Sector performance and valuation update; …...Sector performance and valuation update; "squeezed...

Transcript of Sector performance and valuation update; …...Sector performance and valuation update; "squeezed...

September 4th, 2012

Research Report: Sector update

Davy on Food and Beverages

Sector performance and valuation update; "squeezed middle" a big challenge for consumer-facing companies

www.davy.ie Bloomberg: DAVY<GO> Research: +353 1 6148997 Institutional Equity Sales: +353 1 6792816 Davy Research

John O'Reilly john.o'[email protected] / +353 1 6148915

Jack Gorman [email protected] / +353 1 6148926

Aiden O' Donnell [email protected] / +353 1 6724211

Barry Gallagher [email protected] / +353 1 6149194

Beverages outperform again in past week, extending the sector's market-leading performance year-to-date

• Beverages were the best performing sector in European markets in the past week (+2%), as strong results from large-cap Diageo underlined the recent robust operating performances across the sector. The FTSE E300 was -0.5% in the past week.

• Beverages are the best-performing European sector year-to-date. Food producers are +10% year-to-date, also outperforming the wider market (+8.4%).

• In contrast, the beverage sector performed poorly in the US in the past week. The S&P 500 was flat on the week, but beverages were down -1.5% while food products marginally outperformed (+0.3%).

• Year-to-date, beverages (+8.6%) and food products (+5%) are underperforming the overall market (+12.3%). Changing perception of what defines America's middle class

• In this week's commentary, we review the findings of a recent report by the Pew Research Center ('Public says a secure job is the ticket to the middle class ') and discuss the takeouts for consumer-facing companies. Focus on Britvic and Total Produce; forthcoming newsflow

• Our stock focus this week is on Britvic and Total Produce.

• Results season is starting to wind down. Total Produce (September 4th) and Richemont (September 5th) are of most interest this week.

Please refer to important disclosures at the end of this report.

J&E Davy, trading as Davy is regulated by the Central Bank of Ireland. Davy is a member of the Irish Stock Exchange, the London Stock Exchange and Euronext. For business in the UK, Davy is authorised by the Central Bank of Ireland and subject to limited regulation by the Financial Services Authority. Details about the extent of our regulation by the Financial Services Authority are available from us on request. All prices are as of close of business August 31st unless otherwise indicated. All authors are Research Analysts unless otherwise stated. For the attention of US clients of Davy Securities, this third-party research report has been produced by our affiliate, J&E Davy.

Table of contents

"Squeezed middle" a big challenge for consumer-facing companies 2

Stock focus: Britvic and Total Produce 4

Sector review 6

Company analysis 13

Important disclosures 37

Ratings

ARYZTA Outperform 14/06/2010 Previously Neutral 30/06/2009 Associated British Foods Outperform 05/07/2011 Previously Neutral 03/11/2010 Britvic Neutral 25/02/2011 Previously Outperform 27/09/2010 C&C Outperform 30/06/2009 Carlsberg Neutral 06/01/2010 Previously Outperform 30/06/2009 Continental Farmers Group Outperform 05/08/2011 CSM Neutral 29/04/2011 Previously Outperform 01/09/2010 Diageo Outperform 11/01/2010 Donegal Creameries Outperform 17/09/2010 Previously Underperform 30/06/2009 Frutarom Outperform 21/06/2012 Fyffes Outperform 27/01/2011 Previously Neutral 18/02/2010 Givaudan Neutral 21/06/2012 Glanbia Outperform 11/05/2010 Greencore Group Neutral 11/02/2010 Previously Underperform 30/06/2009 Heineken Underperform 08/06/2010 Previously Neutral 14/08/2009 Kerry Group Outperform 30/06/2009 Naturex Neutral 21/06/2012 Origin Enterprises Outperform 30/06/2009 Pernod Ricard Outperform 22/03/2011 Previously Neutral 27/04/2010 Robertet Neutral 21/06/2012 Südzucker Outperform 15/02/2010 Symrise Outperform 21/06/2012 Tate & Lyle Neutral 04/04/2011 Previously Underperfrom 13/08/2010 Total Produce Outperform 14/05/2010 Previously Neutral 30/06/2009

For full details of current and previous ratings see www.davy.ie/ratings

Research Report: Davy on Food and Beverages September 4th, 2012

2 Davy Research

"Squeezed middle" a big challenge for consumer-facing companies The modern era of consumerism — the thought system that encourages the consumption of goods and services in ever greater quantities — could not be as it is without the continual expansion of the middle class. If the 20th century was marked by one phenomenon, it was the swelling of the middle class demographic. What may be happening to the middle class therefore, actually or in terms of perception, is of great significance. If it is compressing and if this continues, the behavioural change that will follow will impact negatively on consumer spending. There is no all-encompassing, single definition of 'middle class'. It can be defined by income, occupation or relative social standing (as between 'lower' and 'upper' classes). But as well as objective measurements, there is also individual, subjective measurement based on the possessions considered necessary for middle class status like home ownership, a secure job, health insurance or a college education. In a report issued on August 31st ('Public says a secure job is the ticket to the middle class'), the Pew Research Center1 highlights a substantial change in the ranking of possessions considered a pre-requisite of being middle class over the past two decades. It notes that 20 years ago, home ownership was essential to being considered middle class — 70% of Americans agreed to this. This was revealed in a 1991 Time/CNN/ Yankelovich survey. Other possessions considered essential to being middle class (and the percentage of Americans agreeing) at that time were: two or more cars (48%); a college education (46%); stocks, bonds or other investments (41%); and a white-collar job (33%). Pew notes that there are wording differences between its just completed survey and the previous one. While the latter asked about the significance of a white-collar job, Pew asked about a secure job. These wording differences are significant not because of the words themselves but because the circumstances in which the questions were asked are very different — circumstance, actual and anticipated, informs perception. The context for the Pew survey is persistently high unemployment over the past four years and a now widely acknowledged longer-term decline in the share of the working-age public that is employed. For example in 2011, the male employment-to-population ratio was, at 71%, 10 percentage points lower than a decade previously and was at its lowest level since 1951 (89%) when the data were first collated by the US Bureau of Labour Statistics. In addition, median income has been declining. In an earlier report (August 22nd, 2012), Pew noted that since 2000, the middle class has shrunk in size, fallen backward in income (measured as overall mean family income) and wealth, and shed some — but by no means all — of its characteristic faith in the future.

1 The Pew Research Center is a non-partisan fact tank that provides information on the issues, attitudes and trends shaping America and the world. The centre conducts public opinion polling, demographic studies, media content analysis and other empirical social science research. It does not take positions on policy issues.

Research Report: Davy on Food and Beverages September 4th, 2012

3 Davy Research

In light of the unemployment and income trend, it is hardly surprising that in the Pew survey, 86% of respondents said that having a secure job was necessary to be considered middle class. Other possessions believed to be necessary (and the percentage of respondents agreeing to this) were: health insurance (66%); home ownership (45%); college education (37%); and stocks, bonds and other investments (28%). Owning two or more cars is no longer considered a key qualifying possession in the Pew survey and when compared with the survey of two decades ago, there has been a radical change in the ranking of a secure job and home ownership while health insurance — which for many Americans comes through one's job — now features as "an essential ticket to a middle class life". As noted at the outset, the consumerism of the 20th century needed a burgeoning and prosperous middle class. If, as has been observed by many commentators, we are observing a secular squeeze on the middle class demographic, then it is improbable that the consumer expenditure trends in western societies of recent decades will remain unaltered. Part of the evolution of the middle class since the 1950s was the increase in the employment of women. In the US, the female employment-to-population ratio in 1950 was 36%. It rose linearly until 2001 when it reached 68%. But the decade since 2001, according to Pew, was the first in the modern era when women aged 16 to 64 have not made gains in employment rates over the prior decade. In 2011, the level was 62%. To what extent current trends in consumption (i.e. depressed food volume sales) are correlated with the change in the middle class demographic is unknown. But survey results like those of Pew do provide a context in which to measure and assess this. The "squeezed middle" provides a big challenge for consumer-facing companies.

4 Davy Research

Research Report: Davy on Food and Beverages September 4th, 2012

4 Davy Research

Stock focus: Britvic

• Britvic has had a difficult FY 2012 to date, with bad summer weather compounded by a recall of the key Fruit Shoot brand in the UK and some exports markets following problems with the new cap design.

• At the time of the second profit warning of the year in July, Britvic announced that it now expects the recall to cost £15-25m at the PBT line across the current and next financial year. The anticipated impact in the year to end-September 2012 is estimated at £10-18m with the remainder in 2013.

• Britvic has decided to re-supply customers with an alternative market-proven sports cap in the short term. If this re-stock has gone to plan, Fruit Shoot should be on shelves in limited supply now. However, the brand will not be back to full historic volume levels for six months.

• The lower profitability this year has called into question Britvic's ability to maintain its traditional dividend payout ratio. In November, the board will have visibility on FY 2012 preliminaries as well as two months' trading of FY 2013. At that point, it will make a call on whether the fruit shoot effects are one-offs or not. If they are, we are likely to see a dividend broadly in line with the progressive high payout ratios of recent years (c.50%). Aside from Fruit Shoot, there have been some bright points in the business recently. The Pepsi relationship in the UK remains excellent, and Pepsi is continuing to take share in this market. In addition, the franchise business in the US is starting to develop, even if the profit contributions will continue to be immaterial in the short term.

• Our stance on Britvic is 'Neutral'. The stock is well supported by a dividend yield of c.5.5% but the upside is constrained by the difficult trading conditions in core markets and persistent input cost pressures. Britvic trades on a P/E of 10.3x, a c.35% discount to the wider beverage sector.

Britvic share price fluctuations since 2005 IPO

150

200

250

300

350

400

450

500

550

Dec

05

Jun

06

Dec

06

Jun

07

Dec

07

Jun

08

Dec

08

Jun

09

Dec

09

Jun

10

Dec

10

Jun

11

Dec

11

Jun

12

Dec

12

IMS: 1st profit warning

IMS: 2nd profit warning

Permira bid spec

Buys C&C Irish Soft Drinks

Permira exits stock

Period of market share gains, benign input cost pressures.

carbonates strong

Buys French

11F input guidance

5-6% IMS: 5-6% maintained

IMS:3rd profit warning input guidance 9-11%

Weak trading GB & Ireland

H1: Guides mkt to lower end of range

Fruitshoot £1-5m recall

Product recall guidance £15-25m + 4th trading profit

warning

Source: Factset; Davy

12-month forward P/E — beverage sector

17.0 x

10.3 x12.0 x 12.5 x 12.4 x

16.4 x14.3 x

15.9 x

23.9 x

17.6 x16.4 x 16.4 x

17.3 x16.1 x

10.5 x

16.0 x

0x

5x

10x

15x

20x

25x

30x

ABI

Britv

ic

C&

C

Car

lsbe

rg

CC

E

Cam

pari

Dia

geo

Hei

neke

n

Pern

od

Rem

y

SABM

iller

Euro

pean

Lux

ury

Goo

ds

Glo

bal B

rew

ers

Glo

bal S

pirit

s

Stox

x 60

0 F&

B

FTSE

E30

0

Source: Factset

12-month forward EV/EBITDA — beverage sector

9.7x

8.2x

9.9x

12.6x

8.1x

12.1x

15.5x

12.8x

7.0x 7.7x

7.0x

0x

2x

4x

6x

8x

10x

12x

14x

16x

18x

ABI

Britv

ic

C&

C

Car

lsbe

rg

CC

E

Cam

pari

Dia

geo

Hei

neke

n

Pern

od

Rem

y

SABM

iller

Source: Factset

12-month forward dividend yield % — beverage sector

2.5%

5.5%

2.8%

1.3%

2.3%

1.4%

2.8%

2.2% 2.2%

1.7%

2.4%2.1%

2.4% 2.3%

3.1%

4.3%

0%

1%

2%

3%

4%

5%

6%

ABI

Britv

ic

C&

C

Car

lsbe

rg

CC

E

Cam

pari

Dia

geo

Hei

neke

n

Pern

od

Rem

y

SABM

iller

Euro

pean

Lux

ury

Goo

ds

Glo

bal B

rew

ers

Glo

bal S

pirit

s

Stox

x 60

0 F&

B

FTSE

E30

0

Source: Factset

12-month forward EV/FCF % — beverage sector

5.8%5.0%

9.9%

6.7%

4.8% 5.1%4.7%

6.1%

4.0%3.6%

4.5%

0%

2%

4%

6%

8%

10%

12%

ABI

Britv

ic

C&

C

Car

lsbe

rg

CC

E

Cam

pari

Dia

geo

Hei

neke

n

Pern

od

Rem

y

SABM

iller

Source: Factset

Earning growth CAGR 2011-2014f — beverage sector

12.8%

2.6%

5.1%

12.4%

7.8%

11.5% 11.4%9.7%

14.0%

25.4%

11.7%

14.6%

12.1%13.7%

10.3%8.6%

0%

5%

10%

15%

20%

25%

30%

ABI

Britv

ic

C&

C

Car

lsbe

rg

CC

E

Cam

pari

Dia

geo

Hei

neke

n

Pern

od

Rem

y

SABM

iller

Euro

pean

Lux

ury

Goo

ds

Glo

bal B

rew

ers

Glo

bal S

pirit

s

Stox

x 60

0 F&

B

FTSE

E30

0

Source: Factset

5 Davy Research

Research Report: Davy on Food and Beverages September 4th, 2012

5 Davy Research

Stock focus: Total Produce

• Total Produce has traded in a tight range between 39c and 45c for most of the last two years. It briefly moved up towards 50c in early 2012 but failed to maintain that level. It has now built a very solid base and should it take out 45c, it can easily move towards 50c and ultimately higher.

• Despite the fact that defensive names have been in vogue for most of 2012, Total Produce has failed to ride this wave. It has underperformed the market this year, which is a surprise as it possesses many of the defensive qualities that investors were looking for.

• At less than 6x on a P/E basis, its valuation is below its long-term and recent average. The stock has de-rated in an absolute and relative sense over the past 18 months. This is despite earnings increasing consistently.

• Revenues have grown consistently on an annual basis since the de-merger. This is encouraging given the difficulties at a macro level since 2007. Profits have followed a similar trend with management always focused on margin delivery.

• One of the reasons for Total Produce's consistency is its broad product and geographic spread. It has leading positions in many key products and markets in Europe.

Total Produce — share price performance

10

20

30

40

50

60

70

80

90

Jul 06 Jul 07 Jul 08 Jul 09 Jul 10 Jul 11 Jul 12 Source: Datastream

Total Produce — share price relative to the market

40

50

60

70

80

90

100

110

120

130

Jul 06 Jul 07 Jul 08 Jul 09 Jul 10 Jul 11 Jul 12 Source: Datastream

Total Produce — Forward P/E

2x

4x

6x

8x

10x

12x

14x

16x

Dec 06 Jun 07 Dec 07 Jun 08 Dec 08 Jun 09 Dec 09 Jun 10 Dec 10 Jun 11 Dec 11 Jun 12

Source: Factset

Total Produce — revenue growth

0

500000

1000000

1500000

2000000

2500000

3000000

2005 2006 2007 2008 2009 2010 2011

Group Fresh Produce Consumer Foods Source: Davy

Total Produce — Forward P/E relative to E300 index

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

1.1

1.2

Dec 06 Jun 07 Dec 07 Jun 08 Dec 08 Jun 09 Dec 09 Jun 10 Dec 10 Jun 11 Dec 11 Jun 12

Source: Factset

Total Produce — product mix

Stone 16%

Banana14%

Veg/Potato13%Salad

11%

Other10%

Citrus9%

Deciduous9%

Tomato9%

Grape4%

Exotics3%

Pineapple2%

Source: Company Accounts

S E C T O R R E V I E W

6 Davy Research

Food and beverage Newsflow

A U G U S T 3 0 T H

Pernod Ricard: Profit a touch behind consensus; succession plans in place

FACTS: Pernod Ricard has reported (August 30th) full-year results to end-June 2012. ANALYSIS: Pernod reported sales of €8,215m (Davy: €8,179m) with organic growth of 8% (Davy: 7.4%). Profit from recurring operations was €2,114m (Davy: €2,128m) with organic growth of 9.2% (Davy: 10.0%). Pernod's guidance for organic profit growth for the FY was "close to 8%" so it beats its target but consensus had expected 9.6%, so it's a touch behind that. As is customary, Pernod will provide guidance at its Q1 results, but it did say that it is confident in its ability to deliver solid growth this year. This assumes a slowdown in the pace of global economic growth in mature as well as emerging markets, ongoing difficult situation in Western Europe (impact of debt and public deficit reduction measures), continued good growth in the US and strong growth in emerging markets. A number of board changes were announced following the passing of former CEO and chairman Patrick Ricard. Alex Ricard is to succeed the current CEO, Pierre Pringuet, in January 2015. He is appointed deputy CEO and COO. He was also co-opted as a director to replace Patrick Ricard. He joined the group in 2003 and was appointed CEO of Irish Distillers in 2008. In 2011, he joined the group general management as managing director in charge of the distribution network. Daniele Ricard is appointed chairman of the board of directors, and Pierre Pringuet is appointed vice-chairman of the board and will continue to act as CEO (until 2015). EPS was 4.53c (Davy: 4.62c). Net debt was €9,363m, a decrease of €385m before translation adjustments (a similar decrease to last year). Net debt-to-EBITDA was 3.8x compared to 4.4x, triggering a further reduction of 15bps in its interest rate. Overall operating margin was 25.7%, up 75 bps. Gross margin rose 8%, expanding to 61.4%, up 111bps. Advertising and promotion (A&P) investment as a percentage of sales increased slightly to 19.1%, with an 11% increase in investment in emerging markets and a -2% decline in European spend. Structure costs as a percentage of sales increased in line with sales, +8%, with spend very much skewed to emerging markets (+63%) whereas structure cost increased below inflation in Western Europe. Emerging markets (39% of group profit) recorded FY sales growth of 17%. Mature market grew sales 2%. Pernod's top-14 brands (60% of group sales) grew 10% in value, reflecting favourable price/mix of six. Thirteen out of the 14 brands reported growth (Ricard declined as it was affected by the duty increase in France). The following brands showed the strongest growth: Martell (25%), Royal Salute (23%), The Glenlivet (19%) and Jameson (18%). Premium brands represented 73% of sales, compared to 71% in the previous year. Q4 organic sales grew rose 4% (Davy: 3.4%). Technical effects from the impact in France from distributor de-stocking continued into Q4. Excluding these technical effects, Q4 growth was +7%, in line with the underlying trend in the year.

Divisionally, Q4 organic sales growth was: Asia +14% (Davy: +16%); Americas +9% (Davy: +7%); Europe 0% (Davy: +2%) ; and France -25% (Davy: -33%). Asia/RoW (39% of group profit), with FY organic sales growth of +15% (Davy: 15.5%) and operating profit growth of 21% (Davy: 22.9%) remained the driving force for group growth. This was primarily due to Asia, particularly China, India, Vietnam, Taiwan and duty-free markets. Americas (29% of group profit) recorded organic sales growth of +6% (Davy: 5.3%) and operating profit growth of 4% (Davy: 4.1%). In the US, sales growth accelerated to 5%, driven by the continued success of Jameson. Absolut did better in the second half in the US. Brazil showed strong growth (+13%) with the top-14 up 26%. Mexico sales declined (-12%) due to the overhaul of the operating model there. Europe (23% of group profit) recorded organic sales growth of +2% (Davy: 4.3%) and operating profit growth of 4% (Davy: 1.5%). In Eastern Europe, sales growth accelerated to 16% (9% in the previous year). Western Europe showed a slight decline (-1%) over the 12 months. This was primarily attributable to Spain (-4%), the UK (-4%), Greece (-13%) and Italy (-13%). France (9% of group profit) saw organic sales growth of -1% (Davy: -2.8%) following the excise duty hike (14% on average) in January. Operating profit growth was down -3% (Davy: -4.5%). DAVY VIEW: We continue to believe that Pernod can deliver growth in the top tier of the consumer sector. Faster growth in its top-14 brands (primarily Cognac, Scotch and Irish) will improve sales mix, cash-flow and operating leverage. Pernod’s model of investing disproportionately in its top-14 brands and cementing leading positions in faster-growing emerging markets (China and India in particular) is driving its high-single-digit to double-digit organic operating profit growth model. We reiterate our 'Outperform' stance. Price rating: Outperform (22/03/11; previously Neutral, issued 27/04/10).

A U G U S T 2 9 T H

Glanbia: Strong H1 led by Global Nutritionals

FACTS: Glanbia has released (August 29th) its first-half results. It notes a solid start to the financial year and as a result, it is raising its full-year outlook to 8-10% growth on a constant currency basis (previously 5-7%). Our own current forecast is for FY EPS growth of 9.4% on a reported basis. Separately, the company has also outlined plans to create a strategic dairy process joint venture in association with the Glanbia Co-operative Society. ANALYSIS: On a constant currency basis, revenues and profits (EBITA) for the group (including JVs) increased by 1.1% and 1.5% respectively. Total group EBITA margin increased by 10bps. The US Cheese and Nutritionals division grew revenues and profits (EBIT) by an impressive 8.6% and 18.4% respectively year-on-year. This resulted in a margin increase of 10.2%, a 90bps improvement

on the previous year. The revenue growth was split 4.1% volume and 4.5% price/mix. Ongoing efficiency measures in US cheese enabled the business to generate a similar EBIT out-turn to last year despite lower revenues. Global Nutritionals performed exceptionally well in the period, accounting as expected for almost all of the underlying EBIT growth in the group. The result was achieved against a backdrop of higher raw material costs, most notably whey. This is a benefit for the Ingredients Technologies division — a seller of value-added whey solutions — but a challenge for the Performance Nutrition division. The company expects some easing in whey costs in Q4 as new supplies come on-stream and this will be welcomed as the company notes that price elasticity appears to creeping into the segment. However, the overall outlook for Global Nutritionals is positive and a strong year-on-year performance is expected. Dairy Ireland failed to repeat the very strong out-turn of H1 2011. Operating profit fell 14.5% as the company faced a very challenging environment especially in its Dairy Ingredients Ireland segment. The lag between falling selling prices and raw material input cost reductions impacted margins. This out-turn is as expected. The severe drought that is impacting the US currently may put upward pressure on global prices in the second half but it is perhaps too early to build this into assumptions. Overall for the division, which includes Consumer Products and Agri, revenues fell 4.7%. Profits are forecast to be lower year-on-year. Operating profit at the JVs and associates fell by 30% year-on-year on a constant currency basis. As with Dairy Ireland, this part of the business faces a difficult comparator given the strong market dynamic that existed in the cheese market in H1 2011. The H1 2012 out-turn is slightly ahead of the three-year average. The full-year performance is expected to be modestly reduced on 2011. The board is recommending a 10% increase in the dividend to 3.66c per share. Net debt at the half-year decreased slightly year-on-year to €561m. This number is higher than the year-end figure, reflecting the seasonal working capital requirements. DAVY VIEW: These results will be overshadowed by the announcement around the Dairy Ingredients Ireland division. However, this is a very strong set of numbers. The increase in guidance should be taken positively, especially given that the group is experiencing significant raw material pressure in its Global Nutritionals division as well as challenges in Dairy Ireland. Revenue and profit growth is very impressive within Global Nutritionals and notwithstanding the fact that raw materials are an issue in the short term, the underlying momentum in this portion of the business is strong and the trend towards healthier living that underpins much of the demand story looks to have no signs of reversing in the medium term. Price rating: Outperform (30/06/09).

S E C T O R R E V I E W

7 Davy Research

Food and beverage Food

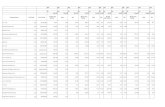

S H A R E P R I C E A N D P E R F O R M A N C E Price 12 Month Mkt. Cap Change % (€) Rel to E300 sector % Pr/Bk Debt/EBITDA Local High Low €m Wk 1 Mth YTD Wk 1 Mth YTD 2011 2011 2012

I N G R E D I E N T S Kerry Group (KYG ID) 3809 3900 2485 6691 1.0 3.1 34.7 2.3 4.2 23.0 3.62 2.1 1.7 Frutarom (FRUT IT) 918 987 797 418 2.4 0.7 5.6 3.7 1.8 -3.6 1.34 1.3 1.2 Givaudan (GIVN VX) 90100 96300 70350 6927 -0.3 -5.2 1.9 1.0 -4.2 -7.0 2.36 1.9 1.6 Naturex (NRX FP) 5300 5500 4300 369 4.7 15.2 2.1 6.1 16.5 -6.8 1.73 1.7 2.0 Robertet (RBT FP) 12200 12600 10820 259 -0.8 1.5 1.7 0.4 2.6 -7.2 1.33 1.0 0.5 Symrise (SY1 GY) 2692 2692 1643 3181 2.0 5.3 30.5 3.2 6.4 19.2 3.48 1.5 1.2 CHR Hansen (CHR DC) 17680 17840 11150 3277 2.0 2.2 41.3 3.3 3.3 29.0 5.06 1.7 1.5 IFF (IFF US) 6052 6301 5131 3920 -1.4 6.2 19.0 -0.1 7.4 8.6 4.41 1.5 1.3 McCormick (MKC US) 6144 6169 4493 6482 0.0 -1.3 25.6 1.3 -0.2 14.6 5.10 1.9 1.4 Sensient Tech (SXT US) 3585 4092 3155 1423 -1.4 -1.1 -2.5 -0.1 0.0 -11.0 N/A 1.3 1.4 Ingredients (12) 2145 2181 1599 33050 0.4 0.7 17.5 1.6 1.7 7.3 3.37 1.8 1.5

D A I R Y P R O C E S S I N G Donegal Creameries (DCP ID) 330 390 300 33 -2.6 0.9 6.3 -1.4 2.0 -2.9 0.66 415.2 2.3 Glanbia (GLB ID) 632 638 430 1861 6.9 3.6 36.7 8.3 4.7 24.8 3.60 2.2 1.7 Dairy Crest (DCG LN) 342 355 290 575 -0.6 0.3 7.3 0.6 1.4 -2.1 1.66 2.4 2.5 Danone (BN FP) 4955 5470 4275 32105 -2.9 0.1 2.0 -1.7 1.2 -6.9 2.45 2.0 1.7 Koninklijke DSM (DSM NA) 3729 4414 3054 6764 -2.4 -6.9 4.0 -1.2 -5.9 -5.0 1.06 0.2 0.8 Nestle SA (NESN VX) 5935 6105 4798 159351 -1.6 -1.2 11.2 -0.3 -0.1 1.5 3.34 0.9 0.7 Saputo (SAP CN) 4156 4617 3617 6637 -5.1 -3.2 13.6 -3.9 -2.2 3.7 4.04 0.5 0.3 Dairy processing (13) 2461 2528 1995 216478 -1.8 -0.8 10.3 -0.5 0.3 0.7 2.82 1.1 1.0

F R U I T D I S T R I B U T I O N Fyffes (FFY ID) 47 47 36 140 4.0 4.7 30.5 5.3 5.8 19.1 1.03 0.7 0.4 Total Produce (TOT ID) 41 50 35 135 -4.4 3.8 10.8 -3.2 4.9 1.2 0.76 1.7 1.3 Chiquita (CQB US) 600 1037 466 219 -2.2 13.3 -25.9 -0.9 14.5 -32.3 N/A N/A N/AFDP (FDP US) 2470 2672 2208 1139 2.0 -1.4 1.8 3.3 -0.3 -7.1 0.87 N/A N/AFruit distribution (4) 4069 4293 3663 1633 1.0 1.2 -0.7 2.3 2.3 -9.3 0.87 0.2 0.2

S P E C I A L I T Y B A K I N G ARYZTA (YZA ID) 3845 4060 3139 3385 0.5 -4.7 2.6 1.7 -3.7 -6.4 1.72 2.2 1.8 Canada Bread (CBY CN) 4405 4988 4200 902 0.4 1.3 8.2 1.6 2.4 -1.3 N/A N/A N/ACSM NV (CSM NA) 1340 1567 925 977 0.3 10.2 11.0 1.6 11.4 1.3 0.94 3.0 2.9 Panera Bread (PNRA US) 15490 16471 10117 3651 0.0 -3.8 12.8 1.3 -2.7 3.0 7.07 -0.7 -0.9 Ralcorp Holdings (RAH US) 7096 7671 5939 3118 0.8 16.3 0.8 2.1 17.6 -7.9 1.50 2.6 2.8 Speciality baking (6) 6768 6850 5278 12424 0.3 2.3 6.4 1.6 3.4 -2.9 1.98 1.9 1.6

F O O D M A N U F A C T U R E R S Greencore Group (GNC LN) 79 84 49 390 -1.4 3.9 61.3 -0.2 5.0 47.3 1.14 3.7 3.0 Associated British Foods (ABF LN) 1324 1332 1038 13221 -0.6 4.4 26.1 0.7 5.6 15.1 1.82 1.1 0.9 Cranswick (CWK LN) 834 858 589 506 -1.0 -3.5 18.4 0.3 -2.5 8.1 1.62 0.4 0.3 Premier Foods (PFD LN) 59 180 33 177 -11.2 -19.6 6.1 -10.1 -18.7 -3.1 0.24 4.6 5.7 UK food manufacturers (3) 1285 1294 931 13904 -0.7 3.7 25.5 0.5 4.8 14.6 1.67 1.5 1.5 Conagra Foods (CAG US) 2511 2718 2299 8139 0.5 -0.5 -2.0 1.8 0.6 -10.5 2.29 1.7 1.5 General Mills (GIS US) 3933 4105 3689 20281 0.2 -0.6 0.3 1.5 0.5 -8.4 3.74 2.1 2.2 PZ Cussons (PZC LN) 304 374 285 1644 -0.5 -1.9 -8.5 0.8 -0.9 -16.4 2.40 0.2 -0.1 Unilever NV (UNIA NA) 2773 2879 2208 95099 -0.2 -1.9 4.4 1.1 -0.8 -4.7 5.47 1.2 1.0 Food manufacturers (10) 1500 1525 1235 157967 0.0 -0.9 3.2 1.3 0.2 -5.8 2.90 1.5 1.4

A G R I B U S I N E S S A N D P R I M A R Y P R O D U C E R S Continental Farmers Group (CFGP ID) 30 36 24 49 13.2 15.4 7.1 14.6 16.6 -2.2 0.70 -0.5 0.3 Origin Enterprises (OGN ID) 386 400 300 533 1.6 5.8 26.6 2.9 6.9 15.6 2.36 1.3 0.9 Austevoll (AUSS NO) 2480 2670 1870 689 4.2 0.8 25.4 5.5 1.9 14.5 0.63 1.6 2.1 Carrs Milling (CRM LN) 935 950 724 105 1.0 4.9 24.8 2.2 6.0 13.9 1.46 -0.3 0.0 K+S (SDF GY) 3890 4768 3040 7445 -2.3 -3.3 11.4 -1.1 -2.2 1.7 2.42 0.2 0.1 Nutreco (NUO NA) 5812 5899 4488 2041 -0.6 -0.4 14.3 0.7 0.7 4.4 2.31 0.9 0.8 Agribusiness (9) 2757 2873 2080 36169 -2.7 -3.0 16.9 -1.5 -2.0 6.7 3.07 0.5 0.4

S W E E T E N E R S Associated British Foods (ABF LN) 1324 1332 1038 13221 -0.6 4.4 26.1 0.7 5.6 15.1 1.82 1.1 0.9 ADM (ADM US) 2675 3350 2416 14005 0.9 0.3 -3.6 2.1 1.4 -12.0 0.93 1.9 1.9 Agrana Beteiligungs (AGR AV) 9000 9185 7230 1278 1.7 -1.1 12.5 3.0 0.0 2.7 1.20 1.5 1.1 Ingredion Inc (INGR US) 5383 5819 3774 3260 -1.4 1.4 5.5 -0.2 2.5 -3.7 1.96 1.9 1.6 Illovo Sugar (ILV SJ) 3010 3015 2295 1312 -0.7 0.5 21.4 0.6 1.5 10.8 2.49 0.5 0.3 Südzucker (SZU GY) 2666 2867 1923 5048 1.3 -5.0 8.2 2.5 -4.0 -1.3 1.53 0.8 0.7 Tate & Lyle (TATE LN) 656 721 570 3857 0.9 -1.6 -1.9 2.2 -0.5 -10.4 2.97 1.1 0.9 Tongaat Hulett (TON SJ) 13974 14040 8949 1391 2.2 -1.6 37.0 3.5 -0.5 25.0 2.19 2.0 1.4 Sweeteners (8) 2204 2253 1777 43372 0.3 0.6 8.5 1.6 1.7 -0.9 1.40 1.5 1.3 FTSE E300 Food Producers (E3FOOD) 1889 1933 1516 -1.2 -1.1 9.5

S E C T O R R E V I E W

8 Davy Research

Food and beverage Food

V A L U A T I O N EPS (c) EPS Gth % Div Yield % Div Cover EV/EBITDA P/E 2011 2012 2013 11-13 2011 2012 2011 2011 2012 2013 2011 2012 2013

I N G R E D I E N T S Kerry Group (KYG ID) 213 235 256 20.2 0.8 0.9 6.6 13.2 11.3 10.3 17.8 16.2 14.9 Frutarom (FRUT IT) 73 93 102 39.7 0.6 0.8 12.4 7.8 6.4 5.7 12.5 9.9 9.0 Givaudan (GIVN VX) 4953 5386 6204 25.3 2.4 2.6 2.3 12.9 12.0 9.9 18.2 16.7 14.5 Naturex (NRX FP) 247 267 296 19.6 0.2 0.2 24.7 12.0 9.8 8.8 21.4 19.9 17.9 Robertet (RBT FP) 1035 1133 1177 13.7 2.2 2.3 3.8 6.5 5.3 4.9 11.8 10.8 10.4 Symrise (SY1 GY) 159 179 192 21.0 2.3 2.5 2.6 11.5 10.4 9.6 17.0 15.1 14.0 CHR Hansen (CHR DC) 617 703 808 31.0 2.0 2.0 1.7 18.0 15.6 14.0 28.6 25.2 21.9 IFF (IFF US) 374 399 433 15.6 1.9 2.1 3.2 10.4 10.0 9.0 16.2 15.2 14.0 McCormick (MKC US) 279 305 335 20.1 1.8 2.0 2.5 14.6 12.9 11.9 22.0 20.1 18.3 Sensient Tech (SXT US) 248 252 270 8.9 2.3 2.4 3.0 8.8 8.6 7.9 14.5 14.2 13.3 Ingredients (12) 1.8 2.0 2.9 12.5 11.4 10.2 18.4 17.0 15.4

D A I R Y P R O C E S S I N G Donegal Creameries (DCP ID) -76 49 54 N/A 4.8 4.8 N/A N/A 0.9 0.5 N/A 6.7 6.1 Glanbia (GLB ID) 46 51 54 16.1 1.3 1.4 5.6 10.6 9.3 8.5 13.6 12.5 11.7 Dairy Crest (DCG LN) 49 47 47 -4.0 6.0 6.2 2.4 5.6 5.9 5.6 7.1 7.3 7.3 Danone (BN FP) 289 308 340 17.6 2.8 3.0 2.1 11.2 10.5 9.5 17.1 16.1 14.6 Koninklijke DSM (DSM NA) 364 308 368 1.0 3.9 4.0 2.5 5.4 6.5 5.5 10.2 12.1 10.1 Nestle SA (NESN VX) 307 343 368 19.7 3.3 3.5 1.6 13.2 11.7 11.0 19.3 17.3 16.1 Saputo (SAP CN) 247 260 287 16.2 0.0 0.0 N/A 10.4 10.0 9.4 16.8 16.0 14.5 Dairy processing (13) 3.2 3.4 1.8 11.7 10.7 9.9 18.2 16.6 15.3

F R U I T D I S T R I B U T I O N Fyffes (FFY ID) 6 8 7 18.7 4.1 5.2 3.1 4.4 3.4 3.4 7.8 6.2 6.5 Total Produce (TOT ID) 7 8 8 10.0 4.6 4.8 3.8 4.7 4.0 3.6 5.7 5.4 5.1 Chiquita (CQB US) 83 -17 67 -19.9 0.0 0.0 N/A 2.0 3.1 2.1 7.2 N/A 9.0 FDP (FDP US) 182 239 253 39.0 0.6 1.6 12.1 7.1 6.2 5.7 13.6 10.3 9.8 Fruit distribution (4) 1.4 2.3 8.2 4.9 4.9 4.2 10.4 8.9 8.7

S P E C I A L I T Y B A K I N G ARYZTA (YZA ID) 310 338 380 22.7 1.2 1.3 6.7 9.1 8.7 7.7 12.4 11.4 10.1 Canada Bread (CBY CN) 343 322 369 7.6 0.0 0.0 N/A 7.1 6.8 6.1 12.8 13.7 11.9 CSM NV (CSM NA) -237 98 150 N/A 5.2 5.4 N/A 7.5 7.7 5.9 N/A 13.6 8.9 Panera Bread (PNRA US) 455 578 680 49.5 0.0 0.0 N/A 14.3 11.6 9.6 34.0 26.8 22.8 Ralcorp Holdings (RAH US) 522 312 388 -25.7 0.0 0.0 N/A 7.5 9.5 8.2 13.6 22.7 18.3 Speciality baking (6) 2.1 2.2 5.5 9.0 9.1 7.7 23.9 17.0 14.2

F O O D M A N U F A C T U R E R S Greencore Group (GNC LN) 10 11 13 26.3 6.8 5.4 1.9 6.9 6.2 5.8 7.6 6.9 6.0 Associated British Foods (ABF LN) 74 86 93 26.0 1.9 2.0 3.0 9.9 8.7 8.3 17.9 15.3 14.2 Cranswick (CWK LN) 72 77 80 11.3 3.4 3.6 2.5 7.0 6.7 6.3 11.6 10.9 10.4 Premier Foods (PFD LN) 18 28 33 83.1 0.0 0.0 N/A 5.3 6.4 5.6 3.3 2.1 1.8 UK food manufacturers (3) 1.9 2.1 3.2 8.9 8.2 7.8 16.6 14.0 12.9 Conagra Foods (CAG US) 184 197 211 14.4 3.7 4.0 2.0 7.7 7.3 6.9 13.6 12.7 11.9 General Mills (GIS US) 256 266 290 13.3 3.1 3.4 2.1 9.8 9.5 9.0 15.4 14.8 13.6 PZ Cussons (PZC LN) 15 16 18 23.6 2.2 2.4 2.2 11.4 10.0 8.7 20.7 19.0 16.8 Unilever NV (UNIA NA) 144 159 175 21.5 3.2 3.4 1.6 13.7 12.4 11.3 19.2 17.4 15.8 Food manufacturers (10) 3.0 3.2 2.1 10.1 9.8 9.3 15.9 15.4 14.1

A G R I B U S I N E S S A N D P R I M A R Y P R O D U C E R S Continental Farmers Group (CFGP ID) 2 3 4 85.7 0.0 0.0 N/A 7.0 5.9 5.1 13.5 9.8 7.3 Origin Enterprises (OGN ID) 40 44 47 16.6 2.4 2.6 4.3 6.9 6.2 5.8 9.6 8.7 8.2 Austevoll (AUSS NO) 393 249 372 -5.3 4.0 4.0 3.9 4.1 5.3 4.0 6.3 10.0 6.7 Carrs Milling (CRM LN) 76 93 97 27.3 2.8 3.1 2.9 5.6 5.0 6.0 12.3 10.1 9.6 K+S (SDF GY) 350 304 348 -0.7 3.3 3.6 2.7 6.3 6.8 6.3 11.1 12.8 11.2 Nutreco (NUO NA) 424 490 525 23.9 3.1 3.7 2.4 8.0 7.2 6.6 13.7 11.9 11.1 Agribusiness (9) 2.7 2.9 2.5 9.2 8.7 7.9 15.0 14.2 13.0

S W E E T E N E R S Associated British Foods (ABF LN) 74 86 93 26.0 1.9 2.0 3.0 9.9 8.7 8.3 17.9 15.3 14.2 ADM (ADM US) 305 225 250 -18.0 2.3 2.6 5.0 6.3 7.6 8.0 8.8 11.9 10.7 Agrana Beteiligungs (AGR AV) 1067 1142 1045 -2.1 3.9 4.0 3.0 5.5 5.1 5.0 8.4 7.9 8.6 Ingredion Inc (INGR US) 468 520 562 20.1 1.2 1.3 7.3 6.8 6.2 5.3 11.5 10.4 9.6 Illovo Sugar (ILV SJ) 133 220 274 106.5 2.2 3.1 2.0 9.2 6.8 5.8 22.7 13.7 11.0 Südzucker (SZU GY) 186 273 224 20.5 2.6 2.7 2.7 7.1 6.2 6.2 14.4 9.8 11.9 Tate & Lyle (TATE LN) 56 57 60 6.2 3.8 4.0 2.3 8.1 7.5 6.9 11.6 11.6 10.9 Tongaat Hulett (TON SJ) 819 1129 1381 68.6 2.1 2.8 2.8 8.5 6.6 5.6 17.1 12.4 10.1 Sweeteners (8) 2.3 2.5 3.6 7.2 7.1 7.0 12.1 12.1 11.5

S E C T O R R E V I E W

9 Davy Research

Food and beverage Beverage

S H A R E P R I C E A N D P E R F O R M A N C E Price 12 Month Mkt. Cap Change % (€) Rel to E300 sector % Pr/Bk Debt/EBITDA Local High Low €m Wk 1 Mth YTD Wk 1 Mth YTD 2011 2011 2012

C&C (GCC ID) 361 393 270 1219 1.0 1.0 25.6 -0.5 0.0 -3.3 1.70 -0.5 -1.0 Global Sector Anheuser-Busch InBev (ABI BB) 6678 6678 3627 107270 2.1 4.1 41.2 0.7 3.1 8.7 3.69 2.3 1.9 Carlsberg (CARLB DC) 51300 52000 32220 10508 0.9 4.5 26.4 -0.5 3.5 -2.7 1.19 2.4 2.0 Constellation Brands (STZ US) 3294 3294 1754 4644 0.1 14.2 64.2 -1.3 13.1 26.4 2.56 3.5 3.4 Davide Campari (CPR IM) 547 575 491 3174 -0.1 -2.6 6.2 -1.5 -3.5 -18.2 2.33 1.9 1.6 Diageo (DGE LN) 1725 1743 1188 54532 0.5 0.0 29.3 -0.9 -1.0 -0.5 7.70 2.2 1.7 Heineken (HEIA NA) 4408 4598 3205 25387 -1.2 0.1 23.2 -2.6 -0.9 -5.1 2.64 2.4 2.1 Molson Coors Brewing (TAP US) 4454 4566 3800 6213 0.1 3.0 5.4 -1.3 1.9 -18.9 1.08 0.8 3.2 Pernod Ricard (RI FP) 8567 8879 5788 22729 -2.2 -2.1 19.6 -3.5 -3.1 -8.0 2.10 3.8 3.1 Remy Cointreau (RCO FP) 9081 9744 5043 4507 -1.3 -5.4 46.3 -2.7 -6.3 12.6 4.57 0.8 0.6 SABMiller (SAB LN) 2780 2869 2005 55883 0.0 -0.2 29.3 -1.4 -1.2 -0.5 2.75 3.3 2.5 Beverage (10) 7438 7474 4692 291559 0.6 1.9 31.8 -0.8 0.9 1.5 3.05 2.5 2.1 Britvic plc (BVIC LN) 320 398 260 976 3.0 5.1 4.7 1.5 4.1 -19.4 N/A 2.4 2.7 FTSE E300 Beverages (E3BEVG) 2755 2788 1764 1.4 1.0 29.9

V A L U A T I O N EPS (c) EPS Gth % Div Yield % Div Cover EV/EBITDA P/E 2011 2012 2013 11-13 2011 2012 2011 2011 2012 2013 2011 2012 2013

C&C (GCC ID) 28 28 31 10.3 2.0 2.3 3.8 8.6 7.9 6.9 13.0 13.0 11.8 Global Sector Anheuser-Busch InBev (ABI BB) 308 370 400 29.7 1.8 2.2 2.6 11.3 10.5 9.3 21.7 18.0 16.7 Carlsberg (CARLB DC) 3369 3763 4098 21.6 1.1 1.1 6.1 8.3 7.6 6.8 15.2 13.6 12.5 Constellation Brands (STZ US) 234 198 264 12.9 0.0 0.0 N/A 10.1 10.0 8.6 14.1 16.6 12.5 Davide Campari (CPR IM) 29 32 36 23.4 1.3 1.4 4.1 11.6 10.7 9.6 19.0 17.3 15.4 Diageo (DGE LN) 94 104 116 23.6 2.5 2.7 2.2 13.8 12.4 11.2 18.3 16.5 14.8 Heineken (HEIA NA) 270 280 308 14.4 1.8 2.0 3.4 8.8 8.1 7.4 16.3 15.7 14.3 Molson Coors Brewing (TAP US) 376 390 406 8.0 2.7 3.1 3.1 7.6 9.3 8.6 11.8 11.4 11.0 Pernod Ricard (RI FP) 453 532 635 40.3 1.8 2.0 3.0 13.1 11.4 10.0 18.9 16.1 13.5 Remy Cointreau (RCO FP) 250 356 418 67.1 2.5 1.6 1.1 21.1 16.6 14.2 36.3 25.5 21.7 SABMiller (SAB LN) 137 150 169 23.3 2.1 2.3 2.3 15.9 13.5 11.8 20.3 18.5 16.5 Beverage (10) 2.0 2.2 2.7 11.9 11.0 9.8 19.1 17.0 15.3 Britvic plc (BVIC LN) 33 27 32 -4.1 5.5 3.6 1.9 6.7 7.3 6.6 9.7 12.0 10.1

S E C T O R R E V I E W

10 Davy Research

Food and beverage Sector screens

F O O D - L O W P / E S T O C K S ( X ) F O O D - L O W E V / E B I T D A S T O C K S ( X ) 2012 2013 2012 2013Premier Foods 2.1 Premier Foods 1.8 Chiquita 3.1 Chiquita 2.1 Total Produce 5.4 Total Produce 5.1 Fyffes 3.4 Fyffes 3.4 Fyffes 6.2 Greencore Group 6.0 Total Produce 4.0 Total Produce 3.6 Greencore Group 6.9 Fyffes 6.5 Tyson Foods 4.2 Austevoll 4.0 Dairy Crest 7.3 Austevoll 6.7 Carrs Milling 5.0 Parmalat SpA 4.4 Origin Enterprises 8.7 Continental Farmers Group 7.3 Parmalat SpA 5.2 Tyson Foods 4.6 Tyson Foods 8.8 Dairy Crest 7.3 Austevoll 5.3 Robertet 4.9 Continental Farmers Group 9.8 Origin Enterprises 8.2 Robertet 5.3 Emmi 5.1 Frutarom 9.9 CSM NV 8.9 Emmi 5.5 Continental Farmers Group 5.1 Austevoll 10.0 Frutarom 9.0 Dairy Crest 5.9 Koninklijke DSM 5.5

F O O D - H I G H Y I E L D I N G S T O C K S ( % ) F O O D - L O W P R I C E / B O O K ( X ) 2012 2013 2012 2013Dairy Crest 6.2 Dairy Crest 6.4 Premier Foods 0.23 Premier Foods 0.21 CSM NV 5.4 Greencore Group 6.2 Continental Farmers Group 0.65 Continental Farmers Group 0.60 Greencore Group 5.4 Austevoll 5.8 Austevoll 0.73 Austevoll 0.69 Fyffes 5.2 CSM NV 5.7 Total Produce 0.74 Total Produce 0.71 Total Produce 4.8 Total Produce 5.0 FDP 0.81 FDP 0.78 Austevoll 4.0 Fyffes 4.9 Parmalat SpA 0.83 Parmalat SpA 0.81 Koninklijke DSM 4.0 Conagra Foods 4.2 ADM 0.93 Fyffes 0.87 Conagra Foods 4.0 Koninklijke DSM 4.2 Fyffes 0.94 ADM 0.88 Tate & Lyle 4.0 Tate & Lyle 4.0 Tyson Foods 0.96 Tyson Foods 0.90 Nutreco 3.7 Nutreco 3.9 CSM NV 0.98 CSM NV 0.94

F O O D - L O W P E G S T O C K S ( X ) F O O D - S H A R E P R I C E M O M E N T U M ( % ) 2012 2013 1 Month 3 MonthsTyson Foods 0.1 K+S 0.2 Dean Foods 29.9 Austevoll 22.4 K+S 0.2 Koninklijke DSM 0.4 Krispy Kreme 18.4 K+S 20.6 Koninklijke DSM 0.5 Carrs Milling 0.5 Ralcorp Holdings 16.3 Symrise 18.5 Carrs Milling 0.6 Frutarom 0.6 Continental Farmers Group 15.4 Krispy Kreme 15.3 Frutarom 0.7 Nutreco 0.6 Naturex 15.2 Associated British Foods 12.8 Robertet 0.7 Robertet 0.6 Chiquita 13.3 Carrs Milling 12.7 Nutreco 0.7 Fyffes 0.8 Parmalat SpA 12.6 Origin Enterprises 11.9 Fyffes 0.7 Glanbia 0.8 CSM NV 10.2 Continental Farmers Group 11.1 Glanbia 0.8 ARYZTA 0.8 IFF 6.2 Naturex 11.0 ARYZTA 0.9 Panera Bread 0.9 Origin Enterprises 5.8 Dairy Crest 10.2

F O O D - L O W D E B T / E B I T D A ( X ) F O O D - L O W D E B T / M A R K E T C A P ( % ) 2012 2013 2012 2013

Parmalat SpA -2.0 Parmalat SpA -1.8 Parmalat SpA -27.7 Parmalat SpA -28.6 Panera Bread -0.9 Panera Bread -1.1 Panera Bread -7.2 Panera Bread -10.4 PZ Cussons -0.1 PZ Cussons -0.3 PZ Cussons -1.2 PZ Cussons -3.0 Carrs Milling 0.0 Syngenta AG 0.1 Carrs Milling 0.8 Syngenta AG 1.0 K+S 0.1 Saputo 0.2 K+S 1.3 Saputo 1.7 Continental Farmers Group 0.3 Fyffes 0.2 Syngenta AG 3.3 Cranswick 3.7 Syngenta AG 0.3 Cranswick 0.2 Saputo 3.4 Fyffes 3.9 Saputo 0.3 K+S 0.3 Continental Farmers Group 4.6 K+S 4.4 Cranswick 0.3 Robertet 0.3 Cranswick 5.4 Robertet 6.3 Fyffes 0.4 Origin Enterprises 0.5 Nestle SA 6.8 Origin Enterprises 6.4

B E V E R A G E - L O W P / E S T O C K S ( X ) B E V E R A G E - L O W P R I C E / B O O K ( X ) 2012 2013 2012 2013Molson Coors Brewing 11.4 Britvic plc 10.1 Molson Coors Brewing 1.00 Molson Coors Brewing 0.95 Britvic plc 12.0 Molson Coors Brewing 11.0 Carlsberg 1.06 Carlsberg 0.97 C&C 13.0 C&C 11.8 C&C 1.56 C&C 1.43 Carlsberg 13.6 Constellation Brands 12.5 Pernod Ricard 1.93 Pernod Ricard 1.76 Heineken 15.7 Carlsberg 12.5 Davide Campari 2.11 Davide Campari 1.92 Pernod Ricard 16.1 Pernod Ricard 13.5 Heineken 2.33 Constellation Brands 2.00 Diageo 16.5 Heineken 14.3 Constellation Brands 2.38 Heineken 2.08 Constellation Brands 16.6 Diageo 14.8 SABMiller 2.61 SABMiller 2.40 Davide Campari 17.3 Davide Campari 15.4 Anheuser-Busch InBev 3.16 Anheuser-Busch InBev 2.80 Anheuser-Busch InBev 18.0 SABMiller 16.5 Diageo 5.23 Diageo 3.90

S E C T O R R E V I E W

11 Davy Research

Beverage charts

U S D I S T I L L E D S P I R I T S V O L U M E S G R O W T H M A T Y O Y ( % ) U S D I S T I L L E D S P I R I T S V O L U M E S G R O W T H Y O Y ( % )

D I A G E O A N D P E R N O D U S S P I R I T S V O L G T H M A T Y O Y ( % ) D I A G E O A N D P E R N O D U S S P I R I T S V O L G T H Y O Y ( % )

T O P S I X P R O D U C E R S V O L G T H M A T Y O Y ( % ) T O P S I X P R O D U C E R S V O L G T H Y O Y ( % )

U S C O N S U M E R S P E N D I N G Y O Y ( % ) U S S A V I N G S R A T E A S A % O F D I S P O S A B L E I N C O M E

S E C T O R R E V I E W

12 Davy Research

Beverage charts

L U X U R Y I N D E X ( D J L U X ) R E L S & P 5 0 0 I N D E X C H I N E S E C O G N A C S H I P M E N T S Y O Y ( % )

N O R T H A M E R I C A I A T A R P K Y O Y G R O W T H ( % ) E U R O P E I A T A R P K Y O Y G R O W T H ( % )

E U R O P E A N B E E R C P I Y O Y ( % ) E U R O P E A N M A L T E D B A R L E Y P R I C E S Y O Y ( % )

R U S S I A N I N D U S T R I A L P R O D U C T I O N F O R B E E R Y O Y ( % ) U K R P I O F F - T R A D E B E E R V S R P I X Y O Y ( % )

C O M P A N Y A N A L Y S I S

13 Davy Research

ARYZTA

Analyst: John O'Reilly Xetra: YZA Email: john.o'[email protected] Bloomberg: YZA ID Phone: +353 1 6148915 RIC: ARYN.I Sector: Speciality baking www.aryzta.com

Price (c) Shares (m) Mkt. Cap (€m) E.V. (€m) Mkt. Cap. / EV (%) Mkt. Weight (%) Free Float (%) Daily No. Shares Traded (m) Daily Value Traded (€m) 3845 88.0 3384.6 4661.5 72.6 7.1 98.3 0.254 9.819

SUMMARY ACCOUNTS Jul09 Jul10 Jul11 Jul12F Jul13F I N C O M E S T A T E M E N T ( € M )

Revenue 3220.5 3009.7 3876.9 4068.6 4234.9 EBITDA 340.6 339.9 485.1 514.9 557.7 Depreciation 60.2 66.9 88.4 87.1 88.7 Amortisation of intangibles 46.3 50.7 94.2 99.4 103.3 Operating profit 234.2 222.2 302.5 328.4 365.7 Other income from operations 0.0 0.0 0.0 0.0 0.0 Share of associate / JV after-tax profits 17.5 31.6 19.5 16.9 18.9 PBIT before exceptionals 251.7 253.9 322.0 345.3 384.6 Group net interest -50.7 -51.5 -67.9 -65.1 -56.0 Other finance costs 0.0 0.0 0.0 0.0 0.0 Total finance costs -50.7 -51.5 -67.9 -65.1 -56.0 Exceptionals -157.2 -4.6 -10.0 -50.0 -50.0 PBT 43.9 197.7 244.0 230.2 278.6 Tax -2.9 -29.6 -15.6 -36.5 -42.8 Minorities (incl. pref. divs.) 13.0 -16.4 -15.8 -16.2 -17.2 Earnings (basic) 54.0 151.7 212.7 177.4 218.6 Average no. of shares (m) - basic 78.4 78.9 82.8 86.3 88.4 Average no. of shares (m) - diluted 78.6 79.4 83.9 86.3 88.4 P E R S H A R E D A T A ( C )

EPS Basic 68.9 192.2 256.8 205.6 247.3 EPS Diluted (Adj) 234.7 244.0 310.1 338.3 380.3 Cash EPS (Diluted) 311.2 328.2 415.4 439.2 480.6 Dividend 35.2 37.0 46.5 49.5 52.8 NBV 1672.6 2044.8 2235.8 2287.2 2427.3 NBV (incl. amortisation of intangibles) 1807.0 2243.5 2541.0 2693.3 2940.6 C A S H F L O W ( € M )

EBITDA 340.6 339.9 485.1 514.9 557.7 Change in working capital 27.0 11.5 -27.1 -26.7 -26.0 Share-based payments 0.0 0.0 0.0 0.0 0.0 Other operating cashflows -57.8 14.8 0.4 -49.8 -49.6 Cash generated from operations 309.8 366.2 458.3 438.4 482.1 Net capital expenditure -79.0 -45.9 -73.8 -150.1 -150.6 Operating cashflow 230.8 320.2 384.5 288.3 331.5 Net interest -51.6 -45.2 -72.1 -80.0 -74.0 Tax -33.4 -30.4 -55.1 -35.5 -41.6 Dividends from associates 23.0 22.4 11.6 18.1 18.6 Dividends to minorities 0.0 -5.8 0.0 -5.6 -5.6 Free cash flow 168.8 261.2 268.9 185.3 228.9 Dividends to shareholders 0.0 -27.9 -30.8 -41.3 -41.7 Acquisitions & investments -137.8 -872.7 -346.0 -92.0 0.0 Business disposals 0.0 0.0 0.0 0.0 0.0 Share Issues / (Buybacks) -47.2 115.0 285.1 140.9 0.0 Translation differences -0.9 7.8 0.0 0.0 0.0 Other 72.9 -39.2 2.8 -52.9 -5.0 Change in net cash / debt 55.9 -555.8 179.9 139.9 182.2 B A L A N C E S H E E T ( € M )

Property, plant & equipment 664.5 945.1 939.9 983.2 1026.8 Intangible assets 1498.4 2264.4 2651.0 2581.7 2508.6 Investments in associates / jv's 202.3 183.5 156.2 191.9 191.9 Working capital -59.3 -124.4 -128.2 -101.7 -76.2 Other 0.0 0.0 35.6 0.0 0.0 Capital Employed 2305.9 3268.7 3654.6 3655.1 3651.0 Financed by Equity capital & reserves 1320.4 1614.2 1839.1 1973.8 2145.7 Minority interests 47.6 59.6 72.4 84.2 96.8 Preference shares 0.0 0.0 285.0 285.0 285.0 Net Debt/(Cash) 671.7 1227.5 1047.6 907.7 725.4 Deferred consideration/debt-related 0.0 0.0 0.0 0.0 0.0 Retirement benefit obligations 0.0 0.0 0.0 0.0 0.0 Net deferred tax 176.5 294.1 309.4 309.4 309.4 Other long-term liabilities 89.8 73.2 101.1 94.9 88.7 Capital Employed 2305.9 3268.7 3654.6 3655.1 3651.0 Intangibles amortised 106.1 156.8 251.1 350.5 453.8 Capital employed inc. intangibles 2412.0 3425.5 3905.6 4005.5 4104.8 Invested capital inc. intangibles 2145.8 3058.2 3495.2 3601.2 3706.7

DIVISIONAL ANALYSIS Jul11 Jul12F Jul13F Jul11 Jul12F Jul13F Revenue (€m) Operating Profits (€m)

Origin 1299.5 1244.9 1257.4 71.0 65.1 65.8 IAWS Food 2577.4 2823.7 2977.5 322.3 362.7 403.1 Total 3876.9 4068.6 4234.9 393.3 427.8 468.9

CALENDAR Date Ex-Div Interims 12-03-12 Finals 24-09-12 27-01-12 AGM 11-12-12 Updated 22-03-12

VALUATION Jul11 Jul12F Jul13F Dec11 Dec12F Dec13F Rel to Sector

P/E 12.4 11.4 10.1 0.5 0.7 0.7 Dividend Yield (%) 1.2 1.3 1.4 0.6 0.6 0.6 Free Cash Flow Yield (pre divs) (%) 7.9 5.5 6.8 Price / Book 1.72 1.68 1.58 0.9 0.9 0.9 EV / Revenue 1.14 1.10 1.02 EV / EBITDA 9.1 8.7 7.7 EV / EBITA 11.1 10.4 9.2 EV / Operating Cashflow 11.5 15.5 13.0 EV / Invested Capital 1.31 1.29 1.21 PEG (Hist P/E/4yr gwth) 0.97

PRICE PERFORMANCE (%) 1 Wk 1 Mth 3 Mths 6 Mths YTD 1 Yr Absolute 0.5 -4.7 2.4 4.2 2.6 17.9 Rel to ISEQ 0.1 -4.5 -0.3 4.9 -5.9 -3.9 Rel to E300 1.2 -6.5 -8.0 3.5 -5.2 5.3 Rel to E300 Food Producers 1.7 -3.7 -4.4 -4.0 -6.4 2.0

PRICE AND P/E HISTORY Price Hist P/E High Low Yr End High Low Average

2012 4060 3350 13.1 10.8 12.1 2011 3895 3132 3749 16.0 10.7 13.7 2010 3500 2582 3499 14.5 11.0 12.9 2009 2790 1617 2570 13.7 8.0 10.9 2008 3800 1879 2300 20.8 9.3 15.1 2007 3920 2790 3010 24.0 15.3 19.7

KEY RATIOS Jul09 Jul10 Jul11 Jul12F Jul13F G R O W T H

EPS Diluted (Adj) (%) 16.1 4.0 27.1 9.1 12.4 Dividend (%) N/A 5.1 25.7 6.5 6.7 Revenue (%) 2.8 -6.5 28.8 4.9 4.1 EBITDA (%) 12.4 -0.2 42.7 6.1 8.3 P R O F I T A B I L I T Y / A C T I V I T Y

EBITDA margin (%) 10.6 11.3 12.5 12.7 13.2 EBITA margin (%) 8.7 9.1 10.2 10.5 11.1 Revenue / Capital Employed (x) 1.49 1.10 1.11 1.08 1.10 R E T U R N

ROCE (before tax, ex. invs) (%) 13.0 10.0 11.3 11.3 12.1 ROE (after tax) (%) 13.7 12.1 14.1 13.9 14.3 Ret. on Inv. Cap. (after tax) (%) 9.8 10.3 11.5 11.3 12.0 WACC (%) 6.7 6.0 5.7 5.3 4.7 F I N A N C I A L / G E N E R A L

EBITDA Int. Cover (x) 6.7 6.6 7.1 7.9 10.0 Group Interest Cover (x) 5.0 4.9 4.7 5.3 6.9 Debt / EBITDA (x) 2.0 3.6 2.2 1.8 1.3 Debt / Equity (%) 49.1 73.3 54.8 44.1 32.4 Debt / Free Cash Flow (x) 4.0 4.7 3.9 4.9 3.2 Avg. Cost of Debt (before tax) (%) 7.2 5.4 4.8 5.2 5.1 Ret. benefits deficit / market cap (%) N/A N/A N/A N/A N/A Dividend Cover (x) 6.7 6.6 6.7 6.8 7.2 Working Capital / Revenue (%) N/A N/A N/A N/A N/A Net Capex / Depreciation (%) 131.3 68.7 83.5 172.3 169.8 Tax rate (%) (unadjusted) 6.5 15.0 6.4 15.9 15.4

CAGR(%) 5 Year 10 Year MAJOR SHAREHOLDERS % Revenue (%) 20.0 11.9 Invesco 10.0 EBITDA (%) 28.3 18.2 Fidelity International Limited 4.8 EPS Diluted (Adj) (%) 13.7 15.0 Och-Ziff Capital Management Group 3.1 Cash EPS (Diluted) (%) 15.0 13.9 Blackrock 3.0 Dividend (%) 11.5 13.0 Fidelity Management and Research 3.0 TSR 6.7 10.1

C O M P A N Y A N A L Y S I S

14 Davy Research

Associated British Foods

Analyst: Jack Gorman/John O'Reilly Email: [email protected]/[email protected] Bloomberg: ABF LN Phone: +353 1 6148926/+353 1 6148915 RIC: ABF.L Sector: Sweeteners www.abf.co.uk

Price (p) Shares (m) Mkt. Cap (£m) E.V. (£m) Mkt. Cap. / EV (%) Free Float (%) Daily No. Shares Traded (m) Daily Value Traded (£m) 1324 791.7 10481.8 12195.8 85.9 44.4 0.939 11.805

SUMMARY ACCOUNTS Sep09 Sep10 Sep11 Sep12F Sep13F I N C O M E S T A T E M E N T ( £ M )

Revenue 9255.0 10167.0 11065.0 12087.0 12823.0 EBITDA 1003.0 1225.0 1213.0 1372.0 1444.0 Depreciation 290.0 324.0 317.0 325.0 330.0 Amortisation of intangibles 85.0 89.0 96.0 99.0 99.0 Operating profit 628.0 812.0 800.0 948.0 1015.0 Other income from operations 0.0 0.0 0.0 0.0 0.0 Share of associate / JV after-tax profits 10.0 16.0 37.0 40.0 40.0 PBIT before exceptionals 638.0 828.0 837.0 988.0 1055.0 Group net interest -78.0 -76.0 -92.0 -104.0 -95.0 Other finance costs 13.0 -8.0 7.0 0.0 0.0 Total finance costs -65.0 -84.0 -85.0 -104.0 -95.0 Exceptionals -78.0 19.0 5.0 0.0 0.0 PBT 495.0 763.0 757.0 884.0 960.0 Tax -112.0 -194.0 -180.0 -222.6 -240.0 Minorities (incl. pref. divs.) -24.0 -23.0 -36.0 -32.6 -36.6 Earnings (basic) 359.0 546.0 541.0 628.8 683.4 Average no. of shares (m) - basic 789.0 788.0 788.0 788.0 788.0 Average no. of shares (m) - diluted 789.0 788.0 788.0 788.0 788.0 P E R S H A R E D A T A ( P )

EPS Basic 45.5 69.3 68.7 79.8 86.7 EPS Diluted (Adj) 57.7 72.2 74.0 86.3 93.2 Cash EPS (Diluted) 94.4 113.3 114.2 127.5 135.1 Dividend 21.0 23.8 24.8 26.8 28.1 NBV 601.8 671.7 729.4 783.9 843.4 NBV (incl. amortisation of intangibles) 645.9 727.2 797.1 864.1 936.2 C A S H F L O W ( £ M )

EBITDA 1003.0 1225.0 1213.0 1372.0 1444.0 Change in working capital 117.0 193.0 -199.0 -67.0 -68.0 Share-based payments 0.0 11.0 8.0 12.0 12.0 Other operating cashflows -152.0 -102.0 -116.0 -31.0 -31.0 Cash generated from operations 968.0 1327.0 906.0 1286.0 1357.0 Net capital expenditure -526.0 -667.0 -776.0 -725.0 -769.0 Operating cashflow 442.0 660.0 130.0 561.0 588.0 Net interest -77.0 -73.0 -88.0 -115.0 -105.0 Tax -135.0 -155.0 -156.0 -221.0 -240.0 Dividends from associates 4.0 6.0 9.0 6.0 6.0 Dividends to minorities -23.0 -29.0 -22.0 -24.0 -27.0 Free cash flow 211.0 409.0 -127.0 207.0 222.0 Dividends to shareholders -161.0 -171.0 -190.0 -200.0 -214.0 Acquisitions & investments -306.0 -82.0 -101.0 0.0 0.0 Business disposals 145.0 4.0 3.0 0.0 0.0 Share Issues / (Buybacks) 9.0 109.0 0.0 0.0 0.0 Translation differences -31.0 -19.0 3.0 0.0 0.0 Other -75.0 -67.0 -57.0 0.0 0.0 Change in net cash / debt -208.0 183.0 -469.0 7.0 8.0 B A L A N C E S H E E T ( £ M )

Property, plant & equipment 3519.0 3941.0 4465.0 4865.0 5305.0 Intangible assets 1913.0 1925.0 1893.0 1807.0 1722.0 Investments in associates / jv's 154.0 159.0 194.0 194.0 194.0 Working capital 970.0 826.0 1057.0 1123.0 1190.0 Other 10.0 152.0 254.0 305.0 354.0 Capital Employed 6566.0 7003.0 7863.0 8294.0 8765.0 Financed by Equity capital & reserves 4748.0 5293.0 5748.0 6177.0 6646.0 Minority interests 328.0 451.0 427.0 436.0 446.0 Preference shares 0.0 0.0 0.0 0.0 0.0 Net Debt/(Cash) 999.0 816.0 1285.0 1278.0 1270.0 Deferred consideration/debt-related 0.0 0.0 0.0 0.0 0.0 Retirement benefit obligations 106.0 99.0 44.0 44.0 44.0 Net deferred tax 212.0 238.0 254.0 254.0 254.0 Other long-term liabilities 173.0 106.0 105.0 105.0 105.0 Capital Employed 6566.0 7003.0 7863.0 8294.0 8765.0 Intangibles amortised 348.0 437.0 533.0 632.0 731.0 Capital employed inc. intangibles 6914.0 7440.0 8396.0 8926.0 9496.0 Invested capital inc. intangibles 6423.0 6997.0 7993.0 8523.0 9093.0

DIVISIONAL ANALYSIS Sep11 Sep12F Sep13F Sep11 Sep12F Sep13F Revenue (£m) Adj. Operating Profits (£m)

Grocery 3638.0 3763.0 3895.0 248.0 192.0 252.0 Sugar 2134.0 2488.0 2669.0 315.0 495.0 441.0 Agriculture 1127.0 1247.0 1279.0 40.0 37.0 40.0 Ingredients 1123.0 1160.0 1197.0 56.0 46.0 60.0 Retail 3043.0 3429.0 3783.0 309.0 348.0 394.0 Central costs 0.0 0.0 0.0 -48.0 -44.0 -46.0 Total 11065.0 12087.0 12823.0 920.0 1074.0 1141.0

CALENDAR Date Ex-Div Interims 24-04-12 06-06-12 Finals 06-11-12 07-12-11 AGM 09-12-11 Updated 12-07-12

VALUATION Sep11 Sep12F Sep13F Dec11 Dec12F Dec13F Rel to Sector

P/E 17.9 15.3 14.2 1.5 1.3 1.2 Dividend Yield (%) 1.9 2.0 2.1 0.8 0.8 0.8 Free Cash Flow Yield (pre divs) (%) N/A 2.0 2.1 Price / Book 1.82 1.69 1.57 1.3 1.3 1.3 EV / Revenue 1.08 0.99 0.94 EV / EBITDA 9.9 8.7 8.3 EV / EBITA 13.3 11.5 10.8 EV / Operating Cashflow N/A 21.4 20.4 EV / Invested Capital 1.52 1.43 1.34 PEG (Hist P/E/4yr gwth) 1.40

PRICE PERFORMANCE (%) 1 Wk 1 Mth 3 Mths 6 Mths YTD 1 Yr Absolute -0.4 5.5 11.5 10.0 19.6 23.6 Rel to FTSE 100 0.8 4.1 3.8 14.1 16.7 16.8 Rel to E300 0.1 2.5 1.4 16.7 16.6 23.3 Rel to Sector -0.9 3.8 14.3 11.9 16.2 14.6

PRICE AND P/E HISTORY Price Hist P/E High Low Yr End High Low Average

2012 1332 1105 18.0 14.9 16.5 2011 1164 940 1107 16.1 13.0 14.7 2010 1182 820 1181 18.9 14.2 16.8 2009 866 613 822 15.8 11.2 13.6 2008 904 612 730 17.1 11.2 14.5 2007 949 773 900 18.6 15.2 16.9

KEY RATIOS Sep09 Sep10 Sep11 Sep12F Sep13F G R O W T H

EPS Diluted (Adj) (%) 5.0 25.2 2.5 16.6 8.0 Dividend (%) 3.7 13.3 4.0 8.1 5.0 Revenue (%) 12.4 9.9 8.8 9.2 6.1 EBITDA (%) 13.3 22.1 -1.0 13.1 5.2 P R O F I T A B I L I T Y / A C T I V I T Y

EBITDA margin (%) 10.8 12.0 11.0 11.4 11.3 EBITA margin (%) 7.7 8.9 8.1 8.7 8.7 Revenue / Capital Employed (x) 1.43 1.45 1.43 1.43 1.42 R E T U R N

ROCE (before tax, ex. invs) (%) 11.0 12.8 11.6 12.4 12.4 ROE (after tax) (%) 9.2 10.7 9.9 10.6 10.5 Ret. on Inv. Cap. (after tax) (%) 8.8 10.5 9.8 10.2 10.1 WACC (%) 6.9 6.1 5.9 5.0 4.2 F I N A N C I A L / G E N E R A L

EBITDA Int. Cover (x) 12.9 16.1 13.2 13.2 15.2 Group Interest Cover (x) 8.2 10.9 9.1 9.5 11.1 Debt / EBITDA (x) 1.0 0.7 1.1 0.9 0.9 Debt / Equity (%) 19.7 14.2 20.8 19.3 17.9 Debt / Free Cash Flow (x) 4.7 2.0 N/A 6.2 5.7 Avg. Cost of Debt (before tax) (%) 8.7 8.4 8.8 8.1 7.5 Ret. benefits deficit / market cap (%) 1.6 1.2 0.5 0.4 0.4 Dividend Cover (x) 2.7 3.0 3.0 3.2 3.3 Working Capital / Revenue (%) 10.5 8.1 9.6 9.3 9.3 Net Capex / Depreciation (%) 181.4 205.9 244.8 223.1 233.0 Tax rate (%) (unadjusted) 22.6 25.4 23.8 25.2 25.0

CAGR(%) 5 Year 10 Year MAJOR SHAREHOLDERS % Revenue (%) 13.0 N/A Wittington Investments 54.5 EBITDA (%) 10.8 N/A Howard Investments 3.6 EPS Diluted (Adj) (%) 7.8 N/A Capital Research & Mgmt 3.1 Cash EPS (Diluted) (%) 9.3 N/A Dividend (%) 5.7 N/A TSR 11.3 9.7

C O M P A N Y A N A L Y S I S

15 Davy Research

Britvic plc

Analyst: Barry Gallagher Email: [email protected] Bloomberg: BVIC LN Phone: +353 1 6149194 RIC: BVIC.L Sector: Beverage www.britvic.com

Price (p) Shares (m) Mkt. Cap (£m) E.V. (£m) Mkt. Cap. / EV (%) Free Float (%) Daily No. Shares Traded (m) Daily Value Traded (£m) 320 242.1 773.6 1223.6 63.2 95.2 1.384 4.172

SUMMARY ACCOUNTS Sep09 Sep10 Sep11 Sep12F Sep13F I N C O M E S T A T E M E N T ( £ M )

Revenue 978.8 1121.4 1290.4 1269.6 1316.6 EBITDA 150.5 181.4 185.7 166.6 179.9 Depreciation 31.8 40.0 35.6 35.6 35.6 Amortisation of intangibles 8.6 9.0 15.1 15.1 15.1 Operating profit 110.1 132.4 135.0 115.9 129.2 Other income from operations 0.0 0.0 0.0 0.0 0.0 Share of associate / JV after-tax profits 0.0 0.0 0.0 0.0 0.0 PBIT before exceptionals 110.1 132.4 135.0 115.9 129.2 Group net interest -23.6 -23.5 -29.9 -31.0 -27.9 Other finance costs 0.0 0.0 0.0 0.0 0.0 Total finance costs -23.6 -23.5 -29.9 -31.0 -27.9 Exceptionals -17.4 0.0 -19.5 0.0 0.0 PBT 69.1 108.9 85.6 84.9 101.3 Tax -22.3 -28.2 -27.2 -21.6 -25.8 Minorities (incl. pref. divs.) 0.0 0.0 0.0 0.0 0.0 Earnings (basic) 46.8 80.7 58.4 63.3 75.5 Average no. of shares (m) - basic 214.9 225.3 240.4 241.4 241.4 Average no. of shares (m) - diluted 220.9 231.3 246.4 249.0 249.0 P E R S H A R E D A T A ( P )

EPS Basic 21.8 35.8 24.3 26.2 31.3 EPS Diluted (Adj) 29.1 38.8 32.9 26.6 31.5 Cash EPS (Diluted) 43.5 56.1 47.3 40.9 45.8 Dividend 15.0 17.6 17.7 11.4 15.2 NBV N/A 16.9 9.1 25.3 42.7 NBV (incl. amortisation of intangibles) 19.5 39.9 36.9 60.0 83.6 C A S H F L O W ( £ M )

EBITDA 150.5 181.4 185.7 166.6 179.9 Change in working capital 13.8 -15.0 -13.5 -12.5 6.1 Share-based payments 6.9 0.0 0.0 0.0 0.0 Other operating cashflows -21.4 0.0 0.0 -7.5 -7.5 Cash generated from operations 149.8 166.4 172.2 146.6 178.5 Net capital expenditure -40.1 -57.2 -49.0 -50.0 -55.0 Operating cashflow 109.7 109.2 123.2 96.6 123.5 Net interest -32.5 -23.5 -26.9 -29.5 -26.5 Tax -18.9 -28.2 -25.6 -20.5 -24.6 Dividends from associates 0.0 0.0 0.0 0.0 0.0 Dividends to minorities 0.0 0.0 0.0 0.0 0.0 Free cash flow 58.3 57.5 70.7 46.6 72.4 Dividends to shareholders -27.8 -39.7 -40.3 -27.6 -36.6 Acquisitions & investments -2.4 -200.7 0.0 0.0 0.0 Business disposals 0.0 0.0 0.0 0.0 0.0 Share Issues / (Buybacks) -3.3 94.2 0.0 0.0 0.0 Translation differences -4.6 0.0 0.0 0.0 0.0 Other 1.8 -1.5 -25.7 -17.0 -6.8 Change in net cash / debt 22.0 -90.3 4.7 2.0 29.0 B A L A N C E S H E E T ( £ M )

Property, plant & equipment 226.0 276.0 243.8 275.2 301.4 Intangible assets 293.1 453.1 439.4 424.3 409.2 Investments in associates / jv's 0.0 0.0 0.0 0.0 0.0 Working capital -58.4 -44.0 -30.9 -9.7 -6.4 Other 58.8 10.0 0.0 0.0 0.0 Capital Employed 519.5 695.1 652.3 689.8 704.2 Financed by Equity capital & reserves -2.5 39.0 22.5 61.2 103.1 Minority interests 0.0 0.0 0.0 0.0 0.0 Preference shares 0.0 0.0 0.0 0.0 0.0 Net Debt/(Cash) 366.4 456.7 452.0 450.0 421.0 Deferred consideration/debt-related 0.0 0.0 0.0 0.0 0.0 Retirement benefit obligations 85.1 85.1 45.1 45.1 45.1 Net deferred tax 25.6 25.6 23.0 23.0 23.0 Other long-term liabilities 44.9 88.7 109.7 110.6 112.0 Capital Employed 519.5 695.1 652.3 689.8 704.2 Intangibles amortised 44.4 53.4 68.5 83.6 98.7 Capital employed inc. intangibles 563.9 748.5 720.8 773.4 802.9 Invested capital inc. intangibles 408.3 549.1 543.0 594.8 622.8

GEOGRAPHIC ANALYSIS Sep11 Sep12F Sep13F Sep11 Sep12F Sep13F Revenue (£m) Operating Profits (£m)

GB and International 882.9 870.1 914.9 112.0 94.9 106.9 Ireland 162.8 142.6 134.4 6.0 5.0 5.5 France 244.7 256.9 267.3 17.0 16.0 17.5 Total 1290.4 1269.6 1316.6 135.0 115.9 129.9

CALENDAR Date Ex-Div Interims 24-05-12 30-05-12 Finals 28-11-12 07-12-11 AGM 27-01-11 Updated 20-07-12

VALUATION Sep11 Sep12F Sep13F Dec11 Dec12F Dec13F Rel to Sector

P/E 9.7 12.0 10.1 0.5 0.7 0.7 Dividend Yield (%) 5.5 3.6 4.8 2.8 1.6 1.9 Free Cash Flow Yield (pre divs) (%) 9.1 6.0 9.4 Price / Book 35.00 12.61 7.48 11.5 4.7 3.2 EV / Revenue 0.96 0.96 0.91 EV / EBITDA 6.7 7.3 6.6 EV / EBITA 8.3 9.3 8.3 EV / Operating Cashflow 10.1 12.7 9.7 EV / Invested Capital 2.28 2.06 1.92 PEG (Hist P/E/4yr gwth) 4.73

PRICE PERFORMANCE (%) 1 Wk 1 Mth 3 Mths 6 Mths YTD 1 Yr Absolute 3.1 6.2 -3.6 -15.2 -0.7 0.5 Rel to FTSE 250 3.5 3.7 -10.8 -14.3 -12.0 -7.3 Rel to E300 3.7 3.2 -12.3 -10.0 -3.2 0.2 Rel to E300 Beverages 1.5 4.1 -15.7 -25.0 -19.4 -24.6

PRICE AND P/E HISTORY Price Hist P/E High Low Yr End High Low Average

2012 398 260 12.1 7.9 10.5 2011 477 290 322 16.4 7.5 9.9 2010 518 398 473 17.3 12.7 15.9 2009 408 207 408 N/A N/A N/A 2008 354 166 264 N/A N/A N/A 2007 399 285 346 N/A N/A N/A

KEY RATIOS Sep09 Sep10 Sep11 Sep12F Sep13F G R O W T H

EPS Diluted (Adj) (%) 19.5 33.4 -15.2 -19.0 18.4 Dividend (%) 19.0 17.3 0.6 -35.6 33.3 Revenue (%) 5.6 14.6 15.1 -1.6 3.7 EBITDA (%) 5.3 20.5 2.4 -10.3 8.0 P R O F I T A B I L I T Y / A C T I V I T Y

EBITDA margin (%) 15.4 16.2 14.4 13.1 13.7 EBITA margin (%) 12.1 12.6 11.6 10.3 11.0 Revenue / Capital Employed (x) 1.81 1.71 1.76 1.70 1.67 R E T U R N

ROCE (before tax, ex. invs) (%) 22.0 21.5 20.4 17.5 18.3 ROE (after tax) (%) 147.6 120.1 88.3 56.2 45.3 Ret. on Inv. Cap. (after tax) (%) 21.6 22.5 21.3 18.1 18.4 WACC (%) 7.0 6.4 6.3 5.8 5.0 F I N A N C I A L / G E N E R A L

EBITDA Int. Cover (x) 6.4 7.7 6.2 5.4 6.4 Group Interest Cover (x) 4.7 5.6 4.5 3.7 4.6 Debt / EBITDA (x) 2.4 2.5 2.4 2.7 2.3 Debt / Equity (%) N/A N/A N/A 735.6 408.4 Debt / Free Cash Flow (x) 6.3 7.9 6.4 9.7 5.8 Avg. Cost of Debt (before tax) (%) 6.3 5.7 6.6 6.9 6.4 Ret. benefits deficit / market cap (%) 11.2 7.6 5.8 5.8 5.8 Dividend Cover (x) 1.9 2.2 1.9 2.3 2.1 Working Capital / Revenue (%) N/A N/A N/A N/A N/A Net Capex / Depreciation (%) 126.1 143.0 137.6 140.4 154.5 Tax rate (%) (unadjusted) 32.3 25.9 31.8 25.4 25.5

CAGR(%) 5 Year 10 Year MAJOR SHAREHOLDERS % Revenue (%) 13.7 N/A Route One Fund 6.2 EBITDA (%) 8.9 N/A Standard Life Investment 4.9 EPS Diluted (Adj) (%) 12.5 N/A Pepsico 4.4 Cash EPS (Diluted) (%) 5.2 N/A Dividend (%) 12.1 N/A TSR 4.4 N/A

C O M P A N Y A N A L Y S I S

16 Davy Research

C&C

Analyst: Barry Gallagher Xetra: GCC Email: [email protected] Bloomberg: GCC ID Phone: +353 1 6149194 RIC: GCC.I Sector: Beverage www.candcgroupplc.com

Price (c) Shares (m) Mkt. Cap (€m) E.V. (€m) Mkt. Cap. / EV (%) Mkt. Weight (%) Free Float (%) Daily No. Shares Traded (m) Daily Value Traded (€m) 361 338.1 1218.8 1079.7 112.9 2.5 95.4 1.047 3.538

SUMMARY ACCOUNTS Feb10 Feb11 Feb12 Feb13F Feb14F I N C O M E S T A T E M E N T ( € M )

Revenue 568.7 529.6 480.8 488.4 514.4 EBITDA 104.5 121.8 131.6 133.8 141.0 Depreciation 15.0 21.3 20.3 21.8 21.8 Amortisation of intangibles 0.0 0.0 0.0 0.0 0.0 Operating profit 89.5 100.5 111.3 112.0 119.2 Other income from operations 0.0 0.0 0.0 0.0 0.0 Share of associate / JV after-tax profits 0.0 0.0 0.0 0.0 0.0 PBIT before exceptionals 89.5 100.5 111.3 112.0 119.2 Group net interest -7.2 -9.4 -5.1 -4.0 0.0 Other finance costs 0.0 0.0 0.0 0.0 0.0 Total finance costs -7.2 -9.4 -5.1 -4.0 0.0 Exceptionals -3.5 -9.1 0.0 0.0 0.0 PBT 78.8 82.0 106.2 108.0 119.2 Tax -8.9 -11.1 -13.8 -15.1 -17.3 Minorities (incl. pref. divs.) 0.0 0.0 0.0 0.0 0.0 Earnings (basic) 69.9 70.9 92.4 92.8 102.0 Average no. of shares (m) - basic 316.8 321.6 323.0 321.3 321.3 Average no. of shares (m) - diluted 323.8 330.1 333.6 333.8 333.8 P E R S H A R E D A T A ( C )

EPS Basic 22.1 22.0 28.6 28.9 31.7 EPS Diluted (Adj) 22.7 24.2 27.7 27.8 30.5 Cash EPS (Diluted) 27.3 30.7 33.8 34.3 37.1 Dividend 6.0 6.6 7.2 8.3 9.2 NBV 98.6 190.9 211.8 231.1 252.2 NBV (incl. amortisation of intangibles) 117.5 209.6 230.5 249.8 271.0 C A S H F L O W ( € M )

EBITDA 104.5 121.8 131.6 133.8 141.0 Change in working capital 33.7 31.5 8.0 0.0 2.0 Share-based payments 0.0 0.0 0.0 0.0 0.0 Other operating cashflows 1.8 4.5 -0.2 0.0 0.0 Cash generated from operations 140.0 157.8 139.4 133.8 143.0 Net capital expenditure -5.4 -21.1 -17.7 -15.0 -15.0 Operating cashflow 134.6 136.7 121.7 118.8 128.0 Net interest -7.0 -8.0 -6.0 -4.0 0.0 Tax -4.7 -8.4 -5.5 -12.1 -13.8 Dividends from associates 0.0 0.0 0.0 0.0 0.0 Dividends to minorities 0.0 0.0 0.0 0.0 0.0 Free cash flow 122.9 120.3 110.2 102.7 114.2 Dividends to shareholders -22.0 -12.1 -18.5 -27.9 -30.6 Acquisitions & investments -224.5 263.9 -11.9 -4.0 0.0 Business disposals 0.0 0.0 0.0 0.0 0.0 Share Issues / (Buybacks) 0.0 0.0 0.0 0.0 0.0 Translation differences 0.0 0.0 0.0 0.0 0.0 Other -15.1 -13.5 -5.2 0.0 -0.0 Change in net cash / debt -138.7 358.6 74.6 70.8 83.6 B A L A N C E S H E E T ( € M )

Property, plant & equipment 187.2 187.2 181.8 175.0 168.2 Intangible assets 507.7 466.3 484.9 488.5 483.9 Investments in associates / jv's 32.1 20.0 19.5 19.5 19.5 Working capital 16.5 7.1 -2.4 -1.1 0.3 Other 0.0 0.4 0.1 0.0 0.0 Capital Employed 743.5 681.0 683.9 681.9 671.9 Financed by Equity capital & reserves 329.4 643.7 714.2 779.2 850.6 Minority interests 0.0 0.0 0.0 0.0 0.0 Preference shares 0.0 0.0 0.0 0.0 0.0 Net Debt/(Cash) 364.9 6.3 -68.3 -139.1 -222.7 Deferred consideration/debt-related 0.0 0.0 0.0 0.0 0.0 Retirement benefit obligations 21.2 15.3 15.1 15.1 15.1 Net deferred tax 0.0 -2.8 0.7 0.7 0.7 Other long-term liabilities 28.0 18.5 22.2 26.0 28.3 Capital Employed 743.5 681.0 683.9 681.8 671.9 Intangibles amortised 63.1 63.1 63.1 63.1 63.1 Capital employed inc. intangibles 806.6 744.1 747.0 744.9 735.0 Invested capital inc. intangibles 757.4 713.1 709.0 703.2 690.9

DIVISIONAL ANALYSIS Feb12 Feb13F Feb14F Feb12 Feb13F Feb14F Revenue (€m) Op. Profit (pre am.) (€m)

Irish Cider 91.5 82.3 80.7 42.2 39.3 37.0 UK and International Cider 215.0 216.9 235.0 39.6 38.8 45.1 Distribution 74.0 80.0 85.0 7.1 8.0 8.5 Tennent's 100.0 109.2 113.7 22.3 25.9 28.6 Total 480.5 488.4 514.4 111.2 112.0 119.3

CALENDAR Date Ex-Div Interims 19-10-11 26-10-11 Finals 16-05-12 23-05-12 AGM 27-06-12 Updated 17-08-12

VALUATION Feb12 Feb13F Feb14F Dec11 Dec12F Dec13F Rel to Sector

P/E 13.0 13.0 11.8 0.7 0.8 0.8 Dividend Yield (%) 2.0 2.3 2.5 1.0 1.0 1.0 Free Cash Flow Yield (pre divs) (%) 9.0 8.4 9.4 Price / Book 1.70 1.56 1.43 0.6 0.6 0.6 EV / Revenue 2.35 2.17 1.90 EV / EBITDA 8.6 7.9 6.9 EV / EBITA 10.1 9.5 8.2 EV / Operating Cashflow 9.3 8.9 7.6 EV / Invested Capital 1.62 1.54 1.44 PEG (Hist P/E/4yr gwth) 1.68

PRICE PERFORMANCE (%) 1 Wk 1 Mth 3 Mths 6 Mths YTD 1 Yr Absolute 1.0 1.0 5.1 -0.1 25.6 18.2 Rel to ISEQ 0.6 1.3 2.3 0.5 15.3 -3.6 Rel to E300 1.7 -0.9 -5.6 -0.8 16.2 5.6 Rel to E300 Beverages -0.5 0.0 -9.2 -17.3 -3.3 -20.6

PRICE AND P/E HISTORY Price Hist P/E High Low Yr End High Low Average

2012 393 281 16.2 11.4 13.7 2011 369 270 287 15.9 11.1 13.8 2010 360 266 338 16.3 12.1 14.1 2009 320 78 301 14.5 2.6 8.4 2008 540 102 145 17.7 3.4 8.4 2007 1390 367 410 46.7 6.8 22.5

KEY RATIOS Feb10 Feb11 Feb12 Feb13F Feb14F G R O W T H

EPS Diluted (Adj) (%) 2.3 6.9 14.3 0.4 9.8 Dividend (%) -33.3 10.0 9.1 15.8 9.8 Revenue (%) 10.5 -6.9 -9.2 1.6 5.3 EBITDA (%) -4.7 16.6 8.0 1.6 5.5 P R O F I T A B I L I T Y / A C T I V I T Y

EBITDA margin (%) 18.4 23.0 27.4 27.4 27.4 EBITA margin (%) 15.7 19.0 23.1 22.9 23.2 Revenue / Capital Employed (x) 0.83 0.71 0.66 0.67 0.71 R E T U R N

ROCE (before tax, ex. invs) (%) 13.0 13.4 15.3 15.4 16.6 ROE (after tax) (%) 20.8 14.6 12.5 11.5 11.6 Ret. on Inv. Cap. (after tax) (%) 12.3 12.0 13.6 13.6 14.6 WACC (%) 7.3 8.7 N/A N/A N/A F I N A N C I A L / G E N E R A L

EBITDA Int. Cover (x) 14.5 13.0 25.8 33.4 N/A Group Interest Cover (x) 12.4 10.7 21.8 28.0 N/A Debt / EBITDA (x) 3.5 0.1 N/A N/A N/A Debt / Equity (%) 110.8 1.0 N/A N/A N/A Debt / Free Cash Flow (x) 3.0 0.1 N/A N/A N/A Avg. Cost of Debt (before tax) (%) 2.4 5.1 N/A N/A N/A Ret. benefits deficit / market cap (%) 2.3 1.3 1.2 1.2 1.2 Dividend Cover (x) 3.8 3.7 3.8 3.3 3.3 Working Capital / Revenue (%) 2.9 1.3 N/A N/A 0.1 Net Capex / Depreciation (%) 36.0 99.1 87.2 68.8 68.8 Tax rate (%) (unadjusted) 11.3 13.5 13.0 14.0 14.5

CAGR(%) 5 Year 10 Year MAJOR SHAREHOLDERS % Revenue (%) -13.3 -4.6 Invesco 9.0 EBITDA (%) -10.6 -1.5 Independent Franchise Partners 7.0 EPS Diluted (Adj) (%) -12.5 6.7 MassMutual 6.0 Cash EPS (Diluted) (%) -10.7 5.5 Southeastern Asset Management 5.4 Dividend (%) -23.2 N/A F&C Asset Management 4.4

C O M P A N Y A N A L Y S I S

17 Davy Research

Carlsberg

Analyst: Barry Gallagher Email: [email protected] Bloomberg: CARLB DC Phone: +353 1 6149194 RIC: CARLb.CO Sector: Beverage www.carlsberggroup.com

Price (dkk) Shares (m) Mkt. Cap (DKK) E.V. (DKK) Mkt. Cap. / EV (%) Free Float (%) Daily No. Shares Traded (m) Daily Value Traded (DKK) 51300 152.6 78261.2 111371 70.3 82.0 0.422 201.550

SUMMARY ACCOUNTS Dec09 Dec10 Dec11P Dec12F Dec13F I N C O M E S T A T E M E N T ( D K K )

Revenue 59382.0 60054.0 63561.0 66238.2 68940.0 EBITDA 13169.0 14214.9 13600.0 13988.7 14914.0 Depreciation 3779.0 3966.0 3784.0 3850.0 3900.0 Amortisation of intangibles 0.0 0.0 0.0 0.0 0.0 Operating profit 9390.0 10248.9 9816.0 10138.7 11014.0 Other income from operations 0.0 0.0 0.0 0.0 0.0 Share of associate / JV after-tax profits 0.0 0.0 0.0 0.0 0.0 PBIT before exceptionals 9390.0 10248.9 9816.0 10138.7 11014.0 Group net interest -2990.0 -2155.0 -2018.0 -1623.0 -1543.5 Other finance costs 0.0 0.0 0.0 -300.0 -100.0 Total finance costs -2990.0 -2155.0 -2018.0 -1923.0 -1643.5 Exceptionals -695.0 -249.0 -268.0 1270.0 -200.0 PBT 5705.0 7844.9 7530.0 9485.7 9170.5 Tax -1538.0 -1885.0 -1837.3 -2243.7 -2292.6 Minorities (incl. pref. divs.) -565.0 -609.0 -543.0 -586.0 -765.0 Earnings (basic) 3602.0 5350.9 5149.7 6656.0 6112.9 Average no. of shares (m) - basic 152.5 152.5 152.8 152.8 152.8 Average no. of shares (m) - diluted 152.5 152.5 152.8 152.8 152.8 P E R S H A R E D A T A ( D K K )

EPS Basic 2362.0 3507.7 3369.4 4355.0 3999.6 EPS Diluted (Adj) 2729.2 3507.7 3369.4 3762.8 4097.8 Cash EPS (Diluted) 5207.2 6107.5 5845.2 6281.9 6649.5 Dividend 350.0 543.0 550.0 573.2 630.0 NBV 35953.4 42119.1 43095.6 48183.2 52968.7 NBV (incl. amortisation of intangibles) 35953.4 42119.1 43095.6 48183.2 52968.7 C A S H F L O W ( D K K )

EBITDA 13169.0 14214.9 13600.0 13988.7 14914.0 Change in working capital 3675.0 716.0 -992.0 -62.6 -254.9 Share-based payments 0.0 0.0 0.0 0.0 0.0 Other operating cashflows -9.0 514.0 315.0 3.1 -267.6 Cash generated from operations 16835.0 15444.9 12923.0 13929.3 14391.5 Net capital expenditure -2923.0 -3326.0 -4571.0 -4288.5 -4451.7 Operating cashflow 13912.0 12118.9 8352.0 9640.8 9939.8 Net interest -1597.0 -1947.0 -2070.0 -1923.0 -1643.5 Tax -1374.0 -2329.8 -1592.0 -2131.5 -2178.0 Dividends from associates 0.0 0.0 0.0 0.0 0.0 Dividends to minorities -591.0 -604.0 -1876.0 -936.0 -994.5 Free cash flow 10350.0 7238.1 2814.0 4650.3 5123.8 Dividends to shareholders -540.0 -746.0 -812.0 -1070.5 -1006.9 Acquisitions & investments -159.0 -2535.0 -312.0 1950.0 50.0 Business disposals 0.0 0.0 0.0 0.0 0.0 Share Issues / (Buybacks) 0.0 0.0 0.0 0.0 0.0 Translation differences 0.0 0.0 -5.0 0.0 0.0 Other -2158.0 -1105.2 -968.0 1.7 465.1 Change in net cash / debt 7493.0 2852.0 717.0 5531.5 4632.0 B A L A N C E S H E E T ( D K K )

Property, plant & equipment 31825.0 32420.0 31848.0 33141.2 35192.4 Intangible assets 81611.0 87813.0 89041.0 89363.0 91120.0 Investments in associates / jv's 2667.0 4877.0 5051.0 5051.0 5051.0 Working capital -9531.0 -10300.0 -8769.0 -9106.0 -9202.0 Other 337.0 241.0 -258.0 -258.0 -258.0 Capital Employed 106909 115051 116913 118191 121903 Financed by Equity capital & reserves 54829.0 64248.0 65866.0 73641.7 80955.8 Minority interests 4660.0 5381.0 5763.0 5547.0 5317.5 Preference shares 0.0 0.0 0.0 0.0 0.0 Net Debt/(Cash) 36663.0 33811.0 33094.0 27562.5 22930.5 Deferred consideration/debt-related 0.0 0.0 0.0 0.0 0.0 Retirement benefit obligations 2153.0 2434.0 3263.0 3263.0 3263.0 Net deferred tax 6505.0 6749.0 6664.0 5914.0 7173.6 Other long-term liabilities 2099.0 2428.0 2263.0 2263.0 2263.0 Capital Employed 106909 115051 116913 118191 121903 Intangibles amortised 0.0 0.0 0.0 0.0 0.0 Capital employed inc. intangibles 106909 115051 116913 118191 121903 Invested capital inc. intangibles 96152.0 103440 104723 106751 109204

GEOGRAPHIC ANALYSIS Dec11P Dec12F Dec13F Dec11P Dec12F Dec13F Revenue (DKK) Operating Profits (DKK)

Northern & Western Europe 36879.0 36828.1 36962.9 5419.0 5394.4 5560.7 Eastern Europe 19719.0 20174.5 21602.0 4286.0 4130.0 4667.2 Asia 6838.0 9102.5 10250.1 1286.0 1727.3 1946.2 Not allocated 125.0 133.0 125.0 -1114.0 -1113.0 -1160.0 Total 63561.0 66238.2 68940.0 9877.0 10138.7 11014.0

CALENDAR Date Ex-Div Interims 15-08-12 Finals 20-02-12 23-03-12 AGM 22-03-12 Updated 17-08-12

VALUATION Dec11P Dec12F Dec13F Dec11P Dec12F Dec13F Rel to Sector

P/E 15.2 13.6 12.5 0.8 0.8 0.8 Dividend Yield (%) 1.1 1.1 1.2 0.5 0.5 0.5 Free Cash Flow Yield (pre divs) (%) 3.6 5.9 6.5 Price / Book 1.19 1.06 0.97 0.4 0.4 0.4 EV / Revenue 1.77 1.61 1.47 EV / EBITDA 8.3 7.6 6.8 EV / EBITA 11.4 10.5 9.2 EV / Operating Cashflow 13.4 11.0 10.2 EV / Invested Capital 1.12 1.04 0.98 PEG (Hist P/E/4yr gwth) 1.42

PRICE PERFORMANCE (%) 1 Wk 1 Mth 3 Mths 6 Mths YTD 1 Yr Absolute 0.9 4.6 14.6 17.9 26.7 31.9 Rel to OMX Copenhagen 0.5 3.8 3.0 12.0 3.9 2.7 Rel to E300 1.6 2.7 2.7 16.9 16.9 18.1 Rel to E300 Beverages -0.5 3.5 -1.2 -2.7 -2.7 -11.2

PRICE AND P/E HISTORY Price Hist P/E High Low Yr End High Low Average

2012 52000 40600 15.4 11.6 13.6 2011 62000 32220 40500 21.6 9.2 15.1 2010 60750 36700 55850 22.3 14.2 18.2 2009 39375 16875 38400 15.3 6.9 12.5 2008 55052 15100 17125 25.0 6.2 17.2 2007 62156 44801 49725 43.0 22.9 28.5

KEY RATIOS Dec09 Dec10 Dec11P Dec12F Dec13F G R O W T H

EPS Diluted (Adj) (%) 5.9 28.5 -3.9 11.7 8.9 Dividend (%) 0.0 55.1 1.3 4.2 9.9 Revenue (%) -0.9 1.1 5.8 4.2 4.1 EBITDA (%) 13.4 7.9 -4.3 2.9 6.6 P R O F I T A B I L I T Y / A C T I V I T Y

EBITDA margin (%) 22.2 23.7 21.4 21.1 21.6 EBITA margin (%) 15.8 17.1 15.4 15.3 16.0 Revenue / Capital Employed (x) 0.55 0.56 0.57 0.59 0.60 R E T U R N

ROCE (before tax, ex. invs) (%) 8.7 9.6 8.8 9.0 9.6 ROE (after tax) (%) 7.5 9.0 7.9 8.2 8.1 Ret. on Inv. Cap. (after tax) (%) 7.1 7.9 7.2 7.4 7.7 WACC (%) 7.2 6.8 6.3 5.7 5.3 F I N A N C I A L / G E N E R A L

EBITDA Int. Cover (x) 4.4 6.6 6.7 8.6 9.7 Group Interest Cover (x) 3.1 4.8 4.9 6.2 7.1 Debt / EBITDA (x) 2.8 2.4 2.4 2.0 1.5 Debt / Equity (%) 61.6 48.6 46.2 34.8 26.6 Debt / Free Cash Flow (x) 3.5 4.7 11.8 5.9 4.5 Avg. Cost of Debt (before tax) (%) 7.4 6.1 6.0 5.4 6.1 Ret. benefits deficit / market cap (%) 3.7 2.9 5.3 4.2 4.2 Dividend Cover (x) 7.8 6.5 6.1 6.6 6.5 Working Capital / Revenue (%) N/A N/A N/A N/A N/A Net Capex / Depreciation (%) 77.3 83.9 120.8 111.4 114.1 Tax rate (%) (unadjusted) 27.0 24.0 24.4 23.7 25.0

CAGR(%) 5 Year 10 Year MAJOR SHAREHOLDERS % Revenue (%) 9.1 N/A Carlsberg Foundation 12.2 EBITDA (%) 14.7 N/A OppenheimerFunds 6.2 EPS Diluted (Adj) (%) 9.9 N/A Cash EPS (Diluted) (%) 3.0 N/A Dividend (%) 12.1 N/A TSR -2.4 6.5

C O M P A N Y A N A L Y S I S

18 Davy Research

Continental Farmers Group

Analyst: John O'Reilly Xetra: CT3 Email: john.o'[email protected] Bloomberg: CFGP ID Phone: +353 1 6148915 RIC: CFGP.I Sector: Agribusiness www.continentalfarmersgroup.com

Price (c) Shares (m) Mkt. Cap (€m) E.V. (€m) Mkt. Cap. / EV (%) Free Float (%) Daily No. Shares Traded (m) Daily Value Traded (€m) 30 163.5 49.0 52.6 93.2 35.0 0.023 0.006

SUMMARY ACCOUNTS Dec09 Dec10 Dec11E Dec12F Dec13F I N C O M E S T A T E M E N T ( € M )

Revenue 12.3 21.1 24.9 32.1 39.9 EBITDA 0.3 6.3 6.8 8.9 11.1 Depreciation 1.4 1.8 1.9 2.2 2.6 Amortisation of intangibles 0.0 0.0 0.0 0.0 0.0 Operating profit -1.0 4.6 4.8 6.7 8.5 Other income from operations 0.0 0.0 0.0 0.0 0.0 Share of associate / JV after-tax profits 0.0 0.0 0.0 0.0 0.0 PBIT before exceptionals -1.0 4.6 4.8 6.7 8.5 Group net interest -0.9 -1.4 -1.4 -1.4 -1.4 Other finance costs 0.0 0.0 0.0 0.0 0.0 Total finance costs -0.9 -1.4 -1.4 -1.4 -1.4 Exceptionals 0.0 0.0 0.0 0.0 0.0 PBT -1.9 3.2 3.4 5.3 7.1 Tax 0.0 -0.6 -0.7 -0.3 -0.4 Minorities (incl. pref. divs.) 0.1 0.1 0.0 0.0 0.0 Earnings (basic) -1.9 2.7 2.7 5.0 6.7 Average no. of shares (m) - basic 82.9 82.9 123.2 163.5 163.5 Average no. of shares (m) - diluted 82.9 82.9 123.2 163.5 163.5 P E R S H A R E D A T A ( C )

EPS Basic -2.2 3.2 2.2 3.1 4.1 EPS Diluted (Adj) -2.2 3.2 2.2 3.1 4.1 Cash EPS (Diluted) -0.6 5.4 3.8 4.4 5.7 Dividend 0.0 0.0 0.0 0.0 0.0 NBV 56.6 60.8 43.0 46.1 50.2 NBV (incl. amortisation of intangibles) 56.6 60.8 43.0 46.1 50.2 C A S H F L O W ( € M )