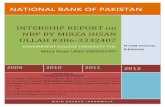

NBP Report 1

Transcript of NBP Report 1

-

8/3/2019 NBP Report 1

1/53

CHAPTER 1

INTRODUCTION

Background of the organization

As part of the academic requirement for completing MBA (Finance) Master of

Business Administration of the students are required to under go two months of

internship with an organization. The internship is to serve the purpose of

acquainting the students with the practice of knowledge of the discipline of

banking administration.

This report is about National Bank of Pakistan. NBP was established in 1949 and

since then, it has expanded its network, becoming the largest commercial Bank of

the country. It offers different products of services to its customers.

Purpose of the internship

The main purpose of the study in hand is together relevant information to compile

internship report on National Bank of Pakistan.

To observe, analyze and interpret data completely and in a useful manner.

1. To work practically in an organization.

2. To develop interpersonal communication.

3. To develop perceivably in communication.

Scope of Study

As an internee in National Bank of Pakistan the main focus of my study research

was on general banking procedure in one of the branches of NBP. These

operations include remittances, deposits, advances, foreign exchange, account

opening, ATM, dispatch and clearing departments.

Similarly different aspects of overall of NBP are also covered in this report.

1

-

8/3/2019 NBP Report 1

2/53

Methodology

The report is based on my two months internship program in National Bank of

Pakistan. The methodology reported for collection of data is primary as well as

secondary data. The biggest of information is my personal observation while

working with staff and having discussion with them. Formally arrange interviews

and discussion also helped me in this regards.

1. Primary Data:

Personal observation

Interviews of staff

2. Secondary Data:

Manuals

Annual reports

Internet

2

-

8/3/2019 NBP Report 1

3/53

CHAPTER 2

HISTORY OF NATIONAL BANK OF PAKISTAN

Golden History Of National Bank Pakistan

In 1949 (September) U.K (United Kingdom). devalued its currency, India

followed suit but Pakistan did not. India said we had contravened the agreement of

keeping both currencies at par. We said we had not done that, India had done it

arbitrarily without consulting us. On October 3, 1949 the two central banks were

to announce the new par value of both currencies but India denied a day earlier.

India also froze our trade - balance surplus that is still an unsettled dispute.

India also withdraws the Marwari merchants who were employed annually for

movement of jute crop by financing it. There being no jute industry, prices fell

sharply, foreign banks and foreign merchants stood aside and an agrarian unrest

was threatening.

Two Ordinances were, therefore, issued

1. Jute Board Establishment Ordinance &

2. NBP Ordinance dated 08.11.1949

National Bank of Pakistan was established on November 9, 1949 under the

National Bank of Pakistan Ordinance 1949 in order to cope with the crisis

conditions which were developed after trade deadlock with India and devaluation

of Indian Rupee in 1949. Initially the Bank was established with the objective to

extend credit to the agriculture sector. The normal procedure of establishing a

banking company under the Companies

3

-

8/3/2019 NBP Report 1

4/53

Law was set aside and the Bank was established through the promulgation of an

Ordinance due to the crisis situation that had developed with regard to financing of

JUTE

Trade. The Bank commenced its operations from November 20, 1949 at six

important jute centers in the East Pakistan and directed its resources in financing

of jute crop. The Banks Karachi and Lahore offices were subsequently opened in

December 1949. The nature of responsibilities of the Bank is different and unique

from other banks/financial institutions. The Bank act as an agent of the State Bank

of Pakistan for handling Provincial / Federal and Government Receipts and

Payments on its behalf. Mr. Ghulam Farooq was chairman Jute Board and Mr.

Mumtaz Hassan was chairman NBP. Until June 1950, NBP remained exclusively

in jute operations, thereafter-other commodities were also taken-up. After that Mr.

Zahid Hussain, Governor SBP assumed additional charge also as chairman NBP's

Board of Directors, and Mr. M.A. Muhajir became its first M.D.

In 1952 NBP replaced Imperial Bank of India. Mr. Mumtaz Hassan as Acting

Governor of SBP negotiated this arrangement. In 1962 when Mr. Mumtaz Hassan

became MD (He had already served NBP for 10 years as its Chairman of

government Director), the number of branches had increased from 6 to 239 and

deposits from Rs.5 crore (50 million) to 106 crore (one bn & 60 mln), profit from

3 million (3 Lac) to 21 million (2.1. crore) and the staff increased from 380 to

7091, as compared to 1949-50. In Dec. 1966 its 600th branch was opened raising

the deposits to 2.31 bn. and staff to 14, 963. Up to 1965, the shareholders had

received 225% of their original investment.

The Bank has also played an important role in financing the countrys growing

trade, which has expended through the years as diversification took place. Today

the Bank finances import/export business to the tune of more than Rs.70 Billion,

whereas in 1960 financing under this head was only Rs. 2 Billion.

4

-

8/3/2019 NBP Report 1

5/53

The field is being de-layered to improve customer services and enable faster

decision-making. As a result of this de-layering zones have been eliminated and

the numbers of

Regions have been increased. Organizational hierarchy at the regional level has

been restructured and operational and business activities have been completely

separated. This separation will improve communication, decision-making and

promote teamwork.

For the third consecutive year, the Bank is recognized as the best Bank in Pakistan

for the year 2004 by the prestigious periodical. The Banker UK (a subsidiary of

Financial Times Group). Were expanding horizons, reaching out, being thereand bringing something for everyone. After all, we are The Nations Bank

PRESIDENT MESSAGE

It gives me great pleasure to announce that National Bank of Pakistan is gearing

up to the challenges faced by the domestic banking industry due to innovations

and advances in the international banking world, which is the consequence of

globalization.

The bank wishes to effectively utilize the financial assistance being extended by

the Government of Pakistan for banking sector reforms aimed at reducing

operating costs and improving profitability.

National Bank of Pakistan is distinct from other banks in that it has a nonprofit

and service oriented motive, which has manifested itself in the area of salary

deposits of government employees and payment of utility bills. The bank renders

both of these services across the country reaching as far as the remotest regions;

from our northern borders to the Arabian Sea. These services do not contribute

towards the earnings of the bank; rather they put pressure on our resources.

Nevertheless, we are committed to serving small savers and the general public of

the country. National Bank is everyones and does not only serve corporate

5

-

8/3/2019 NBP Report 1

6/53

customers. By extending and targeting our research to improve bank earnings,

through customer focus of our commercial and corporate branches, and by

enhanced efforts towards the development of human capital, we shall very soon

transform the bank from a bureaucratic organization to a fast paced, modern, andcompetitive bank.

In conclusion, I firmly believe that we have the vision, which will enable us to

achieve even better results, safeguard the interest of our customers and to assist us

in our march towards progress and prosperity in future.

S. Ali Raza

Chairman & President

VISION STATEMENT: To be recognized as a leader and a brand synonymous

with trust, highest standards of service quality, international best practices and

social responsibility.

MISSION STATEMENT: NBP will aspire to the values that make NBP truly

the Nations Bank, by:

Institutionalizing a merit & performance culture.

Creating a distinctive brand identity by providing

the highest standard of services.

Adopting the best International Management

practices.

Making Shareholders values.

Discharging our responsibility as a good

corporate citizen of Pakistan & in countries where we operate.

CORE VALUES:

Highest standard of integrity.

Institutionalizing teamwork & performance

culture.

Excellence in service.

6

-

8/3/2019 NBP Report 1

7/53

Advancement of skills for tomorrow challenges.

Awareness of social & community response.

Value creation for all shareholders.

7

-

8/3/2019 NBP Report 1

8/53

ORGANIZATIONAL HIERARCHY

PRESIDENT

SENIOR VICE EXECUTIVE PRESIDENT (SVEP)

EXECUTIVE VICE PRESIDENT (EVP)

SENIOR VICE PRESIDENT (SVP)

VICE PRESIDENT (VP)

ASSISTANT VICE PRESIDENT (AVP)

OFFICER GRADE III

OFFICER GRADE II

OFFICER GRADE I

8

-

8/3/2019 NBP Report 1

9/53

Objectives Of NBP

Objectives are ends towards which an enterprise activity is aimed. The purpose of

business is production and marketing of economic goods and services but to

accomplish these objectives to a number of enterprise objectives may benecessary.

National bank of Pakistan has certain objectives. These objectives are

(1) Advancing loans:

One of the main objectives of NBP is advancing loans to industrialists and traders

against security of stock, debentures or other securities

(2) Accept deposits:

Bank provides deposit facility to its customers. The types of deposits are

Profit and loss saving accounts

Fixed account

Current account

(3) Remitting of funds:

The bank provides the facility to its customers remitting large amounts of

money in the form of bank Drafts, Telegraphic Transfer, Mail Transfer to where

ever the customers want.

(4) Sale of promissory notes:

To sell and realize the proceeds of sale of any promissory notes, debentures, stock

receipts, bonds, shares etc.

(5) Selling and realizing property of bank claims:

To manage sell and realize all property whether moveable or immoveable which

may come in any way of the bank in satisfaction of its claim.

(6) Investment or underwriting of stocks:

To invest the funds of the bank in or the underwriting of any of stocks, funds,

shares securities, debentures, bonds or scripts or other securities for money issued

by any public limited companies and to convert them into money when required.

9

-

8/3/2019 NBP Report 1

10/53

Branches & Centers

Branches:

Currently more than 1200 branches are working in over all Pakistan in different

cities and regions including all major and minor cities of Pakistan.Online Branches:

Following are the online branches that are currently working in Pakistan.

Karachi

Islamabad

Rawalpindi

Gujar Khan

Sialkot

Gujranwala

Skhupura

Hyderabad

Quetta

Lahore

Burewala

Multan

Muzaffarabad

Faisalabad

Peshawar

Kohat

Mirpur

Gujrat

Abootabad

Bhawalpur

DG Khan

DI Khan

Jhang

Ladkana

Mardan

Sahiwal

Sargodha

Sucker

Jhelum

Wah Cantt

10

-

8/3/2019 NBP Report 1

11/53

Swift Centers

SWIFT is a main center that is interconnecting all branches with each other.

SWIFT channels mainly do the international transactions of NBP. These

transactions include Foreign Exchange Dealings, Foreign Telegraphic Transferand Letter of Credit.

Through these channels NBP Super Market is sending messages for Letter of

Credit, foreign trade etc. because in every branch SWIFT system is not available

because of problems.

Therefore other branches send application letters to local branches in which

SWIFT system is available and these local branches send message to international

branches for further transactions.

Different Schemes Conducted By NBPDifferent Schemes Conducted By NBP

National Bank of Pakistan always makes efforts to improve its goodwill in the

general public. It introduces different kind of schemes time to time.

The most popular schemes conducted by NBP are as under:

Hajj Mubarak Scheme

NBP Advance Salary Scheme

Fund Management Scheme

11

-

8/3/2019 NBP Report 1

12/53

Hajj Mubarak Scheme

For the convenience of a person with a limited income who desires to perform

Hajj, Hajj Mubarak Scheme is introduced. Moreover, National Bank of Pakistan

processes the Hajj applications of thousands of people successfully more than any

other bank in Pakistan.

NBP Advance Salary Scheme

Do you need urgent funds? If yes then head to National Bank of Pakistan and avail

NBP Advance Salary Scheme, which allow you to draw twenty months salary in

one go. This facility is available to permanent employees of the:

Federal and Provincial governments

Semi-governments, autonomous, semi-

autonomous, local bodies, and government corporations

Other corporations approved by NBP

No guarantee, collaterals, or insurance is required to avail this scheme. NBP gives

the facility to repay the excessive amount within 1 to 60 months. The procedure is

very easy, just fill the application form and choice between 1 to 60 months and

take your NBP. NBP received 20% markup on this loan. It advances twenty

salaries at once.

Functions of NBP

The National Bank of Pakistan performs two types of function. It acts as an

ordinary commercial bank, and at places where there are no branches of State

Bank of Pakistan it represents Pakistan, that is why it cannot be privatized. As a

commercial bank it performs the following functions.

12

-

8/3/2019 NBP Report 1

13/53

Accepting of deposits of money on current

account, saving, term deposit and other profit and loss sharing accounts.

Borrowing money and arranging finance from

other banks.

Advancing and lending money to its clients.

Financing of projects including technical

assistance, project appraisal through long term/short term loans.

Buying, selling, dealing and discounting of bills

of exchange, promissory notes, drafts, bill of lading, other instruments of

securities etc.

Foreign exchange business.

Financing of seasonal crops like cotton, wheat,

rice.

Receiving of bonds, scripts, valuable etc. for safe

custody.

Carrying on agency business of any description

other than managing agent on behalf of clients, including government and

local authorities.

Generating, undertaking, promoting etc. of issue

of shares, bonds.

Transacting guarantees and indemnity business.

Undertaking and executing trusts.

Making investments in other banking companies.

Joint venturing with foreign dealers, agents and

companies for its representation abroad.

Participating World Bank and Asian

Development bank's lines of credit.

Utility services.

13

-

8/3/2019 NBP Report 1

14/53

Providing Hajj services to intending Hajis.

Agent to State Bank of Pakistan for collecting

Payment of pension on behalf of provincial and

central governments.

Treasury business.

Gold finances.

CHAPTER 3

SERVICES OF NATIONAL BANK OF PAKISTAN

Service is an identifiable, intangible activity that is the main object of a transaction

designed to provide want satisfaction to customers.

International Banking

National Bank of Pakistan is at the forefront of international banking in Pakistan,

which is proven by the fact that NBP has its branches in all of the major financialcapitals of the world. Additionally, we have recently set up the Financial

Institution Wing, which is placed under the Risk Management Group. The role of

the Financial Institution Wing is:

To effectively manage NBPs exposure to foreign

and domestic correspondence

Manage the monetary aspect of NBPs

relationship with the correspondents to support trade, treasury and other

key business areas, thereby contributing to the banks profitability

Generation of incremental trade-finance business

and revenues

14

-

8/3/2019 NBP Report 1

15/53

NBP offers:

The lowest rates on exports and other

international banking products

Access to different local commercial banks in

international banking

DEMAND DRAFTS

If you are looking for a safe, speedy and reliable way to transfer money, you cannow purchase NBPs Demand Drafts at very reasonable rates. Any person whether

an account holder of the bank or not, can purchase a Demand Draft from a bank

branch

Mail Transfers

Move your money safely and quickly using NBP Mail Transfer service. And we

also offer the most competitive rates in the market.

Pay Order

NBP provides another reason to transfer your money using our facilities. Our pay

orders are a secure and easy way to move your money from one place to another.

And, as usual, our charges for this service are extremely competitive.

Traveler's Cheques

Negotiability: Pak Rupees Travelers Cheques are a negotiable instrument

Validity: There is no restriction on the period of validity

Availability: At 700 branches of NBP all over the country

Encashment: At all 400 branches of NBP

Limitation: No limit on purchase

15

-

8/3/2019 NBP Report 1

16/53

Safety: NBP Travelers Cheques are the safest way to carry our money

Letter Of Credit

NBP is committed to offering its business customers the widest range of options in

the area of money transfer. If you are a commercial enterprise then our Letter of

Credit service is just what you are looking for. With competitive rates, security,

and ease of transaction, NBP Letters of Credit are the best way to do your business

transactions.

16

-

8/3/2019 NBP Report 1

17/53

Commercial Finance

Us help make your dreams become a reality

Our dedicated team of professionals truly understands the needs of professionals,

agriculturists, large and small business and other segments of the economy. They

are the customers best resource in making NBPs products and services work for

them.

Foreign Remittances

To facilitate its customers in the area of Home Remittances, National Bank of

Pakistan has taken a number of measures to:

Increase home remittances through the banking

system

Meet the SBP directives/instructions for timely and prompt delivery of remittances

to the beneficiaries

New Features:

The existing system of home remittances has been revised/significantly improved

and well-trained field functionaries are posted to provide efficient and reliable

home remittance services to nonresident Pakistanis at 15 overseas branches of the

Bank besides United National Bank (the joint venture between NBP and UBL in

UK)., and Bank Al-Jazira, Saudi Arabia.

Zero Tariffs: NBP is providing home remittance

services without any charges.

Strict monitoring of the system is done to ensure

the highest possible security.

17

-

8/3/2019 NBP Report 1

18/53

Special courier services are hired for expeditious delivery of home remittances to

the beneficiaries.

Swift System

The SWIFT system (Society for World-wide Inter- bank Financial

Telecommunications) has been introduced for speedy services in the area of home

remittances. The system has built-in features of computerized test keys, which

eliminates the manual application of tests that often cause delay in the payment of

home remittances.

The SWIFT Center is operational at National Bank of Pakistan with a universal

access number NBP-PKKA. All NBP overseas branches and overseas

correspondents (over 450) are drawing remittances through SWIFT.

Using the NBP network of branches, you can safely and speedily transfer money

for our business and personal needs.

Short Term Investments

NBP now offers excellent rates of profit on all its short-term investment accounts.Whether you are looking to invest for 3 months or 1 year, NBPs rates of profit are

extremely attractive, along with the security and service only NBP can provide.

Equity Investments

NBP has accelerated its activities in the stock market to improve its economic base

and restore investor confidence. The bank is now regarded as the most active and

dominant player in the development of the stock market. NBP is involved in thefollowing:

Investment into the capital market

Introduction of capital market accounts (under

process)

18

-

8/3/2019 NBP Report 1

19/53

NBPs involvement in capital markets is expected to increase its earnings, which

would result in better returns offered to account holders

N.I.D.A

National Income Daily Account The scheme was launched in December 1995 to

attract corporate customers. It is a current account scheme and is part of the profit

and loss system of accounts in operation throughout the country.

Trade Finance Other Business Loans

Agricultural finance

NBP provides Agricultural Finance to solidify faith, commitment and pride of

farmers who produce some of the best agricultural products in the World.

Agricultural Finance Services:

I Feed the World program, a new product, is introduced by NBP with the aim to

help farmers maximize the per acre production with minimum of required input.

Select farms will be made role models for other farms and farmers to follow, thus

helping farmers across Pakistan to increase production.

Agricultural Credit:

The agricultural financing strategy of NBP is aimed at three main objectives:-

Providing reliable infrastructure for agricultural

customers Help farmers utilize funds efficiently to further

develop and achieve better production

19

-

8/3/2019 NBP Report 1

20/53

Provide farmers an integrated package of credit

with supplies of essential inputs, technical knowledge, and supervision of

farming.

20

-

8/3/2019 NBP Report 1

21/53

Medium term loans and Capital Expenditure Financing:

NBP provides financing for its clients capital expenditure and other long-term

investment needs. By sharing the risk associated with such long-term investments,

NBP expedites clients attempt to upgrade and expand their operation thereby

making possible the fulfillment of our clients vision. This type of long term

financing proves the banks belief in its client's capabilities, and its commitment to

the country.

Loan Structuring and Syndication:

National Banks leadership in loan syndicating stems from ability to forge strong

relationships not only with borrowers but also with bank investors. Because we

understand our syndicate partners asset criteria, we help borrowers meet

substantial financing needs by enabling them to reach the banks most interested in

lending to their particular industry, geographic location and structure through

syndicated debt offerings. Our syndication capabilities are complemented by our

own capital strength and by industry teams, who bring specialized knowledge to

the structure of a transaction.

Cash Management Services:

With National Banks Cash Management Services (in process of being set up), the

customers sales collection will be channeled through vast network of NBP

branched spread across the country. This will enable the customer to manage their

companys total financial position right from your desktop computer. They will

also be able to take advantage of our outstanding range of payment, ejection,

liquidity and investment services. In fact, with NBP, youll be provided

everything, which takes to manage your cash flow more accurately.

21

-

8/3/2019 NBP Report 1

22/53

CHAPTER 4

ORGANIZATIONAL REVIEW

Work Done By Me

During my stay in National Bank of Pakistan, Main Branch Peshawar Cantt

Peshawar. I found it as among one of the best bank in Pakistan. As an internee, I

enjoy working their .NBP has a very cooperative staff .I worked there in very

congenial and supportive environment. The staff over there is always being ready

to guide about bank and its systems.

According to its financial statements it is on a way to progress. Due to its

miraculous working government bestowed its president Syed Ali Raza with

sitara-e-imtiaz in august 2005.

I joined National Bank of Pakistan, Main Branch Peshawar Cantt on 11 th August,

2008. First day, Mr. Abdul Rauf (the in charge of Advance department) introduced

me about the functioning of the branch and the staff. He told me that all

debarments are very important for banking functions. During the Two Months of

my internship, I worked in different sections of the branch and did the maximum

practice of banking system details of which is as under:

Departments In NBP Main Branch Peshawar Cantt

1. Foreign Exchange department

2. Credit & Advance department

3. Bills section/department

4. Remittance section/ department

5. Deposit section/ department6. Govt. section/ department

7. Cash section/ department

8. Establishment /administration section/ department

22

-

8/3/2019 NBP Report 1

23/53

Foreign Exchange Department

In this department I work for three weeks with Mr. Main Saqib Ashfaq, he

working in the deposit section. I also deal the Western Union Money Transfer

activities in this department. It has specific software which link with the Head

office of NBP. For receiving money the ten digits code number is require, the

name of receiver & sender is also require, along with this the NIC No of the

receiver is necessary. The amount transfer is also entering & it provides the

complete information. The detail of the process is print out. It has three parts on

for the customer, other for the in charge of department & the 3 rd is for the purpose

of sending o the Head office of NBP.

All the activities perform in this department are mention in the above chart of

department.

Credit And Advances Department:

It may be defined as:

The sale of goods and services and money claims in the present in exchange for a

promise to pay in future.

The most important activity of the bank is the granting of credit to the customers.

NBP provides short term long terms financing for domestic and international

trade. The policies made by central office of the cash can be amended on the basis

of the rules and regulation, economic risk of each country board of directors and

committee of the NBP made this type of decisions and informed about these

decisions to the branch managers.

The in charge of this department is Mr. Abdul Rauf. They are working under the

control of manager only & free of the control of operational manager.

23

-

8/3/2019 NBP Report 1

24/53

In this department I work five weeks I only perform the duty of President Rozgar

Scheme and Gold loan. The requirements & procedure of Gold loan is following.

Gold Loan Service

First of all the person who need the money from bank as in the form of credit the

NBP provide this facility under the Gold loan for this he need to get the ECIB

(Electronic Customer Investigation Bureau) through it checked that the customer

may or may not borrow money from any other bank of Pakistan. It is software that

is providing to all banks by SBP. After this step the NADRA verification of the

borrower NIC is made. And it is also the necessary step of Gold loan requirements

that the current account will be open in the account opening department, for thepurpose of deposit of insurance and installments to the bank. When it is clear than

the approval is made. The borrower is send to the ANDARSHER for the purpose

of weighting of Gold. The bank made a contract with the Goldsmith that he

performed the duty on behalf of NBP. He weight and valued the Gold and write a

receipt for bank. The bank receives the documents and Gold. The payment is made

to he borrower and the gold is kept in the locker of bank. Under the authority of

Chief Cashier.

The Gold loan is the demand finance. The form is containing of the following

requirements.

Proposal of Rs-------------.Terms & conditions.

Name

Limit

PurposeSecurity

Date of expiryDate of final adjustments

Date of markup

Mode of repayment

Documents

24

-

8/3/2019 NBP Report 1

25/53

President's Rozgar Scheme

if you are aged between 18 and 45 years, you could be eligible for easy

financing for self employment in the categories below:

NBP Karobar Utility Store

NBP Karobar Mobile Utility Store

NBP Karobar Mobile General Store

NBP Karobar Transport

NBP Karobar PCO

NBP Karobar Tele-Centre

In this department only provide the transport facility as Rickshaw. The

requirements & procedures for the product is the following.

ECIB, NADRA verification of NIC, current account. Application form, legal

documents, Authority letter, Sanction letter, Delivery order, purchase order,

registration, insurance. Repayment schedule, To Whom It May Concern, credit

approval memo, internal verification of applicant& witnesses.

Other services of this department:

This department also provides the service of House Building Finance, Car finance,

computer finance to the employees of NBP only. And Advance salary

is provide to those departments employees which has account with

NBP.

Account Openning Department

In this department, I gain the practical knowledge about opening account. This

department deals with opening current and saving account for its customers and all

matters regarding thereof. The customers opening current and saving accounts can

be categorized as following.

25

-

8/3/2019 NBP Report 1

26/53

Individual

Firm

Company

Trust

Staff

Others

Opening Accounts

In order to open an account, first of all the customers have to a verified NIC from

NADRA. The requirements of the account opening form are type of account,

nature of account, currency, Next of skin, personal information, signatures etc.

Types of accounts

Following types of accounts are open in NBP

Saving account

Current or demand account

Fixed account

Saving account (PLS)

This type of account is designed to encourage the saving habit of the customer and

lead to a long-term banking or investment relationship.

Bank saving accounts are in the nature of deposits accounts and are not normally

available for drawings. Rates of interest are typically ahead, by a small margin.

Saving accounts with the banking sector represent a very small proportion of total

deposits.

Current or demand account

26

-

8/3/2019 NBP Report 1

27/53

These are those deposits, which can be drawn by the depositor at my time by

presenting a cheque to the bank. People deposit their money in this account they

gave a ready command on their account in developed and under developed

countries of the world, a very significant part of money is kept under current ordemand account.

Fixed account

Fixed accounts are those, which are deposited for a fixed period of time and are

repayable after the expiry of stipulated time to the customers. Those people who

have surplus funds and want to have save investments deposit the amount in the

fixed account. The rate of interest given to depositor varies with the length ofdeposit, i.e. it is higher for longer period and lowers for shorter period.

Issuance of Cheque Book

After opening the account, a cheque book is given to the customer to sign upon

which the number of cheque book issued and the name of the customer is written.

Bank issues a cheque book against requisition. A cheque book may be of (PLS),

25 & 50 or 100 leave (current A/C).

A cheque book register is maintained by the office. In this register, the cheque

book inventory, cheque books issue is recorded.

Issuance Of New Cheque Book To Old Customer

The accountholders request for the new chequebook by presenting the requisition

slips along with the authority letter to the concerned office. His signatures are

verified before giving him a new chequebook. The presence of the accountholders

is compulsory to get a new chequebook. But if he sends a third person to get his

chequebook then the procedure is as follows;

27

-

8/3/2019 NBP Report 1

28/53

An authority letter is given to the third party by

the accountholders.

The accountholders verify the signature of the

third person on that authority letter. The bank officer gets the signature of that third

person to confirm whether he is the same to whom the accountholder has

sent.

The bank issues the new cheques book and authority letter is kept by the bank.

Clearing Department

In this department, I have worked for two weeks. The in charge of this department

is Mr. Muhammad Kamran, & the in charge of out station clearing is Mr. Amir

Alam Khan. Main branch receives the cheques from all of its branches and makes

the list of these cheques again. Main branch sends these cheques to the state bank

of Pakistan where a clearinghouse exits. In this clearinghouse the representatives

receive their cheques and go back to their bank's main branch. Then the main

branch sends these cheques to their relevant branches where the validity of these

cheques is verified and the accounts of the relevant clients are affected.

The major function of Clearing Department is to receive the cheques, which are

drawn on some other bank. The customer can get the money in his account

at NBP, from the cheques drawn on another bank. The bank accepts these

cheques and collects the amount from that bank on which cheque is drawn

through the Clearing House. Bank charges some commission for this

function.

Stamping

Early in the morning the cheques are received and than arrange in different sets.

All cheques are stamped by a number of different stamps, which is use for specific

28

-

8/3/2019 NBP Report 1

29/53

purpose. The original cheque will be marked with two stamps. Mostly used stamps

are:

National bank of Pakistan

Clearing Stamp

At the end of day, all cheques are counted and then scrutinized in bank-wise and

sent to the Clearing House.

Remittances Department

Remittance is the monitory transfer from one place to another place or from one

country to another country to fulfill the requirements of the customers by the order

of the customer.

I worked in this department for one week. In this department internees are advised

only to observe the working of transfer of money from one place to another place

of the country by the above modes of transferring money.

Issuing a bank draft it is necessary that the draft should be free from alternations.

All the details must be written clearly in ink. After issuance a demand draft it is

handed over to the applicant and its advice containing the particulars of the draft is

sent to drawer branch with its necessary information and payment of the draft is

making on its presentation.

I learn in this department also the basic of the following instruments:

Payment order (p/o)

Demand draft (DD)

Telegraphic transfer (TT)

Mail transfer (MT)

Pay Order

29

-

8/3/2019 NBP Report 1

30/53

It is an instrument, which is payable in demand .Pay order is also called the

bankers cheque drawn upon the issuing bank itself. It is not negotiable and

therefore, bankers tend to cross the instrument Payees account only to avoid the

possibility of dealing with instruments with forged endorsement. The pay order isissued favoring individuals, commercial concerns, and government departments.

On the presentation of pay order, the bank is liable to pay the amount to the

customer.

Demand Draft

If you are looking for a safe, speedy and reliable way to transfer money, you can

now purchase NBPs Demand Drafts at very reasonable rates. Any person whetheran account holder of the bank or not, can purchase a Demand Draft from a bank

branch.

Telegraphic Transfer

It is the message, which is sent from one branch to another on the order of payer to

payee through wire. It is one of the quickest means to transfer fund through the

use of telex/fax/internet or cable. Payment to the beneficiary is affected directly

by the drawee office upon identification or through credit into beneficiarys bank

account. As such remitting office is not required to issue any instrument payment

to the remitter for delivery to the beneficiary.

Mail Transfer

It is the same like TT, but in this type, the message is sent through mail rather than

telex. The procedure is same as TT, but the advice is sent through mail rather than

wired.

New Features:

30

-

8/3/2019 NBP Report 1

31/53

The existing system of home remittances has been revised/significantly improved

and well-trained field functionaries are posted to provide efficient and reliable

home remittance services to nonresident Pakistanis at overseas branches of the

Bank besides Pakistan International Bank (UK) Ltd., and Bank Al-Jazira, SaudiArabia.

Zero Tariffs: NBP is providing home remittance

services without any charges.

Strict monitoring of the system is done to ensure

the highest possible security.

Special courier services are hired for expeditious

delivery of home remittances to the beneficiaries.

Dispatch Department

I worked in this department for two days with Mr. Hamid. This department deals

in receiving of all the posted documents. They receive the posted materials posted

by other banks and institutions. Also mail theirown documents to other

organization. After receiving the documents it is recorded in the registered.

ATM Department

31

-

8/3/2019 NBP Report 1

32/53

I work in this department for three days .on the first day I fill the forms for those

customers whose ATM card are expired and issue the reminders to those customers

through their home address. The ATM is the separate department in the main

branch Peshawar cantt. It is operated by a single person Mr. Zahid. The NBP due tothe fraud in ATM card operation ban the transaction with other banks and the ATM

card of NBP not operative in those banks. They also cannot provide the facility of

Credit Card because the people cannot repay their dues to the bank.

32

-

8/3/2019 NBP Report 1

33/53

CHAPTER 5

FINANCIAL ANALYSIS

Financial Analysis

Financial analysis is an evaluation of a firmsperformance. The source of financial

analysis is the financial statements & Director reports. The main purpose of the

financial analysis is to give a clear picture of the financial position by studying the

relationship & comparison between the items in the statement.

The financial statements are the balance sheet and income statement. The balance

sheet summarizes the assets, liabilities and owners equity of a business at a point

of time, and the income statement summarizes revenues and expenses of the over a

particular period of time.

Seven Years Performance of NBP at a Glance (Rs. In million)

Year 2009 2008 2007 2006 2005 2004 2003

Items

Total assets 762,193 635,133 577,719 553,23

1

468,972432,80

3

415,089

Deposits 591,907 501,872 463,427 465,57

2

395,492362,86

6

349,617

Advances 340,677 316,110 268,839 220,79

4

161,266140,54

7

170,319

Investments 210,787 139,947 156,985 149,35

0

166,196143,52

5

71,759

Shareholders equity 70,907 53,045 37,636 24,900 18,134 14,279 11,959

Pre-tax profit 28,060 26,311 19,056 11,978 9,009 6,045 3,016

After-tax profit 19,033 17,022 12,709 6,195 4,198 2,253 1,149

Earning per share (EPS) 23.34 20.88 17.92 10.48 8.53 5.49 3.08

Return on assets (ROA) 2.49% 4.3% 3.4% 2.4% 2.0% 1.4% 0.8%No of Branches 1,243 1,250 1,242 1,226 1,199 1,204 1,245

No of employees 14,079 14,019 13,824 13,745 13,272 12,195 15,163

On the basis of the view of financial experts I also study and explain the financial

performance of the NBP of the last seven years. (2001 to 2007).

33

-

8/3/2019 NBP Report 1

34/53

NATIONAL BANK OF PAKISTAN

BALANCE SHEET

AS AT 31STDECEMBER, 2009& 20082009

(Rupees in 000s)

2008

(Rupees in 000s)

ASSETSCash &Balance with other

Banks

Lending to FinancialInstitution

investment

AdvanceOperating Fixed Assets

Deferred tax assets

Other Assets

94,873,249

37,472,83221,464,600

210,787,868

340,677,10025,922,979

-

30,994,965

78,625,227

40,641,67923,012,732

139,946,995

316,110,4069,681,974

-

27,113,698

TOTAL ASSETS 762,193,593 635,132,711

LIABILITIES

Bills Payables

10,605,663

Borrowings

Deposits & other accounts

Sub-ordinated loansLiabilities against assets

subject to finance lease

Deferred tax liabilities-net

Other liabilities

7,061,902

10,886,063

591,907,435

-

33,554

5,097,831

30,869,154

10,605,663

11,704,079

501,872,243

-

13,235

2,387,073

26,596,300

TOATAL LIAILITIES 645,855,939 553,178,593

NET ASSETS 116,337,654 81,954,118

PRESENTED BY

Share capital

Reserves

Unappropriated profit

8,154.319

15,772,12445,344,188

7,090,712

13,879,26032,074,677

Surplus on revaluation of

assets

69,270,631

47,067,023116,337,654

53,044,649

28,909,66981,954,118

34

-

8/3/2019 NBP Report 1

35/53

NATIONAL BANK OF PAKISTAN

PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31st DECENBER 2009& 2008

2009

Rupees in000's

2008

Rupees in000's

Mark-up /return/interest earnedMark-up return/interest expensed

50,569,48116,940,011

44,100,93413,947,218

Net mark-up/interest income 33,629,470 30,153,716

Provision against non-performing loans and advanceReversal of provision for diminution in the value ofinvestmentsBad debts written off directly

4,723,084

(40,084)

39,899

30,075,723

(709,461)

5,284

4,722,735 2,371,546

Net mark-up/ interest income afterprovision 28,906,735 27,782,170

NON-MARK-UP/INTEREST INCOME

Fee, Commission and brokerage income

Dividend income

Income from dealing in foreign currenciesGain on sale and redemption of securities

Unrealized loss on revaluation of investment

classified as held-for-tradingOther income

6,781.6833,263,2461,042,8272,341,690

(31,964)

147,363

6,144,6282,891,7551,333,8401,169,515

(4,464)

627,618

Total non-markup/interest income 13,544,845 12,162,892 42,544,845 39,945,062

NON- MARK-UP/INTEREST EXPENSESAdministrative ExpensesOther provision/write offsOther charges

14,205,911168,02717,141

13,443,441(17,283)208,327

Total non mark-up/interest expenses 14,391,079 13,634,485Extra ordinary items - -

Profit before taxation 28,060,501 26,310,577Taxation-Current

-Prior years-Deferred

8,311,500391,497323,731

8,695,598530,65261,981

9,026,728 9,288,231Profit after taxation 19,033,728 17,022,346Unappropriated profit brought forwardTransfer from surplus on revaluation of fixed assets onaccount of incremental depreciation

32,074,67739,007

19,372,52341,060

Profit available for appropriation 51,147,457 36,435,929Basic earning per share

Diluted earning per share

23.34

23.34

20.88

20.88

35

-

8/3/2019 NBP Report 1

36/53

HORIZONTAL ANALYSIS:Profit & Loss AccountBalance Sheet

The horizontal analysis shows the comparison between the current and past year

performance of the organization by comparing the Balance sheet ant profit and

loss statement items. The formula use for horizontal analysis as follow.

VERTICAL ANALYSIS:Profit & Loss Account

Balance Sheet

In vertical analysis all the items of balance sheet and profit and loss statement are

divided by the total assets and total equity and liabilities and the revenue or sales

in balance sheet and profit and loss statement respectively.

36

-

8/3/2019 NBP Report 1

37/53

National Bank of Pakistan

HORIZANTAL ANALYSIS

BALANCE SHEET

AS AT 31STDECEMBER, 2009& 2008ASSETS

2009Rupees in 000s

2008Rupees in 000s

Increase/

decreaseRupees in 000s

%age

Cash &Balance with other Banks

Balance with other Banks

Lending to Financial Institution

Investment

Advances

Operating Fixed Assets

Deferred tax assets

Other Assets

94,873,249

37,472,832

21,464,600

210,787,868

340,677,100

25,922,979

-

30,994,965

78,625,227

40,641,679

23,012,732

139,946,995

316,110,406

9,681,974

-

27,113,698

16,248,022

(3,168,847)

(1,548,132)

70,840,873

24,566,694

16,241,005

-

3,881,267

20.67

(7.79)

(6.72)

50.62

7.77

167.74

-

14.31

Total Assets 762,193,593 635,132,711 127,060,882 20.00

LIABILITIES

Bills PayablesBorrowingsDeposits & otheraccountsSub-ordinated loansLiabilities against assets subjectTo finance leaseDeferred tax liabilities-netOther liabilities

7,061,90210,886,063591,907,435

-33,554

5,097,83130,869,154

10,605,66311,704,079501,872,243

-13,235

2,387,07326, 596,300

(3,543,761)(818,016)90,035,192

-20,319

2,710,7584,272,854

(33.41)(6.98)17.93

-153.52

113.5616.06

Total liabilities 645855939 553178593 92,677,346 16.75NET ASSETS 116,337,654 81, 954,118 34,383,536 41.95Share capital

Reserves

Unappropriated profit

8,154.319

15,772,124

45,344,188

7, 090,712

13,879,260

32, 074, 677

1,063,607

1,892,864

13,269,511

15.00

13.63

41.37

69,270,631 53, 044, 649 16,225,982 30.58

Surplus on revaluation of

Assets-net

47,067,023 28,909,469 18,157,554 62.80

116,337,654 81,954,118 34,383,536 41.95

37

-

8/3/2019 NBP Report 1

38/53

NATIONAL BANK OF PAKISTANHORIZONTAL ANALYSIS

PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31st DECENBER 2009 & 2008

NATIONAL BANK OF PAKISTAN

2009Rupees in 000's

2008Rupees in

000's

Increase/DecreaseRupees in

000s

Changein %age

Mark-up return/interest earnedMark-up return/interest expensed

50,569,48116,940,011

44,100,93413,947,218

6,468,5472992793

14.6621.46

Net mark-up/interest income 33,629,470 30,153,716 3475754 11.52

Provision against non-performingLoans and advancesReversal of provision for diminutionin the value of investments

bad debt written off directly

4,723,084

(40,248)

39,899

3,075,723

(709,461)

5,284

1647361

(749709)

34615

53.56

(105.67)

655.09

4,722,735 2,371,546 2,351,189 99.14

Net mark-up/ interest income afterprovision

28,906,735 27,782,170 1124565 4.04

Fee, commission and brokerageIncomeDividend incomeIncome from dealing in foreigncurrenciesGain on sale and redemption ofSecuritiesUnrealized loss on revaluation ofinvestments classified as held fortrading

other income

6,781,683

3,263,2461,042,827

2,341,690

(31,964)

147,363

6,144,628

2,891,7551,333,840

1,169,515

(4,464)

627,618

637055

371491(291013)

1172175

(36428)

(480255)

10.36

12.84(21.82)

100.22

(816.03)

(76.52)

Total non-mark-up/interest

expenses

13,544,845 12,162,892 1381953 11.36

42,451,580 39,945,062 2506518 6.27

NON MARK-UP /INTERESTEXPENCESAdministrative expenseOther provisions/writeOther charges

14,205,911168,02717,141

13,443,441(17,283)

208,327

762470150744(191,186)

5.67872.20(91.77)

Extra ordinary items

-- - - -

Profit before taxation 28,060,501 26,310,577 1749924 6.65Taxation-Current

-Prior years-Deferred

8,311,500391,497323,731

8,695,598530,65261,981

(384098)(139155)261750

(4.42)(26.22)422.30

9,026,728 9,288,231 (261503) (2.81)

Profit after taxation 19,033,773 17,022,346 2011427 11.81Unappropriated profit/(loss) brought

forwardTransfer from surplus onrevaluation of fixed assets on accountof incremental depreciation

32,074,677

39,007

19,372,523

41,060

12702154

(2053)

65.56

(5.00)

Profit available for appropriation 51,147,457 36,435,929 14711528 40.37Rupees

Basic earning per share 23.34 20.88 2.46 11.78

38

-

8/3/2019 NBP Report 1

39/53

VERTICAL ANALYSIS

BALANCE SHEET

AS AT 31STDECEMBER, 2009 & 2008

2009Rupees

in 000s

%2008

Rupees

in 000s

%

ASSETSCash &Balance with other Banks

Balance with other Banks

Lending to Financial Institution

Investment

Advances

Operating Fixed Assets

Deferred tax assets

Other Assets

94,873,249

37,472,832

21,464,600

210,787,868

340,677,100

25,922,979

-

30,994,965

12.44

4.91

2.81

27.65

44.69

3.40

-

4.06

78,625,227

40,641,679

23,012,732

139,946,995

316,110,406

9,681,974

-

27,113,698

12.37

6.39

3.62

22.03

49.77

1.52

-

4.26

Total assets 762,193,593 100 635,132,711 100

LIABILITIESBills PayablesBorrowingsDeposits & other accountssub-ordinated loansLiabilities against assets subjectTo finance leaseDeferred tax liabilities-netOther liabilities

7,061,90210,886,063591,907,435

-33,554

5,097,83130,869,154

0.921.42

77.65-

4.40

0.664.05

10,605,66311,704,079501,872,243

-13,235

2,387,07326,596,300

1.661.8479.01

-2.08

0.374.18

Total liabilities 645855939 84.73 553178593 87.09NET ASSETS 116,337,654 15.26 81,954,118 12.90Share capital

Reserves

Unappropriated profit

53,044,649 8.

8,154.319

15,772,124

45,344,188

1.06

2.06

5.94

7,090,712

13,879,260

32,074,677

1.11

2.18

5.05

69,270,631 9.08 53,044,649 8.35

Surplus on revaluation of

Assets-net

47,067,023 6.17 28,909,669 4.55

116,337,654 15.26 81,954,118 12.90

39

-

8/3/2019 NBP Report 1

40/53

NATIONAL BANK OF PAKISTAN

VERTICAL ANALYSIS

ROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31st DECENBER 2009& 2008

2009

Rupees in

000's % age

2008

Rupees in

000's

%

ageMark-up/ return/ interest earnedMark-up/ return/ interest expensed

50,569,48116,940,011

10033.49

44,100,93413,947,218

10031.62

Net-mark up/interest income 33,629,470 66.50 30,153,716 68.37

Provision against non-performingloans and advancesReversal of provision for diminutionin the value of investmentsbad debt written off directly

4,723,084

(40,248)

39,899

9.33

(0.07)

0.07

3,075,723

(709,461)

5,284

6.97

(1.60)

0.01

4,722,735 9.33 2,371,546 5.37

Net-mark up/interest incomeafter provision

28,906,735 57.16 27,782,170 62.99

NON MARK UP /INTERESTINCOMEFee, commission and brokerageIncomeDividend incomeIncome from dealing in foreigncurrenciesGain on sale and redemption ofSecuritiesUnrealized loss on revaluation ofinvestments classified as held fortradingother income

6,781,683

3,263,2461,042,827

2,341,690

(31,964)

147,363

13.41

6.452.06

4.63

(0.06)

0.29

6,144,628

2,891,7551,333,840

1,169,515

(4,464)

627,618

13.93

6.553.02

2.65

(0.01)

1.42

Total non mark-up/ interest 13,544,845 26.78 12,162,892 27.5742,451,580 83.94 39,945,062 90.57

NON MARK-UP /INTERESTEXPENCESAdministrative expenseOther provisions/write offs/(reversals)Other charges

14,205,911168,027

17,141

28.090.33

0.03

13,443,441(17,283)

208,327

30.48(0.03)

0.47

Total non mark-up / interestexpenses

14,391,079 0.47 13,634,485 30.91

28,060,501 28.45 26,310,577 59.65

Extra ordinary / unusual items - - - -

PROFIT BEFORE TAXATION 28,060,501 55.48 26,310,577 59.65

Taxation- current-prior years

-deferred

8,311,500391,497

323,731

16.43077

0.64

8,695,598530,652

61,981

19.711.20

0.149,026,728 17.85 9,288,231 21.06

PROFIT AFTER TAXATION

17,022,346 38.59

19,033,773 37.63 17,022,346 38.59

Unappropriated profit broughtforward

19,372,523 43.92Transfer from surplus on revaluation

32,074,677

39,007

63.42

0.07

19,372,523

41,060

43.92

0.09

40

-

8/3/2019 NBP Report 1

41/53

of fixed assets on account ofincremental depreciation

Profit available for

appropriation

51,147,457 101.14 36,435,929 82.61

Basic earning per share 23.34 20.88

RATIO ANALYSIS

Financial analysis is the process of identifying the financial strengths and

weakness of the firm by properly establishing relationship between the items of

balance sheet and profit and loss statement, in order to make rational decision in

keeping with the objective of the organization, for that purpose the management

use analytical tools. To evaluate the financial condition and performance of the

business entity.

The financial ratio is a number that expresses the value of one financial variable

relative to another. Put more simply, a financial ratio is the result you get when

you divide one financial number by another. Calculating an individual ratio is

simple, but each ratio must be analyzed carefully to effectively measure a firms

performance.

Itis important way to state meaningful relationship between two components of a

financial statement. Ratios are guides or shortcuts that are useful in evaluating acompanys financial position and operations and making comparisons with results

in previous years or with other companies. The primary purpose of ratios is to

point out areas needing further investigation.

Therefore in my report I include some of the ratio to show the financial position of

the NBP.

41

-

8/3/2019 NBP Report 1

42/53

Margin Of Profit = Net profit x 100Markup/Return/Interest Earned

2008 2009

19,033,773000

______________ x 100

50,569,481,000

= 37.93%

17,022,346000

_______________ x 100

44,100,934000

=38.59%

Interpretation :

The margin profit ratio show the profitability of bank is not satisfactory.

Return On Total Assets (ROA) = Net Profit After Tax x 100

Total Assets

2008 2009

19,033,773,000

________________- x 100

762,193,593000

= 2.49%

17,022,346,000

_______________ x 100

635,132,711,000

= 2.68%

Interpretation:

The return on total assets is also not satisfactory as compare to the 2009

RETURN ON DEPOSITS = Net Profit x 100

Total Deposits

2008 2009

19,033,773,000

________________ x 100

591,907,435,000

= 3.21%

17,022,346,000

_______________ x 100

501,872,243,000

= 3.39%

Interpretation This ratio is show that the net profit as compare to previous year is

increased but the result is not as favorable as compare to 2008.

Return On Equity (ROE) = _____Net Profit_______ x 100

Shareholders Equity

42

-

8/3/2019 NBP Report 1

43/53

2008 2009

19,033,773,000

________________x 100

69,270,631,000

= 27.47%

17,022,346,000

______________x 100

53,044,649,000

= 32.09%

Interpretation:

The ROE (return on equity) is also not show the satisfactory result because the net profit

is increased but on the other hand the holder equity is also increase and that is way the

result cannot show favorable sign.

Advances To Total Deposits = __Advances____ x 100

Total Deposit

2008 2009

340,677,100,000

________________ x 100

591,907,435,000

=57.55%

316,110,406,000

______________x 100

501,872,243,000

= 62.98%

Interpretation:

The advance to total deposit is increase but by small amounts that are way the result is

not favorable show by ratio result.

43

-

8/3/2019 NBP Report 1

44/53

Advances To Total Assets Ratio = Advances____ x 100

Total Assets

2008 2009

340,677,100,000

________________ x 100

762,193,593

=44.69%

316,110,406,000

______________x 100

635,132,711

= 49.77%

Interpretation:

The advances is increased but by less amount as compare to the increased in total assets

therefore the ratio result is not good.

Debt To Equity Ratio = Total Debt __________ x 100

Shareholders Equity

2008 2009

645,855,939,000

________________ x 100

69,270,631,000

=932.36%

553,178,593,000

______________x 100

53,044,649,000

=1042.85%

Interpretation

The total debt is increased and on the other side the share holder equity is also increased

also that is the ratio is decrease show favorable trend for share holders.

Long Term Debt To Fixed Assets Ratio = Long Term Debt x 100

Fixed Assets

2008 2009

10,886,063,000

________________ x 100

25,922,979,000

=41.99%

11,704,079,000

________________ x 100

9,681,974,000

= 120.88%

Interpretation

44

-

8/3/2019 NBP Report 1

45/53

The long term debt is decreasing from 2008 and fixed assets are increased more than

debts that are good symbol.

Debt Ratio: = Total Liabilities x 100

Total Assets

2008 2009

645,855,939,000

__________________x 100

762,193,593,000

=84.73%

553,178,593,000

______________ x 100

635,132,711,000

= 87.09%

Interpretation

The debt ratio is show that the liabilities are increased at the slow rate than total assets

and that is favorable for NBP.

STOCK HOLDER EQUITY TO TOTAL LIABILITIES: =

STOCK HOLDERS EQYITY X 100

TOTAL LIABILITIES

2008 2009

69,270,631,000

_________________ x 100

645,855,939,000

= 10.72%

53,044,649,000

_______________ x 100

553,178,593,000

= 9.58%

Interpretation The stock holder equity is show favorable trend from 2008.

45

-

8/3/2019 NBP Report 1

46/53

INVESTMENT TO TOTAL ASSETS = INVESTMENT X 100

TOTAL ASSETS

2008 2009

210,787,868,000

_________________ x 100

762,193,593,000

= 27.65%

139,946,995,000

_______________ x 100

635,132,711,000

= 22.03%

Interpretation The investment ratio also increase that show the growth of NBP.

DEPOSITS TO TOTAL ASSETS RATIO = DEPOSITS X 100

TOTAL ASSETS

2008 2009

591,907,435,000

_________________ x 100

762,193,593,000

=77.65%

501,872,243,000

_______________ x 100

635,132,711,000

= 79.01%

Interpretation:

The deposit ratio as compare to total assets is decreasing that show that the total assets

figure is increased more than the previous year.

PROPRIETARY RATIO = STOCK HOLDERS EQYITY X 100

TOTAL ASSETS

2008 2009

69,270,631,000

_______________ x 100

762,193,593,000

= 9.08%

53,044,649,000

_______________ x 100

635,132,711,000

= 8.35%

46

-

8/3/2019 NBP Report 1

47/53

Interpretation

The proprietary ratio is increasing from 2008 to 2009 that is good news for shareholders.

That show the contribution of shareholders is increased.

EARNING PER SHARE: = ______NET PROFIT_____NUMBER OF SHARES

2008 2009

19,033,773,000

________________

815,432

= 23.34

17,022,346,000

_________________

709,071

= 24.00

Interpretation The earning per share is decreasing from 2008 to 2009 that showunfavorable news for share holders.

AVERAGE PROFIT PER BRANCH =

NET PROFIT

____________________________

AVERAGE NUMBER OF BRANCHES

2008 2009

19,033,773,000

_______________

1243

= 15,312.76

17,022,346,000

__________________

1250

= 13,617.87

InterpretationThe average profit of NBP is increasing that show the efficiency of NBP. The number of

branches is decrease and net profit is increased.

47

-

8/3/2019 NBP Report 1

48/53

CHAPTER 6

FINDING CONCLUSION & RECOMMENDATIONS

FINDING From the above discussion I come to the conclusion that the NBP is prove

to a Nations Bank because it provides the large number of services to

their customers. On the basis of financial analysis I point out that the trend

is positive, which indicates that profitability; solvency and liquidity

position of bank is sound. It means that the organization (NBP) is working

progressively and the management is performing its role in a very good

manner.

The global economic environment has changed, creating challenges and

opportunities for the worlds policy makers. The privatization drive has

emerged as a strong tool of transformation, which is being recognized as an

essential ingredient for the economic well-Being of the countries

themselves and for the rest of the world. Now there is a greater awareness

that in an interdependent world all countries gain individually if these

countries become positive contributor to world economic growth as whole.

Banks are playing very important role in the economic growth of the

countries. NBP no doubts a positive contributor in this respect but I think

there are certain points by adopting which can serve more effectively and

efficiently. These points are as under:

This is a computer era. With the use of computer we can increase our

efficiency. NBP should computerize all its branches. By the use of

computer properly these branches can increase there working efficiency.

48

-

8/3/2019 NBP Report 1

49/53

CONCLUSION

NBP as public service oriented institution has to create business

opportunities for themselves. Now a day there is a competition between the

banks.

Central Asian Republics (CARs) have great opportunities of new business

so N.B.P should open new branches in these Republic.

Model Banks like City Bank, Muslim Commercial Bank (MCB) is using

media very effectively to increase the business of banks. So NBP should

use electronic media for its business developments.

The interference of union in banking business should be minimized as it

decreases the working efficiency of the employee as well as the bank.

The working of the Peshawar Cantt. Branch Peshawar is satisfactory but

still these working efficiencies are far from the standard of modern banking

system.

The bank should finance its loans in those projects that are meeting the

required standard and should avoid the political pressure.

The bank should bring forward the new talent as fresh knowledge and

education is considered very important to increase the efficiency and

production.

There is needed to make the outlook situations of branches in those

manners that can compete the other modern banks in the banking market.

Keeping in view the hard work by the staff members at all levels of

management, staff should be given bonus and increment every year.

49

-

8/3/2019 NBP Report 1

50/53

Credit Cards are issued by the different banks like MCB and City Bank etc.

but NBP dont issued this type of finance scheme, there is a place for this

type of scheme in this bank.

RECOMMENDATIONS

Separate desk or counter should be established in every branch to provide

the information as required by the clients.

The environment of the offices should be comfortable so that the client and

staff must feel comfort during business in bank.

Unsecured loan are not to be provided in case of banks directions, their

families, companies or firms.

There are some clients having sound and successful plan but without

financially sound and providing securities bank should forms such policies

that may solve this problem.

I observed that many branches of NBP are over crowded. Less people can

work which extra people perform. Number of employees should decrease or

new branches should opens for the adjustment of these extra employees.

There are some employees untrained which decreases the efficiency of the

bank branch. All the employees should well train.

Most of the bank employees are sticking to one seat only, with the result

that they become master of one particular job and loose their grip on other

banking operation. In my opinion each employee should have regular job

change.

50

-

8/3/2019 NBP Report 1

51/53

Refreshes courses for staff are most important in any international

organization. All the employees should have their courses according to their

requirement.

Every year some of the employees should be sent for training to other

countries and employees from other countries should be brought here.

In commercial institutions like banks reward and punishment system should

be introduced. Means achieve, smart, educated, skilled, self-spoken and

well-dressed staff should be rewarded and appreciated and lazy, lethargic

staff should be warned and punished.

People have to wait for re-cashing their cheques and for paying their utility

bills, which are not good for reputation of bank, it should be improved.

Promotion should be given to competent persons on merit basis.

51

-

8/3/2019 NBP Report 1

52/53

BIBLIOGRAPHY

Avashti, Shiriran 1983 Public administration, six edition New York; Mc GrawHill

book company

Bhatia, H.L, 1984 Public Finance vicar publishing house Pvt. Ltd. Standard Delhi

BUGLE ski, Richard B,1965, The Psychology of learning; Halt and Company

De Silva , D and Denby 2000.bring credit to the poor, New Delhi.Center for

youth and social (CYSD) development ,UK

Himayatullah 1995. Agricultural credit availability & requirement in Pakistan: a

detailed analysis journal of Development & administration 27(4):

Hezayer-N ;sen -G1994increaseing women assess to credit in Asia achievements

and limitation.Gender economic growth and poverty growth and state planning in

Asia

Idrees, M. & M.Ibrahim. 1993, Agri Credit role in the development of Agri,

Journal role in the development of Agri, Journal.

Israr H.Siddiqui; 1983 practice and law of banking in Pakistan THIRD ED royal

book co, Karachi

Kamdar M.S 1989 the Market surplus of wheat in Nawabshah district: a micro

level model, Sarhad Journal of Agri, 5:5;437;2.Khan, M.A & A.S. Khan. 1969. Agri Credit requirement for west Pakistan.

Economic journal 19(2): 27.

Malik , SS. j.1989 Different access and rulral Credit Market in Pakistan. Some

recent evidence . The Pakistan development review .28:4

Muddasir Rizvi 2000, Banking on Micro Credit to Tackle poverty, a journal by

Asia Times.

Qureshi, S., I. Nabi and R. Fawqee 1996. Rural Finance for growth & Poverty

alleviation in Pakistan. Policy Research working paper world Bank (WPS 1593):

viii + 56pp.

Siddiqui, M.A 1995a, credit distribution & agricultural development in Pakistan:

a problem of across to credit. Journal of Rural Development & administration 27

(3):

52

-

8/3/2019 NBP Report 1

53/53