Principles of Insurance Law

-

Upload

prajol-joshi -

Category

Documents

-

view

224 -

download

0

Transcript of Principles of Insurance Law

-

8/6/2019 Principles of Insurance Law

1/43

PRINCIPLES OF INSURANCEPRINCIPLES OF INSURANCE

LAWLAW

-- DR. ANIL RAJ BHATTARAIDR. ANIL RAJ BHATTARAIDIRECTOR,DIRECTOR,

INSURANCE BOARDINSURANCE BOARD

-

8/6/2019 Principles of Insurance Law

2/43

NATURE OF RISKNATURE OF RISK

The starting point for any course onThe starting point for any course oninsurance must be the concept ofinsurance must be the concept ofriskrisk

itself and our understanding of it.itself and our understanding of it.Risk implies some form of uncertaintyRisk implies some form of uncertainty

about an outcome in a given situation.about an outcome in a given situation.

-

8/6/2019 Principles of Insurance Law

3/43

PURE RISKPURE RISK

-- Loss or breakLoss or break--even situationeven situation-- Pure risks involve a loss or, at breakPure risks involve a loss or, at break--

even situation. The outcome can only beeven situation. The outcome can only beunfavorable to us or leave us in the sameunfavorable to us or leave us in the sameposition as we enjoyed before the eventposition as we enjoyed before the eventoccurred .occurred .--The risk of a motor accident, fire at aThe risk of a motor accident, fire at a

factory, theft of goods from a store, injuryfactory, theft of goods from a store, injuryat work are all pure risks, with no elementat work are all pure risks, with no elementof gain.of gain.

-

8/6/2019 Principles of Insurance Law

4/43

SPECULATIVE RISKSPECULATIVE RISK

-- Loss breakLoss break--even or gaineven or gain

-- The alternative to this speculative risk,The alternative to this speculative risk,

where there is the chance of gain.where there is the chance of gain.-- Investing money in shares is a goodInvesting money in shares is a goodexample.example.

-- The investment may result in a loss orThe investment may result in a loss or

possibly a breakpossibly a break even position, but theeven position, but thereason it was made was the prospect ofreason it was made was the prospect ofgain.gain.

-

8/6/2019 Principles of Insurance Law

5/43

BACK GROUND OF INSURANCEBACK GROUND OF INSURANCE

Man has always sought protection from groupMan has always sought protection from groupwhich in fact compelled him to live in groups.which in fact compelled him to live in groups.

The origins of the modern insurance contractThe origins of the modern insurance contractare to be found in the practices adopted byare to be found in the practices adopted byItalian merchants from the fourteenth centuryItalian merchants from the fourteenth centuryonwards, although there is little doubt that theonwards, although there is little doubt that the

concept of insuring was known long beforeconcept of insuring was known long beforethen.then.

For a long time, the common law played littleFor a long time, the common law played littleor no part in the regulation of disputesor no part in the regulation of disputesconcerning insurance.concerning insurance.

-

8/6/2019 Principles of Insurance Law

6/43

INTRODUCTION:INTRODUCTION:

Without risk there is no insuranceWithout risk there is no insurance

Risk is the center point of insuranceRisk is the center point of insurance

Only the pure risk is the concern ofOnly the pure risk is the concern ofinsuranceinsurance

Thousands of risks are hanging overThousands of risks are hanging overmens headmens head

All risks are not transferable to insurersAll risks are not transferable to insurers He wants to share some risksHe wants to share some risks

Insurers are the sole body to share thoseInsurers are the sole body to share thosepure riskspure risks

-

8/6/2019 Principles of Insurance Law

7/43

Contd.Contd.

Insurance is a contract by which oneInsurance is a contract by which oneparty, for a compensation called theparty, for a compensation called the

premium, assumes particular risks ofpremium, assumes particular risks ofthe other party and promises to paythe other party and promises to payto him or his nominee a certain orto him or his nominee a certain orcontingency.contingency.

-

8/6/2019 Principles of Insurance Law

8/43

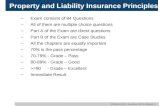

Accident 3D Loss Measured inmoney

Risksupon

Life

Property&

Third party

Death

Damage

Destroy

LifePropertyThirdparty

Insuranceindemnifies

1 2 3 4 5

6

-

8/6/2019 Principles of Insurance Law

9/43

INSURANCE COVERS RISKS OFINSURANCE COVERS RISKS OF

LifeLife

PropertyPropertyThird partyThird party

-

8/6/2019 Principles of Insurance Law

10/43

Insurance Regulation (Cont.)Insurance Regulation (Cont.)

Life Insurance:Life Insurance:--

Whole LifeWhole Life

EndowmentEndowmentTerm LifeTerm Life

-

8/6/2019 Principles of Insurance Law

11/43

-

8/6/2019 Principles of Insurance Law

12/43

ReinsuranceReinsurance

insurance of Insurance= Reinsurance of Insurance= Re--insuranceinsurance

The regulation has mention thatThe regulation has mention thatInsurer should ReInsurer should Re--insure all thoseinsure all thoserisks which are not retained by insurerrisks which are not retained by insurerhimself. Similarly the sub rule 6(2)himself. Similarly the sub rule 6(2)has mentioned that the types of Rehas mentioned that the types of Re--insurance can fixed by Nepalinsurance can fixed by NepalGovernment as advised by InsuranceGovernment as advised by Insurance

Board.Board.

-

8/6/2019 Principles of Insurance Law

13/43

DIFFERENCE BETWEENDIFFERENCE BETWEEN

LIFE AND NONLIFEINSURANCELIFE AND NONLIFEINSURANCE LIFELIFE

LONG TERM BASISLONG TERM BASIS

NOT APPLY INDEMNITYNOT APPLY INDEMNITY RETUN BACK TORETUN BACK TO

INSUREDINSURED

RETURNED WITH BONUSRETURNED WITH BONUS

RATE IS FIXDRATE IS FIXD SAVING PURPOSESAVING PURPOSE

NONLIFENONLIFE

ONE YEAR or LESSONE YEAR or LESS

THANTHAN

INDEMNITY APPLYINDEMNITY APPLY

NOT RETURNABLENOT RETURNABLE

BONUS NOT GIVENBONUS NOT GIVEN RATE IS NOT FIXRATE IS NOT FIX

INSOME CASESINSOME CASES

NOT SAVINGNOT SAVING

PURPOSEPURPOSE

-

8/6/2019 Principles of Insurance Law

14/43

PRINCIPLE OF INSURANCEPRINCIPLE OF INSURANCE

1.UTMOST GOOD FAITH1.UTMOST GOOD FAITH

2.INSURABLE INTEREST2.INSURABLE INTEREST

3.INDEMNITY3.INDEMNITY 4.SUBROGATION4.SUBROGATION

5.CONTRIBUTION5.CONTRIBUTION

6.MITTIGATION6.MITTIGATION

7.PROXIMATE CAUSE7.PROXIMATE CAUSE

-

8/6/2019 Principles of Insurance Law

15/43

Principle of InsurancePrinciple of Insurance

1. UTMOST GOOD FAITH1. UTMOST GOOD FAITH

-- Ordinary commercial contractsOrdinary commercial contracts --

CAVEAT EMPTOR (let the buyerCAVEAT EMPTOR (let the buyerbeware)beware)

-- Insurance contractInsurance contract UbereimaeUbereimaeFideiFidei

(utmost good faith)(utmost good faith)

-

8/6/2019 Principles of Insurance Law

16/43

MEANING OF UTMOST GOOD FAITHMEANING OF UTMOST GOOD FAITH

Each party to a proposal contract isEach party to a proposal contract islegally obliged to reveal the other alllegally obliged to reveal the other allinformation which would influence theinformation which would influence theothers decision to enter the contract,others decision to enter the contract,

whether such information is requestedwhether such information is requestedor not.or not.

-

8/6/2019 Principles of Insurance Law

17/43

BREACHES OF UTMOST GOODBREACHES OF UTMOST GOOD

FAITH:FAITH:

a)a) Non disclosureNon disclosure

b)b) ConcealmentConcealment

c)c) Fraudulent misrepresentationFraudulent misrepresentation

d)d) Innocent misrepresentationInnocent misrepresentation

-

8/6/2019 Principles of Insurance Law

18/43

2. INSURABLE INTEREST:2. INSURABLE INTEREST:

Subject matter of Insurance contracts:Subject matter of Insurance contracts:

InsuranceInsurance--a contract to indemnify the lossa contract to indemnify the loss

subject matter may besubject matter may be

a)a) Any property of financial value or,Any property of financial value or,

b)b) An element which create liabilityAn element which create liability

However, it is the interest of theHowever, it is the interest of theinsured on the subject matter which isinsured on the subject matter which is

insured .insured .

-

8/6/2019 Principles of Insurance Law

19/43

ContdContd

Castellain Vs. Preston (1883)Castellain Vs. Preston (1883) What is it that is insured in a fireWhat is it that is insured in a firepolicy ? Not the bricks and materialspolicy ? Not the bricks and materialsused in building the house, but theused in building the house, but theinterest of the insured in the subjectinterest of the insured in the subjectmatter of insurancematter of insurance

-

8/6/2019 Principles of Insurance Law

20/43

-

8/6/2019 Principles of Insurance Law

21/43

WHEN INSURABLE INTEREST MUST EXIST:WHEN INSURABLE INTEREST MUST EXIST:

a)a) Fire & Accident Insurance: At the time,Fire & Accident Insurance: At the time,the contract is affected and at the timethe contract is affected and at the timeof loss.of loss.

b)b) Marine Insurance: At the time of loss.Marine Insurance: At the time of loss.

c)c) Life insurance : At the time ofLife insurance : At the time ofcompletion of contract (not necessarilycompletion of contract (not necessarily

at the time of loss)at the time of loss)

-

8/6/2019 Principles of Insurance Law

22/43

3. INDEMNITY3. INDEMNITY

Restores the Insured to the sameRestores the Insured to the same

financial position after loss as he enjoyedfinancial position after loss as he enjoyedimmediately prior to loss (simply putimmediately prior to loss (simply putexact financial compensation).exact financial compensation).

-

8/6/2019 Principles of Insurance Law

23/43

Method of Providing Indemnity:Method of Providing Indemnity:

a)a) CashCash

b)b) ReplacementsReplacements

c)c) RepairRepair

d)d) Re installmentRe installment

-

8/6/2019 Principles of Insurance Law

24/43

4. SUBROGATION4. SUBROGATION

--Means the exercise of rights or remediesMeans the exercise of rights or remediespossessed by the another against thirdpossessed by the another against third

person.person.

--Rights acquired by Insurers once theyRights acquired by Insurers once theyprovide Indemnity to the insured.provide Indemnity to the insured.

--A corollary of IndemnityA corollary of Indemnity

-

8/6/2019 Principles of Insurance Law

25/43

5. Contribution:5. Contribution:

-- Doctrine which enables an insurer toDoctrine which enables an insurer tocall upon other insurers similarly (call upon other insurers similarly (but not equally ) liable to the samebut not equally ) liable to the sameinsured to share the cost of aninsured to share the cost of an

Indemnity paymentIndemnity payment-- A corollary to indemnityA corollary to indemnity-- Usually arises by accident rather thanUsually arises by accident rather than

designdesign

-- Only applies to contract of IndemnityOnly applies to contract of Indemnity(not Life & Personal accident )(not Life & Personal accident )

-

8/6/2019 Principles of Insurance Law

26/43

6. Proximate cause6. Proximate cause

Means nearest or proximate or immediateMeans nearest or proximate or immediatecause.cause.

It is helpful in deciding the actual causeIt is helpful in deciding the actual causeof loss when a number of causes haveof loss when a number of causes havecontributed to the occurrence of loss.contributed to the occurrence of loss.

-

8/6/2019 Principles of Insurance Law

27/43

7. MITIGATION7. MITIGATION

Mitigation of loss means to minimize orMitigation of loss means to minimize ordecrease the severity of the loss.decrease the severity of the loss.

It is the duty of the insured to act to minimizeIt is the duty of the insured to act to minimizethe loss.the loss.

Under this doctrine it is prescribed thatUnder this doctrine it is prescribed thatwhenever the insured event occurs, it shall bewhenever the insured event occurs, it shall be

the duty of the insured to take all such steps tothe duty of the insured to take all such steps tominimize the loss as would have been taken byminimize the loss as would have been taken byany person who is not insured.any person who is not insured.

-

8/6/2019 Principles of Insurance Law

28/43

Meaning and coverage of MotorMeaning and coverage of Motor

Vehicle InsuranceVehicle Insurance

For the purpose of insurance MotorFor the purpose of insurance MotorVehicle is defined as the mechanicallyVehicle is defined as the mechanically

self propelled vehicle adapted for useself propelled vehicle adapted for useupon roads.upon roads.

Motor Insurance is the insurance ofMotor Insurance is the insurance of

Motor vehicleMotor vehicle

-

8/6/2019 Principles of Insurance Law

29/43

CLASSIFICATION OF VEHICLESCLASSIFICATION OF VEHICLES

For the purpose of insurance , motorFor the purpose of insurance , motorvehicles are classified in 3 categoriesvehicles are classified in 3 categories

a)a) Private vehiclePrivate vehicle

b)b) Commercial vehicleCommercial vehicle

c)c) Others vehicleOthers vehicle

-

8/6/2019 Principles of Insurance Law

30/43

SALIENT FEATURES OF MOTORSALIENT FEATURES OF MOTOR

VEHICLE INSURANCEVEHICLE INSURANCE

--Limited geographical regionLimited geographical region

--The liability of insurance companyThe liability of insurance company

does not commence until thedoes not commence until theinsurance proposal is accepted byinsurance proposal is accepted bythe company and premiumthe company and premium

-- By means of the cover of risks, 3By means of the cover of risks, 3types of insurance policies aretypes of insurance policies areavailable.available.

-

8/6/2019 Principles of Insurance Law

31/43

ContdContd

Comprehensive Insurance (vehicleComprehensive Insurance (vehicledamage + Third Party Liability)damage + Third Party Liability)

Third Party Liability (TPL) onlyThird Party Liability (TPL) onlyThird party Liability + Theft or fire orThird party Liability + Theft or fire or

bothboth

-

8/6/2019 Principles of Insurance Law

32/43

Limitation of TPL ClaimLimitation of TPL Claim

AA IN MOTORCYCLEIN MOTORCYCLE NOWNOW

a. Physical Lossa. Physical Loss Rs. 25,00,000/Rs. 25,00,000/

b. Property Lossb. Property Loss Rs. 25,00,000/Rs. 25,00,000/

BB Pvt. VehiclePvt. Vehicle

a. Physical Lossa. Physical Loss Rs. 80,00,000/Rs. 80,00,000/

b. Property Lossb. Property Loss Rs. 80,00,000/Rs. 80,00,000/

CC Commercial VehicleCommercial Vehiclea. Physical Lossa. Physical Loss Rs. 50,00,000/Rs. 50,00,000/

b. Property Lossb. Property Loss Rs. 50,00,000/Rs. 50,00,000/

-

8/6/2019 Principles of Insurance Law

33/43

Insurance coverage For Staff ofInsurance coverage For Staff of

VehicleVehicle11 DeathDeath Rs. 5,00,000/Rs. 5,00,000/

22 DisableDisable Rs 5,00,000/Rs 5,00,000/

33 FuneralsFunerals Rs.25,000/Rs.25,000/

44 KuruwaKuruwa Rs. 15,000/Rs. 15,000/

55 Medical Facilities (WhicheverMedical Facilities (Whichevernecessary and as per Bills)necessary and as per Bills)

Rs.1,00,000/Rs.1,00,000/

-

8/6/2019 Principles of Insurance Law

34/43

Insurance coverage ForInsurance coverage For

PassengersPassengers11 DeathDeath Rs. 5,00,000/Rs. 5,00,000/

22 DisableDisable Rs 5,00,000/Rs 5,00,000/

33 FuneralsFunerals Rs.Rs.2525,,000000// 44 kuruwakuruwa Rs.Rs. 1515,,000000//

55 Medical Facilities y and as perMedical Facilities y and as perBills)Bills)

Rs.Rs.11,,0000,,000000//

-

8/6/2019 Principles of Insurance Law

35/43

The Liability for I.C. to CompensateThe Liability for I.C. to Compensate

TPL of Each Type of VehicleTPL of Each Type of Vehicle11 DeathDeath Rs. 5,00,000/Rs. 5,00,000/

22 DisableDisable Rs 5,00,000/Rs 5,00,000/

33 FuneralsFunerals Rs.Rs.2525,,000000//

44 kuruwakuruwa Rs.Rs. 1515,,000000//

55 Medical FacilitiesMedical Facilities Rs.Rs.22,,0000,,000000//

-

8/6/2019 Principles of Insurance Law

36/43

EXCLUSIONS OF MOTOREXCLUSIONS OF MOTOR

INSURANCEINSURANCE Any accidents happened outside the geographical area.Any accidents happened outside the geographical area. Claims arising out of contractual liability of the insured.Claims arising out of contractual liability of the insured. Vehicle being used otherwise than in accordance with limitationsVehicle being used otherwise than in accordance with limitations

as to use.as to use. Vehicle being driven by any person other than driver( DriverVehicle being driven by any person other than driver( Driver

means any person having VDL or Valid driving license)means any person having VDL or Valid driving license) Consequential loss of any natureConsequential loss of any nature Any incident caused by driving the vehicle under the influence ofAny incident caused by driving the vehicle under the influence of

intoxicating liquors of drugs.intoxicating liquors of drugs. If Insurable Interest of the vehicle changes or after cessation ofIf Insurable Interest of the vehicle changes or after cessation of

insurable interestinsurable interest Any incident caused by ionizing radiation, radioactiveAny incident caused by ionizing radiation, radioactive

contamination, nuclear fuel, nuclear waste or nuclear weaponcontamination, nuclear fuel, nuclear waste or nuclear weaponmaterial.material. Any damage or liability while the vehicle being used by govt.Any damage or liability while the vehicle being used by govt.

authority on demand or summon.authority on demand or summon. Any loss caused by war or warlike activities, civil war, Mutiny,Any loss caused by war or warlike activities, civil war, Mutiny,

rebellion, or usurped power.rebellion, or usurped power.

-

8/6/2019 Principles of Insurance Law

37/43

Exclusion of Parts for CommercialExclusion of Parts for Commercial

Vehicle OnlyVehicle Only

Lights, Mudguard and painting are notLights, Mudguard and painting are notcovered in partial loss claim .covered in partial loss claim .

However, in total loss claim theseHowever, in total loss claim theselosses are covered.losses are covered.

-

8/6/2019 Principles of Insurance Law

38/43

Additional CoversAdditional Covers

Comprehensive Motor VehicleComprehensive Motor VehicleInsurance policy can be extended toInsurance policy can be extended tocover following risks on payment ofcover following risks on payment ofadditional premium:additional premium:

1. SRCC + MD + ST1. SRCC + MD + ST

SRCC=STRIKE,RIOT & CIVILSRCC=STRIKE,RIOT & CIVILCOMMOTIONCOMMOTION

MD = MALICIOUS DAMAGEMD = MALICIOUS DAMAGE

ST = SABOTAGE & TERRORISMST = SABOTAGE & TERRORISM

-

8/6/2019 Principles of Insurance Law

39/43

PROCEDURE OF CLAIMPROCEDURE OF CLAIM

What to do in case of claim:What to do in case of claim:

After accident or any event , which can make a claim underAfter accident or any event , which can make a claim underthe policy, the insured should immediately:the policy, the insured should immediately:

-- Give notice to policeGive notice to police-- Give notice to Insurance co. with following detailsGive notice to Insurance co. with following details-- Policy no and detailsPolicy no and details-- Date , time, place, cause of accidentDate , time, place, cause of accident-- Person ,vehicle, properties involved in accident,Person ,vehicle, properties involved in accident,

-- Estimated loss amount (if possible)Estimated loss amount (if possible)-- Third party property damage and personal injury( if any)Third party property damage and personal injury( if any)-- Location of the accident ,Injured person, damaged propertyLocation of the accident ,Injured person, damaged property-- Contract person and addressContract person and address

-

8/6/2019 Principles of Insurance Law

40/43

ContdContd

Generally the following procedure isGenerally the following procedure isadopted for the settlement of claimsadopted for the settlement of claims

under motor insurance .under motor insurance .

Entry of notice: When notice of claim isEntry of notice: When notice of claim isreceived , it is recorded in Claim Registerreceived , it is recorded in Claim Register

..Report to police for police report orReport to police for police report or

statement on accidentstatement on accident

Copy of own damage claim fromCopy of own damage claim from

-

8/6/2019 Principles of Insurance Law

41/43

DISPUTE IN CLAIMDISPUTE IN CLAIM

In difference shall arise on amount ofIn difference shall arise on amount ofmoney to be paid under the policy (money to be paid under the policy (liability being otherwise admitted),liability being otherwise admitted),such difference shall difference shallsuch difference shall difference shallbe resolved as per Insurance Actbe resolved as per Insurance Act20492049

However, in case of refusal of liabilityHowever, in case of refusal of liabilityby the Insurance Company, theby the Insurance Company, thesubject has to be decided by thesubject has to be decided by the

court .court .

MOTOR VEHICLE INSURANCEMOTOR VEHICLE INSURANCE

-

8/6/2019 Principles of Insurance Law

42/43

MOTOR VEHICLE INSURANCEMOTOR VEHICLE INSURANCE

POLICIES CAUSES OFPOLICIES CAUSES OF

REDUCTION IN CLAIMREDUCTION IN CLAIM1.Depreciation1.DepreciationDepreciation is applied to the claim amount (spare parts) as perDepreciation is applied to the claim amount (spare parts) as perthe age of the vehicle.the age of the vehicle.

2.Under2.Under--insuranceinsuranceIf the concerned vehicle is insured for lesser value than the marketIf the concerned vehicle is insured for lesser value than the marketprice (new replacement value less depreciation ) claim amountprice (new replacement value less depreciation ) claim amountsuffers reduction due to under insurance .suffers reduction due to under insurance .

3.Excess3.ExcessExcess is the value which directly applies on the claim amountExcess is the value which directly applies on the claim amountwhich causes significant reduction in claim amount .which causes significant reduction in claim amount .

Usually excess imposed on motor vehicle insurance policies.Usually excess imposed on motor vehicle insurance policies.a) Optional excess ( accepted by the insured)a) Optional excess ( accepted by the insured)

b) Compulsory excess ( excess imposed by tariff)b) Compulsory excess ( excess imposed by tariff)4.Salvage4.Salvage

Salvage is the damaged part of the vehicle, which is replaced bySalvage is the damaged part of the vehicle, which is replaced bythe new partthe new part

In case when the insured is not able to return the salvage to theIn case when the insured is not able to return the salvage to theinsurer, the amount of salvage is deducted from the claiminsurer, the amount of salvage is deducted from the claimamount.amount.

-

8/6/2019 Principles of Insurance Law

43/43

THANK YOUTHANK YOU