REAL ESTATE - Bank AustriaReal Estate Country Facts 09/2018 I 3Depending on their strategic position...

Transcript of REAL ESTATE - Bank AustriaReal Estate Country Facts 09/2018 I 3Depending on their strategic position...

REAL

ESTA

TE

Country Facts

09/2018

Austria’s real estate market “Quo Vadis?”

2 I Real Estate Country Facts 09/2018

Real Estate Country Facts

Imprint: Publisher and media owner: UniCredit Bank Austria AG http://www.bankaustria.atEditor: Bank Austria Real Estate & Public Sector, Walter Bödenauer, Tel. +43 (0)50505-55499Layout: www.horvath.co.at

Date: 28 September 2018

A joint publication of Bank Austria Real Estate & Public Sector, Economics & Market Analysis Austria and Immobilien Rating GmbH (IRG)

Imprint and disclosure pursuant to Sections 24 and 25 of the Austrian Media Act can be found under http://www.bankaustria.at/en/ legal-information-imprint.jsp

Legal notice – please read this important information: This publication is neither a marketing communication nor a financial analysis. It contains information on general economic data, real estate market data and related assessments of real estate market developments. Despite careful research and the use of reliable sources, we cannot assume any responsibility for the completeness, correctness, up-to-dateness and accuracy of information contained in this publication.

The publication has not been prepared in compliance with the legal provisions governing the independence of financial analyses, and it is not subject to the ban on trading subsequent to the distribution of financial analyses.

This information should not be interpreted as a recommendation to buy or sell financial instruments, or as a solicitation of an offer to buy or sell financial instruments. This publication serves information purposes only and does not replace specific advice taking into account the investor’s individual personal circumstances (e.g. risk tolerance, knowledge and experience, investment objectives and financial circumstances).

Past performance is not a guide to future performance. Please note that the value of an investment and the return on it may rise and fall, and that every investment involves a degree of risk.

The information in this publication contains assessments of short-term market developments. We have obtained value data and other information from sources which we deem reliable. Our information and assessments may change without notice.

Real Estate Country Facts 09/2018 I 3

Depending on their strategic position and personal outlook, market participants in the real estate arena have decidedly different takes on cyclical highs and the anticipated market correction. Approaches range from a fresh crisis of confidence in the banking sector triggered by interest rate increases in 2019 to different

assessments of how best to hedge derivative positions. Prophets of doom have little to back up their theories given the continued excellent conditions on the Austrian real estate market – and the fact that:

• interest rates are still extremely low• the strong economy promotes investment and consumption• first-half growth was up 2.8% on the same period a year earlier • banks are offering financing in all segments at historically

attractive rates

This healthy combination is fueling the strong trends seen on both the supply and demand sides in the last few quarters. The ECB has yet to name an exact date for its rate increase and will not bring its securities purchase program to an end before 2019. As the scale and timeline going forward have not been specified, debate is being driven by speculation.

Demand for Austrian real estate still riding highIn terms of investor profile, American and Asian investors are increasingly appearing on the Austrian market. Demand favors larger-volume transactions, while European investors – primarily from Germany – tend to buy in all asset classes across a range of price categories. Austrian developers have plenty of projects in the pipeline for the years beyond 2018, which they will gradually implement. Saturation levels vary across the different market segments. While there is virtually no new retail space under construction, the amount of space added to the Viennese office market appreciated considerably in 2018, which is putting the used office market under pressure. Completion of major office projects such as The Icon Vienna, Austria Campus, Square PLUS and QBC – all with high pre-letting rates – will add around 300,000 m² of prime office space to the Viennese market. Driven by unrelentingly high demand from investors, hotel developments are forging ahead at pace, while niche projects such as logistics properties are also reporting strong interest from investors. Privately financed apartments are a key part of the real estate market. A highly differentiated product which also gives small-scale investors access to the real estate market, developments vary according to location, size, fit-out quality and concept.

Stable underlying conditions continue to bolster property cycle

Branding of individual development projects is now widespread. A new trend, which emerged in 2018, involves the construction of high-rise buildings at waterside locations. Marina Tower, Triiiple and Danube Flats are all examples of high-quality multi-story, riverside residential developments. It should be noted that the current boom in high-rise residential developments is more about putting investment capital to work and pressure to rezone plots in the face of rocketing city center land prices, than a desire to create affordable housing. So far, residential developments of this type are almost exclusively restricted to the highest price segment.

Land banking is a pressing problem for developers in all asset classes, with the current cycle already showing inherent signs of slowing down: a significant increase in square meter prices for construction and acquisition, with a lack of acceptably priced plots in all major urban centers in Austria. Undersupply of investment properties in the core and core+ segments, with undiminished high demand

Yield compression is at a cyclical tipping point, prime yields for individual asset classes are being achieved and no longer undercut top shopping center and office yields are just under 4%. Forward deals are being concluded before projects are even realized.

What can we do for you?We see ourselves as a dependable partner that is in tune with its customers’ requirements and prepared to take risks. Speed and the ability to take quick decisions are particularly important as the market increasingly demands it. Our real estate customers have access to the full range of services offered by the UniCredit Group. We would also like to show you the options at your disposal to hedge against interest rate risks for new and existing loans which we think represent particularly good value given the currently low rates.

Real estate cycle – quo vadis? In light of the positive parameters across the board, the outlook for the Austrian real estate market is still good. Competition remains high as interest from international institutional investors in a limited number of attractive properties persists. Private inheritances and gifts (cash only) will amount to around EUR 18 billion in 2018, a figure which is expected to double by 2050 and part of which will go towards property acquisitions. However, property market cycles do not continue for ever. Unprecedented in recent history, even this unique cyclical extension will come to an end at some point. Which brings us back to Hamlet and the rallying cry for the future: “The readiness is all” – being prepared to react to changes quickly

The editorial team

“IF IT NOT BE NOW, YET IT WILL COME. THE READI-NESS IS ALL”Hamlet

4 I Real Estate Country Facts 09/2018

Real Estate Country Facts

Economic environment in Austria: strong growth despite mounting risks

Austrian economy benefiting from global recoveryFor the first time since the onset of the global financial crisis a decade ago, the world economy has returned to broadly synchronous growth. The upturn in the global economy in 2017 was broad-based, with a range of sectors and regions feeling the benefits. Both emerging and industrialized countries experienced strong economic tailwinds. Against this backdrop, the eurozone economy performed well on three fronts. Growth reached its highest level for ten years in 2017, at 2.5 %, outpacing the US economy for the second successive year. Secondly, for the first time since the financial crisis all of the euro area economies reported growth, and thirdly, growth was well balanced in regional terms – in 2017 the difference in growth rates in the various countries was at its lowest since the introduction of the single currency. The Austrian economy also performed surpris-ingly well last year. The economic upturn was significantly more dynamic and sustained, and was seen in all sectors of the econo-my. Growth increased from 2.0 % to 2.6 %.

The economy kept driving forward in the first six months of 2018, but has rather run out of steam following the strong start to the year. Increased political uncertainty and greater global challenges have weighed on exports over the past few months, and, as a result, the mood in the domestic economy is slightly less upbeat. Confidence has waned slightly across all sectors, and both producers and consumers are rather less optimistic than they were at the start of 2018. In spite of the let-up in the pace of growth since the beginning of this year, Austria recorded average year-on-year GDP growth of 3.2 % in the first half.

As in 2017 and the opening half of 2018, domestic demand is the main driver of growth. Rising employment and faster wage increases have kept private consumption ticking over nicely. Investment has also picked up sharply, with domestic capacity utilization well above the long-term average, while order books remain healthy. With expansive monetary policies still in place, financing conditions are also favorable. The need to catch up as a consequence of the cautious investment policies pursued until 2016 seems to have been satisfied, and with the focus switching from replacement investment to expansion, spending has slowed somewhat in recent months. This, in turn, has affected demand for imports. Although the customs measures imposed by the US on domestic exports have only had a limited impact so far, export growth has been weaker than at the beginning of

2018. However, foreign trade continues to make a positive contribution to economic growth.

In view of the favorable economic situation, conditions on the labor market improved considerably in the first six months of 2018 compared to last year. According to the national calculation method, unemployment dropped by 0.8 percentage points to an average of 8%. This represents a 2.6% rise in employment, meaning 90,000 more people were in work than a year earlier. Labor supply is continuing to rise quickly, as reflected in the decline of over 30,000 in the number of jobseekers during the same period. However, season-ally adjusted figures show that the distinct trend towards improve-ments on the Austrian job market in 2017 has stuttered since the start of 2018. Seasonally-adjusted employment growth has slowed, with only a moderate fall in the number of people looking for work, as the supply of labor has grown more rapidly. The seasonally-adjusted unemployment rate in mid-2018 stood at 7.8%.

At an average of 1.9% in the first half of 2018, annual inflation in Austria was slightly lower than a year earlier. This was due to the relatively small impact of crude oil on prices and the US dollar’s weakness against the euro. However, the tide has turned: inflation began to rise in May, reaching the 2% mark for the first time this year in June. In light of uncertainty resulting from America’s decision to pull out of the nuclear deal with Iran, oil prices are about 20% higher than at the start of this year. This has been compound-ed by exchange rate movements: the euro has fallen by around 5% against the US dollar in the past few weeks.

–0.5

3.0

0.0

2.0

1.5

1.0

0.5

2.5

Source: Thomson Reuters Datastream, Statistik Austria, UniCredit Research

Inflation and interest rates

Euribor 3M10y Government bond yieldCPI

forecast

2015 2016 2017 2018 2019

Real Estate Country Facts 09/2018 I 5

With inflation trending upwards, the European Central Bank has taken initial steps towards normalizing eurozone monetary policy. The bank’s asset purchase program has been limited to EUR 30 billion per month since the start of this year, and it has been announced that after a reduction in monthly net purchases to EUR 15 billion from October, the program will wind down at the end of this year. The ECB will no longer add to its holdings from the start of 2019, but will replace maturing bonds in full with new paper, with a focus on long-term maturities. In this way, the ECB will not only rein in long-term interest rates, but also extend the expan-sive effect of the program. Moreover, the bank’s announcement that it will keep base rates at their current level “at least through-out summer 2019” has put markets’ expectations of interest rate

Protectionism amplifying cyclical economic slowdown Global growth patterns became less synchronous during the first half of 2018. The world economy has slowed and this has had a knock-on effect on the Austrian economy. The country has passed the high point of the economic cycle, although growth prospects over the coming months are still positive. Sentiment remains robust in all sectors after reaching record highs at the beginning of this year. In addition, the impetus from interna-tional factors is slowing, and leading indicators currently point to more stable growth in global trade. Austrian economic growth is set to level off at a solid 2% in the second half. This means that full-year GDP growth could still reach 2.8%. Domestic demand will be the primary growth engine. Although invest-ment will make less of a contribution over the next few months, private consumption will continue to be a driving force, with support from the improved employment situation. Regarding the latter, the jobless rate is expected to fall to an average of 7.7% (national method) or 4.8% under the Eurostat method. That said, forecasts are now more downbeat owing to the rise of protectionism in international trade relations and increased uncertainty caused by political tensions.

Initial steps towards normalization, but European monetary policy remains expansive Higher oil prices and a weaker euro compared to the spring are pushing up inflation, which will stay above the 2% mark through-out the second half of 2018, as increased employment and higher demand prompted by sharper wage increases combine to fuel faster price rises. Austrian inflation is seen averaging a modest 2.1% in 2018, which is at last years level.

0.0%

3.0%

1.0%

2.0%

Source: Eurostat, Statistik Austria, UniCredit Research

Economic growth (real change of GDP in %)

2015 2016 2017 2018 2019

forecastEurozone ViennaAustria

Overview of Austria’s economic dataForecast

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019Economic growth (real. year on year) 1.8 2.9 0.7 0.0 0.7 1.1 2.0 2.6 2.8 2.0

Private consumption (real, year on year) 1.0 1.3 0.5 –0.1 0.3 0.4 1.4 1.4 2.1 1.3

Investment (real, year on year) 1 –2.6 6.6 0.9 1.6 –0.4 2.3 4.3 3.9 3.8 3.0

Exports (visible and invisible) 13.1 5.9 1.4 0.6 2.9 3.5 2.7 4.7 4.8 3.9

Imports (visible and invisible) 12.0 6.0 0.9 0.7 3.0 3.6 3.4 5.1 3.3 3.6

Current account balance (in % of GDP) 3.3 1.6 1.5 1.9 2.5 1.9 2.1 1.9 2.2 2.3

Inflation rate (CPI) (real, year on year) 1.9 3.3 2.4 2.0 1.7 0.9 0.9 2.1 2.1 2.0

Unemployment rate (national criteria) 6.9 6.7 7.0 7.6 8.4 9.1 9.1 8.5 7.7 7.6

Unemployment rate (EU definition) 4.8 4.6 4.9 5.3 5.6 5.7 6.0 5.5 4.8 4.7

Employment (year on year, in %) 2 0.6 1.8 1.3 0.5 0.6 0.9 1.5 1.9 2.3 1.2

Public-sector balance (in % of GDP) –4.4 –2.6 –2.2 –2.0 –2.7 –1.0 –1.6 –0.8 –0.5 0.0

Public-sector debt (in % of GDP) 82.7 82.4 82.0 81.3 84.0 84.8 83.0 78.3 74.7 71.81) Gross fixed capital formation / 2) excluding maternity leave, military service and training programmesSource: Statistik Austria, ÖNB, UniCredit Research

6 I Real Estate Country Facts 09/2018

Real Estate Country Facts

rises on hold. Eurozone base rates are not expected to increase until September 2019 at the earliest. This means that the ECB might only call an end to negative interest rates in the first few months of 2020, after which the window for further normalization of interest rates could begin to close again.

Strong growth in 2019, but clear downside risks GDP growth in Austria is set to remain above the long-term average in 2019, at 2 % – higher than the eurozone average and German economic growth – and will continue to be broad-based. The economic upturn will hold steady, boosted by lively domestic demand, which in turn will prompt strong investment – thanks to high capacity utilization – and robust consumption. Investment in equipment and construction are forecast to grow at significantly reduced rates in 2019, while private consump-

0 15105 20 25 30 35

–1.5

–0.1

0,6

0.7

–6.4

–1.3

–2.5

–4.4

1) Agriculture and forestry, mining, energy and water supply2) Hotels and restaurants3) Business-related services in the broad sense: transport, banking and insurance, real estate4) Public services, education and health, private servicesSource: Statistik Austria, Bank Austria Economics & Market Analysis Austria

Vienna’s share ofAustrian added value (in %)

Trade

Tourism2

Construction

Primary sector1

Manufacturing

Total

Business-related-services3

Other services4

Current Change since 2000 in %-points

Viennese economic dataAverage of

federal provinces(or Austria total)

2012 2013 2014 2015 2016 2017 2018p 2018pGDP per capita (EUR) 47,500 47,400 47,500 48,100 48,700 49,900 51,700 43,880

GDP per capita (as % of Austria) 125.7 124.1 121.8 120.6 119.4 118.8 117.7 100.0

GDP (real, %-chg.) –0.1 –0.5 –0.3 1.2 1.7 2.3 2.6 2.8

Unemployment rate (average, %) 9.5 10.2 11.6 13.5 13.6 13.0 12.3 7.7

Employment (%-chg.) 1.2 0.6 0.6 0.7 1.4 1.9 2.4 2.3

Exports (EUR mn) 18,338 18,641 18,995 18,642 17,847 19,653 19,712 152,000

Exports of goods (as % of Austrian exports) 14.8 14.8 14.8 14.2 13.6 13.8 13.0 100.0

Exports (in % of GDP) 22.4 22.4 22.4 21.3 19.8 20.4 20.0 39.2

Public debt per capita (EUR) 3,039 3,216 3,273 3,551 3,754 3,884 3,922 3,264Source: Statistik Austria, Bank Austria Economics & Market Analysis Austria

tion will barely flag, owing to the favorable employment situation and tax measures such as the new “family bonus”. Along with domestic demand, exports will make a positive contribution to growth next year, albeit to a lower extent as the impact of protectionism is more keenly felt.

With the economic upturn running out of steam, conditions on the Austrian job market will improve only marginally next year. Unem-ployment is only seen falling slightly, to 7.6% using the national method and 4.7% using the Eurostat method, as the growth in employment and the labor supply even out. As a result, structural unemployment will remain well above pre-crisis levels. In 2018, before the financial crisis took hold and the labor market was opened up to jobseekers from the new EU member states, unemployment stood at 5.9% or 4.1%, depending on the calculation method.

This means that demand-driven inflation will probably remain moderate, with sharper price rises only affecting a few service segments. Oil prices are unlikely to have any notable impact on inflation in 2019. All in all, inflation is forecast to decline year on year in 2019, to an average of 2.0%.

Growth also faster in Vienna The Viennese economy slipstreamed its global counterpart in 2017, building up a significant head of steam. Real growth surged from 1.7% in 2016 to 2.3% last year. Services play a vital role in Vienna, and this sector provided the strongest impetus for the capital’s economy. A large number of sectors benefited from the lively private consumption resulting from increased employment, which led to higher disposable incomes. The city also took advantage of global economic tailwinds, particularly its tourism sector. The upturn in global trade and strong domestic demand was a shot in the arm for Viennese industry, which posted an increase in output for the first time since 2011. By contrast, the construction industry made no contribution to growth, as buoyant building construction – especially in the residential segment – was canceled out by the decline in civil engineering.

Real Estate Country Facts 09/2018 I 7

Demand for commercial property reaches all-time high

Record volume of real estate transactionsCommercial real estate investment in Austria reached an all-time high in 2017 according to CBRE, with transactions amounting to almost EUR 5billion. More than half of last year’s investors came from Germany. This trend started to emerge in the first half of 2017 and continued until year end.

Investment activity is equally buoyant this year, reaching EUR 2.3 billion in the first half alone according to CBRE, although suitable properties in Austria are increasingly hard to come by. The trend is expected to remain positive all the way through to the end of the year, although as things currently stand it appears that last year’s record totals will not be matched.

There was a pronounced drop in office property deals in the first half of 2018, which had accounted for well over half of all transac-tions in the previous year and included the sales of the DC Tower and Icon Vienna developments. Instead, the first half of this year was shaped by numerous retail and residential transactions. One stand-out example in the retail segment was the Kika/Leiner deal concluded by Signa Holding. Retail parks are increasingly attracting investors’ attention.

While construction activity in the office segment has been relatively weak in recent years, a large amount of new space is set to come onto the market in 2018. By year end, around – or perhaps more than – 300,000 m² of new lettable space will be added.

This puts even more opportunities for additional transactions at investors’ disposal, but could also increase the pressure on older office properties in less attractive locations.

Prime yields down sharplyPrime real-estate yields have reached new lows. In the office category, they slid to just below 4%, while those for shopping centers stood at around 4%. However, the yield curve for individual asset classes is increasingly leveling off.

0

6

4

3

5

Source: CBRE

Investment in commercial real estate in Austria (in EUR bn.)

2

1

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1. HY2018

Investment by real estate categoryH1 2018

Source: CBRE

Office

Retail

Hotel

Residential

Industrial and logistics

Other

8 I Real Estate Country Facts 09/2018

Real Estate Country Facts

Housing as a social issueShelter is not only a basic human need; it usually represents the single largest financial burden on private households. In Austria, more than 22% of household income goes on housing costs including upkeep and housing-related energy costs – compared with less than 20% in the 1990s – and the figure is rising. And although the level at which housing costs start to have a detrimental impact on quality of life can only be pinpointed on a case-by-case basis, calls for affordable living space mean that there is no significant excess demand on the residential market over the longer term, at least at a wider regional level.

The latest results and short-term forecasts for the construction sector in Austria show that residential construction activity is re-sponding to requirements and that the market is slowly starting to consolidate. Due to the above-average population growth and increase in the number of households in recent years, significant pent-up demand has accumulated, meaning that it will presumably take some time for the balance to be restored on the market. Housing policy in Austria is going to come under more strain than in recent years, particularly if it is to keep pace with the immigration flows expected in future.

Demand exceeds 60,000 new apartmentsDemand for housing is primarily dictated by the number of house-holds, changes in building stock and other aspects of demand that cannot be adequately captured by statistics, such as changing household sizes and shifting consumer preferences – particularly with respect to second homes and apartment purchases for investment purposes. Accordingly, demand forecasts are uncertain. In the past, demand for housing in Austria was covered with 45,000–50,000 units per year (given an average of 33,000 new households per annum over the past 30 years). However, muted construction activity during the first half of the past decade created excess demand, which is likely to continue growing in the years to come, as a result of population growth and a rise in the number of overall households – in spite of the upturn in housing construction activity.

According to the latest household forecasts, demand will increasingly cool over the next few years. After the record average of more than 47,000 new households set up in the 2014–2016 period, the total fell back below the 40,000 mark last year. Over the next five years,

the number of new households is expected to amount to around 30,000. In addition, demolished or rezoned apartments have to be replaced (estimated at 0.4% of housing stock) as well as apartments built as investment properties (around 0.2% of stock) – a total of around 28,000 units (source: IIBW, 2014). As a result, total annual demand for new apartments will not fall much below 60,000 over the next few years.

Demographic forecasts show that demand for housing varies signifi-cantly depending on the region: by 2030, just 12 of the 35 NUTS-3 regions in Austria will experience population growth of more than 5%, while twelve regions will have to contend with a declining number of inhabitants (at present, 61% of the nation’s population live in growth regions; chief among them are the greater Vienna, Linz and Salzburg areas and the cities of Graz, Innsbruck and St. Pölten).

Ultimately, the trend towards smaller household sizes will extend beyond the 2020s; a signal that points to continued growth in demand for small as well as for affordable apartments. This will result in a disproportionate increase in the amount of space required per capita, presenting housing policy with a number of additional challenges (single person households occupy an average of 75 m², while in the average household each person has an average of 45 m² at their disposal).

Construction and housing costs in Austria Imbalances on housing market slowly disappearing

0

50

30

10

20

40

Source: Statistik Austria; UniCredit Research

Strong growth in single-person households in Austria; Changes in single-person and multi-person households in 1,000 units

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Ø 23–32

Ø 33–52

Multi-person households Single-person households

Real Estate Country Facts 09/2018 I 9

200

900

700

300

400

500

600

800

Source: EU-SILC; UniCredit Research*) per month; incl. rent, costs for acquiring living space, upkeep, energy, etc.

Average net household income, in 1,000 purchasing power parity

Housing costs in Austria relatively low as a proportion of household income; 2015

8 12 16 20 24 28 32

NL

CH

DK

DE

NO

LUUKSE Austria

FRBE

FI

Eurorzone

ESSI IT

CZ

PLSK

HU

Hous

ing

cost

*, in

pur

chas

ing

pow

er p

arity

IE

Trend

30

70

50

40

60

Source: GBV, Statistik Austria, UniCredit Research

estimated82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 18

Housing construction in Austria Permits and completions, 1,000 apartments

Permits Apartments completed

Demand for new apartments covered in 2017 and 2018Driven by strong demand on the market, a sharp rise in prices and the availability of cheap financing, successful planning applications and housing construction project completions reached almost record levels over recent years; between 2013 and 2016, a total of around 56,000 apartments came onto the market in Austria each year.

market. At the same time, relatively anemic growth of 3.5% for Vienna in the first quarter of 2018 shows that tensions on the capital’s real estate market are starting to abate (comparative prices are only available for Vienna and the rest of Austria).

Austria’s housing market has remained fairly cheap compared with its international peers, with space more affordable in the country than in other similarly prosperous European nations. While 18% of household income is spent on housing in this country, the figure for the eurozone is more than 21%. This gap has widened a little more in recent years and demonstrates the relative effectiveness of Austrian housing policy.

According to the data currently available, almost 60,000 apartments were built in Austria in 2017, meeting projected demand for new builds (final data were still unavailable at the time of publication). The sharp rise in planning permission granted for 2018 and the 10%-plus surge in new housing construction in the first four months of the year signified a continuation of the recovery. After 2017, cooperative housing associations intend to add a further 17,000 new apartments to the market once again in both 2018 and 2019, which equates to around 2,000 units more per year than over the past decade. This development is expected to relieve some of the pressure on the market for subsidized housing.

Overall, new building activity in Austria is set to add more than 62,000 apartments in 2018, which will go some way to alleviating pent-up demand in the nation’s housing market. That said, it does not mean that all gaps will be closed at regional level, particularly in urban centers.

International comparison of affordable housingAustria’s housing market has become highly unbalanced in recent years due to strong population growth and booming demand for investment properties. As a result, housing prices have increased sharply, by an average of 6% a year nationwide since 2011. The price increases gathered pace once again towards the end of 2017, having lost momentum for a short time during the year, going on to reach more than 7% in the first quarter of 2018. This development shows that the boom in new residential construction activity is yet to have an impact on certain segments of the Austrian housing

A comparison of housing costs and household income based on the number of people in the household shows that people living in all south east European countries pay less than their Austrian counter-parts, but also have lower incomes, particularly in eastern Europe (to adjust for different pricing levels in the different countries, indicators are calculated using purchasing power parity). In western Europe, housing costs represent a slightly lower proportion of income in Italy, France, Finland and Ireland, but are higher in all other larger countries.

Social balance on Austrian housing market deterioratesAn analysis of housing costs for an average household sheds no light on the question of whether the supply of housing on the Austrian market is in fact “socially balanced”. Instead, looking at changes in the incidence of overburdening through living costs – the proportion of households that spend more than 40 % of their disposable income on housing – provides a clearer picture (source: EU-SILC).

In this indicator, too, Austria is still far below the EU average of around 11%, with a figure of 7.1%. However, the gap is narrowing

10 I Real Estate Country Facts 09/2018

Real Estate Country Facts

4

9

7

5

6

8

up to 2 years 2–10 years 10–30 years 30 years and more

+31%

+30%

+29%

+19%

Source: Statistik Austria Mikrozensus; UniCredit Research*) Existing and new tenancies; including operating costs

Rents by contract duration in the past Main lease contracts* in Austria in euros per m²,change 2008–2017

2008 2017

4

10

7

9

5

6

8

Rents by apartment ownershiplease contracts * in Austria, 2008 and 2017 in euros per m²,change 2008–2017

Private landlords of which time-limited contracts

Local authority housing

Housing association property

Source: Statistik Austria Mikrozensus; UniCredit Research*) Existing and new tenancies; including operating costs

+41%

+33%

+25%+23%

2008 2017

all the time. A significant number of households are at risk of poverty (i.e. those with an income of less than 60% of the equivalent net income for the country, or below EUR 14,900 per year for a single-person household; this applies to around 1.25 million people in Austria). By this measure, around 40% of the population are over-burdened, which is in line with the EU average, but the rate is increasing all the time.

Perhaps the clearest indication of the weakness of social housing policy is the above-average proportion of younger demographic groups that are overburdened by their living costs. In 2017, this applied to around 13.3% of those in the 20–29 age bracket, up from 9% in 2011. A comparison of rents by contract duration gives another sign of the disproportionately high cost of entering the Austrian housing market: main lease apartments rented in the past two years cost an average of EUR 9.1/m², compared with just EUR 6.8/m² for rental contracts concluded more than ten years ago.

It should also be noted that only just over half of the contracts concluded in the past two years are genuine new tenancies, which command significantly higher prices.

Over the past few years, house-hunters in Austria have increas-ingly been forced to turn to the private market, which is signifi-cantly more expensive than the market influenced by public authorities (in 2017 around two thirds of all rental contracts with a duration of under two years were concluded with private landlords). A private main-lease apartment cost an average of EUR 8.8 / m² last year, which is at least EUR 2 per square meter more than the cost of renting local authority or housing association properties. Private-sector rents have also increased significantly faster than those for public housing, by 41 % compared with 24 % since 2008. Overall, the indicators reveal that there will primarily have to be a greater focus on social housing construction in Austria.

Real Estate Country Facts 09/2018 I 11

Vienna’s office property market remains one of the most stable in Europe. Last year’s record investment in commercial property of just under EUR 5 billion, and investment this year that is forecast to come in only just shy of the figure for 2017 underlines do-mestic and international investors’ strong interest in Austrian office property, which was by far the most popular asset class last year.

The rapid slowdown in new construction in recent years has helped to preserve the stability of Vienna’s office property market, albeit at the expense of sites outside the traditional prime locations. Against the back-drop of the large volume of high-quality space on the market, offices that no longer satisfy specific requirements reflecting changed forms of use have also come under pressure.

To an extent, space of this kind will disappear completely from the market, and developers will look to re-use or convert it – refurbishment will not always be a financially feasible option for such properties, or they may no longer be attractive for office use on account of their location.

In many cases, due to strong demand for residential space, efforts are being made to convert former offices into apartments, provided they are suitable from a structural point of view and rededication is possible. However, full or partial demolition of certain structures is often necessary, and where there are significant obstacles, total demolition and subsequent construction of a completely new property is preferred over other options. In the past few years, demand has grown for alternative uses, such as converting former offices into hotels, student accommodation or serviced apartments.

Vienna currently has around 11 million m² of office space. This includes older locations and space that no longer fully satisfy modern office standards, as well as small offices, and space in schools and at universities.

Viennese office property market: new construction activity up once again in 2018, with several large-scale projects under way

In terms of office space per capita, Vienna is below the European average, but the figure is still far higher than that for eastern Europe’s capital cities. However, cities such as Prague and Bratislava are slowly but surely closing the gap.

Sharp rise in construction of new spaceIn 2016, construction of new office space in Vienna fell to a record low of 60,000 m². By contrast, in 2017, the amount of new space rose sharply, to about 190,000 m². The supply of new space is set to rise significantly once again this year, and could reach as much as 320,000 m² for both years, including properties for own use, such as company headquarters.

New builds will account for the majority of the total, with only a small proportion resulting from conversions and renovations. The Austria Campus and The Icon Vienna projects alone will add more than 230,000 m² to the city’s stock of office space. A large number of other projects are now under construction or at the planning stage, and in the coming years it will be necessary to

Zuric

h

Geneva

Frankfu

rt

Munich

Copen

hagen

Milan

Hambu

rgPari

sVien

naBerl

in

Bratisla

vaPrag

ue

Warsaw

Budap

est

Buchare

stSo

fia

Moscow

Zagre

b

Belgrad

e0

2

20

4

6

8

18

10

12

14

16

Source: IRG

Office space in m2 per capita 2018

Offic

e sp

ace

in m

2

12 I Real Estate Country Facts 09/2018

Real Estate Country Facts

keep a close eye on how this sizable increase in new space affects the evolution of vacancy rates.

New rentals likely to overtake last year’s totalThe take-up of office space reached around 190,000 m² last year, a decline on 2016. New rentals amounted to around 120,000 m² in the first half of 2018, and in view of the solid performance of both the Austrian and European economies, experts anticipate new letting will surpass 2017 levels by the end of this year.

Rental of new space is generally characterized by a shift away from older offices to more modern ones. Companies often choose to base all their staff at a single location – as is the case at the Austria Campus – taking advantage of synergies and cost savings by consolidating spaces. On the whole, over the past few years there has been a downward trend in the amount of office space per employee, mainly as a result of developments such as shared desk and home office solutions.

Two flagship office projects nearing completion: Austria Campus and The IconWork on the new UniCredit Bank Austria headquarters on the site of the former Nordbahnhof station in Vienna’s second district is heading into the closing stages. All sections of the Austria Campus are scheduled for completion in the second half of this year. The Austrian headquarters of UniCredit Bank Austria, which has been designed with new work concepts and office structures in mind, will occupy more than half of the newly built office space at the site.

Besides QBC 3 and 4, which were completed last year, numerous other projects are taking shape at the Hauptbahnhof site, including office, apartment and hotel developments, and construction of various educational facilities. SIGNA Holding is behind one of the more spec-tacular office projects at the site: The Icon Vienna is an architecturally distinctive development comprising three buildings of different heights behind a curved facade, with a total of around 74,000 m² of modern office space. Last summer, the complex was sold prior to completion to the Allianz Group for more than EUR 500 million.

Further projects planned or under construction at the Hauptbahnhof siteFurther projects are scheduled for completion at the Hauptbahnhof site over the next few years. The QBC 1 and 2 units at Quartier Belvedere are currently under construction, with completion slated for 2020. Plans are also in place for site B.03 to the south of the station on Karl-Popper-Strasse.

An extensive list of projects are planned for Seestadt Aspern, including expansion of the Technology Centre Seestadt, as well as the HoHo, Seehub and Seepark-campus developments.

At Biotope City on the former Coca Cola site in the 23rd district, work is progressing on Wienerberger’s new head office, known as The Brick, and on hotel, office and commercial space. The Soravia Group has invested a total of EUR 100 million at the location and is aiming for completion by 2020. Biotope City has become a more attractive site in view of the planned extension of the underground line U2 to Wienerberg.

New buildings are also going up once again at Vienna International Airport. The development of unit 4 at Vienna Airport Office Park will add about 20,000 m² of office space, as well as co-working areas, conference rooms of various sizes, an event and showroom area, and catering outlets. The project is due to be concluded by 2020.

Projected new office space in 2018 (selected developments)Project Total usable office space (m²) Status

Austria Campus 160,000 completion phaseThe Icon Vienna 74,000 completion phaseInno Center, Inno Plaza extension

17,500 under construction

Lände 3, ViE office project 13,800 under construction Source: IRG

20012002

20032004

20052006

20072008

20092010

20112012

20132018p

20162017

201520140

500,000

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

50,000

Source: IRG, CBRE, EHL

New construction and take-upOffice space in Vienna 2001–2018p

Take-up in m2New construction in m2

Real Estate Country Facts 09/2018 I 13

In addition to developments either under construction or at the planning stage, there are plenty of office projects in the pipeline. However, in many cases the construction schedule and the exact proportion of office space is still to be determined, and where permitted under the zoning regulations, such space could still be converted for other uses.

Top rents on Vienna’s office property market generally stableOffice rents in the Austrian capital remained largely stable in the first half of 2018, although prices in the premium segment have risen in previous years. Top rents for class A office space in at-tractive locations were around EUR 26 / m²/ month in mid-2018.

However, rental costs can be higher for certain spaces in premium properties, such as the top floors of office blocks, and for highly exclusive premises with custom amenities, fixtures and fittings, although such prices are the exception. With a host of new develop-ments under construction, it remains to be seen whether top rents will remain at their current level for the rest of this year or whether increased supply on the office market will put rents under pressure in the long term. A detailed assessment is not possible at present, because such trends depend on short-term, less predictable factors such as economic and political developments.

Demand remains high for space in the city center and other key office locations, while the area around the Hauptbahnhof has also become a sought-after site.

Demand for space in the mid-price segment remains strong – in the current era of desk-sharing solutions and an increased trend towards working from home, optimized use of space still has a significant part to play in demand for offices. Energy efficiency and the lowest possible

operating expenses are among the most important criteria for prospective tenants when choosing a location, and total costs per employee play a more decisive role than the rental cost alone.

Certification according to standards such as DGNB, ÖGNI, LEED and BREEAM is now vital and a matter of course. Global blue chips are unlikely to rent space without corresponding certification, and compliance with building standards is frequently a key factor in renovation and conversion projects. Research has shown that the risk of vacancies at office properties classed as green buildings is measurably lower than at conventional buildings.

Sustainability-related and environmental factors are being incorpo-rated into the new world of work; efforts are being made to more easily combine work commitments and leisure time; and the work-life balance is just as important as ethical and ecological considera-tions, not only for many employees, but also for employers.

There is still pressure on office buildings with low occupancy rates, old space in need of renovation, and premises in unattractive areas outside the most popular office sites, without suitable amenities and links to the public transport network. This negative trend has been apparent for some time, and has resulted in falling rents and rising vacancy rates.

Space in this category that becomes vacant often never comes back onto the market and is converted to other uses, provided this makes financial sense and is permitted under the zoning regulations. Sometimes, the best option is to demolish the existing building and redevelop the plot instead.

Office vacancy rates generally stableVienna still has one of the lowest vacancy rates in Europe, and the relatively low level of new construction in recent years has helped to keep rates down. The office vacancy rate in the Austrian capital held fairly steady in the first half of 2018, standing at about 5.5% at the midway point of the year. However, it is hard to predict how the level of vacancies on the city’s office market will develop.

With up to 320,000 m² of new space forecast to come onto the market by the end of this year, and a number of projects in the pipeline, a rise in vacancies in the long run cannot be ruled out. The main question is whether the removal of old spaces from the market will be balanced out by new construction and new letting.

Unsurprisingly, vacancies at older properties are higher than at sought-after, centrally located offices. Vacancy rates are also above average in some office blocks, with older developments most affected.

Forecast new space, 2019ff (selected developments)Project Total usable office space (m²) Status

Quartier Belvedere, QBC 1 and 2

36,000 under construction

Office Park 4 20,000 under construction Silo Plus 10,700 under construction Biotope City, The Brick 9,500 under construction Technology Centre See-stadt, 2nd unit

6,800 under construction

Seeparkcampus Ost 9,000 planning stage Source: IRG

14 I Real Estate Country Facts 09/2018

Real Estate Country Facts

20062007

20082009

20102011

20122013

2014

H1 20182017

201620150

30

25

20

15

10

5

2.0

3.5

3.0

2.5

4.0

8.0

7.5

7.0

6.5

6.0

5.5

5.0

4.5

Source: IRG

Rents, yields and vacancy rates in the Viennese office market 2006–H1 2018

Prime rents per €/m2/month

Vacancy rate in %Prime yields in %

Sofia

Milan

Moscow

Rome

Warsaw

Amsterda

mMad

rid

Buchare

st

Brussel

s

Stockh

olmLis

bonZa

greb

Centra

l Londo

nPrag

ue

Budap

est

Belgrad

eOslo

Bratisla

vaDub

lin Paris

Copen

hagenVien

naBerl

in0

2

10

12

14

16

4

6

8

Source: IRG

Vaca

ncy

rate

s in

%

Office vacancy rates in Europe in % 2018

Prime yields under pressurePrime yields in the Viennese office sector fell slightly in 2017 and again in the first six months of 2018, reaching about 3.8 % for top-of-the-range properties in prime locations at the end of the first half of this year.

Yields are not expected to move significantly for the rest of this year. Sustained investor demand for top-quality real estate means that a further decline in prime yields in Vienna’s premium office segment is still a possibility, even though any changes are likely to be very small.

Vienna’s office hotspotsCity centerCentral Vienna and the neighboring districts remain the most popular office locations, and demand there is still high. Offices and numerous retail spaces dominate the city center, and over the past few decades the large number of residential properties has fallen gradually.

However, in recent years, as a result of strong demand for large apartments and luxury residential space, former offices in some parts of the city center have been reconverted into apartments. For instance, once Austrian Post moves out of its former head office at Postgasse 8–12, the property will no longer be operated as an office location, but will instead accommodate stylish apartments and a hotel.

Former offices in city center properties dating back to the Gründerzeit era in the mid-to-late 19th century are particularly popular for reconversion into residential space with generously proportioned floor layouts, as these cater to the demands of wealthier clients for expansive luxury living space. However, the boom in luxury properties has slowed, supply is high, and not every property in the premium segment can fully meet the very specific standards of exclusivity that extremely wealthy buyers often expect.

Inside the Gürtel outer ring roadNumerous office properties are located in this section of the city. The popularity of the districts bordering the city center is mainly due to their location and ease of access. However, new builds are rare in these areas. New space comes onto the market from time to time as a result of conversions and refurbishments, such as Telegraf 7 in the sixth district, which features modern offices and co-working areas on the site of a former telegraph office.

Donau CityThe Donau City area (Vienna DC) has grown to become one of the capital’s most important office locations, alongside the city center. A number of imposing office blocks dominate the skyline, including the tallest office tower in Vienna, DC Tower 1, which has further enhanced the standing of the Donauplatte area. A slightly smaller second tower – DC Tower 2 – is at the planning stage, with construction due to begin in 2019. Media reports suggest that the planned DC Tower 3 could be completed before Tower 2; work on Tower 3 could begin this year and construction is scheduled to take about three years. However, it seems that the question of use is still to be definitively resolved, although some stories in the media have mentioned plans for student accommodation.

Real Estate Country Facts 09/2018 I 15

Prater/Messe/HandelskaiIn the past few years, new office hotspots have sprung up in the areas around Handelskai and Messe Wien, and close to the site of the former Nordbahnhof and Nordwestbahnhof stations. The area around Praterstern – where the Austria Campus is currently under development – remains one of Vienna’s largest urban development zones. Last year saw completion of yet another extension to the Viertel Zwei site, the Denk Drei office project. In the near term, the Nordwestbahnhof site, which is still used as a rail freight station, will provide city planners with a host of options for creating a leafy district suited to a variety of uses.

Erdberg/St Marx/GasometerIn recent years, new office developments such as Marxbox, Marximum and the multi-phase TownTown project have shaped the Erdberg, St Marx and Gasometer office location. The Town-Town complex was completed last year with the construction of ORBI Tower.

WienerbergWienerberg in southern Vienna is another firmly established office location. Phase 6 of the extension of Euro Plaza has created additional office space at the site. The Inno Center expansion and The Brick, a mixed-use project, will see the location grow still further.

North Vienna/Heiligenstadt/MuthgasseA number of office developments have taken shape on Muthgasse close to Heiligenstadt station in the 19th district in recent years. These include space2move and the two-unit Square Plus, phase one of which was completed last year.

Western ViennaThe west of Vienna is one of the city’s less developed office locations. A few years ago, a significant amount of office space was built at the Forum Schönbrunn project. At present, no large-scale developments are planned in this area.

Seestadt AspernAspern IQ was the first office property built in the new Seestadt Aspern urban development zone and is currently being extended. Another project, Seeparkcampus West, was finalized last year. Further projects are being implemented, including HoHo (a pre-dominantly timber high-rise), Seeparkcampus Ost and Seehub, and there are numerous projects in the pipeline at this attractive location on the site of the former Aspern airfield.

HauptbahnhofVienna’s newest office location has sprung up around the Haupt-bahnhof station in recent years. The new headquarters of Austrian Federal Railways (ÖBB) and – among others – Erste Bank are located there. Construction work in the area around the Hauptbahnhof is not yet complete. Some developments have been concluded and others are now taking shape, including The Icon Vienna, which is nearing completion, and purely residential developments such as the exclusive Parkapartments am Belvedere.

These will add to the cachet of this urban, city-center location, as well as breathe new life into the district, as in addition to office space the new developments are aimed at creating a diverse mix of apartments, shops, hotels, catering outlets, service providers and health facilities. In next to no time, Hauptbahnhof has become one of Vienna’s most prized office locations, and further modern buildings such as QBC 1 and 2 – both under construction – will soon be added to the ensemble.

Co-working: flexible workspaces as a future megatrend The trend towards co-working has been gaining ground in Austria for some time. From one-person businesses and start-ups to SMEs and company teams, more and more people are giving up their own offices and all the necessary infrastructure in favor of renting space for a certain period from the currently numerous providers of co-working space. They offer users flexible, fully equipped workspaces, while users benefit from the exchange of ideas within a creative and innovative community, and also maintain their independence, as they are not tied to long-term rental agreements.

International providers of co-working spaces have now moved into Austria and supply is on the increase. In view of rising demand, this is a fillip for Vienna and its modern office landscape. But do-mestic developers are not sitting back. Co-working facilities and shared offices are springing up all over the city, including at Office Park 4 at Vienna International Airport, as well as ViE on Erdberger Lände and the Austria Campus. And nobody wants to miss out on a megatrend which will shape the office world of the future.

16 I Real Estate Country Facts 09/2018

Real Estate Country Facts

Shopping centers (SCs) in Austria: growth in space only attributable to modernization and /or expansion of existing SCsAs of June 30, 2018, Austria had more than 2.8 million m² of lettable space at a total of 119 shopping centers. This is equivalent to a density of approximately 318 m² per 1,000 inhabitants. With the EU average coming in at 242 m² per 1,000 head of population, Austria has one of the highest rates in Europe.

At present, shopping centers account for a fifth of consumer spending in Austria. This proportion has remained virtually unchanged over the past few years, as any potential gains in market share have been held in check by a burgeoning online sector.

It also appears that a saturation point has been reached in terms of growth in lettable area. Blank spots on the map, signaling an acute need for new shopping center destinations, have all but disappeared in Austria. As a result, competition has increased on the market, and concentration has also risen. In light of this development, new shopping centers and new construction work are becoming increasingly rare. To protect town center locations against rising vacancy rates, it is becoming more difficult in some instances to obtain permission to build traditional shopping centers, and multifunctional properties are being built as a

result (e.g. Lidl is planning the construction of 3,000 apartments and an elementary school above its stores in order to obtain the necessary planning permissions).

In 2017 and 2018, changes in the amount of available lettable SC space was almost solely attributable to modernization and /or expansion of existing locations. The largest single change of note was the completion (relaunch and expansion) of the Merkur City development in Wiener Neustadt with around 15,000 m² of lettable space.

In the first half of 2018, the LCS shopping center in the center of Leoben was expanded by around 4,000 m², taking its total lettable space to just under 30,000 m². In mid-2018 the Murpark in Graz celebrated the opening of 18 new shops on around 6,000 m².

At present, there are no major shopping center projects under construction. The only definite plans relate to the Shopping Quartier development in Lienz (scheduled to open in 2020).

Shopping centers – new building activity virtually at a standstill

Norway

Luxem

bourg

Sloven

ia

Netherl

ands

Switz

erlan

dAust

ria

CroatiaFra

ncePola

nd

EU-28-av

erage Ita

ly

Slovak

ia

Czech Rep

ublic

German

yTu

rkeyRuss

ia

Hunga

ry

Roman

ia

Bulgari

a0

900

600

500

400

300

200

100

700

800

Source: C&W European SC Development Report May 2018, Michael Bauer Research

0

5,000

10,000

45,000

40,000

15,000

20,000

25,000

30,000

35,000

Leas

able

are

a in

m² p

er 1

,000

inha

bita

nts

Per c

apita

pur

chas

ing

pow

er in

€

Ø EU-28: EUR 16,780,–

Shopping Center Space and Purchasing Power in EuropeLeasable area in m² per 1,000 inhabitants

Austria (excl. Vienna) | Selected SC openings, 2017/2018Shopping center Gross lettable area

(GLA), m²Opened

Merkur City neu Wr. Neustadt (relaunch and expansion)

approx. 15,000 H2 2017

LCS Leoben City Shopping (expansion)

approx. 4,000 H1 2018

Murpark Graz (expansion) approx. 6,000 H2 2018Sources: IRG, Standort+Markt

Austria (excl. Vienna) | Selected SCs under construction and projects Shopping center Gross lettable area

(GLA), m²Scheduled

opening

Kampcenter Zwettl approx. 15,000 ProjectShopping Quartier Lienz approx. 13,000 ProjectSteyr EKZ Kasernengelände approx. 12,000 ProjectEKZ Mattighofen approx. 10,000 ProjectEKZ Bad Ischl (relaunch and renovation)

approx. 8,000 Project

Sources: IRG, Standort+Markt

Real Estate Country Facts 09/2018 I 17

An additional 9,000 m² at the Auhof Center – the last phase of expan-sion according to the operator – is scheduled to open at the end of October. Once the project is completed, the extension will take the total lettable space at the center to around 59,000 m², as well as giving the entire development a more uniform and contemporary appearance.

Going forward, the SC project pipeline for the Viennese market is virtually empty, with only smaller spaces for grocery stores and the like planned as part of new residential and office districts.

Auhof Center to become third-largest mega mall in Vienna and the surrounding areaFor many years, the Shopping City Süd and Donauzentrum develop-ments have been the largest shopping destinations in Vienna and the surrounding area, both with significantly more than 100,000 m² of lettable space.

They are followed by four shopping centers with a lettable area of between 50,000 and 60,000 m², with the Auhof Center set to be-come the third-largest shopping center in the greater Vienna area.

Boundaries between online and offline worlds increasingly disappearing – growth potential in food segment The market for shopping centers has reached saturation point, with only sideways movement in the form of quality upgrades. However,

Vienna’s SC market: pipeline practically emptyThe capital has over 1.8 million m² of retail space. The market shares of the individual segments have changed only slightly due to the minimal movement in the amount of gross lettable space avail-able. Retail parks now account for 42.2% of the total, shopping centers 41.5% and shopping streets 16.3%.

At present, Vienna and the surrounding area have a combined total of around 30 shopping centers with a combined gross lettable area of about 983,000 m². There has been an increase in space of around 26,000 m² since the start of 2017, taking density per 1,000 head of population to around 520 m².

Highlights include the inauguration of the second phase of construction (approx. 20,000 m²) of the new and extended Huma Eleven center on the existing site. Shoppers now have access to around 90 shops on a total of 50,000 m². Another highlight of 2017 was the completion of the new post office HQ (total usable space of 50,000 m²), a mixed-use property on Rochusmarkt. The three lower floors are reserved for commercial units, with the approx. 5,500 m² set aside for service providers, bars and restaurants and grocery stores. Vienna’s first themed shopping center for designer goods, Stilwerk in the Hotel Sofitel building, was unable to establish itself on the market. The vacant space was subsequently remarketed as a hub for Austrian and international start-ups. Number of shopping centers in Vienna

and the surrounding area by sizeNumber Gross lettable area (GLA), m²

14 20,000 9 20,000–45,000 6 more than 50,000

Sources: IRG, Standort+Markt

Vienna | SC projects under constructionShopping center Gross lettable area

(GLA), m² Scheduled opening

Auhof Center (expansion) approx. 9,000 H2 2018Sources: IRG, Standort+Markt, RegioPlan

Vienna | SC openings/closures, 2017/H1 2018Shopping center Gross lettable area

(GLA), m² Opening/closure

Huma Eleven phase II (demolition and rebuild)

approx. 20,000 H2 2017

Post am Rochus – Mein Marktplatz im 3. (mixed use)

approx. 5,500 H2 2017

Stilwerk (closure) approx. 6,000 H1 2017Sources: IRG, Standort+Markt

Importance of individual segments in Viennaas measured by sales space

Source: IRG, Standort+Markt, EHL

Shopping centres 41.5%

Retail park agglomerations 42.2%

Shopping streets 16.3%

Top six shopping centers in Vienna and the surrounding areaName Gross lettable area (GLA), m²

Shopping City Süd approx. 173,000 Donau Zentrum approx. 130,000Auhof Center * approx. 59,000G3 Shopping Resort Gerasdorf** approx. 58,000Millennium City approx. 51,000Huma Eleven approx. 50,000*) after completion of expansion project in October **) excl. retail parkSources: IRG, Standort+Markt

18 I Real Estate Country Facts 09/2018

Real Estate Country Facts

modernization alone often does not go far enough, and as a result many shopping centers are looking to create experiences and taking steps to increase the amount of time spent at the location by bolstering their F&B and entertainment offerings.

The increasing influence of the online retail sector is intensifying pressure and tearing up the rulebook. According to KMU-Forschung, online stores accounted for around 11 % of total consumer spending in Austria last year. Online retailers already have a market share of 17 %, if the grocery segment is taken out of the equation. The highest revenues are generated by technology and media, sport and leisure and fashion and lifestyle. Having already reached a high level, rapid growth in these segments has started to level off to a degree in recent years. With an online share of just 2 %, the online grocery delivery sector is still a niche market given the very dense network of bricks and mortar stores. However, its potential and relative significance is huge, as almost 50 % of Austrian consumer spending is attributable to groceries and health and beauty products. Measures are being put in place to overcome existing barriers (e.g. cold chain / freshness guarantee, delivery logistics and costs, profitability / pricing policy) and participate in future growth, with the arrival on the market of new suppliers like Amazon fresh stoking competition with established grocery giants such as Spar and the REWE Group. Depending on the extent to which the grocery sector can establish its online activities as a distribution channel, spaces and structures in the bricks and mortar segment may also change.

Generally speaking, the boundaries between the online and offline worlds are becoming increasingly blurred. Consumers select shopping destinations, suppliers and sales channels on a case-by-case basis. Shopping center operators and their tenants are trying to respond with different omnichannel models1, which are designed to increase footfall and spending at their destinations. Establishing USPs will also become an important differentiator. Austria remains a popular destination for international retailers’ expansion activities. New entrants to the market tend to prefer premium locations. Prospective tenants’ criteria for a top location are significantly stricter and the number of shopping centers that match their requirements has declined.

The trend towards city center shopping is also gathering pace. IKEA is planning to open its first ever city center location close to Vienna’s Westbahnhof station in 2021. Under a specially adapted concept that takes the specifics of the site into account, there will not be any dedicated car parking or warehouse. It will only sell products that can be transported on foot, by bike or on the subway. All other larger items can be ordered and will be delivered to customers directly from a purpose-built logistics center (construction start: 2018) on the outskirts of the city.

Top SC yields still at an all-time lowThe gap between premium shopping centers and category B and C locations is widening in terms of rent increases. While rent growth is stable at well-established shopping centers, others have to contend with increased downward pressure on prices and in many cases filling empty space involves granting discounts.

At the end of the first half of 2018, shopping center rents in Vienna were between EUR 8 and 120/m² per month, depending on store size. Top yields in the shopping center segment remained at a record low of around 4%. Demand for retail properties remains strong, but there is an unchanged, limited supply of large-scale premium properties. Consequently, yields are still under pressure, against the backdrop of low interest rates, meaning it is not safe to rule out further mild declines.

Retail parks in Austria: little movement on the market Compared with previous years, the amount of space accounted for by retail parks and retail park agglomerations2 has risen only slightly, to 5.3 million m². One reason for this trend is the already high den-sity of around 602 m² per 1,000 inhabitants in Austria. Growing com-petition from online retailers is also posing individual locations with new challenges in terms of their structure and size.

Shopping center rents Range (EUR/m²/month)

Anchor tenants 8–15Shops (depending on size and location) 15–120

Sources: IRG

Selected retail park/ factory outlet center openings, 2017–2018Retail park Gross lettable area

(GLA), m² Opened

Designer Outlet Parndorf (expansion)

approx. 5,500 H1 2017

Interspar FMZ Wels (demoli-tion and rebuild)

approx. 15,000 H2 2017

FMZ Inzersdorf/Sterngasse (former Baumax site)

approx. 10,000 H2 2017

FMZ Kulmax Spittal a. d. Drau (former Baumax site)

approx. 8,000 H2 2017

Intro Shopping Center Sie-gendorf**

approx. 8,000 H1 2018

Fashion Outlet Parndorf (renovation and expansion)***

approx. 8,000 H2 2018

*) originally a shopping center, demolished and reopened as a retail park; **) shopping center by name, but structurally arranged as a retail park; ***) under construction, scheduled opening in 2018Sources: IRG, Standort+Markt

1) Omnichannel approach: bringing together bricks and mortar and online channels at shopping centers. 2) Retail park agglomeration: retail park locations that have grown organically and are not managed by a single operator.

Real Estate Country Facts 09/2018 I 19

In 2017, the revitalization and remodeling of premises formerly occupied by the Baumax home improvement chain to create smaller retail parks (such as the Inzersdorf/Sterngasse retail park in Vienna’s 23rd district and Kulmax in Spittal an der Drau in Carinthia) were the most significant developments on the market. The former Interspar shopping center in Wels was demolished and reopened on the same site as a retail park3.

The only new retail park opening in 2018 was the Intro Shopping Center in Siegendorf with around 8,000 m² in southern Burgenland. Modernization and expansion of the Fashion Outlet in Parndorf4 to around 30,000 m² is expected to be completed by the end of 2018. A new retail park with a focus on F&B and entertainment is currently under construction directly behind it (around 15,000 m²). It is scheduled to open in fall 2018 (future tenants include a bowling alley, an indoor adventure park, Vapiano and OX Steaks & Grill).

Retail park trend: expansion at existing and established sitesWith more than 100,000 m² of lettable space, the shopping world around Parndorf including the Factory Outlet (FOC) is one of the top five retail spaces in Austria. As things currently stand, there is no end to construction activity in sight: in addition to a new hotel project, additional retail park projects are planned, including Frunpark Parndorf with around 20,000 m² (construction scheduled to start in fall 2018) and the first phase of expansion of Pado Shoppingpark. Negotiations regarding the 23,000 m² plot with shopping center planning consent (formerly the SC Neusee project) are ongoing (according to media re-ports, a wholesaler is holding talks with a view to taking over the site).

As Parndorf shows, the general trend in the retail park segment – similarly to that for shopping centers – is moving in the direction of established locations. As a result, the five largest retail park agglomerations in Austria in terms of space are growing all the time and/or bringing in attractive new tenants. A case in point is the French sportswear retailer Decathlon, which opened its first Austrian flagship store at the Vösendorf Nord/Brunn am Gebirge retail park agglomeration (number one in the rankings) on 3,000 m² of space outside Shopping City Süd. In spring 2018 the Klagenfurt-Ost retail park agglomeration (number three in the rankings) expanded with the addition of a new approx. 4,000 m² retail park on the site of the Kika home furnishings store.

Retail park trend: increasing quality of visitor experience Another ongoing trend at retail parks is to improve quality for visitors through – depending on the size, focus and location of the park – implementing various packages of measures including architectural upgrades, F&B and entertainment offers, services and spaces dedicated to services, as well as communication zones and quiet areas in shared areas of the park.

In practice, it is becoming increasingly difficult to distinguish larger retail parks from shopping centers as a number of new and / or refurbished locations are adopting hybrid forms (e.g. retail-park-oriented shopping centers) with an increasing proportion of traditional tenants from the shopping center segment.

Demand is generally healthy for rental space at retail parks that meet contemporary expectations, are easily accessible and combine high-level functionality with a balanced tenant mix. Current rents are stable and range from EUR 7–15/m²/month.

As an asset class, retail parks are enjoying sustained popularity among investors, and attracting new ones, thanks to their largely constant growth in recent years. They are prized for their lower susceptibility to fluctuations in the economy and the ability of individual locations in smaller cities to establish themselves as the retail park for the local area and/or region, catering to shoppers’ daily needs and generating repeat business.

Top 5 retail park agglomerations incl. FOC in Austria

Name Gross lettable area (GLA), m²

Vösendorf Nord/Brunn am Gebirge approx. 229,000Rautenweg West & Ost – 1210/1220 Vienna approx. 149,000Klagenfurt Ost – Carinthia approx. 138,000Parndorf – Burgenland* approx. 100,000Graz – Webling approx. 87,000*) incl. Designer Outlet Parndof, Fashion Outlet Parndorf, PADO Shopping Park, Pannonia Shopping Park, XXX-LutzSources: IRG, Standort+Markt

3) Retail park/shopping center differentiator: all units at a retail park are accessible from the outside, there is no shared mall area and no shared entrance to the property. 4) Former Villagio and Galeriencenter.

Retail park rentsRange (EUR/m²/month)

Shops (depending on size and location) 7–15Sources: IRG

20 I Real Estate Country Facts 09/2018

Real Estate Country Facts

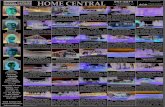

Shopping centers Vienna and the surrounding area

Real Estate Country Facts 09/2018 I 21

Bank Austria

Real Estate & Public SectorWalter BödenauerTel: + 43 (0)50505 – [email protected]

Economics & Market AnalysisWalter PudschedlTel: + 43 (0)50505 – [email protected]

Günter WolfTel: + 43 (0)50505 – [email protected]

Immobilien Rating GmbH (IRG)

Market ResearchAlexander StögbauerTel: + 43 (0)50601 – [email protected]

Helmut SchneiderTel: + 43 (0)50601 – [email protected]

Authors:

Bank Austria Real Estate & Public Sector

International Real Estate FinanceAnton HöllerTel: + 43 (0)50505 – [email protected]

Werner LeitnerTel: + 43 (0)50505 – 56327werner.leitner@ unicreditgroup.at

Public Sector & Subsidised Real EstateWolfgang FiglTel: + 43 (0)50505 – [email protected]

Günter NeuwirthTel: + 43 (0)50505 – [email protected]

Commercial Real EstateChristian WiesbauerTel: + 43 (0)50505 – [email protected]

Contacts:

22 I Real Estate Country Facts 09/2018

Real Estate Country Facts

Some examples of what we can do for you.

Contact: UniCredit Bank Austria AG Commercial Real Estate: Christian Wiesbauer, [email protected] Real Estate Finance: Anton Höller, [email protected] Sector & Subsidized Real Estate: Günther Neuwirth, [email protected]

realestate.bankaustria.at

Haus am SchottentorMixed Use Property

Development & Investment FinancingVienna/ Austria

Lender: UniCredit Bank Austria AGMarch 2018

PortfolioResidential

Investment FinancingVienna/Austria

Lender: UniCredit Bank Austria AGMarch 2018

Amazon Returns CentreReturns Centre

Investment FinancingSered’/ Slovakia

Lender: UniCredit Bank Austria AGApril 2018

EnsembleHousing Project, Erdberger Lände

Development & Investment FinancingVienna/Austria

Lender: UniCredit Bank Austria AGJanuary 2018

Quartier Belvedere CentralServiced Apartments

Development FinancingVienna/Austria

Lender: UniCredit Bank Austria AGOctober 2018

Andel ParkOffice

Investment FinancingPrague/Czech Republic

Lender: UniCredit Bank Austria AGJune 2018