[PPT]Chapter 1: Tax Research - Pearson...

Transcript of [PPT]Chapter 1: Tax Research - Pearson...

![Page 1: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/1.jpg)

1-1©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 2: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/2.jpg)

1-2

TAX RESEARCH(1 of 2)

Overview of tax researchSteps in the tax research

processImportance of facts to the tax

consequencesSources of tax lawTax services

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 3: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/3.jpg)

1-3

TAX RESEARCH(2 of 2)

Professional guidelines for tax services

Citators

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 4: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/4.jpg)

1-4

Overview of Tax Research

(1 of 2)

Close-fact or tax complianceFacts already occurredDiscovery of tax consequencesProper disclosure

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 5: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/5.jpg)

1-5

Overview of Tax Research

(2 of 2)

Open-fact or tax-planningBefore structuring or concluding a

transactionMinimization of taxesCareful compliance permits legal

avoidance of taxation

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 6: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/6.jpg)

1-6

Steps in the Tax Research Process (1 of 2)

Determine the factsIdentify the issues (questions)Locate applicable authoritiesEvaluate authorities

Choose which to follow when authorities conflict

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 7: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/7.jpg)

1-7

Steps in the Tax Research Process (2 of 2)

Analyze facts in terms of applicable authorities

Communicate conclusions and recommendations to clientTreas. Dept. Circular 230 covers

all written advice communicated to clients

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 8: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/8.jpg)

1-8

Importance of the Facts to the Tax Consequences

Ambiguous situations (gray areas)Facts are clear but the law is notLaw is clear but the facts are not

Advance planning permits facts to develop that produce favorable tax consequences

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 9: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/9.jpg)

1-9

Sources of Tax Law(1 of 2)

Legislative processInternal Revenue CodeTreasury RegulationsAdministrative pronouncements Judicial decisionsTax treatiesTax periodicals

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 10: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/10.jpg)

1-10

Legislative ProcessHouse Ways and Means CommitteeVoted on by full HouseSenate Finance CommitteeVoted on by full SenateConference Committee

Voted by both full House and SenateSigned or vetoed by President

Override veto by 2/3 vote by both houses©2011 Pearson Education, Inc. Publishing as Prentice

Hall

![Page 11: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/11.jpg)

1-11

Internal Revenue Code (IRC)

Title 26 of the United States Code enacted by Congress

OrganizationTitle

SubtitleChapter

Subchapter - Part

- Subpart - Section

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 12: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/12.jpg)

1-12

Treasury Regulations(1 of 3)

Treasury Dept. delegates authority to IRS to promulgate Treas. Regs.

Types of Treasury Regulations Proposed: no authoritative weightTemporary

Provide immediate guidanceSame authority as Final Regs.

Final ©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 13: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/13.jpg)

1-13

Treasury Regulations(2 of 3)

Interpretative RegulationsInterpret related Code sectionLess authority than IRC

Legislative RegulationsAlmost the same authority as IRC

Legislative reenactment doctrine

Check date of Regs.Law may have changed after

written©2011 Pearson Education, Inc. Publishing as Prentice

Hall

![Page 14: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/14.jpg)

1-14

Treasury Regulations(3 of 3)

1.165-51 – Income tax165 – IRC citation5 – 5th regulation

Subject matter1 – Income tax20 – Estate tax25 – Gift tax301 – Admin/procedural matters601 – Procedural rules

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 15: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/15.jpg)

1-15

Administrative Pronouncements (1 of 5)

Revenue RulingsMore specific than Regs.Less authority than Regs.

Revenue ProceduresIRS guidance on procedural

matters

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 16: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/16.jpg)

1-16

Administrative Pronouncements (2 of 5)

Citation of Revenue Rulings and ProceduresRev. Rul. (or Proc.) 97-4, 1997-1

C.B. 54th Rev. Ruling of 1997

Beginning with 2000, all four digits of the year are used (e.g., Rev. Rul. 2007-5)

In Cumulative Bulletin 1997-1 on p. 5©2011 Pearson Education, Inc. Publishing as Prentice

Hall

![Page 17: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/17.jpg)

1-17

Administrative Pronouncements (3 of 5)

Letter RulingsReply to specific taxpayer

questionOnly authority for specific

taxpayerLtr. Rul. 200130006 (August 6,

2001)2001 – year30 – week006 – 6th letter ruling of the 30th

week

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 18: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/18.jpg)

1-18

Administrative Pronouncements (4 of 5)

Other interpretationsTechnical Advice Memoranda

IRS advice to an IRS agent on technical matters

Issued to public in form of letter rulingsInformation releases

Like press releasesWritten in lay terms Sent to newspapers

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 19: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/19.jpg)

1-19

Administrative Pronouncements (5 of 5)

Other interpretations (continued)Announcements and notices

More technical than information releases

Address current tax developmentsIRS bound by to follow

Just like Revenue Rulings and Procedures

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 20: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/20.jpg)

1-20

Judicial DecisionsOverview of court systemU.S. Tax CourtU.S. District CourtsU.S. Court of Federal ClaimsU.S. Supreme courtPrecedential value of various

decisions©2011 Pearson Education, Inc. Publishing as Prentice

Hall

![Page 21: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/21.jpg)

1-21

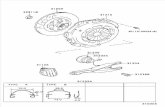

Overview of Court System(1 of 2)

U.S. TaxCourt

U.S. District Courtfor taxpayer's

district

Court of Appeals fortaxpayer's geographicaljurisdiction (1st - 11th &

D.C. Circuits)

U.S . Court ofFederal Claims

U.S. Court of Appealsfor Federal Circult

Suprem e Court

©2011 Pearson Education, Inc. Publishing as Prentice Hall

AppellateCourts

TrialCourts

![Page 22: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/22.jpg)

1-22

Overview of Court System(2 of 2)

©2011 Pearson Education, Inc. Publishing as Prentice Hall

Circuit States Included in Circuit1st ME, MA, NH, RI, PR2nd CT, NY, VT3rd DE, NJ, PA, VI4th MD, NC, SC, VA, WV5th LA, MS, TX6th KY, MI, OH, TN7th IL, IN, WI8th AR, IA, MN, MO, NE, ND, SD9th AK, AZ, CA, HI, ID, MT, NV, OR, WA, GU, MP10th CO, KS, NM, OK, UT, WY11th AL, FL, GAD.C. District of ColumbiaFederal All Districts

![Page 23: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/23.jpg)

1-23

U.S. Tax Court(1 of 3)

Taxpayer does not pay deficiency before litigating case

No jury trial availableRegular and Memorandum

decisionsSmall Cases ProcedureAcquiescence policy

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 24: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/24.jpg)

1-24

U.S. Tax Court(2 of 3)

Regular decisionsFirst time court hears case

Memo decisionsFactual variations of previous

casesSmall cases procedure

Cases of <$50,000 eligibleLess formal than regular tax court

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 25: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/25.jpg)

1-25

U.S. Tax Court(3 of 3)

Acquiescence policyIRS announces whether or not it

agrees with Tax Court decisions

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 26: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/26.jpg)

1-26

U.S. District CourtsMay request a jury trialMust pay deficiency firstUnreported decisions

Decisions not officially reportedPublished by RIA and CCH

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 27: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/27.jpg)

1-27

U.S. Court of Federal ClaimsNo jury trialMust pay deficiency firstDecisions appealable to Circuit

Court of Appeals for the Federal Circuit

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 28: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/28.jpg)

1-28

Circuit Courts of AppealsLosing party at trial level may

appeal decision to appellate courtCircuit Courts of Appeals

Appeals from Tax Court & district courts

Based upon geography Court of Appeals for the Federal

CircuitAppeals from U.S. Court of Federal

Claims ©2011 Pearson Education, Inc. Publishing as Prentice

Hall

![Page 29: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/29.jpg)

1-29

Supreme CourtVery few tax cases are heardHears cases when

Circuit courts are divided orIssue of great importance

Same authority as IRC

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 30: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/30.jpg)

1-30

Precedential Value of Decisions

Same Court

Tpayer’s Circuit

Supreme Court

Golsen Rule

DC X X X

TC X X X X

CFC X X X

CA X X

SC X

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 31: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/31.jpg)

1-31

Tax Services (1 of 2)

Annotated servicesOrganized by IRC sectionUnited States Tax Reporter by RIAStandard Federal Tax Reporter by

CCH

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 32: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/32.jpg)

1-32

Tax Services (2 of 2)

Topical services organized by topicFederal Tax Coordinator 2d by RIATax Management Portfolios by BNACCH Federal Tax Service by CCH

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 33: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/33.jpg)

1-33

Internet as a Research Tool(1 of 2)

©2011 Pearson Education, Inc. Publishing as Prentice Hall

Information CHECKPOINT CCH INTELLICONNECT

Recent developments Newsstand Tax News, Journals, Newsletters

Primary & secondary sources Federal Federal Tax

State and local reporters State & Local State TaxAll int’l references International International Tax

Estate tax Estate Planning Financial & Estate Planning

Pension taxation Pension & Benefits PensionPayroll taxation Payroll Payroll

![Page 34: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/34.jpg)

1-34

Internet as a Research Tool(2 of 2)

Searching methods for CHECKPOINT and INTELLICONNECTKeywordIndexCitationContent

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 35: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/35.jpg)

1-35

CitatorsHistory of the caseList of other authorities that

have cited the case in question

Refer to Table 5 in book for list of terms describing status change in IRS rulings

INTELLICONNECT CitatorCHECKPOINT Citator©2011 Pearson Education, Inc. Publishing as Prentice

Hall

![Page 36: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/36.jpg)

1-36

Professional Guidelines for Tax

Services (1 of 2)

Treas. Dept. Circular 230Pertains to all tax practitionersRules to practice before IRSGuidance on written advice to

taxpayersGives gov’t authority to impose

fines for violations of rules

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 37: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/37.jpg)

1-37

Professional Guidelines for Tax

Services (2 of 2)

AICPA SSTSsEthical framework for

taxpayer/client relationshipHigh standards of careNo duty to verify client

information if not suspicious

©2011 Pearson Education, Inc. Publishing as Prentice Hall

![Page 38: [PPT]Chapter 1: Tax Research - Pearson Educationwps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewOverview of Tax Research(2 of 2) Open-fact or tax-planning](https://reader031.fdocuments.net/reader031/viewer/2022030506/5ab4b47b7f8b9a7c5b8c18ad/html5/thumbnails/38.jpg)

Comments or questions about PowerPoint Slides?Contact Dr. Richard Newmark at University of Northern Colorado’s

Kenneth W. Monfort College of [email protected]

1-38©2011 Pearson Education, Inc. Publishing as Prentice Hall

![[PPT]Chapter 8: Consolidated Tax Returns - Pearson …wps.prenhall.com/wps/media/objects/9604/9834626/ppt_corp/... · Web viewSpecial Loss LimitationsSRLY (2 of 3) NOL allocable to](https://static.fdocuments.net/doc/165x107/5b06cf707f8b9ac33f8d557d/pptchapter-8-consolidated-tax-returns-pearson-wps-viewspecial-loss-limitationssrly.jpg)