Revenue & Receipts Cycle SUBSTANTIVE PROCEDURES - Trade Receivables.

-

Upload

diana-gladish -

Category

Documents

-

view

253 -

download

1

Transcript of Revenue & Receipts Cycle SUBSTANTIVE PROCEDURES - Trade Receivables.

Revenue & Receipts Cycle

SUBSTANTIVE PROCEDURES - Trade Receivables

REFERENCES

LEARNING OUTCOMES

1. Understand the financial statement assertions that are applicable to the account balances, classes of transactions and events in the Revenue and Receipts cycle.

2. Apply the direction of testing correctly to a particular assertion.

3. Understand the fraud risks applicable to the revenue and receipts cycle, including risks of material misstatement.

4. Understand the audit procedures available to the auditor for substantive testing (“auditor’s toolbox”).

Performed to obtain audit evidence of:• The suitability of the

design of the accounting and internal control system

• The effective operation of the system throughout the period of reliance.

Tests of Controls Substantive Procedures

Performed to obtain evidence to detect material misstatements in the financial statements

Conclude on the Control Objectives

Conclude on the Management Assertions

Consist of:• Tests of detail of transactions,

balances and disclosures;• Analytical procedures

AUDIT APPROACH

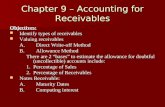

ASSERTIONS

Transactions and events

Sales & Returns (Revenue) Receipts

Occurrence Accuracy Completeness Cut-off Classification

Account balances

Trade receivables Bank & Cash

Existence Rights Valuation Completeness

Assertions applicable to R&R cycle

Presentation and disclosure: RO4 only

DIRECTION OF TESTING

Ex

Val

Occ

Acc

C OMPLETENESS

AFS

TB

GL

DL

SJ

Supp Doc

ACCOUNTING ASPECTS

AN 10/55

Recognition criteria for revenue – IAS 18oWhen can a sales transaction be recognised as revenue?

Allowance for doubtful debtsoUncollectable debts: expensed rather than sale adjustoWhat is a reasonable allowance?

1. Fraudulent financial reporting (i.e. fraudulently manipulating the figures in the financial records. Result: Over- or understatement)

Risk Under/overstated Assertion affected• Creating fictitious sales ? ?• Not recording all sales ? ?• Not allowing for all bad debts ? ?• Recognize sale before delivery ? ?

FRAUD RISKS

2. Misappropriation of assets (theft, embezzlement, unauthorized use of assets etc.). Applies to cash and inventory. Examples?

Inspection Observation Enquiry Reperformance Recalculation Analytical Procedures Other: External confirmation

AUDIT PROCEDURES

[Audit verb] [Party/Process/Doc] [Objective/evidence]

Inspect the delivery note for proof of the customer’s signature

Revenue & Receipts Cycle SUBSTANTIVE PROCEDURES - Trade Receivables

REFERENCES

LEARNING OUTCOMES

1. Understand and explain the financial statement assertions that are applicable to trade receivables.

2. Understand the important accounting aspects applicable to trade receivable.

3. Describe the substantive audit procedures necessary to audit the assertions relevant to the trade receivables account balance.

4. Describe the substantive audit procedures to audit a roll-forward schedule i.t.o. debtors.

Trade Receivables (“debtors”) = account balance, thereforeassertions applicable:

Existence: underlying debtors (asset) making up the balance genuine?

Valuation: account balance included at appropriate carrying value? (after proper allowance for doubtful debts)

Rights: underlying debtors (assets) belong to the entity?

Completeness: all debtors (assets) that belong to the entity included in account balance?

INTRODUCTION

INTRODUCTION

Dr Trade Receivables CrOpening balance R 50 000 Receipts R 600 000

Sales R 750 000 Cr Adjustments R 30 000

Closing balance R 170 000

R 800 000 R 800 000

Opening balance R 170 000

Consider the general ledger control account

Assume allowance for doubtful debts at year-end: R17 000

To which figure to apply account balance assertions?

INTRODUCTION

Trade debtors closing balances at 31 Dec 2012:ABC Distributors R 20 000

DEF Retailers R 40 000

GHI Corporation R 15 000

JKL Wholesalers R 35 000

MNO Trading R 60 000

Grand total (debtors sub-ledger) R 170 000

Consider the debtors list

Above shows the “assets” underlying the account balance

SUBSTANTIVE PROCEDURES

- EXISTENCE

Risk: Debtor balances in financial records are fictitious as there are no actual debtors “behind the balance”.

Audit evidence: - Confirm balance directly with debtor- Verify post year-end receipts

Audit procedures: ?

DEBTORS CONFIRMATIONS

SUBSTANTIVE PROCEDURES

- EXISTENCE

Choose positive vs. negative confirmations

Auditor has control of confirmation process

Select sample from financial records

Mailing of confirmation letters to debtors

Monitor replies Follow up disagreements and no replies

Determine possible misstatement of account balance (under/over)?

Timing of confirmations?

EXAMPLE: DEBTORS CONFIRMATION

Debtor Silver CC Reference R

Amount per XYZ (Pty) Ltd age analysis at year end

Invoice IN2678 20 000

Customer alleges 5% discount for early payment of invoice IN2678 not taken into account by XYZ

(1 250)

Total owing per ABC Distributors 18 750

Audit client name: XYZ (Pty) LtdCustomer (debtor) name: ABC DistributorsYear end: 31 December 2012

Audit procedures to audit the difference?

SUBSTANTIVE PROCEDURES

- EXISTENCE

Subsequent receipts testing

Alternative to debtor confirmations

Agree year end balances to “subsequent receipts”: payments received from debtors after year end.

Example: Silver CC year end balance (31 Dec 2012): R18 750

relates to 1 invoice only: #IN2678 paid on 23 January 2013

How does receipt confirm existence of debtor Silver CC?

SUBSTANTIVE PROCEDURES

- RIGHTS

Risk: The audit client does not own the underlying assets (trade debtors) making up the account balance disclosed in the AFS.

Audit evidence: no debtors ceded, encumbered, factored.

Audit procedures: ?

SUBSTANTIVE PROCEDURES

- VALUATION

Gross amount

Gross amount = add Credit sales less Receipts +/- Adjustments

• Posted to Debtors sub-ledger

• Posted toGL control account

• Sales journal• Cash rec. jnl• Sales returns jnl

Auditor to reconcile GL to sub-ledger/list - Reconciling items?

Unusual entries?

o Credit balances?o Cast! o Procedures on foreign debtors (RO)

TB - AFS

Allowance for doubtful debts

SUBSTANTIVE PROCEDURES

- VALUATION

Risk: Trade receivables over/understated due to allowance being under/overstated.

Audit evidence: - Allowance reasonable - Consistent with prior year

- In-line with accounting policy/IFRS

- Correctly calculated - Authorised senior management - Incl. all potentially irrecoverable

debt - Amount in relation to prior year actual bad debts

Audit procedures: ?

•Why? if all credit sales posted to sub-ledger, then…

SUBSTANTIVE PROCEDURES

-COMPLETENESS

•Entails completeness of debtors (assets), not sales per sé

•Unlikely to confirm completeness with confirmations.

•However, completeness testing here relies on completeness and cut-off of revenue. (Refer to lecture on audit of Sales).

•If recorded in incorrect period, then…

Debtor accounts are created (raised) in sub-ledger (“financial records”)if all sales posted.

• Comparisons and ratio calculations to determine risk areas (“assertions most at risk of misstatement”).

• Usually precedes testing of assertions.

• Unexpected differences (e.g. between current and prior year) can be followed up/specific procedures performed thereon.

SUBSTANTIVE PROCEDURES

-ANALYTICAL PROCEDURES

SUBSTANTIVE PROCEDURES

- ROLL FORWARD

Roll-forward schedule Amount Explanation

Balance 30 Nov 2012 xxxxx Confirmed with debtors

+ Sales xxxxx

- Receipts (xxxxx) Roll-forward testing (sample selections)

+/- Adjustments xxxxx

Closing balance 31 Dec 2012

xxxxx Not confirmed with debtors, but indirectly audited

For various reasons (e.g. time constraints at year end), auditor decides/ is compelled to confirm balances before year end.

Problem then: sufficient appropriate audit evidence not obtained for year end balance. Solution: perform “roll-forward” process as per table below.

Primarily to address the existence and valuation assertions.

SUBSTANTIVE PROCEDURES

- ROLL FORWARD

Audit procedures for roll-forward

Prepare or obtain a client prepared roll forward schedule (see preceding slide) Reperform the mathematical accuracy of the schedule Agree, by inspection, the opening balance to the debtors listing for 30 Nov 2012Agree, by inspection, the closing balance per the roll forward schedule to the

debtors control account in the general ledger and grand total in the sub-ledger.

Ensure the correct transaction totals have been brought across to schedule by inspection of the books of prime entry (e.g. sales journal/ cash book).

Note and obtain explanations for any unusual journal adjustments reflected in the roll forward schedule.

Inspect supporting documentation for all material transactions.

SUBSTANTIVE PROCEDURES

- ROLL FORWARD

Audit procedures for roll-forward (continued…)

Ensure system of internal controls remained effective for the month of December by performing relevant tests of control.

Inspect the debtors control account for post year-end adjustments and inspect supporting documentation for any material/large/unusual adjustments that may relate to the current financial period transactions.

Perform year end cut-off tests or cross reference to work papers i.r.o sales and receipts cut-off tests.

Perform the following analytical procedures: o Compare the balance at 31 Dec 2012 to the balance at 31 Dec 2011. o Compare December sales and receipts with prior months. o Obtain explanations for any unusual differences.

Thank you! Dankie! Enkosi Kakhulu!!

END