TPL LIFE · Apr-17 Mar-17 MoM % NAV per Unit (PKR) 101.66 100.09 1.57% Net Assets Value (PKR '000)...

Transcript of TPL LIFE · Apr-17 Mar-17 MoM % NAV per Unit (PKR) 101.66 100.09 1.57% Net Assets Value (PKR '000)...

Benchmark Return

Asset Allocation

April 2017

Fund Performance Report

TPL LIFE

July 2015

Source: SBP, Average Monthly Rates

Source: PBS

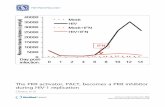

KSE 100 Performance

Source: PSX

Money Market Review and Outlook:

During the period under review, SBP conducted two T-Bill auctions with the month target of

PKR 550 billion against maturity of PKR 527 billion. Major participation during both the T-bill

auction was witnessed in 3M T-bill. Cumulative participation in the auction was PKR 751 billion

with a major amount accepted in 3M T-bill, total amount accepted was PKR 629 billion. The cut-

off yields in the last auction were 5.9910%, 6.0109% and 6.0273% for 3, 6 and 12M T-Bills

respectively.

In the PIB auction, due to participation by market participants at much higher yield than the

previous auction, the SBP decided to reject the auction. Thus, no major change in monetary

policy stance is foreseen in near future.

Equity Market Review and Outlook:

CPI increased by 4.8%YoY (1.4%MoM) in April 2017 compared to an increase of 4.9%YoY

(0.8%MoM) in the previous month. The main contributors to such increase were food, house

rent and education. The overall inflation for 10MFY17 was recorded at 4.1% as compared to

2.8% in 10MFY16. However, this was well below the SBP forecast of 4.5-5.5% for FY17.

The current account witnessed a deficit of USD 6.1 billion during 9MFY17 compared to USD 2.4

billion last year due to heavy imports of machinery and petroleum. In view of such strong

growth in imports and taking stock of developments in international commodity prices and

global economic trends, the current account deficit is likely to increase; however, the country’s

foreign exchange reserves will

remain at comfortable level.

Further, the unchanged monetary policy combined with a comfortable liquidity position in the

interbank market will lead to a continuation of stable market interest rates.

CPI Inflation

April 2017

FUND MANAGER REPORT

Pakistan Yield Curve

Macro Review and Outlook:

Though the political uncertainty continued to strain equity market initially in April, the Panama

case verdict triggered a gain of 2.4%MoM (1,145 points) as the decision was positively

conceived by the market. Sectors that contributed the most to index gain were Automobile

Assemblers and Oil and Gas. Further, Mutual Funds appeared as the largest net buyers,

absorbing almost the entire net selling by Foreigners, Individuals, and Banks/DFIs. On the other

hand, the Fertilizer and Food sector underperformed the benchmark.

During the month of May, the key events that will determine the direction of the market

include Pakistan's inclusion to MSCI‐EM Index, upcoming budget to be announced by the

current regime and newsflows over the JITs findings with respect to Panama Case.

-

1.00

2.00

3.00

4.00

5.00

6.00

CPI Inflation

Strategy

Risk Profile

Pricing Mechanism

Pricing Days

Management Fee

Launch Date

Bid Offer Spread 5%

Apr-17 Mar-17 MoM %

NAV per Unit (PKR) 101.66 100.09 1.57%

Net Assets Value (PKR '000) 3,019 2,469 22.28%

30 Days 60 Days 90 Days 180 Days 365 Days CYTD Since Inception

TPL Progressive Fund - TPF 1.57% 1.53% 0.84% 1.66% N/A 4.30% 3.32%

* Asset Allocation has been developed by looking through the underlying assets of mutual fund investments.

During the month the fund generated an absolute

return of 1.57% against its last month absolute

return of -0.04%.

Value of 100 Rupees invested since inception

TPL Progressive Fund - TPF

INVESTMENT OBJECTIVE:This is an investment fund designed on an aggressive investment strategy to provide higher returns in long term by investing primarily in equities along with

debt / money market instruments.

FUND INFORMATION: RETURNS:

April 2017

Aggressive

High

Daily Forward Pricing

Monday to Friday

1.5%

30-Oct-16

FUND PERFORMANCE:

Absolute Return Annualized Return

Note: Fund returns are net of management fee.

ASSETS UNDER MANAGEMENT:

TPL Progressive Fund - TPF BID PRICE:

Disclaimer: Past performance is not indicative of future performance. Market volatility can significantly affect short-term performance. The value of

investment can fall as well as rise.

ASSET ALLOCATION *:

Apr-17 Mar-17

100.00

100.25

100.55

100.81

100.13 100.09

101.66

100.00

100.20

100.40

100.60

100.80

101.00

101.20

101.40

101.60

101.80

Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17

Cash 18%

TFC's / Sukuk

4% T-Bills

5%

TDR 0% PIB's

0%

Stock 65%

DFI & Others

8%

Deposits 14%

TFC's 4%

T-Bills 8%

TDR 0%

PIB's 0%

Stock 66%

DFI & Others

8%

101.66

99.00

99.50

100.00

100.50

101.00

101.50

102.00

Since Inception Apr-17

Strategy

Risk Profile

Pricing Mechanism

Pricing Days

Management Fee

Launch Date

Bid Offer Spread 5%

Apr-17 Mar-17 MoM %

NAV per Unit (PKR) 102.03 100.62 1.40%

Net Assets Value (PKR '000) 4,070 4,016 1.33%

30 Days 60 Days 90 Days 180 Days 365 Days CYTD Since Inception

TPL Steady Fund - TSF 1.40% 1.17% 1.11% 2.03% N/A 5.33% 4.05%

* Asset Allocation has been developed by looking through the underlying assets of mutual fund investments.

During the month the fund generated an absolute

return of 1.40% against its last month absolute

return of -0.22%.

Value of 100 Rupees invested since inception

TPL Steady Fund - TSF

INVESTMENT OBJECTIVE:

The primary investment objective of this fund is to provide stable returns by balancing the investment in equities and debt / money market instruments.

FUND INFORMATION: RETURNS:

April 2017

Balanced

Moderate

Daily Forward Pricing

Monday to Friday

1.5%

30-Oct-16

FUND PERFORMANCE:

Absolute Return Annualized Return

Note: Fund returns are net of management fee.

ASSETS UNDER MANAGEMENT:

TPL Steady Fund - TSF BID PRICE:

Disclaimer: Past performance is not indicative of future performance. Market volatility can significantly affect short-term performance. The value of

investment can fall as well as rise.

ASSET ALLOCATION *:

Apr-17 Mar-17

100.00

100.27

100.60

100.90 100.85 100.62

102.03

100.00

100.50

101.00

101.50

102.00

102.50

Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17

Cash 36%

TFC's / Sukuk

8% T-Bills

1% TDR 0%

PIB's 1%

Stock 36%

DFI & Others

18%

Deposits 29%

TFC's 8%

T-Bills 13%

TDR 0%

PIB's 1%

Stock 36%

DFI & Others

13%

102.03

98.50

99.00

99.50

100.00

100.50

101.00

101.50

102.00

102.50

Since Inception Apr-17

April 2017

Strategy

Risk Profile

Pricing Mechanism

Pricing Days

Management Fee

Launch Date

Bid Offer Spread 5%

Apr-17 Mar-17 MoM %

NAV per Unit (PKR) 102.01 101.57 0.43%

Net Assets Value (PKR '000) 1,530 1,524 0.43%

30 Days 60 Days 90 Days 180 Days 365 Days CYTD Since Inception

TPL Reliance Fund - TRF 0.43% 0.82% 1.15% 2.01% N/A 5.48% 4.02%

* Asset Allocation has been developed by looking through the underlying assets of mutual fund investments.

30-Oct-16

During the month the fund generated an absolute

return of 0.43% against its last month absolute

return of 0.39%.

Value of 100 Rupees invested since inception

INVESTMENT OBJECTIVE:The primary investment objective of this fund is to generate income by investing in a range of debt instruments of various maturities with a view to maximize

the optimal balance between yield, safety and liquidity.

FUND INFORMATION: RETURNS:

Conservative

TPL Reliance Fund - TRF BID PRICE:

TPL Reliance Fund - TRF

IGI Conservative Fund - ICF BID PRICE:

Disclaimer: Past performance is not indicative of future performance. Market volatility can significantly affect short-term performance. The value of

investment can fall as well as rise.

ASSET ALLOCATION *:

Apr-17 Mar-17

FUND PERFORMANCE:

Absolute Return Annualized Return

Note: Fund returns are net of management fee.

ASSETS UNDER MANAGEMENT:

Low

Daily Forward Pricing

Monday to Friday

1.5%

100.00 100.21

100.54

100.85

101.18

101.57

102.01

100.00

100.50

101.00

101.50

102.00

102.50

Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17

Cash 41%

TFC's / Sukuk

6% T-Bills 13%

TDR 3%

PIB's 1%

DFI & Others

36%

Deposits 41%

TFC's 6%

T-Bills 26%

TDR 2%

PIB's 1%

Stock 0%

DFI & Others

24%

102.01

98.50

99.00

99.50

100.00

100.50

101.00

101.50

102.00

102.50

Since Inception Apr-17

Strategy

Risk Profile

Pricing Mechanism

Pricing Days

Management Fee

Launch Date

Bid Offer Spread 0%

Apr-17 Mar-17 MoM %

NAV per Unit (PKR) 101.81 100.27 1.54%

Net Assets Value (PKR '000) 1,018 1,003 1.54%

30 Days 60 Days 90 Days 180 Days 365 Days CYTD Since Inception

TPL Booster Fund - TBF 1.54% 0.71% 1.00% 1.81% N/A 5.02% 3.61%

* Asset Allocation has been developed by looking through the underlying assets of mutual fund investments.

During the month the fund generated an absolute

return of 1.54% against its last month absolute

return of -0.81%.

Value of 100 Rupees invested since inception

TPL Booster Fund - TBF

INVESTMENT OBJECTIVE:The primary investment objective of the fund is to provide stable returns by balancing the investment in equities and debt / money market instruments.

Returns in this fund are maximized through low expense charge allocations.

FUND INFORMATION: RETURNS:

April 2017

Balanced (without Bid-offer spread)

Moderate

Daily Forward Pricing

Monday to Friday

1.5%

30-Oct-16

FUND PERFORMANCE:

Absolute Return Annualized Return

Note: Fund returns are net of management fee.

ASSETS UNDER MANAGEMENT:

TPL Booster Fund - TBF BID PRICE:

Disclaimer: Past performance is not indicative of future performance. Market volatility can significantly affect short-term performance. The value of

investment can fall as well as rise.

ASSET ALLOCATION *:

Apr-17 Mar-17

100.00 100.16

100.49

100.80

101.09

100.27

101.81

100.00

100.20

100.40

100.60

100.80

101.00

101.20

101.40

101.60

101.80

102.00

Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17

Cash 30%

TFC's / Sukuk 15%

T-Bills 4% TDR

0% PIB's 1%

Stock 36%

DFI & Others

14%

Deposits 16%

TFC's 15%

T-Bills 22%

TDR 0%

PIB's 0%

Stock 37%

DFI & Others

10%

101.81

99.00

99.50

100.00

100.50

101.00

101.50

102.00

Since Inception Apr-17

Strategy

Risk Profile

Pricing Mechanism

Pricing Days

Management Fee

Launch Date

Bid Offer Spread 5%

Apr-17 Mar-17 MoM %

NAV per Unit (PKR) 102.98 101.29 1.67%

Net Assets Value (PKR '000) 1,030 1,013 1.67%

30 Days 60 Days 90 Days 180 Days 365 Days CYTD Since Inception

TPL Interest Free Fund - TIFF 1.67% 2.30% 2.48% 2.98% N/A 8.57% 5.94%

* Asset Allocation has been developed by looking through the underlying assets of mutual fund investments.

During the month the fund generated an absolute

return of 1.67% against its last month absolute

return of 0.63%.

Value of 100 Rupees invested since inception

TPL Interest Free Fund - TIFF

INVESTMENT OBJECTIVE:The primary investment objective of this fund is to generate interest-free income by investing in a range of Islamic investment and shariah-compliant

instruments.

FUND INFORMATION: RETURNS:

April 2017

Islamic Balanced

Moderate

Daily Forward Pricing

Monday to Friday

1.5%

30-Oct-16

FUND PERFORMANCE:

Absolute Return Annualized Return

Note: Fund returns are net of management fee.

ASSETS UNDER MANAGEMENT:

TPL Interest Free Fund - TIFF BID PRICE:

Disclaimer: Past performance is not indicative of future performance. Market volatility can significantly affect short-term performance. The value of

investment can fall as well as rise.

ASSET ALLOCATION *:

Apr-17 Mar-17

100.00 100.16

100.49 100.49 100.66

101.29

102.98

100.00

100.50

101.00

101.50

102.00

102.50

103.00

103.50

Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17

Cash 23%

TFC's / Sukuk 11%

T-Bills 0% TDR

0% PIB's 0%

Stock 36%

DFI & Others

30%

Deposits 22%

TFC's 11%

T-Bills 0%

TDR 0% PIB's

0%

Stock 35%

DFI & Others

32%

102.98

98.00

99.00

100.00

101.00

102.00

103.00

104.00

Since Inception Apr-17