the threat of a worldwide recession looming ever larger, the

poorer members of the global community should not be forgotten

E d i t o r i a l p o l i c yOPEC Bulletin is published by the Public

Relations & Information Department. The

contents do not necessarily reflect the official

views of OPEC or its Member Countries.

Names and boundaries on any maps should not

be regarded as authoritative. No responsibility

is taken for claims or contents of advertise-

ments. Editorial material may be freely repro-

duced (unless copyrighted), crediting OPEC

Bulletin as the source. A copy to the Editor-in-

Chief would be appreciated.

C o n t r i b u t o r sOPEC Bulletin welcomes original contribu-

tions on the technical, financial and environ-

mental aspects of all stages of the energy indus-

try, including letters for publication, research

reports and project descriptions with support-

ing illustrations and photographs.

E d i t o r i a l s t a f fEditor-in-Chief Farouk U Muhammed, mni

Editor Graham Patterson

Assistant Editor Philippa Webb

Production Diana Lavnick

Design Elfi Plakolm

Circulation Damir Ivankovic

A d v e r t i s e m e n t sOPEC Bulletin reaches the decision-makersin Member Countries. For details of its rea-sonable advertisement rates see the appropri-ate page at the end of the magazine. Ordersfrom Member Countries (and areas not listedbelow) should be sent directly to the Editor-in-Chief at the Secretariat address. Other-wise, orders should be placed through thefollowing Advertising Representatives:

North America: Donnelly & Associates,PO Box 851471, Richardson, Texas 75085-1471, USA. Tel: +1 972 437 9557; fax: +1 972437 9558.

Europe: G Arnold Teesing BV, Molenland32, 3994 TA Houten, The Netherlands. Tel:+31 30 6340660; fax: +31 30 6590690;e-mail: [email protected].

Middle East: Imprint International, Suite3, 16 Colinette Rd, Putney, London SW156QQ, UK. Tel: +44 (0)181 785 3775; fax:+44 (0)171 837 2764.

Southern Africa: International MediaReps, Pvt Bag X18, Bryanston, 2021 SouthAfrica. Tel: +2711 706 2820; fax: +2711 7062892.

For most of the 1990s, it seemed as ifnothing could stop the worldeconomy. People in the industrial-

ized nations talked endlessly of the neweconomy and the supposed death of theold boom-bust cycle. Tech stocks boomed,making the young founders of manyInternet start-ups multi-millionaires almostovernight. A new phrase — the ‘Goldilockseconomy’ — was even coined to describethe US economy, which, like the soup inthe popular children’s fairy tale of thatname, was not too hot and not too cold, butjust the right temperature. The old eco-nomic paradigms, it seemed, had been aban-doned, rotting away like empty, disusedfactories, mere relics of the industrial revo-lution.

Meanwhile, in world’s poorer countries,nothing much appeared to change. In thedeveloping nations, countless millions ofpeople remained mired in poverty, withbarely adequate nourishment and watersupplies, and without access to proper healthcare, education, and many other things thatthe citizens of the industrialized world takefor granted. It seemed as if the acceleratingeconomic success of the developed nationswas merely leaving the world’s poor furtherand further behind, widening the alreadyyawning chasm between the haves and thehave-nots.

Realistically speaking, there is no pros-pect that the existing gap between Northand South will be bridged any time soon.However, global economic prospects, whichhad begun to darken even before the eventsof September 11, have altered drastically.The talk is still of a world economy thatcannot be stopped — but this time thedirection is not upward, but downward. Adifferent buzzword is on the lips of thosegurus who, until not so long ago, wereproclaiming the discovery of some kind ofeconomic Holy Grail. The ‘Goldilockseconomy’ has been replaced by a ‘synchro-nous recession’ — one in which the world’smajor economies, including the US, Japan,

Germany and perhaps other Europeancountries as well, all register negative growthsimultaneously.

Such a scenario, warn some economists,could lead to a global downturn on a scalenot seen since the 1930s. If one region ofthe world sinks into recession, growth inother areas can help contribute to recoveryin the afflicted region. But if everybodysinks together, who will pull who out of theswamp? And if this nightmare scenario doescome to pass, it is not just the industrializednations that will suffer. Developing coun-tries, many of them heavily reliant on ex-ports of raw materials — including, of course,oil and natural gas — will find their marketsshrinking and could be dragged under.Trade and foreign direct investment mightwell be hit simultaneously.

The starkness of the reality we are nowfacing ought to give us pause for thought.It is becoming ever more apparent that thevarious elements and regions that make upthe global economy are now intertwined soclosely and interact in ways so complex thatwe may never fully understand them. Glo-balization is not an option that humanitycan either choose or discard. It is simply afact of 21st century life. That does not mean,however, that we must accept the world theway is — inequalities and all. We can, in-deed we must, try to change it for the bet-ter.

The noted science fiction authorWilliam Gibson is often quoted as saying:“The future is already here — it’s justunevenly distributed.” What is needed now,in seeking to combat the threat of a syn-chronous recession, is greater synergy be-tween all nations of the world, developingand developed alike. The intense scrutinythat is currently being focused on the worldeconomy in this time of crisis offers us anexcellent opportunity to re-evaluate, and totry to redress, some of the basic structuralflaws that have led to the North-Southdivide. It is an opportunity that should befirmly grasped.

4 OPEC Bulletin

F O R U MF O R U M

Globalization is actually widening,deepening and speeding up the world’sability to interconnect in a variety of ways,from finance and trade to computeriza-tion and modern technology. It has led tothe liberalization and privatization of theglobal energy sector, which has seen amajor restructuring of the leading oil andgas players, through mergers and acquisi-tions.

Environmental concerns have come tothe fore, necessitating wide-rangingchanges throughout the petroleum indus-try. The dimensions and complexity of thecontemporary challenges facing all of us inthe energy industry, whether oil producersor consumers, are considerable and everchanging.

As far as the energy industry is con-cerned, we all know that global economicgrowth drives demand for oil. The OPECSecretariat has forecast that growth in glo-bal gross domestic product will averagemore than three per cent annually over thenext 20 years. Oil is, therefore, set tomaintain its leading position in supplyingthe world’s energy needs for at least theforeseeable future.

OPEC, in accounting for 76 per centof global proven oil reserves, will continueto play a fundamental role in the worldenergy scene, especially as the key supplierof the incremental barrel. In fact, Figure 1shows that by 2020 world oil demandcould be in excess of 100 million barrels/day and with non-OPEC oil productionlikely to remain relatively stable, OPECMember Countries will be relied upon tosupply the lion’s share of the new demand,which will mostly come from developingnations.

Both oil and gas will play asignificant role in the energyindustry of the early 21st cen-tury, writes the Head ofOPEC’s Petroleum MarketAnalysis Department, JavadYarjani,* in this article.

* Based on Mr Yarjani’s presentation to the7th Annual Middle East Gas Summit, Mus-cat, Oman, October 15–17, 2001.

The global economy of the new mil-lennium is indeed far removed fromthe world economic order OPEC

encountered at its creation some 41 yearsago. Globalization is proving to be a pow-erful force of transformation, opening upborders to trade and capital. Rapid social,political and economic changes are com-bining to reshape the world we live in,although not always to the benefit of all,with a number of social and economicproblems rising to the surface.

In tandem with this oil growth comesnatural gas, which OPEC Members alsohave in abundance. Over the years, gas hasbeen increasing its profile as a fuel ofchoice. It is safe, reliable and a highlyefficient source of power generation. It isnow relatively cheap to produce, althoughcostly to transport to the consuming mar-kets.

Environmental awarenessPerhaps what is most significant in

these days of environmental awareness isthe fact that gas is a cleaner burning fuelthan oil, and substantially more so thancoal. Given the continued market pen-etration of combined cycle gas technologyin power generation, as well as the increas-ing effects of environmental concerns, thispopular resource is expected to be a grow-ing source of energy for fuelling the globaleconomy.

Gas turbine plants have lower capitalcosts, are quick to build, are more efficientand emit fewer pollutants than other fossilfuel based power units. That is why amajor share of new electricity generatingcapacity will be based on gas.

Again, looking at our estimates, theyshow that, globally, the share of gas in thetotal energy mix is expected to rise from22.7 per cent in 2000 to 25.5 per cent in2010 and still further to 29.1 per cent in2020. At the same time, the share of oil inthe mix will slip to 39.9 per cent in 2010from 41 per cent last year, declining againto 38.8 per cent in 2020.

Looking just at the OECD region, theshare of gas in the energy mix is set to risefrom 21.3 per cent last year to 24.3 percent in 2010. By 2020, this figure is ex-

The outlook for world oil pricesand the impact on the gas industry

October 2001 5

F O R U M

pected to have reached 27.6 per cent.Again, compare this with oil, and you seea decline in the mix from 44 per cent in2000 to 42.7 per cent in 2010 and to 41.4per cent in 2020.

In non-OECD countries, the upwardpath for gas is again similar, with its sharein the mix expanding from 24.7 per centin 2000 to 26.9 per cent 10 years later. In2020, the figure is slated to reach 30.4 percent. Here the picture for oil is more stablewith the share falling from 36.8 per centlast year to 36.3 per cent by 2020.

It certainly is an intriguing time to bein the petroleum business, and the gassector is proving to be no exception. Greatstrides have been made since the time gasdiscoveries were only made in associationwith crude exploration activities — a by-product of the oil, as it were.

Unlike the oil market, there is, as yet,

no global market for natural gas, due mainlyto its costly and difficult transportation,coupled with the uneven distribution ofgas reserves throughout the world. How-ever, today’s natural gas market is becom-ing increasingly structured and holdstremendous opportunities for the future.It is a relatively young industry and, evenwith current known reserves, productionis expected to increase significantly.

Untapped gas reservesJudging by the latest research, there is

a lot of untapped gas still waiting to beproduced. Some analysts maintain that,worldwide, natural gas may have up tofour times the resource potential of crude.That spells good news for our MemberCountries, who together possess over 75.5trillion cubic metres of proven gas re-serves, almost 46 per cent of the global

total. For example, Iran, which has thesecond largest gas reserves in the worldafter Russia, has seen its proven depositsrise from 17tr cu m in 1990 to 26.6tr cu min 2000.

In fact, virtually all OPEC MemberCountries have seen expansions in theirgas reserves over the years. Moreover, manyof them have now become established asmajor players in the world gas markets.Algeria, Indonesia, Libya, the United ArabEmirates, and more recently, Qatar andNigeria, are all exporters of gas.

Other Member Countries, such asSaudi Arabia, have gas projects planned,while there is an ambitious scheme be-tween two of our Members for Qatar tosupply gas to the UAE. All these develop-ments have led to an increasing outputcapability within OPEC. The Organiza-tion’s marketed natural gas production in

0

20

40

60

80

100

120non-OPEC productionworld oil demand

20202015201020052000

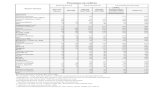

Figure 1: World oil demand and non-OPEC oil production outlook

m b/d

6 OPEC Bulletin

F O R U M

2000 stood at almost 395 billion cu m,compared with 225bn cu m in 1990.However, last year’s output only repre-sented some 16 per cent of the worldwideproduction figure, which shows thefavorable reserves-to-production ratio thatexists within our Organization. This willhold us in good stead for the future as gasdevelopment projects are expanded.

Expanding gas marketApart from the global benefits of an

expanding gas market, especially from theenvironmental standpoint, the fuel alsorepresents a valuable additional asset inrevenue generation for our Member Coun-tries. However, fluctuations in crude oilprices are detrimental to those of gas, giventhe link between the prices of the twofuels, and this subsequently affects theamount of revenue we can earn from gas.

has been learned from past experience isthat an oil price that is too high or too lowdoes not benefit either the producer or theconsumer. Of course, there will always besections of the economy that will prosperunder the different price scenarios, butoverall, large swings in the price of oil aregenerally counterproductive.

An oil market that is stable, with a fairand equitable price, is the way forward forglobal economic prosperity. This is some-thing that OPEC has been professing formany years. And just as a stable, fair priceis essential to the welfare of the oil sector,so the same is true for the gas industry. Ina situation of perpetual instability, it isvery difficult to budget for the years aheadand earmark sufficient investment for gassupply projects, which, by their very na-ture, are costly.

An unstable oil market does not, of

Generally, as more investment isploughed into gas projects, the scope fordeveloping this additional source of in-come will increase. In addition, gas is fastbecoming a substitute for oil products insatisfying our domestic consumption,which ultimately leaves more crude avail-able for export.

Throughout its history, OPEC hashad to overcome numerous difficult chal-lenges, both politically and economically.In fact, it has lived with the spectre of bothhigh and low oil prices, which, in the past,had profound effects on the globaleconomy. Today, the changed worldeconomy is clearly less sensitive to sharpoil price movements, compared with theboom and bust cycles experienced over thepast two decades.

Nevertheless, the simple fact is thatfluctuating oil prices benefit no one. What

0

5

10

15

20

25

30

35

real

nominal

010098969492908886848280787674721970

Figure 2: OPEC spot Reference Basket price 1970–2001

$/b

October 2001 7

F O R U M

‘When we talkabout marketstability, it isvery importantto put today’scrude prices intotheir properhistoricalcontext.’

course, just affect the oil and gas industry.It can also have an adverse effect on theglobal economy, which, in turn affectsdemand for petroleum. It is a vicious cir-cle. With projected demand for oil and gasincreasing in the years ahead, there is anever-greater need to achieve — and sustain— stability in the international petroleummarket.

Deeper understandingNo one is more aware than OPEC of

the need for market stability. Over theyears, the Organization has undertakencountless measures to stabilize the market,often making a substantial sacrifice.Throughout these roller-coaster years, wegained a much deeper understanding ofhow the market works, of its complexmechanisms and its underlying psychol-ogy, as well as a clear appreciation of howother parties in the market react.

OPEC has undoubtedly grown in sta-tus as a key international player, with theproven ability to be innovative and con-structive in the decisions it takes. Themost notable recent example of this hasbeen the successful introduction of ourprice band mechanism last year, whichcombines the flexibility to cope with day-to-day market fluctuations with the needto keep prices within a manageable rangeof $22–28/b that balances the interests ofproducers and consumers.

Discounting the unfortunate events ofthe past few weeks, which have put pricesunder renewed pressure, the average priceof the OPEC Basket so far this year hasremained mostly around the centre of theband, which is widely deemed acceptableto most parties in the oil industry as beingfair. The price band mechanism has beena timely innovation, since it is acting as avaluable barometer for market movementsand can help us chart the direction weshould take in the future.

Maintaining a balanceToday, due to the tragic events of

September 11 in the United States, we arefacing a strong challenge of maintaining abalance in the oil market, while the globaleconomy weakens. This requires very care-ful monitoring of economic trends in the

leading industrialized nations as we seek togauge how this will impact on oil demand.

So far this year, OPEC has felt itnecessary to reduce output by 3.5m b/d, inorder to keep prices within its prescribedband, but our Member Countries are con-

stantly reviewing market trends to try andstay one step ahead of developments.

When we talk about market stability,it is very important to put today’s crudeprices into their proper historical context.Even in nominal terms, the so-calledhigh prices of the past two years are stillwell below those of two decades ago.Even the highest recent monthly averageof $31.48/b in September last year isbelow the annual average of $32.38/b in1982.

It is also important to note that nomi-nal oil prices do not reflect the erosion inthe value of the barrel with time. This isdue mainly to inflation and, depending onthe period under consideration, on cur-rency fluctuations. Thus, we can see fromFigure 2 that the average price of theBasket in the first nine months of this yearof $24.60/b would, in real terms, havebeen equivalent to just over $8/b at mid-

1970s prices. This is well below the nomi-nal level of oil prices in that period ofaround $11–12/b.

Measured in year 2000 US dollars, theprice of oil today is only about 40 per centof its average trend level of 20 years ago.Put simply, consumers are paying far lessfor their crude now, in real terms, thanthey were two decades ago. It is also inter-esting to draw comparisons with OPEC’starget prices over the years, compared withcurrent levels. In December 1986, theOrganization was pursuing a price targetof $18/b. Today, adjusted for inflation,that figure would be around $27/b, which,interestingly enough is within the priceband. By July 1990, OPEC had increasedits price target to $21/b. Again, if trans-lated into 2001 terms, that would alsostand at around the $27/b mark.

Also worth mentioning is the first min-isterial meeting of the Gas Exporting Coun-tries’ Forum, which was held in Iran inMay. This initiative to bring the world’sleading gas exporters together stemmedfrom the inaugural meeting of high-levelexperts from these nations in March.

Resounding successThe Forum proved to be a resounding

success in creating a unique opportunityfor a variety of views and ideas to beexchanged. The gathering firmly plantedthe roots for further co-operation amongthe leading gas players in the future and welook forward to the next meeting, to beheld in another OPEC Member Country,Algeria, next year.

This move is indeed a welcome devel-opment for all associated with the gasindustry, since, as with oil, co-operation atall levels is essential if the gas sector is tosuccessfully meet the challenges that lieahead in the early 21st century.

With a stable and equitable oil price,coupled with a suitable and enabling envi-ronment, today’s gas industry will go fromstrength to strength and most importantly,offer an alternative and strong source ofincome for our Member Countries’ devel-oping economies. Oil will still be the pre-dominant energy source of the future, butgas is set to remain close on its heels in theyears to come.

8 OPEC Bulletin

P R E S I D E N T I A L V I S I TP R E S I D E N T I A L V I S I T

Venezuelan President Hugo Chávez visitsOPEC Secretariat and OPEC Fund

Venezuelan President Hugo Chávezvisited the OPEC Secretariat andthe OPEC Fund in October, dur-

ing the Austrian leg of his tour of Europe,Africa and the Middle East, reports theOPEC News Agency.

Addressing staff at the OPEC Secre-tariat, President Chávez pointed out thatthe Organization and its Member Coun-tries were facing difficult times, as a result ofunforeseen events, and stressed the need forsecuring a “fair and equitable” oil price oninternational markets.

“The oil market is facing a difficultsituation and prices are threatened by im-

balance,” he said in his early morning speechto the OPEC Secretariat in Vienna.

Chávez, who was accompanied on histour by a number of high-ranking govern-ment officials, said that during his talkswith world leaders he had stipulated that oilprices could not be allowed to fall to verylow levels again.

“We need to have a balanced and fairlevel. We don’t want to see them too high,but we must not allow them to come downtoo low,” he asserted.

The Venezuelan President said OPECwould continue to work towards maintain-ing market equilibrium, adding that hisgovernment was firmly committed to the

Right: OPEC Secretary General Dr AlíRodríguez Araque (second r) introduces Ven-ezuelan President Hugo Chávez (second l).Flanking them are Minister of Energy andMines, Alvaro Silva Calderón (r) and Minis-ter of Foreign Affairs, Luis Alfonso Davila (l).

Left: Theaudience, whichincluded Ven-ezuela’s Ambassa-dor to Austria,Gustavo Márquez(front row, centre)listens to PresidentChávez’s speech.

October 2001 9

P R E S I D E N T I A L V I S I T

organization and its policies and objectives.In paying tribute to the work of the

Organization, its Member Countries andthe employees of the Secretariat, he notedthat OPEC had played a very importantrole in the 20th century.

However, it had faced some difficulttimes throughout its history, and was oftenseen as an enemy of the West and the worldeconomy.

Chávez said that in the 21st century,OPEC needed to become very strong andadopt a more geopolitical role, bridging theglobal regions of Africa, Asia, Latin America

and the Caribbean and promoting co-op-eration between North and South.

Turning to his tour, he said that it hadactually been planned in January this year,but following the attacks on New York andWashington on September 11, his visits tothe different countries had taken on a newprofile.

Chávez maintained that although nocorner of the world had been unaffected bythose events, “we will continue going for-ward and our Organization must remainsolid,” he said.

Chávez said that although his countryhad condemned the attacks on the UnitedStates and was “raising its flag” against the

current events, he was concerned about thebombing of innocent people in Afghani-stan and very fearful of war.

“If we have to make war, it should be awar against debt, a war against hunger anda war against injustice. We must think moredeeply. If we want peace, we must havejustice,” he said.

Chávez said he had made very closecontacts with other Member Countries ofthe Organization and had reached a betterunderstanding of their cultures and ways oflife.

The Second OPEC Summit of Sover-eigns and Heads of State, held in Venezuelalast year, had gone a long way in developingrelations among OPEC nations and hadoffered a “wonderful opportunity to showour people to the world.”

Right: PresidentChávez makes apoint during his

address.

Above: PresidentChávez showsoff the com-memorativesalver presentedto him byDr RodríguezAraque.

Right: PresidentChávez in

discussions withDr Rodríguez

Araque.

10 OPEC Bulletin

P R E S I D E N T I A L V I S I T

OPEC Secretary General, Dr AlíRodríguez Araque, in welcoming Presi-dent Chávez, said the Secretariat was hon-oured by his visit and the “importantmission that brings you here today.”

The Venezuelan President then movedon to OPEC’s sister Organization in Vi-enna, the OPEC Fund for InternationalDevelopment. He was received by theFund’s Director General, Dr Y SeyyidAbdulai and other senior officials.

A Fund press release noted that the visitby Chávez represented the first time that aHead of State of an OPEC Member Coun-try had been to its premises.

In his welcoming statement, Dr Abdulaiacknowledged Chávez’s recognition of, andallegiance to, the cause of OPEC and, inparticular, the work of the OPEC Fund.

He recalled the President’s “untiring

Left: The President and his entourage withDr Rodríguez Araque and OPEC manage-ment.

Right: Chávez took time to answer journal-ists’ questions.

Below: Chávez and the Ambassador arewelcomed by the OPEC Fund’s DirectorGeneral, Dr Y Seyyid Abdulai (r).

Right: The President signsthe Fund’s guest book

October 2001 11

P R E S I D E N T I A L V I S I T

efforts” in organizing and hosting the hugelysuccessful Second OPEC Summit.

“The meeting clearly met the set chal-lenge of revitalizing our Organization andreaffirming the commitment to develop-ment made by the generation of leadersbefore us,” he said.

Referring to the ties between Venezuelaand the OPEC Fund, Dr Abdulai noted thedeeply-rooted longevity of the relationship.

Praising Venezuela for its “unflinch-ing” dedication to the Fund, he expressed

hope that such support would continue.In his own address, Chávez spoke of his

personal interest in the development co-operation activities of the OPEC Fund.

“The Fund may be modest in size, butits achievements are great and of immenseimportance to millions of poor peoplearound the world,” he said.

Chávez urged fellow Member Countriesto provide more support to the institution.

“As Members of the OPEC Fund, wehave a responsibility to strengthen and en-large it,” he asserted.

It was also the duty of OPEC MemberCountries “to help build a better world andseek justice and peace,” he affirmed.

Chávez concluded his address by pay-ing tribute to the efforts of Fund manage-ment and staff, who, he said, were “deservingof recognition” for their work.

The Venezuelan President’s official tourinvolved visits to four OPEC Members(Algeria, Saudi Arabia, Iran and Libya),seven European nations (Switzerland,France, Italy, Belgium, Austria, Portugaland Great Britain), and Russia.

His entourage included Minister ofForeign Affairs, Luis Alfonso Davila; Min-ister of Planning and Development, JorgeGiordani; Minister of Energy and Mines,Alvaro Silva Calderón; Minister of Healthand Social Development, Maria LourdesUrbaneja; and Minister of the Office of thePresident, Dios Dado Cabello.

Above right: Dr Abdulai presents Chávezwith a memento of his visit.

Below: Chávez bids farewell to Dr Abdulai.

12 OPEC Bulletin

O P E C S E M I N A RO P E C S E M I N A R

The OPEC Seminar on the theme ‘OPEC and the Global Energy Balance: Towardsa Sustainable Energy Future’ was held at the Intercontinental Hotel, Vienna,Austria, on September 28-29, 2001. Keynote speeches were delivered by many of theOPEC Oil and Energy Ministers, while a broad range of renowned industry experts,high-level government officials from non-OPEC nations and respected academicscompleted the line-up. The event was organized by OPEC in conjunction withCWC Associates, part of the London-based CWC Group.

OPEC holds two-day Seminar on the theme:

“The worldis going throughimmensechanges that arebeing pushedforward by anoverwhelmingglobalizationprocess.”

OPEC and the Global Energy Balance:Towards a Sustainable Energy Future

Opening address byOPEC Secretary General, HE Dr Alí Rodríguez Araque

October 2001 13

O P E C S E M I N A R

I would like to start by once againextending our heartfelt condolences tothe relatives of the victims and the

American people in general for the tragicevents of September 11. Our deepest sym-pathy is with all those grieving after thisappalling catastrophe, which has left us allfeeling moved beyond words.

There are, however, important issuesthat we have gathered together to address.Allow me to start by pointing out that theworld is going through immense changesthat are being pushed forward by an over-whelming globalization process, whichtouches nearly every sphere of daily life,naturally also involving the productionand consumption of energy.

This seminar, entitled OPEC and theGlobal Energy Balance: Towards a Sustain-able Energy Future, will be taking a look atthe ongoing changes in society and howthey affect the energy industry. Addition-ally, we must take into account that thereare factors generated by the actions ofsectors and groups that may accelerate ordisturb these ongoing changes. The eventsof September 11 are an example of this.

In such situations, it is mandatory for

all those in positions of leadership, bothnationally and internationally, to calmlyanalyze all factors, in order to take thedecisions that may best contribute to apeaceful transition. One of the goals ofsuch efforts must be to attack the greatinequalities that presently exist in the world,which condemn hundreds of millions ofpeople to poverty and undernourishment,preventing them from exercising the mostelemental right to a dignified life.

Reaching this objective requires worldstability. And OPEC has been making animportant contribution in terms of help-ing to maintain stability. It will continueto do so, now with even greater emphasis.

Today, as never before, dialogue isrequired. In our case, it means an encoun-ter between producers and consumers, inorder to progress from mere coincidencesin speeches to concrete agreements andresults.

At the same time, it is imperative toremember that the majority of our coun-tries fundamentally depend on oil rev-enues for their development, and thoserevenues are determined not only by oilprices. They also depend on the share that

the owners of the resource obtain from thebenefits generated by oil activities.

Therefore, fiscal policy continues to begreatly important. It must be designed in away aimed at guaranteeing that each oneof the parties involved may obtain the justbenefits generated by this precious energysource.

Another very important factor is theongoing international environmental de-bate and the resulting measures to beadopted, aimed at reducing carbon diox-ide emissions and their possible effects onclimate change.

The problem lies in how to minimizethe environmental impact of energy. Sucha goal, naturally, has its own cost — toapply new technologies for the extractionof oil, to develop new technologies to buildnew refineries, and to offer products ofbetter quality. The problem is — whobears the cost? No single group should beexpected to carry this burden on its own.

Thus, let me conclude by pointing outthat for stability to be possible, we needpeace. To attain peace, we need dialogue.And for a positive dialogue to be a reality,we need equity. Thank you.

Opening address by Algerian Minister of Energy & Mines andPresident of the Conference, HE Dr Chakib Khelil

“OPEC hasachieved anastonishingdegree of successfor a group ofdevelopingcountries.”

14 OPEC Bulletin

O P E C S E M I N A R

It is a great honour to deliver this open-ing address to such an illustrious gath-ering of experts from the energy indus-

try. It is also somewhat of an awe-inspiringexperience, for assembled among us is adazzling array of expertise about energymatters, including government ministers,leading industrialists and acclaimed aca-demics. Their extensive knowledge of theissues that will form the basis of our discus-sions at this seminar promises a lively andstimulating exchange of views, from whichwe shall all undoubtedly benefit.

This two-day seminar, entitled OPECand the Global Energy Balance: Towards aSustainable Energy Future, is the first fullOPEC seminar to be held for almost adecade. Its purpose is to provide the inter-national energy industry with a specialopportunity to examine in depth topicalissues that concern all of us, particularlywith regard to the way the industry is likelyto evolve in the coming decades.

The seminar can be envisaged as theconcluding event in OPEC’s protracted40th anniversary celebrations. It comes ex-actly one year after the historic SecondSummit of OPEC Heads of State, whichwas held in Caracas, Venezuela, on Sep-tember 27-28, 2000.

Guiding principlesAt the Summit, our 11 Member Coun-

tries reaffirmed their commitment to theguiding principles of the Organization, asset out in the time-honoured OPEC Stat-ute, to achieve sustainable order and sta-bility in the international oil market, withreasonable prices and fair returns to inves-tors. They examined oil’s enhanced role infuture world energy demand, emphasisedthe strong link between security of supplyand the security and transparency of oildemand and stressed the need for im-proved dialogue and co-operation amongall parties in the industry. They also revis-ited the issue of oil’s service to mankindgenerally and of the need to tie in energysupply with economic development andenvironmental harmony, so as to helpreduce hardship and poverty in develop-ing nations and stimulate their economies.

Since its establishment in Baghdad,Iraq, in September 1960, OPEC hasachieved an astonishing degree of successfor a group of developing countries. TheOrganization provided these countries with

the support and the confidence to asserttheir legitimate rights in the petroleumindustry, particularly in terms of the ex-ploitation of their indigenous resources, aswell as commanding an influential role inthe pricing of their oil on world markets.OPEC now is respected, far and wide, asan established part of the internationalpetroleum community.

At the same time, oil remains theworld’s premier energy resource. After theturbulent events of recent decades, oil’sintegrity remains intact. We now have anindustry that functions at the cutting edgeof technology and is cleaner, safer, moreunited and better organised than ever be-fore. Many parties can quite fairly claimcredit for this, at all levels of the industry.But it is also, to a great extent, OPEC’sachievement. Who would have thoughtthat a small group of five developing coun-tries, meeting in Baghdad in the middle ofSeptember 41 years ago, would haveevolved into an Organization of such in-fluence and standing in the world energycommunity today?

And so, what of the future? Our pro-jections show that oil will comfortablyremain the world’s frontline energy re-source for the foreseeable future. The ref-erence case from OPEC’s World EnergyModel projects that, even though oil’sshare of world energy demand will declinefrom 41.0 per cent in 2000 to 38.8 percent in 2020, it will still be about tenpercentage points higher than that of thenumber two energy resource, gas. Themarket share of gas will overtake that ofsolids, with gas rising from 22.7 per cent in2000 to 29.1 per cent in 2020, and solidsfalling from 25.9 per cent to 23.6 per centin the same period. Hydro/nuclear com-bined will dip slightly to 8.6 per cent in2020.

The model forecasts a rise in world oildemand from around 76 million barrels/day in 2000 to 106m b/d in 2020. OPEC,with more than three-quarters of theworld’s proven recoverable crude oil re-serves, will watch its market share growfrom around 40 per cent in 2000 to justover 50 per cent in 2020. During thisperiod, Asia will emerge as the world’sdominant oil consumer, with demand over-taking that of North America. In order tomeet the rising level of global oil demand,the investment requirement is staggering,

if consumers wish to receive an orderlysupply of oil at reasonable prices in thefuture.

Unpredictable factors, however, havethe potential to overturn the most rigor-ously conceived projections and signifi-cantly affect the world oil industry in theyears ahead. Areas which require our con-stant attention include the ongoing cli-mate change negotiations, the world tradetalks, the growth of regionalism, and itsinterplay with globalisation, the greenlobby and changes in domestic legislationand consumer behaviour.

Speculative forcesIf we turn our attention to prices now,

we are all familiar with the oil market’sobserved volatility. It is by no means unu-sual for there to be a dramatic change inthe price of crude over a matter of days,weeks or months, generally in response tosome external incident, whose impact isthen greatly exaggerated by speculativeforces. We can find vast anomalies inpricing trends that stretch across decades.There has been much comment in con-suming countries about the price levels ofthe past year or two. But, when today’scrude prices are put in their proper historicperspective, it can be seen that, in realterms, they are well below the levels ofnotable past reference points, such as themid-1970s, December 1986 and July1990. All this instability in the price struc-ture explains OPEC’s efforts over the pastyear to keep prices at a level, $25/b, which,according to our judgement and our sound-ings across the industry, strikes an accept-able balance between the requirements ofproducers and consumers. Our efforts inthis regard have already met with consid-erable success and suggest the future direc-tion of OPEC’s agreements.

Moreover, on top of all this price insta-bility lies the distorting, inequitable phe-nomenon of excessive taxation on oilproducts. For example, an average 68 percent of the final product price paid byconsumers in the European Union goes tothe taxman, while producing countriesattract only a meagre 15 per cent. Acrossthe Atlantic, in the USA, there have beenother factors affecting oil prices, princi-pally a shortage of refinery capacity, strin-gent product specifications, transportproblems, such as an inadequate pipeline

October 2001 15

O P E C S E M I N A R

structure, and just-in-time stock-manage-ment policies.

All in all, for those responsible mem-bers of the global oil community, there ismuch work that needs to be done, if we areto achieve sustainable order and stabilityin the market in the years ahead, so as tomeet the projected rising oil requirementin a smooth and harmonious manner. Inthis regard, the industry stands to benefitfrom the advances that have been made inthe area of co-operation in recent years,among OPEC and non-OPEC producersand also, increasingly, between producersand consumers.

Since OPEC’s establishment in 1960,our Organization and its Member Coun-tries have gained a unique understandingof the way the international oil marketworks, from the perspective of the devel-oping world producer. We have been anintegral part of the development of the

industry during what has been a highlyeventful period.

But this unique experience is still notenough, if we are to continue to play aneffective role in the decades ahead. Some-times, it is necessary to sit back and take adetached look at events and carefully re-evaluate some of the fundamental issuesthat are of concern to us all. That is why weare holding this seminar. That is why weare indebted to all of you who have hon-oured us with your presence — ministers,industrialists and academics, as well asthose who do not fit neatly into thesecategories. We are all here to learn fromeach other. You all have a role to play inensuring that the seminar is a success. Soplease feel free to articulate your views asand when appropriate.

We hope, at the same time, that theseminar will also enable us to form newfriendships and strengthen existing ones.

This will undoubtedly be of benefit to theindustry for years to come

Finally, I should like to express a wordof thanks to all those involved in organis-ing this historic event. Gratitude is due inthe first instance to those national oilcompanies who have generously sponsoredour seminar. Their gracious contributionhas been instrumental in producing anoutstanding forum.

The staff members of the Secretariatand the CWC Group, who together haveworked tirelessly over the past few months,deserve to be applauded. Their profes-sionalism and commitment have, un-doubtedly, been unsurpassed. Theirpursuit of perfection has been particu-larly impressive. I am sure that our discus-sions over the next two days will provethat the efforts of all of you have been wellworthwhile and that the seminar is a greatsuccess.

Seminar sponsored by NOCs of six OPEC MembersThe OPEC Seminar was generously sponsored by the national oil companies of six OPEC MemberCountries. They were Algeria’s Sonatrach, the National Iranian Oil Company, the KuwaitPetroleum Corporation, Qatar Petroleum, Saudi Aramco and Petróleos de Venezuela.

Sonatrachwww.sonatrach-dz.com

National Iranian Oil Companywww.nioc.org

Kuwait Petroleum Corporationwww.kpc.com.kw

Qatar Petroleumwww.qp.com.qa

Saudi Aramcowww.saudiaramco.com

Petróleos de Venezuelawww.pdvsa.com

N.I.O.C.sonatrach

PD

16 OPEC Bulletin

O P E C S E M I N A R

Left: Listening to Dr Manouchehr Takin of theCentre for Global Energy Studies address thesecond session are (l-r) Professor of Economics atthe University of Grenoble, Sadek Boussena;Iranian Minister of Petroleum, HE BijanNamdar Zangeneh; Algerian Minister of En-ergy & Mines and OPEC Conference President,HE Dr Chakib Khelil; Royal Dutch/ShellChairman, Philip Watts; and independentgeologist, Jean Laherrere.

“Future developments in the energymarket will alter the geography of energy

economics fundamentally.”HE Bijan Namdar Zangeneh

Left: BP Vice-President and Chief Economist,Peter Davies, addresses the seminar. Also in thefirst session were (l-r) Director of the IEA’sOffice of Oil Markets and Emergency Prepared-ness, Dr Masaaki Mishiro; Director Emeritus ofthe Centre for International Energy Studies atRotterdam’s Erasmus University, Peter Odell;Iraq’s Dr Abdulilah M Al-Tikriti (representingthe Oil Minister, HE Dr Amer MohammedRasheed); Nigeria’s Presidential Adviser on Pe-troleum and Energy and former OPEC Secre-tary General, HE Dr Rilwanu Lukman; andHead of the Russian Energy Ministry’s ExternalEconomic Activities Department, AlexanderMisyulin.

“I look forward to an expanding dialogue

with OPEC, in a spirit of realism,

transparency and the search

for mutual advantage.”

Dr Masaaki Mishiro, IEA

October 2001 17

O P E C S E M I N A R

Left: Norwegian Minister of Petroleum andEnergy, Olav Akselsen, addresses the third ses-sion, watched by (l-r) Director of the OxfordInstitute for Energy Studies, Professor RobertMabro; the Chairman of Libya’s National OilCorporation, HE Ahmed Abdulkarim Ahmed;Algerian Minister of Energy & Mines andOPEC Conference President, HE Dr ChakibKhelil; and Nigeria’s Presidential Adviser onPetroleum and Energy and former OPEC Sec-retary General, HE Dr Rilwanu Lukman.

“It is the difficulty … of identifyingreference crudes that meet the criteria fora rational oil pricing regime that damns

the pricing formulae system.”Professor Robert Mabro, OIES

Left: Speaking during the fourth session is theHead of UNCTAD’s Trade Analysis and Sys-temic Issues Branch, Murray Gibbs. Also on thepanel were (l-r) Director of the WTO’s CouncilDivision, Paulo Barthel-Rosa; Qatari Ministerof Energy and Industry, HE Abdullah binHamad Al Attiyah; and Algerian Minister ofEnergy & Mines and OPEC Conference Presi-dent, HE Dr Chakib Khelil.

“Globalisation and national economicsovereignty are and will be at the forefront

of political debates nationally andinternationally.”

HE Abdullah bin Hamad Al Attiyah

18 OPEC Bulletin

O P E C S E M I N A R

“We believe it is very important that oilproducers and consumers work together in

a co-ordinated fashion.”HE Alvaro Silva Calderón

Left: Professor Richard Falk of the Centre forInternational Studies at Princeton Universityaddresses the sixth session. Listening are (l-r)Kazakhstan’s Vice-Minister of Energy and Natu-ral Resources, HE Bolat Yelemanov; UNEPExecutive Director, Klaus Topfer; Nigeria’sPresidential Adviser on Petroleum and Energyand former OPEC Secretary General, HE DrRilwanu Lukman; the UAE’s Minister of Petro-leum and Mineral Resources, HE Obaid binSaif Al-Nasseri; and Venezuelan Minister ofEnergy and Mines, HE Alvaro Silva Calderón.

Left: Saudi Arabian Minister of Petroleum andMineral Resources, HE Ali I Naimi, addressesthe fifth session. Watching him are (l-r) Profes-sor Herman Daly of the University of Mary-land’s School of Public Affairs; Sudanese Ministerof Energy and Mining, HE Dr Awad AhmedAl Jazz; Algerian Minister of Energy & Minesand OPEC Conference President, HE DrChakib Khelil; UN Under-Secretary for Eco-nomic and Social Affairs, Nitin Desai; andMelanie Kenderdine of the Gas Research Insti-tute’s Washington Operations Office.

“The United Nations would support aregular dialogue between consumers and

producers which would include developingcountries that have no access to energy.”

Nitin Desai, UN

October 2001 19

O P E C S E M I N A R

lofty ideals which we, as producers andconsumers, must champion. Make nomistake, the old days, when political andeconomic powerhouses are thought to becapable of single-handedly managing themarket, are gone — pure and simple.

It was in this spirit of mutuality thatOPEC decided to organize the Seminar.The mission was to enable us to take a freshlook at many issues facing the industry.The mission was also to navigate the newcentury with a new vision, and a greatersense of responsibility toward the globalcommunity.

Let us not forget that neither oil ex-porters, nor consumers can now work inisolation from the others living in ourshrinking world. As countries become in-creasingly interdependent, transparencyand openness go a long way in maintain-ing economic growth and preserving thewellbeing of humanity.

We were very honoured to be able toattract some of the most senior and re-nowned figures from the petroleum indus-try and other prominent internationalorganizations to take part in our historyand this forum.

The OPEC Seminar: a quest for unity

It goes without saying that it has beenOPEC’s aim, for a long time now, togenerate a continual dialogue with otherproducers. To realize our increasingly re-ciprocal ambitions, a lot of hard work,compromises and true goodwill must comeinto play. Co-operation, not confronta-tion, is the best strategy for the bettermentof our generations and posterity.

A great deal of dedication by the staffmembers of the Secretariat brought thisevent to fruition. It is no hyperbole to saythat arranging the Seminar was a horren-dous race against time.

The massive amount of correspond-ence to Member Countries, speakers andparticipants, as well as hundreds of phonecalls and follow-ups would have been, tosay the least, a nerve-racking experiencefor even the most seasoned staff member.

Nevertheless, those who made theSeminar possible have demonstrated a re-markable sense of professionalism and anunsurpassed commitment. I feel proudand in fact blessed to be teaming up withonly the best. To be successful, it takeshard work and dedication. It was a sweetvictory for all of us.

That sentiment was also echoedacross the corridors of the Seminarvenue. Speakers and attendees who

came from different parts of the world,and who represented the industry’s creamof the crop, found the seminar a truemarketplace of highly intellectual debateson some of the most pressing issues facingthe oil and energy sectors.

Addressing a packed conference room,Their Excellencies the Ministers fromMember Countries and other oil-produc-ing countries demonstrated how adamantthey are about breaking new ground inbridging the gap between producers andconsumers.

This historic event has shown that theOrganization is tirelessly reaching out forthe rest of our global village in search ofmutual objectives. As the custodian of themajority of the world’s oil reserves, OPEC’smessage throughout was compellinglyclear: our quest for a pragmatic partner-ship and for greater interdependency ne-cessitate enormous self-discipline from allparties concerned.

A spirit of goodwill, mutual trust andcollaboration are, undeniably, some of the

Nothing succeeds likesuccess, according to the

English saying, writesOPEC’s Media Relations

Officer, Dr AbdulrahmanAl-Kheraigi (pictured here).This speaks eloquently of theOPEC Seminar, which the

Organization diligentlyorganized last month.

20 OPEC Bulletin

P R E S S R E L E A S E SP R E S S R E L E A S E

of Governors for a period of one year fromJanuary 1, 2002; and

appoints

Mr Mohammed D Al Hamli, Governorfor the United Arab Emirates, as AlternateChairman for the same period.

Resolution No 117.389

The Conference,

upon the recommendation of the Board ofGovernors,

in accordance with Article 38 of the Stat-ute and the Financial Regulations,

approves,

1. The Budget for the year 2002, totallingEUR 16,665,225 (ATS 229,318,501),of which an amount of EUR 3,465,225(ATS 47,682,541) is to be financed bya transfer from the Reserve Fund Ac-count, with the balance being contrib-uted by the Member Countries.

2. That the contribution payable by eachMember Country shall be EUR1,200,000 (ATS 16,512,360) payablein one instalment not later than March31, 2002.

Resolution No 117.390

The Conference,

upon the recommendation of the Board ofGovernors,

approves,

the appointment of TPA ControlWirtschaftsprüfung GmbH to act as audi-

Press Release No 21/2001Vienna, Austria, October 27, 2001

The 117th Meeting of the Conference ofthe Organization of the Petroleum Ex-porting Countries, held in Vienna, Aus-tria, from September 26–27, 2001,adopted the following Resolutions, which,in accordance with customary procedures,have been ratified by the Member Coun-tries and are issued herewith:

Resolution No 117.387

The Conference,

upon the recommendation of the Board ofGovernors,

approves,

that the Secretariat withdraw an amountup to $3 million from the Reserve FundAccount, at the discretion of the Board ofGovernors, in order to cover legal feesincurred during 2001 and 2002 in con-nection with the on-going litigation in theUSA.

Resolution No 117.388

The Conference,

having regard to the rules laid down in theStatute of the Organization, in particularArticle 21; whereas in accordance with theprovisions of Resolution 111.380, the termof office of the Governor for Qatar asChairman of the Board of Governors ex-pires on December 31, 2001;

appoints

Mr Suleiman J Al-Herbish, the Governorfor Saudi Arabia, as Chairman of the Board

tors for the financial year 2001 and tosubmit a report thereon.

Resolution No 117.391

The Conference resolves that the nextOrdinary Meeting of the Conference shallbe convened in Vienna, Austria, on March12, 2002. Done in Vienna this Twenty-Seventh Day of September 2001.

Head of the Delegation of AlgeriaDr Chakib Khelil

Head of the Delegation of IndonesiaRhousdy Soeriaatmadja

Head of the Delegation of theIslamic Republic of IranBijan Namdar Zangeneh

Head of the Delegation of IraqDr Amer Mohammed Rasheed

Head of the Delegation of KuwaitDr Adel K Al-Sabeeh

Head of the Delegation of the SocialistPeoples Libyan Arab JamahiriyaAhmed Abdulkarim Ahmed

Head of the Delegation of NigeriaDr Rilwanu Lukman

Head of the Delegation of QatarAbdullah Bin Hamad Al-Attiyah

Head of the Delegation of Saudi ArabiaAli I Naimi

Head of the Delegation of theUnited Arab EmiratesObaid Bin Saif Al-Nasseri

Head of the Delegation of VenezuelaAlvaro Silva Calderon

Resolutions of the117th Meeting of the OPEC Conference

N E W S L I N E

October 2001 21

N E W S L I N E f r o m t h e O P E C N A N e w s D e s k

ew York — OPEC was praisedlast month for its swift response

to calm nervous international oilmarkets in the wake of the September 11attacks on the World Trade Center in NewYork and the Pentagon in Washington.

Shortly after the attacks, OPEC Sec-retary General, Dr Alí Rodríguez Araque,issued a statement confirming that theOrganization’s Members remained com-mitted to “strengthening market stabilityand ensuring that sufficient supplies areavailable to meet market needs,” and were“prepared to use their spare capacity, ifdeemed necessary, achieve these goals” (seePress Release No 18/2001 on this page fordetails).

The European Commissioner forTransport and Energy, Ms Loyola dePalacio, told reporters that the EU wasgrateful for OPEC’s firm pledge to keepmarkets adequately supplied with oil.

“I would like to thank OPEC,” Ms dePalacio was quoted as sayingby the official Kuwaiti NewsAgency (KUNA).

The pledge by the Organi-zation to boost production, ifnecessary, had assured thatthere was no lasting speculation-driven price increase on inter-national markets, she said.

“OPEC slowed down theprice rise. This is a clear andresponsible position,” shepointed out, adding that Eu-rope would not see a shortageof crude oil.

The European Commis-sioner for Economic andMonetary Affairs, PedroSolbes Mira, added that he didnot expect an oil crisis as aresult of the attacks.

The fact that prices hadfallen again the next day dem-onstrated that the increaseseen in prices on September11 was due to psychologicalreasons and market nervous-ness, he said.

OPEC praised for swift response to calm oil marketsafter September 11 attacks on World Trade Center and Pentagon

Later in the month, the Paris-basedInternational Energy Agency (IEA) saidin a statement that it welcomed OPEC’sdecision at its 117th Conference to leaveits production ceiling unchanged.

The IEA’s Executive Director, RobertPriddle, described the OPEC decision asa “display of moderation” and expressedhis appreciation of the statements byOPEC and its Member Countries to keepoil flowing in the event of any supplydisruption.

Across the Atlantic, the President ofthe American Automobile Association,Bob Darbelnet, attributed the short-termnature of the spikes seen in gasoline pricesin the wake of September 11 to OPEC’smarket-calming comments and decisiveaction on the part of the oil industry andthe US government.

“Preparations necessary for a responseto the terrorist attacks makes many Ameri-cans understandably nervous about future

energy supplies and prices,” Darbelnetnoted.

“However, the co-ordinated responseby OPEC, US oil companies and govern-ment agencies shows co-ordinated actioncan be extremely effective in calmingpublic worry about this vital commodity,”he said.

Meanwhile, individual OPEC Mem-ber Countries also reaffirmed their deter-mination to ensure market stability in thedays following the attacks.

Venezuelan President, Hugo Chávez,assured the US that his country wouldcontinue to supply it with a steady flow ofoil. The Venezuelan leader also expressedhis “profound regret” at what he describedas “cowardly (and) murderous” attacks.

“I have given instructions to Petróleosde Venezuela, and in particular to Citgo,that in addition to increasing securitymeasures at our oil installations in the US,we make an effort to guarantee the supply

of petroleum, fuel, gasoline,and other derivatives to thepeople of the US,” he said.

“This is one of the ways wehave to demonstrate our soli-darity and our firm supportand co-operation,” addedChavez.

The US is the biggest buyerof Venezuelan crude. US-based Citgo is a wholly-ownedsubsidiary of PDVSA,headquartered in Tulsa, whichoperates some 14,000 gasolineoutlets throughout America.PDVSA also has interests in sixUS oil refineries.

Shortly after the September11 attacks, Citgo President,Oswaldo Contreras Maza,confirmed that security meas-ures had “been increased at allinstallations around the US.”

“Citgo has put in placeemergency plans for situationsof this kind. Also, it is work-ing closely with national andlocal organizations to guaran-

N

OPEC Press Release No 18/2001Vienna, Austria, September 11, 2001

OPEC committed to ensuringadequate oil supplies — Rodríguez

OPEC Secretary General, Dr Alí Rodríguez Araque, thisafternoon stated that the Organization was monitoring de-velopments, following the series of tragic events that oc-curred in the United States earlier today.

“All Member Countries remain committed to continu-ing their policy of strengthening market stability and en-suring that sufficient supplies are available to satisfy marketneeds,” he said.

“Furthermore, OPEC’s Members are prepared to usetheir spare capacity, if deemed necessary, to achieve thesegoals,” he emphasized.

Rodríguez Araque categorically refuted suggestions thatsome of the Organization’s Members could use oil as aweapon, stressing OPEC’s continued commitment to se-curing a stable market.

The OPEC Secretary General concluded by extending“the Organization’s heartfelt sympathy to all those affectedby this tragedy”.

N E W S L I N E

22 OPEC Bulletin

inquiring into the fate of the documents,held by an LNG trustee borrowing agencyat its office in the World Trade Center.

The WTC collapsed on September 11,killing thousands of people, after twopassenger jets were hijacked by terroristsand flown into the twin towers.

Despite the building having been to-tally destroyed, Yusgiantoro said he washopeful the documents would be recov-ered because the office that handled themwas a large operation and there must havebeen a backup of the documentation.

He also dismissed suggestions thatIndonesia’s LNG business would be affectedif the documents disappeared in the dis-aster.

Although Purnomo did not name theagency, the media reports, quoting otherofficials, said it was a syndicate of Ameri-can banks that handled the financing ofIndonesia’s LNG developments and trade,including receiving payments from buy-ers in Japan, South Korea and Taiwan.

Indonesian LNG trade has been con-ducted for more than three decades andits contracts with Far Eastern buyers havegenerated annual revenue of around $3.0billion.

The long-term contracts, averagingmore than 20 years each, were all in USdollars. Earnings from these deals wereused to settle long-term project borrow-ings, according to sources familiar withIndonesian LNG trade.

Iranian MP urges oilproducers to take actionagainst crude surchargesTehran — Iranian Member of Parlia-ment, Mohammad Kianoosh-Rad, saidlast month that OPEC and other oil-pro-ducing countries should take actionagainst insurance companies that imposedsurcharges on Gulf crude in the wake ofthe September 11 terrorist attacks on theUnited States.

Immediately after the attacks, Londonunderwriters quoted war-risk surchargesfor vessels sailing to the Middle East thatadded as much as 50¢/barrel to the costof Iranian or Iraqi crude, according to shipmanagers.

Some sources said that the price of

crude oil exports from other countries inthe region could be pushed up by as muchas 25¢/b.

“We are talking war-risk additionalpremiums getting into millions of dollarsfor loading in some parts of the Gulf, say,Mina Al-Bakr (in Iraq), or Kharg Island(in Iran),” one leading tanker managercommented.

Quoted by the Tehran Times dailynewspaper, Kianoosh-Rad said the insur-ance companies had the right to imposesurcharges in critical situations, but un-derlined that the region was calm and thata fake crisis had been created after Sep-tember 11.

According to the MP, the illusion of acrisis in the Middle East was totally un-founded and the terrorist attacks on theUnited States had had no effect on theGulf region.

“There is no reason to declare thatthere is a crisis in the region, especially asfar as it concerns ships passing throughIranian waters,” he noted.

He pointed out that some insurancecompanies were merely taking advantageof the situation, and added that OPECMember Countries and other oil-export-ing nations should take a firm standagainst such tactics.

European companiesmay get US firms’ oiloperations in LibyaBrussels — European oil companies areexpecting a significant boost to their ac-tivities in Libya, following an announce-ment by the Libyan government that UScompanies had one year to return to theiroil blocks in the country, or lose theiroperating licences.

Libyan Foreign Minister, AbdelRahman Shalgam, announced in Septem-ber that Libya could ill afford to leave itsoil fields idle until the United States de-cided to lift sanctions against the country.

“We have agreements with the Ameri-can companies, and those agreements needour co-operation,” Shalgam said. “Eitherthey will come and work, or we will givetheir rights to other companies. If theydon’t decide next year, we are going tomake our decision,” he explained.

tee the security of its personnel and its op-erational facilities,” Contreras Maza com-mented.

Meanwhile, Saudi Arabian Petroleumand Mineral Resources Minister, Ali INaimi, said in a statement carried by theSaudi Press Agency that the Kingdomattached special importance to stabilizingthe oil market.

He reaffirmed that Saudi Arabia wascommitted to the provision of supplies ona continual basis, in various circumstances,and in co-operation with fellow OPECMember Countries, to fill any shortagethat might arise in the market, for anyreason.

The Minister added that the King-dom’s exports to the US and to all otherimporters of Saudi oil were stable andbeing carried out according to ordinaryexport schedules.

The official United Arab EmiratesNews Agency (WAM) quoted the coun-try’s Minister of Petroleum and MineralResources, Obaid bin Saif Al-Nasseri, assaying that the price fluctuations seen afterSeptember 11 would be temporary andwould soon disappear.

Condemning the attacks in a speechdelivered at the Zayed Centre for Co-or-dination and Follow-up in Abu Dhabi, theMinister also stressed OPEC’s determina-tion to ensure a steady flow of oil to worldmarkets, in co-ordination with other pro-ducers.

The Kuwaiti Oil Minister, Dr Adel KAl-Sabeeh, also underlined his country’skeenness to stabilize the market, and saidthat it would take all necessary measuresto tackle any shortage in oil supplies,according to KUNA.

Indonesian Minister saysattack on WTC won’tdisrupt LNG businessJakarta — The destruction of NewYork’s World Trade Center on September11 raised concerns in Jakarta about the fateof documents related to Indonesia’s lique-fied natural gas (LNG) deals, according tomedia reports.

The Indonesian Minister of Energyand Mineral Resources, Dr PurnomoYusgiantoro, said that the government was

N E W S L I N E

October 2001 23

In briefOne casualty of this move would be

the Oasis Group, a US consortium thatincludes Amerada Hess and USX Mara-thon, which suspended its operations in1986 when the US, under PresidentRonald Reagan, issued a series of sanctionsagainst Libya, which banned Americanfirms from working in the country.

Even though the 1992 UN sanctionson Libya were suspended — but notentirely lifted — in 1999, the US hascontinued with its unilateral sanctionsunder the revamped 1996 Iran-LibyaSanctions Act.

The European Union followed the UNand suspended sanctions against Libyaafter two Libyans accused of the 1988bombing of Pan Am flight 103 overLockerbie in Scotland were handed overto be tried in the Netherlands.

Accordingly, industry sources said thatthose likely to gain from Libya’s ultima-tum were European companies, such asSpain’s Repsol-YPF, Austria’s OMV,France’s TotalFinaElf, and Italy’s ENI.

Libya has said that it expects these non-US companies to raise their output capac-ity by one-third over the next five years.Repsol-YPF is involved in pumping oilfrom the country’s Murzuk Basin with itspartners, OMV and TotalFinaElf.

Meanwhile, Shalgam said Italy andLibya have recently agreed on a $5.0 bil-lion dollar gas project, without givingfurther details. Libya is also Italy’s mainsupplier of crude oil.

Kuwait, Saudi Arabiareach accord on NeutralZone activities in 2003Riyadh — Under-Secretary at the Ku-waiti Ministry of Oil, Eissa Aloun, an-nounced recently that Kuwait and SaudiArabia had agreed on how to run opera-tions in the divided Neutral Zone afterFebruary 2003.

The Neutral Zone includes the Khafjioil field, the Kuwaiti portion of which iscurrently operated by the Arabian OilCompany (AOC) of Japan.

Aloun was quoted by the Kuwait NewsAgency (KUNA) as saying Saudi Arabiahad agreed to hand over the administra-tion of the operations in the Neutral Zone

over to Kuwait, after the contract expiresbetween Kuwait and the Japanese-ownedAOC in 2003.

Aloun said that both Kuwait and SaudiArabia had also agreed to continue gasexploration at the offshore Aldurra gas fieldin the Neutral Zone, adding that bothcountries needed the gas to use as fuel andin their respective petrochemical indus-tries.

Concerning the Khafji oil field in theSaudi sector of the Neutral Zone, the AOCis reportedly currently seeking to renewits contract with the Kingdom to operatethe field, after its contract expired in Feb-ruary last year and was not renewed. Priorto that, the AOC had exploited the Saudisector of the Khafji field since 1960.

The AOC still operates the Kuwaitisector of the Khafji oil field, and currentlyproduces 140,000 b/d of crude.

However, separately, KUNA reportedthat Kuwait and Japan had agreed to endthe exploration rights of the AOC in theKhafji oil field when they expire in Janu-ary 2003.

Both countries released a statement lastmonth saying the two parties had signeda memorandum containing basic guide-lines for future detailed negotiations toregulate the relationship between the AOCand Kuwait, KUNA reported.

The contents of the memorandumwere released only nine days after a priorstatement was issued from the AOC an-nouncing it had reached an agreementwith the Kuwaiti government to extendits operational and drilling rights forKhafji, the exploration rights of which theJapanese company has had since 1958.

The second statement released by bothcountries invalidated any supposed dealhaving been brokered, as was suggested bythe AOC, and instead said “an agreementwill be reached that will secure the desiredco-operation, in keeping with the Kuwaiticonstitution’s stipulation concerning theuse and preservation of its resources.”

The memorandum indicated that theguidelines were to be approved by theconcerned authorities. It cited goals forfuture talks that included Kuwait benefit-ing from Japanese technical, research, anddevelopment expertise, which involved thetraining of national labour to take over 100per cent of the operation of all facilities,to replace foreign labour.

Oil supplies unaffected by US attacksNEW YORK — Overall United States and glo-bal oil supplies were only minimally affectedby the attacks on the World Trade Center andthe Pentagon on September 11, according tothe US Energy Information Administration(EIA). It said the attacks occurred against abackground of already tight crude oil andproduct markets in the country and world-wide. Crude prices were likely to remain sev-eral dollars lower than the very high pricesseen a year ago, noted the EIA, adding thatthis assumed normal weather, a sluggisheconomy, no Iraqi outages, compliance byOPEC to its output ceiling, and no unusuallogistical or refinery problems. However, itcautioned that any unforeseen event (such ascontinued stockdraws, refinery outages, se-vere weather, or Middle East tensions) couldact as a catalyst to alert markets to the poten-tial for tight supplies this winter, and oil pricescould swing back upward.

Gas prices steady post-September 11NEW YORK — The nationwide average priceof self-serve regular unleaded gasoline rose byless than one cent in the days following theattacks on the World Trade Center and thePentagon, according to the American Auto-mobile Association (AAA). “This barely per-ceptible rise in gasoline prices to $1.54/gallonindicates motorists and nearly all gasoline sta-tions have reacted calmly and responsiblywith regard to fuel consumption and pricingsince the attacks,” said AAA Vice-Presidentof Public Affairs, Susan Pikrallidas. Immedi-ately after the attacks, a few gas station own-ers reacted by raising prices to extreme levelsin some areas, the Association noted. How-ever, as more information became availableand the US Department of Energy and theoil majors made it clear that the nation’s en-ergy supplies were never threatened, gas pricescame down at the few offending stations.