Real Estate Technology Market Update - GCA Advisors · real estate industry and expands into more...

Transcript of Real Estate Technology Market Update - GCA Advisors · real estate industry and expands into more...

PRELIMINARY CONFIDENTIAL DRAFT

Real Estate Technology Market Update

October Review11/4/2019

22

$2,612

$4,833

$5,677

$250

$605

$1,513

$1,138

$1,694

$2,862

$5,438

$7,190

2015 2016 2017 2018 2019 YTD

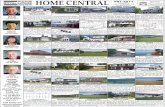

FUNDRAISING AND M&A DASHBOARD

Source: Pitchbook and press releasesRepresents U.S. data across CRE / Investment, Residential Real Estate and Mortgage Technology

(1) Excludes Airbnb, Credit Karma, Houzz, Nextdoor, OYO Hotels and The We Company financing rounds

($MM)Number of Deals Equity Raise

U.S. Financing Activity(1) Select October 2019 M&A Transactions

258

227 223

Debt Raise

285

299

Select October 2019 Financing Transactions

October 28

Acquired

October 29

$30MM +

$300MM debt

Series B

October 29

$319MM

Series C

October 28

$60MM

Series C

October 24

$52MM

Series C

October 23

$50MM

Series B

October 15

$13MM

Growth

October 28

£375MM

AcquiredU.S. PropTech financing YTD exceeds all total

funding for CY 2018

October 1

Acquired

October 1

Acquired

$450MM

October 16

Acquired

October 2

Acquired

October 10

$25MM

Series B

International Deal

October 24

$1.5Bn

Series F

33

For Buyers• Pre-approves and upgrades customers’ offers to cash within 24 hours

• Makes customers more competitive in the market, makes their purchase

more affordable and provides them with certainty of moving into their

new home on time by removing every contingency except inspection

Source: Pitchbook, Company website, press releases(1) Including $505MM of known debt(2) Equity / debt split estimate per Pitchbook

− On October 29, Ribbon announced that it had raised $30MM in equity led by Greylock as well as secured $300MM in a debt facility from Goldman Sachs

− The $300MM debt facility includes an option to be increased by an additional $220MM

− This brings the company’s total funding to ~$559MM(1) to date (including debt)

− Ribbon plans to use its new funding to facilitate the company’s expansion into new markets and accelerate product development efforts

Series B

Transaction Overview Ribbon Overview

$330MM Raised

Headquarters: New York, NY

Founded: 2017

Employees: ~60

Description: A financial technology company that works with lenders and localrealtors to help homeowners buy a new home before they selltheir existing home by upgrading customers’ offers to cash andremoving financing contingencies

Current Investors:

Ribbon Fundraising Timeline

CASE STUDY: RIBBON RAISES $330MM IN SERIES B ROUND (EQUITY + DEBT)

Product Overview

Select Transaction Commentary

Since leading the seed round,

the Ribbon team hasn't slowed

down when it comes to

innovating, and Greylock is

thrilled to continue our support

as the company builds new,

transformative technology for the

real estate industry and expands

into more markets.

Josh McFarland, Partner, Greylock

Ribbon is proving that superior

technology and data plus capital

is what it will take to truly

transform the real estate

industry. As Ribbon continues to

expand across the U.S., buyers

and sellers are the real winners.

Pete Flint, Managing Partner, NFX

“

“

“

“

For Agents• Step in to reserve customers’ homes if realtors need time to get their

mortgage documentation and approvals in place

• Both buying and listing agents earn full commission and get access to

tools like free valuations and a personal account manager

For Lenders• Enables lenders to fund more offers

• Increases pull-through rate

• Tracks all buyers in one place

Buyer finds a home

Ribbon upgrades offer

to cash

Close in as little as 14 days

Buyers sort out financing over

180 days

($MM) Seed Series A Series B

Date 10/18/17 10/25/18 10/29/19

Equity Raised $4.0 $20.0 $30.0

Debt Raised $0.0 $205.0 $300.0

Total Raised to Date $4.0 $229.0 $559.0

(2)

44

[Vacasa] has the potential to

become a global brand that

stands for superior financial

returns for homeowners and exceptional experiences for guests.

Source: Pitchbook, Company website, press releases

− On October 29, Vacasa announced that it had raised a total of $319MM in its Series C round led by Silver Lake with participation from Riverwood Capital, Level Equity and NewSpring

− This brings the company’s total funding to ~$530MM to date and brings its valuation to over $1Bn

− Vacasa plans to further enhance its industry-leading technology platform, accelerate expansion into new markets and grow new offerings

Series C

Transaction Overview Vacasa Overview

$319MM Raised

Headquarters: Portland, OR

Founded: 2009

CEO & Founder: Eric Breon

Employees: ~3,300

Description: Publishes clients’ property listings on top hotel & rental platformsand hires local housekeepers and property managers. The end-to-end vacation rental service aims to provide optimal financialreturns for owners and streamline the booking process for guests

Current Investors:

Vacasa Fundraising Timeline

”

“

Select Deal Commentary

CASE STUDY: VACASA RAISES $319MM IN SERIES C ROUND

Joerg Adams,

Managing Director, Silver Lake

Vacasa Highlights

Vacasa’s revenue has grown

almost seven-fold since our

Series A investment nearly four years ago, and we

expect growth to accelerate in 2020.”

“

Ben Levin, Founder, Level Equity

17+Countries

3,300+Employees

23,000+Vacasa

Homes

2MM+Guests per

Year

Booking Partners

($MM) Series A Series B-I Series B-II Series C

Date 11/14/16 10/17/17 10/18/18 10/29/19

Amount Raised $45.0 $103.5 $64.0 $319.0

Raised to Date $45.0 $148.5 $212.5 $531.5

55Source: Pitchbook, Company website, press releases

Product Summary

CASE STUDY: VACASA RAISES $319MM IN SERIES C ROUND

Rental Income Estimator Rental Listings Marketing Support Property Management

• Provides rental income estimator

tools, leveraging its industry-leading

database of rental histories of its

23,000 homes under management to

automate pricing

• Informed by factors such as weather,

local events and historic trends, rates

update multiple times per day

• Builds customers’ listings with a 3D

virtual tour and high-quality HD

photography

• Listings will be prominently featured

on Airbnb, Vrbo, HomeAway,

Booking.com, etc.

• Provides marketing support through

interior design consultations and

professional photography shoots

• Digital marketing specialists ensure

Vacasa homes are highly visible with

targeted multi-channel campaigns

across search engines, display

advertising, social media and email

• Vacasa homes are cared for by local

staff, including housekeepers and a

local property manager

• Provides 24/7 support from Vacasa’s

reservations and customer service

teams

• Implements guest screening and

liability protection

Real Estate

Agent Network

Industry

Insights

Buy a Vacation

Home

Sell a Vacation

Home

Ancillary

Functions:

Number of Properties Recent Acquisition & Ownership Timeline

Jul 2019

$162 million deal expands Vacasa’s portfolio to more than 23,000 vacation homes around the globe

Jun 2019

Take over the management of its 85 properties in Seattle, Stevens Pass, and Leavenworth, Washington

Apr 2019

Added 450 units in destinations along the Florida Gulf Coast

Mar 2019

Added 12 properties in New Orleans and partners with all the major booking channels (Airbnb, Booking.com, etc.)

0

5,000

10,000

15,000

20,000

25,000

Au

g-1

4

De

c-1

4

Oct

-15

Ap

r-1

6

Jul-

16

Oct

-16

Nov

-16

Feb

-17

Jul-

17

Sep

-17

Nov

-17

Ma

r-1

8

Jul-

18

Oct

-18

De

c-1

8

Ap

r-1

9

Jul-

19

Oct

-19

Portfolio increase from the Wyndham Vacation Rentals acquisition

66Source: Pitchbook, Company website, press releases(1) Premium to the price as of 1/31/19, one day prior to the publication of a Dealreporter article reporting Ellie Mae’s exploration of strategic alternatives

− On October 28, Ellie Mae announced that it had signed a definitive agreement to acquire Capsilon, the leading provider of AI-powered mortgage automation software for mortgage lenders, investors and servicers, from Francisco Partners

− Deal terms were not disclosed

− With the acquisition of Capsilon, Ellie Mae is accelerating the vision of offering an end-to-end SaaS solution for companies in the mortgage industry

Transaction Overview Ellie Mae Recent Acquisition & Ownership Timeline

CASE STUDY: ELLIE MAE ANNOUNCED ACQUISITION OF CAPSILON

Capsilon Highlights

Announced the acquisition of

Nov 2015

Mortgage Returns provided an automated marketing solution to help mortgage originators maximize profitability from clients, prospects and referral partners

Oct 2014

Ellie Mae acquired AllRegs to expand its customer base and add a broad array of content and services that complement their portfolio of product offerings

Oct 2017

Ellie Mae acquired Velocify to combine Velocify’s lead management, engagement and distribution capabilities with Ellie Mae’s Encompass CRM and Consumer Connect

Jan 2014

MortgageCEO provided customer relationship management, and marketing automation solutions for the mortgage industry. The acquisition was consistent with Ellie Mae’s mission to automate every aspect of the mortgage process

Aug 2011

Ellie Mae acquired Del Mar Datatrac in order to boost the company’s loan volume in 2011 to 1.5 million from 1 million with an expanded customer base

Jan 2011

Mortgage Pricing Systems developed loan pricing technology for small, medium and large mortgage banks and lenders

Dec 2009

Ellie Mae acquired Mavent to help the software developer address predatory lending protection and changes to the myriad mortgage regulations on both the state and federal level

Oct 2008

Online Documents provided compliant electronic mortgage documents and related services to the mortgage industry

15% of all U.S. mortgages are processed through

Capsilon technology

$400 billion in new loans touched Capsilon

technology in 2018

160+ customers – 3 of top 10 mortgage lenders

15+ years working with top mortgage companies

450 employees with 200+ engineers in 5 global offices

A portfolio company of

A portfolio company of

Feb 2019

Ellie Mae was acquired by Thoma Bravo for $3.7Bn in cash at $99.00 per share, a 31% premium to its unaffected price(1)

77Source: Pitchbook, Company website, press releases

CASE STUDY: ELLIE MAE ANNOUNCED ACQUISITION OF CAPSILON

Ellie Mae is the leading cloud-

based platform provider for the

mortgage finance industry. Ellie

Mae’s technology solutions

enable lenders to originate more

loans, lower origination costs, and

reduce the time to close with the

highest levels of compliance,

quality and efficiency

Strategic Rationale

Select Transaction Commentary

Capsilon is a provider of cloud-

based document management

technologies for the mortgage

industry. The company’s offerings

support the full lifecycle of a

mortgage by helping lenders and

other mortgage companies with

document recognition, data

extraction, collaborations, loan

delivery and retention

Capsilon’s best-of-breed platform, Capsilon IQ, is used by

companies across the mortgage industry to automate

manual work and power their businesses with trusted data

Capsilon’s integration with the Encompass Digital Lending

Platform will help lenders leverage automation from

consumer engagement through investor delivery and

servicing

Ellie Mae can leverage Capsilon’s AI expertise for future

offerings to further automate document review, data

extraction and analysis, creating yet new efficiencies for

the mortgage industry

With the delivery of our next generation lending platform, we are

accelerating our mission to automate everything automatable for

the residential mortgage market. This includes making strategic

acquisitions of best-in-class solutions to bring more value to the

platform and the ecosystem faster. This is a significant day for the

mortgage industry, as with the acquisition of Capsilon we are

bringing together two market-leading companies and adding to our

platform the pioneer of AI-powered intelligent automation

leveraged by some of the largest lenders and servicers in the

industry.

Jonathan Corr, President and CEO, Ellie Mae

“

“Select Capsilon Clients

Feb 2013

Provides mortgage loan document management software as a service (SaaS) that enables financial institutions to automatically sort, process and share documents

Capsilon Acquisition & Ownership Timeline

Customer

Consolidation &

Upsell

Opportunity

Tech Integration

AI Platform for

Future

Innovations

June 2016

Capsilon received a growth investment from Francisco Partners to support product innovation and keep pace with growing demand from mortgage lenders, investors, and servicers

88

We are incredibly excited about Total Expert’s approach to

building trust and maximizing the long-term value of relationships

between consumers and lenders. The future of consumer finance is

engaging across all product and customer needs during their

financial life, and Total Expert is the category leader powering this

humanized automation and compliance at scale.

Source: Pitchbook, Company website, press releases

− On October 24, Total Expert announced that it had raised a total of $52MM in its Series C round

− This brings the company’s total funding to $86MM to date

− Total Expert plans to use the proceeds to expand on its current team of 218 employees, hiring additional data scientists, designers and industry experts, in addition to accelerating the development of its APIs, machine learning and AI capabilities

Series C

Transaction Overview Total Expert Overview

$52MM Raised

Headquarters: St. Louis Park, MN

Founded: 2012

CEO & Founder: Joe Welu

Description: Developer of an enterprise-grade marketing operating systemdesigned for regulated financial services organizations. Theplatform enables customer facing teams, marketing andcompliance to work together to deliver marketing campaigns

Current Investors:

Total Expert Fundraising Timeline

”

“

Select Deal Commentary

CASE STUDY: TOTAL EXPERT RAISES $52MM IN SERIES C ROUND

Simon Chong, Managing Partner &

Cofounder, Georgian Partners

($MM) Seed Angel Series A Series A-ISeries A-II Series B Series C

Date 12/12/14 NA 4/12/16 2/15/17 10/31/17 10/11/18 10/24/19

Amount Raised $0.5 $0.9 $3.0 $3.0 $6.0 $20.8 $52.0

Raised to Date $0.5 $1.4 $4.4 $7.4 $13.4 $34.2 $86.2

Product Summary

Marketing• Conduct unified, automated

marketing campaigns across

channels including email, social

media, SMS and more

• Intelligent automation using CRM

data optimizes targeting strategies

Sales• Leverage historical client valuations

and business data to extract

insights and maximize lead

conversion

• Seamlessly manage client relations

across the organization through a

CRM purpose-built platform for the

financial industry

Open Architecture• API allows for integration into

existing tech stack and seamless

extension

Compliance• Audit-ready

record

keeping

Select Customers

99

0.0mm

0.2mm

0.4mm

0.6mm

0.8mm

1.0mm

1.2mm

1.4mm

1.6mm

1.8mm

2.0mm

$0.00

$100.00

$200.00

$300.00

$400.00

$500.00

$600.00

$700.00

Nov

-16

Jan

-17

Mar

-17

May

-17

Jul-

17

Au

g-1

7

Oct

-17

De

c-1

7

Feb-

18

Ap

r-18

Jun

-18

Au

g-1

8

Oct

-18

De

c-1

8

Feb-

19

Ap

r-19

Jun

-19

Au

g-1

9

Oct

-19

Source: Capital IQ, Company websites and press releases(1) Commercial Observer, October 1, 2019(2) Projected figures per Wall Street research consensus

CoStar Group 3-Year Stock Price Performance & Select Acquisition History

Transaction Overview CoStar Group Financial Detail(2)

CASE STUDY: COSTAR GROUP ACQUIRES STR

− On October 1, CoStar Group announced its plan to acquire STR, one of the country’s largest hotel data aggregators. The transaction closed on October 22

− The all-cash deal for STR was valued at $450 million, ~7.0x EV / 2019E Revenue and ~28.1x EV / 2019E EBITDA

− The acquisition will allow CoStar to expand their office and industrial property database to include hotel data(1)

To be acquired by

March 10, 2017

July 18, 2017

June 20, 2019

October 12, 2018

November 8, 2018

September 12, 2017

October 1, 2019

$838

$965

$1,192

$1,389

$1,654

$256 $280

$418 $499 $535

CY16A CY17A CY18A CY19E CY20E

Revenues Adj. EBITDA

CAGR: 20%

CAGR:

19%

1010

Founded in 1987, CoStar

conducts expansive, ongoing

research to produce and

maintain the largest and most

comprehensive database of

commercial real estate

information.

STR Highlights

Strategic Rationale

Select Transaction Commentary

CASE STUDY: COSTAR GROUP ACQUIRES STR

STR has become the gold

standard in the global

hospitality industry for premium

data analytics, performance

benchmarking and market

insights having grown its data

assets, product offerings and

geographic reach over the past

34 years.

Source: Company websites and press releases

STR will complement CoStar’s existing offerings and empower CoStar

to provide valuable new services to investors and service providers in the

hospitality industry

The combination of the two companies’ offerings will allow CoStar to

create valuable new and improved tools for investors, lenders, and service

providers for use in developing, financing, valuing, and selling hotel

properties

CoStar will focus on a number of attractive growth areas, including creating

powerful hotel data and analytics in CoStar Suite, driving international

penetration, building and selling new products and expanding benchmarking

to other areas

STR brings an unrivaled

reputation within the global

hospitality industry for their

data integrity, reliability and

strict confidentiality, and we

look forward to continuing to

build on these core values in

the next chapter of STR’s

growth.

Andrew Florance,

Founder and CEO,

CoStar Group

We are very excited to

become part of CoStar. CoStar

brings leading technologies,

analytics and sales capabilities

that we believe will enable STR

to accelerate growth and

increase the value and insights

we provide to our hospitality

clients.

Amanda Hite,

President and CEO,

STR

Aggregates data from over 65,000 hotels worldwide

Aggregates data from nearly nine million guest rooms in

over 180 countries

Distributes more than 1.2 million reports each month

370 employees in 15countries

Provides building information on 80,000

hotels

“

“

“

“

1111

THE LEADING ADVISOR TO THE PROPTECH ECOSYSTEM

Key Sub-Sector Coverage Verticals

Residential RE Software

Commercial RE Software

Mortgage / Lending

Title / Insurance

Home Services

Facilities Management

Construction Tech

IWMS

Chris GoughManaging Director

Head of Real Estate TechnologyPhone: (415) [email protected]

Acquired by

We advised the seller

Acquired by

We advised the seller

Acquired by

We advised the seller

Acquired by

We advised the seller

Acquired by

We advised the seller

Acquired by

We advised the seller

Majority Interest Acquired by

We advised the seller

Acquired by

We advised the seller

Acquired by

We advised the seller

Investment from

We advised the seller

MBO backed by

We advised the sellerWe advised the seller

Acquired by

The Leading Advisor in the Property Tech Ecosystem

Acquired by

We advised the seller

A Portfolio Company of

Acquired by

We advised the seller

A Portfolio Company of

Acquired

We advised the buyer

Majority interest acquired by

We advised the seller

Marcus AnthonyVice President

Phone: (415) [email protected]