Standard Life Global Real Estate Fund - Brokerzone · Real estate investment funds The fund can...

Transcript of Standard Life Global Real Estate Fund - Brokerzone · Real estate investment funds The fund can...

Standard Life Global Real Estate FundAccessing global property

02 Standard Life Global Real Estate Fund

Contents03 Why Standard Life?

04 Why invest in property?

05 An introduction to the Global Real Estate Fund

05 Who looks after your investment?

06 Why invest in the Global Real Estate Fund?

07 Get to know your investment

08 Where in the world?

10 Is this the fund for me?

11 Important things to consider

02 Standard Life Global Real Estate Fund

Standard Life Global Real Estate Fund 03

Why Standard Life?

There’s a lot to look forward toStandard Life is a life savings company. That means we provide pensions, retirement solutions, savings, investments and funds for each stage of your life journey.

In Ireland, we’ve been working in partnership with financial advisers to help people plan and enjoy their futures for more than 180 years.

Our Irish team consists of 400 people, delivering products and services to support customers and advisers.

Choice of investmentsWe work with our strategic partners in Aberdeen Standard Investments, as well as other carefully selected fund managers, to offer you a choice of investment funds to suit your needs. We also give you options that allow you to invest in deposits, exchange-traded funds and self-directed property.

We’re here to helpOur customer service team is only a phone call away on 01 639 7000

04 Standard Life Global Real Estate Fund

Why invest in property?

Property is a fundamental building block of investment portfolios. The asset class provides a cushion against the uncertainty of equity market returns, while providing the potential for stable income and capital appreciation. It can also protect against inflation. At a time of historic low yields from most asset classes, income from long-term lease contracts can be an important component for returns.

In addition, when it comes to property, many investors have a domestic bias, causing them to miss out on the potential for more attractive opportunities from global markets. The Global Real Estate Fund provides Irish investors with an easy way to access global property opportunities.

It is important to consider the following before investing in property:

• Property should only form part of your overall portfolio

• Commercial property is less liquid than other asset classes such as bonds or equities. Selling property can be a lengthy process so you should be aware that you may not be able to sell your investment when you want to

Source: Aberdeen Standard Investments, 2019

Standard Life Global Real Estate Fund 05

An introduction to the Global Real Estate Fund

Commercial property can be an attractive investment opportunity given its stable income return, the potential for capital growth over the long term and the valuable diversification benefits it can offer. However, for most people it’s a difficult area to invest in.

A unique opportunity The Standard Life Global Real Estate Fund offers Irish investors a unique opportunity to invest in global commercial property markets. It invests in a global mixture of direct property, actual ‘bricks and mortar’, and also invests indirectly through listed real estate, Real Estate Investment Trusts (REITs) and other real estate investment funds. By holding assets in different regions and sectors and by investing at different stages of the cycle, investors can limit their exposure not only to property level risk but also to isolated shocks at a sector or city level.

The fund’s hybrid structure provides investors with a level of liquidity not normally associated with real estate funds.

The fund aims to provide investors with long-term growth through a combination of income and capital appreciation.

The Standard Life Global Real Estate Fund has a standard annual management charge of 1.50% and was launched on 15 March 2017. Please talk to your financial adviser about the annual management charge that applies to your policy.

Source: Aberdeen Standard Investments, 2019

Warning: If you invest in this fund you may lose some or all of the money you invest.

Warning: The value of your investment may go down as well as up.

Warning: This investment may be affected by changes in currency exchange rates.

Who looks after your investment?

A global fund manager for a global fund The fund is managed by Aberdeen Standard Investments’ global property team. The 270 strong team, operating in 20 offices worldwide, combine analysis of macroeconomic factors with asset-specific insights in order to deliver a robust investment process. The team provides a full range of in-house resources, such as research and strategy, development, finance and structuring. Guided by their Global Real Estate House View, they analyze the economic health of countries to identify opportunities across international property markets that enables investors to potentially benefit from global real estate themes such as demographic change, urbanisation, technology and environmental, social and governance (ESG) factors.

The team’s foot-on-the-ground approach is beneficial for a global mandate as the team are able to leverage the local knowledge and local market contacts from having local presence around multiple countries internationally.

Local knowledge is crucial to successful investment in non-domestic markets because of differing legal and regulatory safeguards globally; varying levels of transparency, differing levels of liquidity, and even cultural and language barriers. As a result of these potential hurdles, accessing global investment expertise should not be underestimated in realizing the benefits of global diversification and maximising potential returns.

Why invest in the Global Real Estate Fund?

1. Global opportunities The fund invests in global direct property providing access to a broad opportunity set across countries, sectors, strategies and real estate cycles.

2. Diversification The fund uses both direct and indirect property providing investors with access to a highly-diversified real estate portfolio.

3. The potential for better risk-adjusted returns Investing globally can provide investors with the potential for higher returns and lower risk when compared to investing solely in the property market of one single country, such as Ireland.

4. Stable income Commercial property can offer a stable rental income from financially secure long-term tenants.

5. Capital appreciation Property assets can appreciate in value over time, providing the potential for capital growth.

06 Standard Life Global Real Estate Fund

Source: Aberdeen Standard Investments, 2019

Warning: If you invest in this fund you may lose some or all of the money you invest.

Warning: The value of your investment may go down as well as up.

Warning: This investment may be affected by changes in currency exchange rates.

Together with your financial adviser, we want to help you build your life savings so that you can look forward to the future with confidence. We believe that an important part of that is bringing you closer to your investments, so you can really understand how your savings are working. Here, we take a closer look at how the Global Real Estate Fund works.

The Global Property team aims to grow your money through stable income and capital appreciation. To help them achieve this, the types of property held in this fund are outlined below.

Note: Direct foreign property holdings within the fund are hedged to euro, while indirect holdings within the fund are not. Hedging is used as risk management tool.

Standard Life Global Real Estate Fund 07

Source: Aberdeen Standard Investments, 2019

Get to know your investment

Listed real estate - property sharesThese are shares in real estate companies that own, manage and develop properties. These are more liquid than direct real estate as they can be traded on a daily basis.

Real estate investment trusts (REIT)A REIT is an investment trust that invests in property and is traded on the stock market. They operate in a tax efficient structure and most of the rental income they generate must be passed directly to investors.

Real estate investment fundsThe fund can also invest in other real estate investment funds to gain access to other countries and sectors.

Direct propertyA tangible asset often referred to as ‘bricks and mortar’. It allows access to properties that many investors couldn’t afford on their own. It also provides income in the form of rent. This fund can invest in commercial property including offices, retail outlets and industrial buildings.

08 Standard Life Global Real Estate Fund

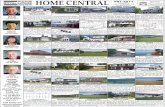

Where in the world?

A global real estate presence delivering worldwide capability.

Investment teams in 18 locations across the globe.

Countries where the fund holds assets

Aberdeen Standard Investments office

Boston

Mumbai (via HDFC)

Seoul

Frankfurt

Calgary

The Hague

St Helier

Melbourne

Czech Republic

Barcelona

Dublin

Sydney

Hong Kong

London

Paris

Dublin

Edinburgh

Beijing

Tokyo

Singapore

Poland

Sydney

Melbourne

Source: Aberdeen Standard Investments, 30 June 2019

Standard Life Global Real Estate Fund 09

Boston

Mumbai (via HDFC)

Seoul

Frankfurt

Calgary

The Hague

St Helier

Melbourne

Czech Republic

Barcelona

Dublin

Sydney

Hong Kong

London

Paris

Dublin

Edinburgh

Beijing

Tokyo

Singapore

Poland

Sydney

Melbourne

We want to make sure that you only invest in funds that are right for you. So how will you know if the Global Real Estate fund is the right fund for a portion of your life savings? Look at the statements below; if they relate to you, then this could be the right fund for you. Your financial adviser can help you make this decision.

• I’m looking for the opportunity to achieve a total return combining income with the potential for some capital appreciation over the longer term

• I’m comfortable with a medium level of risk. This fund is rated three out of seven on the ESMA risk scale, seven being the highest

• I wish to invest in direct real estate, indirect real estate including real estate related equities, real estate investment trusts (REITs) real estate investment funds and cash

• I have an investment time horizon of at least five years

• I accept that due to the illiquid nature of commercial property there may be times when I cannot sell my investment when I want to

This fund may not be suitable if any of the following apply:

• I’m a low risk investor

• I do not want to take any risk with my capital

• I am not prepared to accept periods of losses due to the volatile nature of markets

• I am not willing to accept the possibility of fluctuations in the level of income generated within the fund

• I do not wish to invest in a fund that holds direct real estate, indirect real estate including real estate related equities, real estate investment trusts (REITs) real estate investment funds and cash

• I have an investment horizon of less than five years

• I do not accept that there may be times when I am unable to sell my investment when I want to

Is this the fund for me?

10 Standard Life Global Real Estate Fund

Standard Life Global Real Estate Fund 11

Important things to consider

Risk factors

• Commercial property is less liquid than other asset classes such as bonds or equities. Selling property can be a lengthy process so you should be aware that you may not be able to sell your investment when you want to

• Commercial property transaction charges are higher than those which apply in other asset classes. A high volume of transactions would have a material impact on fund returns

• Property valuation is a matter of judgement by an independent valuer and is therefore a matter of the valuer’s opinion rather than fact

• The fund invests in equities and equity related securities. These are sensitive to variations in the stock markets which can be volatile and change substantially in short periods of time

• Dividend payment policies of the REITs in which the fund invests are not representative of the dividend payment policy of the fund

• The fund may invest in emerging market equities and/or bonds. Investing in emerging markets involves a greater risk of loss than investing in more developed markets due to, among other factors, greater political, tax, economic, foreign exchange, liquidity and regulatory risks

• Investing in derivatives carries the risk of reduced liquidity, substantial loss and increased volatility in adverse market conditions, such as a failure amongst market participants. The use of derivatives may result in the fund being leveraged (where economic exposure and thus the potential for loss by the fund exceeds the amount it has invested) and in these market conditions the effect of leverage will be to magnify losses. Derivatives are financial instruments that derive their value from an underlying asset, such as a share or a bond. The fund does not make extensive use of derivatives

• The fund employs a single swinging pricing methodology to protect against the dilution impact of transaction costs. Due to the high transaction charges associated with the fund’s assets, a change in the pricing basis will result in a significant movement in the fund’s published price

• All investment involves risk. This fund offers no guarantee against loss or that

the fund’s objective will be attained. The price of assets and the income from them may go down as well as up and cannot be guaranteed; an investor may receive back less than their original investment

• Inflation reduces the buying power of your investment and income

• The value of assets held in the fund may rise and fall as a result of exchange rate fluctuations

• The fund could lose money if an entity (counterparty) with which it does business becomes unwilling or unable to honour its obligations to the fund

• In extreme market conditions some securities may become hard to value or sell at a desired price. This could affect the fund’s ability to meet redemptions in a timely manner

• The fund could lose money as the result of a failure or delay in operational processes and systems including but not limited to third party providers failing or going into administration

Fund pricing, switching, transferring or cashing in

You may be one of many investors in a fund. Sometimes in exceptional circumstances:

• we may change the pricing basis of a fund to reflect cash flows in and out. If it’s a property based fund, due to the high transaction charges associated with the assets, this can result in a significant movement of the fund price

• we may also wait before we carry out your request to switch your funds, transfer or cash in your policy. This delay could be up to a month. But for some funds, this may be longer, for example, if it’s a property based fund, it may be up to 12 months because property and land can take longer to sell

If we have to delay switching, transferring or cashing in, we’ll use the fund prices on the day the transactions take place – these prices could be very different from the prices on the day you make the request.

These are processes which aim to maintain the fairness between those remaining invested and those leaving the fund.

At certain times, and when you cash in your policy, there’s likely to be tax payable, depending on the policy type you invested in, and your personal circumstances.

Standard Life International dac is regulated by the Central Bank of Ireland. Standard Life International dac is a designated activity company limited by shares and registered in Dublin, Ireland (408507) at 90 St Stephen’s Green, Dublin 2. Standard Life International dac is part of the Phoenix Group and uses the Standard Life brand under licence from the Standard Life Aberdeen Group.

GRECUST V02 0919 ©2019 Standard Life Aberdeen, reproduced under licence. All rights reserved.

For more information on our funds, please visit www.standardlife.ie/funds

Find out moreTalk to your financial adviser. They’ll give you the information you need. Also, you can call us or visit our website

(01) 639 7000Mon-Fri, 9am to 5pm. Calls may be monitored and/or recorded to protect both you and us and help with our training. Call charges will vary.

www.standardlife.ie

C143170