Project of Ruchi BhavsarFINAL PROJECT REPORT

-

Upload

vijaydigve -

Category

Documents

-

view

225 -

download

0

Transcript of Project of Ruchi BhavsarFINAL PROJECT REPORT

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

1/111

A

PROJECT ON

FINANCIAL ANALYSIS AND REVIEW

FOR

KIRLOSKAR OIL ENGINES LIMITED

SUBMITTED TO

UNIVERSITY OF PUNE

IN PARTIAL FULFILMENT OF TWO YEARS FULL TIMECOURSE

MASTERS IN BUSINESS ADMINISTRATION (MBA)

SUBMITTED BY

RUCHI. S. BHAVSAR

(MBA 2008-10)

RAJARSHI SHAHU COLLEGE OF ENGINEERING PUNE

1

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

2/111

INDEX

SR.

NO.

CONTENTS PAGE

NO.

1. ACKNOWLEDGEMENT 3

2. CERTIFICATE OF ATTENDENCE

BY COMPANY

4

3. CERTIFICATE BY INSTITUTE 5

4. PROJECT PROFILE 6

5. COMPANY PROFILE 15

6. RESEARCH STUDY 23

7. CONCLUSION AND

RECOMMENDATIONS

103

8. LIMITATION 104

9. ANNEXURE 105

10. BIBILIOGRAPHY 108

2

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

3/111

CHAPTER 1 - ACKNOWLEGEMENT

I hereby take the opportunity to express mygratitude towards those who have made great contribution in

completion of this project work. I feel immense pleasure to thanks

to the Chief Financial Officer Mr. Parande, to the Senior General

Manager Corporate Finance Mr. C. L. Bapat, Mr. A. S. Deshpande

the General Manager who were kind and helped me in providing

necessary information and guidance from time to time. Mr.

Malvadkar the Associate Vice President who has given me the

opportunity to work with Kirloskar Oil Engines Limited as projecttrainee. I am immensely thankful to my external project guide

Mr. Mahesh. M. Joshi the Deputy Manager and internal project

guide Prof. Ramesh Mehta who has been a constant source of

inspiration. Both have keen interest and encouraging guidance,

which leads to completion of this project in time, is hard to express

in words.

I offer my sincere thanks to Mr. V. D. Gutte

Manager Corporate Finance, Mr. Limaye Manager CorporateFinance, Mr. Jawalkar Deputy Manager and the whole Corporate

Finance Staff who spared their valuable time and was always

available for guidance in spite of their busy schedule. I am thankful

to Mr. Saurab Jain Manager Cost and works department, Mr.

Mohanty Manager Human Resource, Miss Disha Sharma the

section coordinator and the entire human resource team for

reposing faith and support in the endeavor to carry out the project.In the end, I would like to express my gratitude

towards the respondents, who selflessly adjusted their schedules to

accommodate me in the scheme of things. This project would not

have been successful without their valuable help. I also express my

sincere thanks to all those who contributed in bringing this project

into its current physical form.

3

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

4/111

CHAPTER 2 - CERTIFICATE OF ATTENDENCE

This is to certify Miss Ruchi Bhavsar has completed Summer Training

Program titled, Financial Analysis and Review. In our Orgnisation

Kirloskar Oil Engines Limited Khadki, Pune.Under the guidance of Mr.

Mahesh M. Joshi (Deputy Manager- Corporate Finance) from18th May 2009

to 17th July 2009.She has duly acknowledged all the sources of references

used in this report. This report is based on the Master In Business

Administration (M.B.A) program of University Of Pune.

For Kirloskar Oil Engines Ltd

Mahesh M. Joshi

Deputy Manager Corporate Finance

4

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

5/111

CERTIFICATE BY INSTITUTE

5

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

6/111

CHAPTER - 4

PROJECT

PROFILE

-INTRODUCTION OF

-SUBJECT

-OBJECTIVE

-DATA ANALYSIS

-RESEARCH

-METHODOLOGY

6

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

7/111

-HYPOTHESIS

INTRODUCTION OF SUBJECT

Finance is defined as the art and science of managing money. The major areas of finance

are:

Financial services

Financial management

While financial services is concerned with the design and delivery of advice and financial

products to individuals, businesses and governments within the areas of banking and

related institutions, personal financial planning, investments, real estate, insurance and so

on, financial management is concerned with the duties of financial managers in the

business firm. Financial managers actively manage the financial affairs of any type of

business, namely, financial and non-financial, private and public, large and small, profit

seeking and not-for-profit. They perform such varied tasks as budgeting, financialforecasting, cash management, credit administration, investment analysis, funds

management and so on.

Financial Analysis and Review:-

Financial Analysis and Review involves the application of analytical

tools and techniques to the financial data to get information that is useful in decision

making. The foundation of any good analysis is a thorough understanding of the

objectives to be achieved and the uses to which it is going to be put. Such understanding

leads to economy of effort as well as to a useful and most relevant focus on the points thatneed to be clarified and the estimates and projections that are required.

Financial analysis is oriented towards the achievement of definite

objectives. There are three types of users to whom the financial analysis could be useful.

They are short-term lenders, long-term lenders and finally stockholders. The process of

financial analysis can described in various ways, depending on the objectives to be

obtained. Financial analysis can be used as a preliminary screening tool in the selection of

stocks in the secondary market. It can be used as a forecasting tool of future financial

conditions and results. It may be used as a process of evaluation and diagnosis of

managerial, operating and other problem areas. Financial analysis reduces reliance onintuition, guesses and thus narrows the areas of uncertainty that is present in all decision

7

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

8/111

making process. Financial analysis does not lessen the need for judgment but rather

establishes a sound and systematic basis for its rational application.

Sources of financial information:-

The financial data needed in the financial analysis come frommany sources. The primary source is the data provided by the firm itself in its annual

report and required disclosure. The annual report comprise of the income statement, the

balance-sheet and the statement of cash flows, as well as footnotes to those statements.

Besides this, information such as the market price of securities of publicly traded

corporations can be found in financial press and the electronic media daily. The financial

press also provides information on stock price indices for industries and for the market as

a whole.

Financial statement:-

Every financial manager is involved in financial decision making and

financial planning in order to take right decision at right time, he should be equipped with

sufficient past and present information about the firm and its operations and how it is

changing overtime. Much of this information that is used by financial manager to take

various decisions and to plan for the future is derived from the financial statements. A

financial statement is the compilation of data, which is logically and consistently

organized according to accounting principles. Its purpose is to convey an understanding

of some financial aspects of a business firm. It may show a position at a moment in time,

as in the case of balance-sheet, or may reveal a series of activities over a given period of

time, as in the case of an income statement. Financial statements are the major means

through which firms present their financial situation to creditors, stock-holders andgeneral public. The majority of firms include extensive financial statements in their

annual reports, which are distributed widely

Financial analysis involves the use of various financial statements. These

statements do several things. First, the balance sheet summarizes the assets, liabilities and

owners equity of a business at moment in time, usually the end of a year or a quarter.

Next the income statement summarizes the revenues and expenses of the firm over a

period of time while balance sheet represents a snapshot of the firm s financial position at

a moment in time.

Financial management is planning and controlling of financial resources of

a firm with a specific objective. Since, financial management as a separate discipline is of

recent origin, it is still in a developing stage. It is very crucial for an organization to

manage its funds effectively and efficiently. Financial management has assumed greater

importance today as the financial strategies required to survive in the competitive

environment have become very important. In the financial markets also new instruments

and concepts are coming and one must say that a finance manager of today is operating in

a more complex environment. A study of theories and concepts of financial management

has therefore become a part of paramount importance for academics as well as for

practitioners but there are many concepts and theories about which controversies exist as

no unanimous opinion is reached as yet.

8

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

9/111

IMPACT OF OTHER DISCIPLINES ON FINANCE IN DIGRAMATIC FORM:-

9

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

10/111

OBJECTIVE

10

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

11/111

- To study Financial Statements like income and expenses and balance

sheet- To obtain a true insight into financial position of the company.

- To make comparative study of financial statements of different years.

- To study various ratios to determine the relationship of different factors

which have impact on the financial position of the company.

- To identify the financial strengths and weakness of the company

- To find out the reasons for unsatisfactory results.

- Evaluating company s performance relating to Financial Statement

Analysis.

- To analyze the Cash Flow Statement, and know the cash management ofthe company.

- To analyze the Fund Flow Statement, and to know how the funds are

managed by the company

- To analyze the working Capital Management, to know how company

manages the cash for day to day requirement, inventory, debtors, creditors

etc.

RESEARCH METHODOLOGY

11

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

12/111

Research: Introduction

Research is a purposive investigation of hypothetical propositions. Research as a

process involves defining and redefining problems, hypothesis formulation, organizing and evaluating

data, deriving deductions, inferences and conclusion, after careful testing.

Research: DefinitionResearch concerns itself with obtaining information empirical observation that can used to

systematically develop logically related propositions so as to attempt to establish casual relationship

among variables.

-Black and Champion

Steps in Research Methodology:

Step 1: To decide Objective of the study Study the constituents and the concept of Financial Analysis and Review.

Analyze and interpret Financial Position of the Kirloskar Oil Engines Ltd.

Step 2: To decide Research Design

What is Research Design?

Research Design is a logical and systematic planning and directing of

piece of research. Research design attempts to integrate various aspects of research study. Such

as what, where, when, how, etc. It is a plan structure and strategy of investigation.

Research Design used for project:

- Descriptive Research:

Descriptive study determines the frequency of occurrence of phenomenon of interest or of its association

with something. Descriptive study narrates facts or characteristics. Descriptive study often helps the

researcher to do a lot of spade work and act as launch pads of further researchers.

Descript studies usually employ the principle of sampling as they attempt to make certain

generalizations. They also provide valuable information for policy formulation (Annual Reports).

12

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

13/111

Characteristics: They are well structured.

13

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

14/111

The approach cannot be changed every now and then.

Primary data is collected.

- Exploratory Research:Exploratory design aims at discovering more about various dimensions of the research problem and

associated aspects. The first level of exploratory research aims at discovery of significant variables

involved in the situation. The second level focuses on relationship among variables.

Characteristics: Focus is to discover ideas.

Based on secondary data.

Researcher has to change his focus depending on the availability of new ideas.

Step 3: To determine Sources of DataWhat are Sources of Data?A data source is used to carry out or research or to collect fresh data for obtaining results. There are two

sources of data:

Primary Data

Secondary Data

Primary Data: Data that is collected for the specific purpose at hand is Primary Data.

Characteristics: It is expensive mode of data collection.

Lot of time is spent. It gives accurate results if sample is efficiently selected.

Data used is original in nature.

Primary data sources used in this project: Observation Method

Questionnaire Method

Secondary Data: Data that has been collected earlier for some purpose other than the purpose forpresent study.

Characteristics:

It is economical as the cost of collecting original data is saved. Time involved is comparatively less than primary data.

Secondary data sources used in this project:

Books

Journals

Website of Company

Step 4: To design Data Collection FormsThere are three types of modes to collect data:

Observatory Method

Survey Method Questionnaire Method

14

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

15/111

As far as my data collection method is concerned used Observational Method initially and survey

method was used for the study of project.

Step 5: To determine Sampling DesignSampling is the process of obtaining information about an entire population by examining only part of it.

The items selected constitute what is technically called as Sample.

Their selection process or technique is called as Sample Design.

Survey conducted on the basis of sample is Sample Survey.

Step 6: To organize and conduct field surveyThe survey was done with the help of non-structured questionnaire, by interviewing the Corporate

Manager to get the feedback.

Step 7: To Process and Analyze collected dataThe study and access of the Financial Position of the company as well as the procedure of the Treasury

Management process data collected by survey.

Step 8: To prepare Research ReportThe culmination of the entire research process is Research Report.

Definition:To convey to the interested persons the whole result of the study in sufficient detail and so arranged as

to enable each reader to comprehend the data and to determine for himself the validity of conclusions.:

-American Marketing Society.

The research report has been prepared according to the report writing principles. I have tried my best to

maintain the objectivity, coherence and clarity in the presentation of the ideas. The essence of goodreport is that it effectively communicates its research findings.

HYPOTHESIS

Hypothesis testing refers to as Statistical Decision-Making. Hypothesis is atentative solution or answer to the research problem, which the researcher has to test based on the

available body of knowledge, or on knowledge that can be known.

A hypothesis may be defined as a proposition or a set of propositions set forth as

an explanation for the occurrence of some specific groups of phenomenon either asserted merely as a

provisional conjecture to guide some investigation or accepted as highly probable in the light of

established facts.

15

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

16/111

CHAPTER - 5

COMPANY

PROFILE

- HISTORY

- ABOUT KIRLOSKAR

OIL ENGINES LIMITED

- INTRODUCTION

- BOARD OF DIRECTORS- ORGANISATION

CHART

16

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

17/111

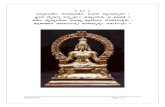

HISTORY

The Founder and theFirst Factory Village

The Kirloskar story starts with Laxmanrao

Kirloskar, the founder. A man who believed

that, understanding of one's environment and

reality was essential to the manufacture of

path-breaking industrial implements. From thissteadfast belief was born the iron plough, the

first Kirloskar product. Originally intended as an essential aid to agriculture, the plough soon became an

icon of reform and revolution.

In January 1910, when the Kirloskar were being ousted from Belgaum to make room for a new suburb,

they found themselves in dire need of a place to live and work. Sensing this need, the Raja of the

princely state of Aundh, who admired and respected Laxmanrao Kirloskar, offered the latter all the land

he needed in Aundh state.

Two months later, Laxmanrao Kirloskar set foot on 32 acres of barren land strewn with cacti andinfested with cobras. Driven by his faith in human ability, Laxmanrao banded together 25 workers and

17

A highlight of theearly history ofthe group isKirloskarwadi,India's firstindustrialtownship. Amodel factory-village created byLaxmanrao andhis band ofdedicatedworkers.

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

18/111

their families and succeeded in transforming the barren expanse into his dream village.

Ramuanna, Laxmanrao's brother, planned and administered the township, Shamburao Jambhekar an all-

round healing man, K.K.Kulkarni, an unsuccessful student, became a manager, treasurer and odd jobs

man, Mangeshrao Rege was the clerk and chief accountant, Anantrao Phalnikar, a school drop-out

flowered into an imaginative engineer. Such was our founder's faith in the human being that, TukaramRamoshi and Pirya Mang, both convicted dacoits, became the trusted guards of Kirloskarwadi

The First Kirloskar Group Company

Kirloskar Brothers Limited (KBL) - the first Kirloskar

venture at Kirloskarwadi was to become the base for all of

the Kirloskar Group's subsequent enterprises. It began as theonly Indian company with its own standard products - the

fodder cutter and the iron plough, which competed with the

British products.

ABOUT

Kirloskar Oil Engines Limited

18

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

19/111

Late.Mr.Shantanurao Kirloskar established, Kirloskar Oil Engines Limited in 1946 with the object of

carrying on the business of manufacturing and selling of all types of combustion engines. The Khadki

(Pune) plant is situated on 55 acres of land and was inaugurated on 25 April 1949, production

commenced immediately thereafter.

Initially production was restricted to small diesel engines having agricultural and industrial applications.

Over the period of time Company developed medium and large engines, bimetal bearings, strip and

bushes. The year 1954-55 was the beginning of the new era of rapid growth. Central Government of

India banned import of small engines in the country. Consequently demand for KOELs engines picked

up. The Company began exporting to Germany, Middle East and Far Eastern Countries.

In 1954 Company started manufacturing bearings primarily for the captive use in stationary engines.

Over a period of time, the Company also developed bearings for automotive engines. With thedevelopment in agriculture and irrigation under the five year plans the demand for Companys engines

soared rapidly. To cope up with increasing demand, Company launched first phase of expansion in

1958.

In 1985-86 Letters Of Intent for manufacture of pipe handling tools was converted into Industrial

License. Company also launched material handling components. In 1992-93 Letter Of Intent was

received for manufacture of Camshafts and Crankshaft for automotive applications.

In 1989-90 Company undertook a scheme for modernization of plan at Pune and Ahmednagar. During

1990-91 Company undertook packing of Gas Turbines for Industrial Power Generation markets in

1MW-10MW range in association with Solar Turbines Inc. U.S.A.

In early 1993 KOEL purchased the products know how and selected manufacturing line from IFA an

East German Company. In late 1993 Company secured ISO-9001 certificate in the first go. Company

has also acquired the ISO-14001 EMS i.e. Environment Management System.

INTRODUCTION

Kirloskar Oil Engines Limited (KOEL) operates in different business segments of awide range of diesel engines, auto components etc. There are currently 12 such segments known as

Strategic Business Units. The SBUs have manufacturing facilities located at different parts of the

country and they deal with a large number of customers spread across the country and overseas.

Business Groups

SEBG:Small Engine Business Group

MEBG:Medium Engine Business Group

LEBG:Large Engine Business Group

19

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

20/111

ACBG:Auto Component Business Group

SBUs are independent profit centers and they generate their surplus funds from their

operations. These SBUs also borrow from the Corporate Finance Department (CFD) from time to time if

the need arises. As per Corporate Policy the surplus funds can be invested by CFD only and not by

SBUs directly. Besides, surplus funds of SBUs, CFD also generate funds from funds management or

other financial activities.

Investment of surplus funds by CFD is an important activity having significant

bearing on overall financial performance and profitability of KOEL. Therefore, timely consolidation of

available funds, their management, accounting and controls ensuring investment in best available

avenues commensurate with risk and liquidity considerations is crucial to ensure optimum returns at

acceptable level of risk and maturity.

VISION

We will become a major Global Player in offhighway engines and power generation

businesses by offering winning combinations of Quality, Cost and Delivery through

innovation and unmatched service.

We will be amongst the Top Five engine companies of the world.

While pursuing the above, we will continue to enhance the value of engine bearing and

valves business.

BOARD OF DIRECRORS

Mr. Atul C. Kirloskar : Chairman & Managing

Director

Mr. Sanjay C. Kirloskar : Vice Chairman

Mr. Gautam A. Kulkarni : Joint Managing Director

Mr. Rahul C. Kirloskar : Director (Exports)

20

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

21/111

Mr. D. R. Swar : Director (Corporate

Services)[Ceased w.e.f. 19 April

2007]

Mr. R. R. Deshpande : Executive Director

Mr. Vikram S. Kirloskar

Mr. U. V. Rao

Mr. H. M. Kothari

Dr. N. A. Kalyani [ceases w.e.f 23 April2007]

Mr. P. G . Pawar

Mr. V. K. Bajhal

Mr. R. Srinivasan

Dr. Naushad Forbes

Mr. A.N. Alawani (w.e.f. 21 January 2009)

Mr. M Lakshminarayan (w.e.f. 24 April 2009)

Mr. Nihal Kulkarni (w.e.f. 24 April 2009)

Mr. Sanjay D. Parande : Chief financial officer

21

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

22/111

Ms Aditi Chirmule : Company secretary

M/s. Dalal & Shah : Auditors

Bankers : State Bank of India,

Bank of Maharashtra,

HDFC Bank Ltd,

ICICI Bank Ltd,

HSBC Ltd

Registrar : Link Intime India Private Ltd

Register office : Laxmanrao kirloskar road,

khadki

Pune - 411003

Location of factories : Pune, Ahnednagar, Nasik,

Kagal,Phursungi (upto 15th

April 2009),

Rajkot, Silvass

22

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

23/111

ORGANISATION CHART

23

CHIEF

FINANCIAL

OFFICER

TREASURER

CONTROLLER

CASH

MANAG

ERRRR

CREDIT

MANAGE

R

FINANCI

AL

ACCOUN

TS

MANAGE

R

COST

ACCOU

NTS

MANAGER

CAPITAL

BUDGETIN

G

MANAGER

FUND

RAISING

MANAGE

R

TAX

MANAGE

R

DATA

MANAGE

R

PORTFOL

IO

MANAGE

R

INTERNAL

AUDITOR

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

24/111

CHAPTER - 6

RESEARCH

STUDY- RATIO ANALYSIS

- DU-PONT ANALYSIS

- LEVERAGES- FUNDS FLOW STATEMENT

- CASH FLOW STATEMENT

- COST OF CPITAL

24

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

25/111

- WORKING CAPITAL

- RECEIVABLES

MANAGEMENT

- COST-SHEET

- BREAK-EVEN ANALYSIS

RATIO ANALYSIS

Ratio analysis is widely used-tool of financial analysis. It

can be used to compare the risk and return relationship of firms of different

sizes. It is defined as the systematic use of ratio to interpret the financialstatements so that the strength and weakness of the firm as well as its historical

performance and current financial condition can be determined. Trend ratios

involve a comparison of the ratios of a firm over time, that is, present ratios are

compared with past ratios for the same firm. The comparison of the

profitability of a firm, say, year 1 through 5 is an illustration of a trend ratio.

Trend ratios indicate the direction of change in the performance-improvement,

deterioration or constancy over the years.

Ratio analysis is the process of determining and

interpretation mathematical relationship based on financial statement. The

comparison of financial ratios against the norms established helps to diagnosis

the financial condition and arrive at conclusions.

The comparison of financial ratios is done against the following:-

Standard set

Historical figures

Inter-firm analysis (head hunting)

25

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

26/111

Ratio analysis is considered as a powerful tool of financial

analysis through which economic and financial position of the business can be

fully X-rayed. They provide a coordinated frame of reference for judging

financial performance. They convey the entire story of the financial adventure

of the enterprise. They comprehend and simplify a heap of financial datathrough one particular figure which conveys the complete meaning. They focus

on the specific relationship in the financial statements.

Basis of comparison: -

Ratios are relative figures reflecting the relationship

between variables. This enables the analysis to draw conclusion regarding

financial operations. The use of ratio as a tool of financial analysis involves

their comparison, for a single ratio, like absolute figures, fails to reveal the true

position. For example,

P /E ratio (price/earnings ratio for a particular script) should be compared over

a period of time to get a true picture of company performance.

Thus comparisons with related facts is the basis of ratio analysis

In ratio analysis, four types of comparisons are involved.

Trend Ratio

Inter firm comparisons Comparisons of items within a single year s financial statement of a firm.

Comparisons with standard or plans

Uses of ratio analysis:-

It helps to understand the efficiency and performance of the firm as a

whole. Its main purpose is to gain insights into the operating and financial

problems confronting the firm.

It helps to identify the trouble or potential trouble spots of the firm.

This would impel the management to investigate those areas more

thoroughly.

It helps to pinpoint relationship that is not obvious from the financial

statements.

It helps to highlight the factors responsible for the present state of

financial statements.

26

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

27/111

It helps the shareholders in evaluating the firms activities and policies

that affect the profitability, liquidity and ultimately the market price of

the shares

It helps to examine the adequacy of funds, the solvency of the firm and

its ability to meet the financial obligations as and when they becomedue.

It is very useful in inter-firm and intra-firm analysis.

A trend can be established by calculating ratios for number of years.

Limitations of ratio analysis:-

There may be a difference between the inventory methods followed by

various firms or different method in the same firm.

Firms follow various methods of depreciation.

There may be a difference between the capital structures of the firms. Window dressing, which means artificially improving the financial

statements is another major drawback

Inflationary factors are not taken into consideration. Thus when the

past performance is analyzed, the figures may have become outdated.

Classification of ratios:-

27

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

28/111

LIQUIDITY RATIOS:-

The importance of adequate liquidity is

the ability of a firm to meet current or short term

obligations when they become due for payment can hardly

be overstressed. Liquidity is the prerequisite for the

survival of the firm. A proper balance between the two

contradictory requirements, that is, liquidity and

profitability, is required for efficient financial

management. Liquidity ratios indicate the financial

strength or solvency of a firm.

PROFITABILTY RATIOS:-The creditors, shareholders and

management are eager to measure its efficiency and

financial soundness. The shareholders invest their funds inthe expectation of reasonable returns. The profitability

ratios can be determined on the basis of either sales or

investments

ACTIVITY RATIOS:-Activity ratios are concerned with

measuring the efficiency in asset management. Theefficiency with which the assets are used would be reflected

in the speed and rapidity with which the assets are

converted into sales. The greater the rate of conversion, the

more efficient is the utilization of assets, other things being

equal.

MARKET VALUE RATIOS:-

28

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

29/111

Market Value ratios are those ratios

which are measured by using market value of the shares.

This ratio is calculated to know the returns the

shareholders as compared to the amount invested in

market value of the shares.

CAPITAL STRUCUTRE:-The long term lenders would judge

the soundness of a firm on the basis of the long term

financial strength measured in terms of its ability to pay

the interest regularly as well as repay the installment of

the principal on due dates. The long term solvency isexamined by the capital structure ratio

These ratios are further divided into:-

29

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

30/111

LIQUIDITY RATIOS:-

1.> CURRENT RATIO :-

30

CURRENT ASSETS CURRENT RATIO =

-----------------------------

CURRENT

LIABILITIES

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

31/111

Rs. In millions

INFERENCE:-

This ratio indicates the solvency of the company. It shows the

proportion of current assets to current liabilities. Normally, it is expected that current ratio

should be 2: 1, which indicates that current assets should be twice as compared to current

liabilities. As the current ratio is less than the ideal ratio hence, it is advisable to the

company to increase its current ratio to be in a favorable position.

2.> ACID TEST RATIO :-

31

YEAR 2005 2006 2007 2008 2009CURRENT

ASSETS

3923234 5264473 6615365 7455319 6819921

CURRENT

LIABILITIES

2949585 4234316 5370163 6452601 4860721

RATIO 1.33 1.24 1.23 1.16 1.40

0

0.5

1

1.5

2005 2006 2007 2008 2009

RATIO

YEAR

Current Ratio

Current Ratio

QUICKASSETS

ACID TEST RATIO =

----------------------------

QUICKLIABILITIES

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

32/111

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

33/111

Rs. In millions

INFERENCE:-

This ratio indicates the proportion of proprietors funds used forfinancing the total assets. Ideally 2/3rd of assets should be financed through proprietors

funds while balance should be financed through borrowed funds. In 2005 and 2006 the

ratio is favorable but in 2007 and 2008 the ratio is quite high hence the firm is not using

external funds adequately.

33

YEAR 2005 2006 2007 2008 2009

TOTAL ASSETS 915425

4

1218556

0

15111223 19327629 18268538

PROPREITORY

FUNDS

562075

5

7183745 8513490 9149913 9600845

RATIO 1.63 1.70 1.77 2.11 1.90

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

34/111

3.> CURRENT ASSETS TO FIXED ASSETS :-

Rs. In millions

INFERENCE:-

This ratio indicates the proportion of current assets to fixed assets. Current

assets are held for short-term purpose while fixed assets are held for long-term purpose.

In 2005, 2006, 2007 and 2008 current assets are more than fixed assets.

PROFITABILITY RATIOS :-

34

YEAR 2005 2006 2007 2008 2009

CURRENT

ASSETS

392323

4

526447

3

661536

5

745531

9

6819921

FIXED ASSETS 144687

2

192220

5

332199

0

710896

3

672978

5

RATIO 2.71 2.74 1.99 1.05 1.01

CURRENT ASSETS

CURRENT ASSETS TO FIXED ASSETS =

-----------------------------

FIXED ASSETS

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

35/111

1.> GROSS PROFIT RATIO :-

Rs. In millions

INFERENCE:-

This ratio shows the margin left after meeting the purchase and

manufacturing costs. It measures the efficiency of production as well as pricing. A high

gross profit ratio means a high margin for covering other expenses like administrative,

selling and distribution expenses. In 2005 gross profit is less which increased in 2006 and

again came slight downward in 2007 and 2008 which should be increased.

35

YEAR 2005 2006 2007 2008 2009

GROSS PROFIT 2250792 489464

9

6395092 7454893 7002799

NET SALES 12618856 1530712

6

20694761 23723049 22732435

RATIOS 17.84% 31.98% 30.90% 31.42% 30.81%

GROSS PROFIT

GROSS PROFIT RATIO = ------------------------ x

100NET SALES

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

36/111

2.> NET PROFIT RATIO:-

Rs. In millions

INFERENCE:-

This ratio shows the earnings left for share-holders as percentage of net

sales. It measures the overall efficiency of all the functions of business firm like

production, administrative, selling, financing, pricing, tax management etc. Higher the

ratio the better it is because it gives an idea of overall efficiency of the firm. As we see

the trend in this ratio it is decreased from 2005 to 2008 which is not favorable for the

company and should be increased.

36

YEAR 2005 2006 2007 2008 2009

NET PROFIT 173894

6

2005874 1784090 1189516 1158930

NET SALES 126188

56

15307126 20694761 23723049 22732435

RATIO 13.78 % 13.10 % 8.62 % 5.014 % 5.10%

NET PROFIT

NET PROFIT RATIO = -------------------- x 100

NET SALES

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

37/111

3.> OPERATING NET PROFIT RATIO :-

Rs. In millions

YEAR 2005 2006 2007 2008 2009

OPERATING NET

PROFIT

1583778 2226493 2872265 3176463 3089805

SALES 12618856 15307126 20694761 23723049 22732435

RATIO 12.55% 14.55% 13.88% 13.39% 13.59%

INFERENCE:-

This ratio establishes the relationship between the net sales and the

operating net profit. Operating net profit is the profit arising out of business operations

only. Higher the ratio the better it is because it gives an idea of overall efficiency of the

firm. In 2006 the ratio is highest but in 2005, 2007 and 2008 it should be increased to

increase the profitability.

37

OPERATING NET

PROFIT

OPERATING NET PROFIT RATIO =

------------------------------------- x 100

SALES

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

38/111

4.> OPERATING RATIO:-

Rs. In millions

YEAR 2005 2006 2007 2008 2009

COST OF GOODS

SOLD

8213011 9994581 13792882 15739044 15294648

OPERATING

EXPENSES

373483 417896 506787 529112 434988

NET SALES 12618856 15307126 20694761 23723049 22732435

RATIO 68.04% 68.02% 69.10% 68.58% 69.19%

INFERENCE:-

This ratio indicates the proportion of cost of goods sold and operating

expenses to net sales. The higher the ratio lower margin is left for operating profit hence

the ratio should be low. In the above chart the expenses more than 60% which reduces the

profitability hence it should be reduced.

38

COST OF GOODS

SOLD+OPERATING EXPENSES

OPERATING RATIO =

------------------------------------------------------------------ x 100NET SALES

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

39/111

5.> RETURN ON CAPITAL EMPLOYED:-

Rs. In millions

YEAR 2005 2006 2007 2008 2009

EBIT 1086153 1582121 2314853 2071130 2116026

CAPITAL

EMPLOYE

D

6137998 7853752 9576638 12578828 13090696

RATIO 17.70% 20.14% 24.17% 16.47% 16.16%

INFERENCE:-

This ratio indicates the percentage of earnings before interest and taxto total capital employed. This ratio is considered to be very important because it reflects

the overall efficiency with which capital is used. This ratio is highest in 2007 as compared

to 2005, 2006 and 2008.

NOTE: EBIT - EARNINGS BEFORE INTEREST & TAXES.

39

EBIT

RETURN ON CAPITAL EMPLOYED =

----------------------------- x 100

CAPITALEMPLOYED

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

40/111

6.> RETURN ON EQUITY :-

Rs. In millions

INFERENCE:-

This ratio indicates the productivity of the owned funds employed in

the firm. It shows the percentage of net profit available for share-holders. In the above

chart it shows a downward trend which is not favorable for company and share-holders as

it decreases the earnings of share-holders. Hence it should be increased.

40

YEAR 2005 2006 2007 2008 2009

OWNERS

EARNINGS

1738946 2005874 1784090 1189516 1158930

EQUITY SHARE

HOLDERS FUNDS

5620755 7183745 8513490 9149913 9600845

RATIO 30.94% 27.92% 20.96% 13.% 12.07%

SHARE-HOLDERS

EARNINGS

RETURN ON EQUITY =

--------------------------------------------- x 100EQUITY SHARE-HOLDERS

FUNDS

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

41/111

7.> RETURN ON TOTAL ASSETS:-

Rs. In millions

YEAR 2005 2006 2007 2008 2009

NPAT 1738946 2005874 1784090 1189506 1158930

TOTAL

ASSETS

9154254 12185560 15111223 19327629 18268538

RATIO 18.99% 16.46% 11.81% 6.15% 6.34%

INFERENCE:-

Returns on assets crudely reflect how well the firm uses its assets in

total. The higher the ratio is favorable as it indicates that the firm is utilizing its assets

profitably. In the above chart the ratio is decreasing which is not favorable for the

company hence it should be increased.

41

NET PROFIT

AFTER TAX

RETURN ON TOTAL ASSETS =

-------------------------------------- x 100

TOTALASSETS

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

42/111

8.> RETURN ON NETWORTH:-

Rs. In millions

INFERENCE:-

This ratio indicates the productivity of the owned funds employed in the

firm. It shows the percentage of net profit after tax available for share-holders which also

includes the net worth of the company. In the above chart it shows a downward trend

which is not favorable for company and share-holders as it decreases the earnings of

share-holders. Hence it should be increased.

42

YEAR 2005 2006 2007 2008 2009

NPAT 1738946 2005874 1784090 1189506 1158930

NET

WORTH

5620755 7183745 8513490 9149913 9600845

RATIO 30.94% 27.92% 20.96% 13% 12.07%

NET PROFIT

AFTER TAX

RETURN ON NETWORTH =

------------------------------------NET -

WORTH

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

43/111

9.> EARNINGS PER SHARE:-

Rs. In millions

YEAR 2005 2006 2007 2008 2009

OWNERS

EARNINGS

1738946000 2005874000 1778324000 1189516000 1158930000

NO. OF EQUITY

SHARES

97086190 97086500 194173000 194173000 194173000

RATIO 17.91 20.66 9.16 6.13 5.97

INFERENCE:-

This ratio is an important indicator of performance of the company. It

indicates the amount of profit available for distribution amongst the equity shareholders.

This ratio should be higher as return to increases. Market price of the companys shares is

directly proportional to earnings per share of the company. In the above chart it shows a

downward trend hence it should be increased.

1.> DIVIDEND PER SHARE:-

43

OWNERS

EARNINGS

EARNINGS PER SHARE =

----------------------------------- NO. OF EQUITY

SHARES

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

44/111

Rs. In millions

YEAR 2005 2006 2007 2008 2009

PROPOSED DIVIDEND 242717000 388346000 388346000 38834600

0

194173000

NO. OF EQUITY SHARES 97086500 97086500 194173000 19417300

0

194173000

RATIO 2.5 4 2 2 1

INFERENCE:-

This ratio indicates the dividend declared per share. This ratio should high as

it indicates the returns to the shareholders. In the above chart dividend per share is highest

in 2006 as compared to 2005, 2007 and 2008.

44

PROPOSED

DIVIDEND

DIVIDEND PER SHARE =

-----------------------------------NO. OF EQUITY

SHARE

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

45/111

1.> DIVIDEND PAYOUT RATIO :-

Rs. In millions

YEAR 2005 2006 2007 2008 2009

DIVIDEND PER SHARE 2.5 4 2 2 1

EARNINGS PER SHARE 17.91 20.66 9.16 6.13 5.97

RATIO 13.96% 19.36% 21.83% 32.63% 16.75%

INFERENCE:-

Dividend payout ratio indicates the percentage of profit distributed as

dividend to the shareholders. A higher ratio indicates that the company is following a

liberal policy regarding the dividend while lower ratio indicates a conservative approach

of the management towards the dividend. The higher the ratio more will be the

investment. In the above chart it shows an upward trend hence it is favorable for the

company.

MARKET VALUE RATIOS:-

45

DIVIDEND PER

SHARE

DIVIDEND PAYOUT RATIO =

-------------------------------------- x 100

EARNINGS PER

SHARE

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

46/111

2.> PRICE EARNINGS RATIO :-

Rs. In millions

INFERENCE:-

This ratio highlights the relationship between the market price of

shares and current earnings per share. Companies with ample opportunities for growth

generally have high price earnings ratio. In the above chart it shows an upward trend

hence it is favorable for the company.

3.> EARNINGS YIELD RATIO:-

46

YEAR 2005 2006 2007 2008 2009

MARKET PRICE 146 154 166 200 122.80

EARNINGS PER

SHARE

17.91 20.66 9.16 6.13 5.97

RATIO 8.15 7.45 18.12 32.63 16.75%

MARKET PRICE PER

EQUITY SHARE

PRICE EARNINGS RATIO =------------------------------------------------------

EARNINGS

PER SHARE

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

47/111

Rs. In millions

YEAR 2005 2006 2007 2008 2009

EARNINGS PER

SHARE

17.91 20.66 9.16 6.13 5.97

MARKET PRICE PER

SHARE

146 154 166 200 122.80

RATIO 0.12 0.13 0.055 0.031 0.049

INFERENCE:-

This is the capitalization rate at which the stock market capitalizes the

value of current earnings. The yield is expressed in terms of the market price of the share.

It serves as a guiding ratio for the intended investors.

4.> DIVIDEND YIELD RATIO:-

47

EARNINGS

PER SHARE

EARNINGS YIELD RATIO =

-----------------------------------

MARKET

PRICE PER SHARE

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

48/111

Rs. In millions

YEAR 2005 2006 2007 2008 2009

DIVIDEND PER SHARE 2.5 4 2 2 1

MARKET PRICE PER SHARE 146 154 166 200 122.80

RATIO 1.71% 2.60% 1.25% 1% 0.81%

INFERENCE:-

This ratio compares the dividend per share to market price of the share. This ratio is a

very important for investors who purchase their shares in open market; they will evaluate

their returns against investment done i.e. the market price paid by them. The higher the

ratio more will be the investments. In the above chart it is advisable to increase the ratio.

ACTIVITY RATIO:-1.> WORKING CAPITAL TURNOVER RATIO:-

48

DIVIDEND PER

SHARE

DIVIDEND YIELD RATIO =

-------------------------------------------- x 100

MARKET PRICE PER

SHARE

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

49/111

Rs. In millions

INFERENCE:-

This ratio compares the net sales with the net working capital of the

business firm. This ratio indicates number of times working capital is turned around a

particular period. The higher the ratio, the better is utilization of the working capital and

also indication of lower working capital. However a very high ratio is a sign of over

trading and a firm may face shortage of working capital. In the above chart it shows an

upward trend hence it is favorable for the firm.

NOTE: - NET WORKING CAPITAL=CURRENT ASSETS CURRENT LIABILITIES

2.> DEBTORS TURNOVER RATIO:-

49

YEAR 2005 2006 2007 2008 2009

NET SALES 12618856 15307126 20694761 23723049 22732435

NET WORKING CAPITAL 973649 1030157 1245202 1002718 1959200

RATIO 12.96 14.86 16.62 23.66 11.60

NET

SALES

WORKING CAPITAL TURNOVER RATIO =

---------------------------------------

NET

WORKING CAPITAL

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

50/111

Rs. In millions

NOTE: -

AVERAGE ACCOUNTS RECEIVABLE =

OPENING DEBTORS, BILLS RECEIVABLE + CLOSING DEBTORS,

BILLS RECEIVABLE

2

DEBTORS COLLECTION PERIOD:-

50

YEAR 2005 2006 2007 2008 2009

CREDIT SALES 12618856 15307126 20694761 23723049 22732435

AVERAGE DEBTORS 2040498 2641021 3488407.5 3728544 2924316

RATIO 6.18 5.80 5.93 6.36 7.77

CREDIT SALES

DEBTORS TURNOVER RATIO =

-----------------------------------------

AVERAGE

ACCOUNTSRECEIVABLE

12MONTHS

DEBTORS COLLECTION PERIOD =

-------------------------------------

DEBTORS

TURNOVER RATIO

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

51/111

Rs. In millions

YEAR 2005 2006 2007 2008 2009

MONTHS 12 12 12 12 12

DEBTORS TURNOVER RATIO 6.18 5.80 5.93 6.36 7.77

DEBTORS COLLECTION

PERIOD

1.94 2.06 2.02 1.89 1.54

INFERENCE:-

This ratio indicates the efficiency of the firm in collecting its

receivables from its customers to whom the firm has sold on credit. It also indicates how

quickly the debtors are turned into cash. The higher the ratio lower is the collection

period, on the other and lower the ratio higher will be the collection period. In the above

charts the debtors turnover ratio should be increased to reduce the collection period.

3.> CREDITORS TURNOVER RATIO: -

51

CREDIT

PURCHASES

CREDITORS TURNOVER RATIO =

--------------------------------------------

AVERAGE

ACCOUNTS PAYABLE

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

52/111

Rs. In millions

NOTE: -

AVERAGE ACCOUNTS PAYABLE =

OPENING CREDITORS, BILLS PAYABLE +CLOSING CREDITORS, BILLS PAYABLE

2

CREDITORS PAYMENT PERIOD:-

52

YEAR 2005 2006 2007 2008 2009

CREDIT PURCHASES 9994581 8213011 13792882 15739044 15294648

AVERAGE CREDITORS 1608077.5 2017569.5 2714362.5 3521925 2454362

RATIO 6.22 4.07 5.08 4.47 6.23

12MONTHS

CREDITORS PAYMENT PERIOD =

--------------------------------------------

CREDITORSTURNOVER RATIO

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

53/111

Rs. In millions

INFERENCE:-

The Creditors Turnover Ratio indicates the credit period allowed by

the creditors to the firm. A high turnover ratio indicates that the payment to the creditors

is quite prompt but it also implies that the firm is not taking full advantage of the credit

allowed by the creditors. A lower ratio indicates that there is not much promptness in

payment made to creditors and needs to be improved. In the above charts creditors

turnover ratio and creditors payment period is favorable for the firm.

4.> INVENTORY TURNOVER RATIO :-

53

YEAR 2005 2006 2007 2008 2009

MONTHS 12 12 12 12 12

CREDITORS TURNOVER RATIO 6.22 4.07 5.08 4.47 6.23CREDITORS PAYMENT PERIOD 1.93 2.95 2.36 2.68 1.93

COST OF

GOODS SOLD

INVENTORY TURNOVER RATIO =

-----------------------------------

AVERAGE

INVENTORY

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

54/111

NOTE: -

AVERAGE INVENTORY =

OPENING INVENTORY + CLOSING INVENTORY

---------------------------------------------------------------------

2Rs. In millions

YEAR 2005 2006 2007 2008 2009

COST OF GOODS SOLD 9994581 8213011 13792882 15739044 15294648

AVERAGE INVENTORY 803576 987743 1296473.5 1712016.5 1238798

RATIO 12.44 8.31 10.64 9.19 12.35

INVENTORY HOLDING PERIOD:-

54

12MONTHS

INVENTORY HOLDING PERIOD =

------------------------------------------

INVENTORY

TURNOVER RATIO

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

55/111

Rs. In millions

YEAR 2005 2006 2007 2008 2009

MONTHS 12 12 12 12 12

IVENTORY TURNOVER RATIO 12.44 8.31 10.64 9.19 12.35

INVENTORY HOLDING PERIOD 0.96 1.44 1.13 1.31 0.97

INFERENCE:-

This ratio establishes the relationship between the cost of goods sold

during a given period and the average amount of inventory held during that period. The

higher ratio is better as it shows the rapid turnover of stock and consequently shorter

holding period, on the other hand if the ratio is lower indicate that the stock is slow

moving and there is longer holding period. In the above chart inventory turnover ratio is

showing a downward trend, hence it should be increased to reduce the holding period.

5.> FIXED ASSETS TURNOVER RATIO:-

55

NET

SALES FIXED ASSETS TURNOVER RATIO =

-----------------------------

NET

FIXED ASSETS

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

56/111

Rs. In millions

YEAR 2005 2006 2007 2008 2009

NET SALES 12618856 15307126 20694761 23723049 22732435

NET FIXED ASSETS 1446872 1922205 3321990 7108963 6729785

RATIO 8.72 7.96 6.23 3.34 3.38

NOTE: - NET FIXED ASSETS= COST OF ASSETS DEPRECIATION

INFERENCE:-

This ratio indicates the amount of sales realized per rupee of investment in

fixed assets. This ratio is more important in manufacturing concerns, as it indicates the

utilization of fixed assets. The higher the ratio higher will be the amount of sales

generated per rupee of investment in fixed assets. In the above chart it is advisable to the

firm to increase the ratio, which will result in higher amount of turnover.

5.> SALES TO CAPITAL EMPLOYED :-

56

NET SALES

SALES TO CAPITAL EMPLOYED =

-------------------------------

CAPITAL

EMPLOYED

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

57/111

Rs. In millions

INFERENCE:-

It indicates the frequency with which sales are generated in relationto capital employed. Higher the ratio, the better it is as it will indicate better utilization of

capital employed, which will result in higher amount of turnover. In the above chart the

ratio should be increased.

NOTE: -NET SALES= TOTAL SALES RETURN INWARD

CAPITAL EMPLOYED = SHARE HOLDERS FUNDS + LONG TERM LIABILITY

6.> TOTAL ASSETS TURNOVER RATIO:-

57

YEAR 2005 2006 2007 2008 2009

NET SALES 12618856 15307126 20694761 23723049 22732435

CAPITAL EMPLOYED 6137998 7853752 9576638 12578828 13090696

RATIO 2.05 1.95 2.16 1.89 1.74

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

58/111

Rs. In millions

YEAR 2005 2006 2007 2008 2009

SALES 12618856 15307126 20694761 23723049 22732435

TOTAL ASSETS 9154254 12185560 15111223 19327629 18268538

RATIO 1.38 1.26 1.37 1.23 1.24

INFERENCE:-

This ratio indicates the amount of sales realized per rupee of investment

in total assets. This ratio is more important in manufacturing concerns, as it indicates the

utilization of total assets. The higher the ratio higher will be the amount of sales generated

per rupee of investment in assets. In the above chart it is advisable to the firm to increase

the ratio, which will result in higher amount of turnover.

CAPITAL STRUCTURE RATIOS:-

58

SALES

TOTAL ASSETS TURNOVER RATIO =

--------------------

TOTAL ASSETS

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

59/111

1.> CAPITAL GEARING RATIO:-

Rs. In millions

INFERENCE:-This ratio indicates the proportion between fixed charge bearing securities

and equity capital. A firm raises finance through owned funds and borrowed funds. A

firm will be considered to be highly geared, if the major portion of total capital is raised

through fixed charges bearing securities. In the above chart the ratio should be increased.

59

YEAR 2005 2006 2007 2008 2009

INTEREST 69802 97367 144024 197054 375953

EQUITY SHAREHOLDERS FUNDS 5620755 7183745 8513490 9149913 9600845

RATIO 0.012 0.013 0.016 0.021 0.039

FIXED CHARGES

BEARING SECURITIES

CAPITAL GEARING RATIO =-----------------------------------------------------

EQUITY

SHAREHOLDERS FUNDS

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

60/111

2.> DEBT-EQUITY RATIO:-

Rs. In millions

INFERENCE:-

This ratio indicates the proportion of borrowed funds to proprietorsfunds. Ideally this ratio should be 2:1 which means that the debt should be twice the

owned capital, if it is less than 2:1 will indicate that firm is not taking any risk. As Debt

Equity Ratio is less than the ideal ratio hence it is advisable to increase this ratio to be in a

more favorable position.

60

YEAR 2005 2006 2007 2008 2009

LONG-TERM DEBT 517243 670007 1063148 3428915 348985

1

SHARE-HOLDERS FUNDS 5620755 7183745

8513490 9149913 9600845

RATIOS 0.09 0.09 0.12 0.37 0.36

LONG-TERM DEBT

DEBT-EQUITY RATIO =

---------------------------------SHARE-HOLDERS

FUNDS

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

61/111

3.> INTEREST COVERAGE RATIO :-

Rs. In millions

INFERENCE:-

This ratio measures how ably the firm can meet its interest obligations. It

describes how well and how easily the firm can service its debt. The higher the ratio the

better is the ability of the firm to discharge its interest expense. In the above chart it

shows a downward trend, hence should be improved.

61

YEAR 2005 2006 2007 2008 2009

EBIT 2082580 2557062 2539044 2071130 2116026

INTEREST 69802 97367 144024 197054 375953

RATIO 29.84 26.26 17.63 10.51 5.63

EARNINGS BEFORE

INTEREST & TAXES

INTEREST COVERAGE RATIO =

---------------------------------------------------

EARNINGS

BEFORE TAXES

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

62/111

DU-PONT ANALYSIS

A method of performance measurement that was started by the DuPont Corporation of

USA in the 1920s, and has been used by them ever since. With this method, assets are

measured at their gross book value rather than at net book value in order to produce a

higher Return on Investment (ROI). It is system of financial analysis, which has received

very good recognition and acceptance world-wide. DuPont analysis helps locate the part

of the business that is underperforming. DuPont analysis tells us that ROE is affected

by three things:-

Operating efficiency, this is measured by profit margin.

Asset use efficiency, which is measured by total asset turnover.

Financial leverage, which is measured by the equity multiplier.

The higher the result the higher will be the return on equity.

Du-Pont analysis divides a particular ratio into components and studies the effect of each

and every component on the ratio. Comparative analysis gives an idea where a firm

stands across the industry and studies the financial trends over a period of time.

FORMULA:-

62

RETURN ON EQUITY = NET PROFIT MARGIN x ASSETS TURNOVER

RATIO x EQUITY MULTIPLIER

ASSETS

EQUITY MULTIPLIER = --------------------------------

EQUITY SHAREHOLDERS

RETURN ON ASSETS = NET PROFIT MARGIN (RATIO) x TOTAL ASSETS

TURNOVER RATIO

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

63/111

COMPARATIVE ANALYSIS OF RETURN ON ASSETS (INVESTEMENT)

Rs. In millions

PARTICULARS 2005 2006 2007 2008 2009

NET PROFITRATIO

13.78 % 13.10 % 8.62 % 5.01% 5.10%

TOTAL

ASSETS

TURNOVER

RATIO

1.38 1.26 1.37 1.23 1.24

RETURN ON

ASSETS

19 17 12 6 6

COMPARATIVE ANALYSIS OF RETURN ON EQUITY:-Rs. In millions

PARTICULARS 2005 2006 2007 2008 2009

NET PROFIT

RATIO

13.78 % 13.10 % 8.62 % 5.014 % 5.10%

TOTAL ASSETS

TURNOVER

RATIO

1.38 1.26 1.37 1.23 1.24

EQUITY

MULTIPLIER

1.63 1.70 1.78 2.11 1.90

RETURN ON 40 28 21 13 12

63

NET PROFIT

NET PROFIT RATIO = --------------------

NET SALES

SALES

TOTAL ASSETS TURNOVER RATIO = ---------------------

TOTAL ASSETS

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

64/111

EQUITY

DU-PONT ANALYSIS TREE DIAGRAM FOR RETURN ON ASSETS(INVESTEMENT):-

64

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

65/111

DU-PONT ANALYSIS TREE DIAGRAM FOR RETURN ON

EQUITY:-

INFERERNCE:-

In Du-Pont Analysis the higher the result the higher will be the return on

equity. In the above calculation it shows a downward trend of returns in both the cases in

65

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

66/111

Return on Assets and Return on Equity which is not favorable for the company. Hence it

is advised to firm to increase the sales and the surplus on sales.

LEVERAGES

Leverage represents a power or an influence of one financial variable

over the other related financial variable. Leverages are classified into three

categories namely, Operating Leverage, Financial Leverage and Combined

Leverage. Generally, it is said that one leverage should be low accompanied by the

other high leverage. If operating leverage is on lower side, financial leverage can

be kept on higher side by employing more debt in the capital structure.

There are three types of leverages they are as follows:-

OPERATING LEVERAGE: -

The Operating Leverage measures the change in the

earnings before interest and tax as a result of change in sales. This leverage is because of

fixed cost in the cost structure. A higher operating leverage indicates that the proportion

of fixed cost is higher, but atthe same time it cannot be overlooked that if sales decrease,

the earnings before interest and tax will decrease at higher rate. Therefore operating

leverage is said to be a double edged weapon.

66

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

67/111

FINANCIAL LEVERAGE:-

The Financial Leverage measures the percentage change in

earnings before tax as a result of changes in earnings before interest and tax. Financial

Leverage will be higher if the difference between earnings before interest and tax and

earnings before tax is higher. This difference will be higher if amount of interest is high.

Therefore it indicates the proportion of debt in capital structure is high or low. The

financial leverage helps to identify the financial risk.

COMBINED LEVERAGE:-

The Combined Leverage expresses the relationship betweencontribution and the taxable income. It helps in finding out the resulting percentage

change in taxable income on account of percentage change in sales

FORMULA:-

67

CONTRIBUTION

OPERATING LEVERAGE =

--------------------------------------------------EARNINGS BEFORE

INTERST AND TAX

EARNINGS BEFORE

INTERST AND TAX

FINANCIAL LEVERAGE =

-----------------------------------------------------

EARNINGS

BEFORE TAX

CONTRIBUTION

EARNINGS BEFORE INTERST AND TAX

COMBINED LEVERAGE = ------------------------------------------ x

-----------------------------------------------

EARNINGS BEFORE INTERST AND TAX

EARNINGS BEFORE TAX

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

68/111

COMPARATIVE STATEMENT OF LEVERAGES

INCOME STATEMENT

Rs. In millions

PARTICULARS 2005 2006 2007 2008 2009

SALES 12618856 15307126 20694761 23723049 22732435

LESS: VARIABLE

COST

10245906.4

2

12782121.2

5

17644122.2

2

20028459.8

3

18444347.28

CONTRIBUTION 2372949.58 2525004.75 3050638.78 3694589.17 4288087.72

LESS : FIXED

COST

1886486.73 1957684.39 2363709.70 2860917.86 2523012.95

EARNINGS

BEFORE

INTEREST AND

TAX

486462.9 567320.4 686929.1 833671.3 1765074.77

LESS: INTERST 69802 97367 144024 197054 375953

EARNINGS

BEFORE TAX

416660.9 469953.4 542905.1 636617.3 1389121.77

LESS: TAX 273832 453821 510930 600560 646508

EARNINGS

AFTER TAX

142828.9 16132.4 31975.1 36057.3 742613.77

LEVERAGESRs. In millions

PARTICULARS 2005 2006 2007 2008 2009

OPERATINGLEVERAGE 4.88 4.45 4.44 4.43 2.43

FINANCIAL

LEVERAGE

1.17 1.21 1.27 1.31 1.27

COMBINED

LEVERAGE

5.70 5.37 5.62 5.80 3.09

68

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

69/111

INFERENCE: -

Operating Leverage:-In the above calculation operating leverage is very high and shows a downward trend but

it is still not favorable as fixed cost is very high. Hence it is advised to reduce operating

leverage to some extent.

Financial Leverage:-

In the above calculation of financial leverage it has shown an upward

trend but it is still favorable for the firm.

Combined Leverage:-

In the above calculation combined leverage is very high and shows an

upward trend which is not favorable for the firm hence, should be reduced to some extent.

69

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

70/111

FUNDS FLOW ANALYSIS

DEFINITION:-

R. A. FOILKE A statement of sources and application of funds is a technical device

designed to analyse the changes in the financial condition of a business enterprise

between dates.

ANTHONY R.N. The fund flow analysis describes the sources from which additional

funds are derived and the use to which these funds were put.

MEANING:-

For the success of any business enterprise, it is but essential that there must be

a regular and smooth flow of funds for efficient conduct of all business operations.

Therefore, a statement showing the flow of funds is prepared to summarise for a given

period the resources made available to finance the activities of an enterprise and the uses

to which such resources have been put to. This statement helps in measuring and

assessing the financial soundness of the business at a particular date. It comprises of two

important words fund and 'flow. The concept of funds flow refers to the changes in

working capital through the sale and purchase of fixed assets, issue of shares and

debentures of floating of long term loans and their redemption and their reflection in the

increase or decrease of current assets and current liabilities. Funds flow statement

analysis helps to examine the liquidity position, its effect on current and futureprofitability and generation of funds in the organization. Lack of liquidity would not only

threaten the short term solvency of the organization but also the long-term survival of the

concern.

SPECIMEN OF FUND FLOW STATEMENT

SOURCES OF FUNDS APPLICATION OF FUNDS

Issue of shares Repayment of loans

Issue of debentures Redemption of debentures

Funds from operation Redemption of preference sharesSale of fixed assets Purchase of fixed assets

Long term loan taken Payment of dividends

Short term loan taken Payment of tax

Income from investments Increase in working capital

Sale of investments Operating loss

Decrease in working capital Loss by embezzlement

Commission received Cost in legal action

Compensation received

Damage received in legal action

Total Total

70

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

71/111

COMPARATIVE FUNDS FLOW STATEMENT FOR FIVE YEARS:-

Rs. In millions

PARTICULARS 2005 2006 2007 2008 2009

SOURCES OF FUNDS

SHARE CAPITAL NIL NIL NIL 194173 450932

LOAN TAKEN (SECURED) 233899 153428 325898 2433488 61655

LOAN TAKEN (UNSECURED) NIL NIL 67243 NIL NIL

DEFFERED TAX LIABILITY 17190 30821 66930 131778 20921

INVESTMENT SOLD NIL NIL NIL 410521 44515

FUNDS FROM OPERATION 2219886 2398315 1377042 1517509 1813475

TOTAL 2470975 2582564 1837113 4687469 2391498

APPLICATION OF

FUNDS

LOAN REPAID (SECURED) NIL NIL NIL NIL NIL

LOAN REPAID (UNSECURED) 13870 664 NIL 67721 719

FIXED ASSETS PURCHASED 351100 618753 471294 3908061 88740

CAPITAL W.I.P 60562 99687 344329 76532 467918INVESTMENT PURCHASED 1769824 1214734 174986 NIL NIL

GRATUITY PAID 20348 25045 10244 41129 63664

COMPENSATED ABSENCES 145645 169316 177529 189588 306672

PENSION & OTHER

RETIREMENT BENEFITS

NIL 13610 12590 8578 75134

WARRANTY CLAIMS PAID NIL 122813 170449 164991 204996

TAX PAID NIL NIL NIL NIL NIL

DIVIDEND PAID 97087 145630 194173 194173 194173

TAX PAID ON DIVIDEND 12439 20425 27233 33000 33000

NET INCREASE IN WORKING

CAPITAL

100 151887 254286 3696 956482

TOTAL 2470975 258256

4

1837113 4687469 2391498

71

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

72/111

INFERENCE:-

Funds flow statement is the report on the movement of funds

explaining how and from where the funds have been generated during the

year and the uses to which the funds have been applied during the year. In

other words, it is a technical device designed to highlight the changes that

have occurred in assets and liabilities between two balance-sheet dates. It

identifies the changes that have taken place and brings out their impact on

the liquid resources of the business.

CHANGES IN WORKING CAPITAL:-

In funds flow statement net increase in

working capital is shown on application side, while net decrease

in working capital is shown on the sources side. Any increase in

current assets result in increase of working capital, while

increase in current liabilities result in decrease in working

capital. In the above funds flow statement working capital is

showing an upward trend which means increase in current

assets which is favorable for the firm, but the stock-out or

shortage situation must be avoided.

FUNDS FROM OPERATION:-

In calculating funds from operation,

non-business expenses like dividend paid, taxes paid etc. or non

cash expenses like depreciation are added back in the net

profits. Similarly, non-cash as well as non-business expenses

are deducted from net profits. In the above statement of funds

flow, funds from operation has shown a decreasing trend which

is not favorable for the firm as its core business profits are

declining hence it is advisable to increase funds from operation.

72

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

73/111

CASH FLOW ANALYSIS

Cash Flow Statement is a statement which indicates sources

of cash inflows and transactions of cash outflows of a firm during an accounting period.

The activities which generate cash inflows are known as sources of cash and activities

which cause cash outflows are known as uses or application of cash. It is appropriately

termed as Where Got Where Gone Statement

The Institute of Chartered Accountants of India (ICAI)

issued Accounting Standard-3 (AS-3) relating to the preparation of cash flow statement

for accounting period commencing on or after April 1, 2000 for enterprise which:-

Have turnover of more than Rs 50 crore.

Is listed in stock exchange (in India or outside India).

Are in the process of listing their equity or debt securities as evidenced by the

board of directors resolution in this regard.

Cash happens to be the most liquid of all the current assets. Itis this liquid asset which constitutes the medium of exchange. Every financial transaction

has an ultimate effect on cash at some time or the other. A large cash holding reduces

profitability. Similarly, inadequate cash holdings would have effect on liquidity and

therefore on profitability. Cash flow statement analysis can therefore be helpful in the

examining the cash effect of financial transactions. It reveals the complete story of cash

movements. It helps to know the reasons for low cash balance inspite of high profits and

high cash balance inspite of low profits. It also helps to understand at what point of time

during the period there was idle cash or excessive cash holdings or inadequate cash.

Appropriate steps can therefore be ensured to correct such situations.

Objectives of cash flow statement:-

To identify the causes of increase or decrease in the cash position of the firm

during the specific period.

To understand the cash generated on account of business operations during the

year.

73

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

74/111

To understand the cash impact on the current assets and current liabilities during

the year.

To understand the investment and financing pattern followed during the year.

To ensure necessary action for maintenance of adequate liquidity.

To help in the projection of future cash flows.

Uses of cash flow statement:-

Payment of dividend in cash.

Repayment of borrowings.

Redemption of preference shares in cash.

Purchase of fixed assets.

Acquisition of other current assets as securities.

Payment to creditors.

Adapt to changing circumstances and opportunities.

Assessing the ability of the company.

Enhances comparability.

To know how much cash is generated from business.

To know the liquidity position.

There are two methods of cash flow:-

74

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

75/111

COMPARATIVE CASH FLOW STATEMENT

Rs. In millions

75

-

8/8/2019 Project of Ruchi BhavsarFINAL PROJECT REPORT

76/111

76

PARTICULARS 2005 2006 2007 2008 2009

Profit before tax 2012778 2459695 2395020 1874076 1805438

ADD:-

DEPRECIATION 266465 279720 318070 437188 802727

LEASEHOLD LAND WRITTEN

OFF

44 44 44 1372 1357

LOSS ON ASSETS SOLD,DEMOLISHED,DISCARDED &

SCRAPPED

1796 1300 6993 7797 8161

LOSS ON SALE OF INVESTMENT NIL NIL NIL NIL 1098

WRITTEN DOWN OF OBSOLETE

& NON-MOVING COMPONENT

18885 7288 7490 103583 69055

BAD DEBTS & IRRECOVERABLE

BALANCES WRITTEN OFF

30708 38919 -115 15318 65547

PROVISIONS FOR DOUBTFUL

DEBTS & ADVANCES

-10706 20968 9176 53331 44982

INTEREST PAID 31636 59076 89367 128603 316924

VRS COMPENSATION PAID 2083 767 325 14648 32761Total 348798 408082 431350 761840 1342612

LESS:-

PROFIT ON SALE OF

UNDERTAKING

NIL NIL 3329 NIL 65365

PROFIT ON SALE OF

INVESTMENT

1133176 974941 190899 NIL NIL

PROFIT ON SALE OF MUTUAL

FUNDS

1760 1703 6980 30812 4417

SURPLUS ON SALE OF ASSETS 5417 32087 128783 28216 7371

INTEREST RECEIVED 12942 15355 10742 5732 1884

DEBITS(EXPENSES)PERTAININGTO EARLIER YEARS

377 192 66 NIL NIL

SUNDRY CREDIT BALANCES

APPROPRIATED

3552 8654 8953 8000 25799

PROVISIONS NO LONGER

REQUIRED WRITTEN BACK

18398 45989 68690 45977 42775

DIVIDEND RECEIVED 191266 257190 422672 126283 126520

LEASE EQUILASITION 19426 -11754 -87417 NIL NIL

Total 1386314 1324357 783660 245020 274131

OPERATING PROFIT BEFORE

WORKING CAPITAL CHANGES

975262 1543420 2042710 2390896 2873919

ADJUSTMENTS FOR:-

TRADE & OTHER RECEIVABLES -384504 -1053007 -888410 -276924 -134553

INVENTORIES -143976 -250530 -437128 -560450 511392

TRADE PAYABLES 426492 1274168 1308694 978007 -1963511

-101988 -29369 -16844 140633 -1586672

CASH GENERATED FROM

OPERATIONS

873274 1514051 2025866 2531529 1287247

VRS COMPENSATION PAID -2083 -767 -325 -14648 -32761

NET CASH GENERATED FROM

OPERATIONS

871191 1513284 2025541 2516881 1254486

DIRECT TAXES -248135 -430047 -648580 -473780 -597665

NET CASH FLOW FROM

OPERATING ACTIVITIES

623056 1083237 1376961 2043101 656821