Squire Mortgage Investment Corporation...Tricities - Kitchener/Waterloo/Cambridge - the economic...

Transcript of Squire Mortgage Investment Corporation...Tricities - Kitchener/Waterloo/Cambridge - the economic...

Canadian Real

Estate: Long-term

Steady Growth

● Stock market volatility

● World Economy

Unstable

● Growing population

and economy =

continuous housing

market growth

Reno & Flipping Houses?Rental Property Management?

● Or you may rely on reputable professionals to

generate safe and secured steady cashflow

● Squire Management Inc. is licensed as a

Mortgage Administrator by Financial Services

Commission of Ontario (FSCO License

#12565)

2nd Mortgage = Higher rate = Higher return to investors

● private 2nd

mortgages

average 12-14%

● private 1st

mortgages

average 6-8%

Why do homeowners

borrow 2nd mortgages?

For many reasons borrowers cannot obtain the full amount they require from a

bank

Because the loan amount is often small.

For example: $50,000 loan at 12% is only $500/month in interest payments

Example:

Purchase price = $500K

Downpayment = $100K

Bank Approval = $350K 1st mortgage

Squire MIC approves $50K

At 12% Monthly Interest = $500 ● Minimum Risk

● Affordable

● Homeowner’s

dream house

Canada’s Strict Underwriting Rules

● Borrowers must typically pay 20% of the purchase price

● Highest Loan to Value Ratio is 80% without mortgage

insurance

● Strict credit check and affordability test

● Borrowers’ repayment ability must be established

● Loan must be backed by quality Canadian Real Estate

Squire MIC Opportunity -

Great Location Great Timing

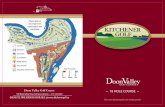

● Squire MIC headquartered in Waterloo, ON

● Tricities - Kitchener/Waterloo/Cambridge -

the economic engine of Canada

● Affordable housing and great jobs

● Tricities’ property values rose by 20.7%

during 2nd quarter of 2017*

● Tightening Mortgage Rules – MIC’s are a

growth market

• Reference Data URL: http://www.newswire.ca/news-releases/kitchenerwaterloocambridge-home-prices-

see-double-digit-growth-in-the-second-quarter-of-2017-634232913.html

Squire MIC -

Safe and Secured● If defaults occur, Squire MIC can sell the property to

repay the loan

● No loss since inception

● Never lend more than 85% of the property value

(weighted LTV approximately 75%)

● Never lend for more than a 1 year term on residential

properties

● Invest in areas with growing real estate values and

stable employment.

● Avoid situations where a loss may occur

Any Potential Risk?

Any investment carries some potential risk. In Squire MIC’s

case 2 things would have to happen for the fund to lose

money on a specific loan...

1. Homeowner is unable or unwilling to make payments

AND

2. The property value falls by more than 25% within 1

year on a 75%* LTV mortgage

*Squire MIC has historically maintained an average LTV of approx. 75%

Risk Protection -

Strategic Diversification

The Fund has met the annual Target Yield of 8.00% since inception

Target Yield with Reinvestment Plan = 8.24%

The Fund has never incurred a loss on any loan

Dividends Paid Quarterly

Target Yield for a $100K Investment is $8,000 per year

Yield of $8,243 With Reinvestment

Why Squire MIC?

● Management are trusted names among investors

● 100% of net profit distributed to investors

● Stable yield

● Not correlated to equity markets

● Offers attractive returns compared with other income funds

● Focused on growth market with huge potential

● Risk diversification to preserve investment capital

● Consistently delivers target rate of return

● Have been helping many homeowners to have their dreams come true.

Many Portfolio Managers

recommend 10% of investment

portfolios be invested in

alternative funds

If you would like to learn more about Squire MIC a

representative from one of our EMD or IIROC partners

will arrange a time to speak with you and answer any

questions you may have.

If you are interested in an investment, they will review

your objectives and provide you with information on how

to invest if you are eligible.