Value Creation Thinking

-

Upload

tran-ngan-hoang -

Category

Documents

-

view

226 -

download

0

Transcript of Value Creation Thinking

-

8/15/2019 Value Creation Thinking

1/55

VALUE CREATION THINKING

1© 2016 Bartley J. Madden Value Creation Thinking

Creating long-term value begins with clarity about the purpose

of the firm and about management’s core responsibilities

Bartley J. Madden

www.ValueCreationThinking.com

May 2016The most up-to-date version of this PowerPoint will be posted at [email protected]

-

8/15/2019 Value Creation Thinking

2/55

www.ValueCreationThinking.com

2

Madden unites the fundamentals of financial valuationwith a unique emphasis on corporate purpose, culture,and knowledge. … He provides an important contributionto our understanding of capitalism at a critical moment

and an illuminating roadmap for the future of business.

—Dominic Barton, GlobalManaging Director, McKinsey& Co.

“A free society is an engine of wealth creation … BartMadden’s Value Creation Thinking is driven by thephilosophy that an understanding of that [wealth creation]process defines a path to the long term increase ininvestor returns. … Beware the crony capitalist firmseeking profits from favors; the money is in creating valuefor customers.”

—Vernon L. Smith, ChapmanUniversity, Nobel Laureate inEconomics, 2002

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

3/55

3

PART I Introduction• Long-term value creation

• The firm’s purpose• Management’s core responsibilities• Life-cycle valuation framework• Eastman Kodak, 3M, Illumina, Amazon,

Whole Foods, JCPenney, Intuit, Walmart• Life-cycle valuation model• Existing assets and future investments• What really causes big long-term moves in stock

prices?• Life-cycles reviews

PART II Knowledge building and reconstructing your worldviewPART III A total system approach to valuation

CONTENTS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

4/55

-

8/15/2019 Value Creation Thinking

5/55

Vision

Survive andProsper

Win-Win Partnerships

Future Generations

5

THE INTERRELATED COMPONENTS OF PURPOSE

We will strive to fulfill the firm’s vision while instilling high ethical standards throughout thefirm. We will survive and prosper by delivering a level of efficiency and innovation thatearns customer loyalty and rewards long-term shareholders. We will strive for win-winrelationships that provide value for those who partner with us in serving our customers. Wewill take care of future generations by designing our products and services, and using ourassets, consistent with environmental sustainability.

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

6/55

#3Knowledge

BuildingCulture

#2ResourceEfficiency

#1Valuation

Framework

6

MANAGEMENT’S CORE RESPONSIBILITIES

#1 To integrate an operationally useful valuation framework#2 To use resources efficiently and organize for continuous improvement#3 To sustain a knowledge-building culture focused on innovation

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

7/55

HighInnovation Competitive Fade Mature

FailingBusiness

Model

Economic

Returns

Long-termCost ofCapital

ReinvestmentRates

FADE%

Time

LIFE-CYCLE VALUATION FRAMEWORK

The rate at which a firm’s profitability fades over time depends primarilyon management’s skill relative to competitors.

7© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

8/55

8

• Understanding investor expectations impliedin current stock prices,

• making insightful forecasts of plausible future scenarioswithin the context of firms’ past performance, and

• judging the impact of management’s strategy and capital

outlays in terms of how much wealth is likely to becreated or dissipated.

THE KEY BENEFITS OF THE LIFE-CYCLEVALUATION FRAMEWORK

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

9/55

9

The top panel displays economic returns calculated as a CFROI (cash-flow-return-on-investment). CFROIs are inflation adjusted, sometimes referred to as real as opposed to

nominal. They remove a variety of accounting distortions so the result is a more accuratereadout of “true” economic returns than the conventional RONA (return-on-net-assets).Importantly, real CFROIs are directly comparable for levels and changes over long timeperiods that include varying inflation rates. The top panel also displays the long-termcorporate average CFROI as a dark horizontal line at 6 percent to approximate the realcost of capital.

The middle panel reflects a firm’s reinvestment rate calculated as a real asset growth rate.The bottom panel indicates a firm’s total shareholder return (dividends plus priceappreciation) relative to the S&P 500 index. Out-performance is seen as a rising trend forthe relative wealth line; market-matching performance is shown as a flat trend; and under-

performance shows as a declining trend. Shareholder returns above or below the S&P 500Index are driven by firms delivering life-cycle performance (economic returns andreinvestment rates) that exceed or fall short of investors’ expectations at the beginning ofthe time period.

A FIRM’S LIFE-CYCLE TRACK RECORD HASTHREE PANELS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

10/55

Rising CFROIs6% Long-termcost of capital

Outperformed S&P 500Long-termunderperformance vs. S&P 500

EASTMAN KODAK dominated the film and camera market for decadesbut failed to adapt to changing technology (digital photography).

Source: Credit Suisse HOLT Global Database 10© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

11/55

11

Managements of high-innovation firms in the startup phase need to quickly confirm or disconfirm the criticalassumptions that determine the viability of their business model.

In the competitive-fade stage, all else equal, higher market valuations are accorded firms that are able toreinvest at high rates. But, all else is not equal, and higher reinvestment rates tend to result in faster fade ofeconomic returns over time. This is due to accelerated competition responding to a big opportunity (signaled byhigh reinvestment rates) to create wealth, plus the added difficulty of managing a fast-growing firm. In addition,a huge influence on a firm’s long-term fade is the degree of management’s success in nurturing a knowledge-building culture. Such a culture has the potential to deliver stable processes and innovation with very favorable

long-term fade, such as that exhibited by 3M.Firms in the mature stage typically are burdened by considerable bureaucracy. For mature firms, it is especiallyimportant to continually improve the efficiency of their existing businesses while simultaneously developing new,wealth-creating innovations that have the potential to scale up to a significant size— efficiency and innovationare the hallmarks of managerial skill. Small, strategic acquisitions may help by providing new skills to leveragecore competencies. However, merging with another large mature company tends to make the problem of

earning greater than cost of capital returns even more difficult to achieve.

In the failing-business-model stage, one likely constraint to improvement is a management worldview that isstrongly influenced by assumptions which are no longer valid. And such obsolete assumptions are most likelyentrenched in the firm’s culture. Getting back to earning the cost of capital, given this burden, may well requirenew management who have a different worldview and are more attuned to a changing business environmentand able to successfully restructure the firm’s operating assets and culture.

KEY POINTS FOR ANALYZING LIFE-CYCLETRACK RECORDS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

12/55

Sustained wealth-creating CFROIs

Modest asset growth rates

1960 to 2014, investor returns matched S&P 500

3M is respected for its innovative culture and remarkable maintenance ofsuperior CFROIs for 55 years.

12Source: Credit Suisse HOLT Global Database© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

13/55

High innovation stage

Early investors did not expectsuch high CFROIs coupled with

high asset growth rates

ILLUMINA is the industry leader of the most technically advanced DNAsequencing machines.

13Source: Credit Suisse HOLT Global Database© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

14/55

Management chose to dampenCFROIs to accommodatemassive reinvestment

AMAZON has made big investments to seize large-scale, new markets(Kindle, cloud data services, etc.)

14Source: Credit Suisse HOLT Global Database© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

15/55

Very large growthin new stores inthe early years

CFROIs at or above the cost of capital

WHOLE FOODS MARKET was the pioneer in selling natural andorganic food while supporting sustainable agriculture.

15Source: Credit Suisse HOLT Global Database© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

16/55

Transition to afailing business

model stage

JCPENNEY hired a new CEO in 2011 who orchestrated a radical overhaulof the firm’s retail store format. Sales plummeted and the CEO was fired.

16Source: Credit Suisse HOLT Global Database© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

17/55

Big improvement in CFROIs

INTUIT sells financial software to consumers and is well known for itspurpose-driven culture that focuses on experimentation and fast learning.

17Source: Credit Suisse HOLT Global Database© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

18/55

OutperformedS&P 500, 13-fold,

1980 to 1990

1980-1990

Big efficiency gains resulted in high CFROIs

20 plus years of massivenew store expansion

WALMART is a stellar example of how the combination of high CFROIsand very high asset growth creates huge shareholder value.

18Source: Credit Suisse HOLT Global Database© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

19/55

● Economic returns above the cost of capital, and● reinvestment rates supportive of maintaining a

● favorable long-term fade rate.

LIFE-CYCLE PERFORMANCE OBJECTIVE

PURPOSE CORE RESPONSIBILITIES

Vision

Survive and

Prosper

Win-Win Partnerships

Future Generations

#3Knowledge

BuildingCulture

#2ResourceEfficiency

#1Valuation

Framework

19© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

20/55

HighInnovation Competitive Fade Mature

FailingBusiness

Model

EconomicReturns

Long-termCost ofCapital

ReinvestmentRates

FADE%

Time

1

2

3

20

USE LIFE-CYCLE VARIABLES TO FORECASTLONG-TERM NET CASH RECEIPTS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

21/55

Fade

Economic

Returns

ReinvestmentRates

Net Cash Receipts t(1+ Investors’ Discount Rate t)t

WarrantedValue =

LIFE

t =1

3

2

1

Today’sAsset Base

LIFE-CYCLE VALUATION MODEL

21© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

22/55

PV Factor 0.9524 0.9070 (A) PV Existing Assets

PV Today 95.24 + 90.70 185.94

NCRs Existing Assets 100 100

+ 1 year +2 year

Today

(B) PV Future Investments

PV Today -95.24 + 136.05 40.81

NCRs Future Investments 150

-100

Today

TOTAL FIRM (A) + (B)

VALUE TODAY 226.75

22

NET CASH RECEIPTS (NCRs) FROM EXISTING

ASSETS AND FUTURE INVESTMENTS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

23/55

23

Stock market valuations are attuned to ROIs on new investments. All else equal, the morecapital reinvested in the future that achieves ROIs greater than the opportunity cost ofcapital, the higher the firm’s market value. Consequently, the middle panel of the life-cycle

charts which displays real asset growth rates is especially important for high CFROI firms. A firm’s management, board, and shareholders should understand what a current stockprice implies for the firm’s future investments in order to better judge the economicsoundness of management’s planned capital expenditures. Business as usual is typicallynot strategically sound for firms priced with significant negative values for futureinvestments.

A % Future scorecard, using current Credit Suisse HOLT data for 1,000 U.S. industrialfirms, is available at www.ValueCreationThinking.com

% FUTURE

Total Firm Value - Value Existing Assets Value of Future Investments

Total Firm Value Total Firm Value% FUTURE = =

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

24/55

24

WHAT REALLY CAUSES BIG MOVES INSTOCK PRICES - WALMART 1980 TO 2000

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

25/55

25

To understand cause and effect concerning significant excess (positive/negative)

shareholder returns, begin by calibrating market expectations at the beginning ofthe selected time period; e.g., year-end 1979. Then compare that to the actuallife-cycle performance during the period (1980 to 1990). If a firm deliversperformance significantly greater than the market expected, its shareholdersalmost always will have earned positive excess returns.

The next slide shows dashed lines as the expected future fade of CFROIs andreal asset growth rates built into Walmart’s year-end 1979 stock price. With aknown market value for Walmart and an estimated investors’ discount rate atyear-end 1979, the implied future life-cycle fades were calculated using the life-

cycle valuation model. In a sense, we use the valuation model in reverse.Instead of calculating a warranted value based on forecasted fade rates forCFROIs and asset growth, we derive implied future fade rates.

WALMART'S TOTAL SHAREHOLDER RETURNSVS S&P 500 INDEX, 1980-1990

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

26/55

0

5

10

15

20

70 75 80 85 90

CFROI %

0

10

20

30

40

70 75 80 85 90

Real Asset Growth Rate %

MarketExpectedCFROI =

10.0%

MarketExpected

AssetGrowth =

7.0%

26

MARKET EXPECTATIONS

WALMART YEAR-END 1979 Actual CFROIs

Actual Real AssetGrowth Rates

Source: Credit Suisse HOLT Global Database© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

27/55

27

Boards of directors need to coordinate with management andimplement a common valuation language that is best suited to:

(1) analyze the impact on the firm’s value of major, board-leveldecisions, especially those that deal with strategy andresource allocation, and

(2) communicate to shareholders why they should be confidentthat major decisions are likely to create long-term value.

A strong case can be made that the proposed Life-Cycle Review,highlighted on the next two slides, is the preferred means to meetthis need.

LIFE-CYCLE REVIEWS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

28/55

28

#1 Value-relevant track records Display value-relevant track records for the firm and its majorbusiness units. Basically, this entails the top two panels of the life-cycle histories. It requires theestimation of economic returns and the calculation of reinvestment rates for each of the firm’s majorbusiness units. Management needs to work through the tradeoffs involved with accuracy versus

simplicity. Details about the calculation of economic returns, such as the capitalization and amortizationof R&D expenditures, need to be explained. Investors should be equipped to reproduce the economicreturn calculation or to use alternative procedures if they so choose. Moreover, reinvestment rates needto be broken down to show organic growth as well as the impact of acquisitions and divestitures.

#2 Strategy and reinvestment Explain both the strategy for value creation for each business unit and

the planned expenditures (or divestments) in the context of the unit’s past performance (its life-cycletrack record). What are the key assumptions that need to be confirmed or disconfirmed for startupbusinesses? Why should expenditures be committed for non-startup businesses that have steadfastlyfailed to earn the cost of capital?

#3 Intangible assets Provide an overview of how the firm’s major intangible assets are utilized toimprove business performance. Intangible assets include brand names, reputation, patents, R&D,cultural rules, processes, tacit know-how, employee motivation, and myriad other ways of coordinatingwork to improve efficiency and promote innovation. They are the keys to value creation for 21 st centurycorporations and yet we are in the first inning of a very long game to understand how to nurture andeventually optimize their use.

COMPONENTS OF LIFE-CYCLE REVIEWS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

29/55

29

1. Gain more long-term investors in the firm’s shareholderbase

2. Earn the right to purposively depress quarterly results tocreate long-term value

3. Improve communications with a common valuationlanguage

4. Apply what is learned from life-cycle valuation principlesto executive compensation

5. Get engaged with a learning process about intangibleassets

THE BENEFITS OF LIFE-CYCLE REVIEWS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

30/55

30

The knowledge-building process can be analyzed in theform of a knowledge-building loop. Adoption of therecommended four core beliefs will upgrade one’sworldview, thereby leading to substantial gains inknowledge-building capability.

The next two slides illustrate the knowledge-building loop

and the contrast between a dysfunctional culture anda high-performance culture.

PART IIKNOWLEDGE BUILDING AND

RECONSTRUCTING YOUR WORLDVIEW

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

31/55

31

PERCEPTIONS

WORLDVIEW

FEEDBACK

ACTIONS ANDCONSEQUENCES

KNOWLEDGEBASE

PURPOSES

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

32/55

DysfunctionalCulture

Management’sWorldview

High PerformanceCulture

My work provides apaycheck, nothing more.

Vision My work helps me live apurposeful life.

I don’t trust management. Commitment

to employeesI trust management.

Avoid identifying problemsand challenging people’sthinking. Better to reduceaccounting costs in smallbut fail-safe ways.

Innovation andefficiency

Experimentation andsystematic problem solvingis how we make progress.

Do whatever it takes tomake accounting targets.Never “rat out” a coworker.

Ethical behavior

Ethical standards (includingintegrity) are nonnegotiableand a code of honor that wepractice proudly.

32

SHAPING THE FIRM’S CULTURE

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

33/55

33

1. Past experiences shape assumptions.

2. Language is perception’s silent partner.

3. Improve performance by identifying and fixing a system’s

key constraints.

4. Behavior is control of perception.

The next seven slides highlight an application of the four core beliefs.

ABBREVIATED DESCRIPTIONOF THE FOUR CORE BELIEFS

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

34/55

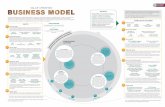

BUSINESS NEED – INNOVATE TO IMPROVEPRODUCTIVITY OF DISTRIBUTION WAREHOUSES

34© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

35/55

1. PAST EXPERIENCES SHAPE ASSUMPTIONS

35

In the past, productivity was improved by helpingworkers locate and retrieve goods faster

Improved stacking arrangements and the likerepresent incremental innovations

Radical innovations often result from closeexamination of rarely, if ever, questioned assumptions

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

36/55

2. LANGUAGE IS PERCEPTION’S SILENTPARTNER

36

Obsolete assumptions often hidden by language

“Locate and retrieve goods” assumes the best system

has workers move to goods

Is there a better way?

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

37/55

3. IMPROVE PERFORMANCE BY IDENTIFYINGAND FIXING A SYSTEM’S KEY CONTRAINTS

37

Key constraint – time for workers to locate andretrieve goods.

Fix constraint – move goods to workers usingKIVA robotic shelves.

Amazon acquired KIVA systems in 2012.

Instead of processing 100 items/hour, workers now

process 300 items/hour in Amazon warehouses.

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

38/55

38

THE KIVA SYSTEM

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

39/55

KIVA SYSTEMS INITIAL MARKETING PROBLEM

39

KIVA solution requires total replacement of acustomer’s existing system.

Customer is purchasing a radically different systemfrom a small startup company.

Very bad consequences if KIVA system fails tofunction properly.

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

40/55

#4 FOCUS ON WHAT PEOPLE ARE

CONTROLLING FOR

A potential customer is controlling for the downside

if the KIVA installation fails.

Full refund if Kiva fails to complete the installation ontime or fails to achieve a specified performance level.

Competitors did not provide a total system/completesolution and therefore were incapable of matchingKIVA’s offer.

KIVA’S SOLUTION

40© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

41/55

41

• Reconstructing Your Worldview: The Four Core Beliefs YouNeed to Solve Complex Business Problems , Madden (2014).

• YouTube video “Reconstructing Your Worldview in FiveMinutes,” reviews Amazon’s KIVA robotic system.

• YouTube video (35 minutes) “Reconstructing Your Worldview,”explains the four core beliefs with application to a variety ofproblems.

• Future videos will be posted at www.ValueCreationThinking.com.

ADDITIONAL EDUCATIONAL MATERIAL

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

42/55

42

A valuation model is a mechanism to generate an expected long-term net cash receipt (NCR) stream forthe firm and then translate this into a present value. Why not simply specify each year’s NCR over thelong term? This would result in users of the model then having no benchmarks to gauge the plausibility

of the specified NCRs, especially those in the distant future. The valuation model should facilitate alearning process, and not just be a logically sound application of discounted cash flow mathematics.With a learning process in mind, there is a compelling rationale to use the three life-cycle variables togenerate the model’s NCR stream. Users can then study life-cycle track records (the past) and make

judgments about likely future track records. The same language is used to understand andcommunicate about the past and the future. With such a common language in place, users can much

more easily explain and discuss with others why they are using a particular set of optimistic/mostlikely/pessimistic forecasts. Different opinions can be debated in a useful way. Experience suggeststhat the more experience users gain with analyses of historical life-cycle track records, the better theirforecasting skill will be with future life cycles. In summary, the life-cycle valuation model and globaldatabase are designed to enable users to better understand firms’ past performance, pinpoint keyvaluation issues, decode market expectations, and help judge the plausibility of forecasts .

The life-cycle valuation model using CFROIs for economic returns was developed at Callard, Madden & Associates in the 1970s and Credit Suisse HOLT continues this research program today. Thiscommercial research program is based on ten critical ideas, many of which differ from mainstreamfinance in important ways. The following slides explain these ten ideas.

PART IIIA TOTAL SYSTEM APPROACH TO VALUATION

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

43/55

43

#1 Adjustment for inflation/deflation

Key life-cycle variables should be adjusted for changes in the purchasing power of the monetary unit andtherefore expressed as real variables. This is essential for the analysis of long-term time series so thatlevels and trends have meaning and are not distorted by inflation/deflation—especially important fortrends in economic returns (e.g., CFROIs) and discount rates.

#2 Project economic return

A project economic return is the real, achieved return-on-investment (ROI) for a completed project. Thisinternal rate of return is calculated after converting all after-tax cash outflows and inflows into units of

constant purchasing power. (In the U.S., this would be done with the GDP Deflator series.)

#3 Cross-sectional economic return

A cross-sectional economic return is calculated from balance sheet and income statements for a givenyear and is consistent with the concept of a real ROI. A RONA (return-on-net-assets) and a CFROI

(cash-flow-return-on-investment) are cross-sectional economic returns. Think of the firm as an ongoingportfolio of projects and the conventional accounting statements capture a cross-section of the status ofthese projects at a single point in time. A plot of the time series of cross-sectional economic returns isused to infer the level of average project economic returns being achieved by the firm.

CRITICAL IDEAS 1, 2, AND 3

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

44/55

FIRM CAPITAL OWNERS

DebtRepayments

ShareRepurchases

Dividends

InterestPayments

NewDebt

StockSale

GrossCashFlow

Outflowsfor New

Investments

CapitalExpenditures

Increase NetWorking Capital

Firm'sNCR

GrossCashFlow

=- Outflows

NewCapitalOutflowCash

Inflow

CapitalOwners’

NCR

CashInflow =-

CashOutflow

NCR NCR

- -

4 NET CASH RECEIPTSCAN BE CALCULATED IN TWO WAYS

44© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

45/55

45

From a logical perspective, there is a compelling rationale to applysystems thinking to a valuation model. With the life-cycle model shownon the next slide, the forecast of future NCRs is highly sensitive to theprocedures used to assign fade rates for economic returns andreinvestment rates. Consequently, the assignment of the investors’discount rate should be contingent on how fade rates are forecasted. In

other words, the valuation model is a package deal—a total system inwhich the handling of one component affects other components in thesystem. Both the early work at Callard Madden & Associates and CreditSuisse HOLT’s current global database use investors’ discount rates thatare based on a market-implied process which is in tune with the fadeforecasting routines used.

5 SYSTEMS THINKING

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

46/55

Fade

EconomicReturns

Reinvestment Rates

Net Cash Receipts t(1+ Investors’ Discount Rate

t)t

WarrantedValue

=

LIFE

t =1

Today’sAsset Base

● Tangible Assets● Intangible Assets

Investors' discount rate candiffer from the long-term

cost of capital

INVESTORS’ DISCOUNT RATE SHOULD BE INTUNE WITH FORECASTS OF FADE

46© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

47/55

47

How might you assign a discount rate in order to estimate the warranted value ofa new municipal bond offering that has not yet been issued? The expected

NCRs are already known in terms of interest and principal payments over the lifeof the bond. With an assigned discount rate, you can calculate a warrantedvalue, which is the expected market price for the bond when it starts trading.

A reasonable approach is to first analyze a large universe of traded municipal

bonds and observe the yield-to-maturity and the credit quality of the sponsoringentities. Based on the current market prices for these bonds, you could then plotyield-to-maturity (i.e., the market-implied discount rate) versus credit quality.Then run a regression equation with yield-to-maturity as the dependent variableand credit quality as the independent variable. The resulting regression line

provides an estimated discount rate for a specified level of credit quality. Youwould see a higher discount rate for lower quality and vice versa. The samelogic applies to estimating investor discount rates for individual firms. Such aprocess requires that each firm in a sample universe of firms have forecastedNCR streams based on standardized fade forecast routines.

6 FORWARD-LOOKING INVESTORS’DISCOUNT RATE

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

48/55

48

Since this research program began in the 1970s, a particularly usefulguidepost has been the value chart. It plots annual warranted valuesalongside actual historical stock prices for a firm. The value chart showshow closely the current “state of the art” model (including fadeforecasting routines) works to replicate historical prices for firms.

Value charts covering a large universe of firms provide insightful

feedback about the accuracy of the model and ideas for researchingpotential “fixes” to improve accuracy.

Firms with systematic and repetitive, year-after-year over- or under-tracking of warranted values versus actual stock prices is whereresearch attention should be given .

7 EVALUATING THE VALUATION MODEL

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

49/55

49

According to the mathematically elegant CAPM theory, which has extraordinarily deep

roots in mainstream finance, a firm’s equity cost of capital equals the risk-free rate plus theproduct of a stock’s Beta multiplied by the risk premium of the overall equity market. Thatrisk premium is the expected return of the equity market over the risk-free rate. But,application of the CAPM equation requires two inputs that are extraordinarily difficult to naildown with any precision—Beta and the risk premium. In principle, these are both forward-looking variables; but, in practice, they are estimated from backward-looking historical data.

Huge variations in the calculated equity cost of capital can result from plausible but sharplydifferent values for these two variables. This translates into huge variations in calculatedwarranted values. Even though academic research has made improvements to thestandard CAPM-Beta procedure, this standard procedure still holds considerable sway in

corporate finance textbooks. A particularly strong argument against use of CAPM-Beta ispresented throughout the 5 th edition of Valuation and Common Sense by Professor PabloFernandez at IESE Business School, University of Navarra. See especially his chaptersentitled “Beta = 1 does a better job than calculated betas” and “CAPM: an absurd model.”

8 AVOID USING A CAPM-BETA EQUITYCOST OF CAPITAL

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

50/55

50

Capitalizing and amortizing intangible assets is necessary if such treatmentmaterially improves the insights contained in life-cycle track records. R&Doutlays have long been capitalized and amortized in the HOLT databasebecause this is necessary to produce meaningful life-cycle track records for firmswith big R&D outlays. For example, the middle panel (real asset growth rates) ofthe life-cycle track records for biopharmaceutical firms is simply misleading ifR&D is not part of the asset base.

Nevertheless, the estimated economic life used for R&D must be considered asonly a rough approximation; but that approximation is better than ignoring theissue. For those intangible assets in which the estimate of a useful life is purespeculation, it is far better to handle in an alternative way. That is, the morevaluable the intangible asset (e.g., brand names, patents, etc.), the morefavorable the future fade rate.

9 INTANGIBLES AND THE ART OF LIFE-CYCLE FADE FORECASTING

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

51/55

51

The ten critical ideas are foundational to the long-term commercial research program thatdiffers from the way academic research progresses. A key ingredient was feedback fromastute portfolio managers and security analysts with detailed country-specific and firm-specific knowledge. They have a vested interest in improvements in the valuation modeland its related database that they subscribe to and use for decision making. Theirfeedback is focused on identifying problems whose solutions can produce practical resultsin terms of better explaining levels and changes in stock prices worldwide as well as

improving forecasts. Academic research in this area favors mathematically elegant theoretical constructs andadvanced statistical techniques geared to publishing journal articles. In contrast, thecommercial research program is expansive in terms of firms analyzed and embracescontinual improvement in measuring economic returns, improving fade forecasts and

investors’ discount rates, plus problem solving keyed to deviations between firms’ historicalwarranted values and their actual stock prices. All this is applied to a large universe offirms worldwide which have different accounting standards and different historical inflationenvironments. The following slide diagrams this continual improvement process.

10 A SYSTEMS-BASED VALUATIONRESEARCH METHODOLOGY

© 2016 Bartley J. Madden Value Creation Thinking

IMPROVING THE VALUATION MODEL

-

8/15/2019 Value Creation Thinking

52/55

Value Chart

Implement

improvement

Test proposedimprovement

Accounting fixes

Conceptualmodel fixes

Life-CycleTrack Record

Global databasecovering a large

universe of companies

52

IMPROVING THE VALUATION MODEL

© 2016 Bartley J. Madden Value Creation Thinking

-

8/15/2019 Value Creation Thinking

53/55

53

Connecting firms’ financial performance to stock market valuations is a very complex task.One neglected area in mainstream finance is the construction of simulation models (Excelspreadsheets) that tie known time series of life-cycle variables to detailed accountingstatements through time. For example, this could be a fruitful path to a betterunderstanding of the costs and benefits of intangible assets—a wickedly difficult problemfor sure.

The early Callard Madden & Associates work began with a model corporation thatconnected business economics to accounting data. It constructed the firm as a portfolio ofongoing projects with known characteristics for project ROIs and a specified capital

structure. With an inputted environment of time series data for inflation/deflation, nominalinterest rates, and real project ROIs and real investment rates, the as-reported accountingstatements were produced each period. The CFROI metric was developed to use the as-reported financial statements to mirror the known, steady-state project ROIs. The next twoslides show: (1) 3M CFROI calculation for 2014 and (2) a simulated earnings/commonequity (book value) using the model corporation with actual U.S. data for inflation/deflationrates and nominal interest rates covering approximately 100 years. The real project ROIswere maintained at 6 percent for every year. The gyrating path of the calculatedearnings/common equity over time should give pause to mathematical model builders whoignore real world complexities like the impact of inflation and deflation on historical-costaccounting statements.

FUTURE RESEARCH

© 2016 Bartley J. Madden Value Creation Thinking

Net Income (Before Extraordinary Items)- Special Items (after tax) CFROI CALCULATION, 3M 2014

-

8/15/2019 Value Creation Thinking

54/55

Special Items (after tax)+ Depreciation/Amortization Expenses+ Interest Expense+ R&D Expense+ Rental Expense+ Minority Interest Expense+ Net Pension Cash Flow Adjustment+ LIFO charge to FIFO Inventory+ Monetary Holding Gain/Loss

- Equity Method Investment Income

Book Assets+ Accumulated Depreciation+ Inflation Adjustment to Gross Plant+ LIFO Inventory Reserve

+ Capitalized Operating Leases+ Capitalized R&D- Equity Method Investments- Pension Assets- Goodwill- Non-Debt Monetary Liabilities & Def. Taxes

Inflation AdjustedGross Cash Flow$8,711

$8,791Release of Non-Depreciating

Assets

12 Year Asset Life

CFROI = 15.2%

$48,350Inflation AdjustedGross Operating

Assets

54

CFROI CALCULATION, 3M 2014References

CFROI Valuation , Bartley J. Madden (1999)Beyond Earnings , David Holland and

Bryant Matthews, forthcoming

© 2016 Bartley J. Madden Value Creation Thinking

IMPACT OF INFLATION/DEFLATION ON

-

8/15/2019 Value Creation Thinking

55/55

0

5

10

15

20

1870 1880 1890 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990

Simulated Earnings/Common Equity

using actual U.S. inflation rates

CFROIs = 6%

%

Years

6% Project ROIs

55

IMPACT OF INFLATION/DEFLATION ONREPORTED EARNINGS/COMMON EQUITY

© 2016 Bartley J. Madden Value Creation Thinking