Personal Finance Final Review. Career Decision Steps What is the difference between a job and a...

-

Upload

phyllis-harper -

Category

Documents

-

view

212 -

download

0

Transcript of Personal Finance Final Review. Career Decision Steps What is the difference between a job and a...

- Slide 1

- Personal Finance Final Review

- Slide 2

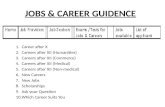

- Career Decision Steps What is the difference between a job and a career? Jobs are usually taken to just earn money Careers usually lead to true satisfaction Selecting a career begins with matching: 1.Your educational level 2.Your skills 3.The amount of money you want to earn

- Slide 3

- Financial Planning Steps Career Strategy You begin the financial planning process with a Career Strategy Ways to develop a career strategy are: 1.Identify your personal and career interests. 2.Make a list of things you enjoy doing. 3.Think about how you could turn an activity that you like into a career.

- Slide 4

- SETTING GOALS -S.M.A.R.T. GOALS S pecific M easurable A ttainable R esults-Oriented T ime bound

- Slide 5

- Time Frame of Personal Goals Short-term: 0 to 3 months to achieve Example: Save to buy a pair of jeans Intermediate: 4 to 12 months to achieve Example: Save for summer vacation Long-term: More than 1 year to achieve Example: Save to purchase a condo SETTING GOALS Know Your Time Horizon

- Slide 6

- SETTING GOALS Identify Your Attitude Toward Money The purpose of goal setting is to provide direction for your planning

- Slide 7

- Evaluating Your Alternatives Evaluate the alternatives: Evaluate the alternatives: Compare consequences Opportunity costs or trade offs Whats the value given up when making one choice instead of another

- Slide 8

- Evaluating Your Financial Health Assets Assets Things you own of value Liabilities Liabilities Amounts you owe to others Net Worth Net Worth Statement listing all assets and liabilities Gives you an idea of your overall general financial situation A minus L = Net Worth

- Slide 9

- Evaluating Your Financial Health Income Wages Salary Tips Gifts Allowance Expenses Taxes Bills Utilities Debts Rent Main Idea: The Difference M ore Income = Cash Surplus Less Income = Insolvency or you must sell off other assets?

- Slide 10

- HOME FILES are used for documents that are fairly easy to replace Advantages Easy to set up Easy to use and access Inexpensive Disadvantages Vulnerable to damage

- Slide 11

- SAFETY-DEPOSIT BOXES are used for documents that are hard to replace Advantages Safe from damage Separate from other documents Access is limited Contents usually insured Disadvantages Harder to access Costs money (about $100 year)

- Slide 12

- Computer Files are used for documents that are easy to keep electronically or that are useful in planning Advantages Automatic calculation of amounts Usually has tool to help in tracking and planning Disadvantages Data can be lost

- Slide 13

- Estimate Your Net Income Gross income Gross income is the total amount of income from your wages before any payroll deductions Payroll deductions (TAXES) Payroll deductions (TAXES) are amounts your employer deducts from your pay Federal Income Tax State Income Tax Local Income Tax Social Security Tax (FICA) Medicare Tax (FICA) Health Insurance Retirement Savings Net Income Take-Home Pay Net Income is your gross pay minus deductions; also known as Take-Home Pay If income is unpredictable decrease your estimated amounts

- Slide 14

- Form W-4 Tells your employer how much to withhold from your paycheck for federal income taxes.

- Slide 15

- Expenses Expenses: represent bills you must pay for items you have used up Two basic types of expenses: Fixed Expenses Fixed Expenses are amounts that cost the same amount every time. Pay Yourself First try payroll deduction Emergency Fund 3-6 months of expenses Emergency Fund savings account with enough money to cover 3-6 months of expenses Loans for car, home or college Variable Expenses Variable Expenses are items that you pay for every month but that fluctuate in amount Includes items like gas for the car and food Tips for estimating amounts

- Slide 16

- The Five Cs of Credit Character: Way you handle money and have repaid debt in the past. Capacity: Ability to pay the debt after other monthly expenses. Capital: Value of your assets or what else you own.

- Slide 17

- The Five Cs of Credit Collateral: Something of value can be given in lieu of payment. Credit History: How you have used credit in the past Creditors will ask about: 1.whether or not you pay your bills on time 2.whether you have ever applied for bankruptcy 3.your current credit rating which can be purchased from one of three agencies

- Slide 18

- Credit Report: Credit Report: record of your personal financial transactions, or credit history For Past 7 to 10 years You should check your credit report at least once a year Credit Reports and Credit History

- Slide 19

- Credit Card and Fees Transaction Fees and Other Charges Three (3) major fees you should watch!!! Cash advances Late payments Exceed credit limit

- Slide 20

- Credit Card Terms Grace Period Known as the free period Lets you avoid finance charges If you pay in full before due date Making minimum payments Takes years to pay off balance Never advised to do!!! Adds interest and increases costs

- Slide 21

- Credit Card Consumer Rights How to Solve a Problem Dont wait until your account is turned over to a collection agency Contact the credit card company and ask for help or make other payment arrangements If you want to dispute a credit report, bill, or denial of credit, write to the appropriate company and send you letter return receipt requested

- Slide 22

- Checking Advantages Easy to pay others Proof of Payment Keeps money safe Helps with Budgeting

- Slide 23

- Debt Cards v. Credit Cards DEBIT Cards DEBIT Cards are available for deposits, withdrawals, transfers and bank statements. Takes your money from your bank account instantly w/o recourse Credit cards Credit cards are available for purchases and cash advances. They run on a billing cycle each month or every period. Rules and regulations apply!

- Slide 24

- Mortgage Types Mortgage: Mortgage: a loan a bank makes to a person or persons to buy real estate Fixed interest rate stays the same Adjustable interest rate can go up or down Can adjust yearly (1 Year ARM) Can adjust at specified times (5/1 ARM)

- Slide 25

- OVERVIEW OF SAVINGS Paying yourself first means that when you get a paycheck, you put away the money you want to save for your goals. There are many reasons to pay yourself first. For example: Treat savings like a normal expense Treat savings like a normal expense Manage your money better Increase your savings Improve your standard of living.

- Slide 26

- Does It Balance? Reconciling your checking account statements Why reconciling is important? Lets you check for mistakes and checks you wrote but did not enter. Gives you a chance to subtract other charges that the financial institution may have added. Lets you add any interest that your checking account may have earned

- Slide 27

- Pros and Cons of EFT Electronic Funds Transfer Pros Direct deposit of pay Convenience Personal Safety Knowledge of account Time SavingsCons May have fees Increased chance that your personal information will be stolen Granting access to your accounts can be problematic

- Slide 28

- Auto Insurance Based on Risk & Loss Based on Risk & Loss Why do you need it? To financially protect yourself, others, and your car in the case of an accident. State Law

- Slide 29

- Insurance and Pennsylvania Law Must maintain automobile insurance Must maintain automobile insurance If not, State can cancel registration, drivers license, suspend other privileges Minimum Requirements by law Minimum Requirements by law Liability Coverage (Mandatory) (Claims against you) $15,000 per individual $30,000 per incident No property damage

- Slide 30

- Insurance Premiums: Payment made for insurance are called premiums Can be monthly, bimonthly, quarterly, semi-annually, or annual Can vary due to coverage

- Slide 31

- Liability Insurance Covers bodily injury or property damage that YOU cause to another person and/or vehicle. 100/300/50 $100,000 bodily injury coverage per person Limit of $300,000 bodily injury coverage per accident Property Damage Limit of $50,000

- Slide 32

- Liability Insurance How to Explain Coverage Limits: 100/300/50 $100,000 bodily injury coverage per person $100,000 bodily injury coverage per person Limit of $300,000 bodily injury coverage per accident Limit of $300,000 bodily injury coverage per accident Property Damage Limit of $50,000 Property Damage Limit of $50,000 This means if 10 people are hurt in an accident they all are covered by $300,000 Any one person is limited to $100,000

- Slide 33

- Collision & Comprehensive Required if you finance your car Covers the cost to repair YOUR car if YOU are at fault in an accident. Dont need this insurance if the cost (premium & deductible) exceeds the value of the car. Deductible: Deductible: The amount of money you must pay first before any claim will be paid Comprehensive covers the costs to repair your vehicle for damage that might occur from: Natural disasters Vandalism Theft Fire Animal hitting the vehicle (i.e. deer) Falling Object Glass Coverage

- Slide 34

- Step #1 Car Buying Identify Personal Wants and Needs How will you use your car? Narrow Your Choices Drive to school Carry Friends Hauling Drive to work Carry family members Sports and Recreation

- Slide 35

- Pricing, Terms, and the Purchase Invoice Price Base Price Monroney Sticker Price (MSRP) Dealer List Price Beware of Bait & Switch Advertise one low-priced car and then switch you to another. The final price will be the negotiated price

- Slide 36

- Why Invest in Stock? Earn regular income dividend payments When do you reap the benefits? Buy low, sell highhopefully Sell at higher price than you bought? Capital gain Sell at lower price than you bought? Capital loss Stocks are a long-term investment strategy

- Slide 37

- A stock certificate or stock share is a piece of paper that shows partial ownership in a corporation.

- Slide 38

- Risks Risk Risk the chance of losing part or all of an investment. Rule #1: Higher RiskHigher Return Rule #2: Higher Risk More volatile price swings Rule #3: Higher Risk Considered more speculative!! Usually the higher the risk the higher the expected return on investment

- Slide 39

- Diversification Spreading or reducing of risk related to purchasing and holding of different types of investments Decreases the overall risk of your portfolio Reduces the impact of economic changes One industry may be up or positive One industry may be up or positive Another may be down or negative Another may be down or negative Doesnt guarantee positive returns but lessens the potential risk associated with investment Can use multiple strategies when diversifying

- Slide 40

- What is a Mutual Fund? An investment company that invests its shareholders money in a diversified portfolio of securities Investment company is the legal term Mutual fund is the popular term Professional management Diversification Each fund has a specific objective

- Slide 41

- Advantages of Mutual Funds Pooled Diversification A process whereby investors buy into a diversified portfolio of securities for the collective benefit of the individual investors Professional management The mutual fund managers are supposed to know what they are doing Low initial outlay of capital You can start with $25 to $50 per month Convenient to buy and sell compared to stocks and bonds Can be sold online, in-person, or by phone

- Slide 42

- Drawbacks of Mutual Funds Transaction Costs Some mutual funds charge sales fees called loads Front-end loads, back-end loads, etc. Many others are no-load funds But some no-load funds can wind up costing you more than load funds Annual Management Fees Typically from 0.5% (or less) to 2.5% (or more) Many mutual funds do not match the markets performance Not federally insured!