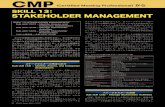

NWPP MC Initiative Public Stakeholder Update

Transcript of NWPP MC Initiative Public Stakeholder Update

NWPP Members’ Market Assessment and Coordination

Initiative

Public Stakeholders Meeting

MC Phase 4 Update

June 24, 2015

Facilitator: Dan Williams, Portland General Electric

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

2

Members of the Northwest Power Pool Market Assessment and Coordination Committee (NWPP MC) believe in the value of collaborating to deliver near- and long-term benefits to their customers by

enhancing the reliability and efficiency of the region’s power system and maximizing the benefits of the region’s resources while preserving local decision making now and in the future.

Current NWPP MC Membership

NWPP MC Initiative

3

• Avista Corporation

• Balancing Authority of Northern California

• Bonneville Power Administration

• BC Hydro, Powerex

• Chelan County PUD

• Clark County PUD (Phase 3 Tools)

• Eugene Water & Electric Board

• Grant County PUD (Phase 3 Tools)

• Idaho Power Company

• NaturEner Wind Holdings

• NorthWestern Energy

• PacifiCorp (Phase 3 Tools)

• Portland General Electric

• Puget Sound Energy

• Seattle City Light

• Snohomish County PUD

• Tacoma Power

• Turlock Irrigation District

• Western Area Power Administration, Upper Great

Plains

NWPP MC Balancing Authorities

4

Program Reach • 14 of the 38 Western

Interconnection Balancing Authorities and 3 Scheduling Entities are Members of the NWPP MC Initiative

• MC Members manage a combined peak load of approximately 38,000 MW

• Address operational and commercial challenges affecting regional power system: – Manage transmission constraints, impacts of variable energy resources

– Access regional balancing diversity

• Respect unique attributes of NWPP MC footprint, including: – Extensive coordinated hydro-thermal systems

– Multiple transmission providers, overlapping systems

– Tightly correlated variable energy resources

– Significant presence of non-jurisdictional entities

NWPP MC Initiative Objectives

5

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

6

• MC Executive Committee on May 29 unanimously adopted priorities for rest of 2015: – Teams of key technical staff complete final design and testing work for

initiatives

– Decision point later in 2015 on whether and how to implement entire staged portfolio in 2016-17, and how best to structure MC Initiative for long-term success

• Pragmatic approach right for the region: – Provides low-cost path to achieve benefits, address most pressing operational,

commercial challenges

– Allows members to address issues and transition systems with minimal disruptions

– Allows for evolution to more advanced program if members determine further benefits to customers

NWPP MC Initiative Current Focus

7

• Key elements include market-focused (automated 15-minute energy market) and operations-focused (centralized regulation reserve sharing group) initiatives: – Centrally Cleared Energy Dispatch (CCED) -- automated 15-minute

market. Market operator centrally clears voluntary bids and offers from participants to inform regional energy dispatch; facilitated under existing regional transmission framework

– Regulation Reserve Sharing Group (RRSG) -- centralized program; enables MC participants to manage to single Area Control Error for NWPP footprint and share in natural offsetting diversity of loads and resources

NWPP MC Portfolio Solution

8

• Key elements supported by: – Common resource sufficiency standard for program participants

– Transmission service and operational coordination enhancements

– Advanced data sharing tools implementation

• Intended outcome: – Reliable, efficient within-hour operating environment, with potential

to enhance in future to bring additional regional benefits.

• Framework provides wide range of benefits while: – Preserving local decision making

– Protecting integrity of region's power system, which has delivered low-cost, clean, reliable power to customers for decades

NWPP MC Portfolio Solution, Continued

9

CCED + RRSG • 15-minute bid clearing with

constant regulation sharing • OATT-based scheduling using

contract-path rights • Single clearing price • Settles voluntary INC and DEC

bids that are awarded • Uses economic bids to access

resource diversity & efficiency • BAs coordinate to share ACE up

to program limits and capture benefits of load diversity

• May release some sub-hourly flexible capacity

CCED+RRSG vs. SCED

10

SCED • 5-minute clearing • Flow-based, as-available

transfers that are security-constrained across MC footprint

• Nodal clearing prices • Settles all load and offered

generation in the MC footprint • Automatically captures net

imbalance diversity • BAs operate independently for

compliance obligations • Flexible capacity carried stand-

alone by each BA

MC Problem Statement Crosswalk

11

KEY

RFF: Regional Flow Forecast – 1-3hr look-

ahead on critical transmission paths

RMD: Resource Monitoring and

Deliverability Tool – assesses capacity

and delivery capabilities for NWPP

footprint

RS: Resource Sufficiency – program

ensures reliability, equitable treatment

CCED: (see above)

RRSG: (see above)

TOP/TSP: Transmission Service Provider

and Transmission Operator Tools –

coordination and data-sharing leveraging

initiatives under existing framework

[currently being scoped]

SCED: (see above)

“X” indicates that the

solution addresses the

problem statement,

not that each solution

is equally effective.

12 (For Illustration Only – Not Approved by Any Parties)

MC Initiative Near-Term Administration Option To be developed fully in 2015 by the NWPP MC work groups, in consultation with the NWPP,

and implemented no later than January 1, 2016, if approved by the NWPP MC members.

NWPP MC Corporation - Stand-alone board / funding

- Full-time staff w/ CEO directed by NWPP MC board - Funding as agreed

NWPP MC Operations-Focused Initiatives

Central Clearing 15-Min Economic Dispatch

Market Operator

- Independent third-party

Resource Sufficiency requirements and pilot programs

as needed

NWPP MC

Corporation-

specific

General

Services

Agreement

NWPP Agreement (Current Structure)

- Autonomous committee-based structure

- Reserve Sharing Group and other committees self-governed

under the NWPP Agreement - Per-capita funding allocation

NWPP

Agreement-

specific

General

Services

Agreement

Board, CEO, staff, and administrative services

contracted to support GSA terms and services (training, etc.)

requested by NWPP Agreement or NWPP MC Corporation

• NWPP MC developing a narrowed Petition for Declaratory Order to address specific questions on CCED market and associated implementation issues

• Will file with the FERC later this year after further review of CCED design concepts and further discussions with the FERC

• Key elements in petition to include: – Voluntary market fundamentals and implications

– Consideration of jurisdictional limits of the FERC over non-jurisdictional entities

– Mobile-Sierra or equivalent protection

FERC Petition for Declaratory Order

13

Agreement among NWPP MC Members on May 29 1. Develop CCED with flexible platform

2. Develop Regulation Reserve Sharing Group (RRSG); expand ACE Diversity Interchange Program

3. Continue support of Regional MC Tools

4. Continue development of Resource Sufficiency methodology

5. Continue development of Transmission coordination opportunities

6. Identify and assess other regional operations integration issues/opportunities

7. Develop durable administrative structure, budget and requirements

Resolution timeframe -- May 31, 2015 - Dec. 31, 2015 – No new funding needed for continued Phase 4 work

– Parties not currently in Phase 4 can still join Phase 4 Work Order

NWPP MC Phase 4 Resolution

14

• July 2015 – Updates on MC activity, approval of mid-term items

• RRSG implementation • RS program • Petition for Declaratory Order filing • CCED transmission policies

• September 2015 – Detailed presentation of all MC Phase 4 components

• RS framework and implementation plan • TSP/TOP, Seams, RRSG, and CCED implementation plans • Governance and costing for 2016-2017 MC Initiative

• November 2015 – Go-Forward vote on MC Initiative, including funding

High-Level Timelines for MC Phase 4

15

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

16

• Regional Flow Forecast (RFF) and Resource Monitoring and Deliverability (RMD) Beta Version 1.0 released March 31, 2015

• MC members working through roll out of RFF tool to merchant function employees and OATT customers

• Software enhancements planned later in 2015

• Data quality is a significant issue; team has deployed additional resources to monitor and provide guidance to MC members

Regional Tools Update

17

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

18

• Develop a draft common methodology for Resource Sufficiency (RS)

• Evaluate the draft common methodology using existing data and/or pilot process

• Recommend an approach to implementation and enforcement of an RS metric

• By September EC: – RS Team will have developed, vetted, and agreed to an

approach for each of the major RS elements

– RS Team will have identified what is needed for implementation

Resource Sufficiency – Team Tasks

19

Resources:

– Thermal

– Hydro

– Wind

– Solar

– Demand Response

– Firm Purchases

Obligations:

– Load

– Firm Sales

Flexible Capacity:

– Balancing Reserves

– Regulation Reserves

– Operating Reserves

Resource Sufficiency – the Formula

20

• Forecast approach for each element

• Estimate of uncertainty for each

element

• Combined uncertainty within the BA

• Balancing reserve planning standard

• Reserve characteristics

• Deliverability assessment

RS = ∑Resources > (∑Obligations+ ∑Flex Capacity Requirement)

Formula must address:

Resource Sufficiency Timeline

21

Resource Sufficiency – 2015 Workplan

22

• VER Capacity Credit • Enforcement • Forecasting – Load and VERs

May/June/July

• Balancing Reserves • Confidence Interval • Transmission Deliverability • Transaction Clarity • Imports/Exports

July/August/September

• Wrapping it all up • Detailed Implementation Plan

October/November

• Evaluation of methods for calculating reliable RS contribution from VERs

• Development of informational and binding check timelines and enforcement options

• VER forecasting options

• Dispatchable Energy Resources (DER) and load treatment

• Working with Regulating Reserve Sharing Group to determine if, how, and when to capture footprint-wide diversity benefits for capacity commitment

Resource Sufficiency – May/June 2015 Focus

23

• VERS TREATMENT: Alternatives for the treatment of VERS based on analysis of options

• ENFORCEMENT: Alternatives for the timing and enforcement of the resource sufficiency metric

• FORECASTING: Alternatives for how to approach load and VER forecasting

Resource Sufficiency – July EC Meeting

24

Vickie VanZandt – Independent Consultant, Northwest Power Pool

Adam Gittler – Independent Consultant, Northwest Power Pool

Bryan Bradshaw – Manager, Chelan County Public Utility District

Kevin Cardoza – Real Time Supervisor, Eugene Water and Electric Board

Shawn Davis – Senior Policy & Operations Analyst, Portland General Electric Merchant

Jim Farrar – Energy Markets Director, Turlock Irrigation District

Robert Follini – Preschedule and Real-Time Manager, Avista

Reggie Gulley – Administrative Support and Project Management, Utilicast

Therese Hampton – Executive Director, Public Generating Pool

Leah Marquez-Glynn – Resource Operations Lead, Tacoma Power

Frank Puyleart – Wind Operations Lead & Balancing Reserves Manager, Bonneville Power Admin, Trans.

Ron Schellberg – Transmission Policy and Development, Idaho Power Company

Matt Schroettnig – Long Term Sales & Purchases, Bonneville Power Administration, Power

Aliza Seelig – Strategic Advisor, Seattle City Light, Power Management

Jeff Spires – Day Ahead Trader, PowerEx

Laura Trolese – Senior Policy Analyst, Public Generating Pool

Zac Yanez – Snohomish County Public Utility District

Resource Sufficiency Team

25

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

26

• A liquid intra-hour regional energy market would yield numerous efficiency benefits for all types of entities in the NWPP footprint – Economic displacement: Utilize available lower-price resources,

including VERs, to displace higher-price generation

– Geographic diversity: Intra-hour variations in VERs and load can offset each other through transactions across a multi-BAA footprint

– Balancing resources optimization: Informs quality, quantity, and cost of setting aside balancing reserves in each hour

Purpose and Overview

27

• A liquid intra-hour market has not developed under the existing manual, bilateral trading framework – Need for bilateral negotiation with individual counterparties regarding

price, delivery location, and transmission responsibility

– Incomplete visibility into opportunities to transact

– Time and burden to execute

• To unlock the benefits of intra-hour transactions, the region needs to develop an automated, centralized market

Purpose and Overview, cont’d

28

• Not all market designs are suitable for implementation in the Northwest at this time – Costs and risks may exceed quantifiable benefits for some entities

– Many designs raise complex issues that apply to all transactions, which cannot be easily tackled

• Transmission access, cost allocation, and congestion management

• Regulatory requirements / FERC role in overseeing market

– Major “paradigm shifts” have been shown to be a barrier to participation in new market formations

Design Objectives for a Northwest Intra-Hour Organized Market

29

• An appropriate market design for the Northwest should prioritize simplicity and compatibility with existing systems and processes – Minimizes implementation timeline, costs and risks, to promote broad

regional support from members and stakeholders

– Attracts greatest level of participation possible once market is implemented, including from embedded loads and resources

– Minimizes risk of unintended consequences or impacts to existing trading and operations paradigm

Design Objectives for a Northwest Intra-Hour Organized Market, cont’d

30

• New entity would oversee the market start-up and future growth and must be responsive to members – Regional governance under an appropriate framework would promote

member-driven growth to target maximum benefits

– Entity would have mandate to represent and advance the interests of the NWPP MC and its customers

• This market institution would itself yield significant long-term benefits for the region – Would interact with other markets at an equal peer level

– Would ensure that coordination and transactions with other markets meet the needs of the Northwest

Market Would Optimally Be Governed and Facilitated by a Regionally Responsive Entity

31

• 15-minute energy market with voluntary buyers / sellers

• Single, public market clearing price for market runs

• Market operator is central counterparty for transactions

• Single, pre-specified delivery location (“Market Zone”)

• Automated clearing of economic bids

• Automated scheduling/tagging of final market awards

• Market operator provides financial settlement of awards

• Transmission compensation and scheduling requirements to be fully consistent with existing practices and with OATT framework

Key Elements of NWPP MC CCED Market

32

• CCED transactions will require transmission to/from the Market Zone, located in BPA’s NW network, using existing OATT framework

• Additional improvements to regional transmission requirements can be pursued by other TSPs

• Options for transmission solutions that resolve concerns of Market Participants not in the BPA NW Market Zone are being explored – Policies will be clarified in the CCED design specifications prior to the

Go-Forward vote in 2015

Transmission Framework for CCED Transactions

33

• Market Operator is central counterparty – Buys and sells energy at single pre-defined Market Zone

– All transactions are at the same market clearing price for that interval

• To automate timely scheduling of market awards – Participants submit e-Tags with bids

– Market Operator auto-updates energy profiles on e-Tags for clearing INC and DEC bids (or “curves”)

15-Minute CCED

34

BPA Market Zone

Market Participant

Market Participant

INC DEC

Simplified Example

• T-25 before each clock hour: – Hourly e-Tags supporting CCED bids must be implemented with a transmission

profile consistent with the bids being submitted

• T-25 before each 15-minute interval: – Sub-hourly e-Tags must be implemented for any CCED bids not supported by an

hourly e-Tag

• T-25 before each 15-minute interval: – INC and DEC bids for the interval are due to the Market Operator (can be “curves”

vs. single-point INC and DEC bids)

• Between T-25 and T-20 prior to each 15-minute interval: – Market solution is determined – Final market awards are communicated to market participants’ ADS – Energy profile on pre-submitted e-Tags is adjusted by the Market Operator

• T-20 before each 15-minute interval: – BPA and other BAs/TOPs begin final reliability assessment and checkout procedures

for the interval (same as today)

• T+7 Days: – Financial settlement for final awards

Market Participant Bidding Timelines

35 Represents Current Design Spec – Subject to Change

• CCED will not model physical flows on transmission systems; it is not a security-constrained optimization

• CCED pricing run will treat all bids and offers as fully deliverable, determining an “unconstrained” market clearing price

• CCED scheduling run will adjust initial cleared bids and offers to ensure awards do not exceed BPA available transmission capacity – BPA will provide Market Operator with information necessary to

perform this assessment by T-25 prior to each interval

• After Market Operator determines final market awards and updated energy profile on e-Tags, CCED transactions will be treated as other schedules (according to transmission service priority)

• BPA will issue curtailments to ensure Market Zone remains balanced from energy perspective – E.g., if external TSP curtails 25 MW CCED INC award, BPA will curtail 25

MW of CCED DEC awards

Ensuring Feasible Market Awards

36 Represents Current Design Spec – Subject to Change

• All counterparties settle directly with the Market Operator • Simple and easy to understand

– Sellers will be paid final awards at Market Clearing Price • Less market administrative charge

– Buyers pay final awards at Market Clearing Price • Plus market administrative charge

• Physical performance – Settlement initially based on final e-Tag values; participants do not settle

on quantities that are curtailed or interrupted – Market Monitor will evaluate and report on physical performance of

market awards

• Market Zone may have short-term imbalances in rare cases – Most likely due to curtailment implementation timing – May result in settlement of imbalances with BPA – Will need to determine how Market Operator would recover (or return)

those charges

Settlements in the CCED

37 Represents Current Design Spec – Subject to Change

• Resource Sufficiency is a vital pre-requisite to CCED implementation – Ensures CCED is a voluntary market, supporting competitive outcomes without intrusive

and controversial offer price mitigation – Promotes supplier participation by assuring purchasers are not leaning on CCED offers – Sets stage to unlock additional geographic capacity diversity benefits of multi-BAA

footprint

• Regulation Reserve Sharing Group – Complementary to 15-minute CCED – Permits netting of imbalances within each 15-minute interval across participating BAAs

• The initial CCED platform will be designed to accommodate potential future enhancements, which may include:

– Shorter lead times between bid submission and start of delivery interval – 5-minute market granularity – Improved regional congestion management tools – Evolution to a full security-constrained economic dispatch (SCED)

Related and Future Initiatives

38

• MC explored the idea of a possible interim solution with some vendors to improve existing 15-Minute bilateral market – Relies on a clearing house, not central counterparty, to match

overlapping bids and offers and create bilateral transactions

– No central counterparty or Market Operator tariff required

– E-Tags will be authored from source to sink based on the matched bilateral transactions (using path information provided with the bids/offers) after the award

• 2015 recommendation: – Focus on the CCED proposal, rather than try to build an interim

market, given the limited staff resources and change management at the operator and trader level

– Encourage traders to use existing intra-hour market infrastructure to increase sub-hourly liquidity

15-Minute Bilateral Market Consideration (Interim Opportunity)

39

Steps to Implement CCED By Oct 2017

40

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

41

• Objective – Identify solutions that leverage regional diversity, collaboration, and

economic efficiency in the allocation and dispatch of regulating and “balancing” reserve (4 seconds - 30 minutes).

• Key Discoveries – Shared objectives and outcomes for Regulation Sharing and Balancing

Reserves Diversity Group

– Regulation Sharing Team and the Balancing Reserves Diversity Group Team should be merged due to overlapping scope

– BAL-001 R2 (BAAL) changes how Balancing Authorities are able to plan for and meet compliance requirements related to their Area Control Error (ACE) allowing them to respond to ACE deviations less frequently and share offsetting ACE biases across Balancing Authority Areas (illustrated on the following slide)

Regulation Reserves Sharing Group

42 Represents Current Design Spec – Subject to Change

• Product 1 – Focus on increasing ACE Diversity Interchange (ADI) participation (Phase 1) and increasing the ADI MW limits (Phase 2) – Phase 1: Targeted to be delivered by Q4 2015

– Phase 2: Targeted to be delivered by 4/1/16

• Product 2 – Focus on the formation of a Regulation Reserves Sharing Group (RRSG). – Phase 1: Targeted to be delivered in 2016 as BAAL (BAL-001-2 R2) is

implemented.

– Phase 2: Explore integration of a capacity market component that relies on economic dispatch protocol similar to SCED as a supplement to the base RRSG program.

Recommended Solution Overview

43 Represents Current Design Spec – Subject to Change

Phase 1 • Expand ADI participation to include all members of the MC Initiative

– 5 of the 14 MC participants currently participate in ADI

Phase 2 • Explore increasing the ADI Program Limits

Collect data during Phase 1 and Phase 2 • Goal of data collection is to test transmission feasibility and the

benefits of increased participation relative to the expected benefits of more advanced programs, such as the Regulation Reserve Sharing Group (RRSG)

Product 1 Proposal

44 Represents Current Design Spec – Subject to Change

• ADI – ACE Diversity Interchange

• ADI is the pooling of several BA’s Area Control Errors (ACE) – 30 MW real-time limit per BA

– 60 MWh energy limit per BA

• Once an entity reaches this limit, their participation is suspended in the limited direction until the entity has reduced to 30 MWh of accumulation

– ADI flows on as-available transmission

– ADI is voluntary

– Any ADI participant can suspend their participation at any time

– Any ADI participant can suspend the ADI program all together

– ADI is automatically suspended any time Contingency Reserves are activated within the footprint

• Cost to join is low (<$25K/entity estimated)

Area Control Error (ACE) Diversity Interchange

45 Represents Current Design Spec – Subject to Change

• Benefits – Increase regional operational coordination

– Reduce energy reserves deployed

– Machine wear and tear reduction

– Large generator ramp in/out management

– Ability to operate generators longer at efficient set points

– Complements Reliability Based Controls (BAAL) • Help smaller BAs meet tighter control requirements

– System Operator experience and training

– Data used to inform Product 2 (Regulation Reserve Sharing Group)

• Risks – Coordinating the necessary communication links

– Member staff time may conflict with other operations-focused initiatives

Product 1, Phase 1: Expand ADI Participation

46 Represents Current Design Spec – Subject to Change

• BC Hydro*

• Idaho Power*

• Northwestern*

• NaturEner*

• BPA (rejoining 7/1/15)*

• Arizona Public Service

• Salt River Project

* MC Initiative Member

Existing ADI Members

47

• BANC

• Turlock Irrigation Dist.

• Portland General

• Tacoma

• Avista

• WAPA – Upper Great Plains

• WAPA – Sierra Nevada

• Chelan

• Seattle

• Puget Sound Energy

(Future) MC ADI Participants

• Description – Expand the existing ADI limits

– Increase the real-time limit from the current 30 MW

– Increase the energy limit from the current 60 MWh

– Will require WECC Performance Work Group review

– Study ADI’s affects on the transmission system

• Benefits – Directly expands the benefits on the existing ADI program

– Expanded operational flexibility

– Data used to inform Product 2 (Regulation Reserve Sharing Group)

• Risks – Transmission utilization

Product 1, Phase 2: Expand ADI Limits

48 Represents Current Design Spec – Subject to Change

• Increase coordination and centralized operation in support of compliance with the BA obligations to comply with BAL-001-2 – Develop a centralized organization

– The CPS2 short-term balancing metric will be replaced with the Balancing Authority Area Limit (“BAAL”) framework

• The standard creates the opportunity for entities to form an RRSG to serve as a Responsible Entity for meeting the BAL-001 requirements (as opposed to individual BAs)

– Whether or not entities are in the RRSG, compliance parameters will change on July 1, 2016 and entities will need to adapt operations

• The proposed RRSG first assumes that participating BAs have implemented ACE Diversity Interchange (“ADI”) and have gained the benefits of sharing data and increasing operational coordination

Product 2 – Regulation Reserve Sharing Group (RRSG)

49 Represents Current Design Spec – Subject to Change

• The RRSG would deliver these efficiencies by developing common reserve requirement metrics and balancing operations practices that take into account the inherent diversity benefit of non-correlated error over a wide footprint

• It would also seek to centralize operation and monitoring to take advantage of BAAL, which allows BAs to operate with a limited amount of Area Control Error in a “dead band”

• Each entity would be expected to bring its identified capacity to allow for RRSG operations with other entities (ie. the RRSG would not be a source of flexible capacity for entities)

Product 2 – RRSG, cont’d

50 Represents Current Design Spec – Subject to Change

Regulation Reserves Capacity Benefits • Higher resolution and more near-term calculation of BAAL reserve

obligation, along with recognizing diversity of error over a wide footprint, may reduce the pool’s total regulation reserve obligations, and thereby individual entities’

Regulation Reserves Energy Benefits • Energy efficiency gains

– Fewer deployments allow generators to remain at efficient set points for a longer period of time

• Reduced wear and tear

– Fewer deployments and movement towards “flatter” deployments due to BAAL reduces wear-and-tear

Benefits of a Regulation Reserve Sharing Group

51 Represents Current Design Spec – Subject to Change

• Defining RRSG Specifications (Begin Immediately) – Define BAAL Reserve Capacity – align definitions & interpretations

– Work with RS to finalize an RRSG RS methodology

– Decide whether to pursue a consolidated or individual request approach

– Define trigger events

– Develop settlements and governance practices

– Determine how the program should interact with individual EMS systems

– Help BAs determine AGC tuning requirements

• Vendor Contracting (Aug 1 – Oct 1, 2015) – RRSG support services (NWPP?)

– Program housing and ICCP data linkage (BPA, Peak?)

– Coding/programming consultants (assuming CRSG platform basis?)

• Program Build (Oct 1 – Mar 1, 2015) – Software development/code changes

– Software documentation

• RRSG Implementation (target July 1, 2016)

RRSG Next Steps

52 Represents Current Design Spec – Subject to Change

Regulation Diversity Program (RDP) Estimated Timeline

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

2015 2016 2017

Recruit new

ADI

participants

Communications +

BA Code Changes + Testing

Rolling “Go Live”

as members join

Define detailed

RRSG Specs

Contracting

w/ vendor

Program build

RRSG Testing

Phase 2: Enhanced RRSG Phase 1: Standing up a RRSG (Implementation of BAL-001)

Phase 1: ADI Expanded

Membership

Expanded

MW Limit

Gather and Analyze Data

Go

Live

Go

Live

Go

Live

MC Go /

No GO

Product 1: ADI Group

Product 2: Regulating Reserves Sharing Group

CIP (4/1) BAAL-001

(7/1) FRR (4/1)

Represents Current Design Spec – Subject to Change

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

54

• MC Objective for Transmission Operations Coordination: – Define opportunities for regional efficiencies, improvements, or

enhancements in how transmission service is provided, managed, or implemented, and/or how transmission operations functions are carried out.

• Team identified: – 4 issue areas

– 1 overall recommendation

• 6 sub-proposals

Module 7 Overview

55

1. Constraint and congestion relief coordination

2. Communication regarding dynamic changes in System Operating Limits from Transmission Operators to Transmission Service Providers that may result in changes to Total Transfer Capability updates on key flowgates

3. Model coordination between WECC, Peak, and individual Operators

4. Open Access Transmission Tariffs ("OATT") and Business Practices ("BP") alignment

5. Real-time coordinated Transmission Operator operations

Transmission Coordination Opportunities

56 Represents Current Design Spec – Subject to Change

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

57

58

Building with the Option for Future Growth - CCED and SCED Visual -

The CCED community

is fully built by 2017 –

everyone’s moved in

and enjoying the

benefits of a well

planned neighborhood.

But the streets, water,

sewer, gas, and

electric are all ready

to expand if the

developers and

community decide to!

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

59

Operations Integration Work Group

• The MC Participants will collaborate with each other, supported by outside experts as the MC Participants deem appropriate, to monitor and evaluate evolving market, operational, tariff, business, and regulatory issues and develop recommended MC Initiative actions to address them.

• Example areas include: – Tools/protocols between NWPP MC TOPs and TSPs

– Potential for common operations and transmission services among adjacent BAs and TSPs (one-to-one, one-to-many)

– PacifiCorp exploring CAISO Participating Transmission Owner (PTO) role

– CAISO EIM footprint expansion impacts

– Integration with PEAK Reliability Coordinator initiatives (ECC, outage coordination, etc.)

60

AGENDA

• Introduction to MC Initiative • High-Level Review of Current MC Status • Deep-Dive on MC Phase 4 Activity

– Module 1 / 2 - Regional Tools – Module 3 - Resource Sufficiency – Module 4 - Centralized Clearing Energy Dispatch – Module 5 / 6 - Regulation Sharing – Module 7 - Transmission – Module 8 - Security Constrained Economic Dispatch – Other Work Areas

• Timelines and Closing Remarks

61

• Select workpapers from MC Phase 3 will be posted to the NWPP MC site in early to mid-July

– Will respect confidentiality agreements related to the SCED RFP responses

– Shows significant staff work on SCED design, integration, and the genesis of the portfolio solutions

• Notice will be sent to the MC Public Stakeholder list with a link to the materials and table of contents

Posting of MC Phase 3 Materials

62

NWPP MC 2015 Roadmap

63

NWPP MC 2016-2017 Roadmap

64 64