Chapter 9 – Accounting for Receivables Objectives: Identify types of receivables Identify types of...

-

Upload

irma-andrews -

Category

Documents

-

view

313 -

download

5

Transcript of Chapter 9 – Accounting for Receivables Objectives: Identify types of receivables Identify types of...

Chapter 9 – Accounting for Chapter 9 – Accounting for ReceivablesReceivables

Objectives:Objectives: Identify types of receivablesIdentify types of receivables Valuing receivablesValuing receivables

A.A. Direct Write-off MethodDirect Write-off MethodB.B. Allowance MethodAllowance Method

There are 2 “bases” to estimate the allowance for doubtful There are 2 “bases” to estimate the allowance for doubtful (uncollectible) accounts include:(uncollectible) accounts include:

1.1. Percentage of SalesPercentage of Sales2.2. Percentage of ReceivablesPercentage of Receivables

Notes Receivable:Notes Receivable:A.A. Maturity DatesMaturity DatesB.B. Computing interestComputing interest

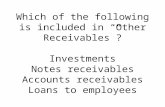

Types of ReceivablesTypes of Receivables ““Receivables” refers to amounts due from individuals or Receivables” refers to amounts due from individuals or

companies.companies. 3 Main Classifications /Types of Receivables:3 Main Classifications /Types of Receivables:

1.1. Accounts ReceivableAccounts Receivable2.2. Notes ReceivableNotes Receivable3.3. Miscellaneous or “Other” receivablesMiscellaneous or “Other” receivables

A/RA/R – amounts owed by customers on account – amounts owed by customers on accountN/RN/R – claims for which formal instruments (i.e. written – claims for which formal instruments (i.e. written

promissory agreement) of credit are issued as proof of debt.promissory agreement) of credit are issued as proof of debt.OtherOther – interest receivable (interest earned but uncollected), – interest receivable (interest earned but uncollected),

advances or loans to employees, tax refund receivable.advances or loans to employees, tax refund receivable.

Valuing Accounts Valuing Accounts ReceivableReceivable

When a company sells to customers “on account” there is an When a company sells to customers “on account” there is an exchange made between parties – a product or service is exchange made between parties – a product or service is provided provided IN EXCHANGE FORIN EXCHANGE FOR a promise to pay a specified a promise to pay a specified amount in the future. (A/R)amount in the future. (A/R)

When a company makes a loan (either to a company or When a company makes a loan (either to a company or individual) there is an exchange – cash provided FOR a individual) there is an exchange – cash provided FOR a promise to pay back the amount borrowed plus interest. (N/R)promise to pay back the amount borrowed plus interest. (N/R)

Discussion Point: Discussion Point: Imagine you have a $10,000 accounts Imagine you have a $10,000 accounts receivable balance, how much of this would you expect to receivable balance, how much of this would you expect to collect?? collect??

A/R must be reported at its A/R must be reported at its net realizable valuenet realizable value ~ the amount ~ the amount reasonably expected to be collectedreasonably expected to be collected

Valuing Accounts Valuing Accounts ReceivableReceivable

The amount of receivables determined to be uncollectible are The amount of receivables determined to be uncollectible are called “bad debt”.called “bad debt”.

Bad Debt is a cost or expense to the company.Bad Debt is a cost or expense to the company.

2 “Methods” Used to Determine Bad Debt Expense:2 “Methods” Used to Determine Bad Debt Expense:

1.1. Direct Write off Method – Direct Write off Method – actualactual amount of bad debt amount of bad debt

2.2. Allowance Method – Allowance Method – estimatedestimated amount of bad debt amount of bad debt

Direct Write off MethodDirect Write off Method This method is This method is NOT GAAPNOT GAAP when receivables are considered to be a when receivables are considered to be a

material (significant) amount, and therefore is not commonly used material (significant) amount, and therefore is not commonly used by companies that sell on account.by companies that sell on account.

The Direct write off method shows only ACTUAL losses from The Direct write off method shows only ACTUAL losses from uncollectible receivables.uncollectible receivables.

For example:For example: Johnny B Good called Best Buy and informed them Johnny B Good called Best Buy and informed them that due to financial constraints and bankruptcy, he will be unable that due to financial constraints and bankruptcy, he will be unable to pay the $500 balance owed on account. Therefore, Best Buy to pay the $500 balance owed on account. Therefore, Best Buy would need to make the following journal entry:would need to make the following journal entry:

Dr.Dr. Bad Debt ExpenseBad Debt Expense $500$500Cr.Cr. A/R – Johnny B GoodA/R – Johnny B Good $500$500

Notice bad debt expense is recorded (debited) ONLY when a Notice bad debt expense is recorded (debited) ONLY when a specific customer’s account is determined to be uncollectible.specific customer’s account is determined to be uncollectible.

QUESTION: Is this method is a good application of the matching QUESTION: Is this method is a good application of the matching principle?principle?

Allowance MethodAllowance Method Involves Involves estimatingestimating bad debt (uncollectible receivables) bad debt (uncollectible receivables)

and recording bad debt expense at the end of each period.and recording bad debt expense at the end of each period. Better use of Better use of matching principlematching principle (than direct write off)– (than direct write off)–

recognizing bad debt expense in the same period that the recognizing bad debt expense in the same period that the corresponding revenues were recognized.corresponding revenues were recognized.

New account:New account: Allowance for uncollectible accounts Allowance for uncollectible accounts (contra-asset). (contra-asset). *Note:*Note: Sometimes the allowance for uncollectible accounts is Sometimes the allowance for uncollectible accounts is called allowance for doubtful accounts.called allowance for doubtful accounts.

Receivables are reported (on the Balance Receivables are reported (on the Balance Sheet/Statement) at Sheet/Statement) at “net realizable value”“net realizable value” = A/R balance = A/R balance LESSLESS the balance in the allowance account. the balance in the allowance account.

QUESTION: So, how would you determine the amount that you QUESTION: So, how would you determine the amount that you estimate will become uncollectible?estimate will become uncollectible?

Allowance MethodAllowance Method2 “Bases” To Calculate (estimate) The Amount Expected to 2 “Bases” To Calculate (estimate) The Amount Expected to

become Uncollectible:become Uncollectible:

1.1. Percentage of SalesPercentage of Sales – income statement approach, – income statement approach, management estimates (using past experience) how much of its management estimates (using past experience) how much of its total credit sales (as a %) for the period are expected to become total credit sales (as a %) for the period are expected to become uncollectible.uncollectible.

2.2. Percentage of receivablesPercentage of receivables –balance sheet approach, –balance sheet approach, management estimates (based on the age) how much of its management estimates (based on the age) how much of its accounts receivable are expected to become uncollectible.accounts receivable are expected to become uncollectible.

*Note:*Note: The journal entry for the estimated amount is the same, but The journal entry for the estimated amount is the same, but the different bases result in different amounts depending on which the different bases result in different amounts depending on which base management chooses to use to estimate the uncollectible base management chooses to use to estimate the uncollectible amount.amount.

Dr.Dr. Bad Debt ExpenseBad Debt ExpenseCr.Cr. Allowance for Uncollectible Accounts Allowance for Uncollectible Accounts

Example - Allowance Method (% of Sales)Example - Allowance Method (% of Sales) Percentage of Sales:Percentage of Sales:Example:Example: Nordstrom estimates that 3% of net credit sales end up to be Nordstrom estimates that 3% of net credit sales end up to be

uncollectible. For July, Nordstrom had $300,000 of net credit sales. The uncollectible. For July, Nordstrom had $300,000 of net credit sales. The journal entry required is:journal entry required is:

Dr. ________________________ Dr. ________________________ $____________$____________Cr. ______________________Cr. ______________________ $____________$____________(____% X $___________) (____% X $___________)

KEY: Using the % of Sales base there is KEY: Using the % of Sales base there is NONO consideration given to the consideration given to the current balance of the allowance account.current balance of the allowance account.

What happens when Joe Jackson, a customer that owes Nordstrom calls and What happens when Joe Jackson, a customer that owes Nordstrom calls and says that he is filing for bankruptcy and actually cannot pay the $500 says that he is filing for bankruptcy and actually cannot pay the $500 balance due.balance due.

The necessary adjusting entry is:The necessary adjusting entry is:Dr.Dr. ________________________________ $___________$___________Cr.Cr. __________________________________________ $____________$____________

Allowance Method - % of Allowance Method - % of A/RA/R

Percentage of ReceivablesPercentage of Receivables – This approach requires the – This approach requires the preparation of a receivables “Aging” schedule. preparation of a receivables “Aging” schedule.

How to Prepare an Aging Schedule:How to Prepare an Aging Schedule: Customer A/R balances are classified or categorized based upon Customer A/R balances are classified or categorized based upon

the length of time they have been outstanding (unpaid) The usual the length of time they have been outstanding (unpaid) The usual categories are; 0-30 days; 31-60 days, 61-90 days etc.) categories are; 0-30 days; 31-60 days, 61-90 days etc.) ________________________________________________________________________________________________________________________________

Once an aging schedule has been prepared, management Once an aging schedule has been prepared, management estimatesestimates the amount of bad debt by multiplying the sum for each the amount of bad debt by multiplying the sum for each category by a percentage of that amount that is expected to be category by a percentage of that amount that is expected to be uncollectible. uncollectible. ________________________________________________________________________________________________________________________________

The The resulting amountresulting amount of each category are added together and of each category are added together and comparedcompared to the current balance in the allowance for uncollectible to the current balance in the allowance for uncollectible accounts. The accounts. The differencedifference is the amount that is recorded in the is the amount that is recorded in the adjusting entry.adjusting entry.________________________________________________________________________________________________________________________________

The percentage of receivable approach requires recognition of the The percentage of receivable approach requires recognition of the current balance in the allowance for doubtful (uncollectible) current balance in the allowance for doubtful (uncollectible) accounts to determine the appropriate amount for the journal accounts to determine the appropriate amount for the journal entry.entry.

Notes ReceivableNotes Receivable A note receivable (N/R) is usually referred to as a written A note receivable (N/R) is usually referred to as a written

promissory note (or agreement) that has a specific payment promissory note (or agreement) that has a specific payment date and involves interest. date and involves interest.

Q: How would you define what interest is?Q: How would you define what interest is?Q: Interest rates are reported for what typical period of time?Q: Interest rates are reported for what typical period of time? Maturity Date = the date the note and related interest must Maturity Date = the date the note and related interest must

be paid to the lender.be paid to the lender. Maturity Date can be expressed in days, months, or years.Maturity Date can be expressed in days, months, or years.

Notes Receivable are recorded when:Notes Receivable are recorded when:A.A. Individuals/companies lend or borrow money.Individuals/companies lend or borrow money.B.B. To settle overdue accounts receivable.To settle overdue accounts receivable.

Notes Receivable

Journal entries for recording notes receivable are required when:

A. The note is issued (dr. note receivable and cr. Cash)

B. Accrual of interest (dr. interest receivable and cr. Interest revenue).

C. Honor (payment) of note at maturity (includes cash proceeds to include the amount loaned and the interest)

Notes Receivable - Issuance

When a note is established (issued) in order to settle a current (open) balance in accounts receivable, the following journal entry must be made.Dr. Note Receivable – JeffersonCr. A/R – Jefferson

When a note is recognized (issued) due to a loan being established, the following journal entry must be made:Dr. Note Receivable - JeffersonCr. Cash

Notes Receivable

Remember: The maturity date of a note (the date the amount is expected to be paid) can be expressed in terms of days OR months OR years.

Calculating Interest: Face Value of Note X Annual Interest Rate X Time =

Interest. Time depends on how the note was expressed. If the

note is a 10 day note, the time would be 10/360 (360 is used for accounting rather than 365). If the note is a 6 month note, the time would be 6/12. Remember, interest rates (unless stated otherwise) are expressed in annual amounts.

Q: What are “accruals”?? Q: What do accruals have to do with notes

receivable??

Notes Receivable - ExampleNotes Receivable - Example

On March 1On March 1stst, Timmy Toys issued a 4 , Timmy Toys issued a 4 month, 5% note to Joey Jungle Gym month, 5% note to Joey Jungle Gym for $10,000. Make the journal entry for $10,000. Make the journal entry for Timmy Toys to record the for Timmy Toys to record the issuance of the note, as well as, all issuance of the note, as well as, all related journal entries for the note:related journal entries for the note:

Notes Receivable - ExampleNotes Receivable - Example 3/1 - Issuance:3/1 - Issuance:

Dr.Dr. Note ReceivableNote Receivable $10,000$10,000Cr.Cr. CashCash $10,000$10,000

3/30 , 4/30, 5/31, 6/30 – Accrue Interest (recorded every month):3/30 , 4/30, 5/31, 6/30 – Accrue Interest (recorded every month):Dr.Dr. Interest ReceivableInterest Receivable $42$42Cr.Cr. Interest RevenueInterest Revenue $42$42

(10,000 X 5% X 1/12)(10,000 X 5% X 1/12)

7/1 – Honor of note receivable (paid in full):7/1 – Honor of note receivable (paid in full):Dr.Dr. CashCash $10,168$10,168Cr.Cr. Note ReceivableNote Receivable $10,000$10,000Cr.Cr. Interest ReceivableInterest Receivable $ 168$ 168