Principles of insurance

-

Upload

devrshi420 -

Category

Documents

-

view

8 -

download

0

Transcript of Principles of insurance

INSURANCE

Insurance is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. An insurer is a company selling the insurance.The insured, or policyholder, is the person or entity

buying the insurance policy. The amount to be charged for a certain amount of

insurance coverage is called the premium.

Insurance governed acts

1) The insurance Act, 1938

2) The life insurance corporation Act, 1956

3) The Marine Insurance Act, 1963

4) The General Insurance Business Act, 1972

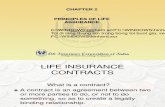

Contract of Insurance

Is a contract whereby the insurer undertakes to make good the loss of another called the insured by payment of some money to him on the happening of a specific event.

Insurable Risk

The law of large number.

The loss produced by the risk must be definite.

The loss must be fortuitous or accidental.

The loss must not be catastrophic.

Criteria of determination of whether a risk can be insured or not

The risk must arise out of the ordinary course of business and it should not be artificially created by parties.

The risk must be common enough to justify its spreading at a nominal cost.

There must be an element of uncertainty as to the occurrence of risk or the time of the occurrence.

The party must have some real interest in avoiding the risk.

Types of insurance

1) Personal or Life insurance

2) Property insurance

3) Liability insurance

4) Guarantee insurance

Fundamental principles of insurance

1) Essential elements of a valid contract. There must be contract between two parties i.e.

insurer and insured. The contract must be in writing. The insurance policy is printed, stamped, signed

my the insurer and handed over to the insured. It should have a valid offer, acceptance and

consideration. There should be a lawful object.

Contd…

2) Principle of co-operation and probability.3) Utmost good faith.4) Indemnity.5) Contingent contract.6) Insurable interest.7) Aleatory contract.8) Term of policy.

Contd…

9) Commencement of risk.10)Premium. 11)Causa proxima.12)Mitigation of loss.13)Contribution.14)Subrogation.15)Reinsurance.16)Double insurance.

Distinction b/w double insurance and reinsurance

Double insurance Reinsurance

Risk The same risk and same subject in insured by the policy holder.

The transfer of part of the risk by the insurer.

Extent of liability of the

insurer

The loss will be shared by all the insurers.

The re-insurer will be liable for a proportion of part of the loss.

To whom liable

Each insurer is directly liable to the policy holder.

The re-insurer is liable only to the first insurer.

Object It is a method of assuring the benefit of insurance.

It is a method of reducing of the risk of the insurer.

Wager

The meaning of ‘wagering’ is staking something of value upon the result of some future uncertain event, such as a horse race, or upon the ascertainment of the truth concerning some past or present event.

An agreement under which each bettor pledges a certain amount to the other depending on the outcome of an unsettled matter.

A matter bet on; a gamble.Something staked on an uncertain outcome.A pledge of personal combat to resolve an issue

or case.

Ingredients of a wager contract

1) It can relate to part, present or future act or event.

2) One party is to win and the other party is to lose upon the determination of the event.

3) There shall be two persons either to whom stands to win or lose

4) Stake is the only interest between the two parties. They have no real interest in the subject matter.

Similarities b/w a contract of insurance and wager

1) Uncertainty: In both uncertainty is involved.

2) Amount :In both money plays an important role.

3) Speculation :both depends upon happening or non-happening of speculative events.

Return of premium

There are circumstances which make the contract of insurance void or even voidable. The contract of insurance is voidable when the affected party has opted to avoid the contract. This usually happens when the consideration has failed.

Circumstances when the insurer is bound to return the premium

1) No risk – no premium.2) Doctrine of pari delicto.3) Frustration and impossibility.4) Non-disclosure of fact or mistake.5) Fraud by the insurer.6) Ignorance of the fact.7) Fraud played by the insurance agent.8) Cancellation/rescission.9) Ultra vires the insurance company.10)Surrender of the policy.