Panel 5 : India - Inbound & Outbound Investment Strategies

Transcript of Panel 5 : India - Inbound & Outbound Investment Strategies

OBEROI - GURGAONNEW DELHI

INDIA

RAJESH RAMLOLL CHAIRMAN : IFA

MAURITIUS BRANCH DEPUTY SOLICITOR GENERAL

OF MAURITIUS 16 OCTOBER 2015

Between India & Mauritius negotiated in 1982 and came into force in 1983

Agreement is now over 30 years old!

In THE 1990s– two things happened:-

(a) India opened up for foreign investments◦ Former Prime Minister late Narsimha Rao and then

Finance Minister, Dr. Manmohan Singh started liberalisation of Indian Economy.

(b) Mauritius enacted the MOBAA Act 1992 –launch of the offshore sector

Main attractions!

Mauritius route attracted attention of tax planners for residents of Third Countries.

Non Resident Indian wishing to invest in India

US Tax Code does not give credit to tax suffered in India

Hence appeal of the Cyprus/Mauritius route to India

Article 13(4) of the DTAC on ‘Capital Gains’ provides for taxation of capital gains arising from alienation of shares in country of residence of investor.

Article 10 – on Dividends (5/15%)

Article 11 – on Interests (Exempt)

Cost of maintaining in “offshore” entity v/s turnover/profits

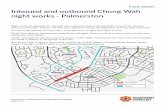

Share of Top Investing Countries FDI (Equity) Inflows (as at June 2015)

Source: http/dipp.nic.in/Eng/Pub/FDI/statistics

Round Trip Financing◦ Section 97(1)(b)(i) Chapter X-A of Income Tax Act

1962 – lack of commercial substance

Black Money Law◦ The Black Money (Undisclosed Foreign Income and

Assets) (Imposition of Tax) Act 2015

◦ The new legislation provides that income from any foreign asset will be taxable at maximum marginal rate: Maximum of 10 years jail sentence for offenders – Penalty of 300% on concealed asset Beneficiary of foreign asset to file return

Double non-taxation◦ Issues of Sovereignty in “BEPS” context

Exchange of information◦ Issues – Automatic Exchange of Information –

Common Reporting Standard – G20 Finance Ministers’ and Central Bank Government Meeting –New Delhi (February 2015)

◦ “full and fast implementation of automatic exchange of information” Jayant Sinha [Minister of State for Finance]

◦ Mauritius – Income Tax Act amended to add new section 76 (5A) to implement CRS as from 01 January 2017 (Finance Act 2015).

Origin – Defunct Direct Taxes Code Bill 2010 (to come into force on April 1, 2011) –section 123

DTC: Was it face saving for India?

Economic Times (July 2012) “Something had to be done to sidestep the treaty and step up tax revenue”

Section 258(8): For the purposes ofdetermining the relationship between aprovision of a treaty and this Code:-◦ (a) Neither the Treaty nor the Code shall have a

preferential status by reason of it being a treaty orlaw: and

◦ (b) the provisions which is later in time shall prevail.

- Later-in-date principle (USA Constitution)

Article 3(2) of Mauritius – India DTA – “any term not defined there in shall unless contextotherwise requires have the meaning which under the local law it has.

What the Courts say in Vodafone (2011) and Sanofi (2012)

Solution – inclusion in the treaty of a “negotiated” GAAR – through a limitation of benefit clause (LOB).

Measures to promote Domestic Manufacturing and improving the Investment Climate (MAKE IN INDIA)

Defers GAAR implementation by two years GAAR to be made applicable from AY2018/19 Grandfathering of investments made up to

March 31, 2017 Prospective application of GAAR (not

retrospective) Important measures for transparent,

predictable and non-adversarial tax system

Both Countries committed to come to an early conclusion of the negotiations

Modi: “We will work together to prevent abuse of the (treaty).. We will do nothing to harm this vibrant sector of one of our closest strategic partners” Extract speech in Mauritius Parliament 12 March 2015

Lutchmeenaraidoo (in Budget speech 23 March 2015 : early conclusion of negotiations

Renegotiations? Yes

Joint Working Group in last meeting in June 2015

Indian GAAR (was part of the defunct Direct Taxes Code Bill 2010)

Add new section 123 in the Income Tax Act 1962

GAAR – introduced by the Finance Act (2012) - Chapter X –A-

The Finance Act 2012 (introducing GAAR in amended version)

Chapter X-A in the Income Tax Act 1962)

Section 98 – inserted with the specific intentionto override tax treaties, where arrangement isdeclared to be an impermissible avoidanceagreement as defined in section 96: perRaghuram and Ramachandra Rao JJ in SanofiPasteur Holding SA v/s Department of Revenue(2012) Hyderabad High Court

Shome Report – September 2012

Hyderabad High Court (Sanofi 2012):-

Strained construction of treaty provisions, werenot authorised by settled principles of statutoryconstruction either by the tax administrator or byjudicial branch at the invitation of the Revenue …would also transgress the inherent and vitalconstitutional scheme of separation of powers.Once the power is exercised by the authorisedagency (legislative or executive) and a treaty isentered into, provisions of such treaty mustreceive a good faith interpretation …

Judicial approach to treaty override

Section 98 of Chapter X – A

Treaty override provision

Treaty has been adversely commented upon by the Joint Parliamentary Committee

Frequent PQs in Lok Sabha

Media issues

Round Tripping

Substance issues

Vodafone (2011)

Certainty and stability from the basicfoundation of any fiscal system. Tax policycertainty is crucial for taxpayers (includingforeign investors) to make rational economicchoices in the most efficient manner. Legaldoctrines like “Limitation of benefits” arematters of policy. It is for the Government ofthe day to have them incorporated in theTreaties …”

Amending Protocol to contain – An LOB Clause (a matter of policy – Supreme Court in Vodafone 2002) to address - Round Trip Financing issues - GAAR – like provision – pricipal purpose test - Substance issues - Expenditure rules – Singapore way? – May be? - New TRC application form in force since 31 August 2015 -to cater for additional substance requirements already in force since 01 January

2015 (vide amendment to section 3 chapter 4 of Guide to Global Business)

Case Law – Azaadi Bachao (2003) and Serco BPO (2015) – Courts will not go behind a TRC.

TRCs issued for India

2013 2014 2015

2,415 3,648 1,706

Larger BEPS context

Double non taxation issues

(A case in point article 13?)

Treaty abuse (Action 6 – Preventing the granting of Treaty Benefits in inappropriate circumstances).

THANK YOU