Spotlight Rental Britain as an Asset Class Autumn 2012 · Spotlight | Rental Britain as an Asset...

Transcript of Spotlight Rental Britain as an Asset Class Autumn 2012 · Spotlight | Rental Britain as an Asset...

Autumn 2012

Savills World Research UK Residential Investment

savills.co.uk/research

SpotlightRental Britain as an Asset Class

savills.co.uk/research 03

Autumn 2012

With a dramatic rise in the number of households joining the private rental sector the need for institutional investment becomes increasingly vital

ForewordA need And An opportunity

i n the Spring of this year we published rental Britain in conjunction with rightmove. the report concluded that by 2016

another 1.1 million households will have joined the private rented sector swelling the total to around 5.9 million.

This we estimated, when combined with average annual growth in rents, means that the amount of rent paid within the private rented sector will rise from £48 billion in 2011 to £70 billion in five years.

So there is both a need and opportunity for institutional investment in the private rented sector, something endorsed by Sir Adrian Montague’s report into removing barriers to institutional investment in this sector.

overcoming barriersIn June the Investment Property Forum (IPF) published a paper entitled Institutional Attitudes to Investment in Residential Property; surveying 42 organisations with total property assets of more than £180 billion which included £7.6 billion of residential real estate held across 26 of them.

The report identified a number of reasons why residential investment was attractive. These included; the profile of returns, the stability of income streams and capital values and the low correlation with other asset classes.

It also identified a number of barriers to entry encountered by those organisations which did not hold any residential real estate, the three main ones being the difficulty in managing a granular asset class, the low income returns (notwithstanding strong total returns) and finally the lack of liquidity and

insufficient market scale in the sector.With just 1% of landlords owning

more than one property according to the 2010 Private Landlords Survey, there are clear difficulties in accumulating significant portfolios from existing rental stock and managing it effectively.

Against this context Rental Britain concluded that:

“Larger institutional investment is critical to meeting the demands for private rented accommodation. This requires rental stock to be delivered into the market at a discount to owner-occupied values.

To facilitate this may require a change in the planning system, with private rental sector houses being increasingly interchangeable with affordable housing”.

In this report Rental Britain as an Asset Class we take a more detailed look at the ability of residential property to meet the needs of a much larger investment market and ways by which the perceived barriers to institutional investment might be overcome.

Given the attention currently being paid to accommodating dedicated new-build, private rented housing within the planning system, it concludes by looking at how this might work in practice in order to meet the needs of government, investors, the development market and Rental Britain. n

Lucian CookResidential Research020 7016 [email protected]: @LucianCook

Executive summaryThe key findings in this issue

n Rental growth forecasts are underpinned by deposit affordability issues, increases in the urban population of 20-34 year olds and forecasts for growth in disposable incomes.

n This rental growth is likely to follow geographical patterns of economic growth, with a widening gap between those markets reliant on housing benefit and those weighted towards more affluent renters.

n The residential investment market is already distinguishing between investment and owner-occupied values.

n Analysis of 107 investment deals with a total acquisition price of £2.5 billion gives an average gross initial yield of 7.0%. This varies from 5.5% in London to 9.2% in the North West.

n New investors in the sector are partnering with existing operators to marry up available investment capital and existing market expertise needed to access stock and generate competitive returns.

n Government intervention has the ability to stimulate further institutional investment in build to let and match their objectives with those of the housebuilders and potential investors.

n Delivering new investment stock in scale may require planning trade-offs between affordable, open market and private rented stock in a way that protects land values and preserves financial viability.

n Dedicating new build stock to the private rented sector for a fixed period allows initial net returns to be enhanced and total returns to be boosted by capital growth. The length of planning restrictions and the returns required by the investment market will dictate the investment value of that stock. In turn, that will affect the mix of tenures delivered to the market.

n An informed and flexible approach to these issues would provide a platform to deliver significant and long overdue institutional investment in this sector.

Spotlight | Rental Britain as an Asset Class

04

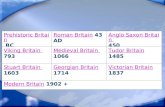

map 1

Urban concentration of ‘Generation Rent’ The map shows the location of the 20% of local authorities in England and Wales with the highest proportion of those aged 20-34 in the adult population

map source: 2011 census data for England and Wales

Market dynamicsThe FUndAmenTAls oF RenTAl demAnd

T he dynamics of the housing market in terms of stretched affordability for first time buyers, localised

supply shortages and rental growth has clearly grabbed the attention of large scale investors who are re-examining the investment opportunities offered in the UK housing market.

But the investment market needs to be sure that these are long-term trends, representing more of a

What underpins the shift towards Rental Britain, and what are the prospects of increased demand for private rented accommodation?

Words by neal hudson

structural shift in the housing market than a short-term reaction to heightened mortgage constraints.

There are two key drivers that point towards increased demand for renting in the long-term.

1. Mortgage affordabilityDeposit affordability is one of the key reasons why younger households are unable to access home ownership thereby increasing demand for private rented sector accommodation. The current first time buyer requires on average a deposit of £28,000 equivalent to four fifths of their annual gross income.

The size of this deposit undoubtedly reflects the current acute lack of mortgage availability in the wake of the credit crunch, particularly at high loan to value ratios.

as a result, we estimate that the number of private rented households across the UK rose by 1.15 million between 2007 to 2011.

Across these local authorities the population of ‘Generation Rent’ has risen by 19% over the past 10 years. The colours on the map illustrate the level of that growth.

The map shows the location of the 20% of local authorities with the highest proportion of those aged 20-34 in the adult population

london inset

newcastle

Bradford & leeds

Peterborough

CardiffBristol

Brighton

manchester

20-34 growthn Over 30%n 20% to 30%n 10% to 20%n 0% to 10%n Negative

20-34 growthn Over 30%n 20% to 30%n 10% to 20%n 0% to 10%n Negative

savills.co.uk/research 05

Autumn 2012

and 34, having grown by 19% in the past decade. No other age group has become so concentrated in specific areas.

Combined with a lack of house building, particularly that aimed at the lower rungs of the housing ladder in urban areas, this has created a supply demand imbalance.

Rental growthTogether these two factors are likely to underpin rental growth in the sector. The extent of that growth is likely to be capped by the affordability of rents. The recently published English Housing Survey indicated that across the private rented sector, rents

In this period, the average first time buyer deposit rose from 10% to 20% of the purchase price. This compounded the effect on deposits of an increase in house price to household income ratios that had occurred in the previous decade.

Critically, this factor meant the issue of deposit affordability existed, but was less extreme, prior to the credit crunch.

In the 1990s, for example, when levels of home ownership were still rising, the average deposit for a first time buyer was 14% of their income. By 2007 it had reached 37% (equivalent to around £13,000). Consequently, the number of UK households in the private rented sector rose from 2.4 million to 3.6 million between 2000 and 2007.

Today, with 97% of mortgages currently taken out by first time buyers requiring capital repayments, their costs (that have also risen in line with house price to household income ratios) affect whether buying or renting is the cheaper option on a month to month basis. Our analysis suggests because of these costs buying remains 21% more expensive than renting.

So even if the brakes do come off accessibility to mortgage finance, first time buyers will still be hampered by deposit and capital repayment affordability.

2. Demographic pressureThere is also evidence of wider demographic drivers affecting the housing demand among ‘Generation Rent’ (20-34 year olds). Recent results from the 2011 census show that they have become increasingly concentrated in urban locations.

map 1 opposite shows the location of the 20% of local authorities where ‘Generation Rent’ makes up the highest proportion of the adult population. It also shows the extent to which that population has grown in these largely urban areas in the past 10 years.

across these locations, 36% of the adult population is aged between 20

UndeRsTAndinG loCAl mARKeTs

Rental growth varies significantly within regions

The findings of Rental Britain suggests there are significant localised variations in rental affordability, meaning the capacity for rental growth varies substantially within regions. Rents have already been pushed upwards in areas where there is a lack of supply and affordability is an issue. This has provided immediate investment opportunities in areas such as Oxford and Brighton.

Those that show capacity for rental growth need to be divided between those where there are the demographic drivers for growth

and those where rents are low because of inherently low tenant demand.

In this respect population growth in ‘Generation Rent’ has not been universal across all urban areas. In the local authorities of manchester, Liverpool, Nottingham, Bristol and milton Keynes rents have risen by more than 20%, but in Warrington and Stockport it has fallen. Similarly in London, growth of over 50% in Hackney, Tower Hamlet and Newham, compares to falls in Sutton, Richmond upon Thames and Bromley.

accounted for 43% of the average gross weekly income spent on rent. This alone indicates that rental growth is likely to be linked closely to earnings growth.

Oxford Economics forecasts net disposable income per capita will rise by 19.2% over the period from 2011 to 2016, with growth of 1.8% in 2012 rising to 4.5% in 2016. against this context we are forecasting rental growth of 20% over a five year period, though there are likely to be variations between region, neighbourhood and sectors of the rental market.

Geographically, we expect rental growth patterns to follow economic growth prospects, with higher growth in London and the South East.

Sectorially, there is the prospect for our rental forecasts to be exceeded, where the tenant profile becomes more weighted to affluent renters. Conversely, rental growth is likely to be reduced in areas where there are high concentrations of tenants reliant on housing benefit. n

“We are forecasting rental growth of 20% over a five-year period although there are likely to be market variations” Neal Hudson, Savills Research

Data source: Savills Research

house price and rental forecastsFive-year forecast values 2012-2016

Forecasts UK london south north

Capital Values 6% 19% 13% -2%

Rental Values 20% 27% 21% 17%

TaBLE 1

Spotlight | Rental Britain as an Asset Class

06

Residential investment oveRComing the BARRieRs

t he residential investment market is undoubtedly changing. over the past 12 months

there has been an influx of overseas capital including from Canada and sweden and UK residential property institutional investment into the sector. however, as an asset class residential property is regarded as being relatively immature.

Because investors are unfamiliar with its granularity and perceive difficulties in building and effectively managing a residential portfolio of scale, they are typically partnering or setting up joint ventures with existing developers and operators in the residential sector. This is to be expected in the early stages of the development of the sector. It is an important part in marrying up the available investment capital and existing market expertise needed to

What returns are on offer to an expanding institutional investment market?

Words by Jacqui Daly

access the housing stock and generate competitive returns from it.

The generation of competitive returns is critical. According to recent research there are some 46 funds or institutions with available funds of £26 billon with an interest in residential investment and UK investment opportunities. However, UK residential investment is in competition with a range of other global real estate opportunities and it is important to understand the strength and weaknesses of the UK residential investment proposition.

UK market returnsOver the past 20 years, UK residential property has outperformed commercial property and other mainstream asset classes on the basis of total returns. Residential returned an annualised average total return of 12.3% whilst the average annualised return from IPD All Commercial Property was 9.1%. The residential returns were therefore 30% higher and also less volatile than commercial property.

However, low income yields have frequently been cited as a major barrier to wide scale institutional investment. Over the same period (1992-2011), 75% of the total return from commercial property has come from income returns (6.8%), while income has accounted for 52% of the total

GRAPH 1

Risk return of residential at an international level

Source: IPD, NAREIT

0 3 6 9 12 15 18 21 24 27

14

12

10

8

6

4

2

0

10 y

r tot

al re

turn

s, c

ompo

und

Switzerland

Austria

Germany

Risk – standard deviation

Netherlands

Finland

France

UK

London

Denmark

US Direct

US Real Estate REITs 50

US Resi REITs

savills.co.uk/research 07

Autumn 2012

the North West (where income returns are expected to make up the majority of the total return in the next 5 to 10 years).

This indicates the current residential investment market, is already distinguishing between investment and owner-occupier value. However, the degree to which these two differ is dependent upon whether investors see different types of residential property as a predominantly income or capital play.

Whatever the capital growth prospects and projected internal rates of return, we expect investors to require a minimum income return. But we do not expect them to ignore capital growth entirely, as we know that this is one of the major attractions of the sector.

international contextThe most appropriate way of setting London residential in the context of other residential real estate markets is to compare its risk and return profile. Using 10 year annualised returns and assessing the volatility of these returns

return from UK residential (6.5%).Despite the inclusion of residential

property in the main IPD index this year, the lack of publicly available information on the market is a significant barrier to its ability to expand through institutional investment. The fact that there is no information available on portfolio deals, prices achieved and gross initial yields prevents large institutions from being able to make rational investment decisions in the residential sector.

To counteract this, Savills has established a proprietary database to track the progress of investment deals across the UK. The database holds information on 108 deals that have taken place during the course of the last 18 months and provides detailed information on the 40 or so investments that are currently being marketed throughout the UK.

The average gross initial yield of these transactions was 6.6% and the average discount was 20% but this varies from 5.5% in London (where medium term capital growth prospects are strongest), to 9.2% in

TABLE 2

investment transaction Activity

Table source: IPD

“Over the past 20 years, UK residential property has outperformed commercial property and other mainstream asset classes on the basis of total returns” Savills Research

shows that there is a group of Northern European countries (Switzerland, Germany, Austria and the Netherlands) where annualised total returns are modest (average 5.5% p.a.) and the returns have been very stable (low levels of volatility).

The UK and London have had higher annualised total returns (average 10% p.a.) which have been more volatile than the very stable returns evidenced in many northern European countries but substantially less volatile than the US REIT market. This is interesting given the US Residential REIT market is the largest in the world with a market cap of $70 billion (£44 billion). Clearly, the returns have been higher than UK residential but the falls have also been much deeper which has created the volatility in the market. The fact US REITs are volatile may explain why it is largely a vehicle for retail investors rather than an institutional investment instrument.

Developing the sectorThe development of a much larger scale investment market in UK residential property, one that builds on the emerging demand from funds and institutions, requires a more detailed understanding of the investment market and greater availability of market information to allow the emergence of a more liquid and efficient market. n

Why invest?

The key features of residential investment

n Undersupplied market with strong growth prospects

n History of real annual house price growth

n High rates of occupancy, in the region of 95%

n Low rates of depreciation versus commercial property

n Different returns profiles can match individual investor’s requirements for income versus capital growth

Average lot size £m

Average number of

units

gross initial yields Discounts

London £26m 75 5.5% 18%

East Anglia £2.3m 26 7.9% 20%

Southern £4.4m 39 7.2% 24%

North West £11m 237 9.2% 25%

North East £2.6m 59 8.8% 25%

Yorkshire & Humber £1.4m 24 9.3% 28%

Scotland £8m 87 6.8% 31%

Regional / National Portfolios £48m 280 7.6% 23%

UK £31m 130 6.6% 22%

Spotlight | Rental Britain as an Asset Class

08

DevelopmentBuilding A Build to let model

B uild to let has long been vaunted as a major part of the solution to meeting the housing

requirements of ‘generation Rent’ and increasing levels of house building to deliver economic growth from the construction sector.

A silver bullet?These, together with a desire to improve the choice and standard of accommodation for the burgeoning so called ‘Generation Rent’ are key goals for the Government.

Build to let will have a valuable role to play in the resurgence of the UK property market. But, above anything, the financials will need to stack up

Words by lucian Cook

From the perspective of the house building industry it has the potential to increase market capacity otherwise constrained by low levels of housing transactions. It also has the ability to substantially de-risk large development sites, that are otherwise stalled.

However, there are questions over how it would impact on the wider financial viability of such sites by affecting developers profit and ultimately land value.

From an investment perspective, there is little doubt that there is an appetite for residential investment, though the ability to deliver that at scale in a way that meets investors requirements has been less clear.

government interventionThe Government now has the opportunity to unlock the potential of build to let. In its simplest form it can provide public sector land specifically for such development. It can also provide tax efficient investment structures, such as REITS, to develop and hold that stock.

GRAPH 1

Build to let in a debt constrained; low growth environment

government development industry

Build to let

investment marketneeds to:

1. House generation Rent

2. improve the quality of rental accommodation

3. Stimulate the development industry

Wants to:1. increase volumes

of house building

2. Forward fund larger stalled sites

What are the market iRR requirements?

What does that mean in terms of development viability?

Wants:1. low risk investment

opportunities with competitive iRRs

needs:1. improved income yield

2. Scale3. management

Supply of land

Trade offs within the planning system

Tax efficient investment structures

Policy opportunity

savills.co.uk/research 09

Autumn 2012

existing Stock 10 year iRR gross initial Yield

Annual Rental growth

5.5% 6.0% 6.5% 7.0%

3% 7.5% 7.9% 8.4% 8.8%

4% 8.6% 9.0% 9.4% 9.8%

5% 9.6% 10.0% 10.5% 10.9%

6% 10.6% 11.1% 11.5% 11.9%

Build to let Stock 10 year iRR gross initial Yield

Annual Rental growth

5.5% 6.0% 6.5% 7.0%

3% 6.7% 7.0% 7.4% 7.7%

4% 7.7% 8.1% 8.4% 8.7%

5% 8.8% 9.1% 9.5% 9.8%

6% 9.8% 10.2% 10.5% 10.8%

We have also run the same analysis on the basis of a ‘rent free’ period of two years and presented the resultant IRRs

More fundamentally, to deliver product at scale, it has the opportunity to use the planning system to bring forward the delivery of dedicated private rented sector stock.Consequently, this stock is valued on an investment basis (thereby meeting the requirements of the investment market), in return for lower levels of affordable housing (thereby protecting the financial viability of development).But the financials need to stack up.

investor returnsIn order to understand how gross initial yields translate into internal rates of return we have produced a working example taking a notional investment of £100 (including purchaser costs), assumed operational costs of 30% and an investment period of 10 years with an investment sale exit at the same initial rates.

The table opposite sets out IRRs related to variations on gross initial yield and potential annual rental growth. In terms of understanding how build to let can be made to work from an institutional perspective we need to move away from the concept of a discount to vacant possession value and consider residential in the same way as commercial real estate assets.

This means developing transparency around operational costs to arrive at net operating income and matching these to investor requirements based on net initial income yields and internal rates of return dependent on the intended investment hold period.

Short-term investors will continue to be driven by capital growth where capital growth prospects exist but longer-term investors will be more reliant on income growth and running yields. With rental growth projected to outperform house price inflation in many mainstream markets, there is an opportunity for longer-term investment in the sector.

Short-term investor appetite can be absorbed by existing stock portfolios (acknowledging a degree of aggregation will need to happen to achieve scale) however, as the sector matures the build to let model will become increasingly in vogue.

Positive for the industryBuild to let could be a real positive for the industry as although it clearly has a lead in period the additional benefits of purpose built stock are vast. This includes higher rates of efficiency on gross to net income ratios, the

TABLE 3

understanding investor returns IRRs delivered from gross investment yields

Table source: Savills Research

potential to create aspiration products which have customer loyalty and sophisticated landlords and managers returning a high level of service to the consumer.

The build to let market will have its challenges as it will need to be focused on land traditionally targeted to the owner occupier market. The majority of this land will be in the control of Britain’s housebuilders who need to play a major role in the progression of build to let.

The development of the build to let market will therefore not only require an acceptance from housebuilders that forward commitments on purpose built stock can be beneficial to the delivery of wider strategic sites by de-risking an element of the scheme, but also an agreement from local authorities that the delivery of private rented stock will specifically meet local housing needs.

Situations where build to let is most likely to be acceptable to housebuilders would include:

n Stalled sites where the owner-occupier market is not active

designs on Build to letDelivering tailored products

Part of the challenge for developers will be to deliver products tailored to the investment market, that are weighted towards the requirements of both ‘Generation Rent’ and the bulk investment market.

Providing more, smaller units at a higher density could have the additional benefit of limiting the trade off with affordable and private housing. Reducing lifecycle repair costs could improve net yields.

Providing electricity, insurance, service charges, ground rents and telephone and internet packages could generate additional income streams from letting.

This tends to be the approach used in more mature international markets that have been highly successfully at securing private investment into the residential sector.

Although there are already some institutional landlords operating in a similar vein in the UK, such as Grainger and Evenbrook, this situation raises the prospect of more investment from landlords willing to provide a service that benefits from scale rather than the approach used by buy to let landlords.

Spotlight | Rental Britain as an Asset Class

Current All PRS Zero Affordabletwo thirds less

Affordableone third less

Affordable

units 500 500 500 500 500

market 350 0 170 230 290

Affordable 150 0 0 50 100

Private Rental 0 500 330 220 110

Vacant Possession Value £150,000 £150,000 £150,000 £150,000 £150,000

% of VP Value

market 100% 100% 100% 100% 100%

Affordable 45% 45% 45% 45% 45%

Private Rental 75% 75% 75% 75% 75%

gross development Value (£)

market 52,500,000 - 25,500,000 34,500,000 43,500,000

Affordable 10,125,000 - - 3,375,000 6,750,000

Private Rental - 56,250,000 37,125,000 24,750,000 12,375,000

gdV 62,625,000 56,250,000 62,625,000 62,625,000 62,625,000

10

n Sites where development finance is constrainedn Larger strategic sites where build to let can act as a catalyst for private sales.

development viabilityThere is a limit on the length of planning restriction, given the impact which this could have on the development mix. This impact is best illustrated by the example of a theoretical 500 unit scheme with 350 market units and 150 affordable units valued at 45% of vacant possession value.

A 100% PRS scheme with a 10-year planning restriction that would fail to deliver a comparable GDV, while dropping all of the affordable units would weight the scheme so heavily to the PRS, it could become difficult to absorb in the market.

Our analysis suggests that, in this case, it is more likely there would be a one third or two third reduction in the affordable units and between market and PRS units on the residue. This may vary according to the relationship between affordable and private rented housing values at a local level; something which could be affected by

TABLE 4

effect of dedicated PRS stock on development mix Assumes 10-year dedication to renting

Table source: Savills Research

making Build to let Pay?Preserving the financial viability of a scheme

The main challenge facing build to let is how to preserve the financial viability of a scheme, without unduly impacting on land value.

In simple terms, a straight swap from private sales to market rent would reduce gross development value and hence land value, a fundamental problem holding back the housebuilders and developers.

Two potential solutions may include:

1. Taking a cue from the student housing sector. Private rented accommodation, without a s106 requirement for affordable

housing, would enhance viability for a site with a range of tenures.

2. Taking this a step further, by reducing the affordable housing provision in return for a balance between private rented accommodation and private sales would also benefit viability and maintain lend value.

Both approaches would require local planning authorities to provide greater flexibility on planning consents, agreement over the length of the PRS provision and the impact on viability.

the withdrawal of subsidy.In the event that a 20-year planning

restriction was imposed, a much lower number of PRS units would be deliverable relative to market units.

Given these kind of trade offs, investors, developers and local authorities should be encouraged

to identify the need and scope for PRS accommodation, so they can make rational decisions and deliver build to let to market capacity. Then the overdue need for institutional investment in the sector can become a reality. Our research suggests there has never been a better time. n

savills.co.uk/research 011

Date

n Residential Property Focus | Q3 2012n Spotlight | Where Best to develop And invest in Residential Propertyn Spotlight | ground Rentsn Special Report | Rental Britain

For more information, visit savills.co.uk/research

Research publicationsOur latest reports

Savills team Research

Residential Capital Markets

Savills plcSavills is a leading global real estate service provider listed on the London Stock Exchange. The company established in 1855, has a rich heritage with unrivalled growth. It is a company that leads rather than follows, and now has over 200 offices and associates throughout the Americas, Europe, Asia Pacific, Africa and the Middle East.

This report is for general informative purposes only. It may not be published, reproduced or quoted in part or in whole, nor may it be used as a basis for any contract, prospectus, agreement or other document without prior consent. Whilst every effort has been made to ensure its accuracy, Savills accepts no liability whatsoever for any direct or consequential loss arising from its use. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without written permission from Savills Research.

lucian CookUK Residential020 7016 [email protected] Twitter: @LucianCook

Jacqui dalyInvestment020 7016 [email protected]

Andrew BrentnallFunding and Development020 7016 [email protected]

neal HudsonInvestment020 7409 [email protected]

James CoghillHead of Residential Capital Markets020 7409 [email protected]

Peter AllenResidential Investment020 7409 [email protected]