Out of the box: blending capital solutions

-

Upload

informa-australia -

Category

Economy & Finance

-

view

388 -

download

0

description

Transcript of Out of the box: blending capital solutions

Social Finance Forum: August 8

Greg Peel

out of the box: blending capital solutions

demand for social finance is increasing

• not-for-profit sector - huge & diverse

• 600,000 organisations

• many different tasks and aims

• capacity of not-for-profit providers of social impact

• subsectors of the not-for-profit sector

• government, community and business building society

supply

• emergence of impact investing

• initiatives around the world

• Australian government programs

linking supply & demand

• developing the mechanisms

• managing risk and yield

• overseas examples

• the bond market

• social impact bonds

• housing bonds

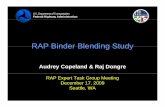

phanthropic

/ donations

grants &

gov’t

contracts

gov’t support

& guarantees

gov’t / SEDIF

/ CDFI

(SEFA,

Foresters,

SVA)

bank lending:

-CSB

- other Banks

community

bank

reinvest

strategy

crowd

funding

-social impact

bonds

- housing

bonds

corporate

impact

support (risk

mitigation)

fixed

interest

impact

investing

(SIDA)

equity

quasi /

equity

impact

investing

Social

return on

investment

social finance and capital markets

United

Kingdom

CDFI tax incentive

social

infrastructure

fund

housing

bonds

social

impact

bonds

big society

capital

emerging markets available

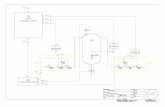

blending capital solutions

• normalising risk and yield

• new products that are attractive to investors

social infrastructure

funding requirements

100%

0%

bank debt

risk appetite

blended capital

solution

• grant / philanthropy

• credit enhancement

• crowd funding

• government support

social infrastructure

project funding requirements

examples of blended

structures

shared equity, home purchase plans

social enterprise funding

microfinance: in-roads

individual

finance

Bendigo Bank

Community

Sector Banking

risk mitigation

risk mitigation

intro / management

corporate

contract

Aboriginal owned

enterprise funding bank

debt

income streams

risk mitigation

affordable finance amount

corporate risk mitigation

blending capital solutions

• normalising risk and yield

• new products that are attractive to

investors

our story

• 2002 - launched as joint venture

of Bendigo Bank & Community 21

consortium of 20 not-for-profit

organisations

• 2013 - eleventh anniversary,

7,000 not-for- profit customers

ranging from small local

community groups to national

charities

our not-for-profit shareholders

connecting digitally

/communitysectorbanking

/csbanking

/csbanking

keep ‘in the loop’ by visiting us at

www.communitysectorbanking.com.au